The Nasdaq 100 Index stands as one of the most influential U.S. equity benchmarks, tracking the market performance of the largest non‑financial companies listed on the Nasdaq stock exchange. Its composition and performance offer a clear view into how innovation‑led, growth‑oriented stocks are moving global markets. In the U.S., this index often serves as a proxy for tech sentiment, impacting everything from portfolio allocation to derivatives pricing. Across sectors like AI, cloud computing, and consumer tech, the Nasdaq 100’s movements directly influence investor decision‑making and risk models. Explore the statistics below to understand how the index is positioned and why it matters to markets worldwide.

Editor’s Choice

- The Nasdaq-100 Index (NDX) rose 8.8% in Q3 2025 and was up ~17.5% YTD through September.

- The 10‑year average return through Q3 2025 stands at ~15.4% annualized.

- The total return version of the Nasdaq‑100 (XNDX) showed an approximate. 23.9% gain YTD as of 09/30/2025.

- Nasdaq‑100 contains the 100 largest non‑financial companies by market cap on Nasdaq.

- At least 81% of Nasdaq‑100 firms beat earnings estimates by weight in Q3 2025.

- Analysts flagged possible removals and reshuffling of certain Nasdaq‑100 constituents in the 2025 annual rebalance.

- Nasdaq’s revamped risk‑oriented intraday volatility index design was announced for upcoming distribution.

Recent Developments

- Nasdaq-100 set new all-time highs, closing at 23,958.47 on October 29.

- Index achieved 22.05% YTD return as of December 26.

- Nasdaq-100 rose 8.8% in Q3, contributing to a 17.5% YTD gain.

- 81% of reporting Nasdaq-100 firms beat Q3 earnings estimates by index weight.

- Nasdaq-100 net income grew 16% year-over-year in Q3.

- Major hyperscalers planned $400 billion in Capex for AI infrastructure.

- Nasdaq introduced the Intraday 35% Volatility Compass 6% Decrement Index variant.

- QQQ cap-weighted outperformed equal-weighted QQQE by 4.65% points YTD.

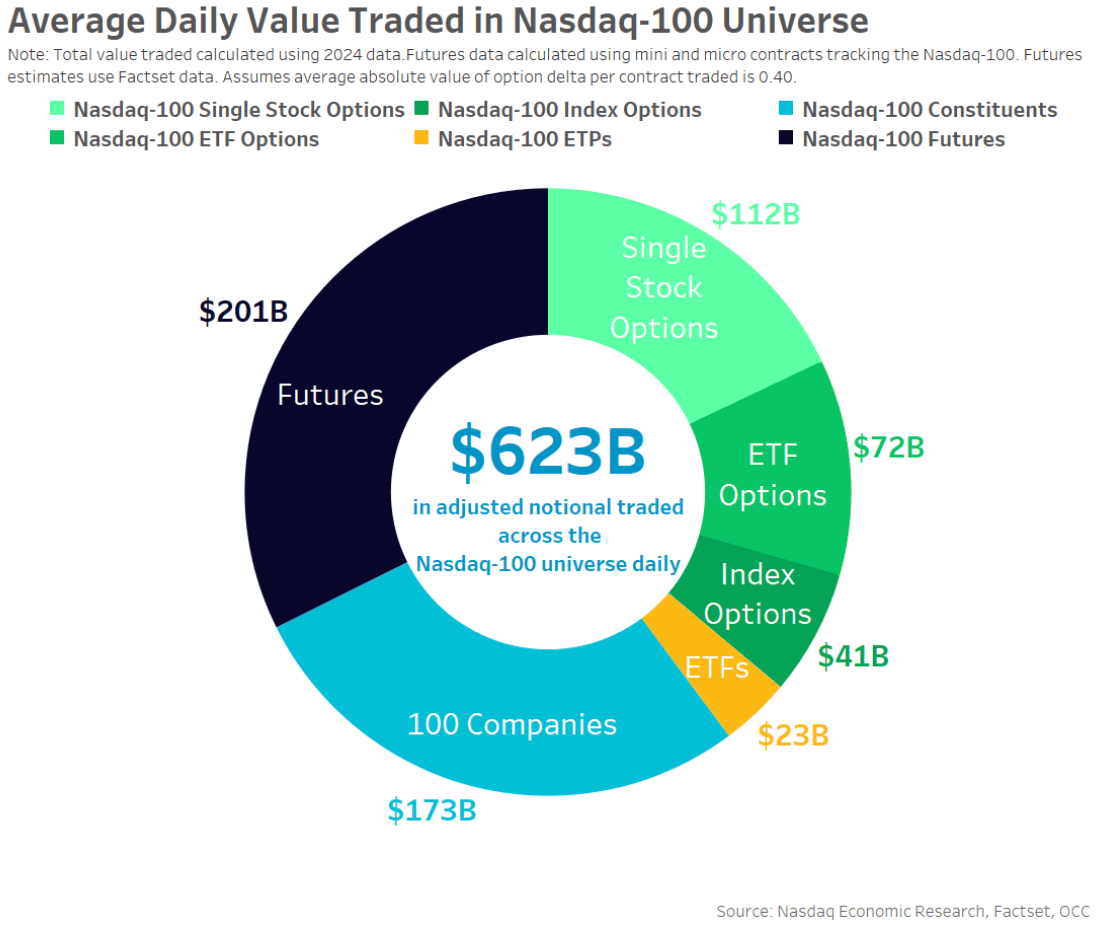

Average Daily Value Traded Across the Nasdaq-100 Universe

- The Nasdaq-100 ecosystem processes $623 billion in adjusted notional value daily, highlighting its role as one of the world’s most liquid equity universes.

- Nasdaq-100 futures dominate trading activity at $201 billion per day, making them the single largest contributor to overall turnover.

- Trading in the 100 underlying Nasdaq-100 companies totals $173 billion daily, reflecting heavy institutional and retail participation.

- Single stock options generate $112 billion in daily value, underscoring strong demand for equity-specific hedging and speculation.

- ETF options account for $72 billion per day, driven by active trading in Nasdaq-linked exchange-traded funds.

- Index options contribute $41 billion daily, supporting macro-level exposure and volatility strategies.

- Nasdaq-100 ETPs represent $23 billion in average daily value, completing the derivatives and cash-market trading mix.

Nasdaq 100 Key Facts

- The Nasdaq‑100 Index comprises 100 large non‑financial stocks listed on Nasdaq.

- It excludes financial institutions from focusing on growth sectors.

- Historically, over 500 firms have been part of the index at various times since 1985.

- Only four companies (Apple, Costco, Intel, and PACCAR) have remained continuously since inception.

- The index uses a modified market‑cap weighting system.

- Nasdaq‑100’s total return version is denoted XNDX.

- Monthly performance has had double‑digit returns in several 2025 periods.

- By September 2025, quarterly return data showed positive performance majority of the year.

Index Methodology and Calculation

- Nasdaq-100 employs a modified capitalization-weighted methodology.

- No single issuer weight exceeds 20% at quarterly rebalance Stage 1.

- Aggregate weight of issuers over 4.5% capped at 40% in Stage 2 adjustment.

- The top 75-ranked companies are selected for annual reconstitution inclusion.

- Five largest securities aggregate weight is limited to 38.5% annually.

- Quarterly rebalances occur in March, June, and September.

- Annual reconstitution is effective in December each year.

- Index includes up to 100 constituents from eligible Nasdaq listings.

- Weights use TSO-derived market capitalization calculations.

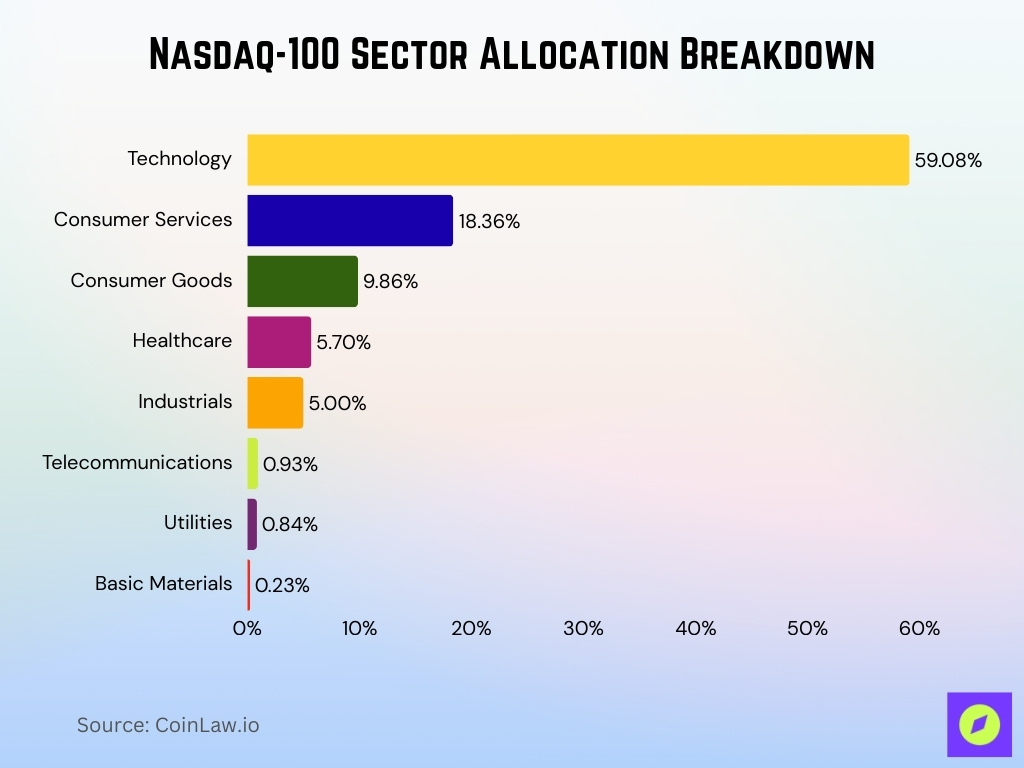

Nasdaq-100 Sector Allocation Breakdown

- Technology dominates the Nasdaq-100 at 59.08%, confirming the index’s heavy concentration in software, semiconductors, and digital platforms.

- Consumer Services represent 18.36% of the index, driven by e-commerce, streaming, and online platform companies.

- Consumer Goods account for 9.86%, reflecting exposure to discretionary spending and branded product leaders.

- Healthcare holds a 5.70% share, providing limited but important defensive diversification within the index.

- Industrials contribute 5.00%, capturing logistics, aerospace, and advanced manufacturing firms.

- Telecommunications make up just 0.93%, indicating minimal exposure to traditional telecom operators.

- Utilities represent 0.84%, underscoring the Nasdaq-100’s low defensive and income-oriented tilt.

- Basic Materials stand at only 0.23%, highlighting the index’s near-absence of commodity-driven businesses.

Eligibility Criteria and Inclusion Rules

- Companies must list exclusively on Nasdaq Global Select or Global Market.

- Non-financial classification required per ICB standards.

- Securities need 3 full calendar months of trading history.

- Minimum 3-month average daily traded value of $5 million USD.

- Free float requirement stands at 10% minimum.

- Annual eligibility review during December reconstitution.

- 200,000 shares minimum average daily volume.

- Current quarterly and annual reports are mandatory.

- No inclusion for companies in bankruptcy proceedings.

Historical Performance and Returns

- The Nasdaq‑100 Index finished Q3 2025 up 8.8% and ~17.5% YTD, continuing strong returns for the year.

- Over the past decade, the Nasdaq‑100’s 10‑year average return was ~15.4% annualized as of September 2025.

- Historical data show double‑digit annual returns in multiple years of the past decade.

- Nasdaq‑100’s performance in 2025 outpaced many broad U.S. equity benchmarks through early December.

- By mid‑December 2025, the index recorded a ~20.6% YTD price return.

- Daily closing values moved from ~24,647 in mid‑December to ~25,656 by Dec 24, 2025, illustrating upward movement.

- Despite lateral swings, the index generally remained above key long‑term support levels throughout 2025.

- 2025 returns have reflected broad gains in technology and consumer growth sectors.

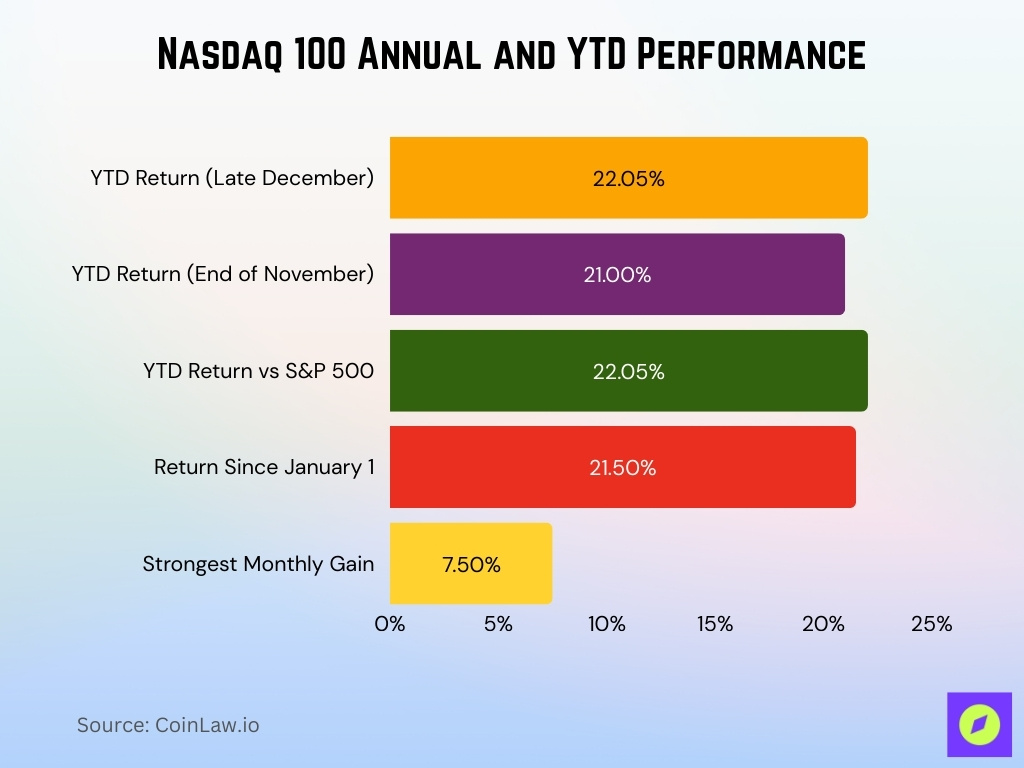

Nasdaq 100 Annual and YTD Performance

- Nasdaq-100 delivered a 22.05% YTD return as of late December.

- Index posted 21% YTD gain through November end.

- Year-to-date performance reached 22.05% surpassing the S&P 500.

- The index achieved a 21.5% return since January 1.

- Nasdaq-100 rallied 7.5% in its strongest monthly period.

- Six-month returns reflected recovery from mid-year dips.

- December trading volume averaged 8.2 billion shares daily.

- Index closed at 23,576.49 on December 9 peak.

Drawdowns and Volatility Metrics

- Nasdaq‑100 experienced significant drawdowns in 2025, including a mid‑year drop of ~25%.

- Spring volatility weighed on returns, with sharp intra‑year swings.

- The CBOE Nasdaq‑100 Volatility Index (VXN) hovered near ~20.7 in Dec 2025, above long‑term lows, indicating elevated volatility.

- Historical volatility readings in 2025 exceeded averages seen in prior years.

- Intraday drawdowns often reversed, showing resilience after steep declines.

- Market swings reflected broader geopolitical and macroeconomic uncertainty influencing equities.

- Drawdowns of the spring underscored the impact of tariff uncertainties on tech‑heavy indexes.

- Despite volatility, the index maintained an overall upward trajectory for 2025.

Constituent Turnover and Rebalancing

- Annual reconstitution added 6 companies, including Alnylam Pharmaceuticals and Monolithic Power Systems.

- Six firms removed: Biogen, CDW, GlobalFoundries, Lululemon, ON Semiconductor, and The Trade Desk.

- Changes effective prior to market open on December 22.

- Reconstitution announcement made after close on December 12.

- Nasdaq-100 supports over 200 tracking products globally.

- Index backs more than $600 billion in assets under management.

- Reference data used from the end of October and November shares outstanding.

- Rebalancing prompted an estimated $50 billion trading volume.

- Turnover represented about 11% two-way portfolio adjustment.

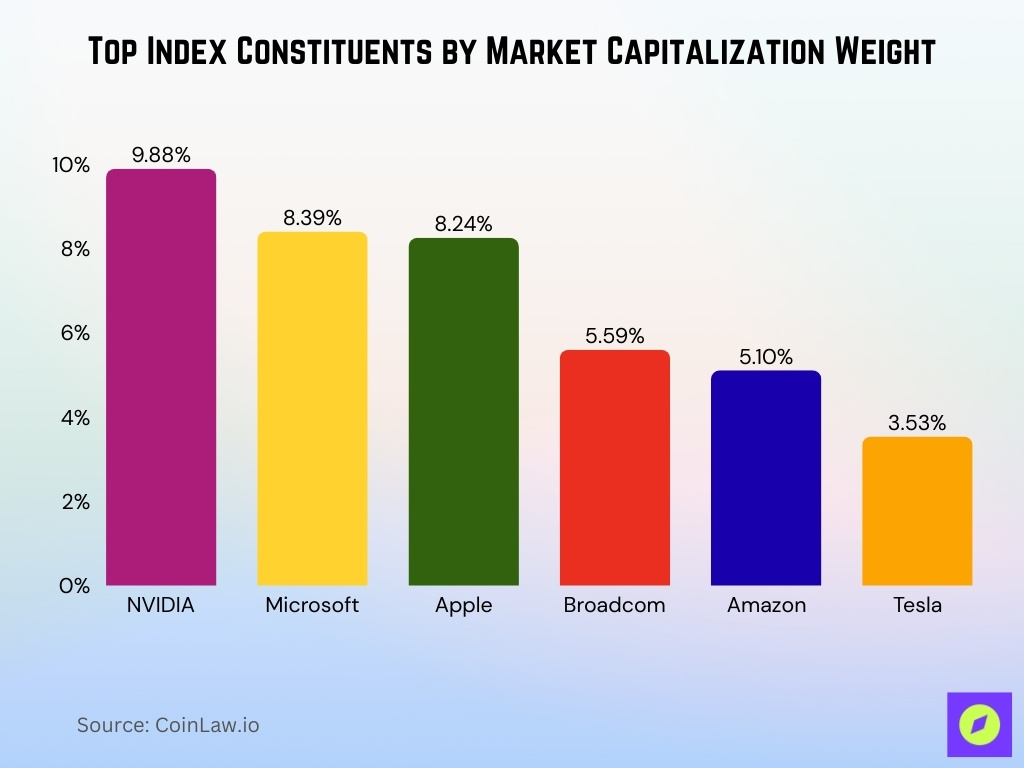

Market Capitalization and Weighting

- Microsoft held 8.39% weight as of September 30.

- Apple maintained 8.24% index weighting.

- NVIDIA led with 9.88% largest constituent share.

- Broadcom occupied a 5.59% position among the top weights.

- Amazon comprised 5.10% of the total index market cap.

- Tesla accounted for 3.53% weighting.

- The top 10 constituents represented over 50% cumulative weight.

- Total Nasdaq-100 market capitalization reached $33.88 trillion.

Dividend Yield and Income Metrics

- QQQ reported a 0.45% dividend yield with $2.79 annual payout.

- Invesco QQQ’s 12-month distribution rate reached 0.49%.

- NEOS Nasdaq-100 High Income ETF delivered a 13.64% forward yield.

- ProShares IQQQ showed a 10.34% 12-month distribution rate.

- QQQ’s ex-dividend date fell on December 22 with a quarterly payout.

- QQQ payout ratio stood at 14.37% of earnings.

- NEOS QQQI has generated a 31.61% cumulative return since inception.

- QQQ’s dividend growth declined 1.81% over the past year.

- Defiance QQQY posted a 35.19% distribution rate as of November.

Futures, Options, and Derivatives Activity

- E-mini Nasdaq-100 futures averaged $239 billion in daily volume.

- Open interest reached 264,085 contracts in active futures.

- 0DTE options comprised around 55–60% of SPX index options volume in 2025.

- Similar short‑dated contracts account for roughly 40–45% of overall options activity, but they do not reach a majority of total US stock trading volume.

- Options trading hit a record 110 million contracts on October 10.

- 0DTE activity tripled over the past 3 years in Nasdaq products.

- E-mini Nasdaq-100 options call premium totaled $11.5 million.

- Nasdaq-100 futures contract multiplier stands at $20 per index point.

- Micro E-mini offers a 1/10th size of standard E-mini contracts.

- 0DTE options exceeded 60% of total US stock trading volume.

Nasdaq 100 ETFs and ETPs

- Invesco QQQ managed $358 billion in assets.

- Invesco QQQM held $55.6 billion AUM with a 0.15% expense ratio.

- iShares Nasdaq-100 CAD-Hedged ETF posted a 21.58% YTD return.

- Nasdaq-100 underpins over 200 tracking products globally.

- Index ETP AUM exceeded $829 billion at the end.

- Invesco QQQ Innovation Suite reached $474.7 billion AUM.

- QQQ averaged 42 million daily volume over the recent month.

- XQQ delivered 28.29% 1-year total return.

- QQQM showed 17.97% YTD performance at NAV.

Frequently Asked Questions (FAQs)

The Nasdaq‑100 posted an approximate 22.05% YTD return as of Dec. 26, 2025.

A total of about 526 companies have been Nasdaq‑100 constituents historically.

The index closed at about 25,656.15 points on Dec. 25, 2025.

Approximately 81% of firms exceeded earnings estimates by index weight in Q3 2025.

Conclusion

The Nasdaq‑100 Index continued to serve as a key barometer for U.S. growth and technology leadership. Its turnover dynamics reflect active reshaping of the market as companies enter and exit based on performance and eligibility rules. Dividend metrics remain modest but diversified through income‑oriented products. Meanwhile, derivatives and ETFs tied to the index support sophisticated trading, hedging, and investment strategies for institutions and retail investors alike.