MicroStrategy has added another 196 Bitcoin to its balance sheet, but the company’s growing reliance on stock sales to fund these purchases is raising red flags among investors.

Key Takeaways

- MicroStrategy bought 196 BTC worth $22.1 million, bringing its total holdings to 640,031 BTC acquired at an average price of $73,983.

- The firm funded 94% of recent Bitcoin purchases through stock dilution, issuing 3.2 million new shares since August.

- MicroStrategy stock (MSTR) rose 2.78% in pre-market trading after the announcement but remains significantly below its yearly highs.

- Investors are voicing concerns as the gap widens between Bitcoin’s price gains and MSTR’s stock performance.

What Happened?

MicroStrategy, led by Executive Chairman Michael Saylor, announced it had purchased an additional 196 BTC for $22.1 million at an average price of $113,048 per coin. This brings its total holdings to a staggering 640,031 BTC, valued at over $71.7 billion based on current prices. However, the announcement came amid growing scrutiny over how the company is funding these ongoing Bitcoin acquisitions.

Strategy has acquired 196 BTC for ~$22.1 million at ~$113,048 per bitcoin. As of 9/28/2025, we hodl 640,031 $BTC acquired for ~$47.35 billion at ~$73,983 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/kZj8Y07Zfb

— Strategy (@Strategy) September 29, 2025

MicroStrategy’s Bitcoin Stack Grows Steadily

MicroStrategy has positioned itself as the largest corporate holder of Bitcoin, maintaining a routine of announcing purchases nearly every Monday. Its latest buy, though modest compared to previous ones, underscores a relentless commitment to accumulating the digital asset.

- Total BTC held: 640,031

- Total value: Over $71.7 billion

- Acquisition cost: $47.35 billion

- Unrealized profit: Approx. $24.35 billion

- Share of BTC supply: 3.2% of global circulation

Despite this accumulation, the company’s Bitcoin buys are shrinking in size. Last week’s 850 BTC purchase, valued at nearly $100 million, contrasts sharply with this week’s smaller $22 million acquisition. Still, the strategy remains aggressive, with Saylor’s signature phrase “Always ₿e Stacking” posted on X hinting at continued purchases.

Always ₿e Stacking pic.twitter.com/XMT5rA0DYL

— Michael Saylor (@saylor) September 28, 2025

Stock Dilution Strategy Draws Investor Criticism

While MicroStrategy’s Bitcoin position continues to grow, so does the backlash over its increasing use of stock dilution to fund these purchases. The firm has issued 3.2 million new shares since August, which accounts for roughly 1.2% of its total float.

- 94% of recent BTC buys were financed through stock sales.

- Recent stock sales included MSTR, STRF, and STRD, raising over $128 million.

- Only $22 million of that total was used to acquire Bitcoin.

This move contradicts earlier promises. In July, Saylor assured shareholders that the company would avoid excessive dilution. However, just a month later, MicroStrategy removed protective guardrails that limited share issuance, prompting concerns about long-term shareholder value.

Market Performance Lags Behind Bitcoin

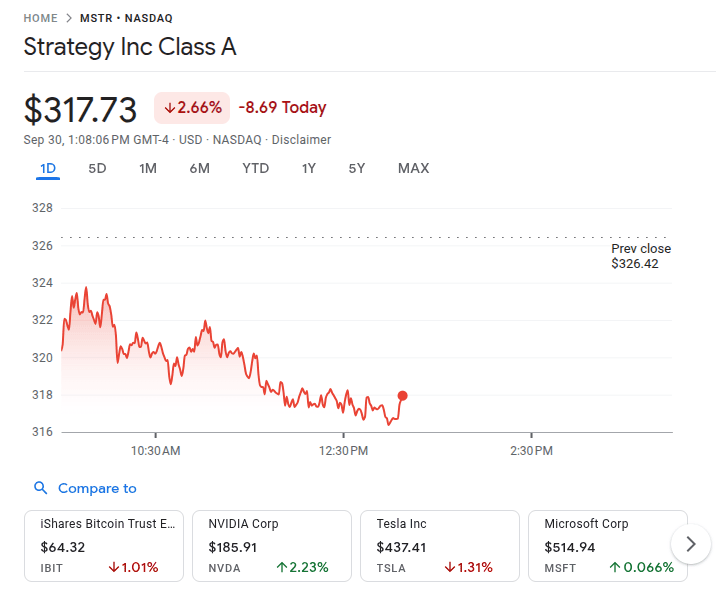

Despite its bold Bitcoin strategy, MicroStrategy stock is underperforming relative to Bitcoin’s gains. The stock is up just 3% year-to-date, significantly trailing Bitcoin’s performance.

- Earlier in 2024, MSTR hit $455 per share.

- Shares recently dipped below $300 before recovering to around $309.

- Bitcoin climbed back to $112,000, eyeing targets of $160,000 to $170,000.

This divergence has left many shareholders wondering if the company’s strategy is delivering value or merely risking further dilution.

CoinLaw’s Takeaway

In my experience, there’s a fine line between bold strategy and reckless risk. MicroStrategy has done an impressive job of positioning itself as a corporate Bitcoin pioneer, but now it’s caught in a balancing act. Issuing stock to buy Bitcoin might work when the market’s roaring, but when Bitcoin underperforms or goes sideways, that dilution hurts.

The optimism around a six-figure Bitcoin price may still come true, especially with the upcoming 2024 halving event, but I found it concerning that shareholder protections were quietly rolled back. If you’re holding MSTR stock, this isn’t just about Bitcoin anymore. It’s about governance, transparency, and whether this strategy serves the long-term health of the company.