HSBC, one of the world’s largest banking and financial services institutions, plays a critical role in global finance. With its operational headquarters in London and a strong presence across Asia, Europe, and the Americas, HSBC offers a unique view of banking trends across both developed and emerging markets. From high-net-worth investment services to mobile banking infrastructure, HSBC’s reach and innovation impact a wide spectrum of the financial world. In this article, we’ll explore the latest HSBC statistics in 2026, covering everything from profitability and customer metrics to ESG performance and digital banking.

Editor’s Choice

- $18.9 billion: Constant-currency profit before tax in H1 2025, reflecting core business resilience.

- 14.6% CET1 ratio: A signal of strong regulatory capital health.

- $2 billion: Planned share buyback to return value to shareholders in 2026.

- $1.9 trillion: Total wealth balances held by HSBC as of Q1 2025.

- 39 million: Total customers served globally by HSBC.

- $852 billion: Assets under management in HSBC Asset Management as of late 2025.

- Zing App closure: Marks a strategic shift in HSBC’s digital payment footprint.

Recent Developments

- HSBC’s profit attributable to ordinary shareholders dropped by 30.6% YoY to $11.51 billion in H1 2025.

- Pre-tax profit fell 26.4% YoY to $15.8 billion in the same period.

- On a constant currency basis and excluding notable items, pre-tax profit grew by $0.9 billion to $18.9 billion.

- HSBC’s RoTE (return on tangible equity) dropped to 14.7%, down from 21.4%, though excluding notable items, it stood at 18.2%.

- HSBC announced a $2 billion share buyback in early 2026.

- The closure of the Zing payments app impacted ~400 roles and signaled a streamlining of the bank’s digital tools.

- Acquisition of Hang Seng Bank (remaining 50%) approved in January 2026, reinforcing HSBC’s presence in Asia.

- Launch of a new onshore asset management business in the UAE to target the regional wealth influx.

- HSBC plans $1.5 billion in cost savings by 2026, including restructuring and layoffs.

Assets and Balance Sheet

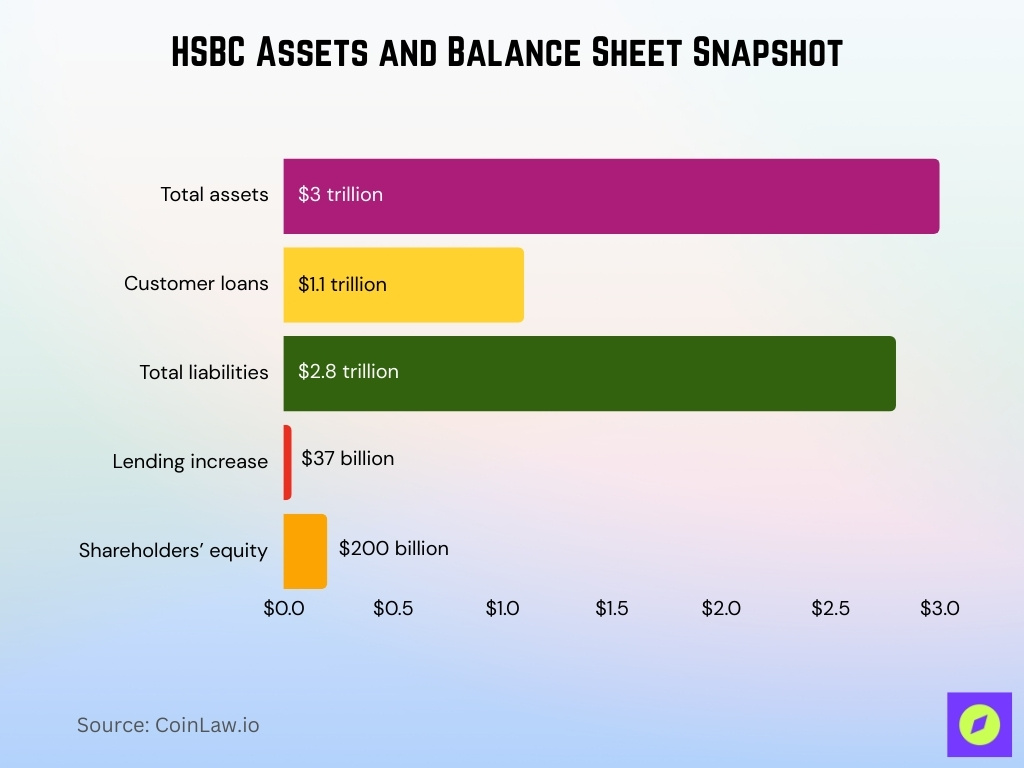

- HSBC’s total assets were reported at over $3 trillion by the end of 2025.

- Loans and advances to customers reached approximately $1.1 trillion, a slight YoY increase.

- Total liabilities rose to approximately $2.8 trillion, reflecting funding growth across segments.

- In Q1 2025, HSBC’s customer lending increased by $37 billion, indicating expanding credit services.

- Shareholders’ equity stood at around $200 billion by late 2025.

- The loan-to-deposit ratio remained conservative, typically under 80%, supporting liquidity.

- HSBC maintained strong liquidity coverage ratios above regulatory minimums.

- The bank continues to operate with a Basel III leverage ratio above 8% in many regions.

- Strategic asset sales and refocus initiatives improved balance sheet composition in 2025.

HSBC Key Facts

- Founded in 1865 in Hong Kong, HSBC is currently headquartered in London, UK.

- As of 2026, HSBC serves around 39 million customers across 57 countries and territories.

- HSBC operates in 6 continents, with key markets in the UK, Hong Kong, mainland China, India, and the UAE.

- The bank employs more than 220,000 staff globally.

- HSBC’s total assets exceeded $3 trillion by the end of 2025.

- The group operates through four major global businesses: Wealth and Personal Banking, Commercial Banking, Global Banking & Markets, and Corporate Centre.

- HSBC has been listed on the London, Hong Kong, New York, and Paris stock exchanges.

- In 2025, HSBC operated an international network of about 4,500 offices, including branches, with a strong concentration in Asia and the UK.

- The Hang Seng Bank acquisition increased HSBC’s customer base in Asia by nearly 4 million.

- HSBC maintains both Islamic banking and conventional operations, especially in the Middle East.

Market Position

- HSBC ranks among the top 10 global banks by total assets in 2026.

- In the FTSE 100, HSBC remains one of the highest-valued financial stocks.

- The bank is a major player in cross-border payments, trade finance, and treasury services.

- HSBC is one of the largest foreign banks in China, with strategic stakes in multiple regional institutions.

- It is the largest bank in Hong Kong by market share, through its own operations and Hang Seng Bank.

- HSBC’s Global Banking and Markets division is a leader in FX and debt markets.

- The bank consistently ranks in Bloomberg’s top 5 FX providers globally.

- HSBC has expanded significantly in the Middle East wealth and asset management sector.

- Strategic exits from less profitable markets have refined HSBC’s competitive focus.

- Its commercial banking business serves over 1.3 million small, medium, and large corporate clients worldwide.

Shareholder Value and Valuation

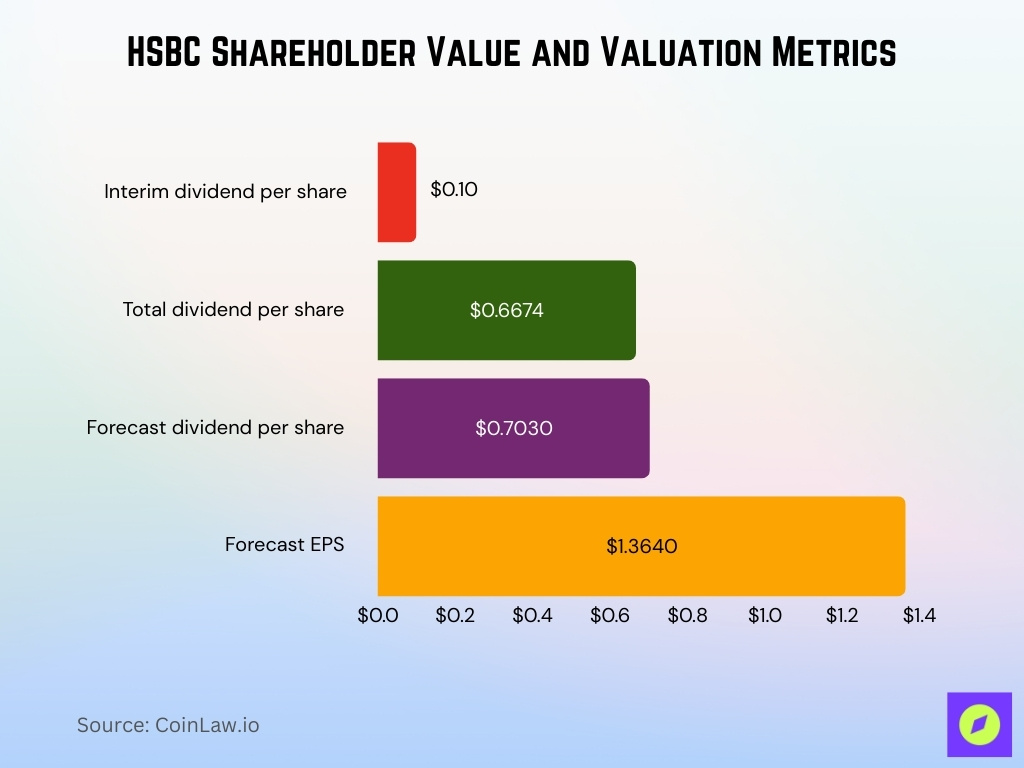

- Third interim dividend for 2025 declared at $0.10 per share.

- The total 2025 dividend per share is projected at $0.6674, yielding 5.69%.

- Forecast 2026 dividend per share of $0.703, with a 6.0% yield.

- Forecast EPS for 2026 is estimated at $1.364.

- Planned annualized cost savings target stands at $1.5 billion by end-2026.

- An additional $1.8 billion in cumulative cost reductions committed by fiscal 2026.

- Forward P/E ratio at 16.9x, below the Banks industry average of 29.1x.

- Fair value estimate for London shares raised to GBX 1,040 post-Hang Seng deal.

Revenue and Income

- Group revenue guidance for 2026 is around $68 billion, implying roughly 3% YoY growth from the $66 billion estimated for 2025.

- Management continues to target banking net interest income of about $42 billion for 2026, maintaining a mid-teens RoTE outlook for 2025–2027.

- Net interest margin is expected to stay near 1.6%, after being 1.57% in H1 2025 amid FX headwinds and lower rates.

- Constant currency revenue excluding notable items is projected to grow at low single digits, from $54.2 billion run-rate in 2025 to roughly $55–56 billion.

- Wealth and personal banking fees and other income are expected to continue double-digit growth, after a 22% constant-currency increase and $44 billion net new invested assets in 2025.

- Asia is expected to remain the largest regional contributor, accounting for a little over 50% of group revenue, supported by $27 billion of 2025 net new invested assets booked in the region.

- Group profit before tax excluding notable items is targeted to hold in the mid-teens billions, broadly in line with the $18.9 billion constant-currency run-rate achieved in 2025.

Profitability Metrics

- In the first half of 2025, HSBC’s profit attributable to ordinary shareholders was reported at $11.51 billion, down 30.6% year‑over‑year.

- Profit before tax for H1 2025 was $15.8 billion, a 26.4% decline from H1 2024.

- Excluding notable items, constant‑currency profit before tax for H1 2025 rose to $18.9 billion, up $0.9 billion from H1 2024.

- HSBC’s return on average tangible equity (RoTE) annualised was 14.7% in H1 2025, compared with 21.4% in H1 2024, and 18.2% when excluding notable items.

- Net profit margins remain supported by fee income growth in wealth and markets segments.

- Non‑interest income from wealth and foreign exchange markets buoyed profitability trends.

- Structural simplification aims to enhance efficiency and future profitability.

- Cost pressures from restructuring and economic headwinds have weighed on reported profitability.

Products and Services Mix

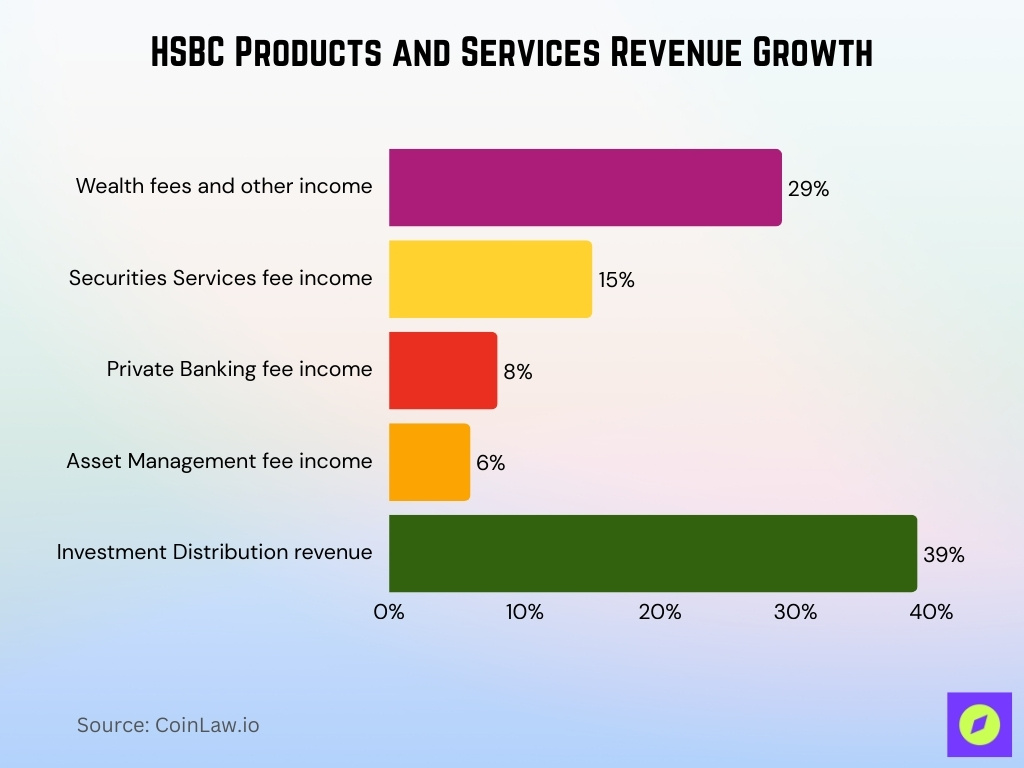

- Wealth fees and other income rose 29% in Q3 2025.

- Wholesale Transaction Banking revenue reached $1.3 billion in Q3 2025.

- Securities Services fee income grew 15% YoY in Q3 2025.

- Private Banking fee income increased 8%, and Asset Management 6% in Q3 2025.

- Investment Distribution revenue up 39% in Q3 2025.

- Global Foreign Exchange fee income showed strong growth in 9M25.

- Banking net interest income totaled $11 billion in Q3 2025.

- Retail banking includes mortgage and consumer lending as core categories.

- Insurance products are offered as life and non-life supplementary lines.

Capital and Liquidity Ratios

- The reported CET1 ratio stood at 14.5% at the group level as of 30 September 2025.

- Total capital ratio remained robust at 20.2% at the end of Q3 2025.

- Basel III leverage ratio was 5.2%, down slightly from 5.4% at the end of Q2 2025.

- Liquidity coverage ratio (LCR) was 139% or $192 billion at 30 September 2025.

- Net stable funding ratio (NSFR) measured 144% at end-Q3 2025.

- Average high-quality liquid assets (HQLA) reached $690 billion in Q3 2025.

- Regional CET1 ratios exceeded 18% in key locations like the Philippines at 18.74%.

- Group CET1 target range maintained at 14.0%–14.5% through 2026.

- The expected day-one CET1 impact from Hang Seng privatization is a 125bps reduction in H1 2026.

Geographic Footprint

- Operates in 57 countries and territories across six continents.

- Serves approximately 39 million customers globally

- Maintains 4,500 offices and branches worldwide.

- Reorganized into four segments: Hong Kong, UK, CIB, International Wealth & Premier.

- Asia contributes over 50% of revenue, with Hong Kong as the core market.

- Hang Seng privatization approved, effective post-January 23 court sanction.

- Strong presence in the UAE with new onshore asset management funds.

- Significant branch networks in Hong Kong (220+) and the UK (529 locations).

- Expansion in the Middle East and North Africa alongside the Asia focus.

Risk Management and Credit Quality

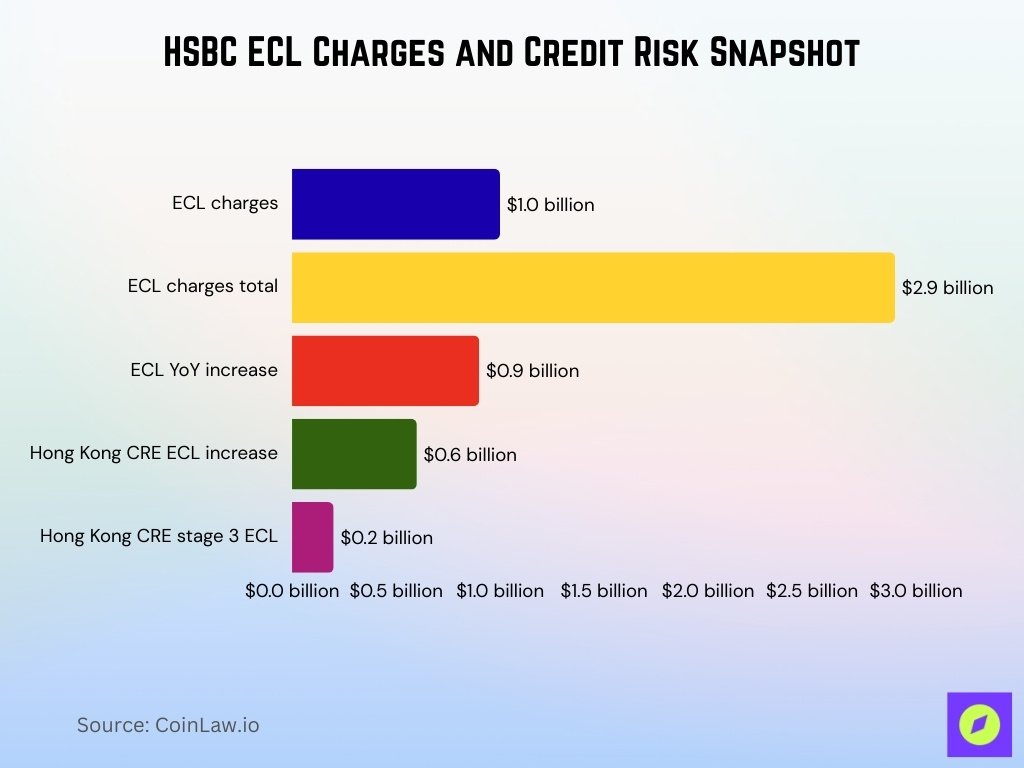

- ECL charges totaled $1.0 billion in Q3 2025, stable YoY.

- 9M25 ECL increased $0.9 billion YoY to $2.9 billion.

- Annualised ECL at 40bps of average gross loans in 9M25.

- Hong Kong CRE ECL charges rose $0.6 billion in 9M25.

- Q3 2025 ECL included $0.2 billion Hong Kong CRE stage 3 charges.

- Stage 3 wholesale exposures drove primary Q3 2025 ECL increases.

- ECL outlook remains ~40bps for the full year 2025.

- Mainland China CRE ECL charges remained immaterial in 9M25.

- CET1 ratio at 14.5% as of September 30, 2025.

Customer Base

- HSBC serves ~39 million customers worldwide.

- Customer accounts grew by $43 billion (reported) and $75 billion (constant currency) in 2024.

- Lending to customers increased by $37 billion in mid‑2025 versus Q1 2025.

- Customer deposits and accounts increased by $52 billion during the same period.

- Digital customers expanded through mobile and online channels.

- Hang Seng Bank’s ~4 million customers will integrate under HSBC Asia Pacific.

- Growth in wealth management clientele supports the affluent services segment.

- Retail customer growth is seen across key markets even amid macro challenges.

Digital and Mobile Banking Statistics

- HSBC HK App active users increased 20% in 2024.

- 12% of HSBCnet corporate customers (26,000) actively use mobile globally.

- Added 463 new features to the HK mobile banking app in 2024.

- UK mobile banking frequency reached 33% daily users by mid-2025.

- 65% of UK adults used mobile apps for financial tasks in 2024.

- Mobile banking interactions up 72%, averaging 150 digital actions yearly.

- UK mobile banking user base projected at 28 million by 2028.

- Online banking is expected to handle over 90% of global interactions.

- HSBC launched HK’s first blockchain-based settlement service in 2025.

Transaction and Payments Statistics

- Wholesale Transaction Banking fee and other income grew 4% to around $4 billion in 9M25.

- Global Foreign Exchange fee income up 7% in H1 2025.

- Securities Services fee income increased 15% YoY in Q3 2025.

- Customer accounts rose $18.6 billion in Q3 2025.

- Constant currency customer accounts growth totaled $25.5 billion in Q3 2025.

- Total customer deposit balances stood at $1.7 trillion.

- Facilitated over $850 billion in global trade volume in 2024.

- Global Payments Solutions saw higher cross-border and real-time payments volumes.

Wealth and Investment Statistics

- HSBC Asset Management held approximately $852 billion in assets under management as of late 2025.

- Wealth revenues in Asia rose by ~32% year‑over‑year in 2024, driving broader wealth segment growth.

- Within Q3 2025, pre‑tax profit in the wealth arm reached $1.292 billion, up 8% compared to the prior year period.

- Wealth fee and other income climbed 24% year‑on‑year to $1.94 billion in Q3 2025.

- Net new invested assets in Q1 2025 totaled $22 billion, with $16 billion booked in Asia, continuing investment momentum.

- Total wealth balances as of March 31, 2025, were $1.9 trillion, rising 7% year‑over‑year.

- HSBC’s global private banking business was ranked among the top 15 largest private banks globally with ~$430 billion in AUM.

- Wealth management’s contribution to overall fee income helps diversify revenue against trading and interest income pressures.

Commercial and Corporate Banking Statistics

- In Q2 2025, HSBC’s corporate and institutional banking unit reported pre‑tax profits of $2.8 billion, down 4% year‑over‑year despite trading and investment banking revenue growth.

- CIB revenue in the same period was $6.9 billion, up about 5%, driven by FX and market activity.

- Investment banking fees grew ~25%, and debt and equity revenue increased ~14.5%, showing ongoing corporate client demand.

- Wholesale transaction banking income showed double‑digit increases, supporting commercial services.

- HSBC’s credit and commercial lending balances increased modestly in late 2025, helping underpin CIB service revenues.

- Mortgage and commercial lending increases in the UK and Asia contributed to CIB’s balance sheet strength.

- Fee income from trade finance and corporate treasury services remains a core revenue driver.

- HSBC’s restructuring of corporate banking units continues to emphasise core segments with higher transactional and advisory profitability.

Sustainability and ESG Statistics

- Mobilized $54.1 billion in sustainable finance during H1 2025.

- Direct Scope 1 and 2 emissions were reduced 76% from the 2019 baseline.

- Financed emissions across target sectors down 30% from baseline.

- Oil & gas financed emissions target: 14%–30% reduction by 2030 from 2019.

- Thermal coal-financed emissions reduction target remains at 70% by 2030.

- 80% of customers expect an accelerated climate transition in the next three years.

- 97% of reported emissions are tied to seven key carbon-intensive sectors.

Frequently Asked Questions (FAQs)

HSBC’s profit before tax in Q3 2025 was $7.3 billion

Total revenues for Q3 2025 reached $17.9 billion, up 3% year‑over‑year.

HSBC’s total assets are estimated at around $3 trillion.

HSBC serves approximately 39 million customers worldwide.

Conclusion

HSBC’s transaction volumes, wealth management growth, corporate segment performance, and credit quality metrics paint a picture of a globally diversified bank navigating a shifting economic landscape. Strategic expansion, particularly in Asia and the Middle East, combined with digital and sustainable finance initiatives, is central to its near‑term priorities. Risk management and ESG commitments underpin resilience, even amid provisioning adjustments and macro uncertainty.