Experian stands among the world’s largest credit reporting and data analytics firms, shaping how lenders and businesses assess creditworthiness, detect fraud, and manage risk. Its data touches billions of credit decisions annually, impacting everyday financial activities from loan approvals to identity verification. In financial services and fraud prevention, Experian’s insights help banks fine‑tune lending strategies and help companies comply with regulations while protecting consumers.

As the company evolves with AI and digital transformation, these statistics reveal why Experian’s role remains pivotal. Continue reading below to explore the latest data and trends shaping Experian’s performance and market influence.

Editor’s Choice

- Organic revenue growth of ~7% in FY2025 reflects resilient demand.

- Expected 9–11% total revenue growth for FY2026.

- 72% of business leaders predict AI‑generated fraud and deepfakes will surge by 2026.

- Over a third of companies already use AI to combat fraud.

- U.S. average monthly consumer debt rose 5.2% to $1,224 in 2024.

- Average U.S. FICO® Score held steady at 715 in 2024.

Recent Developments

- Experian’s FY2025 revenue expanded ~8% at constant exchange rates compared to FY2024.

- Organic growth in North America matched ~8% for the year ending March 31, 2025.

- The company forecasts 9–11% global revenue growth in FY2026.

- FY2025 dividends total 62.50 US cents per ordinary share.

- Experian sees margin expansion of 30–50 basis points in its medium‑term outlook.

- Credit reporting accuracy issues drew regulatory attention, with the CFPB suing Experian over alleged report mishandling in 2025.

- Analysts note potential revenue pressure due to shifts in credit score licensing models introduced by FICO.

- First‑quarter FY2025 results reaffirmed steady growth expectations for the fiscal year.

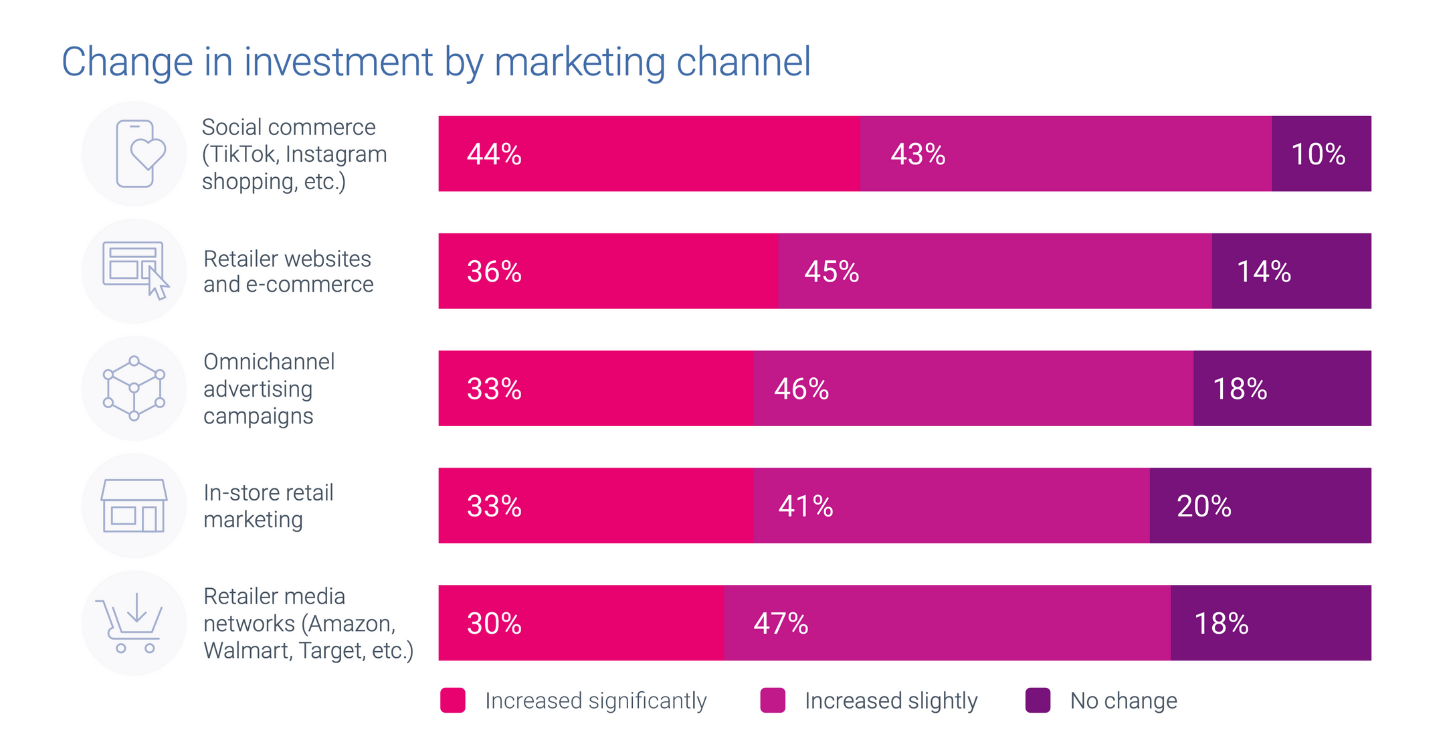

Change in Investment by Marketing Channel

- 44% of businesses significantly increased investment in social commerce platforms like TikTok and Instagram.

- 43% slightly increased their spend on social commerce, while only 10% made no change.

- 36% significantly increased investment in retailer websites and e-commerce, with 45% increasing slightly.

- 33% of marketers significantly boosted spend on omnichannel advertising, and 46% reported a slight increase.

- 33% also significantly raised investment in in-store retail marketing, with 41% increasing slightly and 20% reporting no change.

- 30% significantly increased budgets for retailer media networks (Amazon, Walmart, Target), while 47% increased slightly.

Experian Company Background and History

- Founded in 1996 by combining credit bureau capabilities in the UK and the US.

- Listed independently on the London Stock Exchange in 2006.

- Headquartered in Dublin, Ireland, with operations in over 30 countries.

- Part of the FTSE 100 Index, underscoring market prominence.

- Headquartered in Dublin, Ireland, with operations in over 32 countries and approximately 23,300 people worldwide as of FY2025.

- Over time, Experian has acquired firms to bolster analytics and fraud capabilities.

- Its service footprint spans credit reports, decisioning tools, marketing data, and fraud solutions.

Revenue and Financial Performance

- Experian marks roughly 8% growth versus the prior year at constant exchange rates.

- North America drove a large share of revenue, showing an ~8% uplift year‑over‑year.

- FY2025 organic revenue growth landed at around 7%.

- Analysts expect FY2026 growth of up to 11% in total revenue.

- Margin expansion is forecast at 30–50 basis points over the medium term.

- Continued demand for analytics, fraud, and digital services underpins financial resilience.

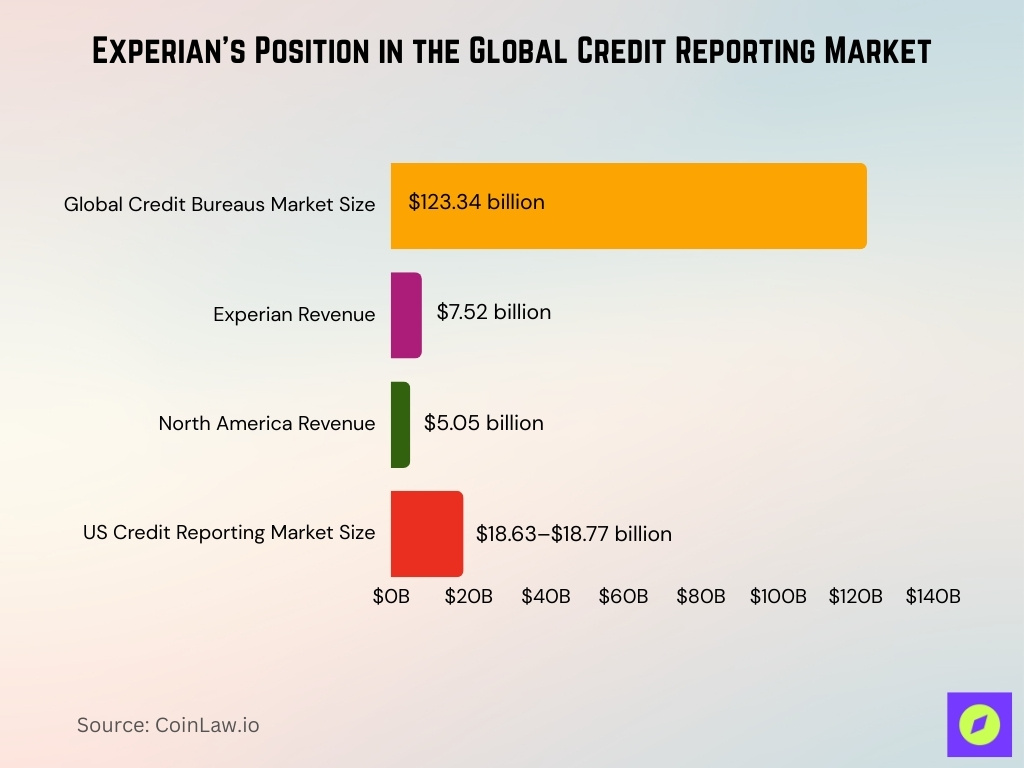

Market Share in Credit Reporting

- Experian holds an estimated 9.1% US credit bureau market share.

- The global credit bureaus market reaches $123.34 billion.

- Experian FY2025 revenue totals $7.52 billion, up 6% YoY.

- North America contributes 67% of Experian Group revenue at $5.05 billion.

- US credit agency market is valued at $18.63–18.77 billion.

- Experian serves credit data for the majority of US households.

Products and Services Overview

- Consumer Services reaches over 200 million free members.

- Identity verification solutions prevent $19 billion annual fraud losses.

- Fraud prevention is adopted by 90% of businesses concerned about threats.

- Over one-third of companies use AI for fraud detection.

- Decision analytics yields 183% ROI and a 12-month payback period.

- Credit monitoring provides daily Experian score updates.

- Premium plans monitor all three credit bureaus.

- Ascend Platform improves approval rates by 12% over three years.

- Employs 23,300 professionals across 32 countries.

- Ranked 6th in IDC FinTech Rankings Top 100.

Credit Score Distribution Statistics

- The average U.S. FICO Score remained 715 in 2024, maintaining a record high.

- Average total U.S. consumer debt rose slightly in 2024 to $105,056.

- Average monthly debt obligations climbed by 5.2% to $1,224 in 2024.

- Non‑mortgage debt balances declined 6.7% year‑over‑year.

- Credit score distributions reflect broad stability amid varying economic conditions.

- Tools like VantageScore continue to offer alternatives to traditional FICO scoring.

- Lenders increasingly use multiple scoring models to assess risk more comprehensively.

- Changes in credit behavior and reporting criteria may affect future score distributions.

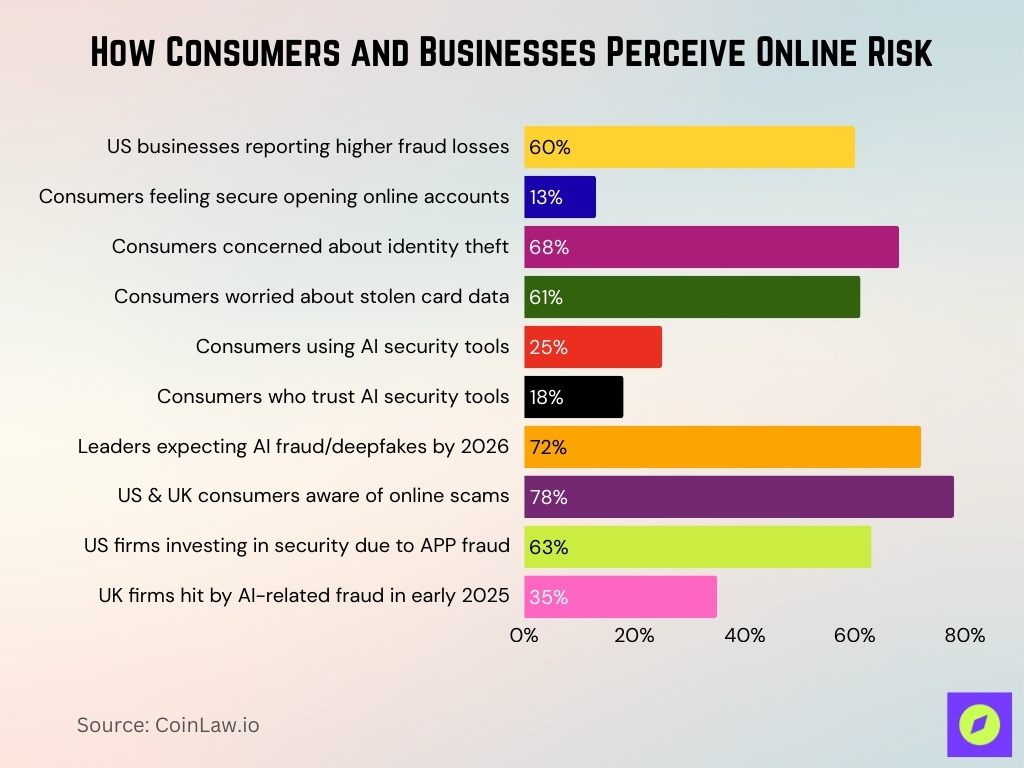

Fraud, Identity, and Risk Statistics

- Fraud losses reported by nearly 60% of U.S. businesses increased in 2025 compared with the previous year.

- Only 13% of U.S. consumers feel fully secure opening new online accounts, signaling trust gaps in digital identity.

- 68% of consumers say identity theft is their top concern when interacting online, with 61% worrying about stolen credit card data.

- Less than 25% of consumers report interacting with AI‑driven security tools, and just 18% trust them completely.

- 72% of business leaders expect AI‑generated fraud and deepfakes to become a major challenge by 2026.

- Across global markets, 78% of U.S. and UK consumers are aware of online scams, yet confidence in data protection remains fragile.

- Authorised Push Payment (APP) fraud is a top threat globally, prompting 63% of U.S. businesses to invest in improved security measures.

- UK data shows 35% of businesses were targets of AI‑related fraud in early 2025.

Analytics, AI, and Decisioning Statistics

- Over 35% of companies are now using AI, including generative models, to fight fraud.

- 63% of U.S. organizations are implementing new analytics methods and building bespoke AI models to enhance customer decision-making.

- Companies cite improving detection of APP fraud as a priority, with 63% investing in analytics.

- Across EMEA and APAC, 65% of firms integrate fraud detection with anti‑money‑laundering (AML) operations.

- In the UK, 60% of companies incorporate credit risk management into broader fraud analytics.

- Machine learning (ML)‑driven fraud detection tools are extending detection capabilities for synthetic identities and complex risk patterns.

- Businesses adopting unified analytics and fraud orchestration report better decision outcomes across lending and digital channels.

Digital Engagement and App Usage

- Free consumer platform serves over 200 million members worldwide.

- Experian mobile app rated 4.7/5 on Apple App Store.

- Google Play users praise the app for monitoring all 3 credit bureaus.

- Experian Boost raises FICO scores by an average of 13 points per user.

- 63% of Boost users see credit score increases.

- UK CreditExpert app is used by over 1 million members.

- Free memberships grew to 96 million in the North America segment.

- Consumer Services revenue achieved a 13% CAGR FY20-25.

- Marketplace revenue posted a 30% CAGR over five years.

- Daily score updates and alerts drive repeated app engagement.

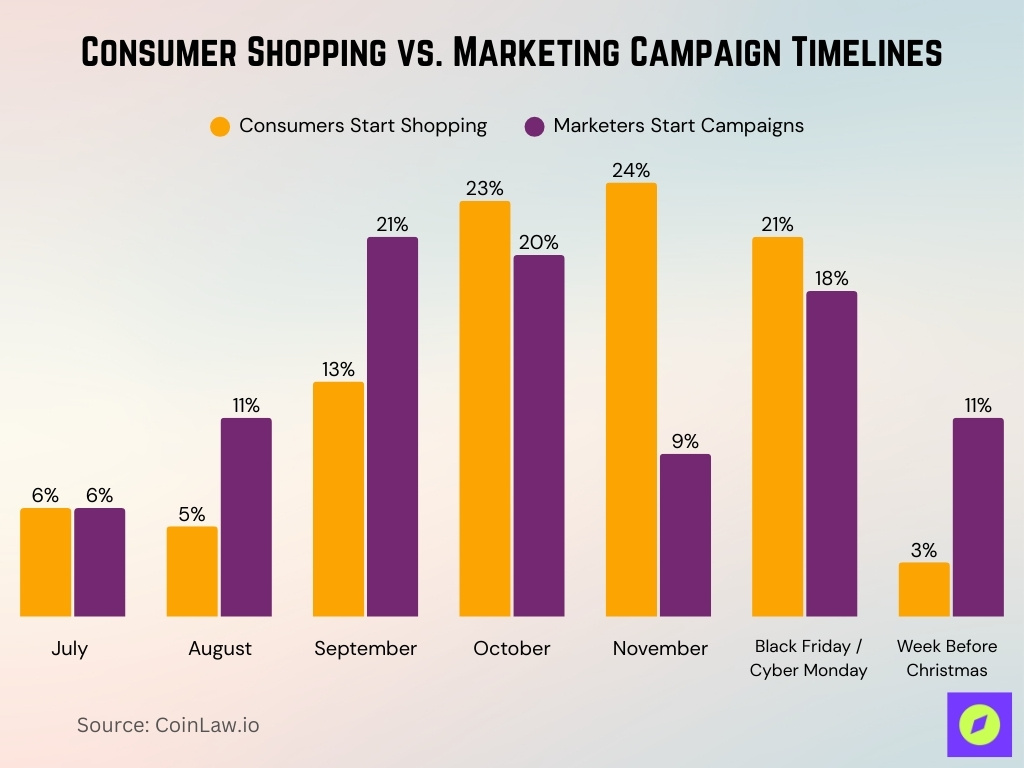

Consumer Shopping vs. Marketing Campaign Timelines

- 6% of consumers and 6% of marketers begin holiday activities as early as July.

- In August, only 5% of consumers start shopping, while 11% of marketers launch campaigns.

- September shows a noticeable gap: 13% of consumers begin shopping vs. 21% of marketers launching campaigns.

- October marks a peak for both: 23% of consumers start shopping, and 20% of marketers run campaigns.

- In November, the highest consumer activity is observed, with 24% starting holiday shopping vs. just 9% of marketers beginning campaigns.

- On Black Friday / Cyber Monday, 21% of consumers and 18% of marketers engage in holiday activity.

- In the week before Christmas, only 3% of consumers shop, while 11% of marketers still push holiday campaigns.

Experian ESG, Diversity, and Inclusion Statistics

- Experian achieved a 100/100 score on the Disability Equality Index in both the U.S. and the UK, reflecting strong inclusion policies.

- The company has reduced the carbon intensity of direct emissions by ~35% and decreased overall energy consumption by 19%.

- Renewable energy usage at Experian rose from 62% to 75% across operations.

- Since 2019, the company has cut Scope 1 and Scope 2 emissions by 82%, underscoring deep sustainability progress.

- In 2025, Experian earned recognition on Financial Times Europe’s Climate Leaders, Newsweek’s World’s Greenest Companies, and TIME’s World’s Most Sustainable Companies lists.

- About 32% of suppliers now have science‑based emissions targets, with another 13% committed to reductions.

- ESG reporting ties to strategic priorities such as financial inclusion, environmental protection, and social impact.

- Initiatives aim to improve financial health, support employee wellbeing, and engage communities in underserved markets.

Frequently Asked Questions (FAQs)

Experian reported $7.507 billion in total revenue for FY2025.

Experian serves over 200 million free members worldwide across its consumer services ecosystem.

Benchmark EBIT grew 11% at constant exchange rates for FY2025.

Only 13% of consumers report feeling fully secure when opening new online accounts.

Conclusion

Experian’s data paints a picture of a company navigating rapidly evolving risks, expanding digital engagement, and strengthening its societal impact. Fraud and identity threats are growing more complex, with AI both a challenge and a solution, leading companies to invest heavily in analytics and security tools. Consumers continue engaging with Experian’s digital platforms at scale, while ESG and inclusion efforts gain traction through measurable progress and global recognition.