As the way we transact evolves, mobile wallets have become more than just a convenient payment tool; they are shaping the future of finance. From local coffee shops to global retailers, mobile wallet adoption has surged, fundamentally transforming how we view money and transactions. In 2025, the mobile wallet industry is at a pivotal moment, growing in both users and technological sophistication. This article explores the key data and trends that define the mobile wallet landscape, from adoption rates to regional market strengths and user preferences.

Key Takeaways

- 185% of consumers in North America used a mobile wallet at least once in 2025, showing deepening trust and convenience in digital payments.

- 2In-app mobile payments accounted for 66% of transactions globally in 2025, fueled by retail app growth and embedded finance trends.

- 3Biometric authentication adoption climbed to 52% in 2025, driven by user demand for faster and more secure checkout experiences.

- 4Apple Pay held a 41% US market share in 2025, still leading, while Google Pay rose slightly to 27% as Android adoption expanded.

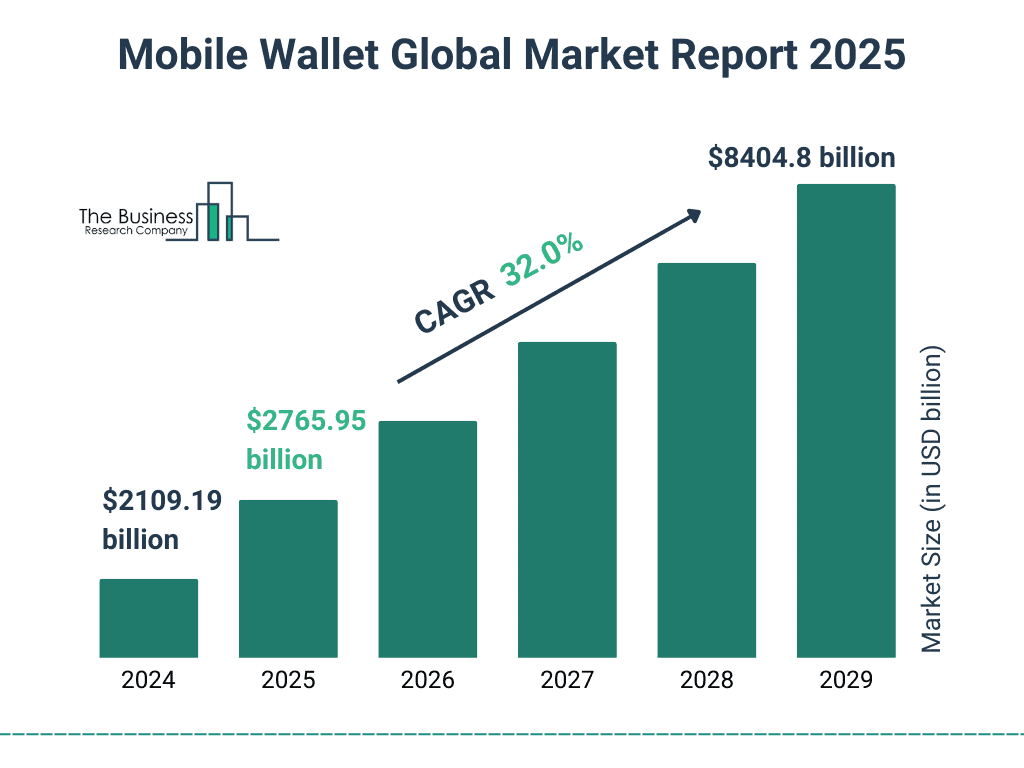

Mobile Wallet Market Growth Outlook

- The mobile wallet market size is projected to grow to $8,404.8 billion by 2029.

- In 2025, the market is expected to reach $2,765.95 billion.

- The market is experiencing a CAGR of 32.0%, indicating rapid and sustained growth.

- This sharp rise reflects increasing digital payment adoption and mobile wallet integration across global financial ecosystems.

Technology Insights

- Biometric authentication grew by 52% in 2025, with facial recognition and fingerprint scanning driving secure and frictionless wallet access.

- Near-field communication (NFC) remains the dominant technology powering mobile wallets globally, supporting the majority of contactless transactions due to its wide compatibility and ease of use.

- An increasing number of mobile wallets are integrating cryptocurrency features, signaling a gradual shift toward blockchain-enabled financial tools in mainstream digital payments.

- Artificial intelligence is steadily being adopted by digital wallet providers to enhance fraud prevention, user personalization, and transaction security across newer wallet platforms

- QR code payments are used by 88% of Chinese wallet users, maintaining dominance in everyday transactions across Asia in 2025.

- Tokenization is adopted by 93% of top mobile wallets, safeguarding users by replacing sensitive data with secure tokens in 2025.

- With the rollout of 5G, mobile wallets benefit from significantly reduced latency, enabling faster and more seamless real-time payment experiences.

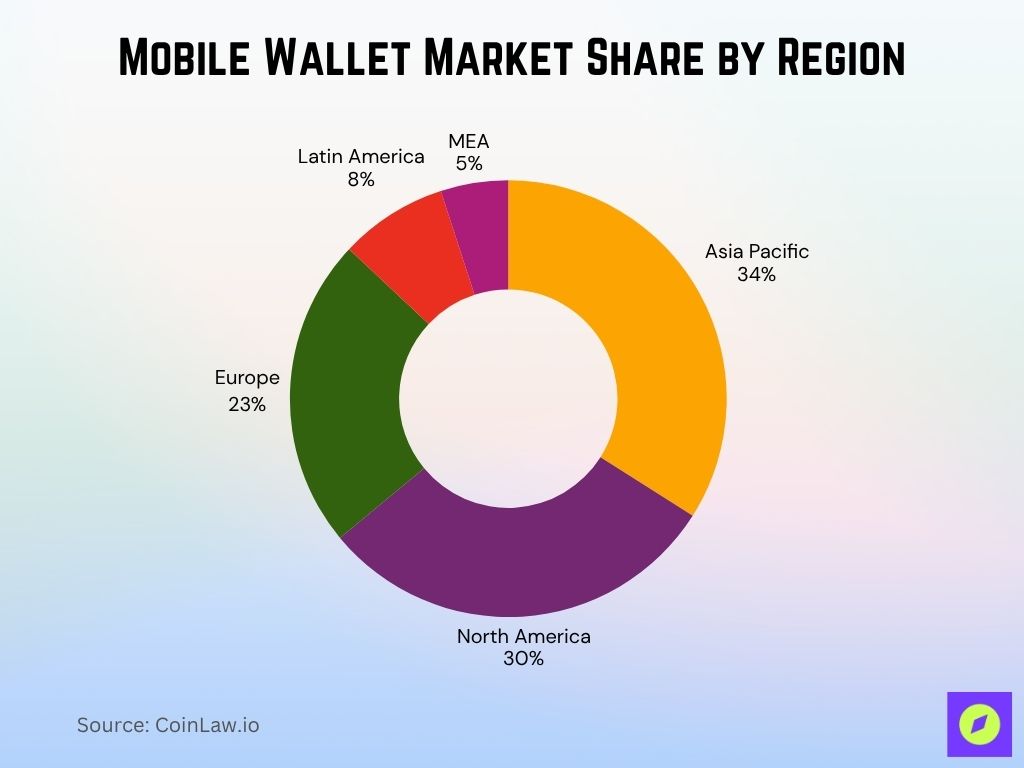

Mobile Wallet Market Share by Region

- Asia Pacific leads the global mobile wallet market with a dominant 34% share, driven by rapid adoption in China and India.

- North America follows closely with 30%, fueled by widespread usage of Apple Pay, Google Pay, and PayPal.

- Europe holds a solid 23% market share, supported by growing fintech infrastructure and contactless payment adoption.

- Latin America accounts for 8%, with increased mobile penetration and digital banking efforts boosting wallet usage.

- MEA (Middle East & Africa) represents the smallest share at 5%, though mobile wallet growth is accelerating in urban centers.

Application Insights

- Retail and e-commerce account for 68% of mobile wallet transactions in 2025, reflecting the ongoing shift to digital-first shopping.

- Public transit mobile wallet payments rose by 34% in 2025, fueled by expanded tap-to-pay systems in major global cities.

- 73% of mobile wallet users made regular in-app purchases in 2025, largely driven by gaming and subscription services.

- Bill payments through mobile wallets grew by 28% year-over-year in 2025, as more providers embraced mobile-friendly billing.

- Loyalty and rewards integration increased by 46% in 2025, appealing to users who value convenience and perks in one place.

- Cross-border transactions rose 24% in 2025, helped by competitive exchange rates and ease of use from global platforms.

- Food delivery and ride-hailing payments were made by 49% of mobile wallet users in 2025, solidifying their place in daily spending.

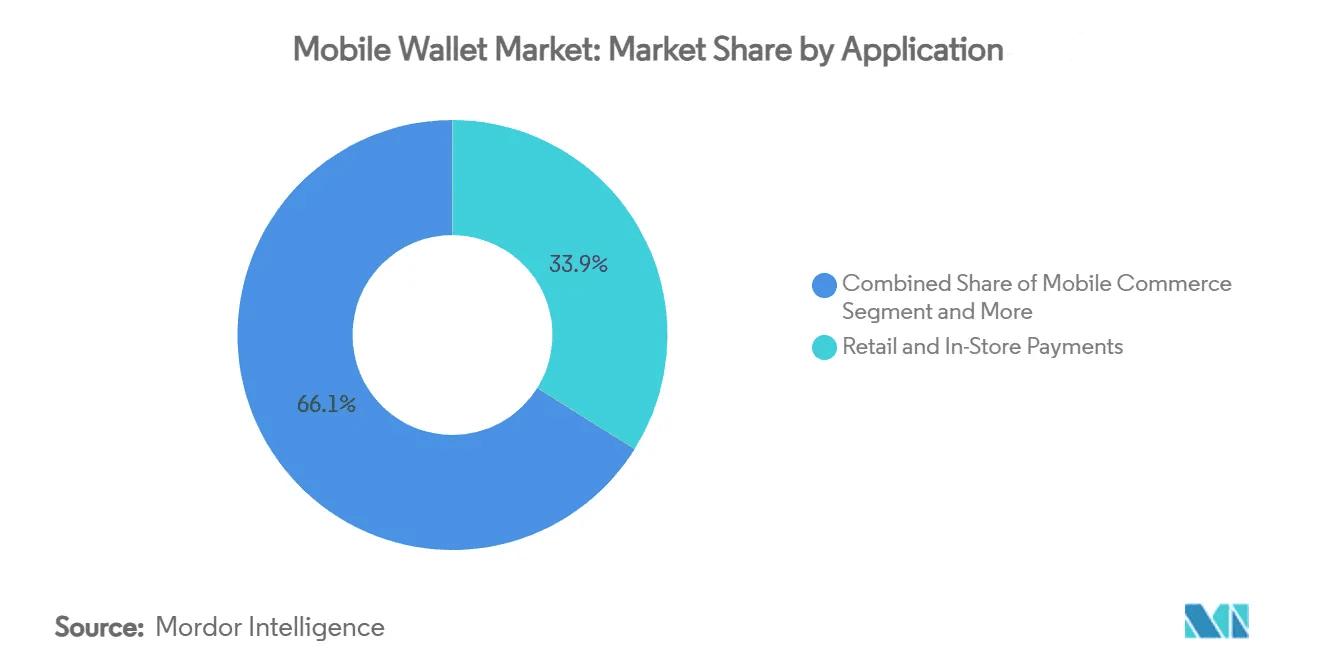

Mobile Wallet Market Share by Application

- Mobile commerce and related segments dominate the market with a 66.1% share, reflecting the surge in online shopping and app-based transactions.

- Retail and in-store payments hold a 33.9% market share, indicating steady growth in physical store adoption of mobile wallet payments.

- The data shows that digital-first commerce is currently the primary driver of mobile wallet usage globally.

Digital Wallet User and Transaction

- Global mobile wallet users reached 3.2 billion in 2025, driven by expansion in Asia, Latin America, and Africa.

- 67% of all mobile wallet users in 2025 are Millennials and Gen Z, maintaining dominance through digital-first preferences.

- China had over 980 million mobile wallet users in 2025, with 65% of adults using them for everyday spending.

- In the US, 56% of smartphone owners have used a mobile wallet at least once in 2025, reflecting deeper integration into daily life.

- Peer-to-peer (P2P) payments through wallets grew by 42% in 2025, continuing to replace traditional banking for casual transfers.

- Contactless payments make up 59% of all mobile wallet transactions in North America in 2025, led by retail and transit use.

- Europe surpassed 320 million digital wallet users in 2025, driven by wider merchant acceptance and neobank adoption.

Most Used Digital Wallets by U.S. Consumers

- PayPal dominates the market, used by 79% of U.S. online consumers, far ahead of its competitors.

- Google Wallet ranks second with 40% usage, showing strong adoption among Android users.

- Groupon’s payment service is used by 20%, leveraging its deal-based ecosystem.

- Apple Passbook follows with 17% usage, largely driven by iOS users and loyalty card integration.

- PayPass by MasterCard has been used by only 5%, reflecting limited traction in mobile NFC payments.

- Dwolla, Venmo, and Isis Wallet each report 4% usage among respondents.

- Zip Pay and Lemon Wallet round out the list with just 3% usage, highlighting their niche adoption.

Consumer Preferences and Usage

- 72% of mobile wallet users in 2025 rank security as their top priority, favoring encryption and biometric login.

- 87% of consumers use mobile wallets for convenience, citing fast access and on-the-go money management.

- Over 54% of users prefer wallets with integrated loyalty programs, valuing rewards and seamless benefits.

- Apple Pay maintains the highest user satisfaction in the US at 91%, praised for its simplicity and safety.

- 62% of young adults aged 18–34 use mobile wallets daily in 2025, both for online checkouts and in-store payments.

- 33% of users say cashback rewards influence their choice of mobile wallet in 2025.

- 49% of SMBs now accept mobile wallets, adapting to evolving consumer payment preferences.

Challenges and Regulatory Landscape

- 68% of consumers cite data privacy as a key barrier in 2025, increasing pressure on wallets to ensure secure data handling.

- EU regulatory demands in 2025, including stricter PSD3 and AI governance rules, raise compliance complexity for mobile wallet providers.

- Interoperability issues affect 27% of users in 2025, limiting cross-platform wallet usage across regions and ecosystems.

- 32% of consumers remain concerned about cybersecurity in 2025, especially regarding fraud, phishing, and identity theft.

- 38% of merchants in North America still lack full mobile wallet support in 2025, slowing universal acceptance.

- Cross-border transaction fees impact 22% of wallet users in 2025, especially in remittance-heavy markets in Asia and Africa.

- Governments in India, China, and Brazil enforce local data storage and KYC rules in 2025, reshaping wallet compliance requirements.

Recent Developments

- Visa and Mastercard now support mobile wallet integration in over 190 countries as of 2025, simplifying global digital payments.

- Apple Pay’s BNPL feature reached 18 million active users in 2025, with strong adoption among Millennials and Gen Z.

- Google Wallet rolled out AI-driven threat monitoring in 2025, enhancing real-time fraud prevention and encryption.

- Samsung Pay expanded crypto wallet support in early 2025, enabling storage and usage of major tokens in select markets.

- PayPal’s crypto P2P feature now processes over $3 billion annually, growing sharply since its 2023 launch.

- Mobile wallet providers like Alipay have introduced sustainability incentives such as “green points,” which encourage eco-friendly consumer behavior through digital rewards programs.

- A growing segment of mobile wallets now supports digital ID functionality, making it easier for users to verify identities across financial, governmental, and commercial platforms.

Conclusion

The mobile wallet industry in 2025 reflects the rapid shifts in how consumers, businesses, and technology interact with money. As digital wallets continue to grow in both reach and functionality, they’re not just changing payment habits; they’re transforming economies. With rising user numbers and new technological advancements, mobile wallets are positioned to become a central part of everyday life globally. As challenges around security, data privacy, and regulatory compliance persist, the industry is also evolving to address these concerns, ensuring that mobile wallets remain a trusted and indispensable tool for financial transactions.