Fidelity Investments remains one of the world’s largest financial services firms, serving millions of individuals, institutions, and retirement savers. Its scale spans broader asset management, retirement solutions, brokerage, and wealth planning services, making it a central player in both individual investing and institutional finance. Fidelity’s offerings power retirement plans for thousands of U.S. employers and influence markets through its mutual funds and ETFs. As you explore this article, you’ll find hard numbers showing how the company has evolved, grown its assets, and adapted its services in the past year and beyond.

Editor’s Choice

- $17.5 trillion in assets under administration reported in Q3 2025, up roughly 17% year‑over‑year.

- $6.8 trillion in discretionary assets as of Q3 2025, up ~18% from Q3 2024.

- $32.7 billion in revenue for the fiscal 2024 reporting period, a 16% increase from 2023.

- Fidelity offers 79 ETFs as of mid‑2025, expanding its exchange‑traded lineup.

- Daily average trades reached 4.4 million by late 2025.

- Over 39 million unique digital users engaged across Fidelity platforms in 2024.

- More than 78,000 associates employed globally by late 2025.

Recent Developments

- Fidelity forecasts 69% of wealth held by top 10% households in 2025, a trend continuing into 2026.

- Fidelity survey shows 67% of wealth firms using Gen AI, 50% at scale.

- Global alternatives AUM projected to reach $32 trillion in five years, private credit $4.5 trillion.

- Model portfolios are expected to hit $2.9 trillion by 2026.

- Wealth M&A purchased assets totaling $909.7 billion in 2024, and record highs continue.

- IT sector profit growth is expected to exceed 20% heading into 2026.

- US consumers account for nearly 70% of US GDP amid AI-driven changes.

- Total HSA assets are estimated at $189 billion for 2026.

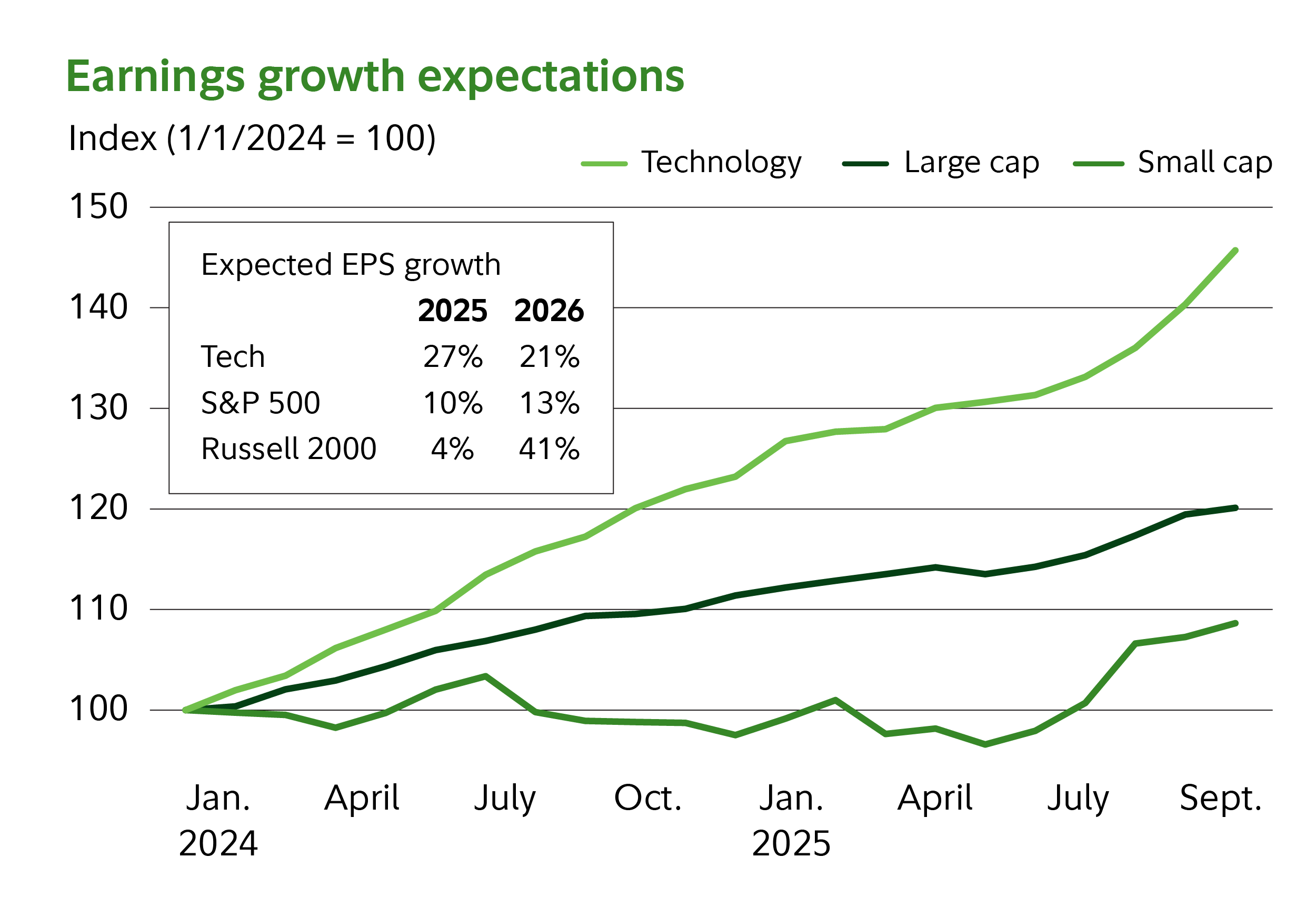

Earnings Growth Expectations and EPS Outlook

- Technology stocks lead earnings expectations, with 27% expected EPS growth in 2025 and a still-strong 21% in 2026, highlighting continued momentum despite slower growth next year.

- Large-cap companies (S&P 500) show steady expansion, posting 10% projected EPS growth in 2025 and accelerating to 13% in 2026, signaling broad-based earnings resilience.

- Small-cap stocks (Russell 2000) lag in the near term with just 4% expected EPS growth in 2025, reflecting tighter financial conditions and higher sensitivity to economic shifts.

- Small caps are expected to rebound sharply in 2026, with projected 41% EPS growth, the fastest among all segments.

- Technology maintains the highest earnings growth profile overall, but the growth gap narrows in 2026 as large-cap and small-cap earnings accelerate.

Fidelity Key Facts and Figures

- Founded in 1946, Fidelity operates globally with roots in Boston, Massachusetts.

- Abigail Johnson leads the company as CEO and chair.

- Over 78,000 employees worldwide as of late 2025.

- Fidelity supports multiple product lines: mutual funds, ETFs, retirement plans, brokerage, and advisory services.

- Reported $32.7 billion in revenue for the 2024 fiscal year.

- Operating income for 2024 was $10.3 billion, up 21% from 2023.

- Unique digital platform users numbered nearly 39.2 million in 2024.

- Customer planning interactions exceeded 8.8 million in 2024.

Assets Under Administration Statistics

- Fidelity AUA reached $17.5 trillion as of Q3 2025, up 17% YoY.

- Assets under administration hit $16.4 trillion mid-2025, with discretionary $6.4 trillion.

- Q1 2025 AUA totaled $15.0 trillion, up 10% YoY; discretionary $5.9 trillion.

- HSA assets under administration reached $34 billion end of Q1 2025.

- Discretionary assets stood at $6.8 trillion in Q3 2025.

- Fidelity ranks 3rd globally with $5.9 trillion AUM in 2024.

- Equity discretionary assets at $3.505 trillion end of 2024.

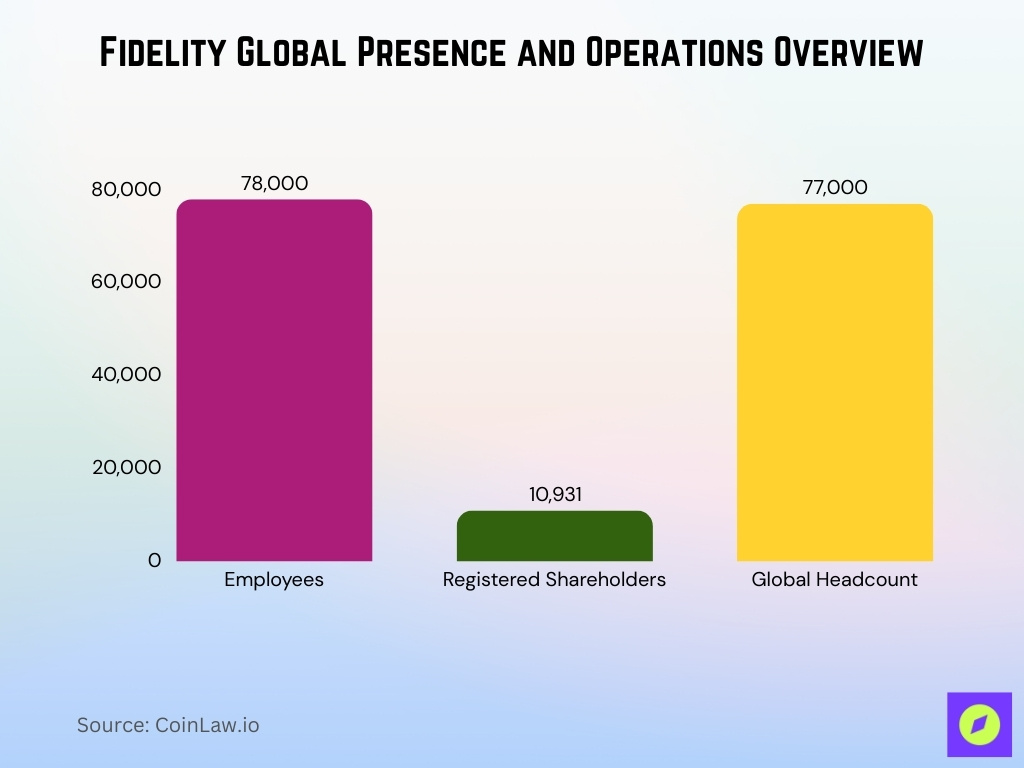

Global Presence and Operations Statistics

- Fidelity employs over 78,000 associates across 11 countries and 14 global regional sites.

- Fidelity International serves 10,931 registered shareholders worldwide.

- Fidelity headcount stands at 77,000, supporting global operations.

- Fidelity operates 217 Investor Centers worldwide.

- Fidelity ranks among the top 10 global asset managers with $4.6 trillion AUM.

- Fidelity International manages over $750 billion in AUM across dozens of countries.

- World’s largest asset managers’ combined AUM surges to record $140 trillion.

Discretionary Assets and Managed Assets Statistics

- Discretionary assets hit $6.8 trillion in Q3 2025, up 18% YoY.

- Discretionary assets reached $6.4 trillion in Q2 2025, up 9% from the prior year.

- Full-year 2024 discretionary assets totaled $5.9 trillion, a record high.

- Equity discretionary assets at $3.505 trillion end of 2024.

- Fixed income discretionary assets stood at $1.107 trillion end of 2024.

- Multi-asset discretionary assets reached $1.511 trillion end of 2024.

- Fidelity mutual funds’ AUM exceeded $5.1 trillion as of late 2025.

- Discretionary assets grew nearly 30% over two years to Q3 2025.

- Alternative investments AUM surpassed $100 billion in managed portfolios.

Net Asset Flows and Fund Flows Statistics

- Fidelity net asset inflows totaled $698 billion in 2024, up 8% from 2023.

- ETF flows on pace for over $1 trillion annual inflows in 2025.

- Bond ETFs recorded record $448 billion inflows in 2025.

- Active fixed-income ETFs captured 40% of all bond inflows in 2025.

- US equity ETFs’ inflows accounted for 73% of equity flows in 2025.

- Active equity ETFs’ inflows reached $301 billion, representing 32% of equity.

- European ETFs saw $25 billion in net inflows in November 2025.

- Long-term funds and ETFs inflows hit $48.76 billion week ended Dec 30, 2025.

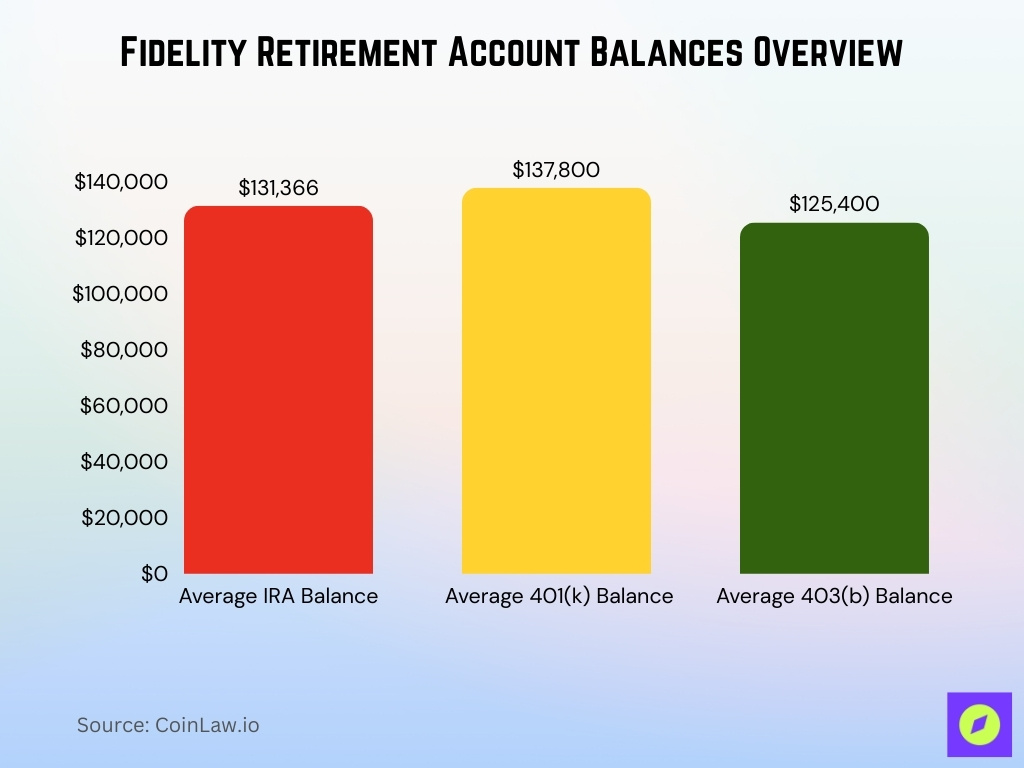

Retirement and Workplace Plan Statistics

- Average IRA balance reached approximately $131,366 in Q2 2025, an 8% increase from Q1 2025.

- The average 401(k) balance was around $137,800, also up 8% over the prior quarter.

- The average 403(b) balance climbed 9% in Q2 2025 to about $125,400.

- Fidelity manages retirement accounts, including IRA, 401(k), and 403(b), exceeding 51 million accounts.

- Fidelity’s retirement savings rates remain near 14.2%, close to recommended contribution levels.

- Employer contributions averaged 4.8%, sustaining workplace plan growth.

- Fidelity’s workplace plans include small and large employer segments with diversified participant pools.

- Workplace insights and plan data support employer decision‑making in benefits design.

Revenue and Profitability Statistics

- Revenue reached $32.7 billion in 2024, up 16% from 2023.

- Operating income hit $10.3 billion in 2024, up 21% YoY.

- Operating expense totaled $22.4 billion in 2024, up 14% from 2023.

- Revenue grew 56% over five years to 2024.

- 2023 revenue was $28.2 billion, up 12% from 2022.

- Operating income reached $8.5 billion in 2023, up 6% YoY.

- Operating margins averaged 30-35% over recent years.

- Assets grew $1 trillion over the past year to $5.9 trillion in early 2025.

Operating Expenses and Efficiency Metrics

- Operating expenses reached $22.4 billion in 2024, up 14% from 2023.

- 2023 operating expenses totaled $19.7 billion, up 12% YoY.

- Revenue exceeded $32.7 billion in 2024, outpacing expense growth.

- Operating margins held at 31.5% in 2024 amid rising expenses.

- Technology investments boosted efficiency by 15-20% in client servicing.

- Automation reduced back-office costs by 10% per transaction in 2025.

- Fixed costs comprised 60% of total operating expenses in 2024.

- Variable expenses tied to trading volume rose 25% with activity surge.

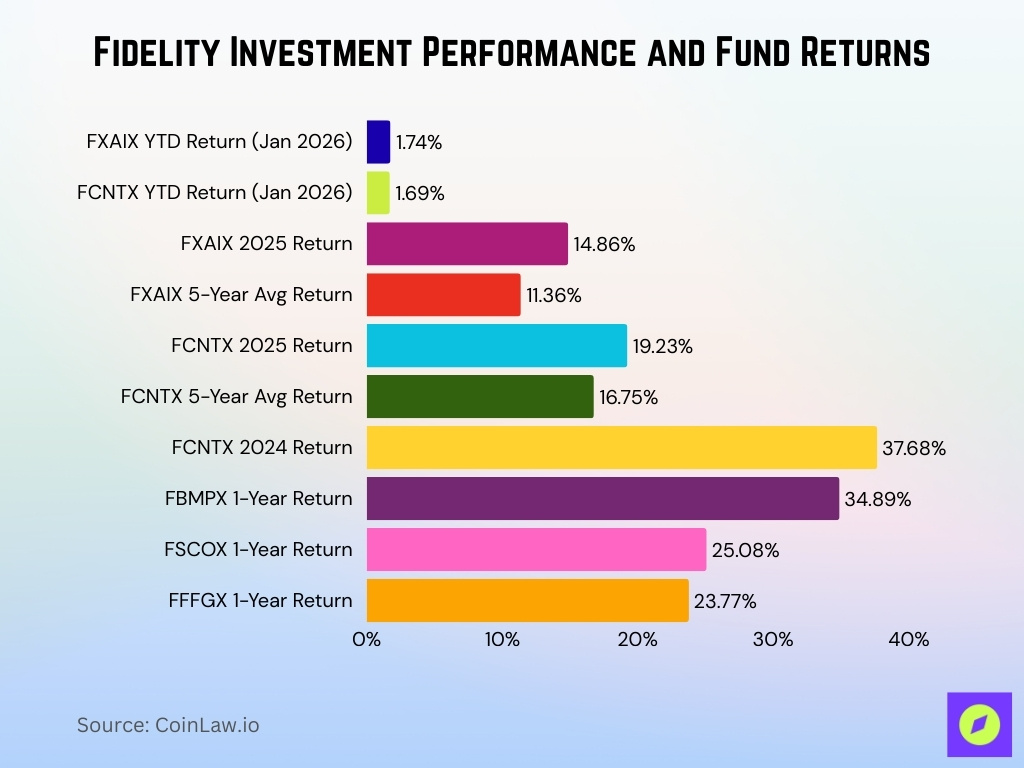

Investment Performance and Returns Statistics

- Fidelity 500 Index Fund (FXAIX) YTD return +1.74% as of Jan 2026.

- Fidelity Contrafund (FCNTX) YTD return +1.69% as of Jan 2026.

- FXAIX 2025 return +14.86%, 5-year avg +11.36%/yr.

- FCNTX 2025 return +19.23%, 5-year avg +16.75%/yr.

- FCNTX 2024 return +37.68%, since inception +16.75%/yr.

- FBMPX Communications fund +34.89% 1-year return.

- FSCOX Foreign Small/Mid Growth +25.08% 1-year.

- FFFGX Target 2045 +23.77% 1-year return.

Customer Base and Account Statistics

- Fidelity’s platforms engaged nearly 39.2 million unique customers in 2024, up 12% from 2023.

- Customer planning interactions reached 8.8 million in 2024, up 14% year‑over‑year.

- Appointments with advisors increased, with 5.5 million booked in 2024 (+13%).

- Calls handled by service teams exceeded 37.5 million in 2024 (+8%).

- Digital engagement and trading activity drive deeper account interaction.

- Daily average trades reported around 4.3–4.4 million in 2025, reflecting heightened activity.

- Fidelity supports brokerage, retirement, and advisory accounts across demographics.

- Enhanced mobile and web interfaces contribute to rising customer touchpoints.

Mutual Funds Statistics

- Fidelity mutual funds’ AUM totals $5.1 trillion as of late 2025.

- Fidelity 500 Index Fund leads with $515 billion in net assets as of June 2024.

- Fidelity Contrafund holds $176.3 billion portfolio net assets as of Dec 2025.

- Fidelity Contrafund NAV at $24.72 as of Jan 2026.

- Strategic Advisers Fidelity U.S. Total Stock Fund at $93.2 billion as of June 2024.

- Fidelity offers hundreds of open-end mutual funds across equity, bond categories.

- Discretionary assets, including mutual funds, reached $6.4 trillion in June 2025.

- Fidelity Contrafund 5-year annualized return: 15.74%.

ETF Statistics

- Fidelity manages 75 ETFs with $146.52 billion total AUM.

- ETF flows on pace for over $1 trillion annually in 2025.

- Fidelity ETF’s average expense ratio is 0.31%, dividend yield is 1.96%.

- Fidelity ETF 1-year return averages 13.03%.

- Bond ETFs record $448 billion in inflows in 2025.

- Active fixed income ETFs 40% of bond inflows 2025.

- US equity ETFs 73% of equity flows in 2025.

- Active equity ETF inflows $301 billion, 32% of equity.

Advisory and Wealth Management Statistics

- Over 1 million accounts transitioned to Unified Managed Household by Q1 2025.

- Retail SMA assets exceed $187 billion as of Q2 2024.

- Defined contribution managed accounts total $113.9 billion end of 2023.

- 53% of advisors use ETFs in portfolios Q4 2024, up from 44% 2023.

- Unique ETFs in Custom Model Portfolios doubled from 2022 to 2024.

- 8,000 wealth advisors subscribed to Model Portfolio updates.

- Discretionary AUM reaches $6.4 trillion mid 2025.

- Customer accounts hit 84.9 million Q2 2024, up 9% YoY.

- 69% of wealth held by top 10% families in 2025.

Digital Platform and Mobile App Usage Statistics

- Fidelity Investments app is rated 4.8/5 from 2.9 million ratings.

- Fidelity Investments’ Android app is rated 4.6 stars on Google Play.

- Unique digital users reached ~39 million in 2024, up 12% YoY.

- Customer accounts total 84.9 million Q2 2024, up 9% YoY.

- Mobile trades increased over 40% year-over-year in a recent survey.

- NetBenefits app serves 15.8 million workplace participants.

- Fidelity Youth app is rated 4.4 stars for financial education.

- Fidelity Health app is rated 4.8 stars on Google Play.

- 128 technical studies are available in mobile charting.

ESG and Sustainable Investing Statistics

- Fidelity ESG ratings cover over 10,000 corporate issuers.

- Fidelity ESG ratings expanded to 4,000 issuers in equity and fixed income in September 2024.

- 15 ESG-focused mutual funds and ETFs are offered.

- ESG ratings scale A (best) to E across sectors.

- 180+ sub-industry ESG indicators reviewed in 2024.

- Fidelity Sustainable Multi-Asset Fund invests 80% in sustainable securities.

- Sustainable U.S. Equity Fund targets ESG leaders.

- Climate Rating assesses net zero alignment.

- 70% minimum portfolio in Europe ex UK for certain sustainable funds.

Frequently Asked Questions (FAQs)

Fidelity reported $17.5 trillion in assets under administration in Q3 2025.

Fidelity’s discretionary assets stood at $6.8 trillion as of Q3 2025.

Approximately 28.5 million unique visitors engaged with Fidelity platforms in Q3 2025.

Conclusion

Fidelity’s data reveals a firm expanding its ETF offerings and managed portfolios while strengthening digital engagement and advisory services. Assets under management and client interactions continue to climb, supported by robust platform usage and evolving sustainable investment strategies. ETF flows remain strong, with passive products capturing notable investor interest, and advisory tools growing in adoption among wealth professionals. As Fidelity deepens its digital footprint and broadens ESG capabilities, the firm’s performance and client‑centric innovations will remain key differentiators for investors navigating the current market environment.