MoonPay has emerged as a major “fiat‑to‑crypto” gateway, enabling users to convert normal money (USD, EUR, etc.) into digital assets across the globe. Its influence spans retail users, platforms, and institutional integrations. In the U.S., for example, MoonPay’s integration with wallets like Exodus allows millions of Venmo users to directly purchase crypto. On the enterprise side, its acquisition of Helio strengthens its ability to support marketplaces and apps in accepting crypto payments. Below, explore key statistics that show how MoonPay is growing, evolving, and positioning itself in the crypto infrastructure space.

Editor’s Choice

- MoonPay achieved 112% year‑on‑year growth in Q1 2025, marking its strongest quarter ever.

- It serves 30+ million verified accounts across 180 countries as of early 2025.

- The company secured a $200 million revolving credit line from Galaxy to manage liquidity stress events like memecoin surges.

- MoonPay acquired Helio for $175 million, as part of its expansion into on‑chain payments for merchants.

- It holds BitLicense and money transmitter licenses in New York by mid‑2025.

- Partnership with Mastercard will enable stablecoin payments across Mastercard’s merchant network.

- The MoonPay platform processes $8+ billion in transaction volume (cumulative or annualized) by 2025.

Recent Developments

- In 2025, MoonPay acquired Helio, a crypto payments firm, to bolster its merchant on‑chain payments capabilities.

- It also acquired stablecoin infrastructure company Iron to expand its fiat–crypto rails and stablecoin tooling.

- MoonPay launched recurring buys for U.S. users, letting them automate periodic crypto purchases.

- The acquisition of Meso was announced to build a global payments network bridging fiat, banks, stablecoins, and blockchains.

- Mastercard and MoonPay partnered to enable stablecoin payments for businesses and users across Mastercard’s merchant network.

- MoonPay secured a $200 million revolving credit line from Galaxy in March 2025 to better handle transaction liquidity spikes.

- The company also relocated or planned to establish a new U.S. headquarters in New York in 2025 as part of expansion efforts.

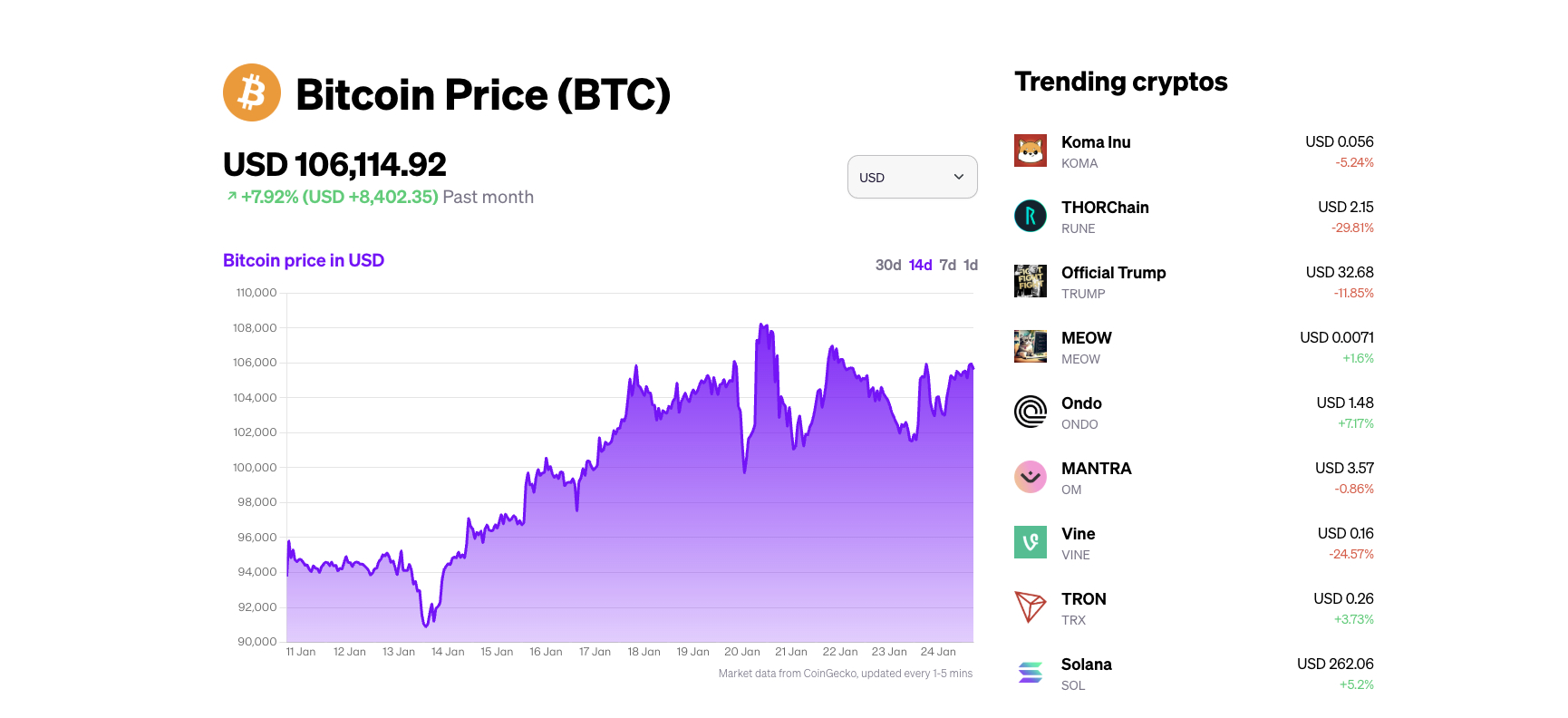

MoonPay Bitcoin Price Page Highlights

- Bitcoin price stands at $106,114.92, showing a +7.92% gain in the past month.

- BTC climbed by $8,402.35 compared to the previous month, with the chart covering Jan 11–24.

- The monthly trading range spanned from around $90,000 to nearly $110,000.

- Koma Inu (KOMA) trades at $0.056, down -5.24%.

- THORChain (RUNE) dropped to $2.15, a sharp -29.81% decline.

- Official Trump (TRUMP) is priced at $32.68, falling -11.85%.

- MEOW token inched up to $0.0071, gaining +1.6%.

- Ondo (ONDO) rose to $1.48, marking a +7.17% increase.

- MANTRA (OM) slipped slightly to $3.57, down -0.86%.

- Vine (VINE) plunged to $0.16, recording a -24.57% loss.

- TRON (TRX) climbed modestly to $0.26, up +3.73%.

- Solana (SOL) strengthened to $262.06, showing a solid +5.2% growth.

Overview of MoonPay

- Founded in 2019 by Ivan Soto‑Wright and Victor Faramond in the U.S.

- Headquartered in Miami but expanding U.S. presence into New York in 2025.

- It is a “non‑custodial” gateway; MoonPay does not hold customers’ crypto directly, instead enabling conversions and transfers.

- MoonPay supports over 110 cryptocurrencies and 30+ fiat payment methods, including credit/debit cards, bank transfers, Apple Pay, Google Pay, and Samsung Pay.

- It operates in more than 180 countries globally as of 2025.

- The platform has been integrated into wallets, exchanges, and dApps, reportedly covering 500+ crypto platforms.

- MoonPay offers an Analytics Dashboard for partners to track volume, engagement, and revenue metrics.

Key MoonPay Statistics

- Cumulative transaction volume processed, $8+ billion as of 2025.

- Annualized transaction volume via Helio (now under MoonPay), $1.5+ billion.

- Verified accounts, 30+ million across 180 countries.

- Year-on-year Q1 2025 growth, 112%.

- First quarter 2025 net revenue up nearly 50% vs prior periods.

- U.S. search interest rose ~22% year-over-year, with ~222,000 monthly searches.

- MoonPay’s credit line of $200 million is secured for liquidity flexibility.

- In 2025, its uptime for APIs and widgets remains effectively 100% over 90‑day windows.

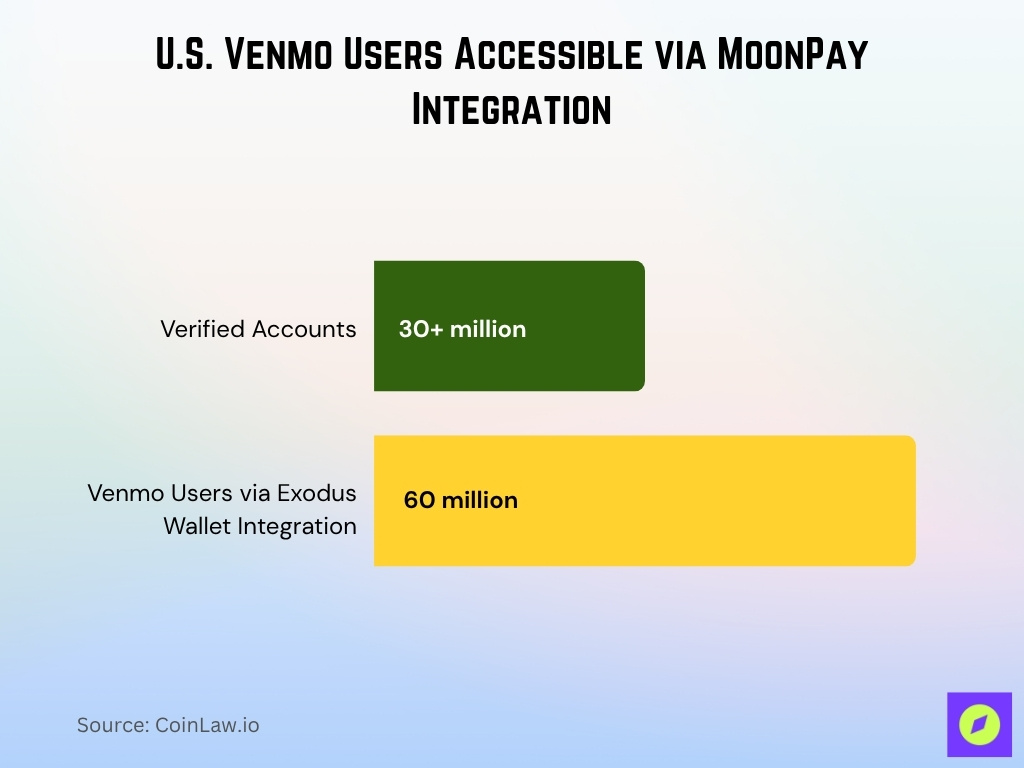

MoonPay User Growth

- The platform reports 30+ million verified accounts globally in early 2025.

- Integration with Venmo gives access to 60 million U.S. Venmo users via the MoonPay-enabled Exodus wallet.

- Search interest in MoonPay grew 22% over the past year, indicating increasing user awareness.

- In a marketing campaign with BRD, MoonPay drove 320 extra daily signups and a 31% conversion lift, also generating $150k in incremental daily volume.

- It operates in 180+ countries, giving it a broad market reach and user acquisition potential.

- Its integration into multiple wallets and platforms (e.g., Exodus, dApps) helps scale user addition through partner channels.

Transaction Volume and Revenue

- In Q1 2025, MoonPay’s transaction volume surged 123% year-over-year.

- During 2024, the company recorded 112% net revenue growth relative to 2023.

- MoonPay reports that Helio (which it acquired) processes over $1.5 billion in annualized volume and powers more than 6,000 merchants.

- The Helio platform, before acquisition, offered payment options to over 1 million end users across merchant sites.

- MoonPay now supports integrations with more than 500 crypto exchanges and wallets, increasing its transaction distribution footprint.

- The Q1 2025 net revenue jumped nearly 50% compared to prior periods, driven largely by increases in volume.

- As of 2025, MoonPay holds approval for BitLicense and money transmitter licenses in New York, enabling full U.S. state-level operations.

- In its 2025 U.S. expansion, MoonPay relocated or inaugurated a headquarters in Manhattan (SoHo) to better serve the U.S. market.

Supported Currencies and Payment Methods

- MoonPay supports over 110 cryptocurrencies.

- It accepts 30+ fiat payment methods, including credit/debit cards, bank transfers, Apple Pay, Google Pay, and Samsung Pay.

- The platform recently enabled Top‑Up with Apple Pay (for U.S., UK, EU users) to fund MoonPay Balance without additional MoonPay fees.

- MoonPay now integrates support for Revolut Pay in select regions, adding flexibility.

- Card payments (credit/card) remain a key rail for its NFT and crypto checkout experiences.

- Its developer API supports multi‑quantity NFT purchases in a single transaction.

- The partnership with Mastercard includes enabling stablecoin payments converted at the point of sale using card rails.

- MoonPay’s integrations now reach over 150 million merchants via Mastercard’s network extension.

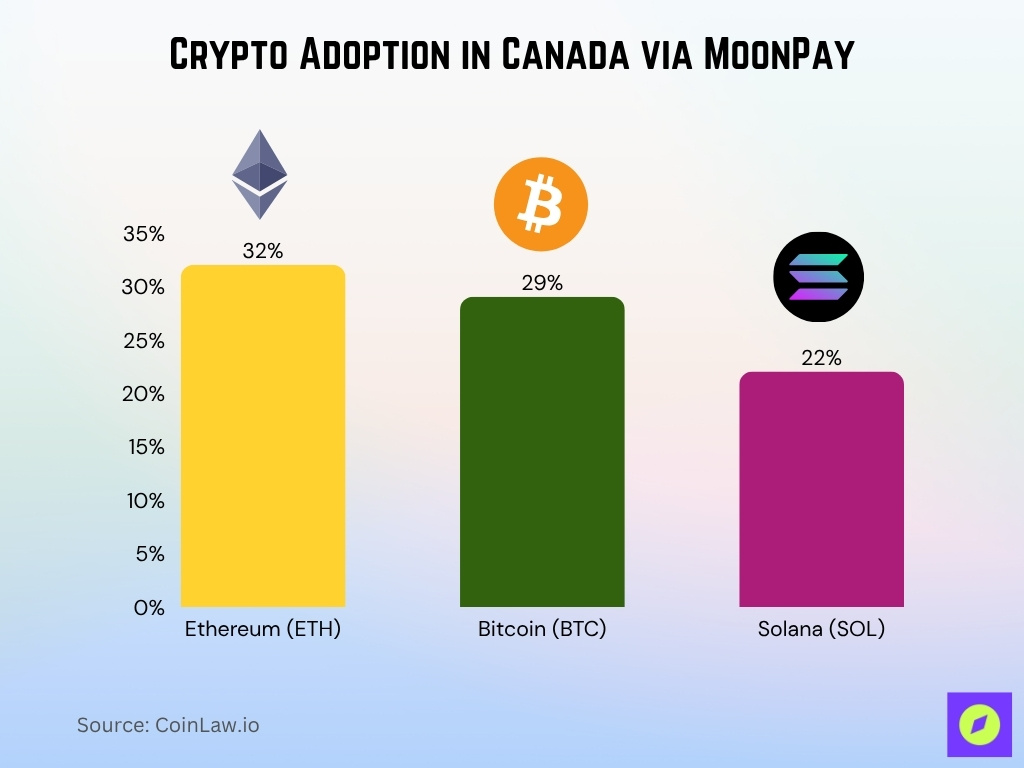

Crypto Adoption in Canada via MoonPay

- Canada ranked 5th among MoonPay’s most popular countries by number of transacting customers.

- By transaction volume, Canada placed 8th globally on MoonPay’s platform.

- Ethereum (ETH) is the most purchased cryptocurrency in Canada, accounting for 32% of MoonPay transactions.

- Bitcoin (BTC) follows closely, making up 29% of transactions.

- Solana (SOL) ranks third, with a 22% share of purchases through MoonPay.

Geographic Reach and User Demographics

- The company operates in more than 180 countries globally.

- MoonPay’s services now extend to all 50 U.S. states, thanks to its BitLicense and transmitter license approvals.

- Through its Mastercard collaboration, MoonPay potentially reaches users in countries where Mastercard is accepted, 150M+ merchants.

- The TRON ecosystem collaboration expands MoonPay’s exposure to TRON’s 303 million users and 10.3 billion+ transactions to date.

- MoonPay’s global footprint includes countries in Europe, Australia, the UK, Canada, and others.

- The regional user growth appears strongest in North America, followed by Europe and emerging markets (LatAm, APAC).

- Via wallet integrations and dApps, MoonPay’s reach includes both retail users and institutional partners.

- Marketing campaigns (e.g., via BRD) have driven 320 extra daily signups and conversion uplift.

Business and Institutional Partnerships

- MoonPay acquired Helio, integrating its merchant checkout capabilities.

- Through Helio, MoonPay supports 6,000+ merchants across e-commerce, NFT, ticketing, and dApp platforms.

- Mastercard is a key partner, enabling stablecoin-to-fiat conversion at the merchant point-of-sale.

- MoonPay also acquired Iron, a stablecoin infrastructure company, to bolster its rails.

- Luxury app Dorsia already uses MoonPay for crypto payments, representing consumer-brand uptake.

- MoonPay’s technology powers checkout through over 500 crypto wallets and exchanges.

- MoonPay’s partnership with TRON gives it access to TRON’s developer ecosystem and user base.

- Through partnership-based marketing, platforms using MoonPay see measurable uplift in conversion and volume.

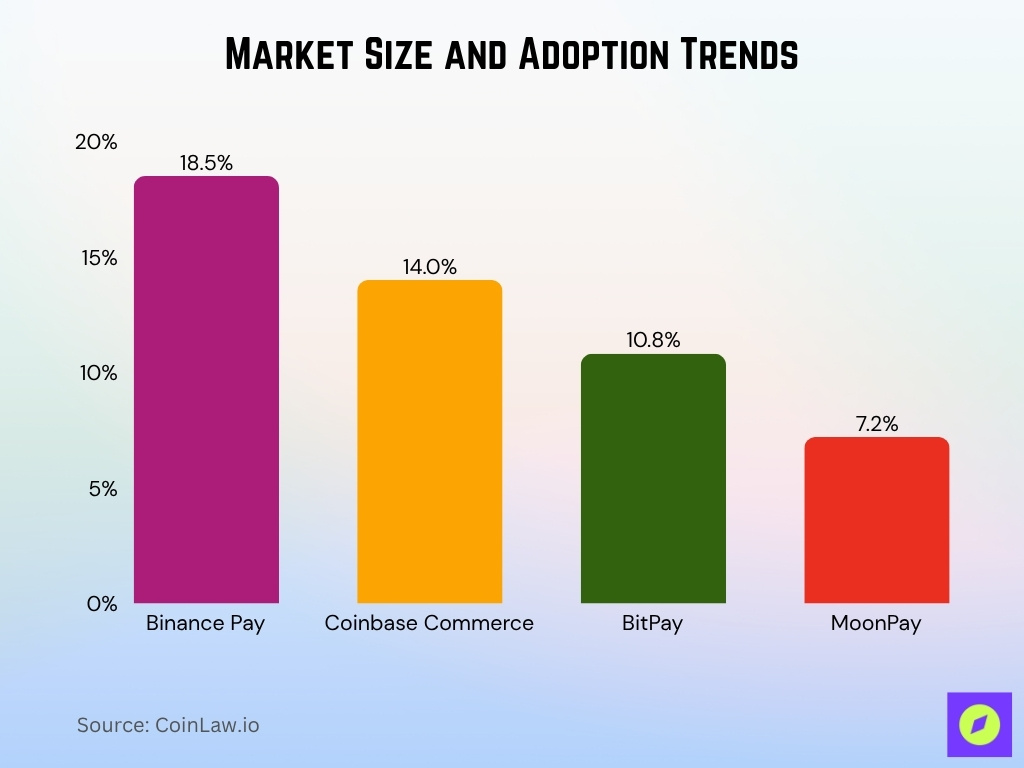

Market Size and Adoption Trends

- In 2025, MoonPay holds a 7.2% share in the crypto payments sector.

- Binance Pay leads 2025 with ~18.5% market share, Coinbase Commerce ~14%, BitPay ~10.8%, and MoonPay ranks among the top 5.

- Gateways enabling direct NFT checkout now represent ~15% of crypto payment infrastructure adoption.

- Stablecoin transfers account for trillions in monthly volume globally.

- Regional adoption, growth are strong in the U.S. and Europe, and emerging markets show rising uptake.

- E‑commerce merchants increasingly adopt crypto rails.

- Web3 and gaming sectors drive demand for integrated fiat-to-crypto rails.

MoonPay Product Offerings

- MoonPay Checkout (NFT / digital goods) allows card-based purchase of digital assets without requiring crypto beforehand.

- HyperMint (self‑service minting platform) enables brands and developers to mint and manage NFTs at scale.

- Buy / Sell / Swap crypto rails, accessible via APIs and integrated into third‑party wallets.

- Analytics Dashboard for partners to monitor volume, conversion, and performance metrics.

- Recurring Buys, scheduled crypto purchases, live for U.S. users (except NY).

- MoonPay Pots, a relatively new feature to lets users stake or earn passive income.

- Sell to MoonPay Balance, converting crypto to fiat and transferring to a card, PayPal, or bank.

- Web3 Passport / KYC solutions are embedded in its API stack to vet users and reduce fraud risk.

NFT Checkout and HyperMint Statistics

- In its changelog, MoonPay introduced MoonPay Checkout to simplify NFT and digital goods purchases via credit card.

- MoonPay’s NFT checkout supports multi‑quantity purchases in one transaction.

- HyperMint is positioned as a no-code tool for creators, brands, and developers to mint and distribute NFTs at scale.

- The platform has been used for high-profile collections like Alec Monopoly’s 6,500‑NFT collection, using HyperMint and its checkout feature.

- MoonPay claims HyperMint allows creation/deployment of smart contracts and NFT projects within minutes.

- Via HyperMint, projects can combine minting, royalties, and distribution logic in a unified interface.

- MoonPay markets HyperMint as reducing friction for NFT ticketing, merchandise drops, or community token gating.

MoonPay Fees and Pricing

- MoonPay levies three types of fees in many regions: a Network Fee, a MoonPay Fee, and an Ecosystem Fee.

- For card payments, MoonPay often charges up to 4.5%, with a minimum fee of $3.99 / €3.99 / £3.99.

- In Europe, MoonPay’s ecosystem fees can go up to 10%, but typically remain between 0% and 2%.

- The price you see includes any spread, which reflects volatility risk and operational buffers.

- Payments via fiat may also incur bank or card provider fees or FX conversion charges.

- MoonPay Balance allows users to buy and sell crypto without additional MoonPay fees, though network and ecosystem fees still apply.

- Recurring Buys run off MoonPay Balance, but network fees and ecosystem fees still apply.

- MoonPay has run promotions where every 5th transaction is fee‑free to attract frequent users.

Performance Indicators and Analytics

- MoonPay claims near 100% API uptime over 90‑day windows.

- Conversion metrics from partner integrations demonstrated 320 extra daily signups.

- Assets processed, cumulative volume > $8+ billion.

- Helio, under MoonPay, processes ~ $1.5 billion annualized volume.

- Internal dashboards offer metrics such as volume by fiat/crypto pair, drop‑off rates, geographic usage, and partner revenue shares.

- Growth in network traffic and transaction counts has increased by over 2× year over year.

- Search interest for “MoonPay” rose ~ 22% year-over-year.

- Market share among crypto payment gateways is estimated at 7.2% in 2025.

Competitors and Market Position

- MoonPay’s top direct competitors include Transak, Ramp, and Mercuryo.

- As of early 2025, MoonPay’s post-money valuation is estimated to be approximately $3.4 billion.

- Smaller gateways compete on lower fees, niche regions, or faster settlement.

- Some competitors specialize in on‑ramp only, while MoonPay spans on‑ramp, off‑ramp, NFT checkout, and stablecoin bridging.

- MoonPay’s acquisitions strengthen its moat relative to rivals.

- Merchants favor providers with regulatory compliance.

- Some competitors offer zero‑fee promotions, MoonPay counteracts via selective promotions.

- MoonPay’s integration with Mastercard gives it an edge.

Notable Investments and Valuation History

- The company has raised $643 million.

- In March 2025, it secured a $200 million conventional debt round.

- Earlier, the company raised ~$555 million in a Series A in late 2021.

- Its acquisition of Helio was valued at ~$175 million.

- Its acquisition of Iron and Meso adds significant strategic value.

- MoonPay is recognized in industry lists like CNBC Disruptor 50 (2025).

- The company’s valuation growth reflects investor confidence.

Key Opportunities for Growth

- Expand deeper into emerging markets.

- Scale off‑ramp services in more jurisdictions.

- Grow subscription/recurrence models.

- Integrate with traditional financial infrastructure.

- Offer more embedded finance / BNPL in crypto checkout flows.

- Expand NFT / Web3 commerce partnerships.

- Build developer tools / SDKs to reduce integration friction.

- Leverage stablecoin rails and real-time settlement.

Frequently Asked Questions (FAQs)

~ 123% increase over Q1 2024.

Nearly 50% higher than the prior comparable period.

$200 million.

Over 6,000 merchants with $1.5 billion+ in annualized transaction volume.

Valuation: ~$3.4 billion, Total funding raised: $650.7 million.

Conclusion

MoonPay has evolved from a simple crypto on‑ramp into a multifaceted infrastructure provider, powering fiat‑to‑crypto flows, NFT checkout, merchant integrations, and compliance‑driven stablecoin bridges. Yet the path ahead demands execution, winning new markets, deepening regulation adherence, and staying ahead of agile competitors. In an industry defined by volatility, MoonPay’s blend of scalability, regulatory alignment, and product breadth gives it a fighting chance to lead.