Ethereum surged 56 percent in July, marking its strongest monthly performance in three years, driven by record-breaking ETF inflows and growing institutional demand.

Key Takeaways

- 1Ether surged 56 percent in July, its best month since July 2022.

- 2ETF inflows hit $5.37 billion, with 19 consecutive days of positive flow.

- 3BlackRock’s iShares ETH ETF crossed $10 billion in assets, becoming the third-fastest ETF to do so.

- 4Despite the price rally, Ethereum network activity and revenue remain relatively flat.

What Happened

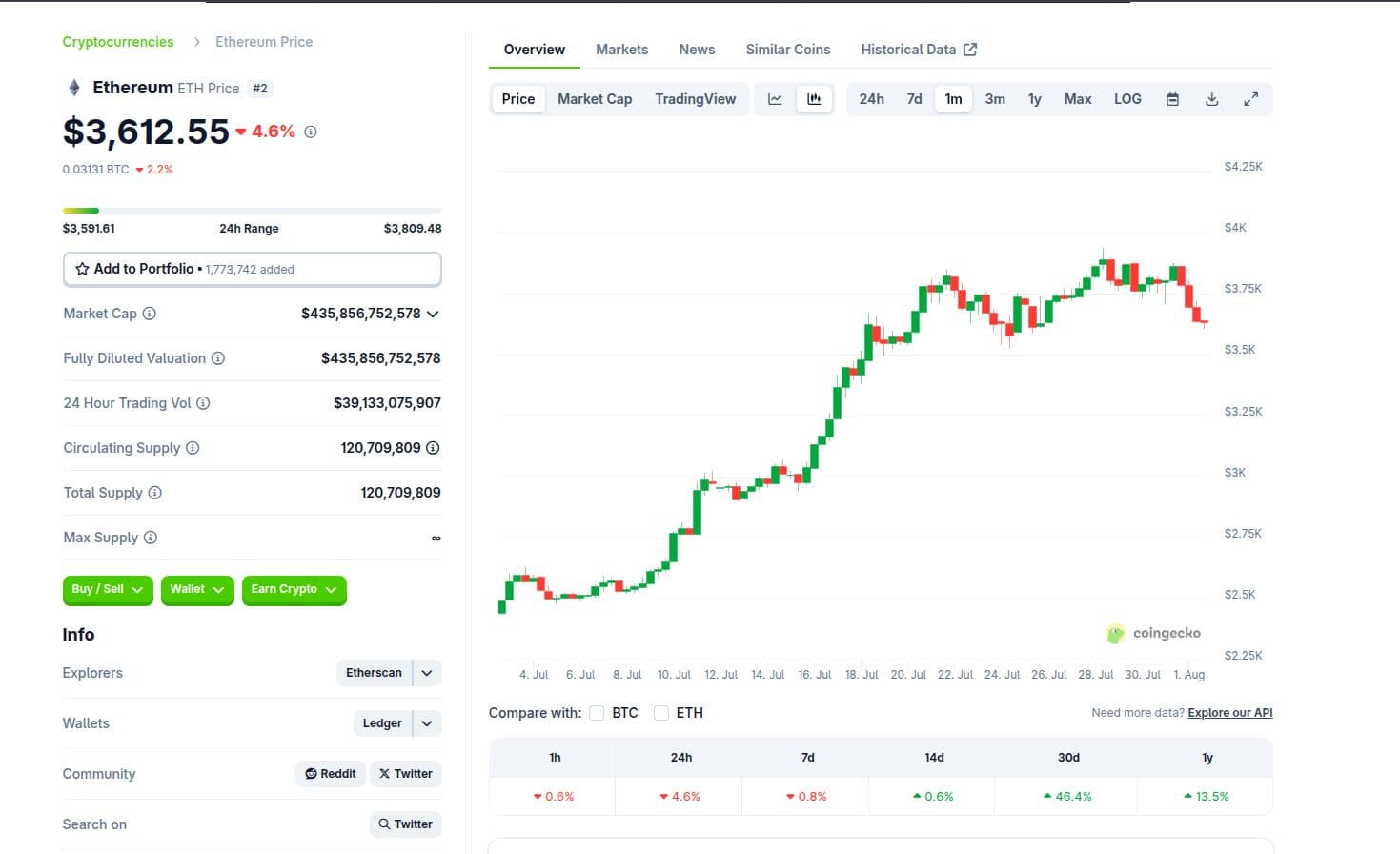

Ethereum (ETH) ended July with a remarkable 56 percent price gain, jumping from $2,468 to $3,862. This marks its biggest monthly surge since July 2022, echoing sentiments from market analysts who compare Ethereum’s current trajectory to the early days of 1990s tech stocks.

ETF Inflows Spark Ethereum Rally

Much of this price momentum is being credited to strong and consistent inflows into spot Ether ETFs. Between July 3 and July 30, these funds saw net inflows totaling over $5.37 billion, setting a 19-day streak that ties the all-time record for continuous daily gains.

- July 16 recorded the highest single-day inflow with $727 million.

- For six consecutive days, Ether ETFs outperformed Bitcoin ETFs in net inflows.

- BlackRock’s iShares Ethereum ETF reached $10 billion in assets in just 251 days, making it the third-fastest ETF to hit that milestone.

Eric Balchunas, Senior ETF Analyst at Bloomberg, commented on the trend via X (formerly Twitter), writing, “Ether is starting to look like a ‘90s tech stock as ETFs catch fire,” highlighting its appeal to institutional investors and aligning Ethereum more with innovation than Bitcoin’s digital gold narrative.

Institutional Interest and Long-Term Vision

Ethereum’s rise is being seen as more than just a crypto rally. The comparison to early-stage tech stocks underscores a belief that Ethereum could be foundational to a decentralized internet. Major firms like Ether Machine and SharpLink have poured over $100 million into ETH, a testament to the confidence among institutional players.

Despite the excitement, some analysts urge caution regarding Ethereum’s on-chain performance.

Network Revenue and Activity Show Modest Growth

According to Markus Thielen, CEO of 10x Research, Ethereum’s revenue and network activity have not kept pace with its price rally. He noted:

- Ethereum network revenue grew only 3 percent in the past month.

- Activity increased by a modest 5 percent, signaling weak on-chain engagement.

- 90 percent of ETH trading activity appears to originate during Asian market hours.

Thielen compared today’s numbers with November 2021, when Ethereum generated $1.5 billion in monthly revenue on a market cap of $300 billion, yielding an annualized return of 6 percent. Now, with a market cap of $466 billion, the network’s annualized revenue stands at just $764 million, pointing to lower returns and possibly reduced long-term attractiveness unless fundamentals improve.

CoinLaw’s Takeaway

I think this rally is exciting, but it’s important we keep both eyes open. On one hand, Ethereum is clearly drawing serious attention from institutions, with ETF inflows showing no signs of slowing. That’s a big deal. On the other hand, the actual network usage and revenue tell a more cautious story. Prices are booming, but the tech needs to catch up if we want this momentum to last. I’m optimistic, but I’ll be watching the fundamentals closely.