Nubank has rapidly evolved from a fintech disruptor into one of Latin America’s largest digital financial institutions. Its scale, efficiency, and innovation set benchmarks not only in Brazil but across global markets. With an expanding customer base and a growing portfolio of financial services, Nubank impacts sectors ranging from retail banking and credit to AI-driven underwriting and ESG finance. From reshaping access to financial products in Mexico to deploying real-time fraud detection via AI, the company’s influence is widespread. This article presents a comprehensive, statistics-driven look into Nubank’s recent performance, product diversification, and future trajectory.

Editor’s Choice

- In Q3 2025, Nubank’s Brazil customer base exceeded 107 million, representing more than half of the country’s adult population.

- The company reported $4.2 billion in revenue in Q3 2025, up 39% YoY.

- Monthly activity rates exceeded 83% across active customers.

- The efficiency ratio reached 27.7% in Q3 2025, a leading performance indicator.

- Deposits reached $38.8 billion in Q3 2025, up 34% YoY.

- In Brazil, Nubank’s customer base exceeded 107 million, serving over 60% of adults.

- The average monthly cost to serve an active customer was under $0.80.

Recent Developments

- Nubank filed for a U.S. banking charter in 2025, aiming to expand beyond Latin America.

- In Q3 2025, net income reached $783 million, showcasing operational profitability.

- AI implementation boosted credit limit allocation accuracy and fraud prevention.

- Nubank launched NuInsurance and NuCel to diversify into insurtech and telecom.

- Mexico and Colombia’s customer bases exceeded 15 million combined.

- Nubank added NuTravel and NuShopping to increase ecosystem integration.

- The company emphasized ESG efforts, including financial literacy initiatives and environmental sustainability.

- Nubank was listed on TIME’s 100 Best Companies for 2025.

- Interest-earning portfolio reached $17.7 billion in Q3 2025, up 54% YoY.

- Revenue for FY2024 hit $11.5 billion, marking a 58% YoY increase.

Global Neobanking Market Growth Outlook

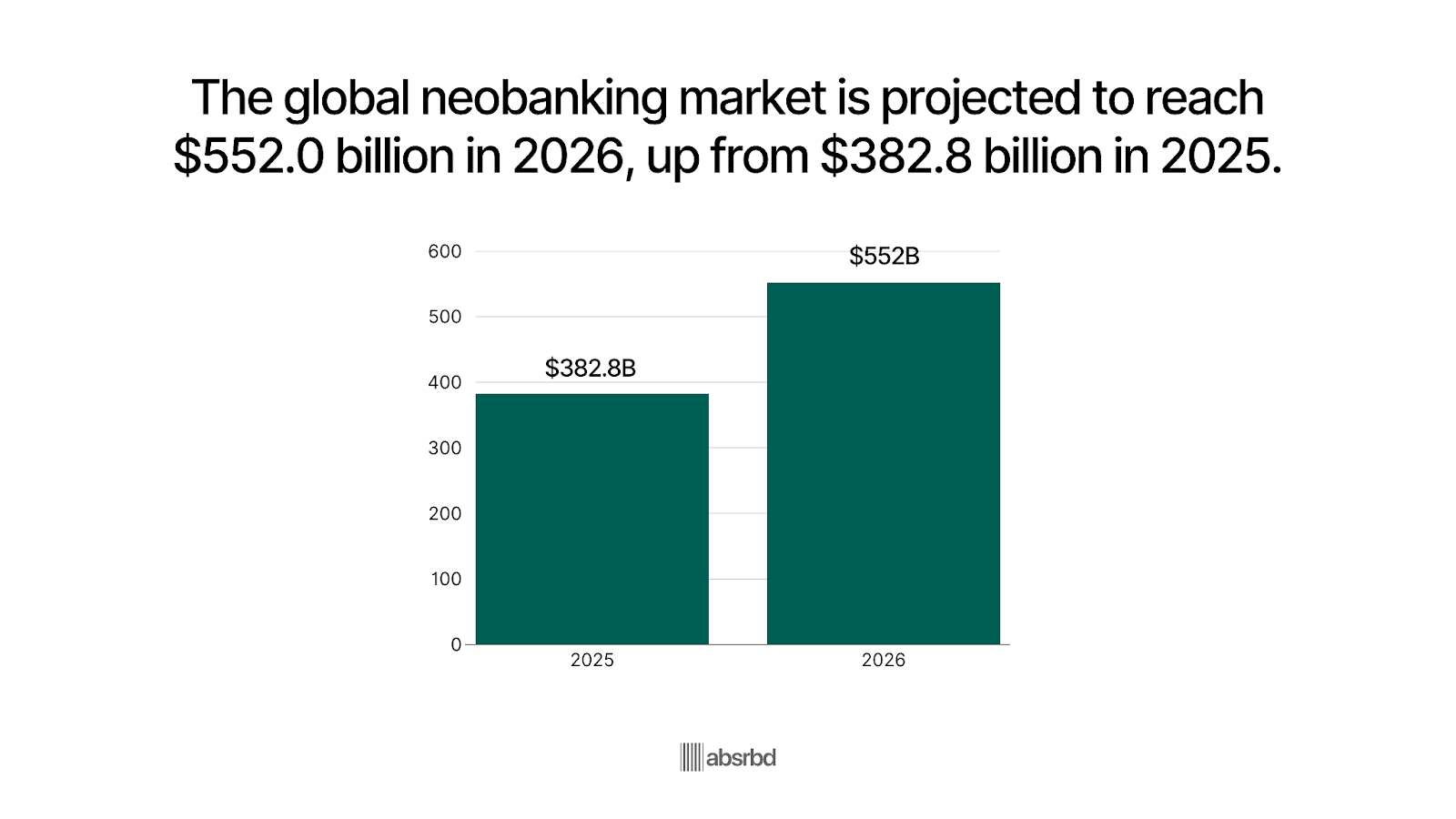

- The global neobanking market is projected to reach $552.0 billion in 2026, highlighting rapid expansion across digital-first banks.

- Market size is expected to grow from $382.8 billion in 2025 to $552.0 billion in 2026, showing strong year-over-year momentum.

- This represents an absolute increase of $169.2 billion in just one year, underscoring the accelerating adoption of neobank services.

- Growth is driven by mobile-first banking, rising financial inclusion, and increasing demand for low-cost digital financial services worldwide.

What Is Nubank?

- Nubank is a Brazil-based neobank offering credit cards, checking accounts, personal loans, and investment services.

- Founded in 2013, it is now one of the largest digital banks in the world by customer count.

- Nubank serves 127 million customers across Brazil, Mexico, and Colombia.

- Q3 2025 revenue reached a record $4.2 billion, up 39% YoY FX-neutral.

- Net income hit $783 million in Q3 2025, with 31% annualized ROE.

- Customer deposits grew to $38.8 billion, up 34% YoY FX-neutral.

- Credit portfolio expanded to $30.4 billion, increasing 42% YoY FX-neutral.

- Gross profit totaled $1.8 billion with a 43.5% margin in Q3 2025.

- ARPAC rose to $13.4, up 20% YoY, reflecting deeper engagement.

- Cost-to-serve remains low at $0.70 per active customer.

- The efficiency ratio improved to 27.7% amid rapid scaling.

- Added 4.3 million net new customers in Q3 2025 alone.

User Demographics and Segmentation Statistics

- Brazil remains the core market, with 107 million customers, representing over 60% of the adult population.

- Mexico accounts for about 12 million users, capturing a significant share of younger demographics.

- By mid‑2025, Nubank’s Colombia user base reached approximately 3.4 million, contributing to a combined 15+ million customers across Mexico and Colombia.

- 55% of Nubank’s total users are between the ages of 18 and 35.

- Female users account for 46% of the total customer base.

- Over 85% of customers interact monthly, highlighting high engagement.

- The digital-first model attracts tech-savvy and mobile-centric populations.

- Nubank maintains relatively low customer acquisition costs due to its digital virality.

- Urban and semi-urban users dominate the customer base, but penetration in rural markets is growing.

Digital Usage and App Performance Statistics

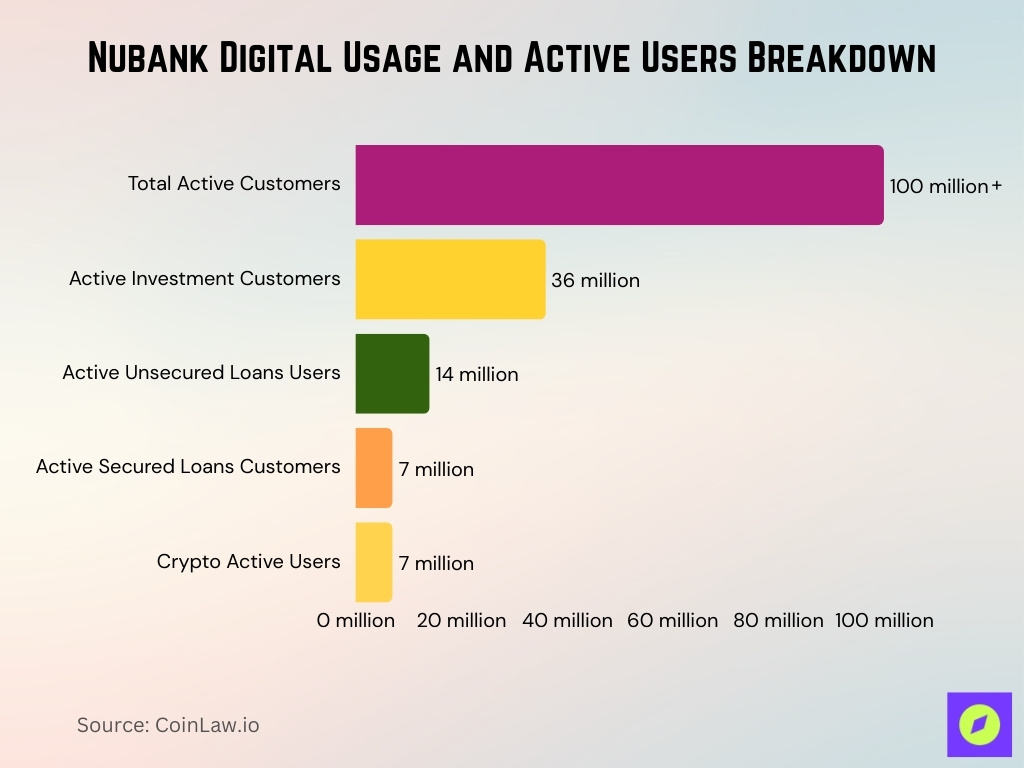

- 100+ million active customers surpassed a milestone in Q2.

- 36.2 million active investment customers, up 70% YoY.

- 13.6 million active unsecured loans users, up 56% YoY.

- 6.8 million active secured loans customers, up 158% YoY.

- 6.6 million crypto active users, growing 41% YoY.

- Monthly activity rate exceeds 83% for 127 million customers.

- 105 million monthly active users with $13.4 ARPAC in Q3.

- Q2 activity rate at 83.2% for 122.7 million total customers.

- Long-tenured ARPAC reaches $27.3 for 8+ year customers.

Customer Engagement and Activity Statistics

- Nubank’s customer activity rate in Q3 2025 was above 83%.

- The average customer used at least three Nubank products per month.

- ARPAC (Average Revenue Per Active Customer) increased steadily throughout 2025.

- Over 75% of customers use the mobile app weekly.

- The mobile app recorded a 4.8-star rating on app stores in 2025.

- Customers log in an average of 18 times per month.

- Real-time notifications, bill tracking, and goal-setting tools are among the top-used features.

- Pix transactions account for 60% of fund transfers within the Nubank ecosystem.

- The number of monthly active users surpassed 99 million in 2025.

- Engagement increased with the rollout of personalized recommendations and in-app tools.

Product and Service Mix Statistics

- The credit card portfolio grew 24% YoY FXN, representing 67% of credit revenue.

- Personal loans share reached one-third of the total credit portfolio.

- Secured loans expanded 200% YoY FXN within the lending segment.

- Unsecured loans increased 70% YoY FXN.

- Over 20 million active lending contracts across products.

- Ultravioleta eSIM provides 10GB non-expiring international data.

- NuCel plans start at 15GB for R$45, with unlimited WhatsApp.

- 29 million customers gained their first-ever credit card via Nubank.

- Lending portfolio totals $5.7 billion, up 97% YoY FXN.

- Credit cards reached $15.2 billion, up 33% YoY FXN.

Competition and Market Share Statistics

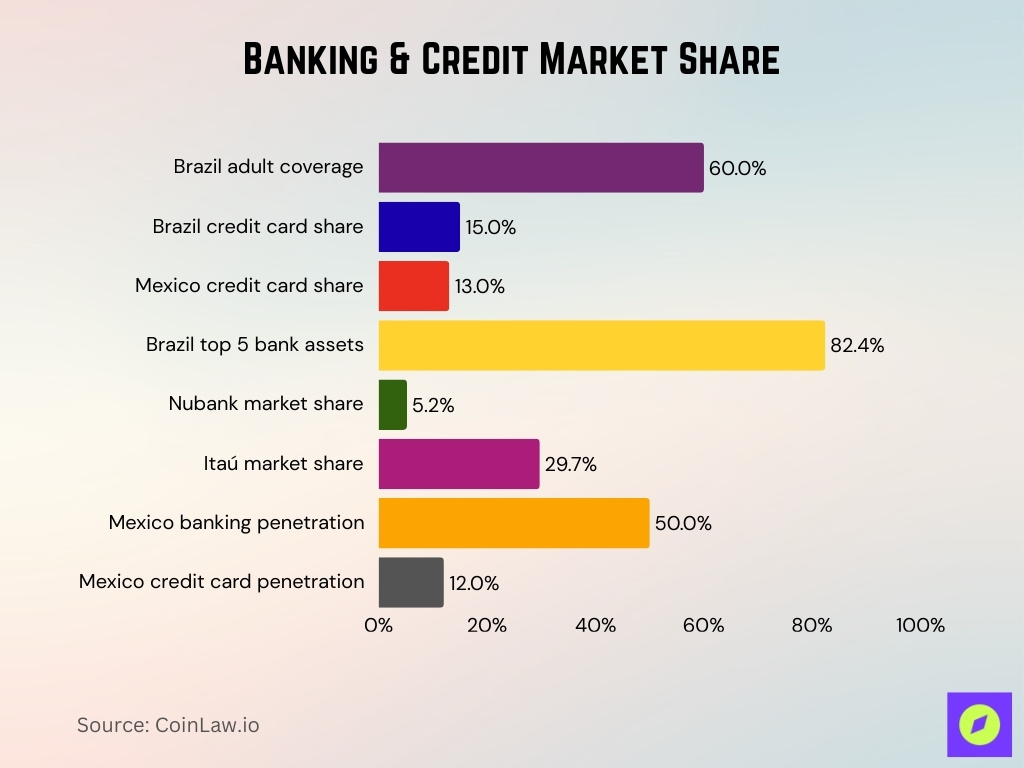

- Brazil’s adult population coverage is at 60% with 110 million customers.

- Mexico serves 1 in 4 banked customers, 12 million total.

- Colombia reaches 1 in 10 adults, 4 million customers.

- Brazil’s credit card market share is at 15%, room to double.

- Mexico credit card customers 6.3 million, 13% population.

- Brazil banking assets share by top 5 incumbents: 82.4%.

- Nubank digital customers: 17.3 million, 5.2% market share.

- Itaú Unibanco holds 29.7% market share with 15.2 million digital users.

- Mexico’s banking penetration is 50%, and credit cards are 12%.

Credit Card and Lending Portfolio Statistics

- Nubank’s total credit portfolio reached $30.4 billion in Q3 2025, up 42% YoY.

- The interest-earning portfolio (IEP) expanded 54% YoY to $17.7 billion in Q3 2025.

- In Q2 2025, card and loan receivables were $27.3 billion, up 40% YoY.

- Nubank’s Q1 2025 credit portfolio was $24.1 billion, reflecting 40% growth YoY.

- Default rates (90+ days) rose modestly to around 6.6% in mid-2025, consistent with seasonal patterns.

- Early delinquency (15-90 days) was about 4.4% in Q2 2025, showing disciplined asset quality.

- Credit cards remain central to lending growth, supporting both unsecured personal credit and purchase financing through app channels.

- Growth in lending has accompanied broader product adoption across Brazil, Mexico, and Colombia.

- Credit offerings and underwriting enhancements with AI have helped boost card limits and usage.

- Nubank often ranks first in Brazil for the number of customers with credit products among lenders.

Deposits and Funding Statistics

- Total deposits reached $38.8 billion in Q3 2025, up 34% YoY FXN.

- Q2 2025 deposits hit $36.6 billion, growing 41% YoY FXN.

- Q1 2025 deposits increased to $31.6 billion, up 48% YoY FXN.

- Deposits support $30.4 billion credit portfolio expansion.

- IEP grew to $17.7 billion alongside a deposit surge.

- Brazil deposits dominate, with Mexico at $3.3 billion+.

- Cost of funding improved to 89% of interbank rates in Q3 2025.

- Q2 2025 funding cost stood at 91% of blended interbank rates.

- Q1 2025 funding cost was 90% of blended interbank rates.

ESG, Sustainability, and Social Impact Statistics

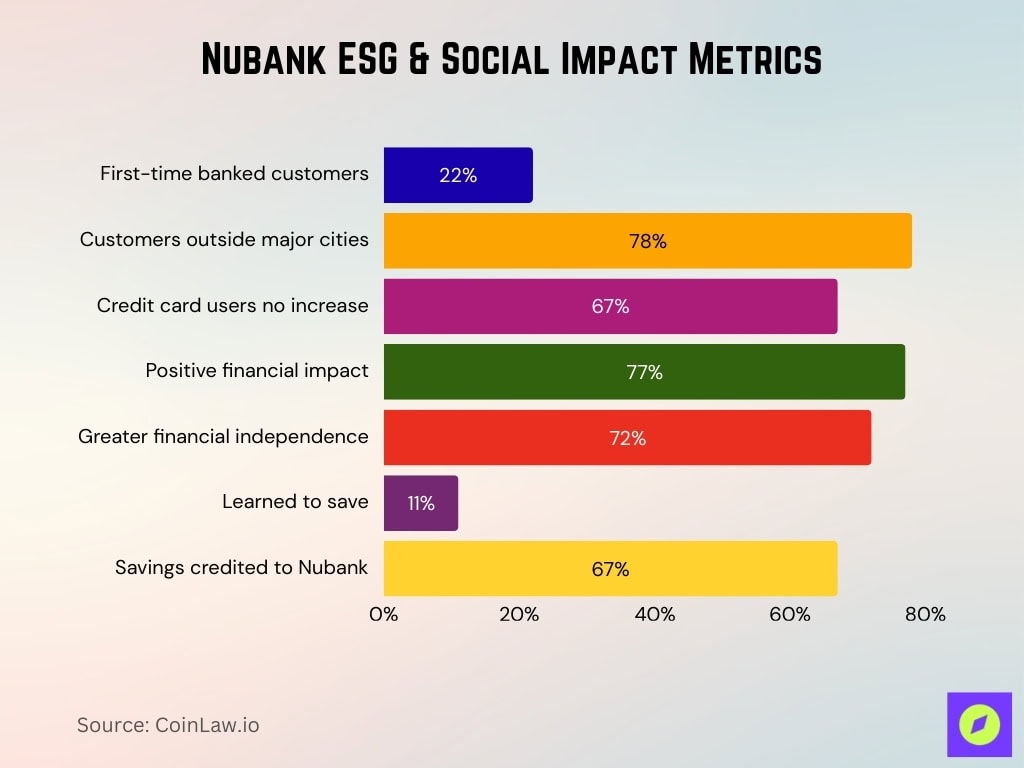

- Customers saved $8 billion in bank fees in 2022.

- Avoided 248 million hours in lines/phone waits over 5 years.

- 3.8 million people are financially included in Brazil alone.

- 22% of Mexico customers had their first banking relationship.

- 78% Mexican customers are outside large urban centers.

- 67% credit card users saw no increase.

- 77% reported a positive financial life impact.

- 72% gained greater financial independence.

- 11% learned to save, 67% credited Nubank.

Revenue and Income Statistics

- Nubank reported $4.2 billion in revenue in Q3 2025, up 39% YoY.

- Total net income in Q3 2025 was $783 million, a strong year-over-year rise.

- Q2 2025 revenue reached $3.7 billion, up 40% YoY.

- In Q1 2025, Nubank generated $3.2 billion in revenue, expanding 40% YoY.

- Net interest income hit $2.3 billion in Q3 2025, a 32% YoY increase.

- Gross profit reached $1.8 billion in Q3 2025, up 32% YoY; margin improved to 43.5%.

- Sustained revenue growth signals enhanced monetization and product uptake.

- Revenue expansion was balanced between interest and fee-based income.

- Increased customer engagement directly contributed to top-line growth across geographies.

Profitability and Margin Statistics

- Net income rose to $783 million in Q3 2025, a 39% YoY increase, reflecting strong profitability.

- Return on equity (ROE) reached 31% in Q3 2025, exceeding industry averages.

- Gross profit margin improved to 43.5%, up from 41.2% YoY, showcasing operational leverage.

- Nubank delivered $1.8 billion in gross profit in Q3 2025, driven by revenue growth and cost controls.

- Operating income margin increased to 24.6%, highlighting disciplined expense management.

- The company achieved net income growth for six consecutive quarters, reinforcing profitability consistency.

- Cost-to-income ratio dropped to 27.7%, reflecting one of the lowest in the industry.

- Improved product cross-sell contributed to margin expansion across customer segments.

- Net interest margins (NIM) exceeded 15% on a risk-adjusted basis, supporting returns on lending assets.

- The combination of high engagement and product usage has underpinned sustained earnings growth.

Assets, Equity, and Balance Sheet Statistics

- Nubank’s total assets reached $49.5 billion in Q3 2025, up 25% YoY.

- Shareholder equity stood at $11.3 billion, a stable foundation for growth.

- Cash and cash equivalents totaled approximately $2.1 billion, providing ample liquidity.

- Total liabilities were $38.2 billion, largely comprising customer deposits and debt obligations.

- The company maintained a Tier 1 capital ratio above regulatory minimums, ensuring solvency.

- Asset growth closely tracks deposit and loan portfolio expansion.

- Nubank’s loan-to-deposit ratio remains below 80%, showing conservative lending practices.

- Deferred tax assets and goodwill remained stable, indicating no material impairments.

- Retained earnings grew YoY as profitability continued to rise.

- Nubank’s balance sheet strategy emphasizes liquidity, simplicity, and digital scalability.

Stock Performance and Shareholder Statistics

- Nu Holdings (Nubank’s parent) is publicly traded on the NYSE, offering Class A ordinary shares to global investors.

- Q3 2025 revenue of $4.2 billion and $783 million net income drove a stock price rise of roughly 3% in post-market trading.

- A strong annualized return on equity (ROE) of ~31% in Q3 2025 supports shareholder returns and investor confidence.

- Shares gained positive sentiment with net income beating analyst forecasts coming into late 2025.

- Nu’s book value and stable earnings-per-share (EPS) metrics signal valuation support for long-term holders.

- Stock performance has reflected Nubank’s rapid earnings growth and profitable scaling through 2025.

- Institutional and retail investors track key performance indicators like ARPAC and activity rates linked to share valuations.

- Nubank’s listing in the Russell 1000 index increases visibility to U.S. equity funds.

- Analyst coverage often highlights Nubank’s competitive margins and customer scale as positive drivers for market sentiment.

Unit Economics and Efficiency Statistics

- Nubank’s efficiency ratio improved to 27.7% in Q3 2025, showing enhanced productivity and reduced cost per dollar earned.

- The monthly average cost to serve an active customer remained low at around $0.80 as of mid-2025, reflecting strong operational leverage.

- Gross profit margins expanded to 43.5% in Q3 2025, indicating more revenue retained after direct costs.

- Risk-adjusted net interest margin (NIM) rose to 9.9% in Q3 2025, highlighting quality returns on the lending book.

- Nubank maintains lower operating expenses relative to many traditional banks, which often report cost/income ratios near 45–50%.

- Active customer engagement supports higher ARPAC trends, lifting unit economics.

- Increasing cross-sell of products (credit cards, loans, savings) drives incremental revenue per customer.

- Nubank’s scalable digital model enables economies of scale as the customer base grows.

Geographic Footprint and Market Penetration Statistics

- Nubank operates primarily in Brazil, Mexico, and Colombia, with strong penetration in each.

- By mid-2025, Nubank served over 107 million customers in Brazil, equivalent to more than 60% of the adult population.

- In Mexico, Nubank reached about 12 million customers, representing roughly 13% of the adult population.

- In Colombia, the customer base was around 3.4 million, nearing 10% market share in adult banking segments.

- Nubank’s deposits in Mexico grew significantly, with roughly $6.7 billion in local funding by mid-2025.

- Colombian deposits spiked year-over-year, increasing by around 841% as of Q2 2025.

- International expansion efforts include applying for a U.S. national bank charter in 2025, signaling next-phase growth outside Latin America.

Innovation, Technology, and AI Adoption Statistics

- Ingests 1 trillion logs daily from thousands of services.

- Processes 1 petabyte of data daily with 45-day retention.

- Stores 45 petabytes of searchable logs for analysis.

- Engineers run 15,000 queries scanning 150 petabytes daily.

- In-house logging platform cuts costs by 50% vs vendor.

- Processes petabytes of data daily for secure banking.

- 120+ professionals in the Information Security BU.

- 1,300 employees support cloud-native operations.

- Hyperplane acquisition accelerates AI-first foundational models.

Frequently Asked Questions (FAQs)

Nubank serves approximately 60 % of Brazil’s adult population through its digital banking services.

The monthly average cost to serve per active customer remained below $1.00, at $0.90 in Q3 2025.

Total deposits reached $38.8 billion in Q3 2025, marking a 34 % YoY increase.

Conclusion

Nubank’s statistical landscape shows a company that has scaled its digital banking model across Latin America with strong customer growth, robust financial performance, and efficient operations. Key metrics like activity rates, revenue expansion, and profitability reinforce its competitive edge. Expansion efforts, including strategic moves toward the U.S. market, signal ambition beyond traditional geographies. Nubank’s commitment to innovation, ESG practices, and shareholder value underscores why it stands out in global fintech trends and sets the stage for future growth.