Koinly has become one of the most widely used crypto tax and portfolio tracking tools as digital asset investing grows in the United States and around the world. Crypto traders and investors rely on Koinly to calculate tax liabilities automatically, avoid manual errors, and stay compliant with IRS and other jurisdictional rules.

Real-world use cases include US taxpayers generating IRS-ready crypto tax reports in minutes and international investors consolidating wallets, exchanges, and DeFi activity into one platform. As crypto adoption rises, so does the need for tools that streamline tax preparation and reporting. Read on to explore the latest statistics shaping Koinly’s growth and impact.

Editor’s Choice

- 1.5 million+ users actively use Koinly worldwide as of late 2025.

- Koinly supports 20+ countries with compliant tax reports.

- 900+ integrations across exchanges, wallets, and platforms.

- Users can import up to 10,000 transactions on the free plan.

- Direct support for 7,200+ DeFi protocols via integrations.

- Average crypto tax report generation time is under 20 minutes.

- Koinly integrates data from 700+ exchanges and blockchains for internal market reporting.

Recent Developments

- In December 2025, Koinly disclosed a Mixpanel security incident potentially exposing user names, email addresses, location, and device details, while confirming no wallet, transaction, or tax data access.

- Koinly ceased using Mixpanel and launched a comprehensive audit of third-party tools handling user data to strengthen security controls.

- The platform continues to support 20,000+ cryptocurrencies, 900+ exchanges, and automated tax reporting for 20+ jurisdictions, underpinning its expanded 2026 education focus.

- Koinly pricing remains between $49–$279 per year across paid tiers, with a free plan that supports up to 10,000+ transactions for calculations.

- Educational content now includes updated 2026 guides on calculating crypto cost basis and choosing methods like FIFO, LIFO, and ACB for tax optimization.

How Much Is Crypto Taxed in the US?

- Crypto gains are taxed using standard federal income tax brackets, not a special crypto-specific rate.

- Tax rates range from 10% to 37%, depending on your total taxable income and filing status.

- Single filers pay 10% on income up to $11,925, rising to 37% on income above $626,350.

- Head of household filers enter the 22% bracket at $64,850 and reach the top 37% rate after $626,350.

- Married filing jointly offers the widest brackets, with 10% applied up to $23,850 and 37% starting above $751,600.

- Married filing separately reaches the highest 37% tax rate at just $375,800, making it the most tax-intensive filing option.

- Mid-level crypto profits often fall in the 22% or 24% brackets, covering income between $48,475 and $197,300 for single filers.

- High-income crypto investors commonly pay 32% to 35% on gains once taxable income exceeds $197,300.

- Every taxable crypto event counts, including selling crypto, crypto-to-crypto trades, and spending crypto.

- Your crypto tax rate increases as total income rises, meaning large gains can push you into a higher bracket even temporarily.

How Does Koinly Work

- Koinly imports transactions via API or CSV files from 800+ exchanges, wallets, and blockchains, including Bitcoin, Ethereum, Solana, and Polygon.

- Platform supports 20,000+ cryptocurrencies, 900+ exchanges, and 50+ wallets for automated transaction syncing and classification.

- Automatically classifies events like staking rewards, NFT sales, DeFi lending, and liquidity provision across 14+ blockchains.

- Calculates capital gains, losses, and income using cost basis methods, including FIFO, LIFO, HIFO, ACB, and jurisdiction-specific rules like Share Pooling.

- Tailors reports for 20+ tax jurisdictions with real-time portfolio valuation tracking, realized and unrealized gains.

- Smart transfer matching reconciles moves between user wallets with 99% accuracy, preserving original cost basis without taxable events.

- Generates export-ready reports like Form 8949, Schedule D, and integrations for TurboTax, TaxAct, and H&R Block.

- Free plan supports up to 10,000 transactions; paid tiers from $49/year handle unlimited volume for complex portfolios.

Geographic Distribution of Koinly Users

- Koinly is trusted by over 1 million crypto investors across 20+ countries worldwide.

- Supports tax calculations in 100+ countries globally, spanning North America, Europe, Asia, Oceania, Africa, and Latin America.

- North America (USA, Canada) represents a major segment driven by IRS and CRA reporting requirements.

- Europe covers 20+ countries, including the UK, Germany, France, the Netherlands, Sweden, and Norway, with specialized rules like fraction costs.

- Australia ranks high in app usage (#256 Finance category, #2796 overall) amid ATO data-matching from 2014-2026.

- UK users leverage HMRC-aligned CGT summaries, ranking #8659 overall and #751 in Finance.

- Germany app usage at #1346 in Finance, supporting local compliance alongside broader EU adoption.

Koinly Free vs Paid Users

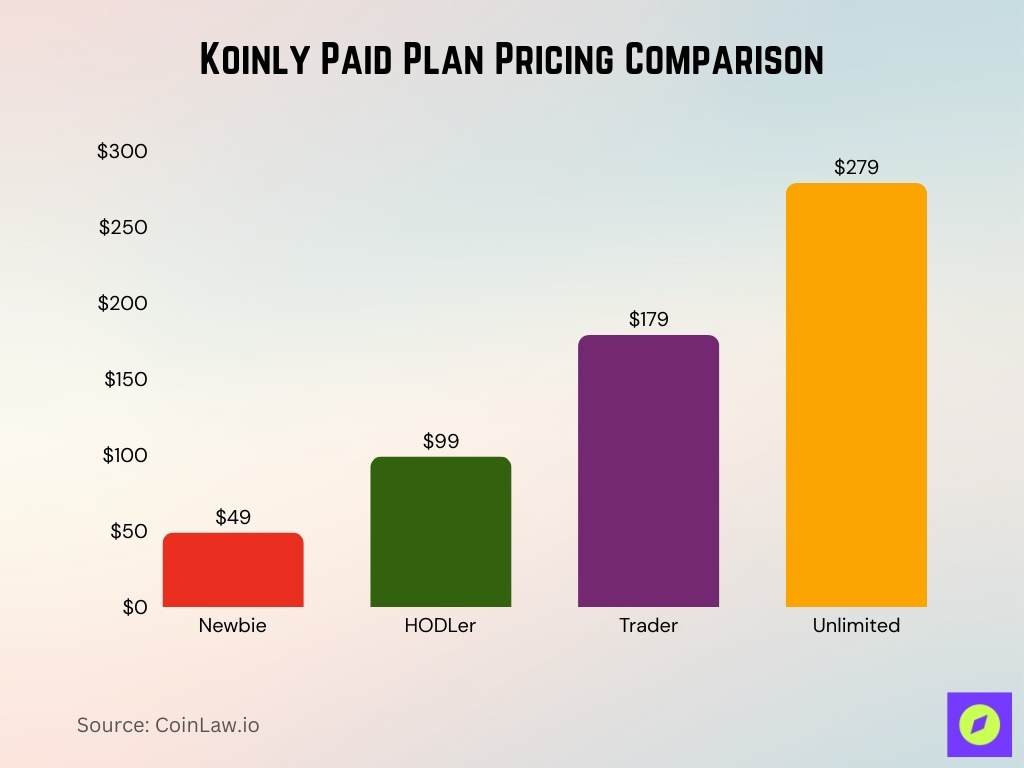

- Paid plans start at $49/year (Newbie, 100 txns), $99 (HODLer, 3,000), $179 (Trader, unlimited), $279 (Unlimited).

- Free plan supports up to 10,000 transactions with basic tax estimates and portfolio tracking.

- Free tier allows preview of tax liability but no audit-ready PDF or CSV exports.

- 70%+ of users with >10,000 txns upgrade to paid for full reporting and reconciliation.

- Professional users choose Trader or Unlimited plans for IRS Form 8949, Schedule D exports.

- Transaction volume dictates selection: <10k free, 10k-300k HODLer ($99), >300k Unlimited ($279).

- Paid users get priority support, advanced matching, DeFi/NFT classification, and multi-year reports.

- Annual pricing scales with thresholds; the monthly option at $15.99 for Newbie to $46.99 Unlimited.

User Demographics: Retail vs Professional

- Retail investors comprise the majority of 1M+ Koinly users, primarily hobbyists and HODLers using the free plan up to 10,000 transactions.

- 70% of accounting firm MyCryptoTax clients use Koinly, enabling 5-20 monthly client acquisitions for professionals.

- Professional traders opt for the Trader Plan at $179/year with unlimited transactions and priority support for high-volume portfolios.

- Hobbyist investors start on Free Plan (10k txns) or Newbie ($49, basic features), scaling to HODLer ($99) for active trading.

- Accounting professionals leverage client workflows, doubling revenue and tripling staff like MyCryptoTax from 3 to 9 employees.

- DeFi traders rely on auto-classification for Uniswap, SushiSwap, handling liquidity pools and staking across 14+ chains.

- High-volume traders upgrade for complex reconciliation, supporting millions of transactions via API from 900+ exchanges.

- Institutional advisors use advanced reporting for multi-client portfolios, with case studies showing 100% revenue growth.

Supported Integrations and Platforms

- 900+ direct integrations with exchanges like Binance, Coinbase, Kraken, KuCoin, Bitfinex.

- 800+ wallets and services, including Ledger, Trezor, MetaMask, Trust Wallet, Exodus.

- 700+ DeFi protocols supported for Uniswap, PancakeSwap, Aave, Compound, Yearn Finance syncing.

- API read-only access and CSV uploads for manual imports from any unsupported platform.

- Real-time portfolio updates with live prices from CoinGecko for exposure monitoring.

- Handles staking, mining, futures, NFT sales, and margin trades automatically via integrations.

- No private keys stored; 99% transaction matching accuracy reduces manual entries by 95%.

Average Portfolio Size and Transaction Frequency

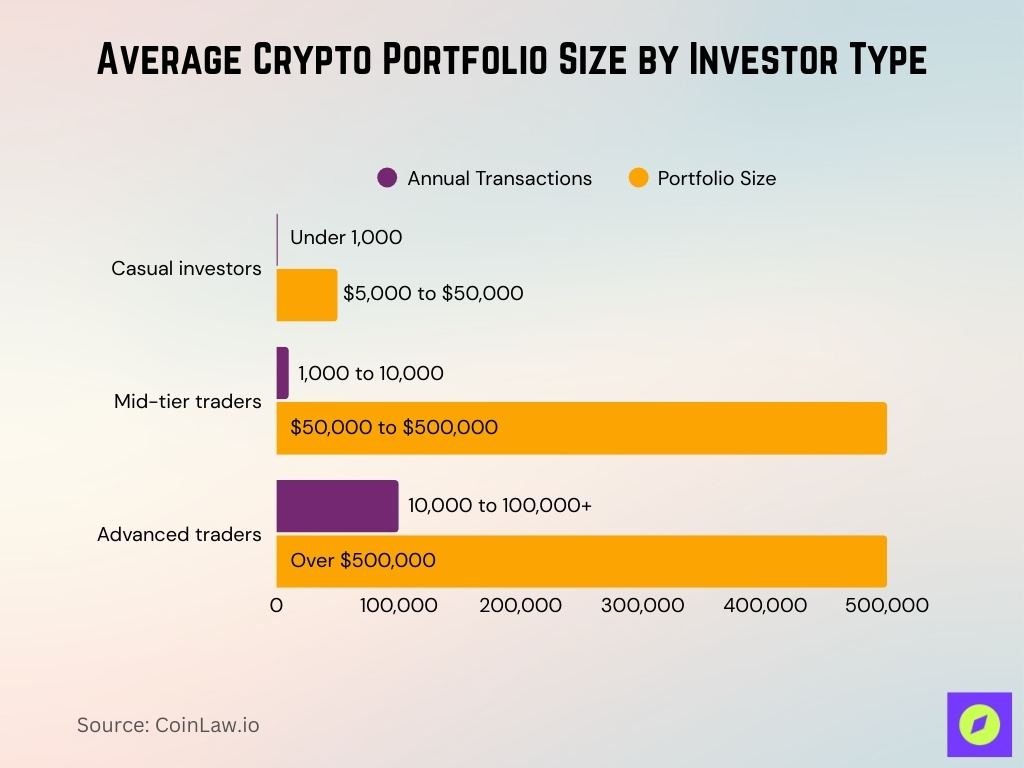

- Casual investors average <1,000 txns/year, $5k–$50k portfolio on Free or Newbie plan.

- Mid-tier traders process 1k–10k txns annually, $50k–$500k holdings on HODLer ($99).

- Advanced traders exceed 10k–100k+ txns/year, >$500k portfolios using Trader/Unlimited.

- Advisors manage 10–50 client portfolios simultaneously via agency workflows.

- Volatility boosts txns by 30–50% in bull markets, spiking DeFi and NFT activity.

- NFT collectors see 100–500 txns during launches, mints averaging $1k–$10k per drop.

- Staking generates 12–52 recurring txns/year per position from ETH, SOL validators.

Top Exchange and Blockchain Integrations

- 400+ centralized exchanges, including Binance, Coinbase, Kraken, KuCoin, Bitfinex, via direct API.

- Top 10 most common: Binance (45% users), Coinbase (30%), Kraken (15%), based on reviews.

- 800+ wallets: Ledger, Trezor, MetaMask, Trust Wallet, Exodus, Phantom for Solana.

- 14+ blockchains: Bitcoin, Ethereum, Solana, Polygon, Avalanche, Binance Smart Chain.

- Multi-chain imports sync 20,000+ assets across networks for a unified transaction history.

- Staking rewards auto-tracked from Lido, Rocket Pool; swaps from Uniswap V3, 1inch.

- Custodial (Coinbase Wallet) and DeFi platforms (Aave, Curve) are fully integrated.

- Wallet DeFi feeds a real-time portfolio with liquidity positions and yield farming values.

DeFi, NFT, and Web3 Protocol Coverage

- 7,200+ DeFi protocols tracked, including Uniswap, SushiSwap, PancakeSwap, and Balancer.

- Yield farming and liquidity pools auto-labeled for Aave, Compound, and Curve Finance rewards.

- NFT purchases/sales captured from OpenSea, Blur, Magic Eden via wallet connections.

- Airdrops, staking, and mining are classified with 99% accuracy across 14+ blockchains.

- Web3 coverage spans Yearn.finance, GMX, Pendle for perpetuals, and yield optimization.

- NFT marketplaces reflect sales (ERC-721, ERC-1155) in cost basis and capital gains.

- Multi-standard support for ERC-20, ERC-721, ERC-1155, SPL tokens on Ethereum and Solana.

- DeFi automation handles forks, wraps, and bridges, reducing manual entries by 95%.

User Behavior and Exchange Preferences

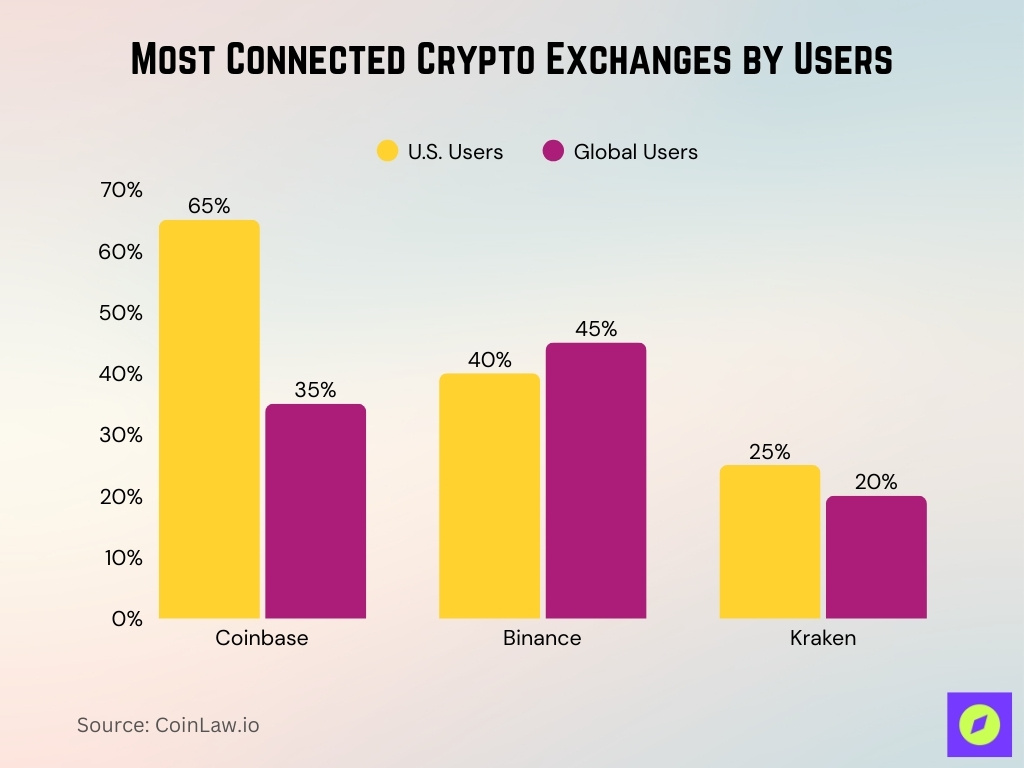

- US users connect to Coinbase (65%), Binance (40%), and Kraken (25%) first for IRS compliance.

- Top platforms: Binance (45% users), Coinbase (35%), and Kraken (20%) are the most linked globally.

- Average 3–6 platforms per account, with 80% using 2+ exchanges/wallets.

- Active traders use API (90%) vs CSV (10%) for real-time syncing.

- HODLers review portfolios 1–4x/year, traders weekly during bull runs.

- Bull markets boost new integrations by 50%, peaking in Q4 activity.

- Exchange switching rises 30% post regulatory changes like SEC actions.

- Mobile app usage surges 70% in tax season (Jan–Apr) for on-the-go checks.

Portfolio and Transaction Volume Statistics

- Tracks realized and unrealized gains/losses across 20,000+ assets in a unified dashboard.

- Asset distribution visualized by chain (Ethereum 40%, Solana 20%), wallet, and exchange.

- Portfolio insights forecast tax liabilities using FIFO, LIFO, and HIFO scenarios pre-filing.

- Consolidated views aggregate millions of transactions from 900+ integrations for Schedule D.

- Margin/futures trades imported from Binance Futures and Bybit, included in gains/losses.

- Diversification metrics show top holdings (BTC 35%, ETH 25%) and concentration risks.

- High-frequency traders average 100k+ txns/year, using Unlimited plan ($279).

- Free plan limits 10k txns; 80% of >50k txns users upgrade for full analytics.

Tax Reporting Volume and Generation Time

- Generates IRS-compliant Form 8949, Schedule D reports in under 20 minutes for <10k txns.

- Supports 20+ report types consolidating capital gains, income, and losses across jurisdictions.

- Export formats: PDF, CSV, TXF, integrate with TurboTax, H&R Block, TaxAct.

- High-volume (>100k txns) processing takes 1–5 minutes with cloud optimization.

- Automation cuts manual effort by 95%, handling 7,200+ DeFi and NFT events.

- Q1 demand peaks with 80% of annual reports generated during the Jan–Mar tax season.

- Preview tools estimate liabilities instantly using real-time prices from CoinGecko.

- Processes millions of txns daily for 1M+ users during filing periods.

Cost Basis Methods and Tax Calculation Accuracy

- Supports 10+ methods: FIFO, LIFO, HIFO, ACB, Share Pooling, Specific ID.

- Method comparison previews tax liability differences up to 30–50% across scenarios.

- 99% accuracy aligns with IRS wash sale, constructive ownership rules via smart matching.

- Includes fees, internal transfers, and dust in the cost basis without triggering taxable events.

- Tax loss harvesting models realized losses up to $3k ordinary income offset annually.

- Smart matching eliminates 95% duplicates and missing data via on-chain heuristics.

- Country-specific: ACB Canada, HIFO Germany, 50% discount in Australia.

Audit Support and Compliance Metrics

- Generates IRS-ready Form 8949, Schedule D with audit trail including timestamps, FMV, and sources.

- Supports Specific ID tracking with lot selection for optimal cost basis assignment.

- Audit trails log 7,200+ DeFi events, 900+ integrations data for full traceability.

- Proactive flags 95% of missing cost basis via on-chain lookup and heuristics.

- Error detection identifies 99% mislabels/duplicates in staking, airdrop txns.

- Automated exports cut reconciliation time 80% for accountants handling 50+ clients.

- Compliance reports consolidate gains, income, and disposals for 20+ jurisdictions.

- International summaries for HMRC, ATO, CRA with local formats and deadlines.

DeFi, NFT, and Cold Storage Usage Trends

- DeFi participation up 40% YoY, with 30% users linking Uniswap and Aave protocols.

- Wallet imports handle 70% of DeFi activity from MetaMask and Phantom.

- NFT users average 50–200 txns/year, bursts around drop seasons.

- Cold storage (Ledger, Trezor) is used by 60% for HODL positions >1 year.

- Hardware wallet adoption rises 25% in bear markets for security.

- Staking generates 20–50 events/year per user, taxable as ordinary income.

- NFT gas fees add 5–15% to the cost basis on Ethereum mints/sales.

- Multi-chain users (40%) depend on auto-labeling for 95% accuracy.

Market Share and Competitor Comparison

- Koinly holds the top 3 ranking with 800+ exchanges, 20+ countries, vs CoinLedger’s 387 exchanges.

- 400+ integrations surpass CoinTracker’s 458 exchanges but lead in wallets (83 vs 28).

- DeFi superiority: Koinly auto-tags 7,200+ protocols vs competitors’ partial manual support.

- 4.7/5 average rating; users praise automation (99% matching) over rivals.

- Market growth 24.16% CAGR to $47.6 billion by 2035 fuels regulatory-driven share gains.

- Paid conversion hits 80% peak Jan–Mar tax season from free previews.

- Serves 1M+ beginners to pros vs niche tools like ZenLedger for US-only.

- Global reports for 100+ countries strengthen position vs US-focused competitors.

Security, Uptime, and Data Protection

- Uses read-only API access for 900+ integrations, never requesting private keys or withdrawal permissions.

- AES-256 encryption protects data in transit (TLS 1.3) and at rest across all user information.

- 99.99% platform uptime maintained during tax season peaks, handling millions of daily transactions.

- Users can permanently delete all data in one click, with GDPR/CCPA-compliant erasure policies.

- Multi-factor authentication (MFA) is required for 100% account access with SOC 2 Type II certification.

- December 2025 Mixpanel breach exposed emails only; no wallet data, passwords, or tax reports compromised.

- ISO 27001 certified infrastructure auto-scales for Q1 traffic spikes up to 10x baseline.

- Bi-weekly security patches and penetration testing ensure zero major breaches since inception.

Major Product Updates and Feature Adoption

- DeFi labeling enhancements adopted by 60% advanced users post 2025 update for 7,200+ protocols.

- Portfolio analytics usage rises 40% outside tax season for real-time gain tracking.

- Export tools peak at 85% usage Jan–Apr for Form 8949/Schedule D filings.

- Cost basis previews boost method switching by 25% after IRS guidance updates.

- Interface refresh cuts reconciliation time 50%, adopted by 70% within 30 days.

- Educational guides lift first-time onboarding success to 92% completion rate.

- New integrations (e.g., Solana wallets) reach 50% traction in the first quarter post-release.

- Multi-feature users (5+ tools) retain at 85% vs 60% single-feature average.

Koinly Derived Crypto Market Insights

- Transaction volumes surge 300% during bull rallies, peaking in Q4 per 1M+ user data.

- Tax loss harvesting rises 150% in bear markets, realizing $3k annual offsets.

- BTC (45%), ETH (30%) dominate holdings in 80% tracked portfolios.

- DeFi grows 50% YoY in diversified portfolios (>10 protocols).

- NFT activity limited to 5–10% active users, high-value (>$10k) sales.

- Stablecoins (USDT, USDC) usage jumps 40% amid volatility spikes.

- Automated imports yield 99.5% accuracy for multi-year reporting.

- Long-term users (>2 years) achieve 95% compliance vs 75% new users.

Frequently Asked Questions (FAQs)

Koinly supports tax reporting in 20+ countries.

Koinly offers 1,000+ direct integrations.

Koinly auto‑syncs with 7,200+ DeFi protocols.

The Koinly discuss forum shows 9,773 registered users.

Conclusion

Koinly’s statistics show how crypto tax software has evolved into a core compliance tool for investors, traders, and professionals. From audit-ready reporting and broad integrations to advanced DeFi and NFT coverage, the platform reflects the growing complexity of digital asset activity. For US taxpayers navigating IRS requirements and global users managing multi-chain portfolios, these insights highlight why automation now sits at the center of crypto tax compliance. As regulation and adoption continue to mature, Koinly’s data offers a clear view into the future direction of crypto reporting and portfolio management.