Imagine a bustling digital marketplace where every transaction flows seamlessly. Behind this smooth operation lies a silent enabler, the payment aggregator. With e-commerce and digital payment ecosystems booming, payment aggregators are at the heart of this transformation. They simplify operations for businesses of all sizes by consolidating multiple payment methods into a single interface. From small startups to global enterprises, these systems are paving the way for an increasingly cashless world. Let’s dive into the latest insights, statistics, and trends defining this vital sector.

Editor’s Choice

- $6.96 billion global value of the payment aggregator market in 2025, driven by the rapid expansion of electronic transactions.

- The US market is projected to reach $1.35 billion in 2025 with a year-over-year growth rate of 12% for payment aggregators.

- 2.3 billion consumers globally used platforms powered by payment aggregators in 2025.

- 55% of e-commerce transactions in 2025 were completed using mobile wallets integrated with payment aggregators.

- 2.5%–3.5% average transaction fee charged by US payment aggregators to small businesses in 2025.

- 27% reduction in cross-border payment processing time in 2025 achieved through aggregator technology innovation.

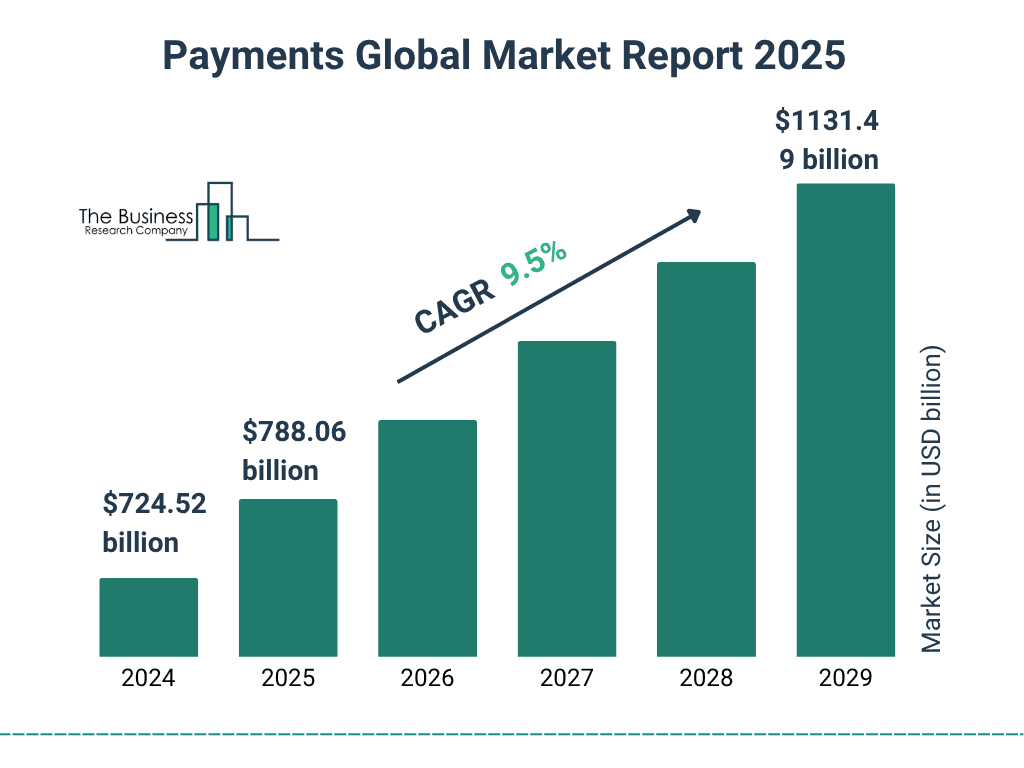

Global Payments Market Outlook

- The global payments market is valued at $724.52 billion in 2024, marking a strong base year for digital transaction growth.

- By 2025, the market is projected to reach $788.06 billion, showing continued momentum in online and mobile payments.

- The sector is forecast to grow at a CAGR of 9.5% from 2024 to 2029.

- By 2029, the total market size is expected to climb to $1,131.49 billion (over $1.1 trillion).

- This represents an absolute increase of more than $400 billion over five years.

- Growth drivers include rising fintech adoption, expansion of e-commerce, and global shift toward cashless economies.

- Key opportunities lie in real-time payment systems, cross-border digital payments, and the integration of AI and blockchain in transaction processing.

- The steady upward trend underscores the resilience of the digital payment ecosystem despite regulatory and competitive pressures.

Revenue and Monetization Strategies

- 2.5%–3.5% global average transaction fee for aggregators in 2025 as payment volumes surge.

- 23% of aggregator revenue in 2025 stemmed from premium services like custom integrations and advanced fraud detection.

- 41% growth in subscription-based models among aggregators targeting enterprise clients in 2025.

- 12% of global aggregator revenue in 2025 came from dynamic currency conversion fees as cross-border payments soared.

- 28% average development cost savings for businesses using white-label aggregator solutions, creating a $2.1 billion market opportunity in 2025.

- 36% reduction in transaction disputes due to AI-driven fraud detection, significantly lowering operational losses in 2025.

- $2.6 billion combined annual revenue unlocked by aggregators partnering with fintech companies in 2025.

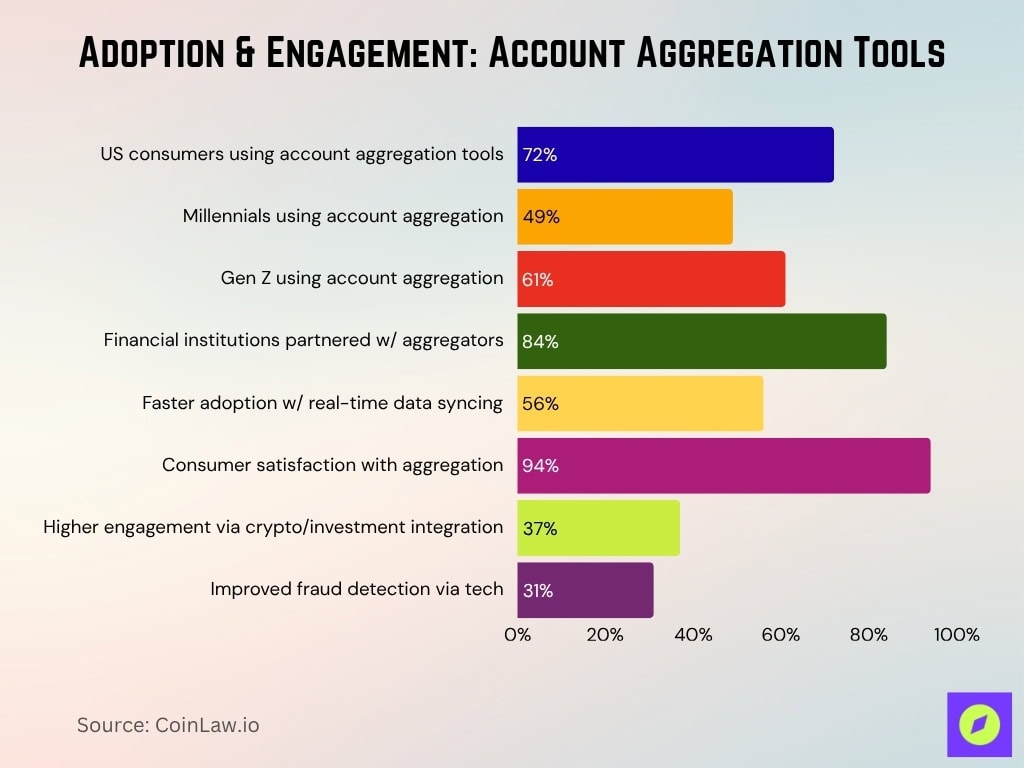

Connecting Accounts: Consumer Use of Account Aggregation

- 72% of US consumers used account aggregation tools to manage multiple bank accounts and payment apps in 2025.

- 49% of Millennials and 61% of Gen Z users accessed financial data through account aggregation platforms in 2025.

- 84% of financial institutions partnered with payment aggregators to streamline account connectivity for end-users in 2025.

- Aggregation platforms with real-time data syncing reported 56% faster user adoption in 2025 compared to those without this feature.

- Consumer satisfaction with aggregation services reached 94% in 2025, driven by seamless payment and account tracking options.

- Platforms integrating investment accounts and cryptocurrency wallets saw 37% more user engagement in 2025.

- Fraud detection rates improved by 31% in 2025 with advanced aggregation technology leveraging machine learning.

Benefits of Using a Payment Aggregator

- Businesses using payment aggregators in 2025 reduce the complexity of managing multiple payment gateways by consolidating transactions on a single platform.

- Aggregators allow businesses to save up to 18% in annual operational costs in 2025 by avoiding direct processor agreements.

- Payment aggregators enable businesses to accept payments in 1–2 days on average in 2025, compared to traditional setups that take up to 2–3 weeks.

- Aggregators support seamless international transactions, enabling businesses to transact in over 210 currencies worldwide in 2025.

- Advanced fraud detection systems integrated with aggregators helped businesses reduce chargebacks by 33% in 2025.

- 84% of consumers in 2025 feel more confident using platforms with well-known payment aggregator methods due to enhanced trust and security.

Payment Aggregator vs. Payment Gateway

- Payment aggregators in 2025 provide a single interface for multiple payment methods, while gateways focus on facilitating individual transactions.

- Aggregators typically charge a higher transaction fee, 2.5%–3.5% while gateways may offer lower fixed rates for high-volume businesses in 2025.

- Aggregators support credit cards, mobile wallets, and crypto payments in 2025, offering more flexibility than traditional gateways.

- Aggregators are plug-and-play in 2025, making them ideal for SMEs, whereas gateways often require custom development.

- Payment gateways in 2025 require businesses to set up individual merchant accounts while aggregators manage compliance and onboarding for clients.

- Aggregators provide advanced analytics on customer behavior in 2025, while gateways primarily focus on transaction records.

- 71% of small businesses in 2025 use payment aggregators compared to 29% relying on gateways, underscoring their growing popularity.

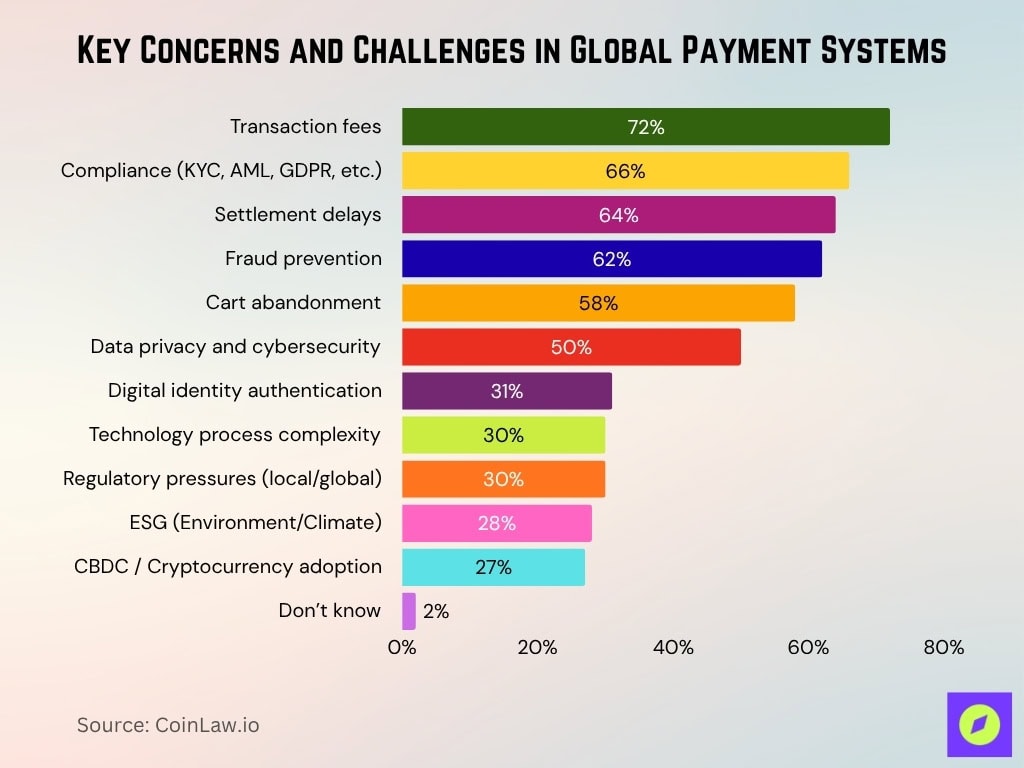

Key Concerns and Challenges in Global Payment Systems

- Transaction fees (72%) are the top concern for businesses and consumers, showing strong demand for lower-cost digital payment solutions.

- Compliance issues (66%), covering KYC, AML, and GDPR, remain a major challenge as regulators heighten scrutiny worldwide.

- Settlement delays (64%) disrupt cash flow and user satisfaction, driving interest in instant and real-time payment infrastructure.

- Fraud prevention (62%) ranks high, emphasizing the need for AI-based fraud detection and risk analytics.

- Cart abandonment (58%) continues to hurt e-commerce merchants, highlighting the importance of seamless checkout experiences.

- Data privacy and cybersecurity (50%) remain persistent threats amid rising data breaches and phishing incidents.

- Digital identity authentication (~31%) gains importance as payment providers adopt biometric and multi-factor verification.

- Technology process complexity (30%) reflects integration hurdles between legacy systems and modern digital platforms.

- Regulatory pressures (~30%) show that global and local compliance demands continue to add cost and operational strain.

- ESG and environmental factors (~28%) emerge as newer concerns as fintechs aim for sustainable and carbon-neutral operations.

- CBDC and cryptocurrency adoption (~27%) reflect ongoing uncertainty over central bank digital currency frameworks.

- Only 2% of respondents expressed uncertainty, signaling high industry awareness of key payment system challenges.

Grow Your Business with Payment Aggregation

- Aggregators reduce cart abandonment rates by 23% in 2025 by offering diverse payment options like credit cards, mobile wallets, and PayPal.

- Businesses using aggregators with one-click payment features report a 40% boost in repeat purchases in 2025.

- Aggregators support transactions in over 110 countries in 2025, allowing businesses to tap into international markets with ease.

- Subscription-based models integrated with aggregators saw 27% higher retention rates in 2025.

- Aggregators provide actionable analytics into transaction trends, helping businesses make data-driven decisions to improve revenue in 2025.

- Using trusted aggregators increases customer confidence, with 73% of consumers in 2025 citing security as a key factor in their purchasing decisions.

- Businesses leveraging aggregators for cryptocurrency payments experienced a 17% increase in customer acquisition in 2025.

Technological Innovations and Integrations

- Aggregators using AI-powered fraud detection reported a 38% reduction in fraudulent transactions in 2025.

- 67% of payment aggregators in 2025 use open banking APIs to enhance connectivity and interoperability between banks and payment platforms.

- Aggregators offering cryptocurrency support saw a 54% increase in transaction volume in 2025, with Bitcoin and Ethereum leading usage.

- Over 78% of aggregators in 2025 optimized their platforms for mobile-first transactions, responding to continued growth in mobile wallet adoption.

- Voice-activated payment market projected to grow by 21% annually through 2028, driven by aggregator integration in 2025.

- Aggregators offering white-label solutions enabled improved payment portal customization and boosted customer experience for 45% of business clients in 2025.

- 28% of aggregators in 2025 adopted real-time settlement technology, significantly improving business cash flow and transaction speed.

Competitive Landscape

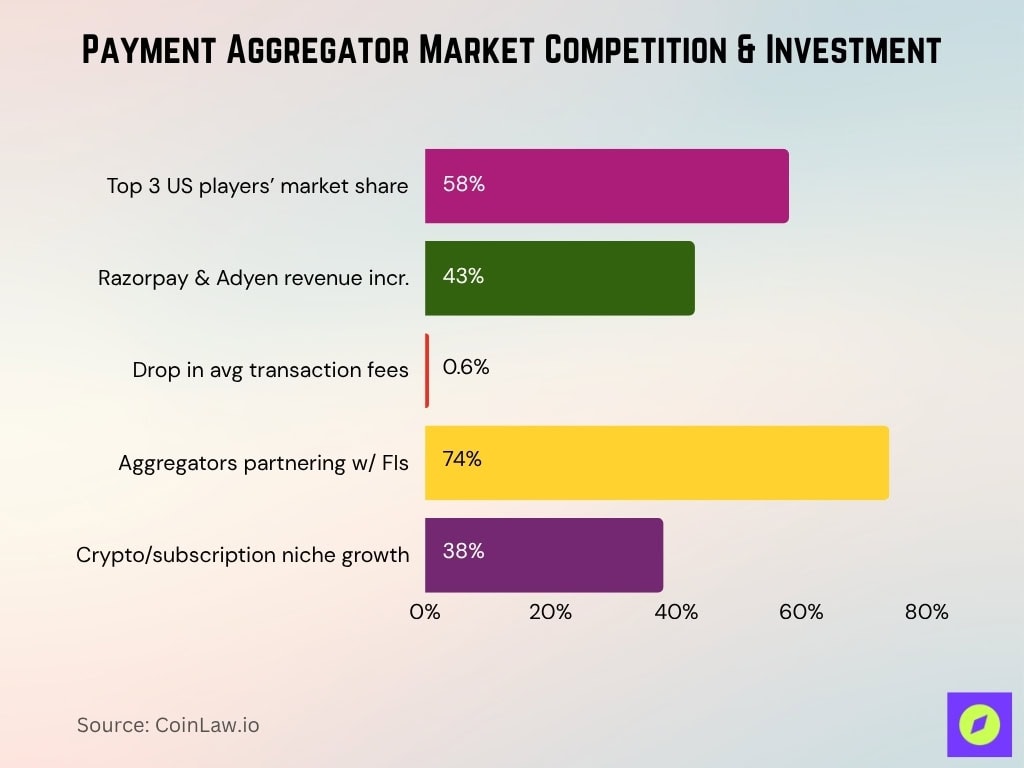

- Stripe, PayPal, and Square together held a 58% US market share among payment aggregators in 2025.

- Emerging competitors like Razorpay and Adyen increased revenues by 43% in 2025, solidifying their position in global markets.

- Competitive transaction fees dropped by an average of 0.6% in 2025, leading to thinner aggregator margins but benefiting businesses.

- Over 74% of aggregators formed partnerships with banks and fintech firms to broaden their service offerings in 2025.

- Niche aggregators focused on crypto and subscriptions saw 38% growth in 2025 as digital business models expanded.

- Payment aggregators attracted $6.1 billion in venture funding in 2025, reinforcing sector growth and innovation.

- Major players completed 28 global acquisitions of smaller aggregators in 2025 to extend their international reach.

Regulatory Environment and Compliance

- Over 86% of payment aggregators enhanced their compliance frameworks in 2025 to meet GDPR, PCI DSS, and AML standards.

- Aggregators in emerging markets faced licensing delays of 8–10 months on average in 2025 due to evolving regulatory requirements.

- Aggregators employing AI-driven KYC systems reduced onboarding fraud by 44% in 2025.

- Aggregators must comply with local taxation and reporting rules for cross-border payments in over 62 countries in 2025 as cross-border volumes rise.

- The Durbin Amendment continues to shape US payment processing costs for aggregators working with debit card networks in 2025.

- Aggregators failing to meet compliance regulations faced penalties averaging $1.8 million per incident in 2025.

- End-to-end encryption adoption in 2025 led to a 54% decrease in data breaches among payment aggregators.

Regional Market Analysis

- North America market size for payment aggregators reached $1.62 billion in 2025 with a 12% annual growth rate.

- Europe saw 79% of e-commerce platforms using aggregators in 2025 due to ongoing PSD2-driven regulatory changes.

- Asia-Pacific accounted for 48% of global payment aggregator revenue in 2025, led by China and India.

- Latin American cross-border platforms experienced 31% growth in 2025, establishing the region as a key market for aggregators.

- Middle East and Africa digital payment initiatives drove 22% market growth for aggregators in 2025, spurred by programs like Vision 2030.

- Southeast Asia led global crypto payment adoption in 2025, supported by aggregator platforms and regulatory acceptance.

- The global shift to direct-to-consumer models boosted payment aggregator demand in all major regions in 2025.

Top U.S. Financial Data Aggregators

- Plaid in 2025 dominated the market with over 12,000 financial institution connections powering top fintech apps like Venmo and Robinhood.

- Yodlee processed over 21 billion transactions in 2025, cementing its status as a go-to account aggregation provider.

- MX focused on enhancing data analytics for financial institutions, serving 87% of the top US banks in 2025.

- Finicity expanded open banking partnerships with Visa across the US, supporting thousands of financial institutions in 2025.

- Zabo specialized in cryptocurrency aggregation, integrating with over 360 crypto platforms in 2025.

- TrueLayer achieved 104% year-over-year growth in its US operations in 2025 by expanding into investment and insurance aggregation.

- Synapse offered white-label aggregation solutions, empowering 60+ fintech startups with next-gen connectivity in 2025.

Recent Developments

- 18% of payment aggregators in 2025 incorporated blockchain technology to enhance security and efficiency.

- Voice-activated transactions were enabled by aggregators in 2025, driving adoption among tech-savvy users and supporting a projected 21% annual market growth.

- 32% of aggregators adopted real-time payment (RTP) systems in 2025, significantly improving settlement speeds.

- Platforms offering AI-driven personalized payment suggestions achieved 28% higher user retention in 2025.

- Integration with cross-platform apps like WhatsApp and Instagram allowed aggregators to reach new social commerce markets in 2025, boosting penetration by 22%.

- 24% of aggregators in 2025 supported hybrid payment models combining cryptocurrency and fiat transactions.

- Aggregators committed to sustainability, with 16% implementing carbon-neutral technologies in 2025.

Frequently Asked Questions (FAQs)

$6.96 billion.

2.5%–3.5% per transaction.

39%.

Conclusion

The payment aggregator industry is evolving at a breakneck speed, redefining how businesses and consumers handle financial transactions. As market growth continues, innovations in AI, blockchain, and open banking are paving the way for a more inclusive financial ecosystem. While regulatory challenges and competition pose hurdles, the industry’s future remains promising, with immense opportunities for businesses ready to adapt and integrate. Whether you’re a small business owner or a global enterprise, embracing payment aggregation could be the key to unlocking new heights.