MicroStrategy (Nasdaq: MSTR), now doing business as Strategy Inc, has transformed from a traditional enterprise software firm into the world’s most prominent Bitcoin treasury company. This pivot has redefined its financial profile, making its corporate strategy inseparable from the performance of Bitcoin and market sentiment toward digital assets.

The company’s journey illustrates how digital asset accumulation and corporate finance can converge, influencing everything from balance sheets to investor valuations. For investors and analysts focused on performance and risk, these statistics set the stage for understanding Strategy’s evolving role in both tech and crypto markets. Explore the detailed data and trends below.

Editor’s Choice

- 712,647 BTC: MicroStrategy’s approximate Bitcoin holdings as of January 26, 2026.

- ~$75,979: Average Bitcoin purchase price per BTC as of January 26, 2026.

- ~3.4%: Portion of the total 21 million BTC supply held by MicroStrategy.

- $8.2 billion: Long‑term debt carried as of Q3 2025.

- $474.94 million: Trailing twelve‑month revenue.

- 7.72 billion: Net income (ttm).

- ~$62–62.5 billion: Estimated value of Bitcoin holdings at BTC around $87–88k.

Recent Developments

- In early 2026, Strategy announced significant Bitcoin purchases worth approximately $2.13 billion for 22,305 BTC during January 12–19, 2026.

- Strategy expanded BTC holdings to ~673,783 BTC via MSTR ATM sales as reported in late 2025.

- Equity and debt financing continue to fund purchases as part of an ongoing accumulation strategy.

- Reports indicate elevated unrealized losses on digital assets. Q4 2025 saw a ~$17.44 billion paper loss.

- Analyst coverage reflects mixed sentiment, with adjustments in price targets while maintaining long‑term BTC exposure themes.

- Market discussions suggest broader concerns around leverage and dilution tied to continuing BTC strategy.

- Strategy’s brand transition from MicroStrategy underscores its Bitcoin‑first positioning to investors.

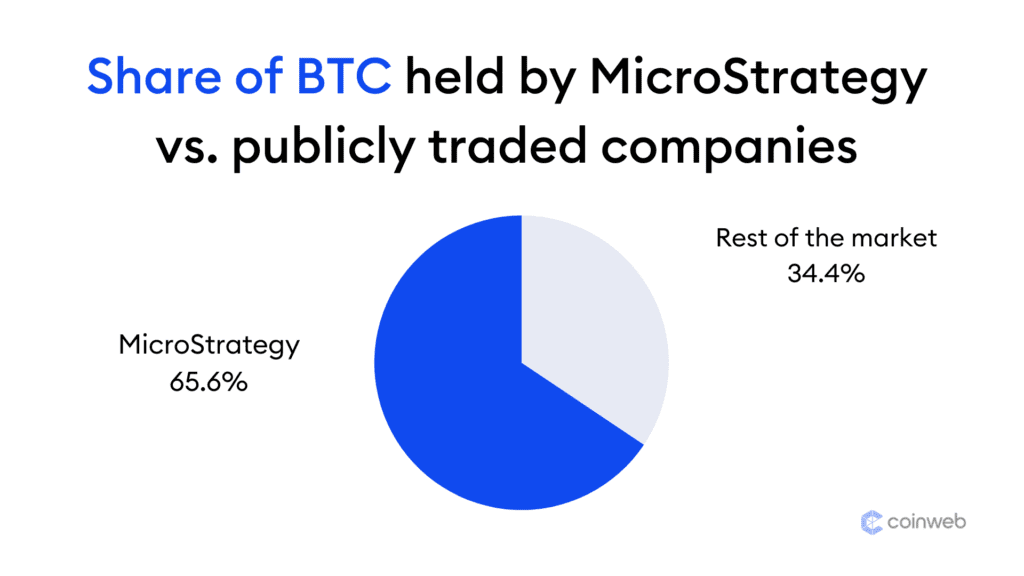

MicroStrategy’s Dominance in Public Company Bitcoin Holdings

- MicroStrategy controls 65.6% of all Bitcoin held by publicly traded companies, highlighting its unmatched position as the largest corporate BTC holder.

- All other public companies combined account for just 34.4%, underscoring how concentrated corporate Bitcoin ownership has become.

- MicroStrategy alone holds nearly two-thirds of public-company Bitcoin, reinforcing its role as the most aggressive and conviction-driven corporate Bitcoin treasury.

- The data emphasizes how MicroStrategy’s Bitcoin strategy significantly influences corporate BTC market dynamics, investor sentiment, and treasury adoption trends.

MicroStrategy Company Background

- Founded in 1989 as a business intelligence and software company.

- Pivoted toward Bitcoin as a primary treasury reserve asset beginning in 2020.

- Renamed “Strategy Inc” in August 2025 to reflect its core focus.

- Operates globally, offering enterprise analytics software alongside BTC exposure vehicles.

- Leadership under Executive Chair Michael Saylor has driven the aggressive BTC accumulation ethos.

- The company maintains both a traditional software business and digital asset holdings.

- Extensive ATM equity programs and convertible instruments funded BTC purchases.

- Shares trade on Nasdaq under the ticker MSTR, attracting investors seeking Bitcoin leveraged exposure.

Total Bitcoin Holdings by MicroStrategy

- ~712,647 BTC: Total BTC held as of Jan 26, 2026.

- ~3.38%: Share of Bitcoin’s total capped supply of 21 million.

- ~$62 billion: Estimated market value of holdings at recent BTC prices.

- ~$53.9 billion: Aggregate cost of BTC purchases so far.

- Peak period holdings: Passed 580,000 BTC mid‑2025 after additional purchases.

- Holdings > 500,000 BTC: Already by early 2025, crossing this threshold.

- Regular accumulation: Weekly or monthly increases seen through 2025 into 2026.

- First sale history: Only one small sale of 704 BTC in 2022; otherwise, no BTC has been sold.

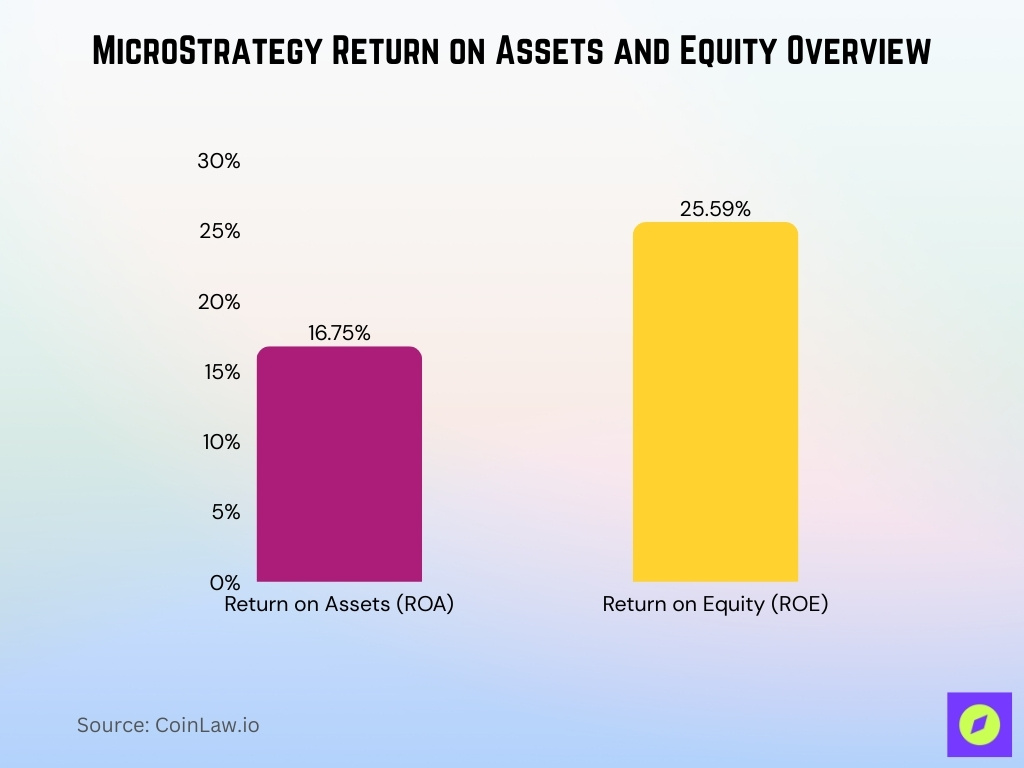

Key Financial Statistics and Balance Sheet Overview

- Return on assets: ~16.75%.

- Return on equity: ~25.59%.

- Revenue (ttm): ~$474.94 million, reflecting a tech firm with modest ongoing software sales.

- Net income (ttm): ~$7.72 billion, heavily influenced by BTC valuations.

- Profit margin: ~1,667.09%, largely due to accounting adjustments tied to BTC asset valuations.

- Long‑term debt reported at ~$8.2 billion due to debt instruments financing BTC purchases.

- The balance sheet reflects a high concentration of digital assets relative to traditional operating assets.

- The current ratio of around 0.66 indicates a modest liquidity cushion vs obligations.

MicroStrategy Revenue and Profit Trends

- 22.1% revenue drop over three years.

- Q3 revenue reached $128.69 million.

- Q2 net income hit $10.02 billion with $32.60 diluted EPS.

- 2025 guidance: $34 billion operating income, $24 billion net income.

- Q3 2025 EPS at $8.42, surpassing estimates.

- TTM revenue $474.94 million, up 1.65% YoY.

- Q1 2026 revenue forecast $117.42 million, EPS $46.02.

- 2026 revenue projection: $500 million, up 3.11%.

- 2026 net profit forecast is $13 billion.

- Q4 2025 unrealized BTC loss was $17.44 billion.

Market Value and Average Purchase Price of Bitcoin

- Current average cost: ~$75,979 per BTC across holdings.

- Total cost basis: ~$53.9 billion for the current BTC stack.

- Market value: ~$62.27 billion estimated BTC portfolio value recently.

- Paper gains: ~$8.34 billion unrealized gains on BTC at recent prices.

- BTC price swings: Average purchase prices have ranged from under $30,000 in early years to over $90,000 in recent buys.

- Value influence: Holders’ aggregate value depends heavily on Bitcoin’s market price.

- Historic cost diversity: Earlier, smaller purchases brought down aggregate cost relative to recent buys priced higher.

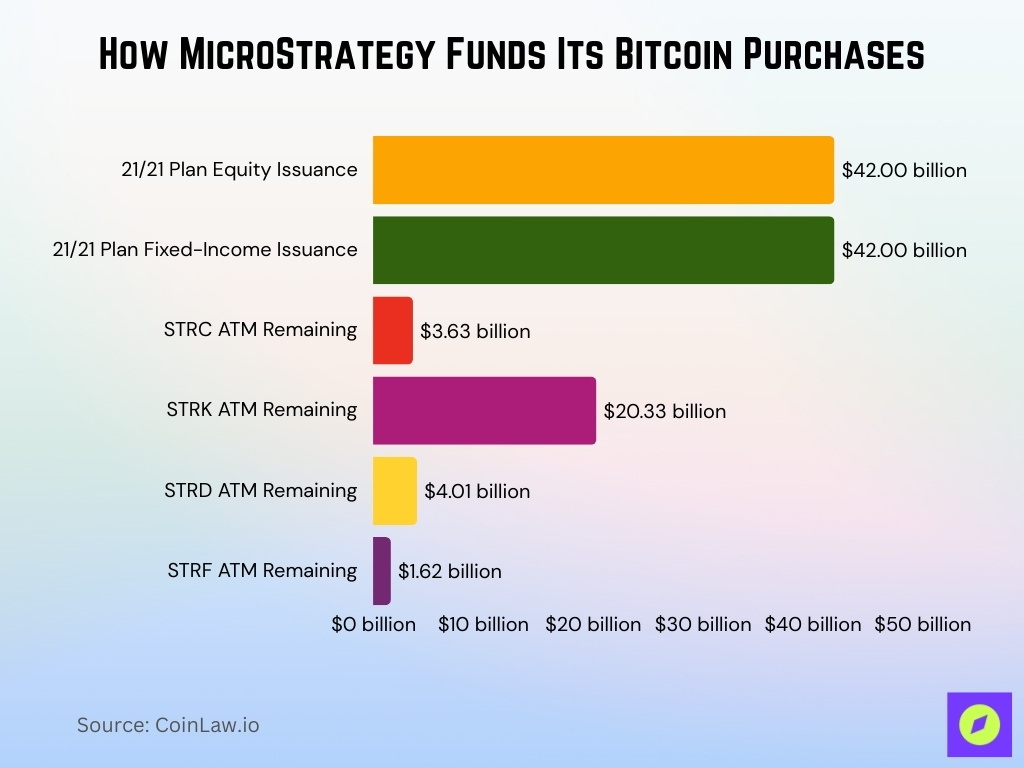

Debt and Equity Issuance for Bitcoin Acquisition

- 21/21 Plan: $42billion equity + $42 billion fixed-income through 2027.

- STRC ATM remaining $3.63 billion.

- STRK ATM remaining $20.33 billion.

- STRD ATM remaining $4.01 billion.

- STRF ATM remaining $1.62 billion.

MicroStrategy Realized and Unrealized Gains on Bitcoin

- Q4 2025 unrealized loss $17.44 billion on BTC holdings.

- Full year 2025 unrealized loss is $5.40 billion.

- Q3 2025 unrealized gain $3.9 billion.

- Avg cost basis $75,979/BTC for 709,715 BTC.

- Recent avg purchase $91,519/BTC for 13,627 BTC.

- Holdings value Jan $64.736 billion.

- No realized gains/losses from BTC sales.

- Deferred tax benefit Q4 $5 billion.

Financing Methods for Bitcoin Purchases

- 2025 ATM raised $20 billion YTD for BTC.

- 2025 preferred stocks STRK/STRF/STRD/STRC raised $5.6 billion.

- Jan 20-25, 202,6 ATM sold 1,569,770 shares net $257 million.

- STRC IPO closed $2.52 billion, 28M shares at $90.

- Q3 2025 ATM $2 billion bought 27,200 BTC.

- Convertible notes 2029 $3 billion net $2.97 billion.

- Jan 2026 ATM $264 million bought 2,932 BTC.

- 5-year convertibles borrowed $7.27 billion.

- Preferred STRF yield 31%, STRK 19%, STRC 8%.

- ATM capacity post-Jan significant remaining.

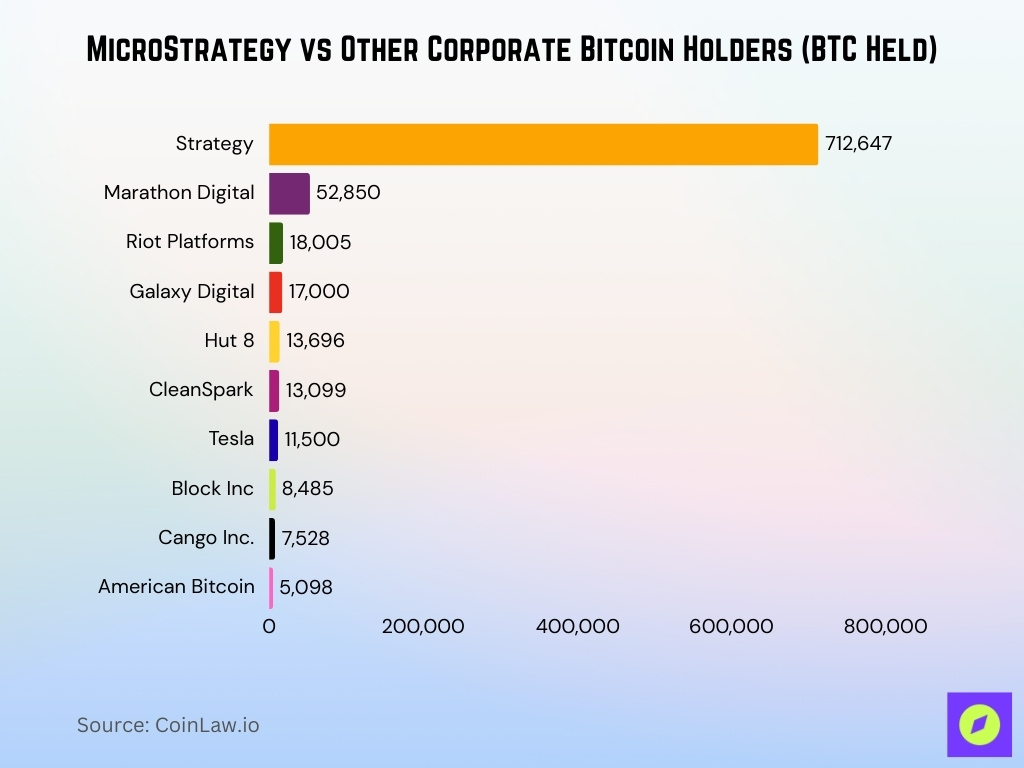

MicroStrategy vs Other Corporate Bitcoin Holders

- Strategy 712,647 BTC (3.4% supply).

- Marathon Digital 52,850 BTC (0.25%).

- Riot Platforms 18,005 BTC (0.09%).

- Hut 8 13,696 BTC (0.07%).

- CleanSpark 13,099 BTC (0.06%).

- Tesla 11,500 BTC (0.05%).

- Block Inc 8,485 BTC (0.04%).

- Galaxy Digital 17,000 BTC (0.08%).

- Cango Inc. 7,528 BTC (0.04%).

- American Bitcoin 5,098 BTC (0.02%).

Impact of Bitcoin on MicroStrategy’s Financials

- Q4 2025 unrealized BTC loss was $17.44 billion.

- The full 2025 unrealized loss is $5.40 billion.

- 2025 stock decline 47.5% vs BTC ~8% drop.

- Q4 deferred tax benefit $5.01 billion.

- BTC holdings 90% of the balance sheet.

- Leverage ratio assets/equity 1.2x.

- 3-month MSTR -46.87% vs BTC -22.86%.

- Q1 2025 core revenue $111.1 million, down 3.6% YoY.

- Total debt was $8.1 billion at the end of Q1 2025.

- Short-term debt $316,000 vs cash reserves.

Bitcoin as a Share of Total Assets and Supply

- Holdings 712,647 BTC as of Jan 26.

- Represents 3.4% of the 21M total BTC supply.

- Circulating supply 19.98M BTC Jan 29.

- BTC holdings value $62.5 billion.

- Avg cost ~$75,979/BTC, total cost ~$53.9 billion for 712,647 BTC.

- Unrealized gain $8.3 billion.

- BTC ~90% of total assets.

- Holdings 3.57% of circulating supply.

- Jan 20 holdings 709,715 BTC valued at $53.92 billion.

Stock Price and Market Capitalization Trends

- Current market cap stands at $52 billion.

- Stock price recently at $408.52 with a 52-week range of $102-$543.

- YTD 2026 performance shows +7.34% return.

- Market cap fluctuated between $41 billion and $53 billion.

- One-year return approximately -53% amid BTC volatility.

- Diluted mNAV at 0.94x, trading at 6% discount to Bitcoin NAV.

- Three-month returns reflect ~50% decline with crypto sentiment weakness.

- Holds 712,647 BTC valued at about $62–62.5 billion.

- Recent Bitcoin purchase: 13,627 BTC for $1.25 billion.

Earnings, Valuation, and Analyst Forecasts

- Q4 2025 unrealized Bitcoin loss: $17.44 billion.

- Q4 2025 EPS consensus: $46.02.

- 2025 full-year unrealized loss: $5.4 billion.

- Analyst average price target: $483.99.

- Forecast 2026 revenue: $500 million.

- Current P/E ratio: 8.08.

- Forecast 2026 net profit: $13.0 billion.

- 2026 EBITDA estimate: $19.8 billion.

- Forecast EPS 2026: $46.97 average.

- Current EV/Sales: 112.67.

MicroStrategy Software and Analytics Business Overview

- Total revenue Q3 2025: $128.7 million, up 10.9% YoY.

- Subscription services revenue Q3 2025: $46.0 million, up 65.4% YoY.

- Serves over 4,414 companies globally.

- Employees: 1,534.

- TTM revenue: $474.94 million, up 1.65% YoY.

- Product licenses and subscriptions Q3: $63.3 million, up 62.9% YoY.

- Subscription billings growth Q1 2025: 38% YoY to $24.5 million.

- 55% customers in the United States, IT services lead the industry.

- Q4 2025 revenue forecast: $117.42 million.

- Annual 2024 revenue: $463.46 million.

Frequently Asked Questions (FAQs)

MicroStrategy holds approximately 712,647 BTC, making it the largest corporate Bitcoin treasury.

The company’s average cost per BTC is around $76,040.

MicroStrategy controls about 3.38% of the total 21 million BTC supply.

The company raised billions, including at least $264 million in a late January 2026 stock sale to fund BTC purchases.

Conclusion

MicroStrategy’s evolution into Strategy Inc has created a hybrid profile where Bitcoin treasuries, stock market valuation, and traditional enterprise software intersect. Its dominant Bitcoin holdings shape financial results, influence risk profiles, and define investor expectations more than software revenues.

While BTC accumulation has delivered powerful gains in prior cycles, the associated volatility and fair‑value accounting challenges continue to test the resilience of its stock and earnings. As institutional interest in crypto grows, Strategy remains a central case study in how digital asset strategies can reshape corporate finance. For investors and analysts alike, understanding these statistics is essential to navigate a company that sits uniquely at the crossroads of tech and crypto.