The cryptocurrency exchange Bitfinex has grown significantly since its founding in 2012. The number of people working at Bitfinex offers a useful lens into its scale, operations, and global strategy. In an environment where crypto firms are judged on agility and global reach, workforce figures reflect not just headcount but strategic depth. For example, institutional trading services and international regulatory efforts both require sizable teams across locations. Explore how Bitfinex’s staffing unfolds in the full article below.

How Many People Work at Bitfinex?

- Approximately 283 employees as of September 2025.

- Bitfinex operates across 6 continents, indicating global staffing spread.

- Bitfinex’s estimated revenue per employee is $162,500, calculated from ~$63.5 million annual revenue and 283 staff.

- Bitfinex’s North American team numbers ~182 but includes staff and contractors, reflecting a majority regional share.

- On employer reputation, Bitfinex holds a rating of 4.7 out of 5 stars on Glassdoor, based on about 39 reviews.

Recent Developments

- In 2025, the profile of Bitfinex’s workforce remains relatively stable despite broader crypto-market shifts.

- The directory breakdown indicates a large U.S.-based component (~182 U.S. employees), which may reflect customer-service, compliance, or support functions.

- The mention of six continents implies growth in regions such as Asia, Europe, and Latin America, reflecting an international operational push.

- The relatively modest size (for a global crypto exchange) may reflect outsourcing or heavy automation in core operations.

- Employee review metrics, for example, 99% would recommend working there, suggesting a stable internal culture despite external market volatility.

- Publicly available data does not provide full transparency on contract, full-time vs. part-time employment, leaving a gap in the public picture.

Bitcoin Price Surges to $100K Milestone

- Bitcoin on Bitfinex has officially surpassed $100,000, marking a new all-time high.

- Price climbed from around $13,478 in mid-2022 to $102,170 in early 2025.

- This represents an increase of $88,692 and a massive 573.75% gain over the period.

- The weekly high reached $102,710, while the low stood at $94,222.

- The weekly open was $101,240, with a +0.92% rise by the week’s close.

- The $100,000 level acted as a key psychological barrier before being decisively broken.

- The surge highlights Bitcoin’s 2.5-year recovery from its 2022 lows following market downturns.

- This uptrend underscores renewed institutional confidence and mainstream adoption, driving demand.

- The chart’s timeframe shows consistent upward momentum and sustained volume into early 2025.

- Analysts view this as a potential beginning of a new bull cycle if prices hold above $100K.

Bitfinex’s Current Team (Key People)

- Jean‑Louis van der Velde – Chief Executive Officer: A technologist and serial entrepreneur with 30 years of international tech experience.

- Giancarlo Devasini – Chief Financial Officer: Has been instrumental in the development of Bitfinex since around 2013 and leads financial strategy.

- Stuart Hoegner – General Counsel: A seasoned cryptocurrency lawyer and accountant who joined Bitfinex in 2014.

- Claudia Lagorio – Chief Operating Officer: Oversees day-to-day operations and supports scaling and global coordination.

- Peter Warrack – Chief Compliance Officer: Responsible for regulatory oversight, compliance frameworks, and risk controls.

- Paolo Ardoino – Chief Technology Officer: Leads technology strategy and infrastructure for the exchange platform.

Bitfinex Departments and Staff Breakdown

- Key departments likely include trading operations, compliance and legal, technology and infrastructure, customer support, and corporate functions such as finance and HR.

- Given the high productivity metric (~$162,500 revenue per employee), there is likely a strong weighting toward technical and engineering staff.

- Positive employee sentiment often correlates with strong departmental integration and retention.

- While direct departmental percentages aren’t publicly listed, the breakdown implies that a large share is in North America, followed by Asian and European functions.

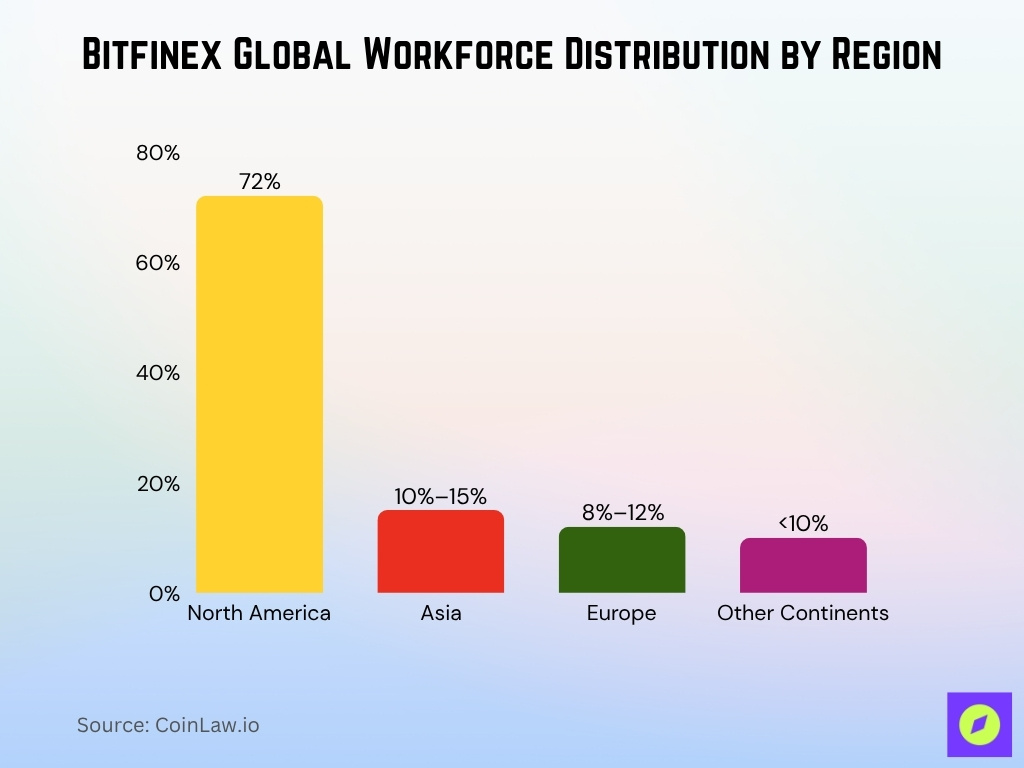

Global Workforce Distribution

- Bitfinex’s team distribution: North America ~72%, Asia 10-15%, Europe 8-12%, with smaller teams across other continents.

- Bitfinex lists physical presence or employee distribution across 6 continents.

- The global spread supports localized customer service, regulatory compliance, and regional marketing efforts.

- The presence on six continents suggests commitment to global markets rather than purely U.S. operations.

- This distribution enables the exchange to operate across time zones for 24/7 trading and support.

Remote Work and Hiring Trends

- Bitfinex offers fully remote roles with salaries ranging from $50k to $70k USD for remote candidates.

- The company has a fully distributed team across Asia, Europe, North and South America.

- Bitfinex lists 100% remote jobs in accounting, finance, and analyst roles globally.

- Remote roles include data analyst and growth positions in Italy, Germany, Spain, the UK, and Poland for 2025.

- Remote hiring lowers dependency on geographic markets, allowing access to global talent pools.

Industry Comparisons

- About one-third of crypto industry jobs are at exchanges or brokerages.

- A major competitor, Binance, had around 7,000 employees in 2023.

- Another key player, Crypto.com, had about 4,000 employees in 2022.

- Bitfinex’s employee headcount is listed as 283–287, within the “201–500” range, much leaner than competitors.

- On employer directories, Bitfinex is listed in the “201-500 employees” range.

- These comparisons show that Bitfinex operates with a much leaner workforce than the largest exchanges, yet still supports global operations.

- A leaner employee base may translate into faster decision-making, though it may also impose limits on rapid scaling.

- In an industry where user growth and regulatory demands rise, workforce size becomes a key metric for operational readiness and resilience.

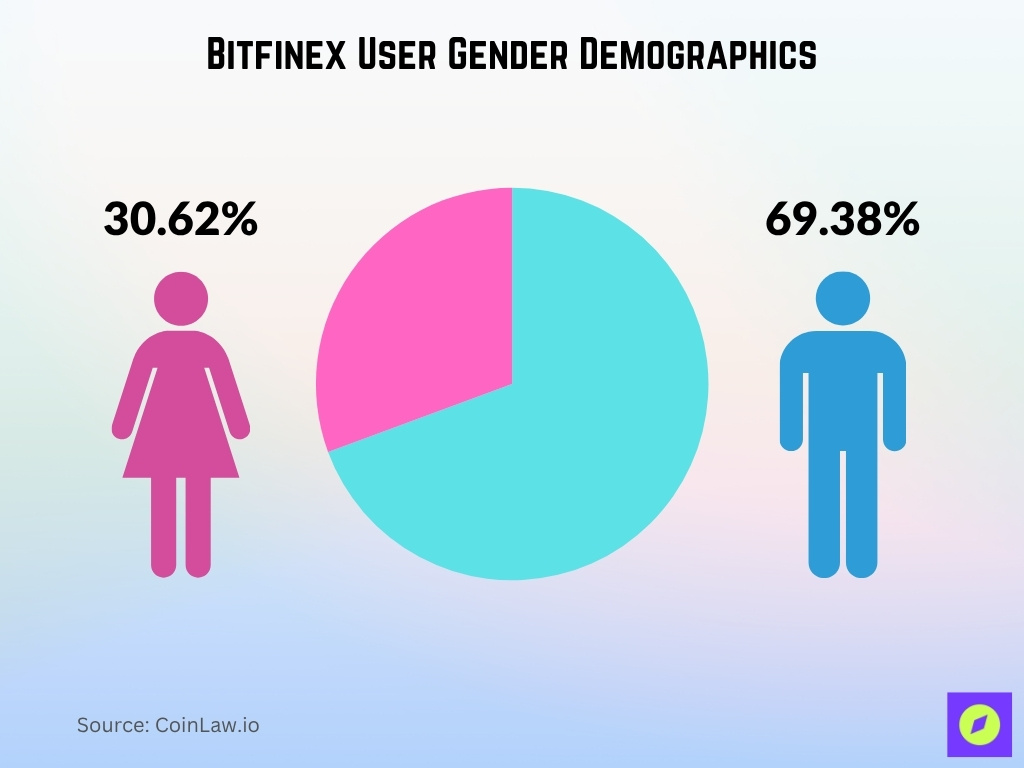

Gender and Age Demographics

- Visitor demographics show about 69.38% male vs 30.62% female visitors.

- The largest age group among website visitors is 25–34 years old, suggesting user interest skews younger.

- On the employer review site, Bitfinex has an overall 4.7/5 rating with 39 reviews, and 99% of employees would recommend working there.

- On the diversity and inclusion rating, Bitfinex has a rating of 4.9/5.

- There is no publicly available breakdown of employees by gender at Bitfinex, so internal gender representation remains unverified.

- Similarly, age distribution among employees is not publicly disclosed, making precise demographics unavailable.

- Given the remote-first model and global hiring, workforce diversity in geography may be higher than age/gender data suggests.

- The visitor demographic skew (25-34 yrs, male majority) may hint at internal culture and hiring bias toward younger, technically oriented staff.

- Without full disclosure from the company, these demographic bullets are indicative rather than definitive.

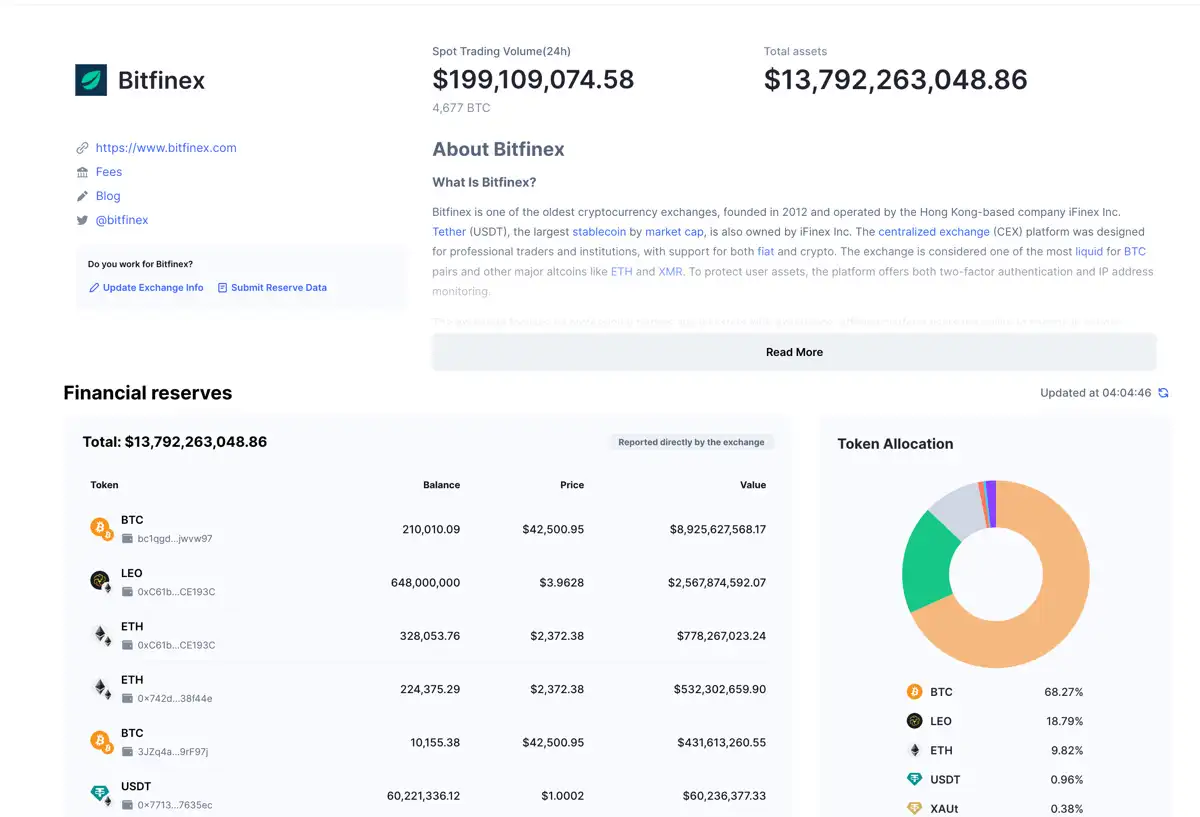

Bitfinex Financial Reserves

- Total assets held by Bitfinex amount to $13.79 billion as of 2025.

- 24-hour spot trading volume is $199.1 million, equal to around 4,677 BTC traded daily.

- Bitcoin (BTC) dominates reserves with 210,010 BTC worth $8.93 billion, making up 68.27% of total assets.

- LEO Token, Bitfinex’s native token, contributes $2.57 billion, or 18.79% of reserves.

- Ethereum (ETH) holdings total 552,429 ETH across wallets, valued at $1.31 billion, representing 9.82% of assets.

- Tether (USDT) accounts for $60.2 million, approximately 0.96% of total reserves.

- A small portion, 0.38%, is held in XAUT (gold-backed tokens) for asset diversification.

- The exchange’s asset structure shows a strong BTC concentration, signaling confidence in Bitcoin as a core reserve.

- Operated by iFinex Inc., Bitfinex remains one of the most liquid and institutionally focused centralized exchanges.

- Overall, the reserve data underscores Bitfinex’s financial stability and transparency heading into 2025.

Employee Statistics by Region

- Remote job listings span Europe (UK, Germany, Spain, Poland) and other continents, suggesting multi-continental hiring rather than concentration in one region.

- The company notes staff across Asia, Europe, North and South America, aligning with its global operational footprint.

- Around 55% of all crypto-industry employees live in North America and Europe, with the U.S. alone accounting for about 29%.

- The remote model likely means some employees reside in lower-cost regions (Asia, Latin America) to service global functions, though specific numbers are unverified publicly.

Frequently Asked Questions (FAQs)

Approximately 283 employees.

$67,359 per year.

Across 6 continents.

Conclusion

In summary, Bitfinex’s staffing profile paints the picture of a compact but globally distributed workforce operating in a rapidly evolving crypto landscape. The company remains lean compared to industry giants, yet its remote-first, cross-continental model supports coverage and operations across markets. Employee ratios, hiring trends, and global distribution suggest a strategic focus on agility, scalability, and geographic flexibility. As regulatory demands, user growth, and market volatility accelerate, Bitfinex’s workforce dynamics will be a key indicator of its future adaptability.