Nvidia (NASDAQ: NVDA) stands as a defining force not only in the semiconductor industry but in the broader landscape of AI, gaming, and cloud infrastructure. From powering self-driving cars to accelerating AI model training, Nvidia’s footprint is massive and growing. This article digs deep into the latest NVDA stock data, financials, valuation metrics, and performance trends to offer a complete view of how this tech juggernaut is faring.

Editor’s Choice

- Nvidia’s market capitalization surpassed $3.3 trillion in early 2025, making it the second most valuable publicly traded company behind Apple.

- Nvidia’s revenue crossed $88 billion in FY 2025, a new company record.

- The company maintained a net profit margin above 50%, highlighting exceptional operating efficiency.

- Institutional investors now hold over 70% of NVDA shares, underscoring Wall Street’s confidence in the firm.

- Nvidia’s free cash flow topped $28 billion, enabling aggressive R&D and share repurchase initiatives.

- Its data center segment alone generated $52 billion, representing more than half of the company’s total revenue.

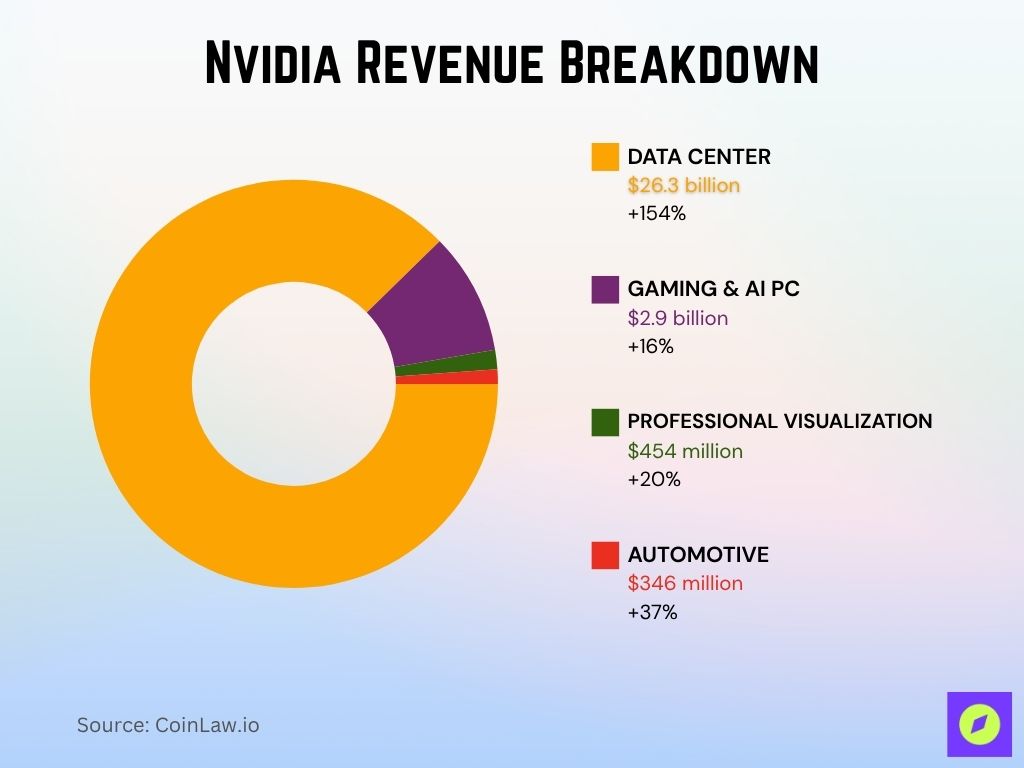

Nvidia Revenue Breakdown

- Nvidia reported a total revenue of $30 billion, marking a massive 122% year-over-year increase in Q2 FY 2025. This showcases Nvidia’s dominant position in the AI and data processing market.

- The Data Center segment generated $26.3 billion, contributing the bulk of earnings with a remarkable 154% growth. This reflects surging demand for AI infrastructure and enterprise-grade GPUs.

- Gaming and AI PC revenue reached $2.9 billion, up by 16% compared to last year. While growth was moderate, the segment still remains a steady performer.

- Revenue from Professional Visualization hit $454 million, registering a 20% increase, driven by creative and enterprise applications.

- Automotive segment pulled in $346 million, achieving a 37% growth, signaling Nvidia’s growing footprint in AI-driven automotive technologies

Nvidia’s Market Capitalization Trends

- Nvidia reached a market cap of $3.3 trillion in Q1 2025, a near 3x increase in two years.

- The company’s valuation has now eclipsed that of Amazon and Alphabet, a milestone few would have predicted five years ago.

- Fueled by massive institutional inflows and AI-driven growth, Nvidia’s daily average market cap growth in late 2024 exceeded $4 billion.

- The company’s PE ratio remained in the 60–75 range, with high expectations baked into its valuation.

- Nvidia briefly surpassed Apple’s market cap for a few days in April 2025 before normalizing below it.

- Nvidia’s trailing 12-month (TTM) revenue growth rate of over 105% contributed heavily to this valuation spike.

- Analysts now value Nvidia using a blend of forward EV/EBITDA multiples and AI infrastructure leadership, reflecting its hybrid role as a hardware and platform company.

NVDA Stock Performance Over the Past Year

- NVDA stock returned over 240% from January 2024 to January 2025, outperforming all major tech indexes.

- Stock hit an all-time high of $1,280 per share in May 2025 before a modest correction.

- The company announced multiple stock buybacks in 2024 totaling $12 billion, boosting investor confidence.

- Daily trading volumes exceeded 50 million shares on several key earnings days in 2024.

- Nvidia’s stock had only 4 negative trading months in 2024, an extraordinary feat for a high-beta tech stock.

- The stock’s beta dropped to 1.3 in early 2025, indicating reduced volatility due to its mega-cap status.

- Nvidia’s inclusion in more defensive and income ETFs added liquidity and stability to NVDA trading patterns.

- Retail investor interest also soared, with NVDA being the most traded stock on Robinhood and Fidelity for 11 straight months.

- The split-adjusted 5-year return now exceeds 3,000%, dwarfing other chip stocks.

- Options trading activity on NVDA ranked in the top 3 for U.S. equities, driven by AI momentum.

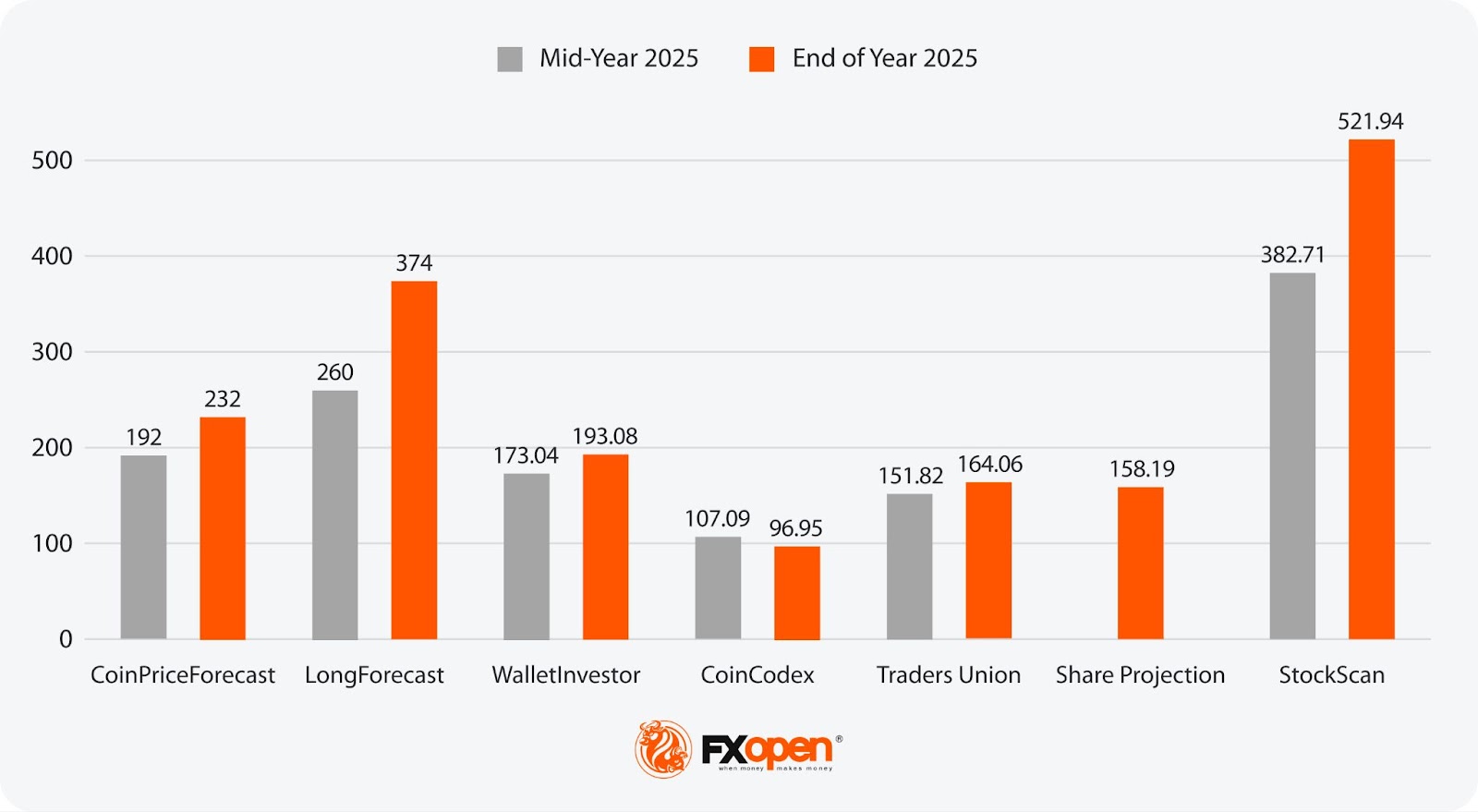

Analytical Nvidia Stock Price Predictions

- CoinPriceForecast expects Nvidia stock to rise from $192 (mid-year) to $232 by the end of 2025, indicating a modest upward trend.

- LongForecast projects a jump from $260 mid-year to $374 by year-end, reflecting strong growth potential.

- WalletInvestor sees Nvidia growing from $173.04 to $193.08, showing steady confidence in performance.

- CoinCodex predicts a slight decline, with stock dropping from $107.09 to $96.95, suggesting a bearish outlook.

- Traders Union expects an increase from $151.82 to $164.06, a conservative but positive forecast.

- Share Projection offers a year-end estimate of $158.19, placing it in the lower-mid range of predictions.

- StockScan gives the most bullish forecast, from $382.71 to $521.94, signaling strong optimism for Nvidia’s stock.

Valuation Ratios

- NVDA’s forward P/E ratio is 70, reflecting investor expectations of continued double-digit growth.

- Its price-to-sales (P/S) ratio stands at 38, higher than historical norms due to strong margin expansion.

- EV/EBITDA ratio is around 60, placing Nvidia at the top end of mega-cap tech valuations.

- The PEG ratio hovers near 1.3, suggesting the current valuation is in line with long-term earnings growth.

- NVDA trades at 8.5x book value, consistent with its asset-light model and IP-driven profits.

- The stock’s free cash flow yield is approximately 0.85%, reflecting a reinvestment-heavy strategy.

- Nvidia’s dividend yield remains under 0.1%, but the focus is squarely on growth and buybacks.

- Analysts argue Nvidia is now a platform company, justifying premium valuation metrics.

- The stock trades at 20–30% above analyst average price targets, suggesting expectations may still be catching up to performance.

Key Financial Metrics Driving NVDA Stock

- FY 2025 revenue exceeded $88 billion, a 44% YoY increase.

- Gross margins rose to 76% in 2025, reflecting pricing power in AI GPUs and software solutions.

- Operating income reached $46 billion, making Nvidia one of the most profitable chipmakers ever.

- Net income surged to over $40 billion, aided by scale and cost efficiency.

- R&D expenditure hit $10.5 billion, up 25% YoY, heavily focused on AI and autonomous platforms.

- Earnings per share (EPS) crossed $15.

- Nvidia reported $36 billion in cash reserves, enabling aggressive capital deployment.

- Capital expenditures increased to $6.2 billion, mainly directed toward AI server infrastructure.

- Return on equity (ROE) remained above 65%, one of the highest in the S&P 500.

- The data center and automotive segments drove more than 75% of profit growth.

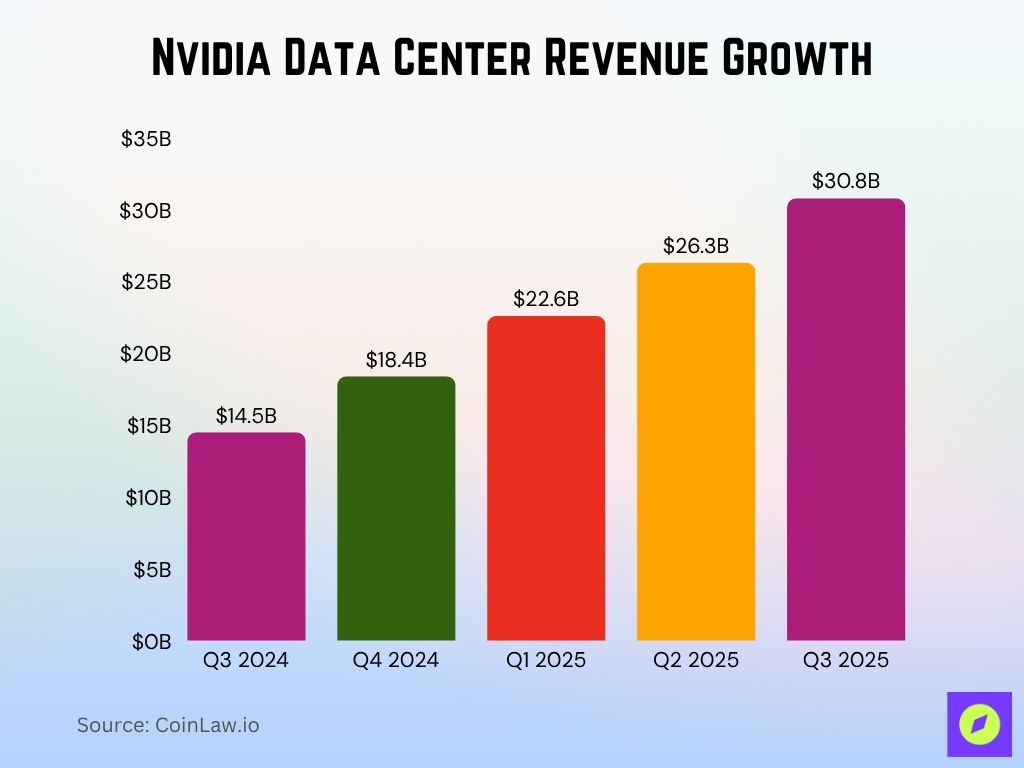

Nvidia Data Center Revenue Growth

- In Q3 2024, Nvidia’s data center revenue stood at $14.5 billion, marking the beginning of a strong growth trend.

- Revenue rose to $18.4 billion in Q4 2024, driven by increasing demand for AI infrastructure and cloud services.

- By Q1 2025, Nvidia reached $22.6 billion, continuing its upward momentum in the data center sector.

- In Q2 2025, revenue surged to $26.3 billion, reflecting the company’s deeper penetration into enterprise and hyperscaler markets.

- Q3 2025 hit a new peak with $30.8 billion, showcasing a 100% year-over-year growth and solidifying Nvidia’s leadership in data center technology.

Financial Efficiency

- Nvidia’s operating margin reached an industry-leading 52% in 2025, well above the semiconductor sector average.

- The company maintains a return on invested capital (ROIC) of 48%, highlighting highly efficient use of shareholder funds.

- Asset turnover ratio stands at 0.94, signaling strong revenue generation from a relatively lean asset base.

- Nvidia’s net profit per employee is now over $1.6 million, a testament to its high-value, knowledge-driven model.

- The SG&A expense as a percentage of revenue dropped to 7.8%, showing lean operational scaling.

- Inventory turnover held steady at 3.2, a healthy sign for a hardware-heavy enterprise.

- Nvidia reduced its days sales outstanding (DSO) to just 28 days, improving cash cycle dynamics.

- The firm’s R&D-to-revenue ratio has been optimized at ~12%, ensuring sustained innovation without eroding profits.

- Operating leverage is evident as revenue growth outpaces expense growth, amplifying margins.

- Its AI software stack, NVIDIA AI Enterprise, now contributes significantly to operating income, offering recurring revenue.

Financial Position

- Nvidia’s cash and equivalents total $36 billion, giving it a fortress-like balance sheet.

- The company has no significant long-term debt obligations, keeping its debt-to-equity ratio below 0.1.

- Total assets reached $94 billion, with a solid mix of current and long-term assets.

- Nvidia’s current ratio is 3.1, well above industry norms, indicating strong liquidity.

- Shareholder equity exceeded $56 billion as of Q1 2025, reflecting compounded retained earnings.

- Despite heavy CapEx, Nvidia maintains a positive net cash position of $25+ billion.

- Nvidia’s working capital efficiency improved, with net working capital up 22% YoY.

- The company’s balance sheet supports potential strategic acquisitions in AI startups.

- Nvidia’s capital adequacy position allows sustained buybacks without debt risk.

- Credit rating agencies reaffirmed Nvidia’s AA+ rating in January 2025, citing strong cash flows and low leverage.

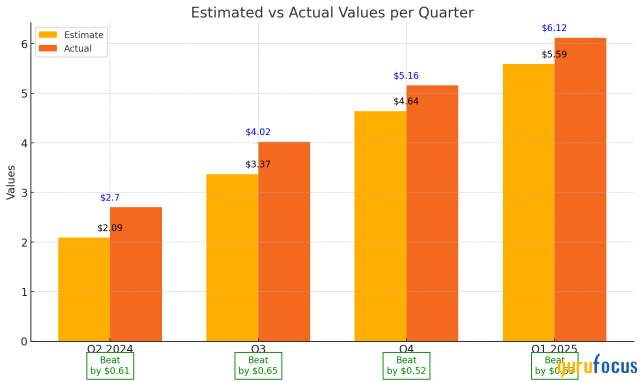

Nvidia Estimated vs. Actual Earnings

- In Q2 2024, Nvidia beat estimates of $2.09 with actual earnings of $2.70, an upside of $0.61.

- Q3 2024 showed continued strength, as actual earnings hit $4.02, exceeding the $3.37 estimate by $0.65.

- For Q4 2024, Nvidia reported $5.16 in earnings versus a $4.64 estimate, beating expectations by $0.52.

- In Q1 2025, actual earnings reached $6.12, surpassing the $5.59 estimate by $0.53, maintaining a consistent trend of outperformance.

Institutional vs. Retail Ownership

- As of 2025, institutional investors hold 71.5% of Nvidia’s outstanding shares.

- Top institutional holders include Vanguard, BlackRock, and Fidelity, each owning over 5%.

- Retail participation remains strong, with NVDA among the top 3 most held stocks on Robinhood and eToro.

- Nvidia’s investor base has expanded globally, with sovereign wealth funds from Norway and Singapore increasing stakes.

- The stock’s inclusion in major ETFs like QQQ, VTI, and SOXX has driven passive investment demand.

- Nvidia conducted over 40 investor roadshows globally in 2024, targeting institutional transparency.

- Retail trading volumes rose sharply after each earnings beat, indicating continued interest from individual investors.

- Nvidia’s stockholder base exceeds 1.3 million, reflecting wide public ownership.

- The company’s ESG ratings have bolstered its appeal to institutional sustainability funds.

- Nvidia offers a comprehensive investor relations portal, which contributed to enhanced visibility and trust.

NVDA Dividend and Share Buyback

- Nvidia’s annual dividend payout remains at $0.16 per share, unchanged for several years.

- While the dividend yield stays minimal (under 0.1%), Nvidia favors buybacks for shareholder returns.

- The company repurchased over $12 billion in shares in 2024 alone.

- A new $25 billion share repurchase authorization was announced in March 2025.

- Nvidia’s buyback strategy has reduced outstanding shares by nearly 2.8% in the past 12 months.

- Share repurchases have been EPS-accretive, significantly lifting per-share earnings.

- Nvidia maintains sufficient cash reserves to continue buybacks without borrowing.

- The firm favors opportunistic buybacks, especially during market corrections.

- Nvidia has kept its payout ratio under 5%, channeling most profits into R&D and CapEx.

- Analysts suggest Nvidia could start modestly increasing its dividend post-2025, especially as revenue stabilizes.

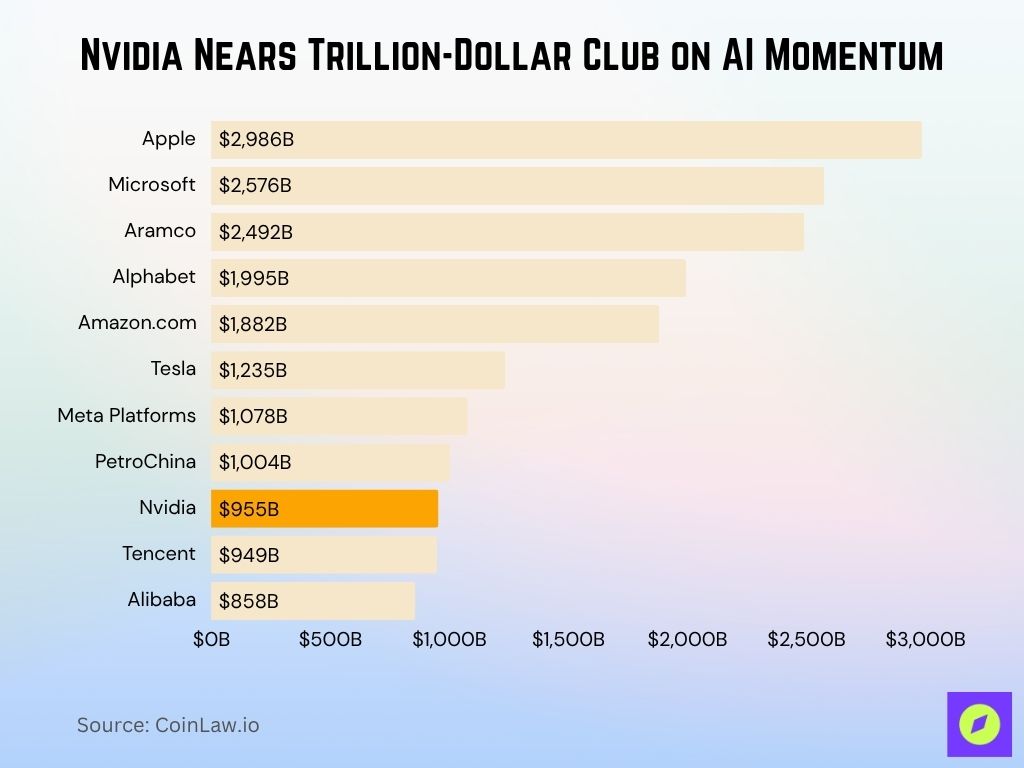

Nvidia Nears Trillion-Dollar Club on AI Momentum

- Apple leads the global peak market cap rankings with a staggering $2,986 billion, holding the crown as the world’s most valuable company.

- Microsoft follows closely at $2,576 billion, driven by its dominance in cloud computing and productivity software.

- Saudi Aramco ranks third with $2,492 billion, reflecting its massive oil revenues and global energy influence.

- Alphabet, Google’s parent company, reached a peak market cap of $1,995 billion, boosted by its ad empire and AI advancements.

- Amazon.com peaked at $1,882 billion, thanks to its e-commerce and AWS cloud services leadership.

- Tesla crossed the $1.2 trillion mark at $1,235 billion, showcasing its strong position in the EV and energy sectors.

- Meta Platforms (Facebook) hit $1,078 billion, driven by social media dominance and metaverse ambitions.

- PetroChina achieved a peak of $1,004 billion, reflecting the strength of China’s state-backed energy sector.

- Nvidia reached $955 billion, based on a share price of $385.99 as of May 25, showing it’s on the brink of joining the trillion-dollar club.

- Tencent and Alibaba reached $949 billion and $858 billion, respectively, highlighting the influence of China’s tech giants.

Nvidia’s Earnings Per Share (EPS) History

- Nvidia’s FY 2025 EPS crossed $15.00, a 51% YoY surge.

- Q4 2024 saw EPS hit $4.10, beating consensus estimates by 22%.

- The company has beaten EPS expectations in 12 consecutive quarters.

- In just three years, Nvidia’s annual EPS has tripled from $5.12 in FY 2022 to over $15 in FY 2025.

- Adjusted EPS growth is largely attributed to data center sales, gross margin expansion, and operational efficiency.

- The company’s EPS CAGR over the past five years now exceeds 35%, one of the highest among S&P 500 companies.

- EPS variability is low, reflecting predictable revenue and operating margins.

- Nvidia’s forward EPS estimate for FY 2026 stands at $18.10, based on continued AI adoption.

- TTM EPS from recurring software services reached $2.4, signaling a transition toward a SaaS-influenced earnings mix.

Stock Volatility and Trading Volume Data

- NVDA’s average daily trading volume in 2025 exceeds 41 million shares, reflecting massive liquidity.

- On earnings days, volume spikes have surpassed 60 million shares, underlining intense investor focus.

- Implied volatility on NVDA options hovers around 45%, higher than peers like AMD or Intel.

- The stock’s historical volatility has decreased from pandemic-era highs to 28%, due to mega-cap stabilization.

- NVDA remains one of the top 5 most traded stocks on the Nasdaq by dollar volume.

- In 2024, options contracts on NVDA were the most traded tech options by retail and institutional investors alike.

- Put/call ratios have leaned bullish, indicating sustained positive sentiment in the options market.

- Nvidia’s beta declined to 1.29 in 2025, reflecting steadier performance.

- Algorithmic trading accounts for over 55% of NVDA’s daily volume, largely driven by momentum and earnings algorithms.

- Post-earnings announcements, the stock experiences average price swings of 6–8%, reflecting market sensitivity to guidance.

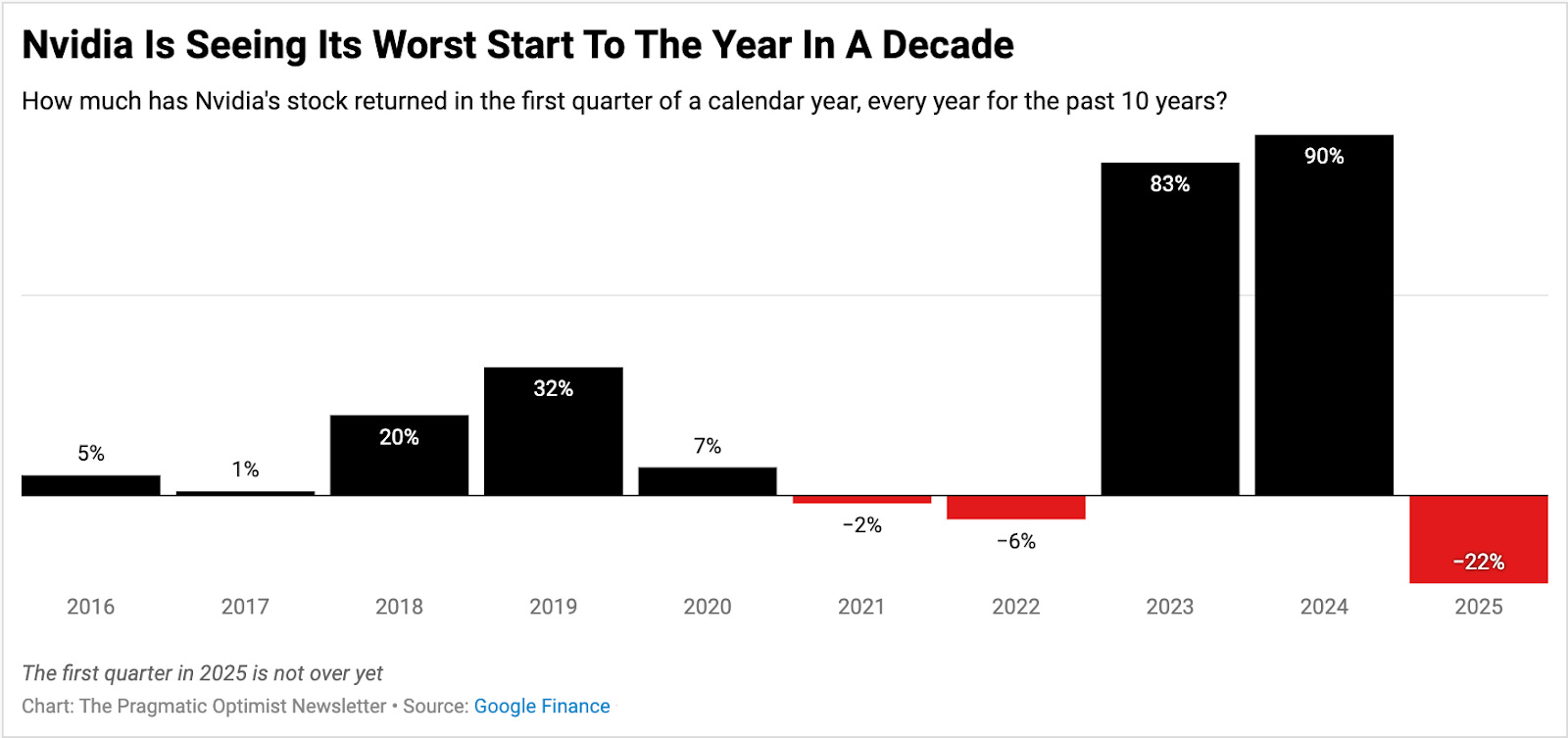

Nvidia’s First-Quarter Stock Returns

- In 2025, Nvidia saw its worst Q1 performance in a decade, with a return of –22%, signaling a sharp investor pullback despite recent AI momentum.

- 2024 delivered Nvidia’s strongest Q1 in 10 years, with an impressive +90% return, followed by +83% in 2023.

- From 2016 to 2020, Nvidia’s Q1 performance remained modest but mostly positive, with returns of +5% (2016), +1% (2017), +20% (2018), +32% (2019), and +7% (2020).

- The stock dipped in early 2021 and 2022, posting –2% and –6% returns respectively, before rebounding strongly in 2023 and 2024.

Nvidia’s Q1 2025 downturn breaks its two-year bullish streak and highlights growing market volatility or correction pressures.

Impact of AI and Data Center Demand on NVDA Stock

- Nvidia’s AI-focused H100 and B100 GPU chips continue to drive unprecedented revenue growth in 2025.

- The data center segment generated over $52 billion, representing 59% of total revenue.

- Over 75% of Fortune 500 companies now deploy Nvidia AI infrastructure.

- Nvidia partners with OpenAI, Meta, Amazon, and Google, securing major AI infrastructure contracts.

- AI training workloads are now responsible for over 40% of GPU unit sales.

- The company’s CUDA ecosystem and AI Enterprise suite are now mission-critical in cloud deployments.

- Nvidia’s DGX Cloud and inference platforms grew 135% YoY, powered by enterprise demand.

- Expansion of AI training clusters by Microsoft Azure and Oracle Cloud further amplifies GPU demand.

- Nvidia’s Grace Hopper Superchips gained traction in hyperscaler and government contracts.

- As AI adoption widens, investors see Nvidia not just as a chipmaker but as an AI platform company, supporting elevated valuation multiples.

Comparison of NVDA Stock with Other Tech Giants

- Nvidia’s market cap of $3.3 trillion now places it ahead of Amazon and Alphabet.

- Over the past 12 months, NVDA returned 240%, while Apple gained 38%, Microsoft 52%, and Amazon 21%.

- Nvidia’s gross margin of 76% exceeds that of Apple (44%) and AMD (51%).

- Nvidia’s forward P/E of ~70 is higher than Microsoft’s (~35) but justified by faster earnings growth.

- Revenue from data centers alone, at $52 billion, is nearing Amazon Web Services’ scale in terms of profitability per dollar.

- Nvidia’s R&D investment as a percentage of revenue (12%) is higher than Alphabet’s, highlighting a focus on cutting-edge tech.

- Unlike Meta or Alphabet, Nvidia generates most of its revenue directly from AI hardware/software integration, a unique position.

- Nvidia’s EPS growth over 3 years (CAGR 35%) beats every major tech competitor.

- Institutional ownership in Nvidia has now surpassed that of Tesla and AMD.

- Nvidia’s balance sheet is more cash-heavy and less leveraged than most large-cap tech firms, giving it resilience.

Nvidia Stock Split and Historical Price Movements

- Nvidia executed a 4-for-1 stock split in 2021, followed by a 10-for-1 split in June 2024, boosting liquidity.

- Post-2024 split, NVDA stock opened at $120 per share, making it more accessible to retail investors.

- Since its IPO in 1999, NVDA has returned over 1,000x to long-term holders.

- From its March 2020 pandemic low, NVDA stock has grown by over 12x, driven by AI and data centers.

- The 2024 stock split was strategic, preceding a major earnings beat and an expansion into retail ETFs.

- The split aligned Nvidia’s share price with average retail trading comfort levels, boosting volume.

- Historical data shows every split year has been followed by a 20–40% price rally in the subsequent months.

- Analysts believe the split helped NVDA attract ESG and retail inflows, amplifying post-split momentum.

- Nvidia is now included in fractional share platforms globally, expanding investor accessibility.

- The company hinted at future split opportunities should price growth continue to outpace trading norms.

Recent Developments Affecting NVDA Stock

- In early 2025, Nvidia launched the Blackwell GPU platform, enabling faster and more energy-efficient AI training.

- Announced a multi-billion dollar partnership with Samsung and TSMC for advanced 3nm GPU manufacturing.

- Nvidia’s acquisition of a robotics software company in January 2025 signaled expansion into autonomous systems.

- Unveiled new generative AI services integrated into Omniverse, expanding Nvidia’s software footprint.

- Signed long-term GPU supply deals with Microsoft, Oracle, and AWS, locking in future revenue streams.

- Increased investments in edge AI and automotive computing, boosting next-gen revenue channels.

- Regulatory greenlight for expanding in China through joint ventures, mitigating past geopolitical concerns.

- Nvidia introduced a carbon-neutral initiative for data center products, appealing to ESG-focused investors.

- Expanded partnerships with universities for AI research, ensuring a steady pipeline of AI talent and innovation.

- Launched a beta version of Nvidia Cloud Studio, a creative suite aimed at content developers and AI creators.

Conclusion

Nvidia has transcended its origins as a graphics card maker to become a central pillar of the global AI infrastructure. Its explosive growth, driven by AI, cloud computing, and platform economics, has propelled it into a league of its own. With stellar financials, rising institutional support, expanding product lines, and bullish analyst coverage, NVDA stock shows few signs of slowing down. As we look ahead, Nvidia remains a compelling narrative, part tech titan, part innovation engine, and fully embedded in the future of AI-driven enterprise.