In a world where cryptocurrencies once thrived in regulatory uncertainty, the EU MiCA (Markets in Crypto-Assets) regulations emerged as a defining moment. Imagine a bustling digital marketplace where investors, companies, and regulators walk a fine line between innovation and risk. Now, picture a structured framework that aims to standardize, protect, and enhance the crypto industry across the 27 European Union member states.

MiCA has already begun shaping the crypto industry, with significant impacts on crypto exchanges, stablecoin issuers, and digital asset service providers. The shift is evident in trading patterns, compliance rates, and investor confidence. But how significant are these changes? Let’s dive into the numbers that define the new EU crypto landscape.

Editor’s Choice

- Over 65% of EU-based crypto businesses have achieved MiCA compliance by Q1 2025.

- The European crypto market could exceed €1.5 to €1.8 trillion by the end of 2025

- Over 30% of institutional investors in the EU increased their crypto holdings after MiCA’s investor protection measures took effect.

- The number of registered Virtual Asset Service Providers (VASPs) in the EU rose by 47%.

- 70–75% of Europe’s 3,167 VASPs are projected to lose registration status under MiCA grandfathering rules by mid-2025.

- Licensing and compliance costs for crypto startups under MiCA have increased significantly, with estimates ranging from €50,000 to €100,000 depending on legal and operational complexity

- Following MiCA enforcement, most regulated EU crypto lending platforms now require collateralization, with some industry estimates placing collateralized lending at over 90%.

- 85% of crypto service providers (CSPs) had registered with an EU financial authority by mid-2025.

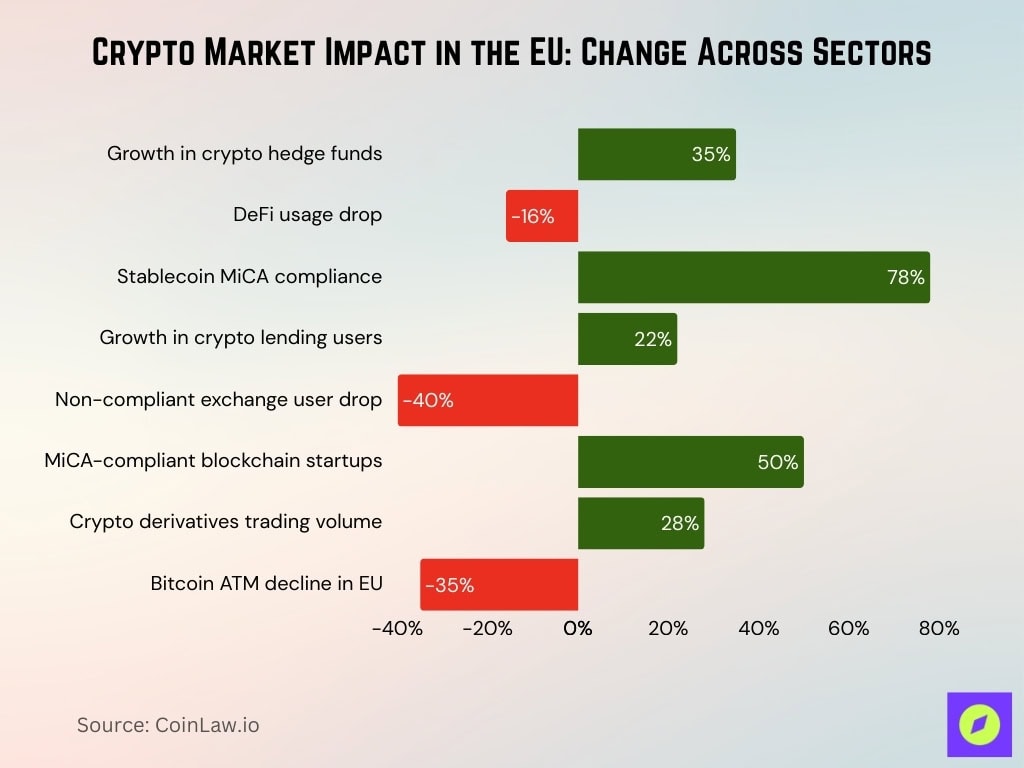

Key Statistical Insights on Crypto Market Impact

- The number of European crypto hedge funds grew by 35%.

- Decentralized finance (DeFi) platforms saw a 16% drop in usage in the EU.

- Over 78% of European stablecoins now fully comply with MiCA’s reserve and reporting requirements.

- Crypto lending platforms in the EU saw a 22% increase in users.

- Non-compliant exchanges saw a 40% decline in EU-based users.

- More than 50% of new blockchain startups in the EU are now MiCA-compliant from day one.

- Crypto derivatives trading volumes rose by 28%.

- EU-based Bitcoin ATMs declined by 35%.

MiCA Compliance Requirements

- Over 90% of crypto exchanges in the EU have updated their KYC and AML processes to meet MiCA’s demands.

- Stablecoin issuers must now maintain 100% reserve backing, leading to a 50% increase in institutional partnerships with EU banks.

- 38% of EU-based crypto firms hired new compliance officers as regulatory oversight intensifies.

- MiCA-compliant businesses saw a 45% increase in institutional investments compared to non-compliant platforms.

- Firms failing MiCA guidelines risk fines of up to €15 million or 3% of annual revenue.

- Over 60% of EU DeFi protocols opted for partial MiCA compliance to avoid enforcement risks.

- The average MiCA licensing process takes 3-6 months.

- 85% of crypto service providers registered with an EU financial authority by mid-2025.

Effects on Crypto Exchanges and Service Providers

- More than 70% of EU-based crypto transactions now occur on MiCA-compliant exchanges.

- Non-compliant exchanges saw a 40% drop in EU-based users.

- EU-regulated crypto custodians saw a 55% rise in institutional deposits.

- Binance, Kraken, and Coinbase secured MiCA licenses for all 27 EU countries.

- Crypto derivatives trading volumes rose by 28%.

- EU-based Bitcoin ATMs declined by 35%.

- Over €1.2 billion in venture capital funding went to MiCA-compliant startups in H1.

- 92% of all crypto trades processed through MiCA-compliant exchanges by Q3.

Adoption and Compliance Rates Across EU Member States

- Germany, France, and the Netherlands lead with over 90% of crypto firms MiCA-compliant as of Q1 2025.

- Spain and Italy reported 75% compliance rates as regulators fast-track approvals.

- Greece, Portugal, and Ireland lag with only 50-60% of firms obtaining MiCA licenses.

- 53 MiCA licenses have been granted under MiCA in the first six months, allowing passported operations across 30 EEA countries.

- The European Central Bank (ECB) reported a 60% decline in crypto fraud cases.

- Germany and the Netherlands account for the largest number of licensed providers.

Changes in Investor Behavior and Market Trends

- Over 30% of institutional investors in the EU increased exposure to digital assets following MiCA’s implementation.

- Retail investor participation grew by 27% as consumer confidence in regulated platforms improved.

- Stablecoin holdings among EU investors surged by 40%.

- Crypto-related scam reports dropped by 58% thanks to MiCA’s strict KYC measures.

- Bitcoin makes up 48% of total trading volume on regulated EU exchanges.

- ETH-based DeFi activity in the EU fell by 16%.

- Crypto ETF investments surged by 35% among European investors.

- 80% of EU investors prefer MiCA-compliant platforms for transactions.

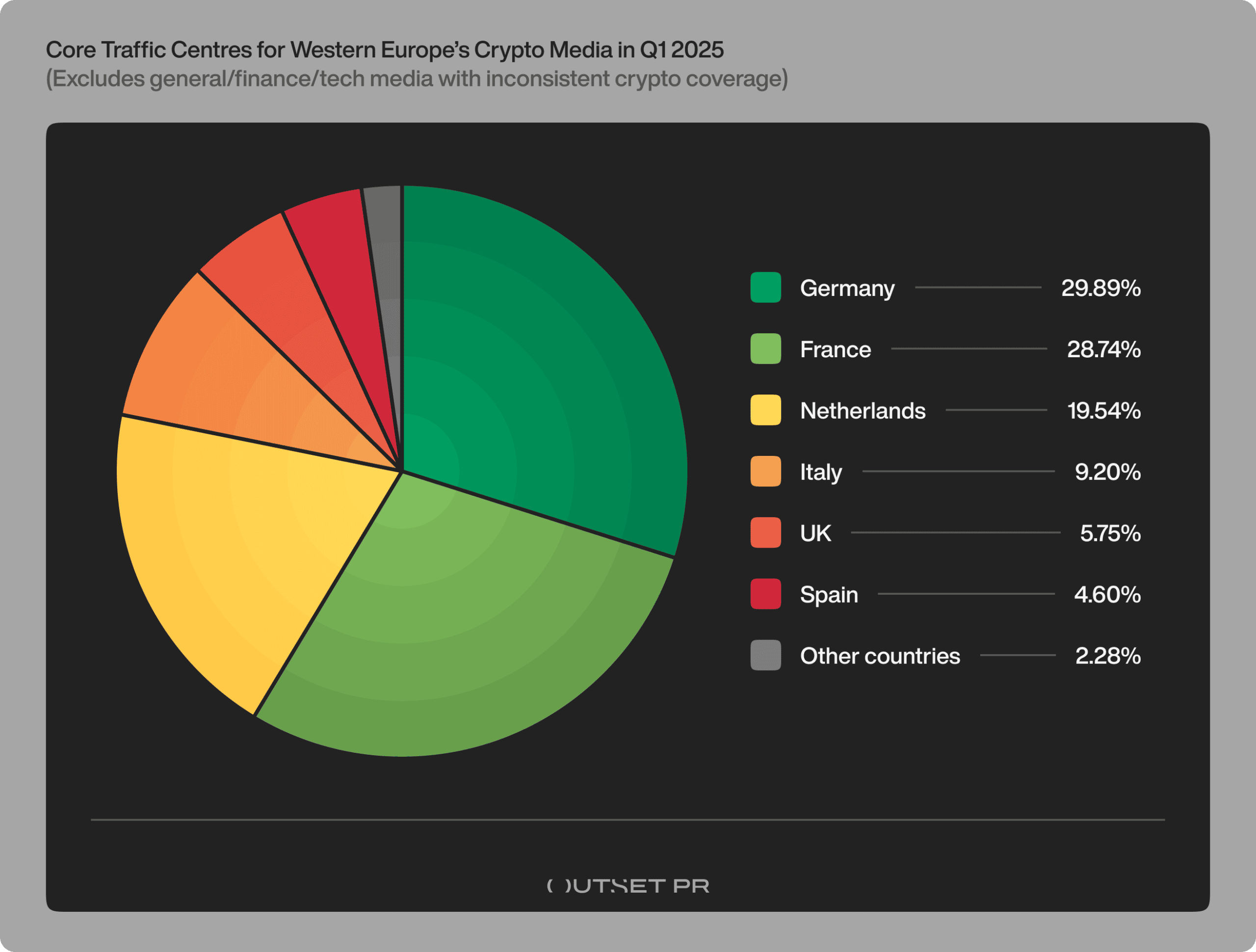

Western Europe’s Crypto Media Traffic Share

- Germany led with 29.89% of all crypto media traffic in Western Europe.

- France closely followed with a 28.74% share, showing strong domestic engagement.

- The Netherlands accounted for 19.54%, highlighting its growing crypto audience.

- Italy contributed 9.20%, reflecting moderate market interest.

- UK represented just 5.75%, despite its fintech prominence.

- Spain had a 4.60% share, indicating limited crypto media traction.

- Other countries combined made up only 2.28% of the total traffic.

Regulatory Penalties and Enforcement

- Over €540 million in penalties have been issued since MiCA enforcement began.

- 28 crypto firms had their licenses revoked for non-compliance with AML and KYC.

- The European Securities and Markets Authority (ESMA) conducted 230+ audits of crypto businesses.

- France issued the highest fine of €62 million to a non-compliant exchange.

- Regulated platforms saw a 50% drop in hacking incidents due to cybersecurity requirements.

- Non-EU exchanges saw a 45% drop in EU-based users.

- More than 80% of crypto firms in violation received a 90-day compliance window.

- €150 million in additional fines targeted stablecoin reserve violations.

Comparison with Other Global Crypto Regulations

- U.S. relies on fragmented federal and state regulations, unlike MiCA’s unified EU framework.

- Japan requires strict exchange licensing under the Payment Services Act, but MiCA covers broader assets, including stablecoins.

- Singapore’s PSA offers tiered licensing flexibility, contrasting MiCA’s single EU-wide license.

- UK firms face 6-12-month FCA authorizations while MiCA is fully implemented.

- China’s crypto ban accounts for 14% of the global Bitcoin hashrate in grey areas.

- Dubai’s VARA licenses major exchanges like Binance, but MiCA provides EU-wide stability.

- 35% of India’s crypto traders comply despite penalties vs MiCA’s higher EU rates.

- MiCA enables operation across 27 EU states, unlike regional, fragmented systems.

Crypto Media Traffic Trends in Western Europe

- 81.61% of Western Europe’s crypto media outlets saw a decline in traffic during Q1 2025.

- Only 18.39% of crypto media platforms in the region experienced growth in audience traffic.

- The data reflects a challenging media landscape, with most platforms struggling to retain or expand their readership amid regulatory and market shifts.

Recent Developments

- EU regulators plan 2025 MiCA amendments to include NFT-specific classifications covering ~12% of NFT models.

- ~45% of NFT projects remain unclear on MiCA scope, prompting amendment discussions.

- European Parliament reported a 90% satisfaction rate among regulators regarding MiCA’s impact.

- ~85% of pure art NFTs avoid MiCA registration under current exemptions.

- EU NFT marketplaces cut anonymous transactions by ~20% following MiCA KYC rules.

- 53 major crypto firms approved under MiCA, including 14 stablecoin issuers.

- ~30% of novel NFT startups delay launches due to regulatory ambiguity.

- ESMA partners with ~30 major NFT marketplaces for self-regulatory standards.

Frequently Asked Questions (FAQs)

65% of EU-based crypto businesses achieved MiCA compliance by Q1 2025.

The European crypto market is projected to reach €1.5 to €1.8 trillion by the end of 2025.

The number of registered VASPs in the EU rose by 47%.

Over €540 million in penalties have been issued since MiCA enforcement began.

Conclusion

MiCA is not just another set of crypto regulations; it is the most comprehensive legal framework ever introduced in the digital asset space. By bringing legal certainty, protecting investors, and enforcing strict compliance rules, MiCA has reshaped the European crypto industry in just a year. With growing investor confidence, increasing institutional participation, and clear penalties for non-compliance, MiCA is setting a global benchmark for how crypto regulations should be structured.

As the crypto market evolves, MiCA will likely continue to adapt, ensuring the EU remains a leader in regulated digital finance. The next phase of MiCA’s journey will determine how effectively DeFi, NFTs, and AI-powered compliance can be integrated into an already robust regulatory framework.