Memecoins, cryptos born more from community jokes than fundamentals, have grown from fringe curiosities into serious speculative assets. They’re influencing liquidity flows, social media sentiment, and even political branding. In the marketing world, a brand might issue a meme token to boost engagement, and in finance, hedge funds may allocate small bets to high-volatility memecoins. Below are the data‑driven insights that frame the current memecoin landscape.

Editor’s Choice

- The total memecoin market cap recently peaked around $77 billion, accounting for ~2.2% of the total cryptocurrency market.

- BNB Chain’s memecoin ecosystem surpassed $38.7 billion in value, with $335 million daily trading volume reported.

- Over the first half of 2025, meme token creation exceeded 800,000 per month, averaging ~1,117,943 new tokens monthly.

- According to MetaTech Insights, the memecoin market was worth $68.5 billion in 2024 and is projected to reach $925.2 billion by 2035 (CAGR ~26.7%).

- In 2024, the top 10 memecoins held ~90% of the memecoin sector’s market capitalization.

- Dogecoin’s 24h trading volume in 2024 was ~$546 million, PEPE’s was ~$761 million, and SHIB’s was ~$206 million.

- In 2025, the memecoin market is estimated to occupy 5–7% of the global crypto market, valued at $80–90 billion.

Recent Developments

- In mid-2025, BNB Chain commanded 45% of all memecoin DEX volume, overtaking Solana, which declined to 25%, with Ethereum trailing at 20%.

- Since its launch on Jan 17, 2025, $TRUMP soared to a $27 billion market value in less than a day, sparking further attention on presidential themes.

- Over 700 Trump-themed copycat memecoins launched in the weeks following the official $TRUMP token, with 192 incorporating Trump family names and 67 using “official” branding.

- Pump.fun now faces federal lawsuits and allegations of extracting nearly $500 million in fees and launching over 11 million tokens, of which 98% collapsed within 24 hours.

- The “Cultivation” meme token achieved a $32 million market cap in 4 hours and recorded $105.7 million in trading volume.

- Recent reporting highlighted that less than 1% of new tokens on Pump.fun graduate to tradable status on major DEXs.

- Major memecoin launches now commonly feature governance and have undergone security audits, reflecting appeal to institutional capital.

- The SEC formally classified many memecoins as collectibles, not securities, reducing regulatory protection for retail investors in 2025.

- In 2024, the memecoin sector’s total capital grew over 500%, contributing to a rapid migration of speculative volume from large caps to meme altcoins in early 2025.

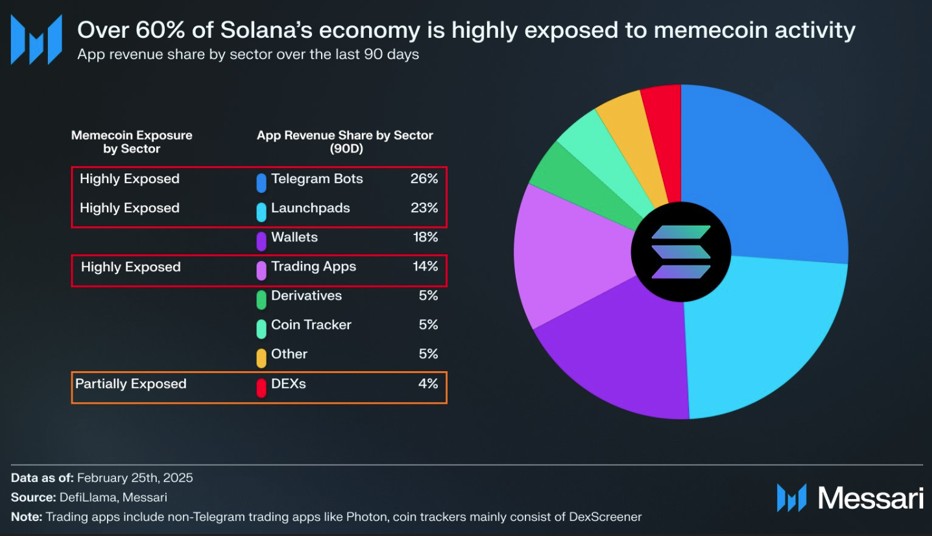

Solana’s Economy Highly Exposed to Memecoin Activity

- Over 60% of Solana’s economy is now highly exposed to memecoin-related activity, underscoring the chain’s growing meme-driven ecosystem.

- Telegram Bots lead all sectors, generating 26% of app revenue, driven by trading automation and meme token launches.

- Launchpads rank second with 23%, showing the surge in new memecoin issuances on Solana.

- Wallets contribute 18% of total revenue, boosted by increased on-chain transactions and user onboarding.

- Trading Apps account for 14%, reflecting high daily activity in meme token swaps and speculation.

- Derivatives, Coin Trackers, and Other Apps each represent 5%, indicating moderate engagement outside core meme functions.

- DEXs (4%) are partially exposed, as many meme traders prefer bots and launchpads over traditional decentralized exchanges.

Market Overview

- The total memecoin market cap is around $63.6 billion (recent snapshot).

- In 2025, memecoins represent 5–7% of the global crypto market, roughly $80–90 billion in value.

- In 2024, the memecoin market was estimated at $68.5 billion, with forecasts projecting massive future growth.

- Top 10 memecoins controlled ~90% of sector capitalization in 2024.

- The MarketVector™ Meme Coin Index tracks the performance of the 6 largest memecoin names.

- The 24h trading volume for memecoins stands at ~$7.61 billion.

- Meme tokens’ share of the sector high is driven by a few names (DOGE, SHIB, PEPE).

- The memecoin market has increasingly become a domain of speculation-driven capital rotation.

Memecoin Issuance Statistics

- In early 2025, the memecoin issuance exceeded 800,000 per month (avg ~1,117,943).

- January 2025 alone saw 1.7 million new meme tokens launched.

- The issuance surge shows that low barrier to creation remains a defining trait of memecoins.

- Meme coin development services are estimated as a $70+ million market currently.

- In 2025, top-performing meme coins reportedly deliver an average ROI of 150% over launch baselines.

- The high frequency of launches intensifies saturation and dilution risk across new projects.

- Many launches skip rigorous vetting or audits, increasing the probability of rug pulls or scams.

- Some launchpads claim millions of memecoins launched via their platform.

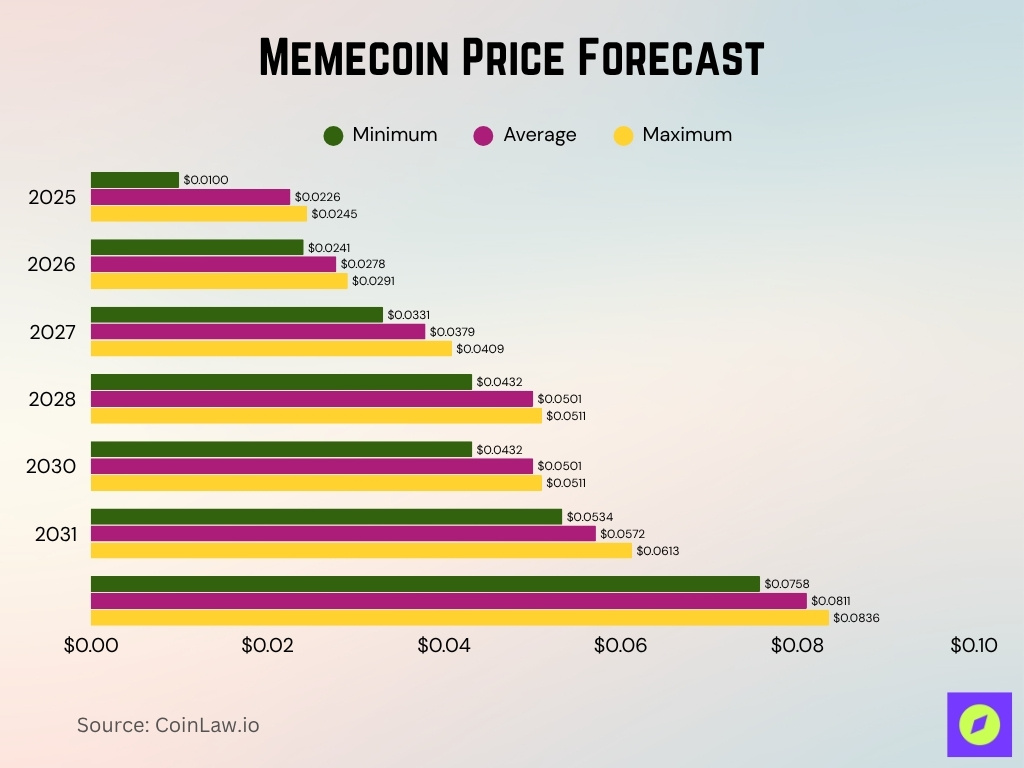

Memecoin Price Forecast

- In 2025, the memecoin market is projected to average $0.0226, with potential highs reaching $0.0245, reflecting early market stabilization.

- By 2026, prices could climb to an average of $0.0278, marking a 23% increase from 2025’s average.

- 2027 forecasts show a continued rise to an average of $0.0379, with highs near $0.0409, signaling stronger investor confidence.

- The 2028–2029 period maintains an average of $0.0501, suggesting a potential consolidation phase after rapid gains.

- By 2030, the average price could reach $0.0572, with peaks hitting $0.0613, as broader adoption and token utility improve.

- The long-term outlook for 2031 shows significant growth, with an average price of $0.0811 and a maximum of $0.0836, representing over a 250% increase from 2025 levels.

Number of Active Memecoins

- In 2024, CoinMarketCap listed 2,229 memecoins overall.

- Many newly issued coins vanish quickly or are delisted; thus, the active count tends to fluctuate.

- Analytical reports suggest thousands of live memecoins at any time in 2025.

- For the “Memecoin” token itself (ticker MEME), there are active listings in 217 markets globally.

- Its circulating supply is ~57 billion of a 69 billion max, demonstrating how tokenomics affect activeness.

- New meme coins often saturate quickly, leaving many with negligible liquidity.

- The survival rate of new tokens over 6 to 12 months is low, but exact attrition data is hard to track publicly.

- Curated indices and rankings filter lesser‑active memecoins, reducing the count dynamically.

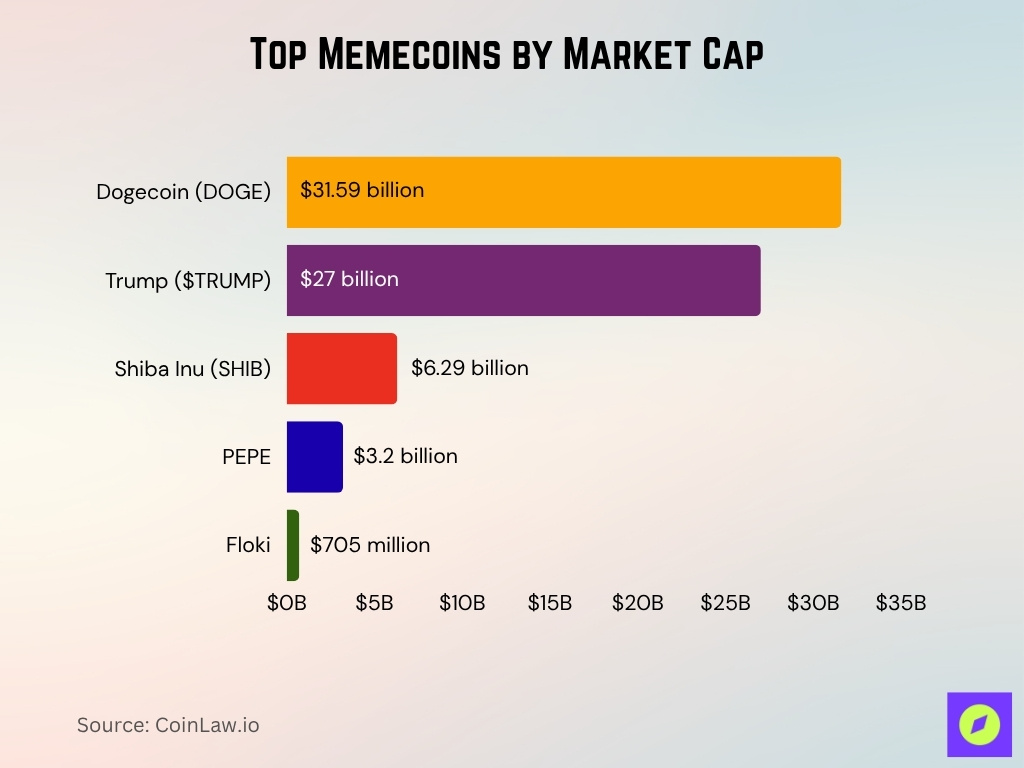

Top Memecoins by Market Cap

- Dogecoin (DOGE) led with a market cap above $31.59 billion, remaining the largest memecoin by value.

- Shiba Inu (SHIB) held the #2 slot with a market cap of $6.29 billion, followed by PEPE at $3.2 billion.

- The $TRUMP memecoin topped a market cap of $27 billion within 24 hours of launch, then fell sharply amid heavy trading.

- Floki’s market cap fluctuated around $705 million, while meme ranking positions often shift within hours on social hype.

- The MarketVector™ Meme Coin Index in October 2025 tracked top memecoins by market cap: DOGE, SHIB, PEPE, BONK, FLOKI, and TRUMP.

- BONK surged over 15% in a single day in July 2025, reaching a $1.6 billion market cap and ranking as the fifth-largest memecoin.

- Roughly 80% of $TRUMP’s total token supply remains owned by entities controlled by Donald Trump or his affiliates.

- The $TRUMP launch generated over $350 million in token sales and related platform fees.

- In July 2025, the total memecoin market cap surged from $51 billion to $73 billion within a single month, led by these top tokens.

- The top 10 memecoins accounted for ~90% of the entire memecoin sector’s total capital by mid-2025.

Memecoin Volatility Metrics

- The U.S. SEC’s February 2025 advisory noted memecoins “tend to experience significant market price volatility,” with risk levels higher than most crypto assets.

- POPCAT and similar meme tokens have demonstrated daily price swings of up to 53%, making sudden reversals a norm for the sector.

- CoinDesk’s Memecoin Index dropped 23.4% in 24 hours on whale-driven liquidations, with PEPE losing over 25% in a week.

- In 2025, meme tokens frequently trade within “squeeze zones,” with 2×–4× breakout moves often following social-driven surges.

- The memecoin sector posted average YTD returns of +1,313% in H1 2025, making it the only profitable crypto segment during that period.

- Research finds memecoin volatility typically exceeds 11.7% daily, far above the average for most altcoins or Bitcoin.

- BONK ranks as the most volatile major memecoin, with JEETS, PEPE, and BOME showing strong daily price movement correlations above 0.72–0.83.

- New launches see survival rates below 8% after 60 days, and most lose over 97% of their peak value amid rapid bust cycles.

- Whale or bot-driven price cascades can amplify hourly volatility by 6× compared to organic retail trades.

- Despite the frequency of high-profile crashes, the memecoin sector P&L averaged +33.08% through Q3 2025, driven by a handful of outperformers.

Trading Volume of Memecoins

- In early October 2025, top memecoins consistently saw 24h trading volume over $9 billion, led by hype spikes.

- Pump.fun reported a daily trading volume of approximately $264 million, with all-time volume exceeding $73 billion by Q4 2025.

- Q1 2025 saw memecoins account for up to 25% of total crypto trading volume at the sector’s local peak.

- By April 2025, the memecoin share dropped to 1.8% of the entire crypto market, reflecting a major retreat from earlier highs.

- The memecoin sector lost about 58% of its value between January and April 2025, with volumes falling ~63% during this period.

- Dogecoin and PEPE each maintained 24h trading volumes above $500 million and $760 million, respectively, by mid-2025.

- Daily trading volume on pump.fun ranged from $96–320 million through summer and autumn 2025, depending on meme launch counts.

- Social media virality, celebrity catalysts, and influencer-driven launches remain the core drivers for sudden volume surges, often increasing by 2–5× within hours.

- Fewer than 5% of all launched memecoins manage to sustain high volume beyond their first 72 hours.

- “Graduation” from launch to main DEXes on pump.fun saw fee collection exceeding $139 million in 2025, driving liquidity flows for top tokens.

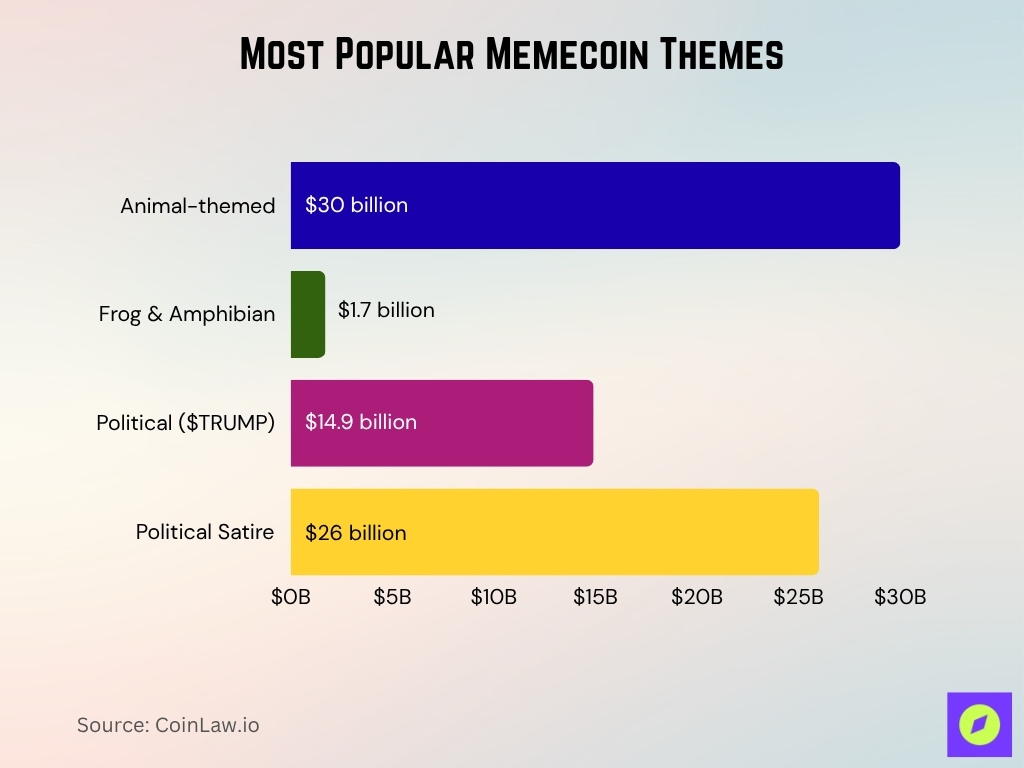

Most Popular Memecoin Themes

- Animal-themed memecoins (DOGE, Shiba Inu, BONK, WIF) maintained a collective market cap above $30 billion in 2025, dominating meme branding.

- Frog and amphibian meme coins, led by PEPE, saw daily trading volumes surge over $1.7 billion in July 2025, with social engagement rising 27% month-on-month.

- Political memecoin $TRUMP launched in 2025, reaching an all-time high market cap of $14.9 billion before volatility wiped out $5 billion minutes after its peak.

- Meme coins centered on political satire (TRUMP, MAGA, BODEN) spiked Solana’s meme trading volumes to $26 billion during major U.S. political events.

- BONK (dog/POM) neared a 1 trillion token burn milestone this year, with over 1 million holders on Solana.

- Hyper-deflationary meme coins with burn models accounted for about 21% of top-performing launches this year.

- Utility-lite “10×” promise tokens comprise about 17% of daily trending meme launches, often surging and fading within weeks.

- NFT-drop-integrated meme tokens regularly enter Top 50 meme coin lists within 2–5 days of launch, leveraging viral branding.

- Pop culture-linked memecoins (e.g., anime, music) can see 300–600% daily price spikes during hashtag trend surges on X.

- By April 2025, fewer than 10% of Top 100 meme coins by market cap still reflected their original Q1 themes, underscoring trend churn.

Blockchain Distribution of Memecoins

- Over 6 million memecoins have launched on Solana’s pump.fun since the platform was created in January 2024.

- As of mid-2025, pump.fun supports an average of 65,000 daily meme token launches on Solana and now spans Base via meme minting APIs.

- Solana memecoin DEX trading volume peaked at $206 billion for January 2025, representing 79% of Solana’s overall monthly trade activity.

- By February 2025, daily launches on pump.fun had dropped from 70,000 peak to 25,000 amid market cooldown and reduced retail interest.

- Fewer than 2.1% of Solana memecoins “graduate” from launch platforms to major DEXs like Raydium, with most failing to build sustainable liquidity.

- Liquidity fragmentation persists, with successful memecoins often split across 3–5 major chains, yet many pools per chain remain shallow.

- Meme launches increasingly migrate toward blockchains with average transaction fees below $0.01, driving adoption for Solana, BNB, and Base over Ethereum.

- Solana, Base, and BNB together represent 95% of new meme token launches, while Ethereum’s market share fell below 5% for memecoins in Q2 2025.

- Market manipulation and wash trading detection are more challenging on less-audited blockchains, with up to 67% of suspicious flows reported on new meme chains in 2025.

Multichain Memecoin Statistics

- By Q3 2025, DOGE and SHIB each support more than four major chains, with active multichain bridging networks spanning BNB, Base, Arbitrum, Polygon, and Ethereum.

- Bridged pools supply 10–25% of total DOGE liquidity on top exchanges, while smaller coins see as much as 40% bridged volume during hype cycles.

- More than 13 million unique wallet addresses interacted with multichain memecoin bridges in 2025 alone.

- Fragmentation of user wallets has led to an estimated 18–35% inflation in active user counts due to duplicate cross-chain holdings.

- The total cross-chain bridge volume for memecoins rose 420% during celebrity token launches and major NFT drops in Q2 2025.

- In 2025, 21% of the top 100 meme coins implemented cross-chain mint/burn mechanics to sustain supply parity across networks.

- Memecoin projects leveraging chain-agnostic token contracts achieved 2–3 times wider distribution, yet showed 17% lower wallet retention than single-chain peers.

- Ethereum and Solana collectively accounted for 78% of all memecoin cross-chain settlements by value, while Base grew to a 16% share in summer 2025.

- Security events related to multichain bridges caused losses exceeding $190 million for memecoin holders by September 2025.

- Memecoin sentiment scores correlated with bridge volume spikes, with social-driven bridge traffic showing 1,100% short-term surges after influencer events.

Social Media Activity and Trends

- Mentions of “memecoin” and related hashtags rose ~53% from January 2024 to 2025, outpacing chatter around many altcoin verticals.

- Viral memes, influencer posts, and coordinated campaigns can trigger 20%+ price moves within hours.

- Platforms like X (formerly Twitter), Reddit, Discord, and TikTok are primary drivers of sentiment.

- Some projects use NLP sentiment scoring; positive scores above ~70% often precede brief rallies.

- Coordinated social media bounties (posting, reposting) are used to artificially amplify attention.

- Comment bots and fake accounts inflate engagement metrics, masking real interest.

- Across many memecoin communities, active Discord or Telegram groups exceed 50,000–100,000 members.

- Some projects host “meme contests,” AMAs, or NFT giveaways to stoke social virality and engagement.

Investor Demographics and Profiles

- A survey noted that among U.S. crypto investors, ~31% said their first exposure to crypto was via a memecoin.

- Younger investors (ages 18–34) are disproportionately more active in meme sectors, drawn by social media familiarity and speculative upside.

- Many memecoin holders hold small positions, often < 1% of their overall portfolio.

- A subset of “whales” or large holders may control 20–50% of the circulating supply in some tokens.

- Many retail investors enter mid‑cycle after observing short‑term gains, exposing them to reversal risk.

- Some institutional interest is emerging, but mainly via structured thematic funds or small allocations within alternative asset classes.

- Communities tend to be technologically literate, social media‑native, and risk-tolerant.

- In emerging markets (Asia, Latin America), memecoins often overlap with speculative trading in local FX/crypto corridors.

Risk Factors and Scam Statistics

- The memecoin boom demands scaled detection of rug pull risks, backdoor drains, and malicious token logic.

- Over $2.17 billion has been stolen from crypto services (not exclusively memecoins) in 2025 so far.

- Scam addresses in 2024 reportedly collected about $12 billion in illicit flows (0.14% of on-chain volume).

- Analysts estimate 95% of newly launched tokens may be scams or low‑probability failures, and many collapse swiftly.

- In many ecosystems, 60% of new tokens are active for less than one day.

Security and Vulnerability Data

- In 2025, over 91% of new memecoins on the Base chain were found to have at least one security vulnerability.

- Approximately 1 in 6 Base memecoin launches in 2024–2025 were scams or “trap” tokens implementing honeypot logic.

- Fewer than 15% of memecoins launching in 2025 underwent any formal smart contract audit.

- Crypto thefts in the first half of 2025 exceeded $2.17 billion, surpassing the total for all of 2024.

- The Bybit hack resulted in a single loss event of $1.5 billion, making it the largest crypto heist ever recorded.

- Mint and burn logic flaws, owner withdrawal bugs, and misused delegatecall are among the top exploit patterns impacting memecoins in 2025.

- Phishing attacks and fake token swap portals are responsible for a growing share of losses, with social engineering involved in nearly 40% of reported crypto incidents.

- Cross-chain bridge contracts accounted for 18% of all memecoin exploit vectors so far in 2025.

- Automated bot-driven sandwich attacks and front-running exploits contributed to market manipulation in over 35% of low-liquidity pools.

- Centralization risk in token distribution was flagged in >25% of audited Solana memecoin smart contracts in 2025.

Sniper Bot Activity in Memecoin Markets

- Up to 80% of early trading volume on memecoin launch platforms like Pump.fun is driven by sniper bots, especially within the first few blocks.

- In 2024, over 15,000 memecoin issuances on Pump.fun saw active manipulation by more than 4,600 sniper wallets using automated strategies.

- A single sniper bot accumulated profits exceeding $6.8 million from memecoin trades on Pump.fun in just one month, netting ROI as high as 2,227× on individual trades.

- Sniper bots collectively generated over 15,000 SOL in realized profits across thousands of transactions during peak activity periods in 2024.

- Studies found 87% of sniper bot trades on Pump.fun were profitable, reflecting their efficiency in front-running and rapid execution.

- On average, bots execute trades within under one second of new memecoin liquidity events, far faster than most human traders.

- During some launches, bots accounted for over 70% of total unique wallet interactions in the first 10 blocks of trading.

- Volume bots simulate organic order flow via randomized wallet rotations and intervals to avoid detection, supporting liquidity in over 100+ new tokens daily.

- Sophisticated sniper bots monitor DEX mempools to analyze new contract deployments, enabling anticipation of thousands of launches per month.

- The largest bot-driven memecoin trades can create price spikes of 100–500% within minutes, before rapid reversals as human traders attempt to follow.

Memecoin Launch and Listing Trends

- The platform pump.fun has launched over 6 million meme tokens as of January 2025.

- Some platforms generate revenue in the hundreds of millions, pump.fun reportedly generated ~$800 million in fees.

- A launch fee or “swap fee” (1%) is common on many memecoin platforms.

- The number of memecoin launches per day is astonishing, ~40,000 to 50,000 new memecoins per day in 2025 total.

- A large share of launches never graduate to major DEX listings or CEX listings.

- Some tokens use “listing milestones” to unlock visibility or liquidity incentives.

- Copycat projects (e.g., “$TRUMP clones”) proliferate rapidly, 700+ variants by some reports.

- Memecoin IPO-style launches or ICO rounds are rare; most rely on liquidity mining or community seeding.

Historical Performance and Growth

- In 2024, memecoin trading volume surged to over $35 billion during the peak of the sector’s spring rally.

- Memecoin market capitalization grew by more than 550% between Q1 and Q2 2024, outpacing most other crypto segments.

- Dogecoin held a market cap above $10 billion throughout 2024, remaining the most prominent memecoin by valuation.

- More than 60% of new memecoins launched during 2023–2024 failed to reach their six-month anniversary, highlighting sector volatility.

- In early 2024, the top five memecoins collectively accounted for over 40% of all speculative crypto trading volume.

- Returns greater than 100× were recorded for tokens like PEPE and FLOKI from launch to their respective peaks in 2024.

- Memecoin prices dropped as much as 85% during bear cycles in 2023–2024, quickly erasing speculative gains.

- Community governance features were added to over 30% of leading memecoins by late 2024 to increase resilience.

- The number of unique wallet holders for memecoins surpassed 18 million by May 2024.

- Roughly 25% of memecoins surviving past one year integrated cross-chain bridges to support asset flow and stability.

Frequently Asked Questions (FAQs)

The memecoin sector’s market cap was about $63.6 billion.

The sector added nearly $17 billion, rising about 29 % during July.

The market is expected to grow at about 26.7 % CAGR over that decade.

Memecoins achieved an average +1,313% return in the first half of 2025.

Conclusion

Memecoins have shifted from crypto side shows to heavyweight actors in speculative markets, steered heavily by social media, bot infrastructure, and permissionless token issuance. Yet alongside their gains come disproportionate risks, scams, hacks, and ruthless volatility. For those navigating this space, rigorous due diligence, on-chain analytics, and community signals are essential tools, not optional extras. The numbers here offer a compass, not a guarantee. Dive into the full article to see how each segment interlocks in the broader memecoin narrative.