In the world of investing, high share prices often command attention, but they don’t always justify admiration. Some of the market’s most expensive stocks are also its weakest earners, bleeding losses despite lofty valuations. For investors chasing momentum or prestige tickers, this paradox can be a costly trap. Whether driven by hype, future speculation, or a broken business model, these underperformers show that price alone doesn’t equal performance, especially when profits are nowhere in sight.

Key Takeaways

- 1Several highly valued companies reported hundreds of millions in losses, despite strong brand visibility or sector buzz.

- 2A high market cap or rapid revenue growth doesn’t guarantee earnings success.

- 3Stocks in EVs, biotech, crypto, and cloud tech are showing widening gaps between valuation and profitability.

- 4Investors must look past hype and monitor net income trends, R&D spending, and the timeline to profitability.

- 5Learning to spot the disconnect between revenue and earnings can help protect long-term portfolio growth.

Understanding the “Expensive but Failing” Profile

Below defines a stock with inflated valuation and weak earnings: These often attract attention through hype or growth potential, yet consistently fall short on profitability and cash flow.

- Negative net income across multiple quarters

- Earnings-per-share (EPS) consistently below expectations or in the red

- Misalignment between revenue growth and cost control

- Heavy cash burn through R&D or infrastructure

- Ongoing reliance on investor capital or dilution to stay afloat

This imbalance is especially prevalent in innovation-heavy sectors where the promise of future growth often overshadows present-day financial performance.

Top 5 High-Priced Stocks That Flopped on Earnings

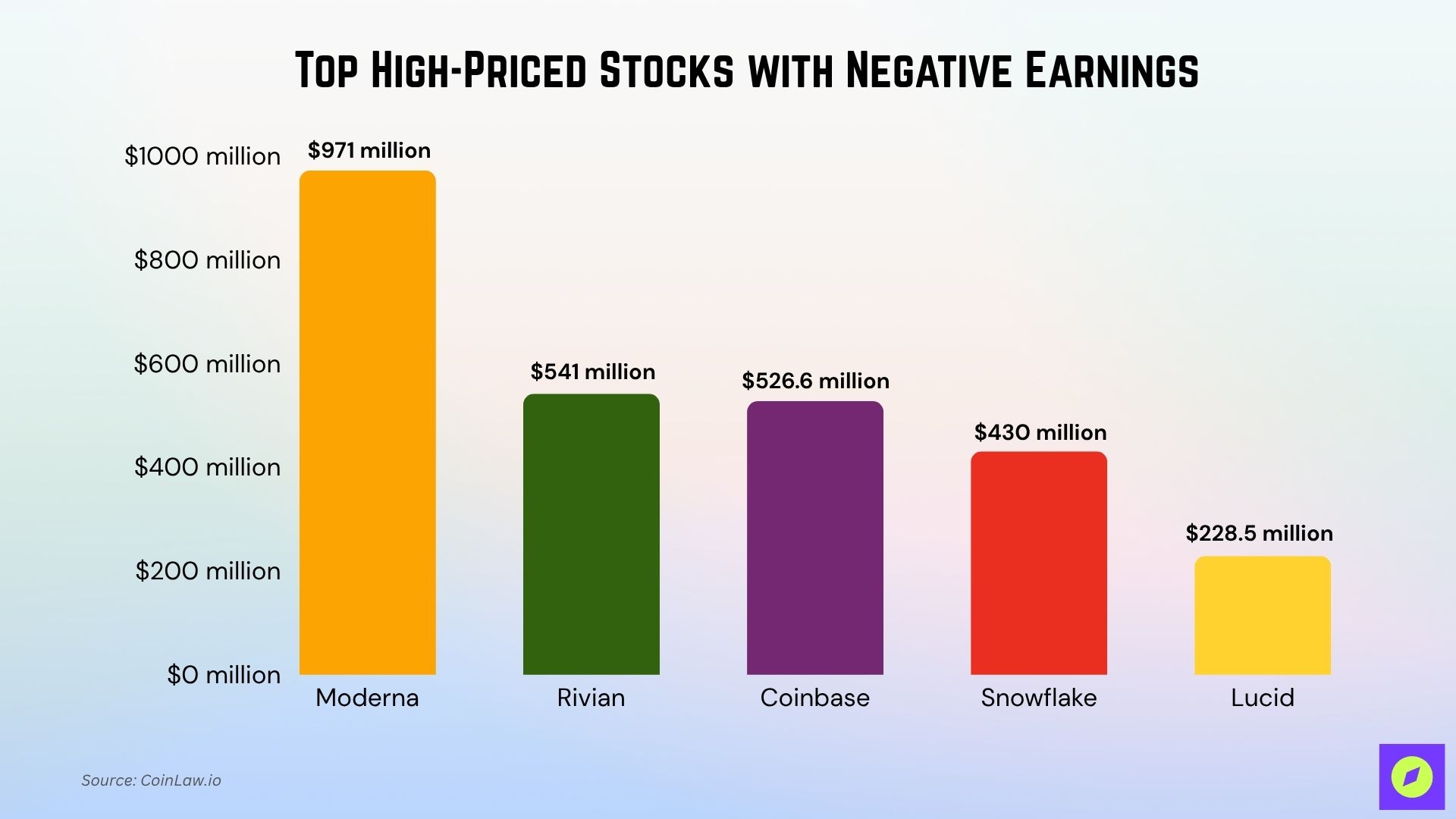

The following companies highlight the danger of investing based on storylines alone. Though widely known and heavily traded, they posted significant net losses in Q1 2025, underscoring a growing gap between market cap and fiscal discipline.

| Company | Net Loss | Key Issue | Profitability Outlook |

| Moderna (MRNA) | $971 million | R&D-heavy with declining COVID product demand | No clear rebound in the near term |

| Rivian (RIVN) | $541 million | Manufacturing scale-up not offsetting costs | Delayed, under review |

| Coinbase (COIN) | $526.6 million | Crypto revenue is too volatile for consistent profit | Unstable, market-dependent |

| Snowflake (SNOW) | $430 million | High opex, still not reaching breakeven | Dependent on the long-term scale |

| Lucid (LCID) | $228.5 million | High costs + luxury EV demand lagging | Projected by 2027 |

🔻 1. Moderna (MRNA)

Once a pandemic-era success story, Moderna has struggled to maintain profitability as COVID-19 vaccine demand declined sharply. With limited commercial products beyond its initial breakthrough, the company now faces mounting losses and uncertain pipeline performance.

- Net Loss: $971 million

- Revenue Collapse: Post-COVID product sales down over 35%

- Earnings Outlook: Struggling to replace pandemic-era success

Once a biotech juggernaut, Moderna has lost its financial momentum. With few commercial products outside its flagship vaccine and ongoing R&D costs, the company is hemorrhaging cash. The $971 million loss is a stark reversal from its pandemic-era highs and shows how quickly biotech valuations can erode when pipelines dry up.

🔻 2. Rivian (RIVN)

Despite early hype as a Tesla rival, Rivian has yet to prove it can scale profitably in the competitive EV space. Persistent production issues and high operational costs continue to drag earnings deep into the red.

- Net Loss: $541 million

- Production Costs: Still high relative to revenue

- Path to Profitability: Improving, but dependent on continued scale gains

While the loss is down significantly from previous quarters, Rivian’s cash burn and operational hurdles highlight that strong demand must be met with disciplined execution. Investors are watching closely to see whether this trend of narrowing losses continues.

🔻 3. Coinbase (COIN)

Coinbase remains a dominant name in crypto trading but has failed to achieve consistent earnings amid industry volatility. Revenue swings and regulatory uncertainty have made profitability an ongoing challenge for the exchange.

- Net Loss: $526.6 million

- Revenue Dependency: Volatile, tied to crypto trading volume

- Structural Issues: High legal, security, and compliance costs

Coinbase tends to perform well during periods of high crypto trading activity, but its earnings are highly sensitive to market volatility and regulatory shifts, making consistent profitability a challenge over time. Regulatory pressure, a shifting crypto landscape, and high operating overhead continue to weigh on its performance.

🔻 4. Snowflake (SNOW)

Snowflake has consistently delivered strong revenue growth, but profitability remains elusive due to ongoing investment in R&D, infrastructure, and market expansion. The company’s valuation often hinges on future potential rather than present-day earnings, leading to ongoing debate among investors about sustainability.

- Net Loss: $430 million

- Revenue Growth: +26% YoY, but still unprofitable

- Burn Rate: High investment in tech and workforce expansion

Snowflake’s growth story remains strong, but profits remain elusive. Despite surpassing $1 billion in quarterly revenue, its $430 million net loss reveals deeper concerns about sustainability. The company continues to spend aggressively on development and marketing, betting that scale will bring earnings, eventually.

🔻 5. Lucid Group (LCID)

Lucid’s strategy of building premium electric vehicles has faced persistent challenges, namely, high production costs, slower-than-expected delivery scaling, and extended timelines for profitability. Despite ample funding, the company’s long-term success will depend on achieving manufacturing efficiency and consistent demand in a competitive EV market.

- Net Loss: $228.5 million

- Vehicle Deliveries: Over 3,000 units, but still far below targets

- Profit Timeline: Not expected until 2027

Lucid faces the same EV pain points, high manufacturing costs, expensive supply chains, and tepid demand at the luxury end. Despite large-scale backing, the company is nowhere near breakeven. The $228.5 million loss is part of a consistent pattern of red ink, and investor patience may be running out.

Red Flags: How to Spot Trouble Before It Hits

If you’re evaluating high-priced stocks, especially in speculative sectors, there are key signals that earnings might not keep up with valuation. Here are the top red flags investors should watch for:

- Negative net income for multiple consecutive quarters

- Revenue growth without margin improvement

- Persistent R&D or capex spending with unclear ROI

- Delayed profitability projections (especially beyond 2+ years)

- Over-reliance on dilution, debt, or external funding

- Heavy insider selling during downtrends

- Missed earnings guidance, repeatedly

In the case of Moderna, Rivian, Lucid, Coinbase, and Snowflake, most of these boxes were ticked before their worst quarters. Yet many investors stayed in too long, believing the brand strength or sector tailwinds would carry them through.

Investor Takeaways: Growth Is Good, But Profits Matter

Not all high-priced stocks are bad bets. Some growth-oriented companies take years to become profitable and ultimately reward patient shareholders. However, ignoring earnings altogether is a dangerous game.

Here’s how smart investors stay balanced:

- Track earnings trends, not just revenue

- Compare company performance to sector averages

- Be wary of firms that always have a “next big thing,” but no results

- Diversify between growth and income stocks

- Use stop-losses or position sizing to manage risk in speculative holdings

- Pay attention to guidance revisions, not just quarterly beats or misses

In fast-evolving industries like crypto, EVs, and AI, it’s easy to get swept up in the future. But real value stems from execution, turning innovation into income.

Conclusion: Valuation Without Validation Is Risky

Expensive doesn’t always mean exceptional. As we’ve seen with companies like Moderna and Snowflake, sky-high valuations can mask serious financial fragility. Meanwhile, Coinbase’s volatility, Rivian’s production struggles, and Lucid’s delayed profits all underscore one timeless truth: a stock’s price is a reflection of expectations, not reality.

For investors in 2025 and beyond, the lesson is clear: demand earnings discipline, even from the flashiest tickers. Whether you’re a traditional equity investor or crypto-leaning growth seeker, the foundation of long-term gains still lies in strong fundamentals, scalable business models, and timely execution.

When price and profits don’t align, don’t ignore the disconnect; invest around it.