Alternative Investment Industry Statistics 2025: Navigating Hedge Funds, Real Estate, and More

Updated · Feb 10, 2025

In recent years, alternative investments have gained significant attention, primarily as a hedge against market volatility and inflation. Investors are looking beyond traditional stocks and bonds, seeking more diverse asset classes to balance risk and return. From hedge funds to private equity, real estate to digital assets, alternative investments are shaping the future of global finance. In this evolving landscape, understanding the key statistics and trends for 2024 can provide valuable insights into where the industry is headed.

Editor’s Choice: Key Growth Drivers

- Alternative investments are projected to reach a market size of $23.21 trillion by the end of 2024, a marked increase from $19.4 trillion in 2020.

- The global private equity market continues to expand, with assets under management (AUM) expected to surpass $10.4 trillion in 2024, up from $9 trillion in 2023.

- Institutional investors are increasing their exposure to alternatives, with 35% of institutional portfolios now allocated to these asset classes.

- Hedge funds are expected to experience a 5.2% growth in assets under management, reaching a total of $5 trillion in 2024.

- Real estate investments continue to dominate the sector, with a CAGR of 8.5% from 2022 to 2024.

- Digital assets such as cryptocurrencies are expected to account for 10% of the alternative investment market by 2024.

- Sustainability-focused funds are projected to grow by 45% in the coming year, driven by investor demand for ESG-compliant strategies.

Market Size and Asset Classes

- The alternative investment market is forecasted to reach $23.21 trillion by 2024, up from $22.1 trillion in 2023, reflecting a CAGR of 6%.

- Hedge funds remain a cornerstone of the market, managing $5 trillion in 2024, compared to $4.75 trillion the previous year.

- Private equity is the largest segment within alternatives, with a projected $10.4 trillion AUM by 2024, growing at an annual rate of 9%.

- Real estate investments are expected to capture 20% of the alternative investment space, driven by demand for income-producing assets.

- Venture capital investments in the technology sector are predicted to see a 12% increase, fueled by innovations in AI and blockchain.

- Commodities are becoming a more integral part of alternative portfolios, accounting for 5% of total alternative assets.

- Infrastructure investments are seeing rapid growth, expected to reach $1.5 trillion by 2024, as governments prioritize sustainable development projects.

Hedge Fund and Private Equity Trends

- Hedge fund performance rebounded in 2023, delivering average returns of 8.7%, with projections for 2024 expected to average around 7%.

- The top-performing hedge funds are those focusing on long/short equity strategies, which have provided 10%+ annual returns over the past two years.

- Private equity fundraising surged in 2023, raising a total of $860 billion, with 2024 expected to exceed $900 billion.

- Buyout funds remain the most popular in private equity, accounting for 60% of the total capital raised.

- Venture capital funds saw record inflows, particularly in technology and healthcare startups, with $330 billion raised in 2023.

- Distressed asset funds are expected to rise, as a possible economic downturn may create opportunities in distressed sectors, potentially increasing by 20% in 2024.

- Secondaries funds, which buy stakes from existing investors, are also seeing growth, with $130 billion expected to be raised in 2024, as investors seek liquidity solutions.

Real Estate and Infrastructure Investments

- The global real estate investment market is set to grow to $12.5 trillion by 2024, driven by demand for commercial properties and sustainable infrastructure.

- Commercial real estate investments are expected to make up 60% of total real estate investments, with multifamily units and logistics properties leading the way.

- Green building investments are projected to grow by 25% as investors prioritize environmentally sustainable developments.

- Real estate investment trusts (REITs) are expected to deliver returns of 6% in 2024, largely due to favorable interest rate conditions.

- Infrastructure funds are forecasted to reach $1.5 trillion AUM by 2024, with key investments in renewable energy and transportation projects.

- Urbanization trends continue to drive demand for real estate, with over 68% of the global population expected to live in urban areas by 2050, spurring investments in smart cities and urban renewal projects.

- Affordable housing projects are receiving increased attention, with a projected 15% growth in investment as governments and private investors collaborate to address housing shortages.

| Metric | Value |

| Commercial Real Estate Share | 60% |

| Green Building Investment Growth | 25% |

| Real Estate Investment Trusts (REITs) | 6% (return) |

Cybersecurity and Digital Transformation Risk

- The alternative investment industry faces increasing risks from cybersecurity threats, with over 30% of firms reporting a cyberattack in the last year.

- Cybersecurity investments in the financial sector are projected to grow to $280 billion by 2024, as firms bolster their defenses against evolving digital threats.

- Digital transformation in investment management has led to 60% of firms adopting AI and machine learning technologies for portfolio management and risk assessment.

- Blockchain technology is gaining traction, with 20% of alternative investment firms incorporating blockchain-based solutions for transparency and security.

- Cyber insurance is becoming a critical component of risk management, with the market for cyber insurance expected to reach $20 billion by 2024.

- Regulatory scrutiny around digital asset management and cybersecurity is expected to increase, with 45% of firms anticipating higher compliance costs.

- Insider threats remain a key risk, with 53% of financial institutions citing employee-related incidents as the primary cause of security breaches.

Evolving Industry Landscape and Associated Risks

- The alternative investment landscape is rapidly evolving, with 15% of traditional asset managers now offering alternative investment products to their clients.

- Environmental, Social, and Governance (ESG) considerations are becoming mainstream, with 75% of investors prioritizing ESG factors in their decision-making process.

- Regulatory risks are intensifying, with 42% of fund managers citing increased compliance requirements as a top concern for 2024.

- Geopolitical tensions continue to impact the market, with 35% of investors adjusting their portfolios in response to international conflicts and trade disputes.

- Climate change risks are prompting investors to reallocate funds, with 22% of firms reducing their exposure to high-carbon industries.

- Liquidity risks are rising as some alternative investments, such as private equity and real estate, remain relatively illiquid compared to traditional markets.

- The rise of retail investors in alternatives is reshaping the industry, with non-institutional capital flows growing by 18% in 2023 and expected to continue upward in 2024.

Drive Demand in New Channels

- Retail investors are showing increased interest in alternative investments, with over 30% of alternative assets now accessible to non-institutional investors through digital platforms.

- Online investment platforms saw a 40% growth in users in 2023, enabling individual investors to access hedge funds, private equity, and real estate deals previously reserved for institutions.

- The tokenization of assets is predicted to be a major disruptor, with $16 billion in tokenized assets expected to be traded on blockchain platforms by 2024.

- Environmental and social impact funds are gaining popularity among retail investors, with 23% of individual portfolios now including ESG-focused alternatives.

- Crowdfunding platforms for real estate and private equity saw a 30% increase in investment volume in 2023, and this trend is expected to accelerate.

- Financial advisors report a growing demand from their clients for exposure to alternatives, with 68% now recommending a diversified alternative portfolio for long-term growth.

- Robo-advisors are beginning to offer alternative investment products, with automated platforms managing over $50 billion in alternative assets by 2024.

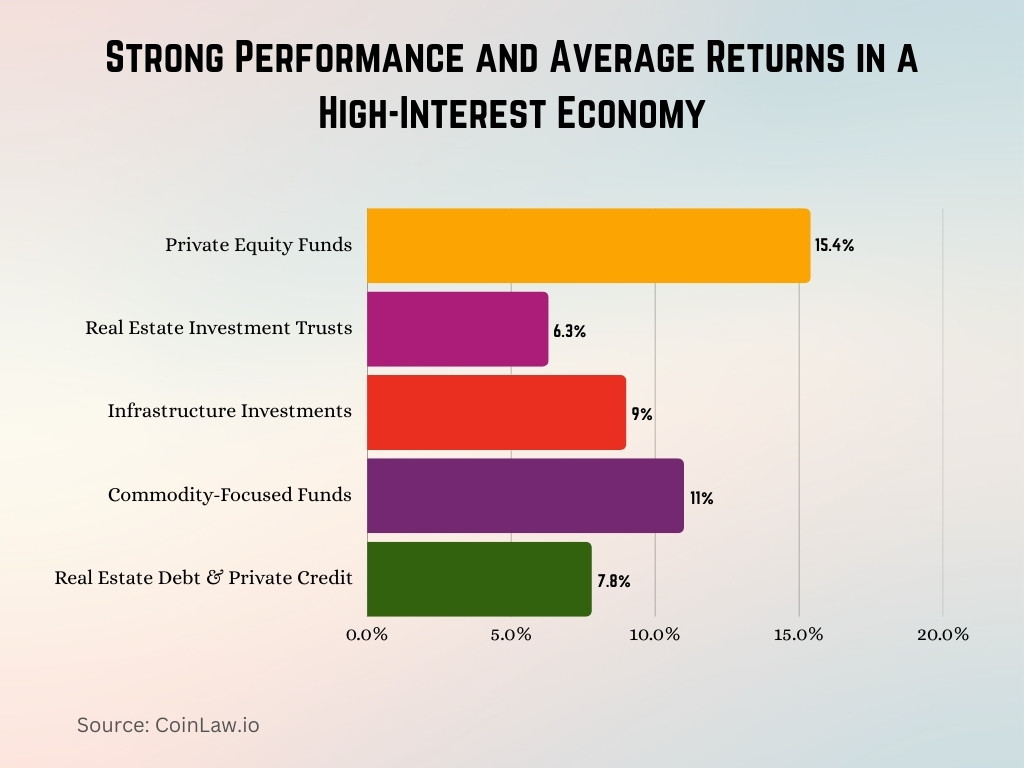

Performance and Returns in a High-Interest Environment

- Alternative investments are proving resilient in the current high-interest environment, with average returns of 7.5% across hedge funds, private equity, and real estate in 2023, expected to stay above 6% in 2024.

- Hedge funds, particularly those utilizing macro strategies, have outperformed traditional asset classes, delivering returns of 8% in 2023.

- Private equity funds saw an average internal rate of return (IRR) of 15.4% in 2023, slightly lower than the 16.2% recorded in 2022, but still outpacing public markets.

- Real estate investment trusts (REITs) have continued to perform well, offering average annual returns of 6.3%, despite the rising interest rates.

- Infrastructure investments have been a haven for investors, with 10-year infrastructure funds yielding 9% returns on average.

- Commodities, particularly energy and metals, have seen a resurgence, with commodity-focused funds delivering 11% returns in 2023, benefitting from inflationary pressures.

- The demand for income-generating alternatives, such as real estate debt and private credit funds, has risen, providing average returns of 7.8% in the past year.

Technology Integration and Innovations

- Artificial intelligence (AI) is revolutionizing portfolio management, with 25% of alternative investment firms now using AI-driven models to enhance performance and risk management.

- Blockchain technology is gaining wider adoption, with $16 billion worth of alternative assets tokenized and traded on blockchain platforms by 2024.

- Robo-advisors are making alternatives accessible, with automated platforms expected to manage over $50 billion in alternative assets by 2024, an increase from $35 billion in 2023.

- Big data analytics is empowering alternative asset managers to make better investment decisions, with 60% of firms integrating data-driven insights into their strategy.

- Fintech partnerships are on the rise, with 40% of alternative investment firms collaborating with fintech companies to streamline operations and offer digital solutions to investors.

- Smart contracts on blockchain are enhancing transparency and security in private equity and real estate transactions, reducing the need for intermediaries and speeding up settlement times by 20%.

- AI-powered risk management systems are being used by 35% of hedge funds to monitor market volatility and optimize portfolio performance in real time.

Regulatory and Risk Considerations

- Regulatory oversight of the alternative investment industry is increasing, with 65% of fund managers expecting more stringent compliance requirements in 2024.

- ESG reporting standards are becoming mandatory in many regions, with 55% of asset managers preparing for enhanced regulatory scrutiny around sustainability practices.

- Anti-money laundering (AML) regulations have expanded, impacting 30% of alternative investment firms as they increase their efforts to comply with cross-border transaction rules.

- The rise in cybersecurity regulations is prompting 45% of investment firms to allocate more resources to cyber risk management.

- Data privacy laws, such as GDPR and CCPA, are expected to affect 20% of firms that handle investor data across multiple jurisdictions, increasing operational complexity.

- Taxation risks remain a concern, especially in private equity and real estate, with 45% of investors worried about potential tax law changes affecting returns.

- The ongoing push for greater transparency in fees and performance reporting is driving 30% of firms to adopt new disclosure standards, particularly in Europe and North America.

Recent Developments

- Private equity continues to see robust deal flow, with $900 billion expected to be raised globally in 2024, marking a 4% increase from the previous year.

- Hedge funds are experiencing renewed interest as AI and algorithmic trading strategies outperform traditional stock-picking methods, contributing to a 5.2% growth in AUM.

- Real estate tokenization is gaining traction, with $5 billion in tokenized real estate transactions expected by 2024, making it easier for investors to access fractional ownership of properties.

- Venture capital investment in AI startups is predicted to grow by 12%, particularly in the healthcare and fintech sectors, as these industries embrace automation and innovation.

- Impact investing is on the rise, with $1.2 trillion in AUM focusing on sustainable development goals (SDGs), expected to grow by 30% over the next three years.

- Decentralized finance (DeFi) is making inroads into the alternative investment space, with 10% of firms exploring ways to integrate DeFi protocols for enhanced transparency and liquidity.

- Institutional investors are driving the demand for ESG-focused alternatives, with 75% of global pension funds committed to increasing their allocations to sustainable assets by 2025.

Conclusion

As we move further into 2024, the alternative investment landscape continues to evolve, driven by technological innovations, shifting regulatory frameworks, and a growing focus on ESG investing. Investors are increasingly looking towards alternative assets to diversify their portfolios and enhance returns, especially in a high-interest-rate environment. With global AUM projected to surpass $23 trillion, it is clear that the sector will play an even more critical role in the broader financial ecosystem in the years to come.

Sources

Barry Elad is a dedicated tech and finance enthusiast, passionate about making technology and fintech concepts accessible to everyone. He specializes in collecting key statistics and breaking down complex information, focusing on the benefits that software and financial tools bring to everyday life. Figuring out how software works and sharing its value with users is his favorite pastime. When he's not analyzing apps or programs, Barry enjoys creating healthy recipes, practicing yoga, meditating, and spending time in nature with his child. His mission is to simplify finance and tech insights to help people make informed decisions.