Fiserv, Inc. stands today as one of the largest financial‑technology firms globally, powering payments, banking, and commerce infrastructure for thousands of merchants and institutions. It continues to play a crucial role, from powering credit‑card networks to enabling point‑of‑sale (POS) systems for small businesses, shaping how consumers pay and how businesses receive funds. Through this article, readers can understand Fiserv not only by its headline figures but by the granular metrics that signal its health and strategic direction. Explore on as we dig into the numbers behind Fiserv’s performance.

Editor’s Choice

- In the first nine months of 2025, Fiserv’s GAAP revenue reached $15.91 billion, up 5% year over year.

- Third‑quarter 2025 GAAP earnings per share (EPS) jumped to $1.46, a 49% rise over Q3 2024.

- The company’s trailing 12‑month (TTM) revenue is roughly $21.16 billion as of 2025.

- Fiserv’s 2024 total revenue was approximately $20.46 billion, marking a ~7.1% increase over 2023.

- Operating margin in 2024 rose to about 28.7%, up around 240 basis points compared to 2023.

- In Q2 2025, adjusted EPS reached $2.47, a 16% year‑over‑year increase.

- Fiserv’s market capitalization stood at about $34.1 billion as of late November 2025, placing it among large‑cap global fintech stocks.

Recent Developments

- In Q3 2025, revenue modestly increased 1% year over year, to $5.26 billion from $5.215 billion.

- Merchant Solutions segment grew ~5% in Q3 2025, while Financial Solutions saw a ~3% decline.

- Fiserv launched a strategic turnaround plan named “One Fiserv,” aiming to re-prioritize client service, technology platforms like Clover, embedded finance and stablecoin offerings, and operational efficiency.

- In August 2025, Fiserv secured a new revolving credit facility, increasing its borrowing capacity to $8.0 billion through 2030.

- In acquisitions, Fiserv bought CardFree, Inc., a platform offering integrated ordering, payment, and loyalty solutions for merchants.

- It also agreed to acquire StoneCastle Cash Management, subject to closing by early 2026, a move reflecting focus on cash‑management services for clients.

- Despite these strategic moves, in October 2025, Fiserv cut its full‑year organic revenue growth guidance to 3.5%–4%, down from prior guidance of ~10%.

- Adjusted EPS guidance was likewise lowered to $8.50–$8.60 from the prior range of $10.15–$10.30.

Key Fiserv Company Facts

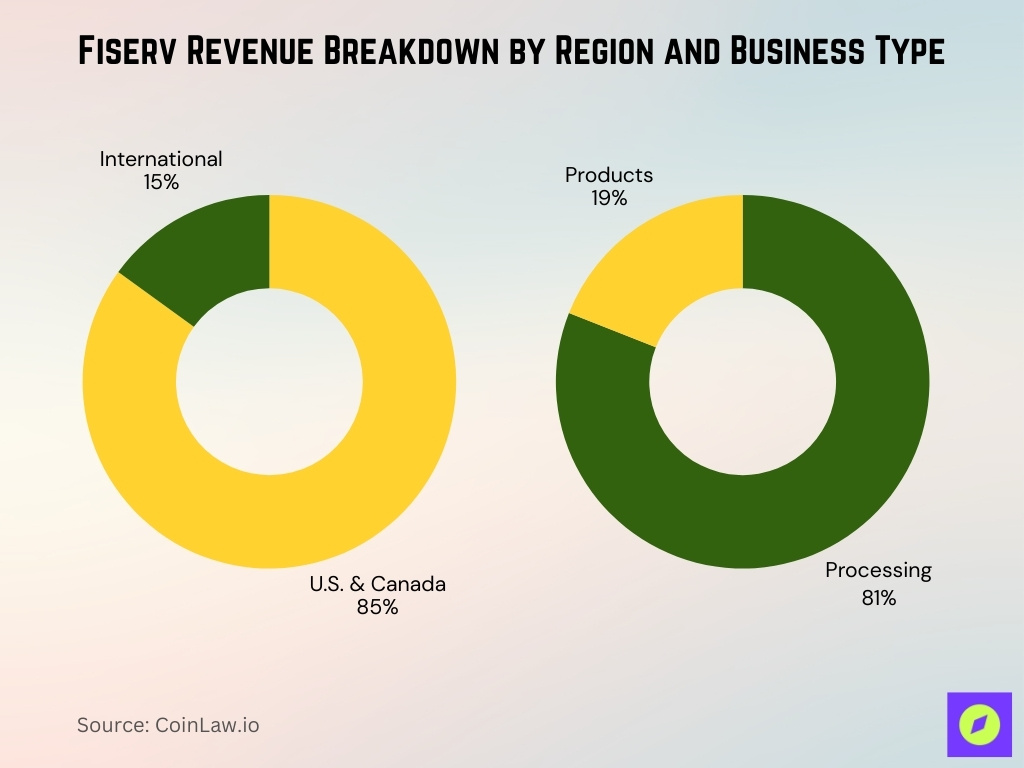

- 85% of Fiserv’s revenue came from U.S. and Canada, showing strong reliance on North American markets.

- The remaining 15% was generated from international operations, indicating limited global exposure.

- 81% of revenue was derived from processing services, reflecting the company’s core transaction-driven model.

- 19% of revenue came from product sales, such as hardware and software solutions

- Fiserv was founded in 1984 and today operates as a multinational fintech headquartered in Milwaukee, Wisconsin.

- Its services include payment processing, debit and credit card issuance, POS terminals, electronic bill‑pay, ACH transfers, ATM networks and banking software.

- In 2024, Fiserv ranked #208 on the Fortune 500 and #269 on the Forbes Global 2000.

- The company serves a broad set of client types, including banks, credit unions, mortgage and leasing firms, broker‑dealers, insurers, and retailers.

- Its point-of-sale platform, Clover, remains a core product offering, especially for small businesses and merchants.

- In 2024, Fiserv’s operating income rose substantially, reflecting both scalable revenue growth and improved productivity across segments.

Financial Performance & Revenue Trends

- 2024 revenue: ~$20.46 billion, up ~7.1% from 2023’s ~$19.09 billion.

- 2025 TTM revenue is roughly $21.16 billion, showing continued overall top‑line growth.

- In Q2 2025 alone, GAAP revenue rose 8% to $5.52 billion compared to Q2 2024.

- For the first nine months of 2025, total GAAP revenue hit $15.91 billion, growing 5% year over year.

- Revenue growth in Merchant Solutions was especially strong: Q2 2025 saw 10% growth in that segment.

- For 2024, Merchant‑segment revenue rose by $909 million, an increase of about 10% from 2023.

- Financial‑segment revenue in 2024 increased by $376 million, or roughly 4%, compared to 2023.

Profitability and Margin Metrics

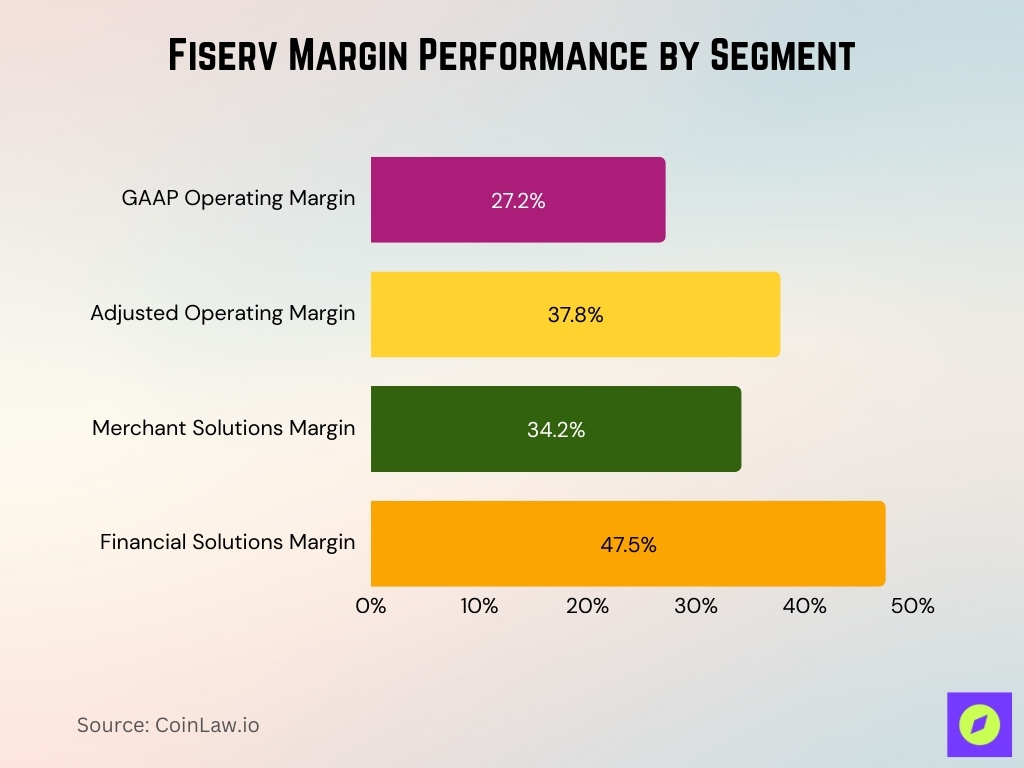

- In Q1 2025, Fiserv, Inc. improved its GAAP operating margin to 27.2%.

- Adjusted operating margin rose to 37.8%, reflecting better cost controls and operational efficiency.

- Within Fiserv’s segments in Q1 2025, the Merchant Solutions margin held at approximately 34.2%.

- In the Financial Solutions segment, margin improved to 47.5% in Q1 2025.

- Cost of revenue as a share of processing revenue edged down in the first nine months of 2025 compared to 2024.

- Margin gains reflect strategic emphasis on higher‑margin operations such as digital payments and software revenue.

- In Q3 2025, net income attributable to Fiserv rose to $792 million, up from $564 million in Q3 2024.

- Profitability remains supported by a diversified revenue mix, which cushions against swings in any one segment.

Earnings Per Share (EPS) Statistics

- Q3 2025 diluted EPS: $1.46, compared with $0.98 in Q3 2024.

- The increase reflects both higher net income and share‑count reductions.

- TTM EPS as of late 2025: $6.49.

- 2024 full-year EPS: $5.41, up from $5.02 in 2023, a 7.8% increase.

- EPS growth from 2023 to 2024 reflects margin improvements and a stable business mix.

- In Q3 2025, adjusted EPS declined about 11% compared with Q3 2024.

- Full-year 2025 EPS guidance revised to $8.50–$8.60.

- The updated guidance reflects cautious revenue assumptions despite cost discipline.

Balance Sheet and Cash Flow Figures

- Q1 2025 operating cash flow: $648 million, down from $831 million in Q1 2024.

- Q1 2025 free cash flow: $371 million, down from $454 million year over year.

- TTM free cash flow remains robust.

- Q3 2025 net income included a $100 million gain from asset sales.

- Debt-to-adjusted EBITDA ratio stands at 2.9×.

- Revolving credit facility increased to $8.0 billion through 2030.

- Nearly 10 million shares repurchased for $2.2 billion, reducing share count by ~5%.

- Cash flow and balance sheet remain structurally resilient.

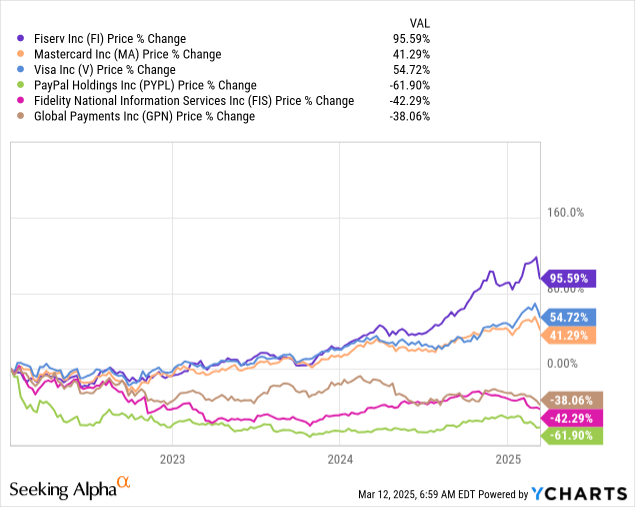

3-Year Share Price Performance of Major Payment Companies

- Fiserv Inc. delivered the strongest return with a +95.59% increase, nearly doubling its stock value since early 2022.

- Visa Inc. posted a solid gain of +54.72%, reflecting continued dominance in global payments.

- Mastercard Inc. rose by +41.29%, maintaining healthy growth within the credit and debit card space.

- PayPal Holdings suffered the steepest decline with a –61.90% drop, signalling investor retreat from digital wallet providers.

- Fidelity National Information Services (FIS) saw a significant fall of –42.29%, highlighting pressure in traditional fintech infrastructure.

- Global Payments Inc declined by –38.06%, underperforming its peers in the merchant services segment.

Market Capitalization and Valuation Metrics

- Market capitalization as of late 2025: $33.06 billion.

- Enterprise value: $62.5 billion.

- Trailing P/E ratio: 9.5–9.8×.

- Forward P/E ratio: 7.3–7.5×.

- Price-to-sales ratio: 1.62–1.67×.

- Price-to-book ratio: 1.36×.

- Valuation multiples reflect cautious investor sentiment.

- Fiserv trades at a discount compared to peers, reflecting risk factors.

Share Price Performance Statistics

- 2025 YTD share price drop stands at nearly 71%.

- Shares plunged over 40% in a single day after Q3 2025 results.

- By late‑2025, Fiserv’s market cap had dropped to about $33 billion, implying a ~70%+ one‑year decline from roughly $117 billion at the end of 2024, leaving the stock sharply negative for the year.

- Fiserv’s market value dropped from roughly $116.9 billion at end‑2024 to around $33–34 billion by late‑2025, reflecting a market‑cap decline of roughly 70–73% year over year.

- Stock hit a 52-week low of $66.58 after dropping from $238.59 high.

- Current P/E ratio is at a multi-year low of 9.23x versus a historical 25-38x.

- Current P/B ratio at 1.33x, down from prior 4.39x peak.

- Organic revenue growth outlook slashed to 3.5-4% for 2025 from 10%.

- Adjusted EPS guidance cut to $8.50-$8.60 from $10.15-$10.30.

- Q3 adjusted EPS declined 11% year-over-year to $2.04.

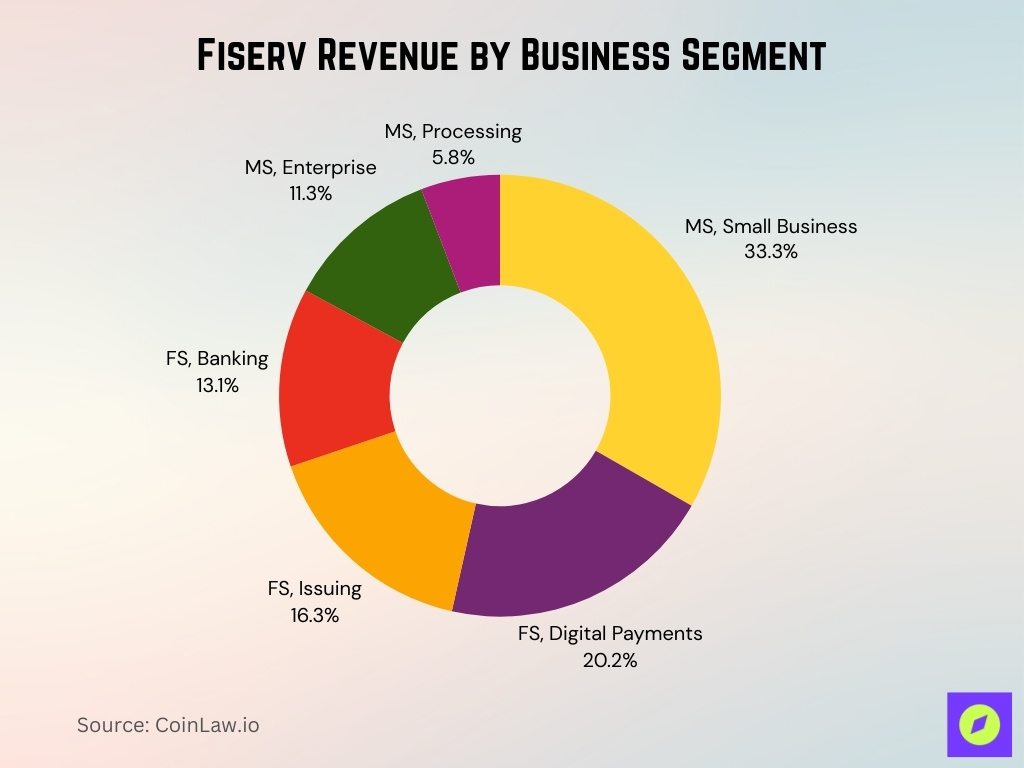

Fiserv Revenue Breakdown by Business Segment

- Small Business Merchant Solutions (MS) led Fiserv’s revenue mix, contributing 33.3%, driven by Clover and point-of-sale growth.

- Digital Payments under Financial Solutions (FS) represented 20.2%, showing strong demand for API-based payment infrastructure.

- Issuing services made up 16.3%, reflecting stable volumes in credit and debit card management.

- Banking software and services brought in 13.1%, highlighting Fiserv’s footprint in core banking systems.

- Enterprise Merchant Solutions accounted for 11.3%, showing traction in large-scale client integrations.

- Processing services under MS contributed the smallest share at 5.8%, suggesting it’s a niche but stable segment.

Fiserv Market Share in Payments and Fintech

- Fiserv ranks #1 in the IDC FinTech Top 100 for the third year running.

- Serves over 6 million merchant locations globally.

- Supports 25,000 financial transactions per second.

- Works with around 10,000 financial institutions worldwide.

- Holds 5.31% market share across the professional services sector.

- Recognized as “Leader” in digital banking by IDC MarketScape.

- Positioned as both a processor and a technology provider.

- Maintains a strong presence among U.S. merchant acquirers.

Competitive Position and Rankings

- Ranked #1 in IDC FinTech Top 100 for the third consecutive year.

- Named Leader in IDC MarketScape North America Retail Digital Banking 2025-2026.

- Serves nearly 10,000 financial institutions and 6 million business locations globally.

- Clover revenues surged 30% year-over-year in Q2 2025 with 24% VAS penetration.

- Acquired TD Bank’s Canadian portfolio, adding 3,400 merchants and 30,000 locations.

- Clover is now expanding to Canadian merchant services via a multi-year TD partnership.

- Made four international acquisitions in two months, boosting Q1 2025 revenue 5% YoY.

- Reaches nearly 100% of U.S. households through a diverse payment ecosystem.

- Leadership across acquiring, core processing, digital banking, and money movement segments.

Client and Financial Institution Coverage

- Serves 10,000 financial institutions globally.

- Covers 6 million+ merchant locations.

- Clover supports 700,000 businesses worldwide.

- Most Clover merchants generate $200,000–$250,000 in annual revenue.

- Balanced revenue mix across merchant and bank services.

- Expansion into Europe strengthens the client base.

- Partnership with TD Bank adds 3,400 merchants and 30,000 locations.

- Strong infrastructure links banking and commerce.

Merchant Locations and Payment Volumes

- Reaches over 6 million merchant locations.

- Clover powers 700,000+ businesses.

- Clover GPV reached $313 billion, up ~17%.

- Merchant revenue continues to grow.

- TD Bank migration adds to payment volume.

- Capable of handling 25,000 TPS.

- Poised to benefit from global payment market growth.

Transaction Processing Volume and Throughput

- Capable of processing 25,000 TPS globally for 6 million merchants.

- Serves nearly 10,000 financial institutions worldwide.

- Clover processes over $313 billion in annualized gross payment volume.

- Clover GPV reached $296 billion annualized in Q1 2025, up 8% YoY.

- Merchant Solutions revenue hit $2.59 billion in Q3 2025, up 5% organically.

- Clover revenue grew 27% YoY in Q1 2025 with 24% VAS penetration.

- Processes payments across 13 countries via Clover expansion.

- Handles STAR and ACCEL debit networks with surging transaction volumes.

- Merchant Solutions targets 11% CAGR through 2026 revenue of $12 billion.

Frequently Asked Questions (FAQs)

Fiserv’s TTM revenue is $21.16 billion.

Fiserv serves over 6 million merchant locations globally.

Around 10,000 financial institutions worldwide use Fiserv’s services.

Fiserv can handle up to 25,000 financial transactions per second at peak load.

Conclusion

Fiserv remains a foundational player in global payments and fintech, not despite volatility, but because of its tremendous scale, infrastructure, and diversified business model. The growth of its Clover platform, with hundreds of billions in annual gross payment volume, along with recognition from IDC and industry analysts, reinforces Fiserv’s status as a leader in both banking‑tech and payment processing convergence.

Still, near‑term challenges, such as slower growth forecasts, investor scepticism, and increasing competitive pressure, underscore the importance of execution. The firm’s expansion initiatives, like merchant acquisitions and geographic diversification, and strong infrastructure, could deliver upside, but sustained performance depends on navigating macroeconomic headwinds and evolving payment trends.