Cryptocurrency has exploded in scale and complexity, and so has the tax landscape around it. As governments strive to capture revenue and deter evasion, reporting rules and compliance demands have tightened worldwide. In the U.S., for example, brokers will begin issuing Form 1099‑DA for crypto sales. Meanwhile, nations like Germany offer zero tax on crypto held for more than one year. These policy shifts already affect investment strategies, cross‑border flows, and audit risks. Read on to see the most current stats guiding global crypto tax reporting today.

Editor’s Choice

- 55% to 95%: the estimated range of non‑compliance or misreporting in crypto holdings globally.

- 88%: share of crypto holders in Norway (in one study) failing to declare crypto income.

- 17.3%: average short‑term crypto gain tax rate in 2024, per Blockpit report.

- 11.12%: average long-term crypto gain tax rate across assessed jurisdictions.

- 0%: long-term capital gains tax in jurisdictions like Germany (for > 1 year holding).

- 10–37%: U.S. ordinary income and short-term crypto tax band.

- 21 countries: count of jurisdictions with zero percent tax on crypto profits, per Henley report.

Recent Developments

- As of Jan. 1, 2025, U.S. crypto brokers must report gross proceeds of digital asset sales via Form 1099‑DA.

- From 2026, U.S. brokers must also include cost basis information on that form.

- OECD’s Crypto‑Asset Reporting Framework (CARF) is under finalization and will enable cross‑border exchange of crypto transaction data.

- PwC’s Global Crypto Tax Report 2024 tracks 59 tax regimes, showing tightened reporting across U.S., EU, and international markets.

- Misreporting estimates fall dramatically when third‑party data is mandated, e.g., GDPR‑style transparency reduces misreporting from ~55% to ~5%.

- Indonesia is revising crypto tax rates: domestic trades are taxed at 0.21% (up from 0.1%), and foreign-exchange platform trades are taxed at 1%.

- Kenya passed a crypto regulation bill that sets a framework for exchanges and licensing under the capital markets regulator.

- The Senate in the U.S. voted to repeal a rule that would have required DeFi platforms to report user transactions starting in 2027.

Standard Deduction for Crypto Taxes

- Single filers can claim a standard deduction of $14,600 on their crypto-related income.

- Married couples filing jointly receive a deduction of $29,200, offering the highest allowance.

- Head of household status qualifies for a deduction of $21,900, providing added relief for single parents or caretakers.

- These deduction thresholds help offset taxable crypto gains and vary by filing status.

- The 2025 increase in deduction limits reflects ongoing inflation adjustments and IRS crypto tax rules.

Trends in Global Cryptocurrency Tax Compliance

- Average short‑term gain tax rate across surveyed jurisdictions: 17.3% in 2024.

- Average long‑term gain tax rate: 11.12% in 2024.

- Many countries are narrowing the gap, making income tax and capital gains tax more consistent across crypto types.

- Adoption of uniform reporting standards (like CARF) is rising across G20 and OECD nations.

- Investor behavior is shifting, with shorter holding periods to avoid new compliance burdens.

- Exchanges are integrating tax reporting tools (e.g., cost basis tags) to ease user compliance.

- Regions with lax tax enforcement see slower compliance growth.

- Enforcement budgets for crypto‑specific tax units have increased in many national tax agencies.

Key Factors Affecting Crypto Tax Payment Rates

- Perceived audit risk: When taxpayers believe there’s a high chance of audit, compliance rises.

- Marginal tax rates: In high-income brackets, crypto income is taxed at up to 55% in jurisdictions like Japan.

- Complexity and ambiguity: The pseudonymous nature of crypto makes linkage to taxpayers difficult.

- Third‑party reporting presence: In jurisdictions where exchanges or brokers must share data with tax authorities, noncompliance drops meaningfully.

- Holding period incentives: Some countries reduce rates for long-term holdings or exempt them altogether (e.g., Germany).

- Withholding or TDS schemes: India imposes 1% TDS on crypto transfers to create a reporting trail.

- Penalties and enforcement visibility: High fine risk can deter noncompliance, though actual enforcement is uneven.

- Awareness and tax literacy: In surveys, ~50% of crypto users admit to not filing any crypto-related taxes.

- Infrastructure maturity: Emerging markets often lack a strong reporting infrastructure, increasing underreporting.

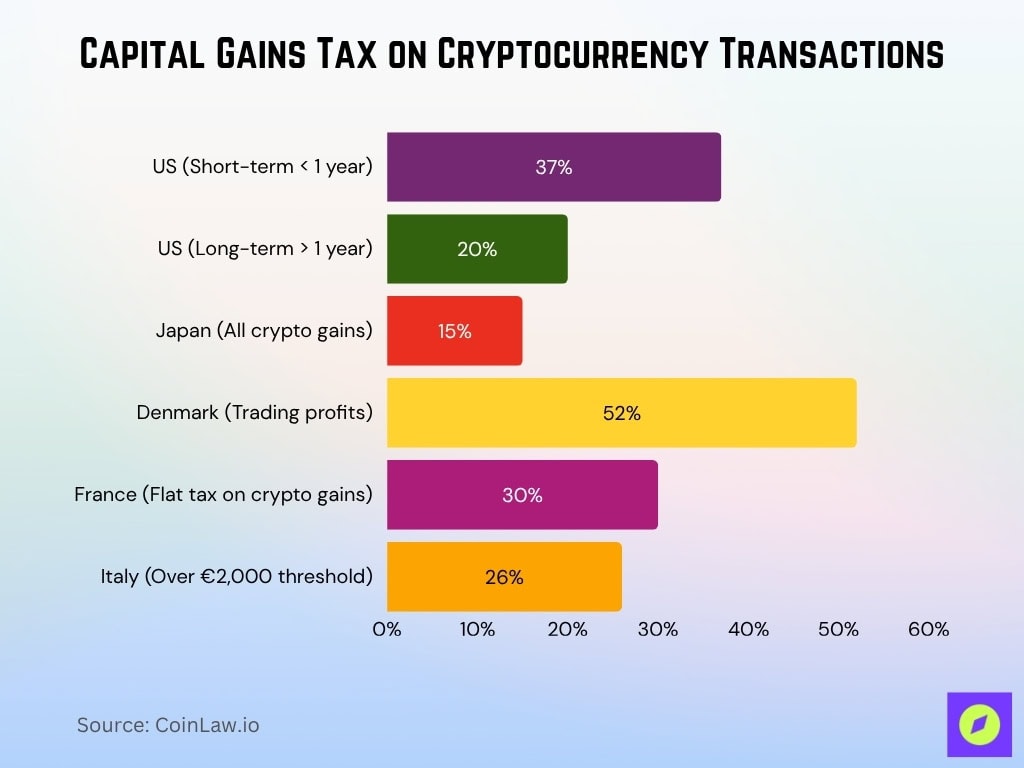

Capital Gains Tax on Cryptocurrency Transactions

- In the U.S., short-term crypto gains (held < 1 year) are taxed at ordinary rates: 10%–37%.

- Long-term crypto gains (held > 1 year) in the U.S. may be taxed at 0% to 20%, depending on income.

- Japan treats crypto gains as “miscellaneous income” taxed progressively at 15% to 55%, regardless of holding period.

- Denmark imposes up to 52% tax on profits from trading, depending on the type of transaction.

- France applies a flat 30% (including social charges) on digital asset capital gains.

- Italy applies a 26% rate on crypto capital gains above a threshold of €2,000.

Income Taxation on Crypto Earnings

- In the U.S., crypto earned as compensation, staking, or mining is taxed at ordinary income rates and included on a schedule like a W‑2 or Schedule C.

- Japan taxes staking and mining similarly, with rates from 15% to 55% under “miscellaneous income.”

- In Switzerland, private investors typically have 0% capital gains, but if crypto activities are treated as professional, income tax up to 40% may apply.

- Malta exempts long-term crypto gains but taxes short-term and income-like crypto activity at ordinary rates (15%–35%).

- In India, all crypto gains (no distinction) are taxed at 30%, which may cover both gain and income contexts.

- Spain treats crypto mining as business income, potentially taxed at progressive rates up to ~ 45%.

Crypto Tax‑Free Jurisdictions

- The UAE has zero personal income tax and zero capital gains tax on crypto for individuals, remaining tax-free even for short-term gains in 2025.

- Cayman Islands applies no personal income, corporate, or capital gains taxes to either individuals or businesses holding or trading crypto assets.

- Germany exempts crypto gains from taxation when assets are held longer than 1 year by individuals, but short-term gains are taxed up to 45%.

- In Malta, long-term crypto holdings are tax-exempt for individuals, though routine trading or business activity can trigger tax obligations.

- Portugal previously allowed gains from crypto held for over 365 days to be completely tax-free, although new rules are reducing exemptions starting from 2025.

- Singapore imposes no capital gains tax on crypto for individuals, though businesses must pay tax on income from crypto-related operations.

- In Malaysia, casual crypto gains by individuals are often untaxed, but frequent professional trading can be taxed as income at rates up to 30%.

- Both Bermuda and the Bahamas are recognized for imposing minimal or zero tax burdens on crypto holdings and gains, attracting crypto investors globally.

- In 2025, over 12 countries maintain official tax-free or low-tax status for crypto, but several (including Germany and Malta) are reviewing possible changes.

- Dubai’s Free Zones allow qualifying crypto businesses to remain corporate tax-free if requirements are met, but general corporate crypto profits above AED 375,000 face a 9% corporate tax since 2023.

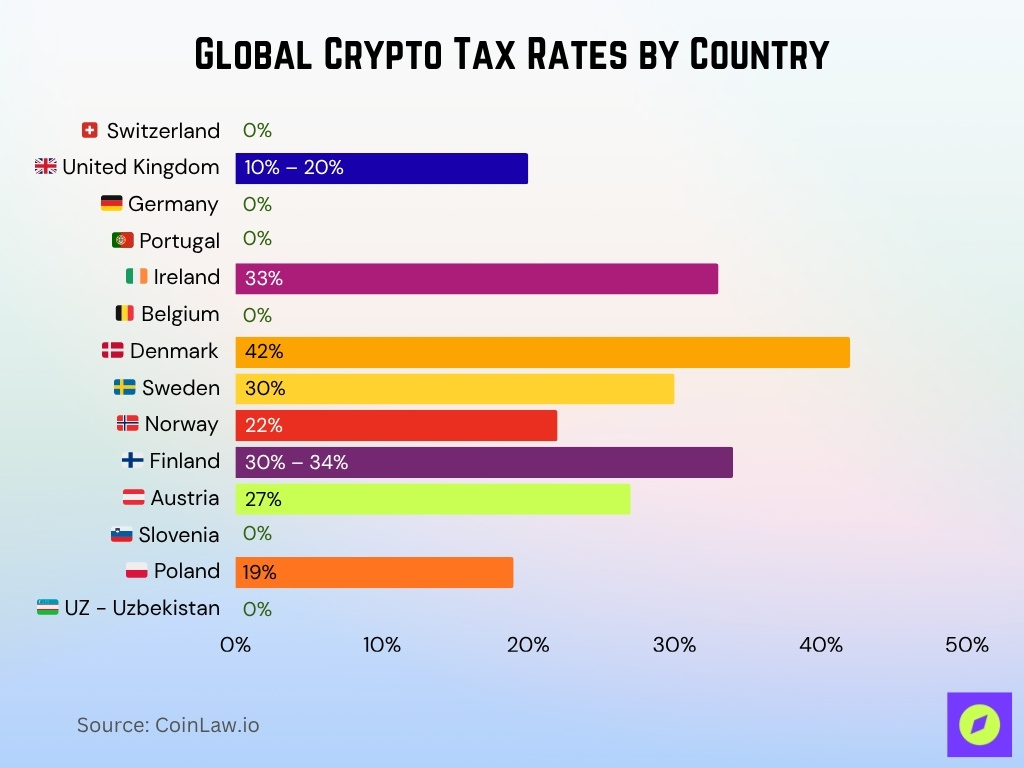

Global Crypto Tax Rates by Country

- Switzerland, Germany, Portugal, Belgium, Slovenia, and Uzbekistan all offer 0% crypto tax, making them top tax-free jurisdictions for digital asset gains.

- United Kingdom taxes crypto gains at 10% to 20%, depending on income and asset duration.

- Ireland imposes a flat 33% tax on crypto gains.

- Denmark has one of the highest rates, taxing crypto at 42%, depending on the transaction type.

- Sweden applies a 30% capital gains tax on crypto.

- Norway taxes crypto profits at 22%, below the Nordic average.

- Finland ranges between 30% and 34%, depending on income brackets.

- Austria applies a flat 27% tax on digital asset capital gains.

- Poland taxes crypto at a fixed rate of 19%, favorable compared to neighboring EU states.

Taxable Events in Cryptocurrency

- 56% of countries now treat crypto income as taxable, up from 48% in 2024, including sale, swap, mining, airdrops, and staking rewards.

- Swapping or trading crypto assets (e.g., BTC for ETH) is a taxable event in over 80% of major jurisdictions worldwide in 2025.

- The U.S. IRS reported collecting over $38 billion from crypto-related taxes in 2024, a 45% jump from the previous year.

- 43% of countries where mining is allowed tax mining rewards as income at fair market value upon receipt.

- Staking rewards are taxed as income upon receipt in over 75% of documented tax frameworks as of 2025.

- Airdrops and hard forks are treated as taxable income when received in more than 30 national tax systems, including the U.S., UK, and Australia.

- Transferring crypto between wallets owned by the same person is generally not a taxable event, though precise recordkeeping is required in all countries with crypto tax regulations.

- Burning tokens or redenominations may be classified as a disposal/acquisition event with tax consequences in about 20% of developed economies.

- Gifts and inheritance of crypto can trigger inheritance or gift taxes, which apply in 37% of OECD countries as of 2025.

- Using crypto for goods or services is taxable in the U.S., triggering gain/loss calculations for every purchase above $200 per transaction.

Exchange Reporting and Regulatory Developments

- Over 60 jurisdictions have formally committed to CARF implementation for crypto asset reporting by 2026, representing more than 80% of OECD member countries.

- Crypto-Asset Service Providers (CASPs) under CARF are now legally required to collect tax residence, taxpayer identification numbers, and self-certification documents from users for compliance.

- Starting in 2025, U.S. brokers must issue Form 1099‑DA for sales and exchanges of digital assets, mandating reporting of gross proceeds and cost basis for each transaction.

- Proposed U.S. rules exclude certain DeFi and non‑custodial wallet activities from mandatory 1099‑DA reporting, though these may be revisited in future regulations.

- 90% of OECD tax authorities now have formal requirements for crypto platforms to report user transaction data, up from 76% in 2022.

- Auditable transaction reporting by exchanges cut estimated noncompliance rates by about 35% in the EU since 2023.

- More than 70% of leading exchanges now offer advanced tax reporting tools such as automated cost basis tracking, CSV export for Form 8949/1099, and transaction tagging.

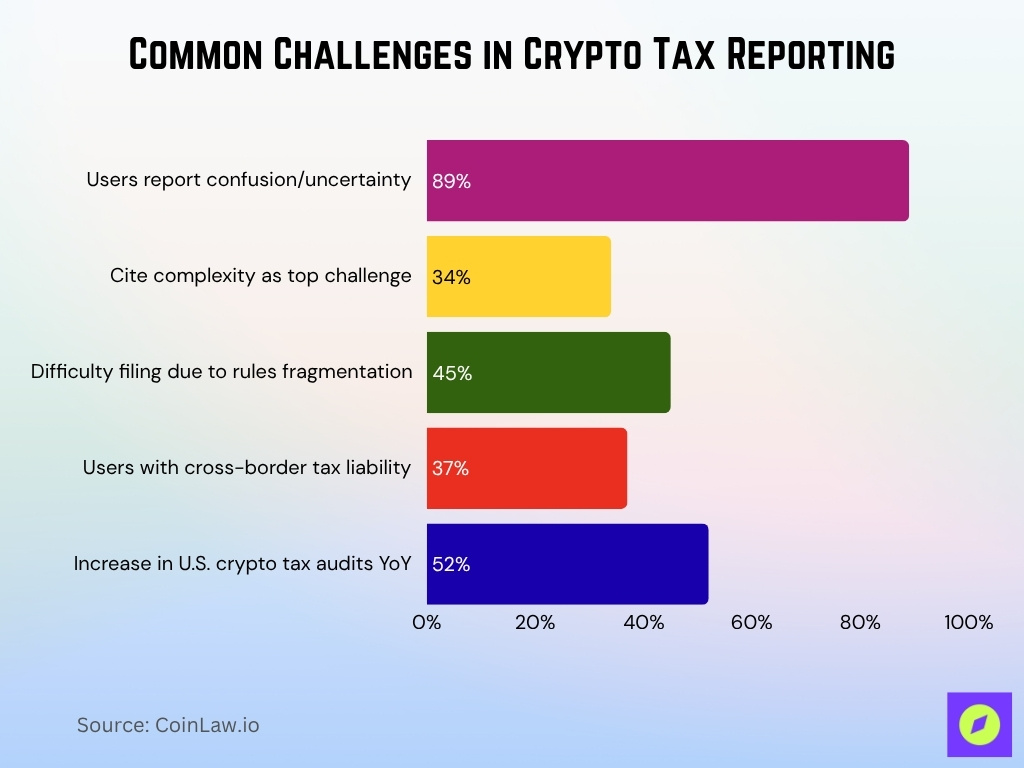

Common Challenges in Crypto Tax Reporting

- 89% of crypto users report confusion or uncertainty about at least one aspect of crypto tax reporting requirements, with 34% citing complexity as their top challenge.

- In 2025, 45% of surveyed crypto holders had difficulty filing taxes due to fragmented regulation and inconsistent national rules.

- More than 37% of crypto users make cross-border transactions that may trigger multi-jurisdictional tax liability and disputes.

- Tax audits focusing on crypto transactions increased by 52% in the U.S. from 2024 to 2025, overwhelming IRS analytics resources.

- Nearly 50 countries still lack comprehensive tax guidance on DeFi, staking, forks, or NFTs as of 2025.

- Wallet-by-wallet cost basis reporting, now required in the U.S., affects users with over 20 million active multi-wallet accounts, increasing recordkeeping workloads.

- Unresolved valuation timing issues contributed to reporting discrepancies on more than 15% of U.S. crypto tax returns for 2024 filings.

- Rapid innovation has outpaced regulators, and 7 of the 10 fastest-growing crypto sectors (DeFi, NFTs, liquid staking) had no clear tax rules in major economies at the start of 2025.

- Law enforcement links only 5‑10% of suspicious wallet addresses definitively to individuals using blockchain analytics, leaving most actors pseudonymous.

- Penalty rates for crypto tax noncompliance now range from $10,000–$250,000 in the U.S., with over $400 million in fines levied since 2023.

Recent Changes in Crypto Tax Laws and Rules

- In the U.S., Congress introduced the Lummis digital assets tax bill in 2025, aiming to extend wash‑sale rules to digital assets and create a de minimis exemption on small crypto gains.

- The U.S. also passed a resolution repealing an IRS expansion of the “broker” definition for DeFi platforms, nullifying certain reporting requirements.

- IRS mandates for brokers to issue Form 1099‑DA begin Jan 2025; by 2026, these forms must include cost basis alongside gross proceeds.

- The IRS has shifted from the “universal wallet” cost basis method to a wallet‑by‑wallet approach, forcing more granular recordkeeping.

- In Indonesia, starting August 2025, domestic crypto transactions face a 0.21% tax (up from 0.1%), and foreign exchange platform trades will be taxed 1%.

- Globally, noncompliance penalties have escalated, crypto tax evasion fines rose 33% in 2024 vs prior years, with the IRS alone collecting $235 million from unpaid crypto taxes.

- In 2025, 78% of the world’s largest economies will have formal crypto taxation policies in place.

- Over 60 jurisdictions have committed to implementing the OECD’s Crypto‑Asset Reporting Framework (CARF), expanding cross‑border reporting obligations.

- Tax authorities are shifting toward criminal enforcement in severe crypto noncompliance cases, not just civil penalties.

Global Cryptocurrency Market Growth and Tax Implications

- The global crypto market cap surpassed $3.5 trillion in mid‑2025.

- Transaction volumes via exchanges surged by 28% year-over-year in 2024.

- Emerging markets, particularly in Southeast Asia, saw user growth exceed 30% annual increases.

- In Indonesia, crypto transaction value in 2024 exceeded 650 trillion rupiah (~$39.7 billion).

- As exchange volume rises, reported taxable event frequency increases proportionally.

- Some jurisdictions now estimate $50 billion+ in unreported digital asset revenue in the U.S. alone.

- The growth puts pressure on tax administrations to invest in crypto audit and analytics capacity.

- Increased trading and DeFi sophistication may drive new loopholes or avoidance strategies unless regulation keeps pace.

- Growing cross‑border flows complicate jurisdictional claims and collection.

Enforcement and Penalties for Crypto Tax Noncompliance

- Crypto tax evasion fines rose 33% globally in 2024.

- The IRS collected $235 million in unpaid crypto taxes in 2024.

- In the U.S., penalties for noncompliance may reach $250,000 for serious cases.

- In Germany, crypto noncompliance penalties can reach €500,000 in certain contexts.

- Over 400 enforcement actions were taken globally against crypto firms in 2024.

- AML/CFT violations accounted for 60% of top crypto compliance fines in 2024.

- In Africa, penalties increased by 78% in 2024, despite lower absolute volumes.

- Tax authorities are increasingly pursuing criminal cases for egregious crypto tax fraud.

- Even KYC/AML failures in crypto platforms often lead to tax-related fines.

Frequently Asked Questions (FAQs)

56 % of countries worldwide now impose taxes on crypto income.

Global averages approximate 17.3 % for short‑term gains and 11.12 % for long‑term gains.

At least $50 billion of the U.S. federal tax revenue gap is attributed to unreported digital asset transactions.

The IRS has obtained data from over 14,000 cryptocurrency accounts.

Conclusion

Global crypto tax reporting is no longer a niche issue; it’s a fulcrum of fiscal policy, compliance risk, and innovation. Enforcement is intensifying, rules are evolving quickly, and technological tools will shape which investors stay compliant and which run risk. As tax authorities gain better data and analytical power, the window for avoidance narrows. In the final analysis, staying informed and aligned with legislation will not be optional, but essential.