Imagine you’re standing in a bustling marketplace, where transactions flow seamlessly without the burden of upfront payments. This is the world Klarna envisions, a future where financial flexibility empowers consumers and drives merchant success. Klarna, a leader in the Buy Now, Pay Later (BNPL) space, has redefined how we shop online. Its innovative payment solutions, combined with cutting-edge technology, make it a crucial player in reshaping global e-commerce.

Editor’s Choice: Key Milestones

Klarna’s journey is punctuated with significant achievements that reflect its growth and industry leadership. Below are some of the most noteworthy milestones:

- 2025 revenue is projected to exceed $2.4 billion, continuing Klarna’s strong momentum in the BNPL sector.

- Klarna’s valuation climbed to $9.2 billion in Q2 2025, reflecting renewed investor confidence and strategic expansion.

- Klarna now serves over 180 million active users globally, solidifying its position as a top alternative payments platform.

- In 2025, Klarna deepened its AI integrations beyond ChatGPT, enhancing real-time personalization and predictive shopping features.

- Merchant adoption rose another 18% in 2025, expanding Klarna’s network to nearly 600,000 global partners.

- In-app transactions increased by 30% in 2025, reinforcing Klarna’s dominance in mobile-first e-commerce experiences.

- Klarna maintained carbon-neutral operations through 2025, while investing further in sustainable fintech initiatives.

Klarna Overview

Founded in 2005 in Stockholm, Sweden, Klarna revolutionized the way consumers interact with merchants. Known for its Buy Now, Pay Later (BNPL) services, Klarna allows users to shop immediately while spreading payments over time. Klarna operates in over 45 countries, facilitating transactions across multiple industries, including fashion, electronics, and travel.

Key highlights of Klarna’s market position:

- Klarna processes over 2 million transactions daily, making it a leader in the global BNPL market.

- Its mobile app boasts 70 million downloads, making it one of the most popular e-commerce tools.

- Klarna’s solutions cater to a diverse audience, with users spanning Gen Z to Boomers, indicating its wide appeal.

- The brand recorded a 30% YoY increase in US users, further establishing its footprint in North America.

- Klarna employs over 5,000 people worldwide, driving innovation and customer-centric solutions.

Revenue and Profitability

Klarna’s financial performance underscores its dominance in the global BNPL space, with continued gains in revenue and profitability throughout 2025.

- Klarna’s 2025 revenue is projected to surpass $2.4 billion, up 26% year-over-year, fueled by global user and merchant growth.

- Operating losses declined by 41% vs. 2023, signaling a sharper focus on cost efficiency and scalability.

- Subscription services revenue rose by 28% in 2025, supporting Klarna’s strategy to diversify recurring income streams.

- The US market delivered more than $950 million in revenue, reinforcing Klarna’s leadership in North American BNPL.

- Profit margins in Europe improved another 18% in 2025, thanks to optimized credit underwriting and lower processing costs.

- Klarna’s interest income from deferred payments surged by 40%, underscoring growing reliance on installment-based purchases.

- Klarna’s 2025 profitability is expected to grow by 31%, propelled by increased user engagement and merchant integration.

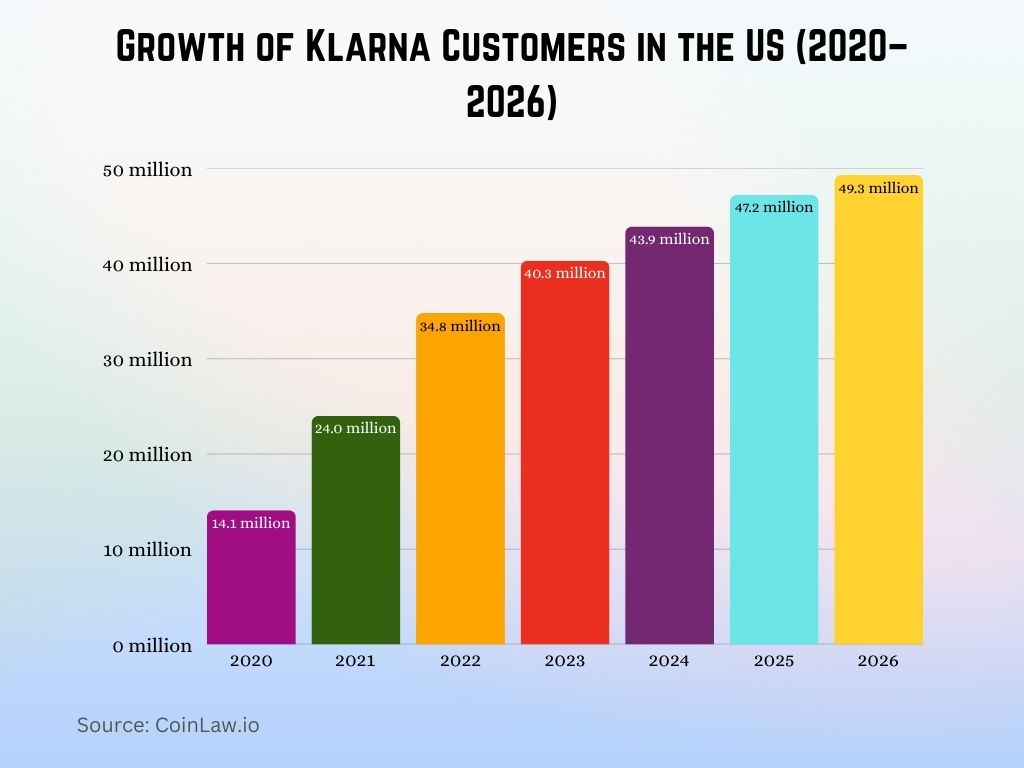

Growth of Klarna Customers in the US

- Klarna’s customer base in the United States has seen significant growth from 2020 to 2026, with projections continuing on an upward trend.

- In 2020, Klarna had 14.1 million users in the US.

- By 2021, this number jumped to 24.0 million, reflecting a 70% year-over-year increase.

- In 2022, Klarna’s US customers reached 34.8 million, showing sustained strong growth.

- The customer count hit 40.3 million in 2023, crossing the 40 million milestone.

- The upward trend is expected to continue with 43.9 million users in 2024, followed by 47.2 million in 2025.

- By 2026, Klarna is projected to serve 49.3 million customers in the US.

- Overall, this represents a 3.5x increase in users over a 6-year span.

Klarna GMV (Gross Merchandise Value)

The Gross Merchandise Value (GMV) processed by Klarna reflects the scale of its operations and its influence in global commerce.

- Klarna’s 2025 GMV is projected to exceed $92 billion, marking a strong 15% year-over-year growth.

- The US market now contributes approximately 34% of total GMV, reflecting Klarna’s accelerating footprint in North America.

- Fashion and beauty segments contributed 40% of GMV, showcasing Klarna’s strength in retail partnerships.

- Klarna processed over 1.45 billion global transactions in 2025, setting a new company record for transaction volume.

- In Europe, Klarna holds a 48% BNPL market share, maintaining its lead as the region’s top provider.

- Strategic partnerships drove a 29% boost in average order value (AOV) for Klarna merchants in 2025.

- Emerging markets like India and Southeast Asia helped fuel GMV expansion, accounting for over $8 billion in new volume.

Klarna Users

Klarna’s user base continues to grow, cementing its position as a consumer favorite for flexible payments.

- By mid-2025, Klarna will have surpassed 180 million active users.

- The Klarna app ranks in the top 3 shopping apps globally, with over 85 million downloads to date.

- Over 70% of Klarna users are millennials or Gen Z, reflecting its appeal to younger, tech-savvy audiences.

- User satisfaction remains high at 94%, driven by Klarna’s intuitive and fast checkout experience.

- Klarna added 12 million new users in North America in 2025, reflecting a 25% YoY increase fueled by product expansions.

- Klarna’s pay-in-4 service is now used by 83% of US users, confirming it as a core driver of user engagement.

- Klarna maintains a strong 88% user retention rate in 2025, showcasing continued loyalty in a competitive market.

Merchant Partnerships

- Klarna works with over 600,000 merchants globally in 2025.

- Leading brands, including H&M, Sephora, IKEA, and newer partners, continue to adopt Klarna for seamless checkout integration.

- Merchants saw an average 27% boost in revenue after Klarna integration, driven by higher conversions and customer loyalty.

- 64% of merchants report a drop in cart abandonment rates, showcasing Klarna’s effectiveness in improving checkout completion.

- Klarna’s “Try Before You Buy” program grew by 45% in merchant adoption, aligning with rising demand for risk-free shopping.

- The travel and experience sector drove 18% of new merchant partnerships in 2025, led by airlines and OTAs using Klarna.

- Klarna’s AI-powered tools helped merchants grow AOV by 21%, personalizing the user journey across digital storefronts.

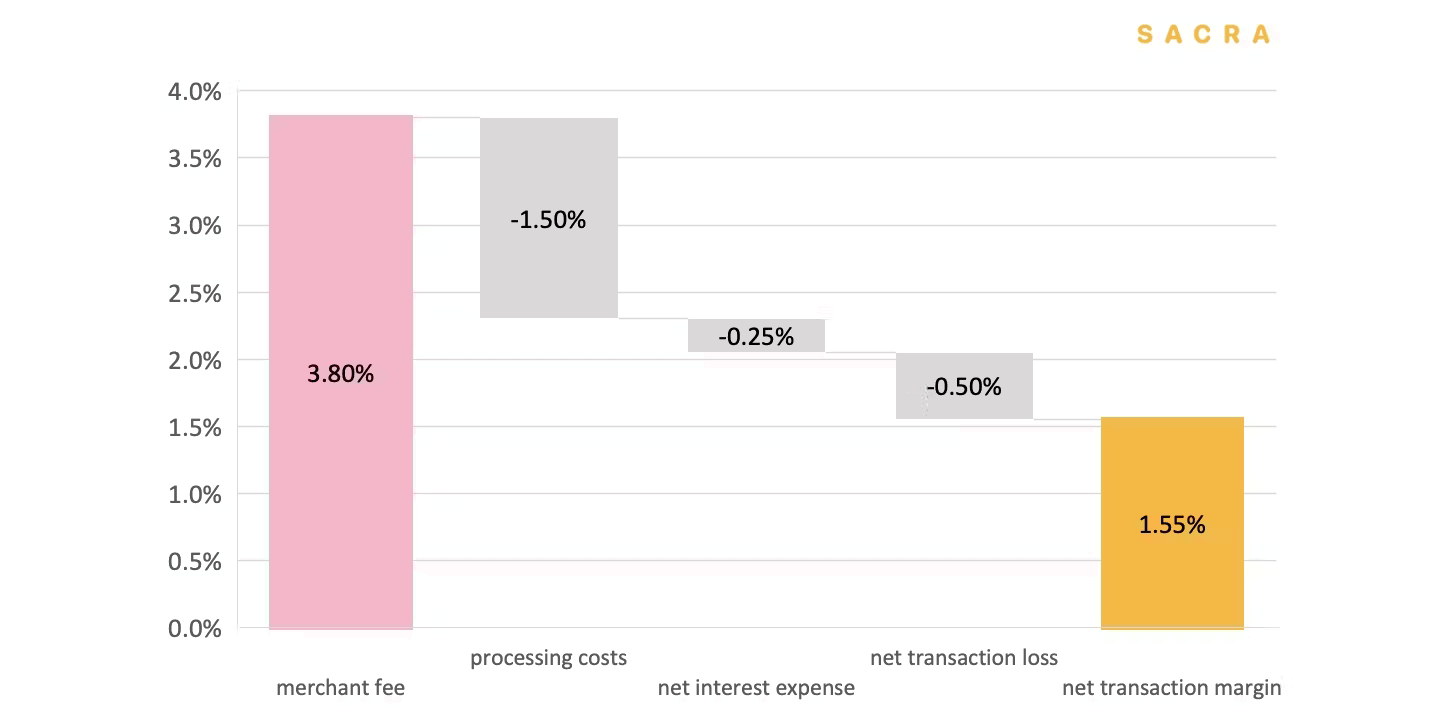

Klarna’s Net Transaction Margin Breakdown

- Klarna charges a merchant fee of 3.80% per transaction.

- From this, processing costs account for -1.50%, reducing the gross margin.

- Net interest expenses further deduct -0.25%.

- Klarna also incurs -0.50% from net transaction losses (e.g., defaults or fraud).

- After all deductions, Klarna ends up with a net transaction margin of 1.55%.

Klarna and Generative AI: Cooperation with ChatGPT

Klarna has been at the forefront of leveraging generative AI to enhance its services and customer experience.

- Klarna integrated ChatGPT-powered shopping assistance in its app, offering personalized product suggestions.

- Users engaging with AI-driven recommendations reported a 30% higher purchase likelihood, boosting merchant sales.

- Klarna’s AI feature processes over 1 billion data points daily, ensuring accurate and tailored suggestions for users.

- The integration of generative AI reduced customer service response times by 40%, improving user satisfaction.

- Klarna’s collaboration with OpenAI resulted in a 15% increase in app engagement, highlighting the innovation’s success.

- Over 25 million users accessed Klarna’s ChatGPT-powered features within the first six months of its launch.

- AI-driven fraud detection prevented $200 million in potential losses for Klarna and its merchants.

Klarna in Society

- Klarna maintained carbon-neutral operations through 2025, while expanding investments in climate-positive fintech solutions.

- The Klarna Foundation donated over $28 million in 2025 to global social, educational, and environmental initiatives.

- Klarna’s financial literacy programs reached 13 million consumers, promoting smarter, more responsible spending across markets.

- More than 68% of Klarna employees joined community service efforts, reinforcing a culture of corporate social responsibility.

- Klarna enhanced its green shopping feature in 2025, helping users track and offset carbon emissions per transaction.

- The “Pay Later for Good” initiative raised over $7 million in 2025 for nonprofits through seamless in-app donations.

- Klarna saw a 56% increase in female leadership roles, continuing to set new standards in DEI across fintech.

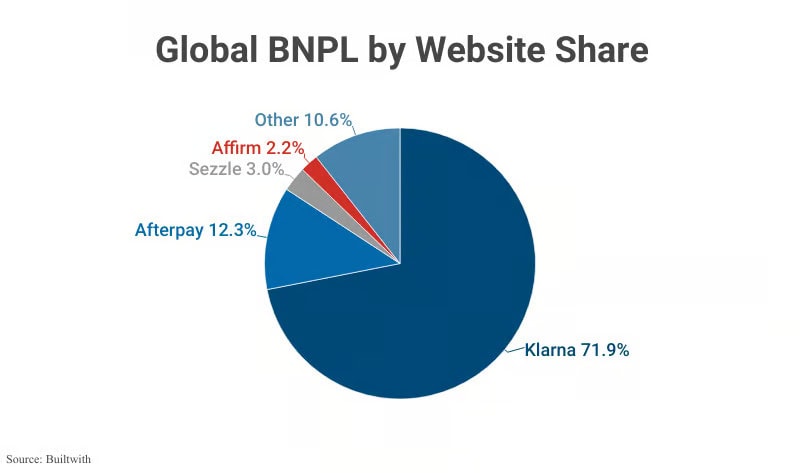

Global BNPL Market Share by Website Usage

- Klarna dominates the global BNPL (Buy Now, Pay Later) landscape with a massive 71.9% website share.

- Afterpay holds the second-largest share at 12.3%.

- Sezzle accounts for 3.0%, followed by Affirm with 2.2%.

- All other BNPL providers combined fall under “Other,” totaling 10.6%.

Recent Developments

- In 2025, Klarna rolled out real-time returns processing, cutting refund wait times by up to 80% for users and merchants.

- Klarna’s expansion in Southeast Asia contributed to a 13% rise in global market share, accelerating its international footprint.

- The Klarna Rewards Club surpassed 42 million members, fueling increased loyalty and frequency of purchases.

- The Klarna Card now has over 7.5 million active users, blending BNPL flexibility with traditional card convenience.

- Klarna’s crypto investment feature saw a 60% YoY increase in adoption, enabling users to trade top coins in-app.

- A 2025 partnership with Meta expanded BNPL integration across Instagram, Facebook, and WhatsApp storefronts.

- Klarna entered pre-IPO readiness stage in 2025, aligning its financials and governance for a potential late-2025 listing.

Conclusion

Klarna’s story is one of resilience, innovation, and rapid growth. With a robust merchant network, cutting-edge technology, and a commitment to sustainability, Klarna is not just reshaping the BNPL landscape but also paving the way for a more inclusive and user-friendly financial ecosystem. As the company continues to expand and innovate, it remains a leader in e-commerce and a key player in the global fintech industry. Klarna is undoubtedly a brand to watch in 2025 and beyond.