The global pension fund landscape stands as a cornerstone of financial security, impacting millions worldwide. Imagine this: retirees depending on decades of savings, carefully invested and managed to ensure their futures remain secure. Behind the scenes, pension funds act as silent guardians, navigating shifting markets, regulatory hurdles, and demographic challenges. This article delves into the critical statistics and insights that define the current state of global pension funds, guiding both professionals and policymakers.

Editor’s Choice

- $58.5 trillion: The estimated total assets under management (AUM) by global pension funds in 2025.

- 65%: The share of total global AUM held by the largest pension markets.

- 60%: The typical proportion of assets allocated to equities and fixed income in 2025 portfolios.The

- United States, Japan, Netherlands continue to lead in pension fund market size, collectively managing over 60% of global AUM.

- 70% of global pension fund liabilities are still represented by Defined Benefit (DB) plans.

- 11.3%: The median return on public pension fund investments in fiscal 2025.

- Public pension reserve funds are estimated to hold approximately $11 trillion globally in 2025, reflecting over 12% cumulative growth since 2022 due to market appreciation, rising contributions, and alternative investment gains.

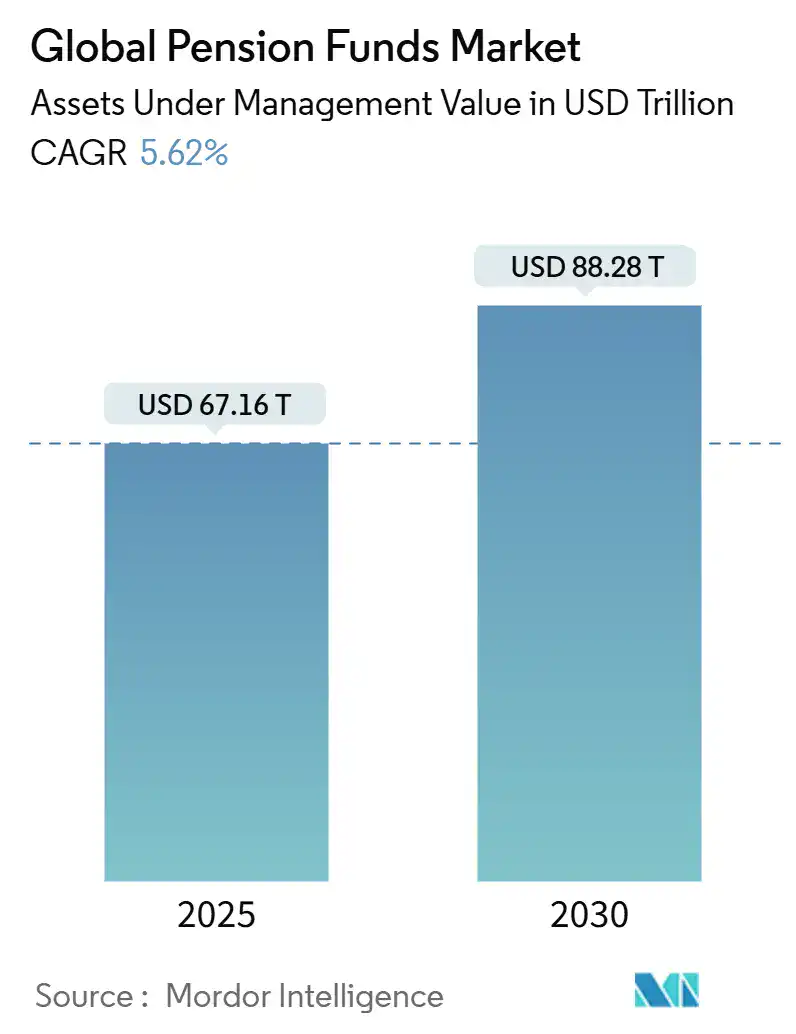

Global Pension Funds Market Outlook

- The global pension fund market will reach $67.16 trillion in 2025.

- By 2030, assets under management are projected to climb to $88.28 trillion.

- This growth reflects a steady CAGR of 5.62% over the forecast period.

- The rise highlights increasing reliance on pension funds as long-term financial security vehicles.

- Expanding AUM underscores the sector’s role in shaping global investment flows.

Total Assets Under Management

- $58.5 trillion is the global pension fund AUM in 2025, reflecting growth from 2024.

- $28 trillion is North America’s share of the global AUM in 2025, dominating the pension fund industry.

- $18 trillion Europe’s AUM in 2025, while Asia‑Pacific contributes $12 trillion.

- Double‑digit growth in emerging markets such as Brazil and India in 2025 marks a shift in global asset distribution.

- 25% Private equity and alternative investments now make up pension fund portfolios in 2025, reflecting stronger diversification.

- $12.4 trillion of the global value of Defined Contribution (DC) plans in 2025 is growing ~8% year over year.

- 45% ESG considerations now influence pension fund investments in 2025, showcasing increased sustainability focus.

Asset Allocation Strategies

- 60% of pension funds globally now allocate to equities and fixed income to maintain a balanced portfolio.

- Alternative investments like private equity and hedge funds account for about 23% of total allocations.

- Real estate investments make up around 11% of allocations.

- ESG-aligned strategies are adopted by roughly 45% of funds.

- The United States leads in private equity allocation with 32% of its pension portfolios in alternatives.

- European pension funds allocate an average of 48% to fixed income for stability.

- Asia-Pacific funds allocate close to 17% toward infrastructure projects in 2025.

Largest Pension Funds by Country

- Japan’s GPIF remains the largest globally, managing over $1.7 trillion in assets.

- The U.S. Thrift Savings Plan now holds about $937 billion in assets.

- Netherlands’ ABP has total invested assets of about $560 billion.

- Canada’s CPPIB ended fiscal 2025 with $714.4 billion in net assets.

- South Korea’s NPS holds assets exceeding $1.2 trillion.

- In Latin America, Brazil’s Previ now manages over $150 billion in assets.

Performance Metrics and Returns

- The average annual return for pension funds in 2025 is around 11.3%.

- Real estate investments now yield about 8.1% on average.

- Alternative investments (private equity, etc.) are delivering 10%+ returns in many funds.

- Fixed-income portfolios are producing modest returns near 3.5%.

- Emerging market equities continue to lead with returns near 11%.

- ESG-focused portfolios are outperforming, averaging 7.5% returns.

- Hedge funds show mixed results, ranging from –2% to 12% depending on strategy.

Public Pension Reserve Funds’ Assets

- PPRFs now collectively manage about $12.3 trillion, up some 12%–15% from prior years.

- Japan’s GPIF leads with $1.8 trillion, still setting the pace globally.

- The US Social Security Trust Funds hold around $2.72 trillion in reserves in 2025.

- Canada’s CPP Investment Board manages $731 billion (≈ $540 billion) in assets.

- Europe’s ABP handles roughly $620 billion in diversified holdings.

- Emerging economies like Brazil and India have reported 15%–20% annual growth in reserve fund assets.

- 35% of PPRF portfolios are committed to ESG-compliant investments in 2025.

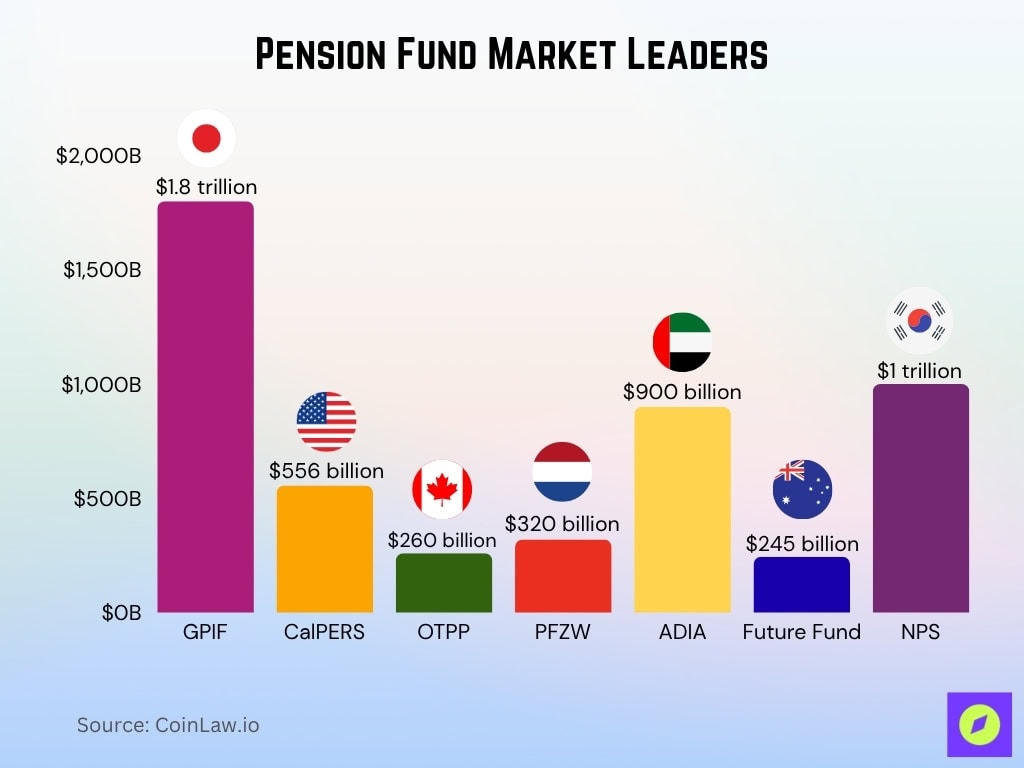

Pension Fund Market Leaders

- Japan’s GPIF leads with about $1.8 trillion in assets as of mid-2025.

- CalPERS now manages approximately $556 billion with an 11.6% return in fiscal 2025.

- Ontario Teachers’ Pension Plan (OTPP) holds around $260 billion in assets in 2025.

- PFZW in the Netherlands manages close to $320 billion, focusing heavily on sustainability.

- Abu Dhabi Investment Authority (ADIA) commands about $900 billion in its sovereign portfolio.

- Australia’s Future Fund is valued at $245 billion in 2025 with a strategic growth focus.

- South Korea’s NPS remains a regional powerhouse with around $1.0 trillion under management.

Impact of Demographic Changes

- Aging populations continue to raise dependency burdens, with the global age dependency ratio hitting ~54.7%.

- Developed nations such as Japan and Germany feature old-age dependency ratios over 40%, straining pension systems.

- Global life expectancy at birth now averages ~73.5 years, extending pension payout periods.

- Migration influences labor force dynamics with immigrant contributions comprising ~15% of pension inflows in some European systems.

- Fertility rates have fallen to ~1.6 births per woman in many developed regions, challenging future pension funding.

- Retirement ages are rising globally, with a new norm around 65–67 years in several OECD countries.

Regulatory and Policy Developments

- SECURE 2.0 Act in the US mandates auto-enrollment for new retirement plans in 2025, expected to boost participation by ~12%.

- Europe’s IORP II Directive now enforces stricter governance and transparency rules across pension funds.

- The OECD is pushing for higher retirement ages (e.g., to 67–70 years) to enhance pension system sustainability.

- New ESG rules like SFDR require pension funds to disclose sustainable investment practices and integrate ESG risk data.

- Tax breaks for private pensions have expanded in Latin America, increasing individual contributions by ~10–15%.

- Emerging markets are scaling universal pension schemes, with India’s NPS growing ~20% annually.

- Cybersecurity rules have tightened, with ~30% of funds now allocating budgets for advanced threat detection systems.

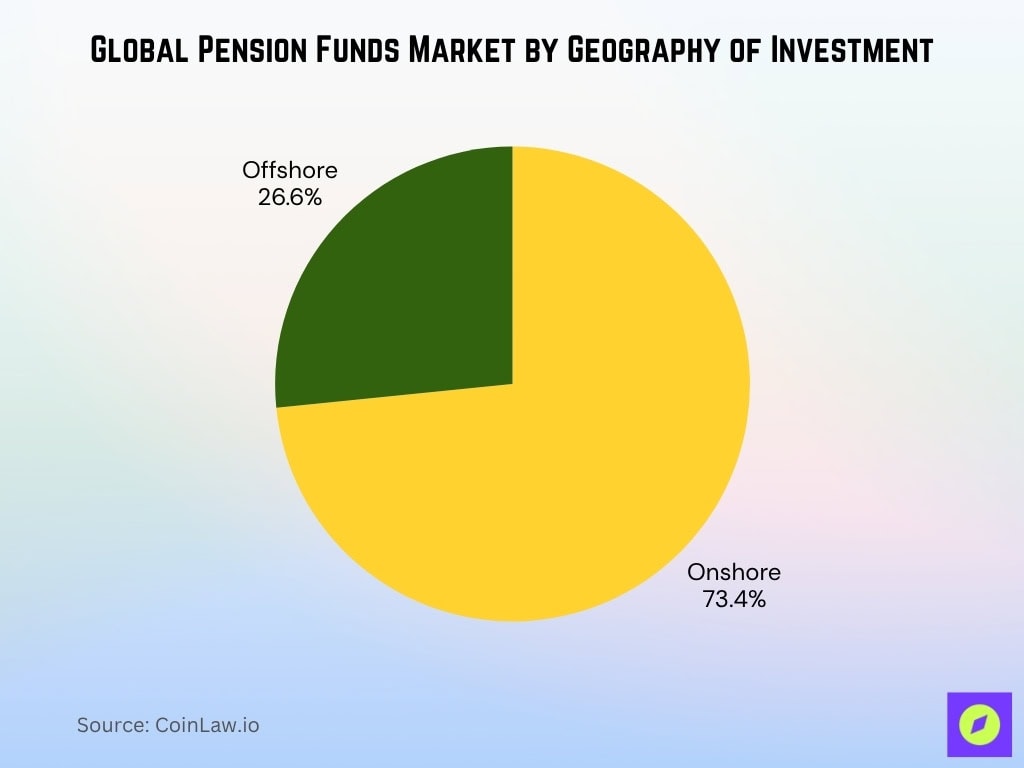

Global Pension Funds Market by Geography of Investment

- Onshore investments hold 73.4% of the global pension fund market, showing a strong preference for domestic allocation.

- Offshore investments account for 26.6%, reflecting diversification strategies, but still a smaller share overall.

- The dominance of onshore investments highlights the importance of local market stability and regulatory familiarity.

- Offshore allocations remain relevant as funds seek global exposure and higher returns in international markets.

- The data underscores a cautious but balanced approach between domestic security and offshore opportunities.

Recent Trends and Innovations

- Digital transformation is advancing rapidly, with about 45% of pension funds piloting blockchain or tokenization for transparency and efficiency.

- Robo-advisors and digital platforms now influence $3 trillion in retirement assets globally.

- AI and machine learning are increasingly applied to portfolio optimization, driving ~8–12% improvements in return forecasting.

- ESG investments continue surging with over $7 trillion in sustainable assets under pension fund management.

- Infrastructure and renewables now account for 13% of global pension fund allocations.

- Hybrid pension plans combining DB + DC features are adopted by ~20% of large pension systems.

- Financial literacy efforts are growing, with 25% of pension members participating in educational workshops in 2025.

Frequently Asked Questions (FAQs)

Global pension assets reached $58.5 trillion in 2024, representing 68% of GDP across the 22 major markets covered.

Japan’s GPIF manages about ¥250–260 trillion in assets, with the latest disclosures placing it around ¥250 trillion for FY2024 and ~¥260 trillion by June 2025.

CPP Investments reported $714.4 billion in net assets as of March 31, 2025, with a 9.3% net annual return.

The seven largest markets account for 91% of the $58.5 trillion total measured in the 2025 global pension assets study.

Conclusion

The global pension fund industry underscores its critical role in securing the financial future of millions worldwide. As assets under management grow to unprecedented levels, funds must navigate complex challenges, from demographic shifts to regulatory changes. Innovations in technology and investment strategies, particularly in ESG and alternative assets, present opportunities for sustainable growth. Policymakers and fund managers must collaborate to address emerging risks while adapting to evolving economic and social landscapes. By doing so, pension funds can remain resilient, ensuring they continue to serve as a vital safety net for future generations.