Justin Sun remains blacklisted from World Liberty Financial three months after his WLFI tokens were frozen, with their value dropping by a staggering $60 million.

Key Takeaways

- Justin Sun’s locked WLFI tokens have plunged in value by $60 million since being frozen in September 2025.

- World Liberty Financial blacklisted 272 wallets, including one tied to Sun, citing phishing attacks and suspicious activity.

- Sun had invested $75 million in WLFI and claimed the freeze was “unreasonable” and undeserved.

- The ongoing dispute raises serious questions about transparency, governance, and risk management in decentralized finance (DeFi).

What Happened?

In September, Justin Sun was blacklisted by World Liberty Financial (WLFI), a DeFi project tied to former President Donald Trump. The project froze Sun’s wallet containing WLFI tokens, citing security concerns following a phishing attack. Despite investing heavily in the project, Sun’s tokens have remained inaccessible and have lost $60 million in value.

Justin Sun is still blacklisted by WLFI

— Bubblemaps (@bubblemaps) December 22, 2025

in 3 months, his locked tokens dropped $60m in value

absolutely brutal https://t.co/3Af2px04h5 pic.twitter.com/4qxuiE4qwJ

Why Sun’s Tokens Were Frozen?

WLFI froze 272 wallets in total, pointing to a large-scale phishing attack and other high-risk activities. According to their public breakdown:

- 215 wallets were tied to an active phishing attack.

- 50 wallets were frozen upon users’ request after reporting compromise.

- 5 wallets were flagged for high-risk exposure.

- 1 wallet was flagged for suspected misappropriation of funds, later linked to Justin Sun through blockchain analysis by Bubblemaps.

WLFI did not name Sun directly, but analytics platforms including Bubblemaps and Arkham Intelligence connected the flagged wallet to him. They also confirmed that Sun’s WLFI tokens have plummeted in value, tracking the project’s token price drop.

Despite WLFI’s claim that its actions were for user protection and not aimed at specific individuals, Sun pushed back, saying:

He also emphasized his $75 million investment and called the freeze “unreasonable.”

Token Value Collapse

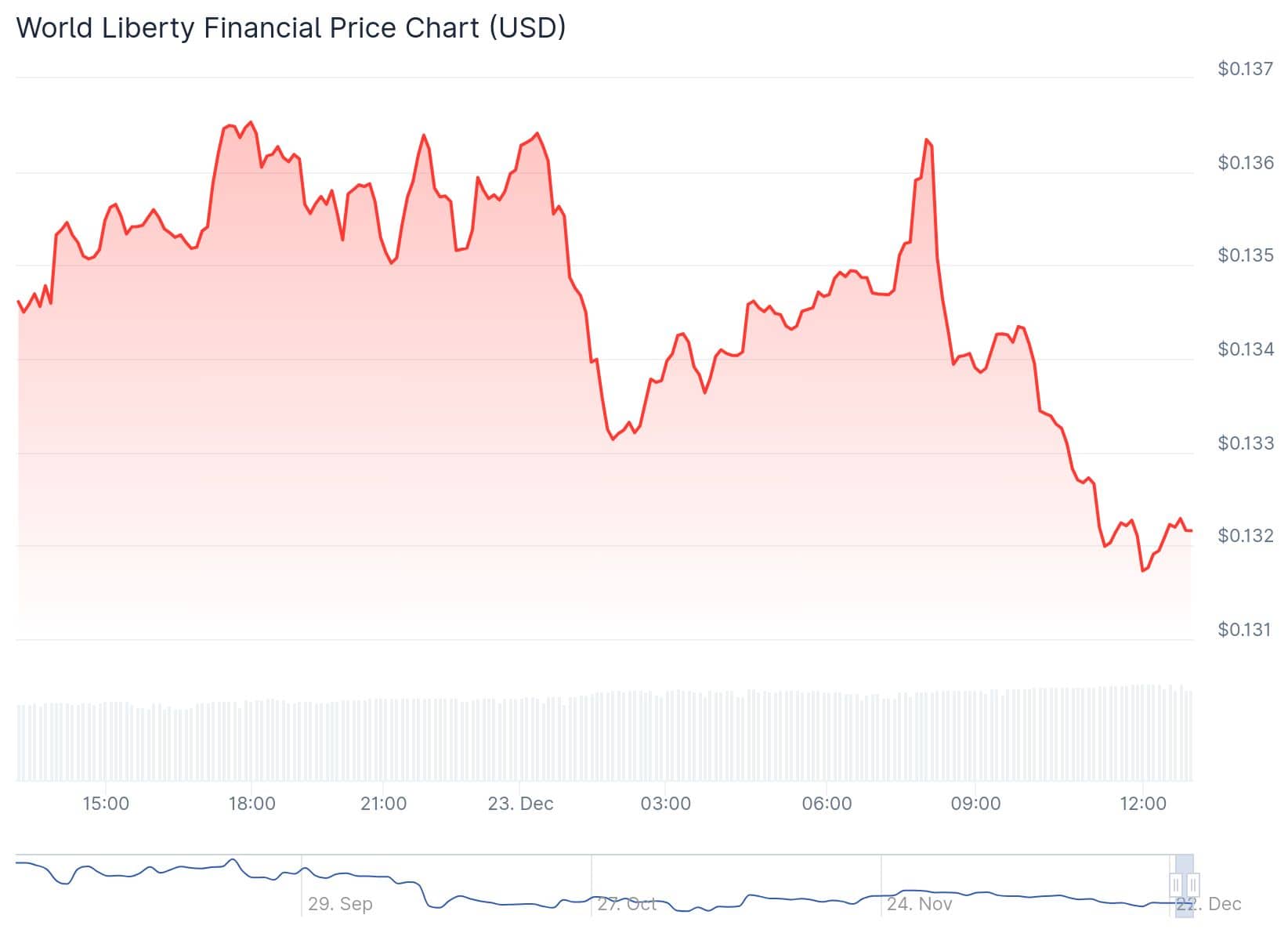

Since the freeze, the price of WLFI has fallen over 40%, and Sun’s locked balance of 545 million tokens is now worth approximately $74 million, down from a much higher valuation in August.

- Sun initially held close to 3 billion WLFI tokens, according to Arkham Intelligence.

- The value of his holdings dropped sharply around August and September.

- Current market data shows WLFI trading near $0.14, down significantly from its initial listing price.

Despite attending a Trump-hosted gala and receiving the “Trump Golden Torbillon” watch after becoming the largest holder of the TRUMP memecoin, Sun’s support for Trump-linked crypto projects hasn’t protected him from scrutiny.

Governance and Transparency in Question

The standoff between Justin Sun and WLFI has exposed deeper issues within DeFi, particularly around:

- Lack of dispute resolution mechanisms.

- Ambiguity in token governance.

- Concerns over decentralization when core teams retain blacklist powers.

WLFI insists it does not “seek to blacklist anyone” and responded only when alerted to suspicious activity. Still, the absence of clear communication and a resolution timeline has shaken confidence in the platform.

CoinLaw’s Takeaway

In my experience, this is a textbook example of how decentralization can go sideways when governance isn’t clearly defined. Justin Sun is a seasoned player, yet he found himself frozen out of a project he heavily backed. I found it shocking how little transparency was offered during the process. If a billionaire investor can lose $60 million without recourse, what does that say for everyday token holders? This WLFI episode is a wake-up call for anyone betting big on the promise of “community-led” DeFi. Always read the fine print and know who holds the power behind the scenes.