Regulators are cracking down harder than ever, and penalties for non-compliance in crypto transactions are surging worldwide. For many crypto businesses and investors, understanding the risks of non-compliance is no longer optional; it’s essential. This comprehensive breakdown of crypto compliance penalties offers insights and data that matter whether you’re an investor, a compliance officer, or an exchange operator.

Editor’s Choice

- 139 regulatory penalties across sectors, including crypto, totaled $1.23 billion in H1 2025.

- The average fine for non-compliant crypto businesses reached $3.8 million globally in early 2025.

- OKX agreed to pay $504 million in penalties for AML violations and unlicensed money transmission.

- BitMEX fined $100 million by US authorities for Bank Secrecy Act and AML violations.

- KuCoin operator penalized C$19.6 million (≈$14 million) by Canada’s FINTRAC for registration and reporting failures.

- Global regulatory penalties against financial institutions, including crypto‑exposed cases, reached about $1.23 billion in H1 2025, with North America accounting for roughly 55% of the total fine value.

- US regulators imposed $2.5 billion in crypto penalties, SEC leading with $1.69 billion for securities violations.

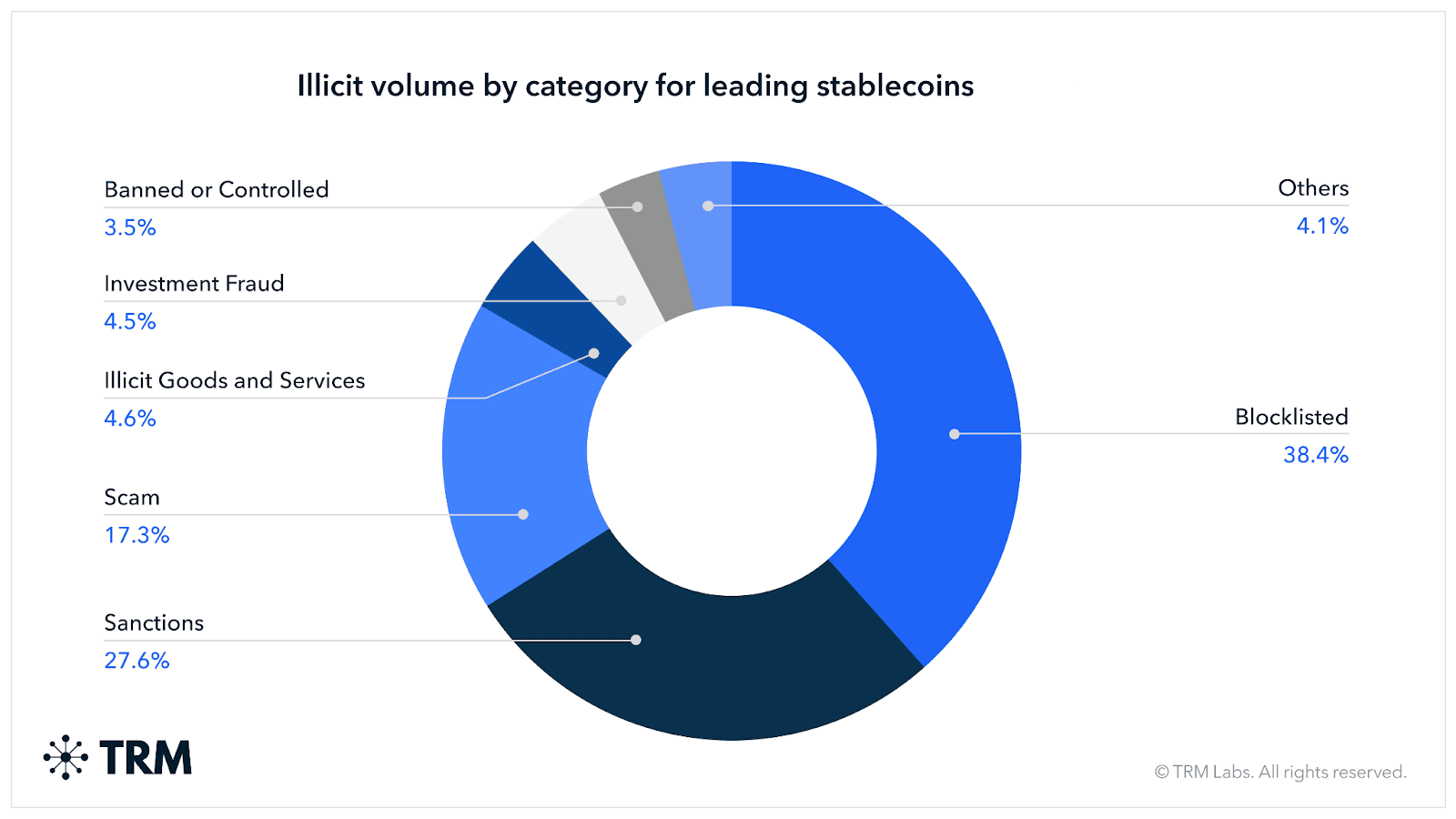

Illicit Stablecoin Activity Breakdown

- Blocklisted addresses accounted for the largest share at 38.4%, indicating aggressive blacklisting efforts against suspicious wallets.

- Sanctions-related activity made up 27.6% of illicit stablecoin volume, highlighting increased usage by sanctioned entities.

- Scams contributed 17.3%, showing continued exploitation of stablecoins in deceptive schemes.

- Illicit goods and services were responsible for 4.6% of the volume, tied to underground marketplace transactions.

- Investment fraud represented 4.5%, including Ponzi schemes and fake crypto investment platforms.

- Other illicit categories made up 4.1%, encompassing miscellaneous or uncategorized misuse.

- Banned or controlled entities accounted for 3.5%, reflecting enforcement against restricted organizations and regions.

Regional Breakdown of Non-Compliance Penalties in Crypto Transactions

- United States regulators imposed $2.5 billion in crypto penalties, led by the SEC’s $1.69 billion.

- Canada‘s FINTRAC fined KuCoin operator C$19.6 million (≈$14 million) for AML failures.

- United Kingdom, aligned with MiCA, imposed £520 million on crypto businesses.

- Germany saw non-compliance penalties reach €310 million.

- Singapore‘s MAS levied $450 million in fines for stricter AML controls.

- Japan‘s FSA imposed $390 million in fines, up 29% year-over-year.

- South Korea recorded ₩410 billion in compliance fines.

- Australia‘s AUSTRAC issued $210 million across 52 investigations.

- United Arab Emirates regulators fined $160 million targeting Dubai exchanges.

- Brazil led Latin America with $75 million, followed by Mexico’s $52 million.

Fines and Financial Penalties Imposed for Crypto Regulatory Breaches

- Global fines for crypto regulatory breaches reached $6.2 billion in the first nine months, surpassing 2024’s total.

- US SEC imposed $1.69 billion in penalties against crypto firms for securities and AML violations.

- FCA in the UK levied £520 million across 12 major enforcement actions targeting crypto marketing breaches.

- Australia’s AUSTRAC issued $210 million in fines from 52 investigations into crypto platforms.

- Singapore MAS enforced $450 million primarily for AML and licensing failures by exchanges.

- Germany’s BaFin collected €310 million from MiCA non-compliant crypto service providers.

- EU average fine per action hit €8.4 million, up 25% with 139 penalties sector-wide.

- Japan’s FSA fined $390 million, focusing on DeFi platforms’ AML deficiencies.

- Brazil regulators enforced $75 million, a 22% rise, targeting unregistered platforms.

- South Korea imposed ₩410 billion on exchanges for user fund protection breaches.

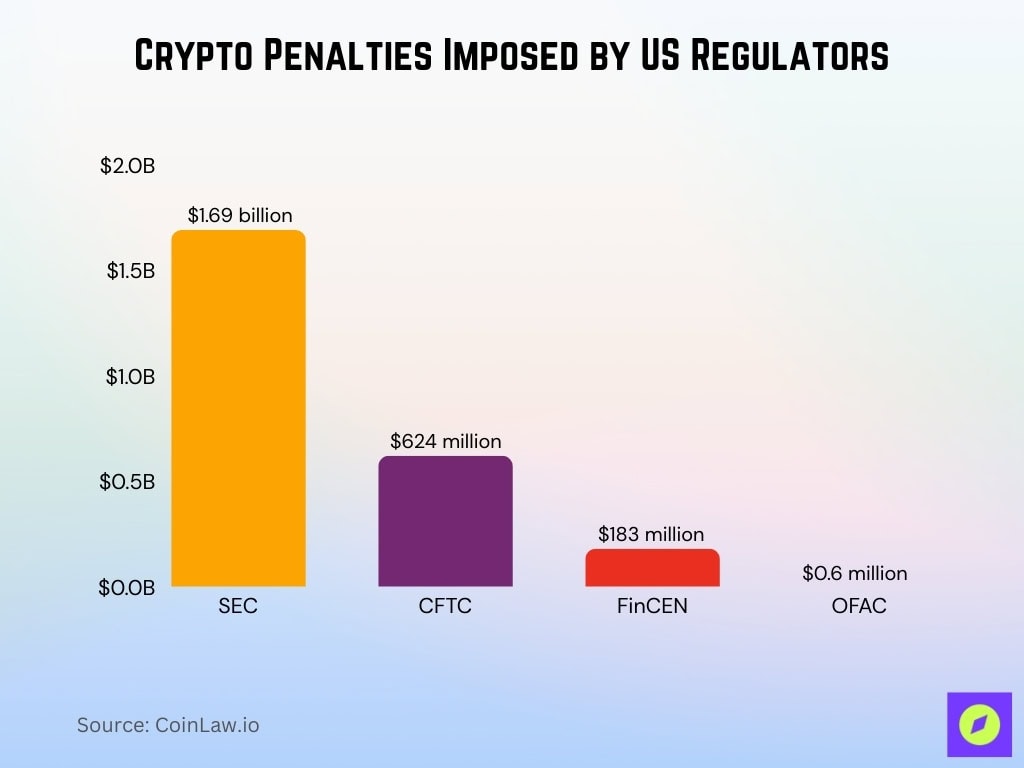

Crypto Penalties Imposed by US Regulators

- The SEC led enforcement with $1.69 billion in penalties, dominating the regulatory crackdown on cryptoasset violations.

- The CFTC followed with $624 million, largely targeting derivatives and market manipulation cases.

- FinCEN issued $183 million in fines, focusing on AML and compliance failures in crypto platforms.

- OFAC imposed $0.6 million, reflecting its narrower scope focused on sanctions violations.

Criminal Charges and Legal Actions for Crypto Non-Compliance

- Globally, over 120 crypto executives and insiders were under active criminal investigation for fraud, market abuse, or AML breaches, with more than 60 arrests tied to large-scale schemes.

- The US Department of Justice has prosecuted cases involving more than $2 billion in intended losses since 2019, including a $263 million crypto crime ring that led to charges against 12 defendants.

- TRM Labs reports illicit crypto transaction volume at $45 billion, yet law enforcement-linked initiatives have frozen over $130 million in suspected illicit proceeds.

- Interpol-led cyber‑enabled financial crime operations across 40 countries recovered $439 million, including $97 million in virtual and physical assets and nearly 400 crypto wallets frozen.

- Interpol and partner agencies arrested more than 1,500 suspects linked to cryptocurrency fraud rings, recovering around $950 million in assets.

- Europol’s Operation SpecTor targeting dark‑web crypto crimes resulted in 288 arrests and seizures of $53 million in crypto.

- China’s Ministry of Public Security dismantled 2,700 crypto fraud networks, recovering approximately $1.8 billion in related assets.

- India’s Enforcement Directorate froze about $290 million in crypto assets in multiple investigations tied to illegal loan apps and investment scams.

- The FBI’s Virtual Asset Exploitation Unit dismantled three major Ponzi schemes totaling $1.2 billion in investor losses.

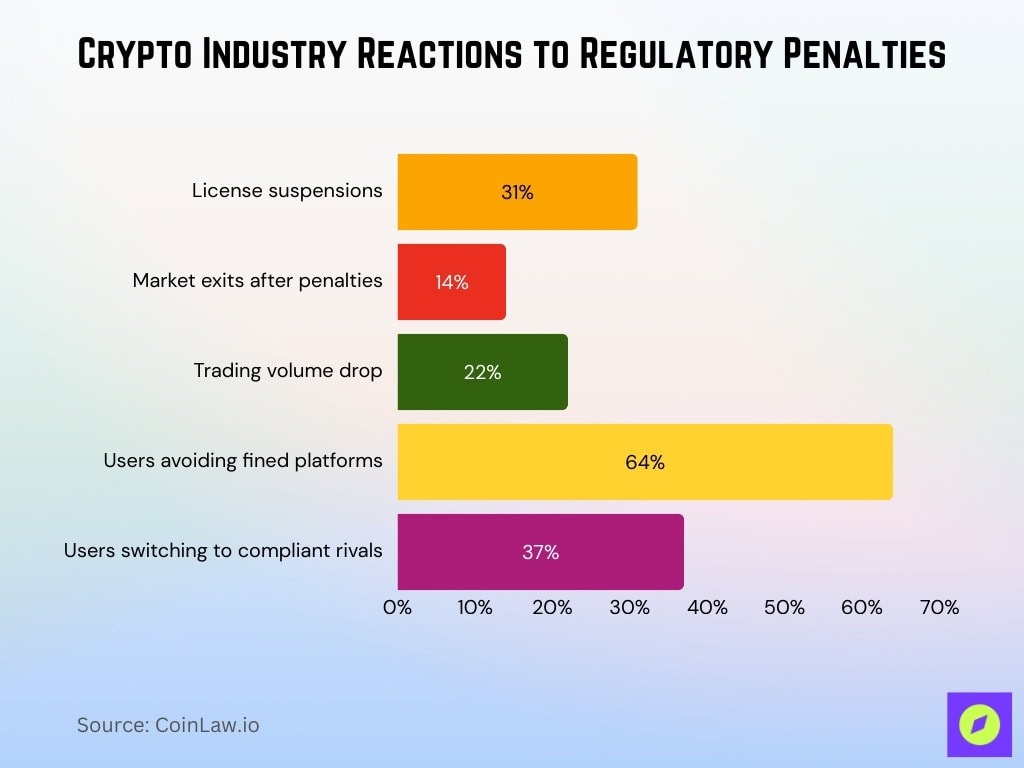

Impact of Non-Compliance Penalties on Crypto Businesses

- About 31% of penalized exchanges faced license restrictions or suspensions, while 14% exited at least one national market after enforcement.

- Trading volumes on exchanges named in enforcement actions fell by an average of 22% in the first 90 days, with some seeing intraday outflows above $500 million.

- Surveys indicate 64% of crypto investors are less likely to use previously fined platforms, and 37% shifted to competitors viewed as regulation-first.

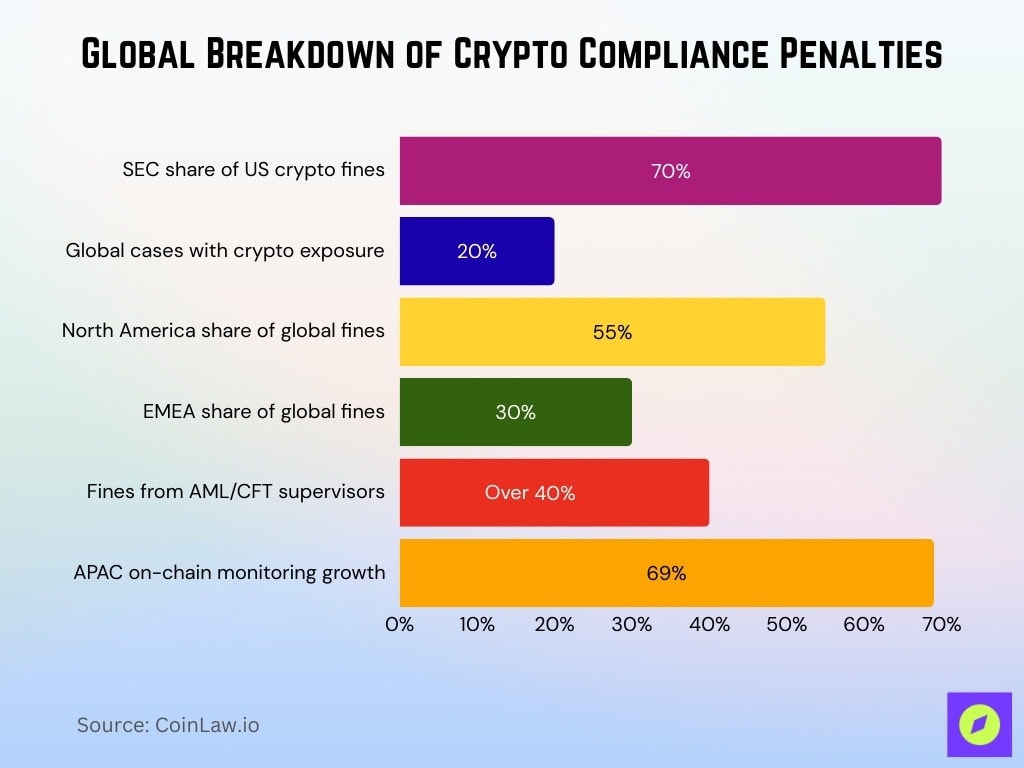

Trends in Regulatory Enforcement and Penalty Issuance

- Regulators issued 139 financial penalties totaling $1.23 billion in H1, a 417% increase versus $238.6 million across 118 fines a year earlier.

- Over 40% of these penalties were tied to AML, KYC, and sanctions failings, with digital asset and crypto exposures featuring in roughly 1 in 5 cases.

- North American authorities accounted for about 55% of the total fine value, with Europe and the Middle East contributing a combined 30%.

- APAC supervisors reported double‑digit growth in enforcement, helping drive a 69% year‑over‑year increase in on‑chain transaction monitoring across the region.

- Cross‑border coordination expanded, with joint actions referenced in more than 25% of major enforcement press releases reviewed by policy analysts.

- MiCA implementation and related EU regimes triggered a sharp rise in crypto compliance audits, with some member states increasing on‑site inspections by 60%.

- Whistleblower and tip‑off channels contributed to roughly 10–15% of notable enforcement cases, often unlocking sanctions evasion and fraud investigations involving crypto.

- Supervisors increasingly targeted real‑time monitoring and Travel Rule gaps, noting 99 jurisdictions had implemented Travel Rule requirements by mid‑year.

Role of Regulatory Bodies in Enforcing Compliance Penalties

- The US SEC led crypto enforcement with about $1.69 billion in penalties, accounting for nearly 70% of the total US crypto fine value.

- Global regulators issued 139 penalties totaling $1.23 billion in H1, with crypto exposure cited in roughly 20% of cases.

- North American agencies generated around 55% of the total fine value, while EMEA regulators contributed approximately 30%.

- AML/CFT supervisors drove over 40% of global crypto fine volume, signaling a shift toward financial-crime enforcement.

- APAC regulators recorded double-digit enforcement growth, supporting a 69% rise in monitored on-chain transaction flows.

Compliance Measures Adopted by Crypto Companies to Avoid Penalties

- Around 85% of centralized exchanges now use automated KYC systems, up from 67%, representing an almost 20-percentage-point increase in two years.

- About 78% of large crypto firms now allocate more than 10% of annual budgets to compliance, compared with roughly 6% two years ago.

- After major AML fines, regtech spending rose by about 27%, with over 80% of top platforms upgrading monitoring tools.

- More than 60% of leading exchanges added specialized compliance staff, with some expanding teams by 30–40% post-enforcement.

- Roughly 72% of major trading platforms run real-time transaction monitoring, reducing false-positive alerts by 20–25% on average.

- Over 50% of surveyed firms implemented stricter geoblocking and sanctions screening, blocking users from at least 10–15 high-risk jurisdictions.

- About 70% of major exchanges and custodians require annual AML/CFT training, with over 40% mandating quarterly refreshers for high-risk roles.

- Travel Rule and wallet-screening adoption now spans 99 jurisdictions, significantly tightening cross-border VASP transfer traceability.

Future Outlook on Crypto Transaction Compliance and Penalty Trends

- Global crypto and digital‑asset compliance penalties are projected to reach around $6.8 billion for 2025, representing roughly a 10% increase on the $6.2 billion recorded in the first nine months.

- Around 80% of regulators worldwide are expected to adopt real-time transaction monitoring by 2026, embedding continuous screening into licensing rules.

- Expansion of the EU’s MiCA regime to DeFi and stablecoins is forecast to raise crypto enforcement in Europe by roughly 30–35%.

- Policy analysts expect North America and Europe to drive more than 60 joint cross-border enforcement actions focused on AML and terrorism financing risks.

- Formal licensing or registration requirements for DAOs are anticipated in at least 10 jurisdictions, including Germany, South Korea, and the UAE.

Frequently Asked Questions (FAQs)

The average penalty per non-compliant crypto business is about $3.8 million, up 21% from the previous year.

In the first half of the year, regulators issued 139 penalties totaling $1.23 billion, a 417% increase from $238.6 million a year earlier.

The United States accounts for roughly 47% of total crypto-related fines, with about $2.4–2.5 billion in penalties.

Conclusion

The landscape of crypto compliance is more demanding than ever. Global regulators are enforcing tougher rules, while crypto companies race to implement robust compliance frameworks. The cost of non-compliance isn’t just financial; reputational damage, loss of user trust, and even criminal charges are on the line.

For crypto businesses and investors, understanding these statistics isn’t just about keeping informed; it’s about staying ahead. The evolving regulatory landscape means that proactive compliance is now the standard, not an option. Successful navigation of the crypto world will require adaptability, transparency, and a commitment to regulatory best practices.