Filecoin is a decentralized data storage network designed to make web storage more secure, cost‑efficient, and resilient by connecting users needing storage with independent providers all over the world. It plays a pivotal role in the broader Web3 infrastructure by supporting applications that require encrypted, distributed data storage and is increasingly integrated into real-world use cases like enterprise archival systems and decentralized content delivery services.

Filecoin’s metrics reflect both technological progress and market pressures, making this an important year to examine key statistics that define its economic and network performance. Let’s explore the latest data and trends shaping Filecoin today.

Editor’s Choice

- Filecoin’s market cap hovered near $1.1 billion as of late 2025, underscoring its position among mid‑tier crypto assets.

- FIL price shows high forecast variability with average 2025 predictions from $1.58 to potential highs above $6.00.

- Network utilization rose to ~36% despite a drop in total committed capacity.

- Active stored data held near ~1,110 PiB in late 2025.

- Around 2,500 datasets (about 2,491) were onboarded in 2025, underscoring steady adoption by large‑scale storage clients.

Recent Developments

- Network utilization rose from 32% to 36% in Q3.

- Total storage capacity declined 10% to 3.0 EiB post-v27 upgrade.

- Active deals reached 35.2 million with 1,110 PiB stored in Q3.

- Successful data retrievals surged 388% over the past year.

- Paid storage utilization is projected to hit nearly 100% from 29%.

- Active addresses crossed 2 million, up 150% year-over-year.

- Daily transaction volume hit $500 million, growing 75% from 2024.

- F3 upgrade delivered 450x faster finality, from 7.5 hours to minutes.

- Network fees increased 14% to $793,000 in Q3, driven by penalties.

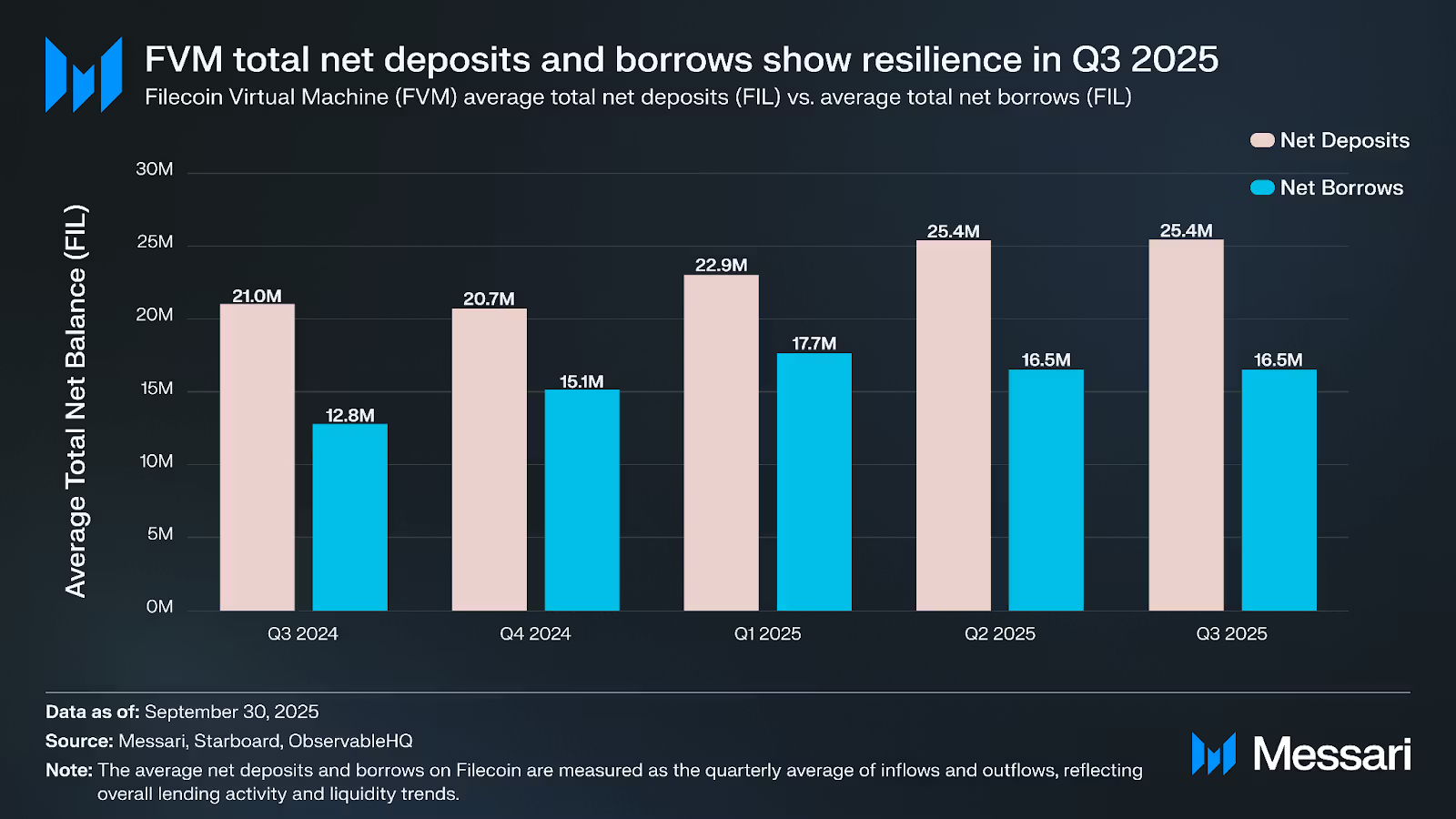

FVM Net Deposits and Borrowing Activity

- Net deposits on the Filecoin Virtual Machine reached 22.9 million FIL in Q1 2025, signaling steady capital inflows at the start of the year.

- Deposits increased to 25.4 million FIL in Q2 2025, reflecting stronger DeFi usage and protocol adoption on FVM.

- Q3 2025 maintained elevated deposits at 25.4 million FIL, showing sustained liquidity confidence rather than short-term speculation.

- Net borrowings peaked at 17.7 million FIL in Q1 2025, highlighting higher leverage demand during early-year market volatility.

- Borrowing activity eased to 16.5 million FIL in Q2 and Q3 2025, suggesting more cautious risk management as market conditions stabilized.

- The gap between deposits and borrows widened in mid-2025, underscoring a liquidity-heavy environment and improving on-chain financial resilience for the Filecoin ecosystem.

Supply and Inflation Statistics

- The token’s yearly supply inflation rate is estimated in the mid‑teens to high‑teens (~15–19%) in 2025, reflecting ongoing network emissions and gradual circulating supply expansion.

- This inflation equates to roughly 100–115 million new FIL tokens added over the past year, consistent with ~4–5% QoQ circulating supply growth and network issuance schedules.

- Annual issuance continues to influence staking yields and miner rewards.

- Circulating supply has expanded ~4–5% QoQ.

- A significant portion of the total supply remains staked or allocated to incentives.

- Inflation metrics remain high relative to many fixed‑supply tokens, impacting scarcity narratives.

All‑Time High and All‑Time Low

- That ATH represents a ~99% decline compared to much lower 2025 prices.

- The all‑time low of around $2.00 was recorded in mid‑2025 on CoinGecko, with most major trackers showing post‑launch lows in the $2–$2.50 range rather than below $1.50.

- Current price levels (around $1.30–$1.40 in late 2025) remain far below historical peaks, with live quotes near $1.31–$1.35 on major trackers.

- FIL’s price floor behavior is influenced by broader crypto market trends.

- Price swings tied to news events have created temporary low points.

- ATH to current comparisons highlight long‑term volatility risks.

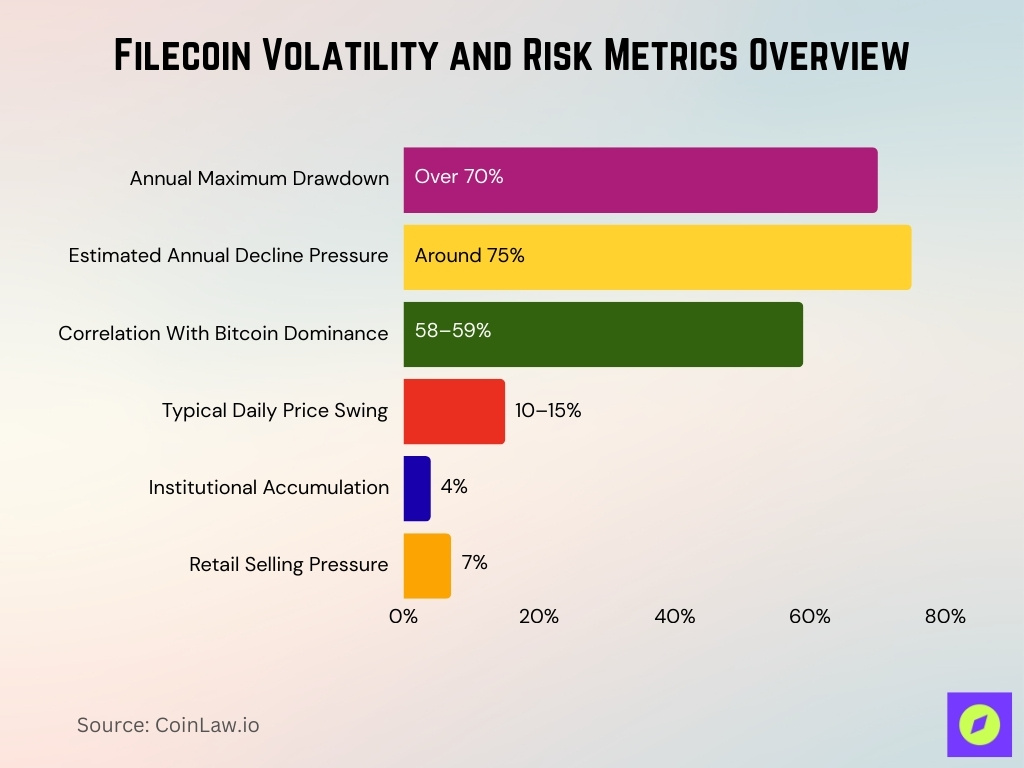

Volatility and Risk Metrics

- FIL’s price volatility remains high in 2025, with annual swings exceeding 70% drawdowns, reflecting market sensitivity to broader crypto trends.

- Some analysts estimate FIL faced ~75% annual decline pressures in 2025 amid macro and technical pressures.

- Correlation with Bitcoin dominance rises above 58–59%, meaning FIL’s risk profile closely tracks broader market movements.

- Daily price swings occasionally exceed 10–15%, highlighting intraday volatility among traders.

- Standard deviation of returns remains above many large‑cap crypto assets, reinforcing FIL’s classification as a high‑volatility token.

- Institutional and retail sentiment metrics suggest contradictory flows (4% accumulation vs 7% selling) in late 2025, underscoring strategic entry/exit behaviors.

Market Dominance and Rank

- FIL ranks #62 by market cap at $954 million.

- Market cap dominance stands below 0.04% of the total crypto market.

- 24-hour trading volume hits $146.85 million, top 100 liquidity.

- FIL secures #74 position on CoinGecko with $1.89 billion cap.

- FDV is valued at $2.56 billion amid 1.95 billion total supply.

- Trading volume surges 39.6% to $184 million in the recent 24 hours.

- Holds the top position among storage coins by network valuation.

Derivatives and Open Interest Statistics

- Open interest reaches $190.21 million across futures markets.

- Futures volume totals $277.60 million in 24 hours, exceeding spot.

- Aggregated open interest stands at $118.5 million for perpetuals.

- 24-hour open interest change records -1.84% fluctuation.

- Spot volume lags at $33.81 million versus derivatives dominance.

- Open interest share captures 0.24% of the total derivatives market.

- Futures volume surges 8x over spot trading in recent sessions.

- Perpetual contracts dominate with 100% of tracked open interest.

- 24-hour futures volume hits $277.60 million, top exchange activity.

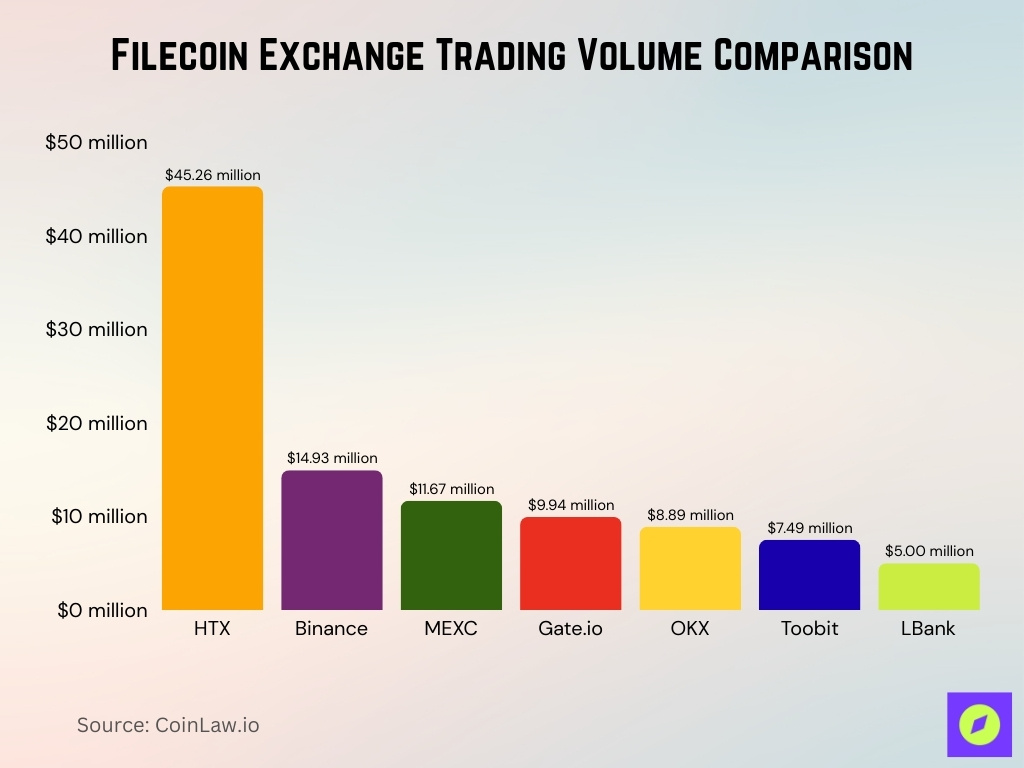

Exchange Listings and Liquidity

- HTX leads with $45.26 million FIL/USDT volume, 25.14% share.

- Binance records $14.93 million FIL/USDT, $609K +2% depth.

- MEXC contributes $11.67 million volume, $850K liquidity depth.

- Gate.io sees $9.94 million trades, $346K buy-side depth.

- OKX handles $8.89 million FIL/USDT, $481K +2% liquidity.

- Toobit achieves $7.49 million volume despite 0.11% spreads.

- LBank adds $5 million trades with $863K +2% order depth.

On‑Chain Activity Overview

- Active addresses surpass 2 million, up 150% year-over-year.

- Daily transaction volume reaches $500 million, 75% growth from the prior year.

- Active storage deals total 35.2 million, storing 1,110 PiB.

- FVM hosts 4,700 unique contracts with over 3 million transactions.

- The top 100 whales control 40% of the 718 million circulating supply.

- Active addresses grow 25% to 1.2 million in Q4.

- Daily new deals average 2.8 PiB, down 19% quarter-over-quarter.

- 2,491 datasets supported, with 925 exceeding 1,000 TiB.

- Net DeFi deposits exceed 30 million FIL from staking and DEXs.

Effective and Utilized Storage Data

- Network storage utilization reached ~36% in Q3 2025, up from ~32% in Q2.

- Total committed capacity dropped ~10% quarter‑over‑quarter to 3.0 EiB amid miner consolidation.

- Active storage remained strong at ~1,110 PiB, reflecting sustained long‑term dataset commitments.

- Daily new onboarding declined around 19% QoQ, signifying a cooling in raw data inflows.

- Verified datasets exceeding 1,000 TiB increased by ~7%, showing larger high‑capacity deals.

- Storage utilization gains were driven by sustained use of existing storage rather than expansion of capacity.

- Removal of older sector methods improved operational efficiency but trimmed overall size.

- Effective storage (paid, real demand) increasingly supplants miner‑generated storage fills, indicating a maturing economy.

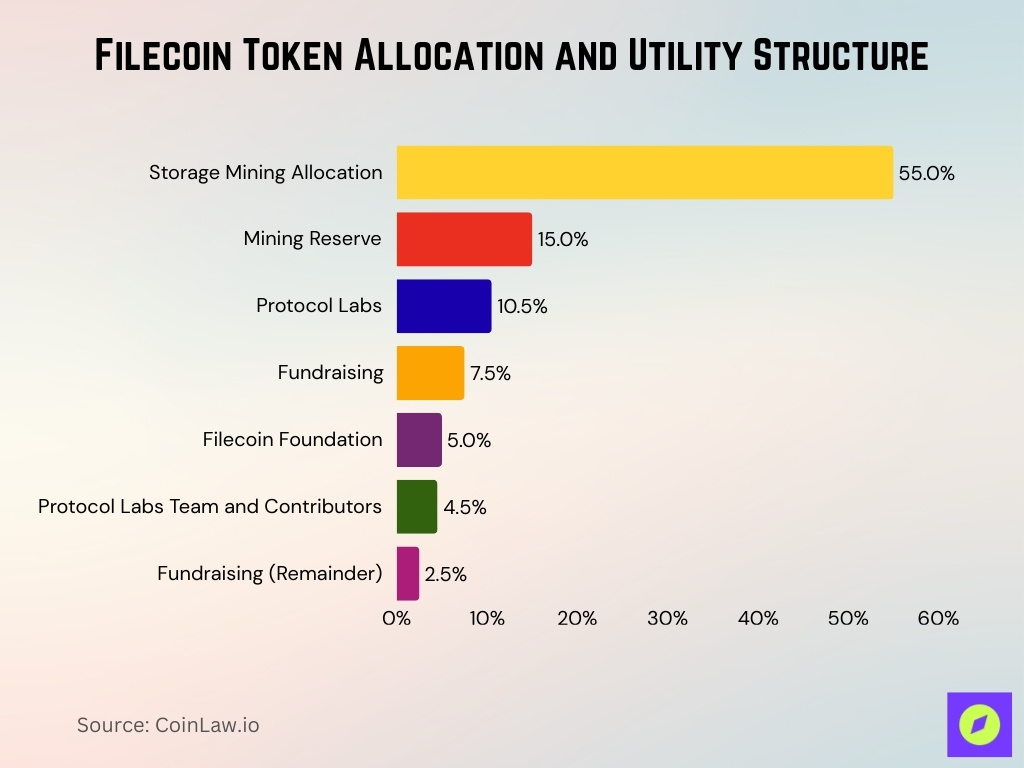

Filecoin Token Allocation and Utility Structure

- Storage mining allocation dominates at 55.0%, ensuring the majority of FIL supply directly supports network security, data storage, and retrieval services.

- Mining reserves account for 15.0%, providing long-term incentives to sustain miner participation and stabilize the network as usage grows.

- Protocol Labs holds 10.5%, aligning core development funding with ongoing ecosystem innovation and upgrades.

- Fundraising via the 2017 SAFT represents 7.5%, reflecting early capital formation while remaining limited relative to utility-driven supply.

- The Filecoin Foundation controls 5.0%, supporting grants, research, and community development initiatives.

- Protocol Labs team and contributors receive 4.5%, tying contributor incentives to network performance and adoption.

- Only 2.5% remains from fundraising remainders, highlighting a lean allocation model with minimal dilution pressure.

- Overall, over 70% of FIL supply is tied to mining and network operations, reinforcing real economic utility rather than speculative distribution.

Storage Provider and Miner Statistics

- In Q3 2025, total network committed capacity dropped by ~10% QoQ to 3.0 EiB, reflecting miner consolidation and exits of smaller operators.

- Despite capacity shrinkage, network utilization improved to ~36% in the same period.

- Active storage remained near ~1,110 PiB, only down ~1% from the previous quarter.

- The average number of active deals stood at about 35.2 million, indicating sustained market participation.

- Verified datasets (those > 1,000 TiB) rose to ~925, up ~7%, showing growth in high‑volume storage contracts.

- Filecoin Plus onboarding streamlined enterprise client deals, increasing stability at higher deal values.

- Miner exits were partly due to stricter operational and collateral requirements post‑protocol upgrades.

- Network consolidation favored larger, more efficient providers capable of handling enterprise‑grade workloads.

Deal Activity and Client Adoption

- Total active storage from paid deals held around 1,110 PiB in Q3 2025, showing stable demand despite fewer new deals.

- Average daily new deal volume declined ~19% QoQ, from 3.4 PiB to ~2.8 PiB.

- The decline in new deals correlates with reduced onboarding activity following major upgrade changes.

- Verified storage now drives most network activity, with smaller or short‑term deals sharply reduced.

- Onboarded datasets grew to ~2,491 total, up ~3% QoQ, signaling continued long‑term adoption.

- Partnerships with enterprise and research clients underline real‑world utilization.

- Lower storage pricing continues to attract traditional businesses seeking cost‑efficient archival solutions.

- The continued focus on enterprise cold storage use cases suggests deeper integration within data‑intensive verticals.

Transaction and Gas Fee Statistics

- Filecoin uses a gas structure inspired by EIP‑1559, with fees partly burned and allocated to network participants.

- In Q3 2025, total network fees reached ~$792,900, up ~14% QoQ from Q2.

- Penalty fees accounted for ~99.5% of total fees, reflecting stricter miner obligations and slashing events.

- Base fees dropped ~97% QoQ to ~$4,100, suggesting reduced transaction congestion after upgrades.

- Batch fees fell 100% QoQ to $0, tied to deprecated legacy transaction methods.

- Overestimation fees collapsed ~98% QoQ to ~$157, indicating lower typical gas activity.

- Gas patterns suggest a stronger influence from penalty inputs than from typical deal or transaction volume.

- Overall, fee dynamics reflect a transitional period where consolidation and optimization reshape network costs.

Developer Activity and Ecosystem Growth

- ProPGF grants awarded $3.68 million to 14 infrastructure teams.

- 1,593 developers contributed across Filecoin repositories past year.

- FVM deployed over 5,000 smart contracts, processing 3.2 million transactions.

- 1,149 commits recorded versus the market average of 62.

- 1,730 GitHub commits across 213 core repositories.

- DApp ecosystem storage transactions surged 45% quarter-over-quarter.

- Monthly metrics track daily PiBs onboarded and FIL in paid deals.

- 1593 total developers active, with top repos leading contributions.

Comparisons With Other Storage Coins

- FIL market cap leads at $1.85 billion vs AR $512 million and STORJ $43 million.

- Storage category totals $4.98 billion, with FIL holding the top rank.

- FIL surged 50% driving AR 38% and STORJ gains in November.

- Arweave AR ranks #179 with $28.78 million 24h volume.

- Storj STORJ at #875 with $15.29 million daily trades.

- Siacoin SC trails at #332 with $192 million cap.

- FIL storage under $1/TB/month vs Storj $4/TB/month.

- Decentralized storage is cheaper by 60-80% than centralized clouds.

Frequently Asked Questions (FAQs)

Network utilization increased to 36% from 32% in the prior quarter.

Total committed storage capacity was approximately 3.0 EiB, down about 10% QoQ.

Total network fees reached around $793,000, with 99.5% driven by penalties.

Price projections for 2025 range from roughly $2.68 up to about $6.75, depending on the model.

Conclusion

Filecoin’s performance reflects a network in transition, balancing consolidation of storage providers with greater emphasis on verified, enterprise‑grade deals and ecosystem quality. Network utilization improved even as capacity contracted, highlighting more efficient storage use. Transaction fee dynamics shifted significantly due to protocol upgrades, pointing to evolving operational patterns. Developer engagement and ecosystem funding continue to expand, with tools and cross‑chain solutions growing the platform’s capabilities. When compared with other decentralized storage coins, Filecoin remains a leading choice for projects that prioritize scale, verified storage, and real‑world utility.