Pepe Coin (PEPE) has emerged as one of the most talked‑about memecoins in the crypto space, attracting both retail and speculative investors since its launch in April 2023. The token’s market dynamics combine high volatility with community‑driven momentum, making it a compelling case study in the broader cryptocurrency ecosystem. In the United States, traders use Pepe for speculative strategies on major exchanges, while global meme‑coin communities track its trends as a bellwether for retail sentiment in crypto markets. Explore the full article to understand the latest Pepe Coin statistics and market insights.

Editor’s Choice

- Market cap: Roughly $2.1–$2.2 billion as of early 2026.

- Price level: Approximately $0.0000050 per PEPE in January 2026.

- Circulating supply: ~420.69 trillion tokens (fixed supply).

- FDV (Fully Diluted Valuation): About $2.1 billion, matching current max supply valuation.

- 24‑hour trading volume: Between $400 million and $800 million levels.

- Live exchange rank: Around #35–#56 among all crypto assets.

- Price volatility: Notable swings >20–50% during short bursts.

Recent Developments

- One strong weekly rally in early January saw PEPE gain over 50% in seven days, making it one of the top-performing major meme coins over that span.

- On January 2, PEPE recorded a single-day jump of over 30% on KuCoin, with trading volume surpassing $1 billion within hours on that venue.

- Around the New Year, PEPE’s 24-hour trading volume exceeded $600 million, its highest daily volume in about a month, signaling renewed speculative activity.

- A high-profile trader projected PEPE’s market cap climbing from roughly $1.7 billion to as much as $69 billion by late 2026 under an aggressively bullish outcome.

- Year to date in mid-January, PEPE was reported up about 50% in 2026, supported by a roughly 370% surge in trading volume versus late 2025 levels.

Pepe Price Prediction Insights

- PEPE average price is projected to rise from $0.0000072 in 2026 to $0.0000315 by 2031, indicating steady long-term growth.

- Minimum price estimates increase from $0.0000062 in 2026 to $0.0000215 in 2031, suggesting higher price floors over time.

- Maximum price forecasts expand sharply, climbing from $0.0000088 in 2026 to $0.0000410 in 2031, reflecting strong upside potential.

- 2027 outlook shows an average price of $0.0000098, delivering an estimated +36% ROI year over year.

- 2028 projections accelerate, with an average price reaching $0.0000135 and an implied +87% ROI.

- 2029 marks a key growth phase, as average price estimates hit $0.0000182, translating into a +153% ROI.

- 2030 forecasts indicate continued momentum, with an average price of $0.0000245 and a projected +240% ROI.

- 2031 represents the strongest upside scenario, where average prices reach $0.0000315, and cumulative ROI rises to +325%.

- Overall, the data suggests compounding growth, with PEPE potentially delivering triple-digit returns over a multi-year holding period under favorable market conditions.

Key Pepe Coin Facts

- Launch date: April 2023, with no presale or initial offering.

- Blockchain: ERC‑20 token on the Ethereum network.

- Max/total supply: Fixed at ~420.69 trillion PEPE with no further emissions.

- Ownership: Contract ownership renounced, fully decentralized tokenomics.

- Transaction tax: Zero tax on transfers, boosting retail appeal.

- All‑time high: Roughly $0.00002803 during peak market conditions.

- All‑time low: Near $0.00000006 shortly after launch.

- PEPE’s trend correlates strongly with wider memecoin market cycles.

Fully Diluted Valuation (FDV)

- FDV matches the market cap exactly at $2.03 billion, given 100% circulating supply ratio.

- Live FDV reported as $2.09 billion across aggregated exchange pricing.

- Theoretical FDV at the recent high of $0.000005347 equates to $2.25 billion.

- FDV at the daily low price of $0.00000483 measures $2.03 billion minimum.

- Across major trackers, FDV ranges $2.03–$2.17 billion depending on the price feed.

- Fixed supply of 420.69 trillion PEPE tokens ensures no future FDV dilution.

- Mkt Cap/FDV ratio holds steady at 1.0, reflecting fully unlocked valuation.

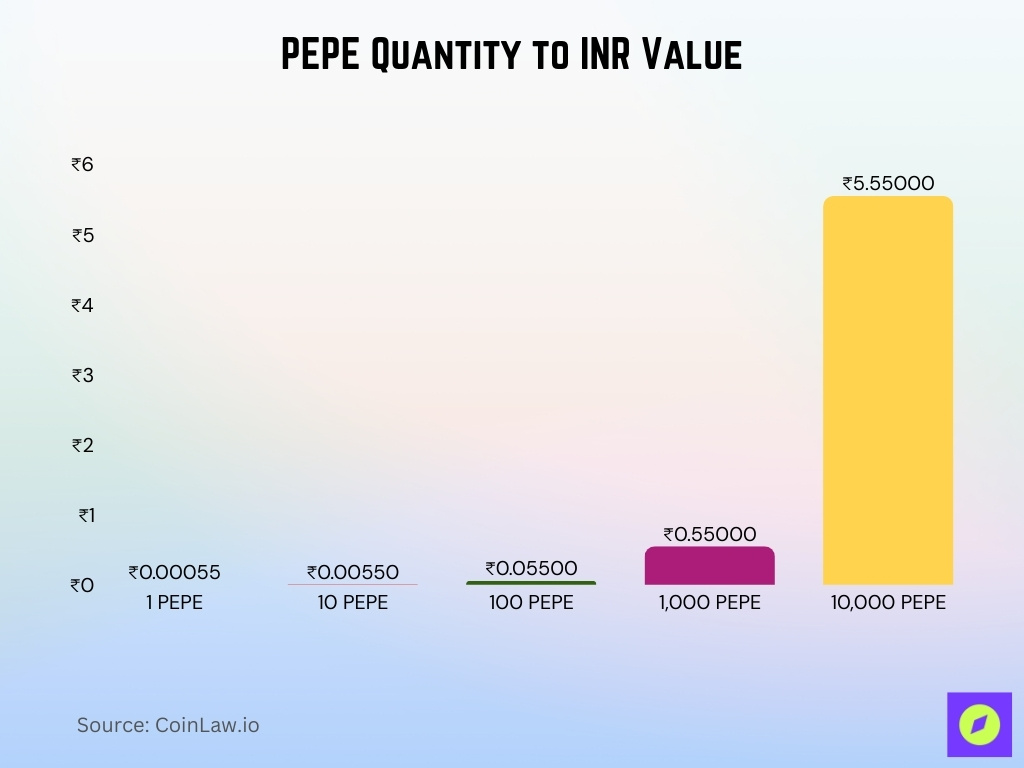

PEPE Quantity to INR Value

- 1 PEPE is valued at approximately ₹0.00055, highlighting the token’s extremely low unit price.

- 10 PEPE costs about ₹0.0055, making small-volume exposure accessible to retail traders.

- 100 PEPE equals roughly ₹0.055, showing how value scales linearly with token quantity.

- 1,000 PEPE is priced near ₹0.55, crossing the half-rupee mark.

- 10,000 PEPE carries an estimated value of ₹5.55, demonstrating how large token counts still translate into modest fiat amounts.

- Overall, PEPE’s pricing structure enables investors to accumulate thousands of tokens for just a few rupees, reinforcing its appeal as a high-supply, low-price memecoin.

Pepe Coin Trading Volume Statistics

- 24-hour trading volume at $394 million with -25% daily change.

- Recent daily volume reached $1.8 billion, up 77% from the prior day.

- January 22 volume totaled $515 million across all exchanges.

- January 2 surge saw volume exceed $1 billion within hours on KuCoin.

- 24-hour volume jumped 600% to over $1 billion during 30% rally.

- Another spike hit $805 million with 370% increase in 24 hours.

- Current 24-hour volume stands at $525 million with price up 1%.

- Volume-to-market cap ratio at 25% on high-activity days.

- OKX PEPE/USDT pair contributes significantly to overall exchange volumes.

Pepe Liquidity and Depth Metrics

- Binance PEPE/USDT shows $3.7 million +2% depth and $5 million -2% depth.

- OKX PEPE/USDT liquidity pool at $1.57 million +2% depth and $1.79 million -2%.

- Bybit PEPE/USDT order book depth $796k buy side and $792k sell side.

- KuCoin PEPE/USDT maintains $416k +2% and $434k -2% liquidity depth.

- MEXC PEPE/USDT pair offers $4 million +2% depth and $4.3 million -2% depth.

- HTX PEPE/USDT liquidity reported $209k buy and $226k sell depth.

- Gate.io PEPE/USDT depth at $285k +2% and $272k -2% levels.

- Recent Binance analysis notes strong liquidity with 24 trillion PEPE volume movement.

- DEX pools add supplementary liquidity beyond CEX-dominant PEPE/USDT pairs.

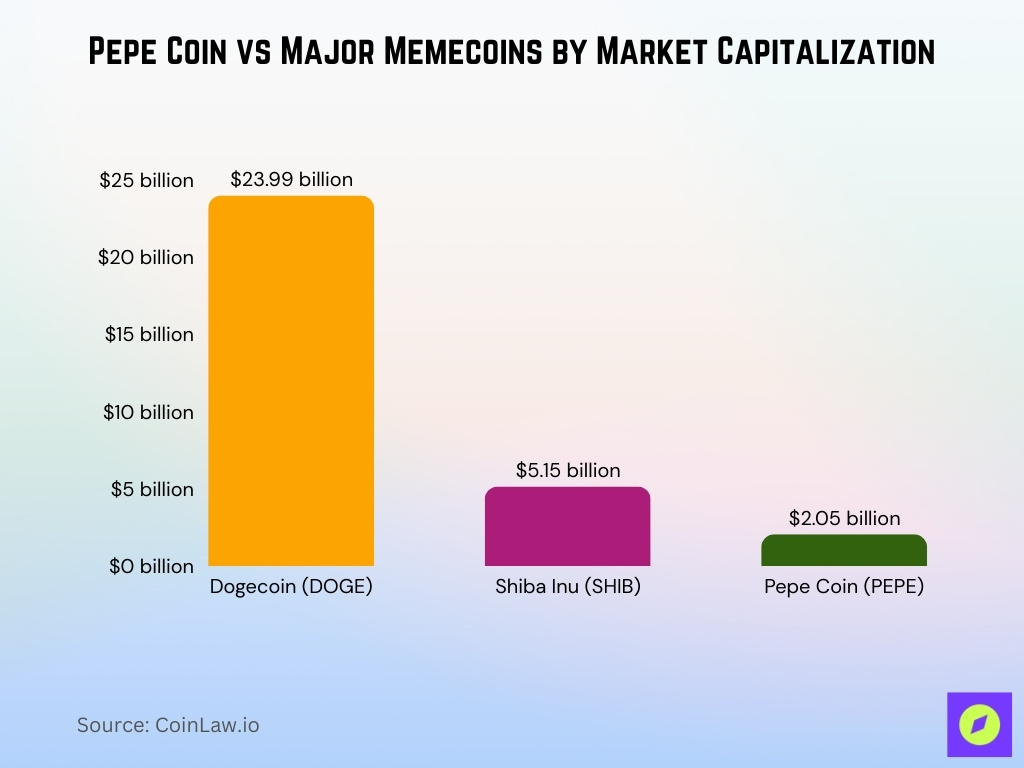

Pepe Coin Market Capitalization Statistics

- Compared to DOGE‘s $23.99 billion and SHIB‘s $5.15 billion, PEPE holds third place among major memecoins, with a current market cap stands at $2.05 billion.

- Ranks approximately #36–#44 among all cryptocurrencies by market capitalization.

- Fully diluted valuation (FDV) aligns closely at $2.05 billion due to a fully circulating 420.69 trillion supply.

- Unlocked market cap reported near $2.09 billion, reflecting complete token accessibility.

- January 1 market cap hovered around $1.7 billion, marking a ~20% year-to-date increase by mid-month.

- The recent 24-hour volume at $428.82 million equates to 20.83% of the market cap ratio.

On-Chain Activity Statistics

- The top 15 wallets control 33% of the total 420.69 trillion PEPE supply.

- Largest single whale wallet holds 62.07% of top holders’ 138.63 trillion tokens.

- Daily active addresses show a decline amid reduced speculative momentum.

- Daily average transaction volume rose from $100 million to $180 million.

- 36 whale transfers exceeding $1 million each executed in a single day.

- PEPE outperforms DOGE and SHIB with higher active address counts.

- The top 10 holders control 15–20% of the total supply with moderate concentration.

- Network growth expanded 39% with 36 major whale transactions recently.

- Derivatives open interest hit $257.18 million, up 7.87% daily.

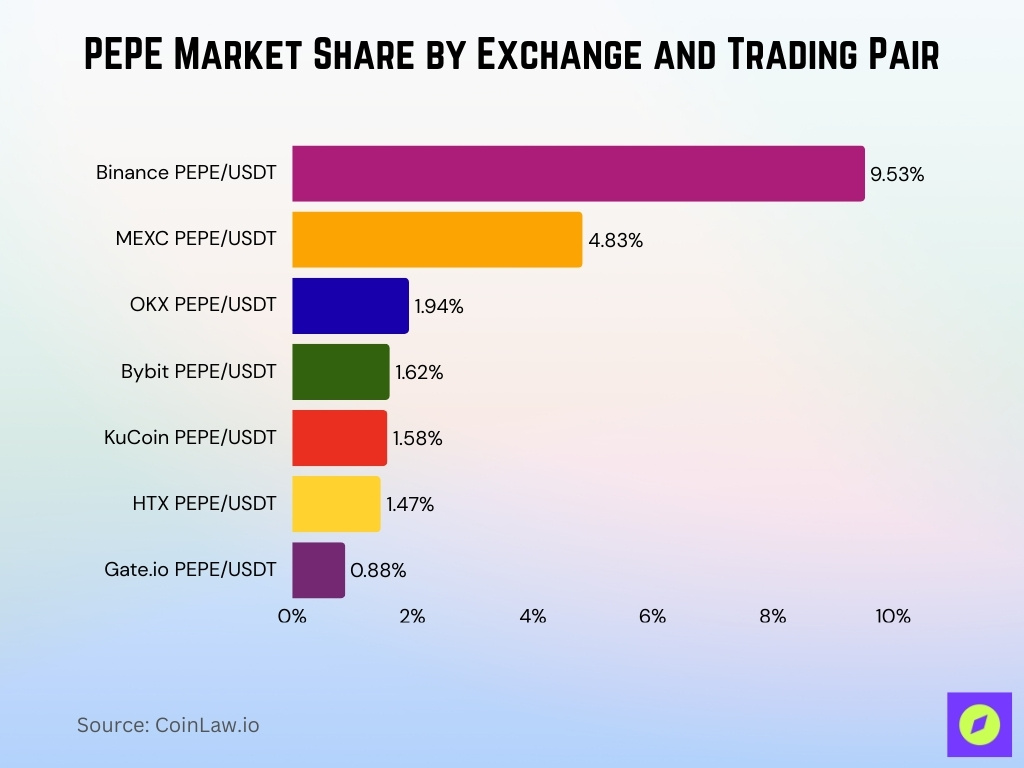

Exchange Listings and Liquidity Venues

- Binance PEPE/USDT leads with $172 million 24h volume and 9.53% total share.

- OKX PEPE/USDT contributes $35 million in volume, holding 1.94% market share.

- MEXC PEPE/USDT volume at $87 million, capturing 4.83% of total trades.

- KuCoin PEPE/USDT records $28.5 million 24h volume with 1.58% share.

- Gate.io PEPE/USDT sees $16 million volume accounting for 0.88% share.

- HTX PEPE/USDT handles $26.5 million volume, representing 1.47% total.

- Bybit PEPE/USDT volume $29 million with 1.62% of overall trading activity.

- Bitget is listed among the top 20 venues supporting PEPE with notable liquidity depth.

- Uniswap V3 (Ethereum) provides DEX liquidity alongside 30+ CEX listings.

Market Sentiment and Fear–Greed Indicators

- Crypto Fear & Greed Index at 24 signaling Extreme Fear.

- PEPE-specific Fear & Greed shows mixed bullish predictions dominating recent news.

- RSI reading at 82 indicates overbought conditions amid buying pressure.

- Social sentiment shifted from fear to optimism with 54% weekly price jump.

- Bearish traders faced $2.99 million in liquidations during recent surges.

- Crypto Fear & Greed dropped to 20, reflecting collapsing broader sentiment.

- 79% bearish market feeling per technical indicators analysis.

- RSI is near neutral levels with no overbought/oversold extremes currently.

- Fear & Greed at 32 (Fear) signaling a negative investor outlook.

Frequently Asked Questions (FAQs)

PEPE’s FDV is approximately $2.04 billion based on current pricing and max supply.

In certain venues, PEPE’s 24‑hour volume has been quoted near $1.09 billion in recent sessions.

There are approximately 507,200 holders of PEPE tokens.

Conclusion

Pepe Coin’s statistics underscore the unique dynamics of a memecoin thriving on community engagement, trading volume, and speculative sentiment. Widespread exchange listings give PEPE robust access across centralized and decentralized platforms, while diverse trading pairs support its liquidity structure. On‑chain metrics signal active participation from both retail holders and larger token movements.

However, shifting market sentiment and fear–greed oscillations reflect the meme‑driven psychology that continues to shape price trends. As the cryptocurrency landscape evolves, PEPE remains a quintessential example of how cultural interest, exchange access, and trading behavior interplay in shaping asset statistics and market narratives.