Ethereum ETFs posted their sixth consecutive day of outflows, deepening market concerns as Bitcoin also faltered, while Solana and XRP stood out with continued investor interest.

Key Takeaways

- Ethereum ETFs saw over $96 million in daily net outflows, led by a $102 million redemption from BlackRock’s ETHA product.

- Bitcoin ETFs recorded $161 million in outflows, with Fidelity’s FBTC alone accounting for $170 million in redemptions.

- Solana and XRP ETFs attracted strong inflows, signaling growing investor confidence in select altcoins amid broader market uncertainty.

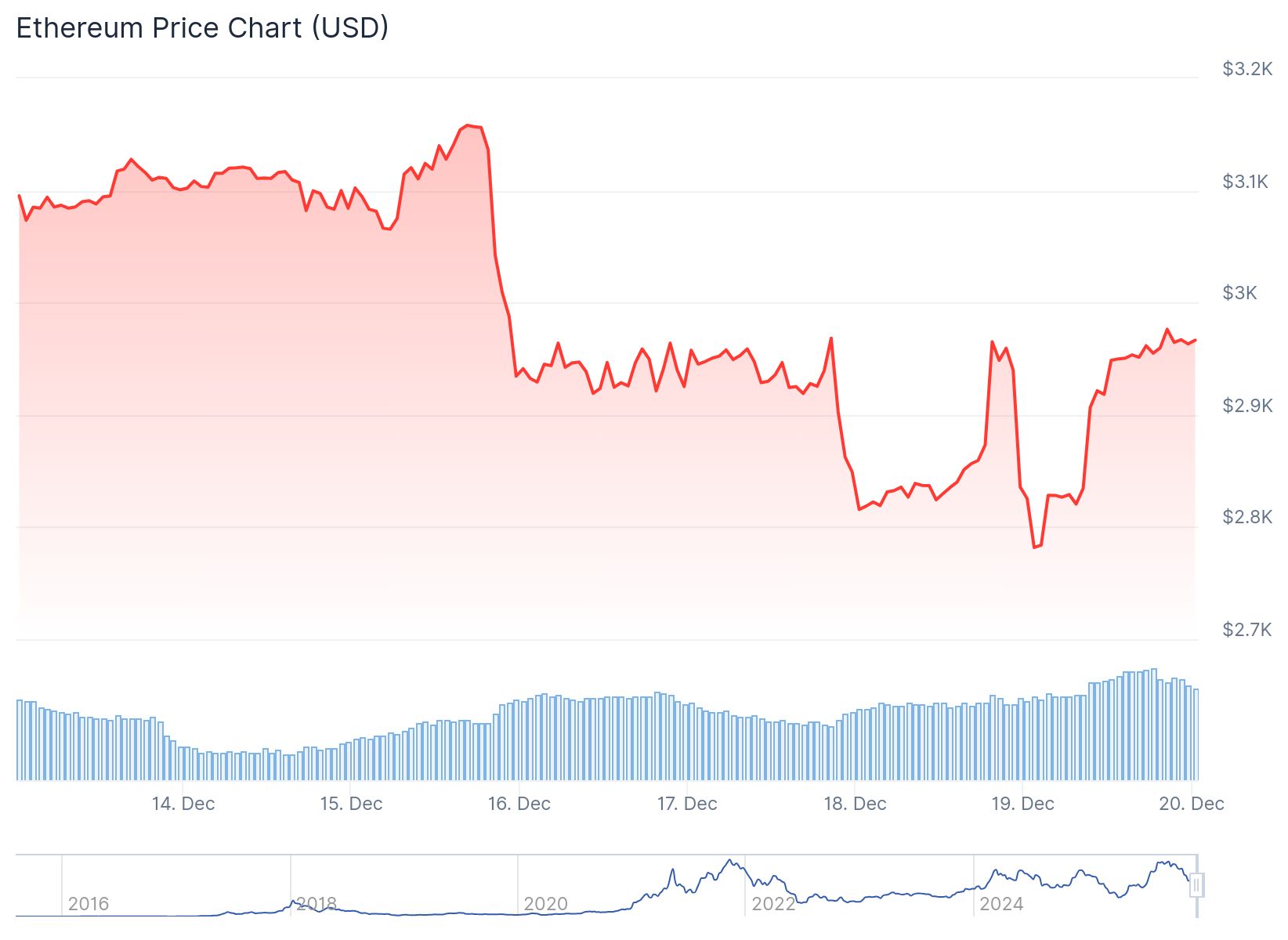

- Open interest in Ethereum derivatives rose, while large buy orders between $2,700 and $2,800 suggest institutional support.

What Happened?

Spot Ethereum ETFs in the U.S. continued to bleed for a sixth straight day, tallying a net outflow of $96.6 million, with BlackRock’s ETHA driving most of the decline. At the same time, Bitcoin ETFs also struggled, recording $161 million in net redemptions. In contrast, Solana and XRP ETFs bucked the trend, seeing millions in inflows as investor interest rotated into altcoins.

🚨BREAKING: 🇺🇸 Ethereum spot ETFs recorded a net outflow of $96.6M on December 18.

— DustyBC Crypto (@TheDustyBC) December 19, 2025

BlackRock clients sold $102.2M worth of $ETH. pic.twitter.com/D93wTB9JC0

Bitcoin and Ethereum Face Renewed Pressure

Bitcoin’s attempt at a rebound was short-lived. Instead, it faced another wave of ETF redemptions, largely driven by Fidelity’s FBTC, which saw $170.28 million exit. Ark & 21Shares’ ARKB and Bitwise’s BITB also reported outflows of $12.27 million and $11.54 million, respectively. BlackRock’s IBIT was a lone bright spot, bringing in $32.76 million, but it was not enough to offset broader losses. Total trading volume across Bitcoin ETFs stood at $5.16 billion, with net assets dipping to $111.04 billion.

Ethereum mirrored Bitcoin’s decline. The largest pressure came from BlackRock’s Ethereum Trust (ETHA), which offloaded $102.2 million in assets. Smaller gains were recorded by Grayscale’s Ether Mini Trust and ETHE, adding $2.89 million and $2.74 million respectively. Despite the redemptions, Ethereum ETF trading remained active, totaling $2.15 billion, and net assets held at $17.07 billion.

Altcoins Gain Favor as Investors Rotate

While the top two cryptocurrencies faced selling pressure, altcoins like Solana and XRP showed surprising resilience.

Solana ETFs brought in $13.16 million, led by Fidelity’s FSOL with $6.57 million. Bitwise’s BSOL, Grayscale’s GSOL, and VanEck’s VSOL also saw inflows. XRP ETFs fared even better, pulling $30.41 million in new capital, with Grayscale’s GXRP and 21Shares’ TOXR leading the gains.

- Solana ETF trading volume reached $77.74 million, with net assets at $876.34 million.

- XRP ETF assets stood at $1.14 billion, supported by $63.86 million in daily trading.

Market Sentiment Signals Mixed Outlook

The market’s divergence is clear. While investors pull back from Bitcoin and Ethereum, they’re not exiting crypto entirely. Instead, they are reallocating toward altcoins, particularly those perceived as undervalued or structurally sound in the current regulatory and technological environment.

Adding to Ethereum’s complex picture, open interest in ETH futures rose to $11.79 billion, even as price action remained capped below the $3,000 mark. This suggests growing leverage and potential volatility, with traders bracing for a sharp move once the $2,700 to $2,800 support range is tested.

Crypto Payroll Impact: A New Concern

The ongoing outflows from Ethereum ETFs also raise new concerns for businesses considering crypto payroll options. The $97.67 million outflow recorded on December 18 reflects cautious investor sentiment and has implications for how employers may approach paying salaries in crypto.

Experts suggest that firms looking to adopt crypto payroll systems should:

- Monitor ETF fund flows for market signals.

- Evaluate the stability of specific ETF products.

- Diversify payroll with stablecoins or multiple crypto assets.

- Educate employees on the volatility and benefits of crypto compensation.

Even as Ethereum ETFs face redemptions, inflows into Grayscale products show that selective interest remains, offering some guidance for cautious but forward-looking crypto payroll adoption.

CoinLaw’s Takeaway

In my experience tracking ETF behavior, these kinds of shifts often tell us more about market strategy than panic. While Ethereum and Bitcoin are under pressure, the flows into Solana and XRP ETFs reveal a calculated rotation, not a mass exit. For those in the crypto space, whether investors or businesses, this is a moment to observe, not overreact. I found the emerging divergence in ETF demand especially telling. It’s a reminder that crypto is not one monolithic market, but a complex ecosystem where capital moves fast and often smartly.