The fintech industry continues to reshape global financial services and employment patterns, driven by digital innovation and shifting business priorities. As the sector grows beyond traditional banking roles into areas like AI, payments, and compliance, demand for specialized talent has expanded across multiple regions and job functions. Firms from Silicon Valley to London are adapting hiring strategies to remain competitive, while cities like Charlotte are emerging as major fintech talent hubs. Explore how these trends are influencing job creation and workforce dynamics worldwide.

Editor’s Choice

- Annual fintech industry growth rate: ~5.38%, outpacing many traditional finance sectors.

- North America leads fintech market share (~34%), reinforcing its role as a major employment center.

- AI-related roles in fintech are expanding rapidly, tied to rising automation and analytics integration.

- 6,425 fintech job vacancies posted in London in 2025 already exceed 2024 totals, highlighting regional demand spikes.

- Mid‑sized fintech firms reported workforce growth of ~13% in a recent quarter.

- Fintech engineer roles are projected to be among the fastest‑growing job types over the next decade.

Recent Developments

- Fintech hiring remains strong in 2025, particularly in areas like payments, open banking, and banking‑as‑a‑service (BaaS).

- Mid‑sized fintechs reported a ~13% workforce growth in one quarter, even as broader tech markets cool.

- Global fintech revenues grew ~21% year‑over‑year in 2024, supporting expanded hiring budgets.

- London’s fintech roles in 2025 have already surpassed last year’s job postings, driven by AI and digital finance demand.

- Launches and expansions by companies such as Wealthfront and Airwallex signal ongoing investment momentum, with implications for job growth.

- Regulations around data, compliance, and digital assets are influencing hiring in risk and legal functions.

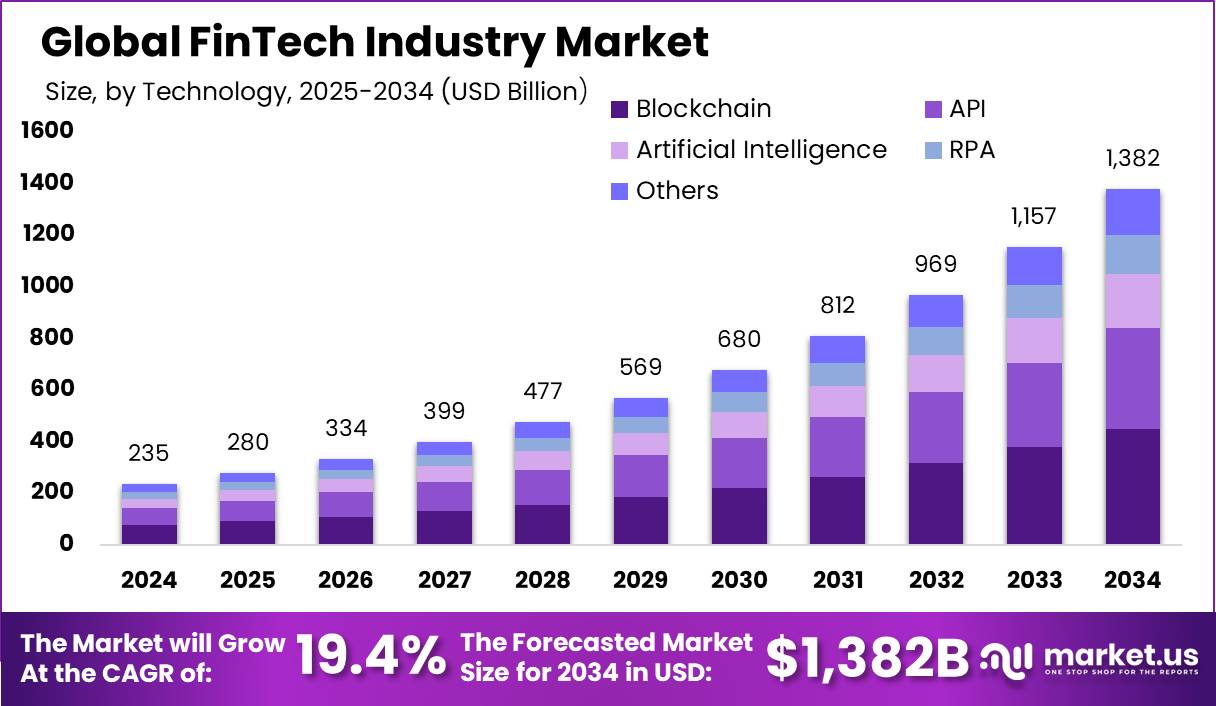

Global FinTech Market Outlook

- The global FinTech market will grow at a CAGR of 19.4% from 2025 to 2034.

- The market size is expected to rise from $280 billion in 2025 to $1,382 billion by 2034.

- In 2024, the market stood at $235 billion, indicating strong momentum entering 2025.

- By 2026, the market is projected to hit $334 billion, growing steadily with tech adoption.

- The FinTech market crosses the $500 billion mark in 2029, reaching $569 billion.

- In 2030, the market will exceed $680 billion, nearly tripling from 2025 levels.

- AI, Blockchain, API, RPA, and Other technologies are key contributors to this growth.

- The market is forecasted to reach $1 trillion by 2033, hitting $1,157 billion before surging to $1,382 billion in 2034.

Regional Distribution of Fintech Jobs

- North America holds ~34% of the global fintech market share, driving high job density in hubs like New York and San Francisco.

- Europe posted over 6,425 fintech vacancies in London alone through 2025, exceeding prior year totals.

- Brazil captures 42% of LATAM fintech funding with 15% sector employment growth, boosting demand in São Paulo.

- UAE fintech sector grows at 15% CAGR with DIFC reporting 10% workforce increase and over 1,500 quarterly roles.

- Singapore leads APAC hiring with talent pool up 61% in 2024, signaling strong 2025 job expansion in software engineering.

- India fintech funding tops $27 billion cumulatively, supporting abundant roles in neobanks and agrifinance startups.

- Since 2018, Los Angeles fintech employment has grown by about 20–23%, with the region home to 250+ startups and over $1.2 billion raised in venture deals.

Headcount Growth in Fintech Startups vs. Incumbents

- Fintech 100 startups average 61% headcount growth over the past year vs. 13% fintech sector average.

- Mid-sized fintechs report ~13% team expansions in recent quarters amid selective scaling.

- Payments and BaaS startups lead with strong headcount gains in product and engineering roles.

- UK fintech vacancies surged 61% year-on-year early 2024, driven by tech and AI demand.

- Revolut targeted a 40% workforce boost in 2024 from 8,000 to 11,500 employees.

- Fintech revenues grew 21% year-over-year, outpacing 6% in broader financial services.

- Startups in the AI and crypto segments show the fastest hiring in compliance and development teams.

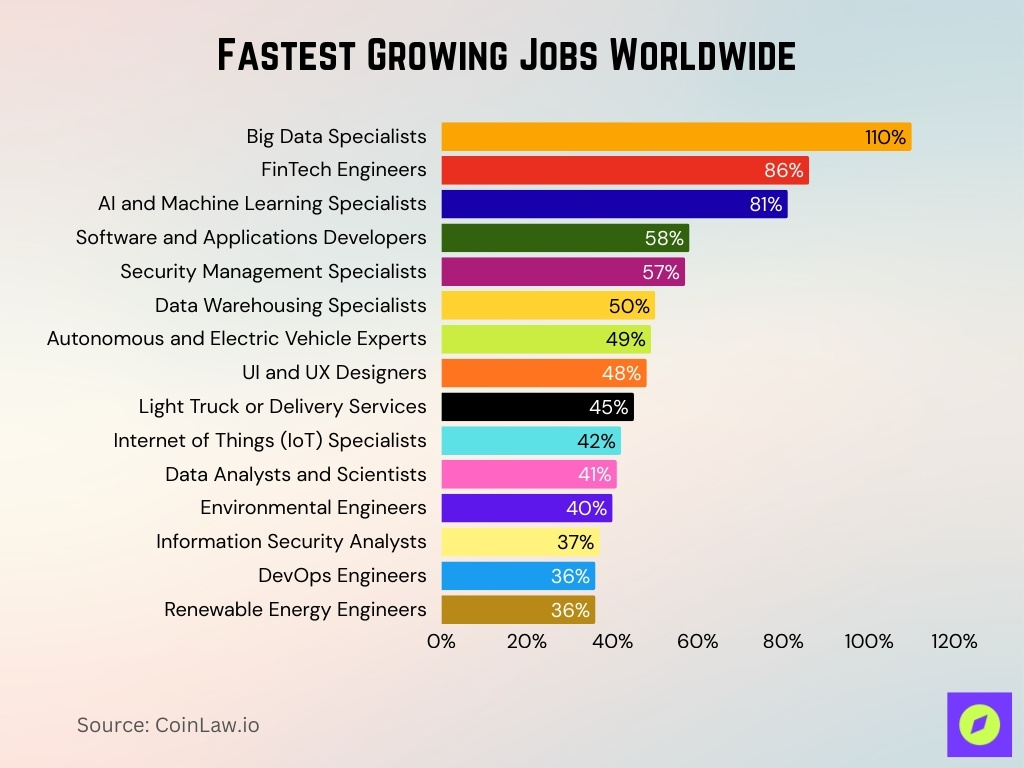

Fastest Growing Jobs Worldwide

- Big Data Specialists top the global demand charts with projected growth of 110%.

- FinTech Engineers are set to grow by 86%, driven by digital finance expansion.

- AI and Machine Learning Specialists will see an increase of 81%, reflecting AI adoption across industries.

- Software and Applications Developers are forecasted to grow by 58%, powered by ongoing digital transformation.

- Security Management Specialists will rise by 57%, as cybersecurity becomes a top priority.

- Data Warehousing Specialists are expected to grow by 50%, supporting data-driven decision-making.

- Autonomous and Electric Vehicle Experts will grow by 49%, fueled by the shift to EVs and self-driving tech.

- UI and UX Designers will expand by 48%, as user-centric design remains critical in tech products.

- Light Truck or Delivery Services Roles are projected to grow by 45%, driven by e-commerce logistics.

- IoT Specialists will see growth of 42%, aligning with smart tech adoption.

- Data Analysts and Scientists will increase by 41%, essential for analytics and forecasting.

- Environmental Engineers are expected to grow by 40%, linked to green tech and climate goals.

- Information Security Analysts will expand by 37%, with cybersecurity threats on the rise.

- DevOps Engineers and Renewable Energy Engineers are both forecasted to grow by 36%, reflecting automation and clean energy shifts.

Risk, Compliance, and Legal Roles in Fintech

- Fintech firms account for over 20% of all UK Risk and Compliance roles, up from 12% in the prior year.

- Fintech risk and compliance vacancies surged 26% amid regulatory scrutiny, while banks cut hiring by 30%.

- Financial Crime roles in fintech grew 52% as firms bolster anti-money laundering defenses.

- Credit Risk positions in fintech expanded nearly 200% driven by advanced lending models.

- Compliance roles in fintech are projected to rise 56%, comprising 28% of all such vacancies.

- Risk management roles are expected to increase 115% year-on-year in the fintech sector.

- KYC compliance positions in fintech are set for 98.4% growth, focusing on fraud prevention.

- 85% of financial crime departments plan to hire in 2025 versus 58% for compliance teams.

- AML analyst demand projected at 19% growth rate through 2028, exceeding average occupations.

Full-Time, Part-Time, Contract, and Freelance Role Mix

- Fintech contract jobs represent 1.35% of all UK IT contracts, with 356 daily rate postings.

- In fintech and IT sectors, full-time freelancers average around $80,000 to $90,000 per year, often exceeding salaried counterparts depending on skills and region.

- 54% of Singapore fintech firms plan significant hiring, dominated by full-time roles.

- Freelancers contribute $1.5 trillion globally, with fintech powering gig payments.

- Fintech contractors command median daily rates of £550, rising to £750 at the 75th percentile.

- 36% of the US workforce engages in gig economy freelancing, contributing $1.27 trillion.

- 82% of freelancers report more opportunities than full-time employees at 63%.

- Agency freelancers comprise 43% of high-earning independent fintech specialists.

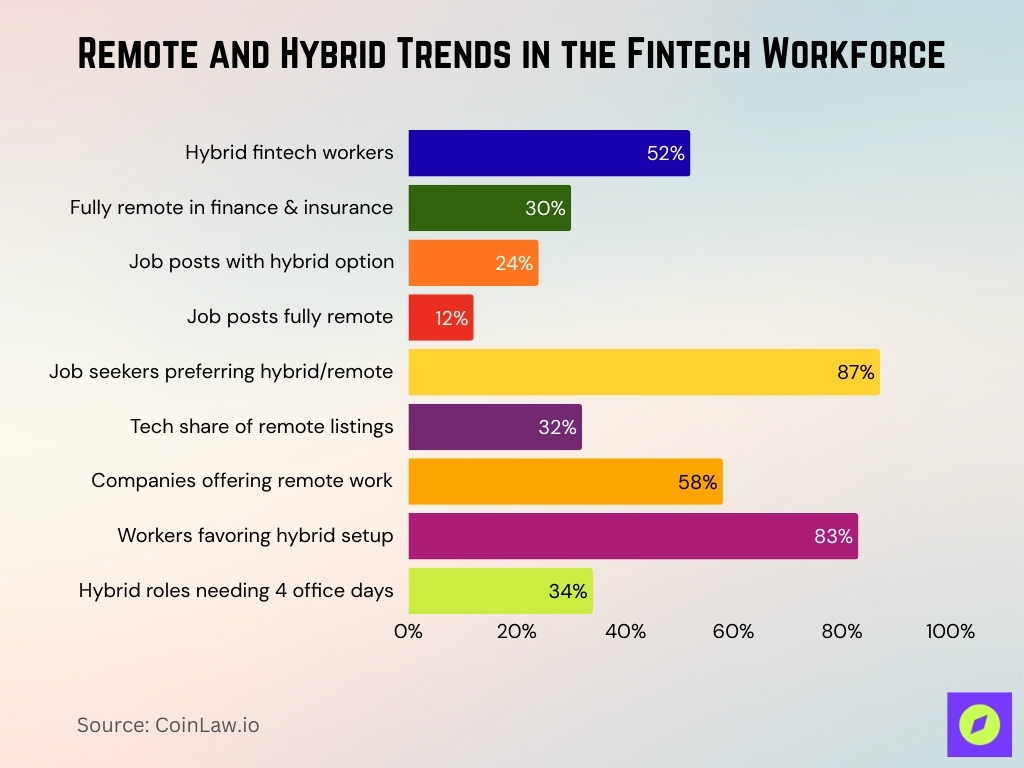

Remote, Hybrid, and On-Site Work Patterns in Fintech

- 52% of remote-capable fintech employees work hybrid models combining office and home days.

- The finance and insurance sector leads with 30% fully remote workers among major industries.

- 24% of new fintech job postings offer hybrid arrangements, while 12% list fully remote.

- 87% of fintech job seekers prefer hybrid or remote roles over fully on-site positions.

- Technology dominates remote fintech listings at 32% of all flexible work opportunities.

- 58% of fintech companies provide remote options for at least part of their workforce.

- 83% of global fintech workers favor hybrid environments for productivity and balance.

- 34% of hybrid fintech roles require four office days weekly, up from prior years.

- Fintech remote roles attract 2x more applicants than traditional on-site positions.

Diversity and Inclusion in Fintech Employment

- 85% of fintech companies plan to strengthen diversity and inclusion programs, signaling inclusive culture value.

- 57% of fintech firms report MSMEs as a significant customer base, driving inclusive hiring priorities.

- 47% of surveyed fintechs serve low-income individuals, correlating with diverse talent strategies.

- 41% of fintech customer growth targets women entrepreneurs, boosting gender diversity initiatives.

- 55% of new hires at leading fintechs were women, with company-wide diversity KPIs tracked.

- Women hold 29% average representation in fintech software roles, prompting targeted recruitment.

- 40% of women report gender discrimination in fintech interviews, spurring equitable practices.

- Diverse fintech teams show 37% customer growth and 40% revenue increase, outperforming peers.

Skills and Qualifications in Demand

- AI/ML skills top 78% of fintech job postings requiring Python, TensorFlow, and MLOps expertise.

- Fintech cybersecurity job postings rose by over 110% year-on-year, driven by rising regulatory scrutiny and demand for certifications like CISSP and ISO 27001.

- Roughly 60–65% of advanced fintech roles now require blockchain proficiency, especially in Solidity, smart contracts, and DeFi systems, reflecting demand in the crypto and payments sectors.

- RegTech compliance skills appear in 72% of postings amid GDPR, PSD2, and AML regulatory pressures.

- Data analytics expertise is required by 68% of roles using SQL, Tableau, and real-time financial modeling.

- CAMS certification boosts AML compliance hiring prospects by 45% over non-certified candidates.

- 61% of London fintech vacancies demand AI development alongside cybersecurity capabilities.

- Cloud platform skills like AWS and API integrations feature in 53% of engineering job descriptions.

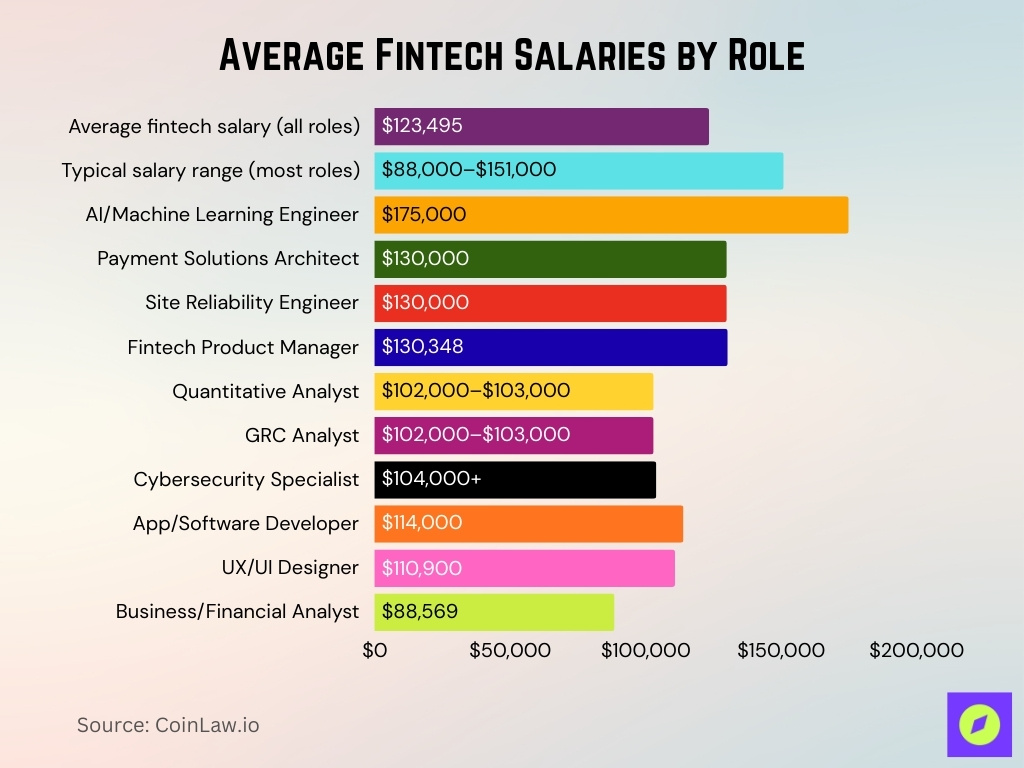

Average Fintech Salaries by Role

- The average annual fintech salary in the U.S. is about $123,495, equivalent to $59.37 per hour as of late 2025.

- Typical U.S. fintech salaries range broadly, with most professionals earning between $88,000 and $151,000 annually.

- Specialized roles such as AI/Machine Learning Engineers average around $175,000 per year in fintech firms.

- Payments Solutions Architects and Site Reliability Engineers average roughly $130,000 per year in key fintech employment markets.

- Fintech Product Managers earn about $130,348 annually, reflecting the premium on cross‑functional skills.

- Quantitative Analysts and GRC (Governance, Risk & Compliance) Analysts both command salaries near $102,000–$103,000 in the U.S. fintech space.

- Roles such as Cybersecurity Specialists tend to average over $104,000 per year, given increasing security demand.

- App/Software Developers and UX/UI Designers typically earn around $114,000 and $110,900, respectively, underscoring strong demand for user‑centric engineering talent.

- Business/Financial Analysts enter lower on the spectrum with averages near $88,569 per year, though experience and specialization can quickly raise compensation.

Talent Flows Between Fintech and Traditional Finance

- London financial services hiring rose 14% year-on-year in Q2, with >52,000 vacancies forecast, heavily skewed toward fintech and digital roles.

- Technology-related vacancies across UK finance grew 39%, driven by automation and integration projects overlapping with fintech skill sets.

- AI-specific roles in banking grew 13% in six months as AI headcount rose from 60,000 to nearly 80,000, intensifying competition with fintech for tech talent.

- London finance vacancies increased 10% year-on-year in H1 with demand concentrated in fintech, AI, cybersecurity, and compliance roles.

- One analysis estimates around 26,000 fintech job openings globally in early 2025, only 18% below the all-time high, signaling strong pull for finance talent.

- Average US fintech salary sits at $123,495, with top performers above $184,500, drawing experienced bankers into fintech roles.

- 70% of finance and accounting leaders are increasing the use of contract talent in H2, enabling cross-sector movement on digital transformation projects.

Future Outlook for Fintech Employment

- Structural labour‑market transformation is expected to affect 22% of jobs worldwide, with 170 million new roles created and 92 million displaced, yielding net growth of 78 million positions.

- FinTech engineers are projected to be the second-fastest-growing job globally by 2030 among all roles tracked.

- Globally, 40% of jobs may be affected by AI, with up to 27% of roles in advanced economies potentially enhanced rather than replaced, favoring tech‑centric sectors like fintech.

- Automation is expected to increase the share of automated tasks from 21% to 38% by 2030, leaving only 28% of tasks fully human‑driven and accelerating demand for advanced fintech skills.

Frequently Asked Questions (FAQs)

About 75% of fintech companies hire staff and create job opportunities related to fintech.

Mid‑sized fintech firms reported a workforce increase of ~13% in a single quarter.

Global fintech funding in H1 2025 hit $44.7 billion across 2,216 deals.

Fintech revenues grew 21% year‑over‑year in 2025 compared to slower growth in traditional finance.

Conclusion

The fintech employment landscape shows a balanced blend of opportunity and transformation. Compensation remains competitive, especially for high‑skill roles in AI, cybersecurity, and product leadership, while evolving demand continues to reshape how talent flows between fintech and traditional finance. Growth will be fueled by technological innovation, geographic expansion, and a dynamic shift toward skill‑based hiring. For professionals and employers alike, staying agile in skill development and responsive to market shifts will be key to thriving in this evolving employment ecosystem.