Neteller remains one of the most enduring digital wallets and online payment solutions in the fintech space. Since its launch in 1999, it has expanded into a global platform enabling secure money transfers, merchant payments, and cross‑border transactions. Today, millions of users rely on Neteller to move money online, fund trading accounts, and pay for digital services across borders.

Its impact spans everyday consumers, forex traders, and online businesses alike, from facilitating seamless deposits on trading platforms to offering digital payments for international freelancers. Explore the key Neteller stats that show how it continues to shape digital finance.

Editor’s Choice

- About 2.5 million users worldwide are served via Neteller, spanning personal and business transactions.

- Neteller operates in more than 200 countries and territories around the world.

- The platform processes roughly $7 billion in annual transaction value.

- In the global mobile‑wallet market, Neteller holds an estimated ~2.12% share.

- Over 3,400 merchants globally accept Neteller payments.

- In merchant solutions and digital wallets combined, Paysafe (Neteller’s parent) saw a 6% organic revenue increase in Q3 2025.

- Online finance platforms place Neteller in the top 200 finance sites worldwide.

Recent Developments

- Paysafe reported 6% organic revenue growth in digital wallet offerings, including Neteller, in Q3 2025 compared with 2024.

- Adjusted EBITDA for Paysafe’s digital wallet unit rose 11% year‑over‑year.

- New product initiatives are underway to expand wallet and digital banking integrations.

- Ongoing efforts to optimize portfolio and sales capabilities aim to broaden consumer engagement.

- Neteller’s digital wallet services continue to integrate with fintech partners worldwide.

- Customer reward and cashback promotions ran through early 2025, incentivizing first transactions.

- Regulatory compliance adjustments continue worldwide to maintain cross‑border service access.

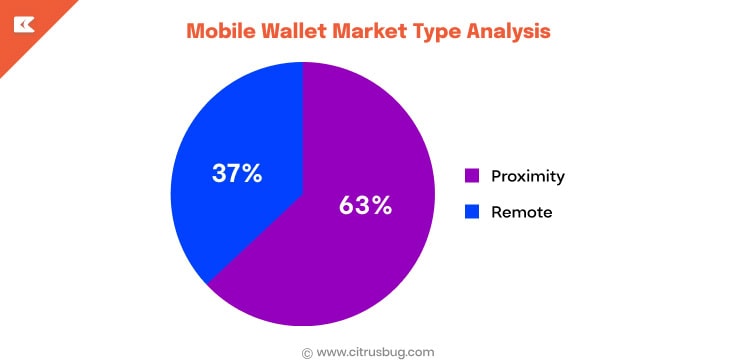

Mobile Wallet Market Type Analysis Insights

- Proximity mobile wallets dominate the market, accounting for 63% of total mobile wallet usage, driven by widespread NFC-enabled payments and in-store transactions.

- Remote mobile wallets hold a 37% market share, reflecting strong usage in e-commerce, online bill payments, and digital services.

- The higher share of proximity wallets highlights growing consumer preference for contactless and point-of-sale mobile payments.

- Remote wallet adoption remains significant, supported by rising online shopping, subscription services, and cross-border digital transactions.

What is Neteller?

- Neteller is a digital wallet and online payment platform established in 1999.

- Part of Paysafe Group reporting Q3 2025 revenue of $433.8 million.

- Digital Wallets segment, including Neteller, generated $194.4 million in Q4 2024.

- Supports payments in more than 20 currencies worldwide.

- Features enhanced security with an average user rating of 3.9/5.

- Verified accounts are trending for faster transactions in 2026.

- Available in over 100 countries with mobile app support

Neteller User Base and Growth

- Serves approximately 2.5 million active users globally.

- Available in over 200 countries and regions.

- Supports 22 currencies for international transfers.

- Handles more than $7 billion in yearly transactions.

- Partners with over 3,400 merchants worldwide.

- Holds 2.12% market share in digital payments.

- Used by 204 companies as of 2025.

- Digital Wallets revenue grew 8% to $205.7 million in Q3 2025.

- Verified accounts trending with higher limits in 2026.

- Global rank #53,407 with strong finance category presence.

Neteller Account Types and Verification Levels

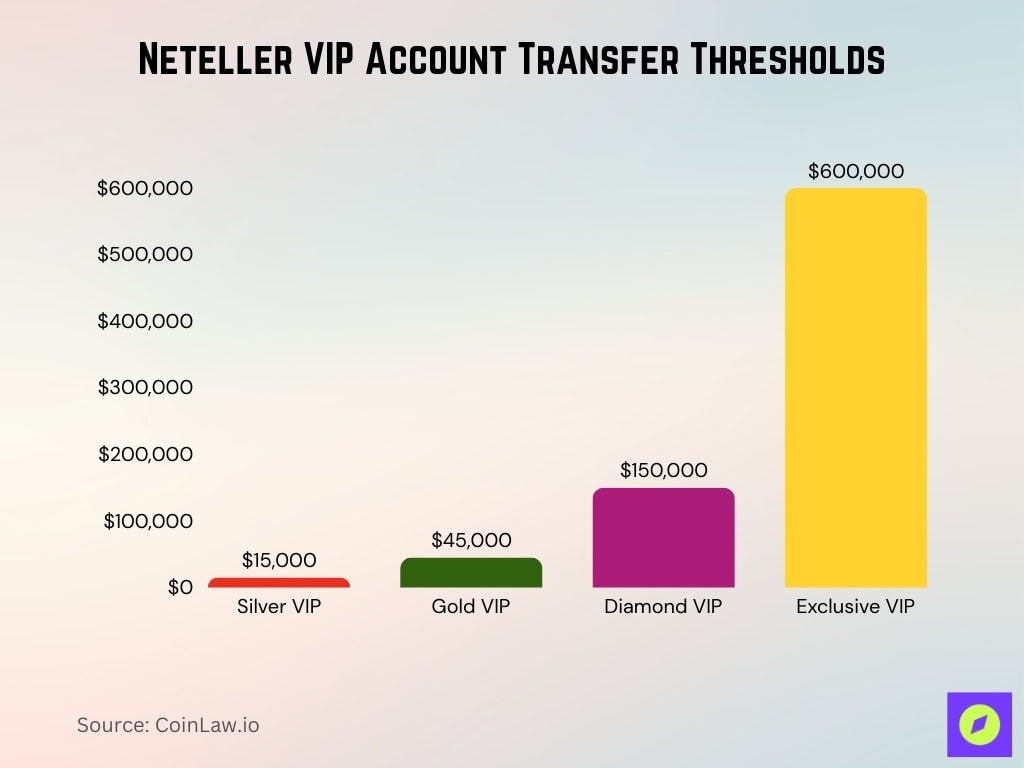

- Silver VIP requires $15,000 merchant/crypto transfers quarterly.

- Gold VIP threshold at $45,000 for quarterly transfers.

- Diamond VIP demands $150,000 quarterly transfers.

- Exclusive VIP needs $600,000 quarterly transfers.

- VIP FX fees range 1.30%-3.19% by level.

- Crypto fees are 1.30%-1.50% for buy/sell transactions.

- Supports 28+ currencies in verified wallets.

- Verification is processed within 24 hours, typically.

Supported Countries and Regions

- Available in all countries on the account registration form drop-down.

- Services 200+ jurisdictions worldwide.

- Supports 22 currencies across supported regions.

- Lists 22 European countries, including Austria, Belgium, France, and Germany.

- Crypto services are available in 60+ countries, like Argentina, Australia, and Brazil.

- No new registrations from India, but existing accounts are active.

- No new accounts from Russia, Belarus, Donetsk, or Luhansk regions.

- U.S. consumers are supported with limited business accounts.

- Europe and the UK fully support the Net+ card for payments and ATMs.

Age and Demographic Profile of Neteller Users

- The minimum age requirement is 18 years for all accounts.

- 66% of fast payment users are active in the finance category.

- 60 customers with 100-249 employees use Neteller.

- Forex trading leads with 22 customers, and poker has 12.

- 77% positive reviews from 13 users, averaging 3.9/5 rating.

- 34% iGaming players are aged 18-34, 40% aged 35-54.

- Online gambling male users hold a 69% share.

- 25-40 years segment accounts for 53.13% in online gambling.

- 81 heat score and 65 growth score as of 2025.

Deposit and Withdrawal Statistics

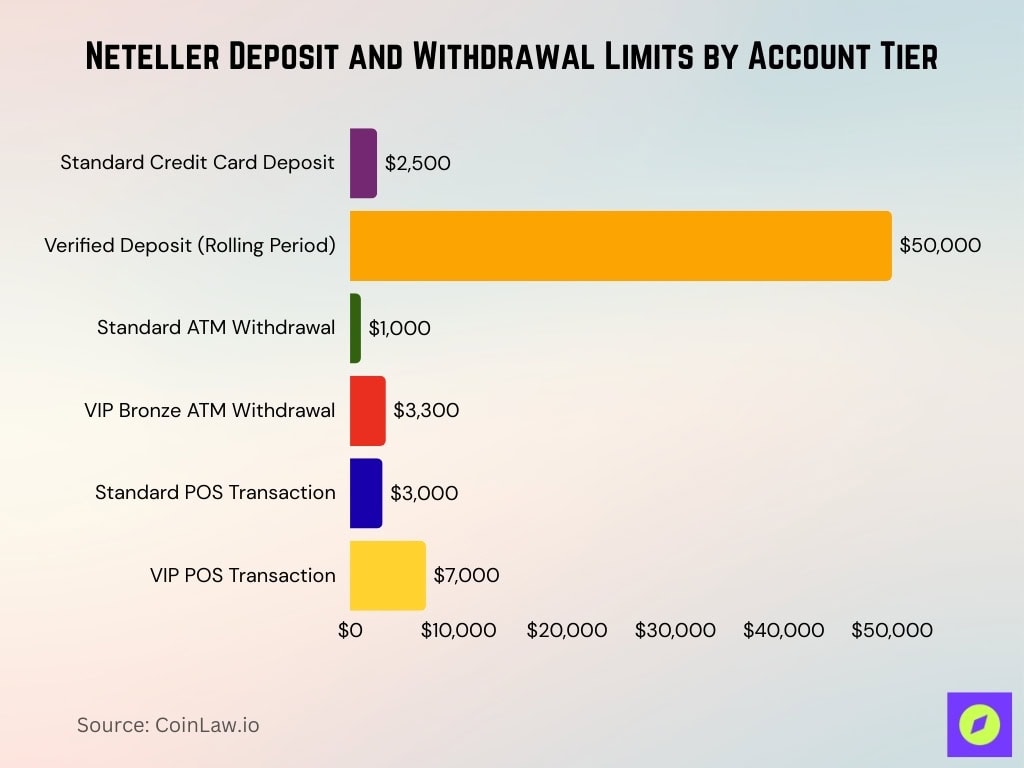

- Standard daily deposit limit up to $2,500 via credit card.

- Verified daily deposit reaches $50,000 rolling period.

- ATM withdrawal limit $1,000 daily for standard users.

- VIP Bronze ATM limit increases to $3,300 daily.

- POS transaction limit $3,000 daily for standard.

- VIP POS limit $7,000 daily.

- Bank withdrawal minimum $20-$40 per transaction.

- Bank maximum withdrawal $100,000 per transaction.

- Withdrawal to the bank typically takes 1-3 business days.

Transaction Volume and Value

- Neteller contributes over $7 billion in yearly transactions.

- Digital Wallets revenue hit $205.7 million in Q3 2025, up 8%.

- Digital Wallets showed 4% organic revenue growth YTD 2025.

- Q3 2025 revenue totaled $433.8 million, up 2% YoY.

- Adjusted EBITDA grew 7% to $127 million in Q3 2025.

- Supports 260 payment types across 48 currencies.

- 10% volume increase reported in Q3 2025.

- Neteller.com ranks top 200 in finance traffic globally.

Merchant and Business Adoption

- Over 3,400 merchants globally accept Neteller payments.

- Merchant Solutions revenue reached $232.2 million in Q2 2025.

- Merchant Solutions’ organic growth hit 7% in Q3 2025.

- Supports 260+ payment methods for merchant integrations.

- Access to 40+ currencies enhances merchant flexibility.

- 60 companies with 100-249 employees use Neteller.

- 57% of merchants report higher checkout conversion with wallets.

- 53% of merchants gain new customers via digital wallets.

- Forex brokers lead with 22 merchant customers.

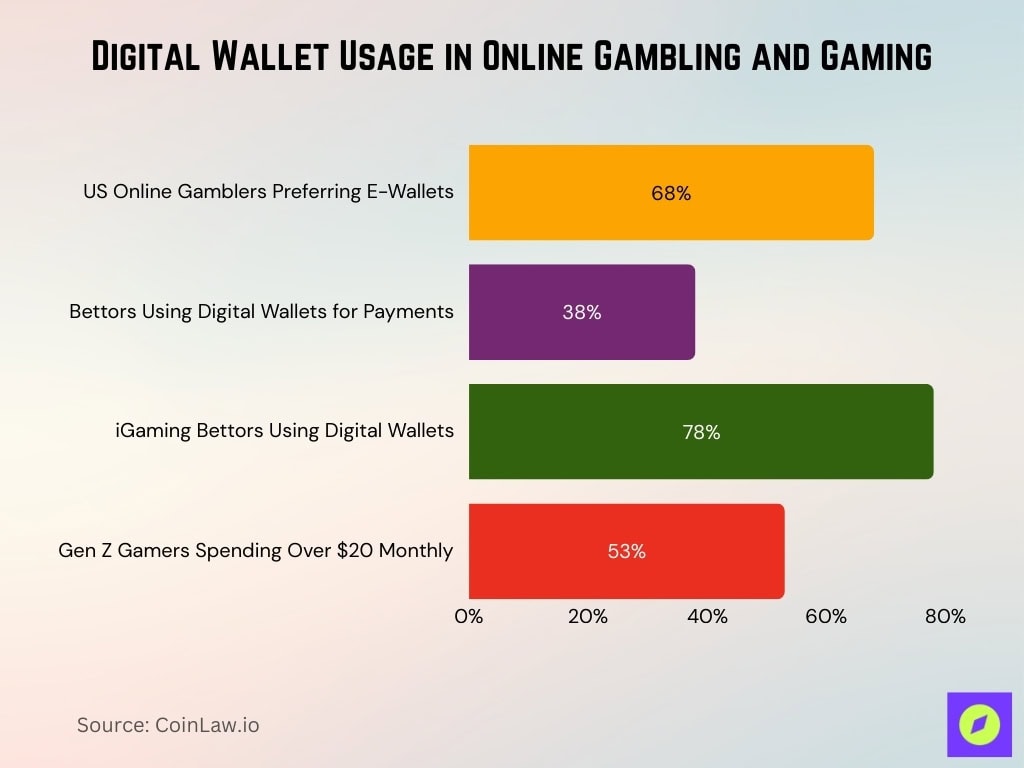

Online Gambling and Gaming Usage

- 68% of US online gamblers prefer e-wallets like Neteller.

- 38% of bettors use digital wallets for gaming payments.

- 78% of bettors utilize digital wallets in iGaming.

- 53% Gen Z gamers spend over $20 monthly on in-game purchases.

- Paysafe iGaming merchant volume grew 8% in Q3 2025.

- Digital wallets generated $190.9 million in iGaming revenue in Q3 2025.

- 50%+ iGaming expansion drove double-digit bookings growth in Q3 2025.

- 7.3 million active Digital Wallet users, including gaming.

Usage in Forex and Trading Platforms

- Accepted by top 10 forex brokers, including eToro, Oanda, and Forex.com.

- Supports 22 forex broker merchant customers.

- Available in 130 countries via the CMC Markets partnership.

- Enables instant deposits for FX, commodities, indices, and shares trading.

- 75.5% of Pepperstone retail accounts lose money using Neteller.

- 74-89% retail CFD accounts lose money at IC Markets.

- Partners with CMC Markets for 35+ years of trading experience.

- Forex CFD fees are low with EUR/$avg 0.93 pips at Fusion Markets.

- Access over 60 currency pairs via Forex.com Neteller integration.

Usage by Industry and Sector

- 22 merchants in the forex trading sector.

- 12 merchants in poker and online gaming.

- 10 merchants in auctions and e-commerce.

- Serves sectors including education, health, insurance, and investing.

- 204 companies across retail, services, and entertainment.

- Supports 260+ payment types in 120 markets.

- Processes transactions in 40+ currencies across multiple industries.

- iGaming drives 8% merchant volume growth in Q3 2025.

Fees and Cost Structure

- Neteller charges a standard transfer fee of about 2.99% + $0.50 for many wallet transactions, for Standard accounts.

- International transfers can cost up to 4.99%, depending on region and currency movement.

- Sending funds internally to other Neteller users typically carries a 2.99% fee (min. $0.50).

- Receiving money on Neteller is generally free, which supports peer‑to‑peer usage.

- Deposits often incur a 2.50% fee, though larger deposits, e.g., $20,000+, may avoid this cost.

- Net+ Prepaid Mastercard has a $10 annual fee, with ATM usage at 1.75% and foreign exchange charges.

- Some withdrawal methods, e.g., to a bank or card, may range up to ~3.99% or fixed currency costs.

- Regional and account tier, Standard vs True or VIP, can alter fee structures and conversion costs.

Card (Net+ Card) Usage Statistics

- The Net+ Prepaid Mastercard lets users spend online or in‑store wherever Mastercard is accepted.

- Net+ cards are used for in‑store purchases, online shopping, and ATM cash withdrawals globally.

- The Net+ card supports instant wallet spend without needing direct bank account integration in some regions.

- ATM withdrawals incur a 1.75% fee, while purchases in shops or restaurants remain free of direct charges.

- Annual maintenance cost for the Net+ card is $10, a modest fee relative to global prepaid card competitors.

- Foreign exchange costs and ATM fees represent a significant portion of card‑related revenue.

- Virtual and physical card options allow users flexibility for everyday spending or travel.

- Card usage complements wallet transactions by enabling offline merchant acceptance.

Mobile App Usage Statistics

- Mobile wallets like Neteller continue gaining relevance as mobile internet usage rises worldwide.

- Neteller holds an estimated ~1.83% share of the global mobile‑wallet market, competing within a crowded category.

- Integrated mobile features include balance checks, instant transfers, and transaction histories on Android and iOS.

- App review platforms rate Neteller’s ease of use around 3.9/5 in 2026, indicating moderate user satisfaction.

- Users cite fast payment processing and simple login as key mobile app advantages.

- Some users report occasional account access and customer support challenges through mobile interfaces.

- Mobile usage drives increased transaction frequency as digital wallets replace traditional methods.

- App adoption is particularly strong among younger, tech‑savvy cohorts who transact regularly on the go.

Customer Satisfaction and Ratings

- Neteller’s overall user rating on GetApp sits at ~3.9/5, suggesting mixed but generally positive reviews.

- Around 77% of reviewers offer positive feedback on transaction speed and reliability.

- Ease of use and wallet convenience are frequent highlights in user reviews.

- Some users report challenges with account access, fund release, or service responsiveness.

- Ratings vary across platforms, reflecting differences in user expectations and regional support.

- Customer service quality scores tend to be lower than core features’ scores, indicating room for improvement.

- Likelihood to recommend ratings hover in the mid‑range on software review sites.

- Wallet reliability in payment processing is cited as a strong point by many users.

Security, Fraud, and Chargeback Statistics

- 128-bit SSL encryption secures all transactions.

- Two-factor authentication protects every account login.

- The chargeback fee stands at £25 per incident.

- Non-compliance fee set at $60 per violation.

- The prohibited transaction fee reaches $60.

- Incorrect reversal fee $25 per attempt.

- Anti-fraud systems detect unusual activity automatically.

- 14 years max prison for money mule fraud convictions.

- Biometrics enhance fraud detection models.

Frequently Asked Questions (FAQs)

Neteller holds an estimated 2.12% market share in the mobile wallet category.

3 countries (United States 31.21%, United Kingdom 22.70%, Malta 10.64%) are the leading customer markets for Neteller mobile wallets.

Neteller services account registrations in 200+ countries worldwide.

Paysafe supports payments across 48 different currencies.

Conclusion

Neteller remains a key player in digital wallets, offering versatile payment options, global reach, and competitive services for individuals and businesses alike. From multi‑tier accounts and prepaid cards to mobile experiences and integration with broader payment ecosystems, it continues adapting to digital finance trends.

While customer satisfaction reflects some challenges in support and accessibility, its core strengths lie in seamless wallet transactions and broad merchant acceptance. Understanding its fees, usage patterns, and security features helps users make informed decisions in a crowded fintech landscape and invites deeper exploration of how Neteller compares with other payment solutions.