Polkadot has officially capped the supply of its native token, DOT, at 2.1 billion, marking a major shift from its previous unlimited inflation model.

Key Takeaways

- Polkadot DAO approved Referendum 1710, capping DOT’s maximum supply at 2.1 billion tokens with 81% voter support.

- The previous model minted 120 million DOT annually with no supply ceiling, potentially reaching over 3.4 billion tokens by 2040.

- The new system introduces a two-year issuance reduction cycle, aiming for a more predictable and deflationary token economy.

- Despite the long-term bullish potential, DOT’s price saw short-term volatility, testing resistance near $4.50.

What Happened?

Polkadot’s decentralized autonomous organization (DAO) passed a historic governance vote to introduce a hard cap on DOT’s total supply, officially ending its unlimited issuance model. The move aims to introduce scarcity, improve predictability, and align DOT with other cryptocurrencies that have fixed supply structures.

🚨 DOT supply → capped at 2.1 Billion 🚨

— Polkadot (@Polkadot) September 14, 2025

The Polkadot DAO has signaled support for a hard cap, by passing Referendum 1710 on the “Wish For Change” track, with 81% in favor.

Today ⤵️

→ 1.6 Billion DOT exist

→ 120M DOT/year minted each year

→ No supply cap

What Ref. 1710… pic.twitter.com/OJMtDumAZC

A Paradigm Shift in Polkadot’s Tokenomics

Under the previous tokenomics model, Polkadot minted approximately 120 million DOT each year, representing a roughly 10% annual inflation rate. With no cap in place, this would have ballooned the total supply to over 3.4 billion DOT by 2040.

By passing Referendum 1710 with 81% support, the DAO has now capped total DOT issuance at 2.1 billion tokens. The updated framework introduces a step-down issuance model that will reduce new token emissions every two years on March 14 (Pi Day). This change is projected to limit total supply to around 1.91 billion by 2040, significantly cutting down inflation.

Supporters of the proposal emphasized that the change would help:

- Strengthen DOT’s position as a store-of-value.

- Improve monetary discipline within the ecosystem.

- Attract institutional investors looking for assets with a more predictable supply.

Governance in Action: The OpenGov Framework

The vote was facilitated through Polkadot’s OpenGov governance system, launched in 2023. This framework enables any community member to propose changes and vote directly or delegate voting power. The successful passage of this referendum showcases the power and agility of decentralized governance.

Polkadot’s governance continues to evolve, reinforcing the role of community consensus in major economic decisions. While the referendum is not legally binding, it reflects strong agreement among stakeholders, further legitimizing the new monetary direction.

Market Reaction and Token Performance

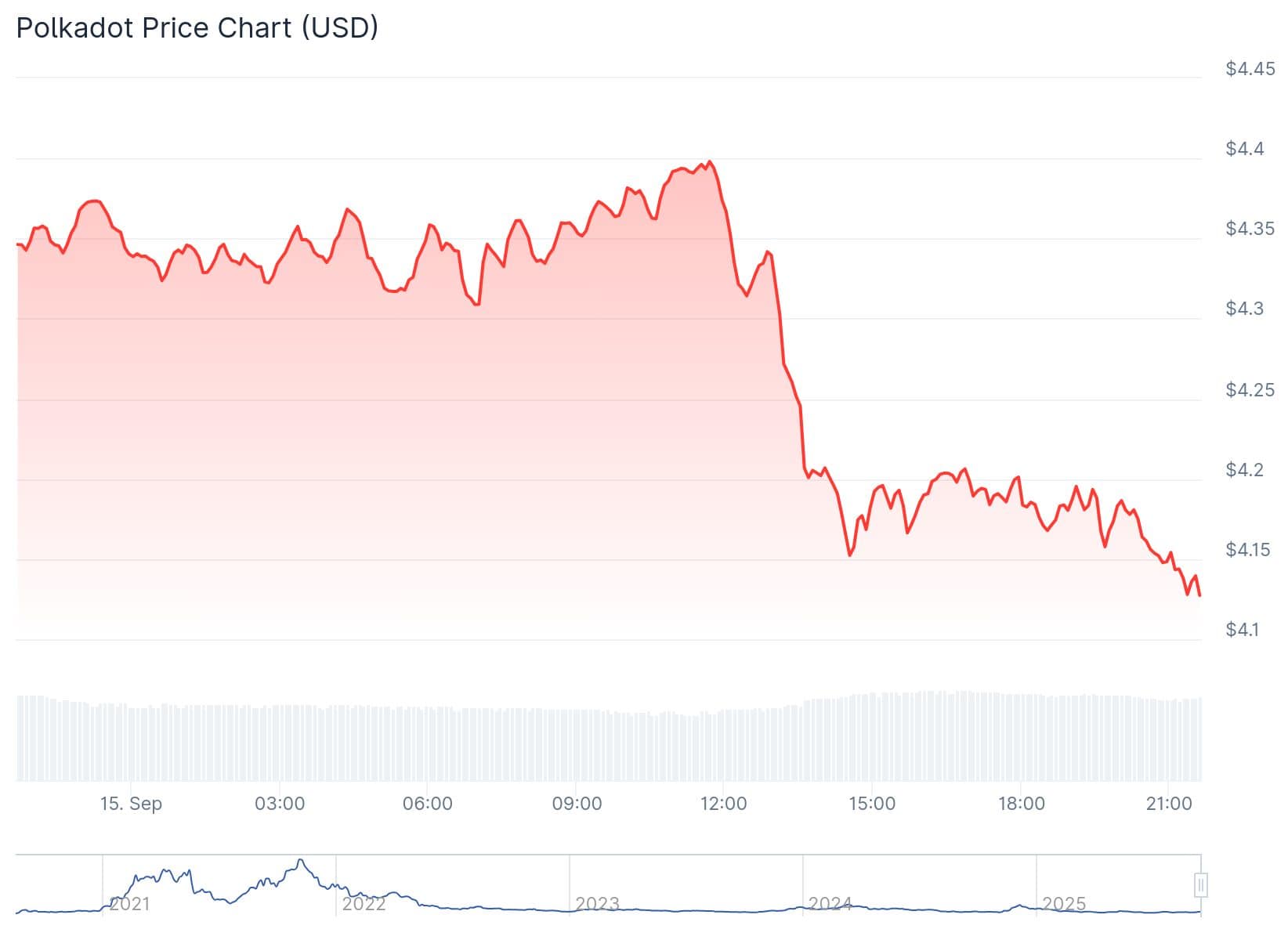

Despite the long-term implications, the announcement led to short-term volatility in DOT’s market price.

- DOT fell nearly 5% following the announcement, dropping from $4.35 to $4.12.

- The token later rebounded to $4.37, up 8% on the week, though still 92% below its all-time high.

- DOT is currently testing a key resistance level at $4.50.

Technical indicators show mixed signals:

- The Relative Strength Index (RSI) sits at 61, suggesting bullish but cautious momentum.

- MACD has turned positive, but Commodity Channel Index readings hint at potential pullbacks.

- If bullish sentiment strengthens, price targets of $4.80 to $5.00 could be within reach.

- On the downside, $4.00 and $3.80 remain crucial support levels.

Meanwhile, derivatives market activity has slowed:

- Open interest dropped 2.35% to $605 million.

- Derivatives volume fell 43% to $446.5 million, signaling reduced speculative trading.

Polkadot Eyes Institutional Integration

Alongside this tokenomics reform, Polkadot has launched the Polkadot Capital Group, a new initiative aimed at bridging traditional finance and blockchain technology. The division plans to connect institutions such as banks, asset managers, venture capital firms and OTC traders to opportunities within the Polkadot ecosystem.

This initiative will also highlight blockchain use cases including:

- Decentralized Finance (DeFi)

- Staking protocols

- Real-world asset (RWA) tokenization

These moves align with Polkadot’s broader ambitions to gain credibility and adoption in institutional circles.

CoinLaw’s Takeaway

In my experience covering crypto governance, this is one of the boldest moves I’ve seen from a major Layer-0 protocol. By capping DOT’s supply, Polkadot is signaling a shift toward long-term sustainability and economic maturity. I found the timing especially strategic, with the 2.0 upgrade coming soon and a fresh push to court Wall Street. This isn’t just about scarcity; it’s about reshaping how investors view the project. While the market is still processing the news, I believe this decision adds a serious layer of credibility to DOT in the eyes of more conservative players in the space.