Former New York City Mayor Eric Adams is denying any financial gain from the troubled NYC Token project, which lost millions in value just hours after launch.

Key Takeaways

- NYC Token lost over 80 percent of its value shortly after its launch, wiping out more than $400 million in market capitalization.

- Eric Adams and his team deny moving or profiting from investor funds, despite on-chain data showing suspicious liquidity withdrawals.

- Crypto analytics firm Bubblemaps reported that a wallet linked to the deployer withdrew $2.5 to $3 million, fueling “rug pull” allegations.

- The project claimed the liquidity was rebalanced due to unexpected demand, and no tokens were sold by the team.

What Happened?

The NYC Token, launched on the Solana blockchain and promoted by Eric Adams, spiked in value before crashing by more than 80 percent within hours. The token’s rapid rise and collapse sparked investor outrage and led to allegations of a “rug pull,” a term for when insiders drain a project’s liquidity, leaving others unable to sell.

Amid these accusations, Adams’ team has strongly denied any wrongdoing or financial benefit from the token launch.

Statement: pic.twitter.com/krRJEV4tjp

— NYC Token (@buynyctoken) January 13, 2026

NYC Token’s Wild Launch and Immediate Crash

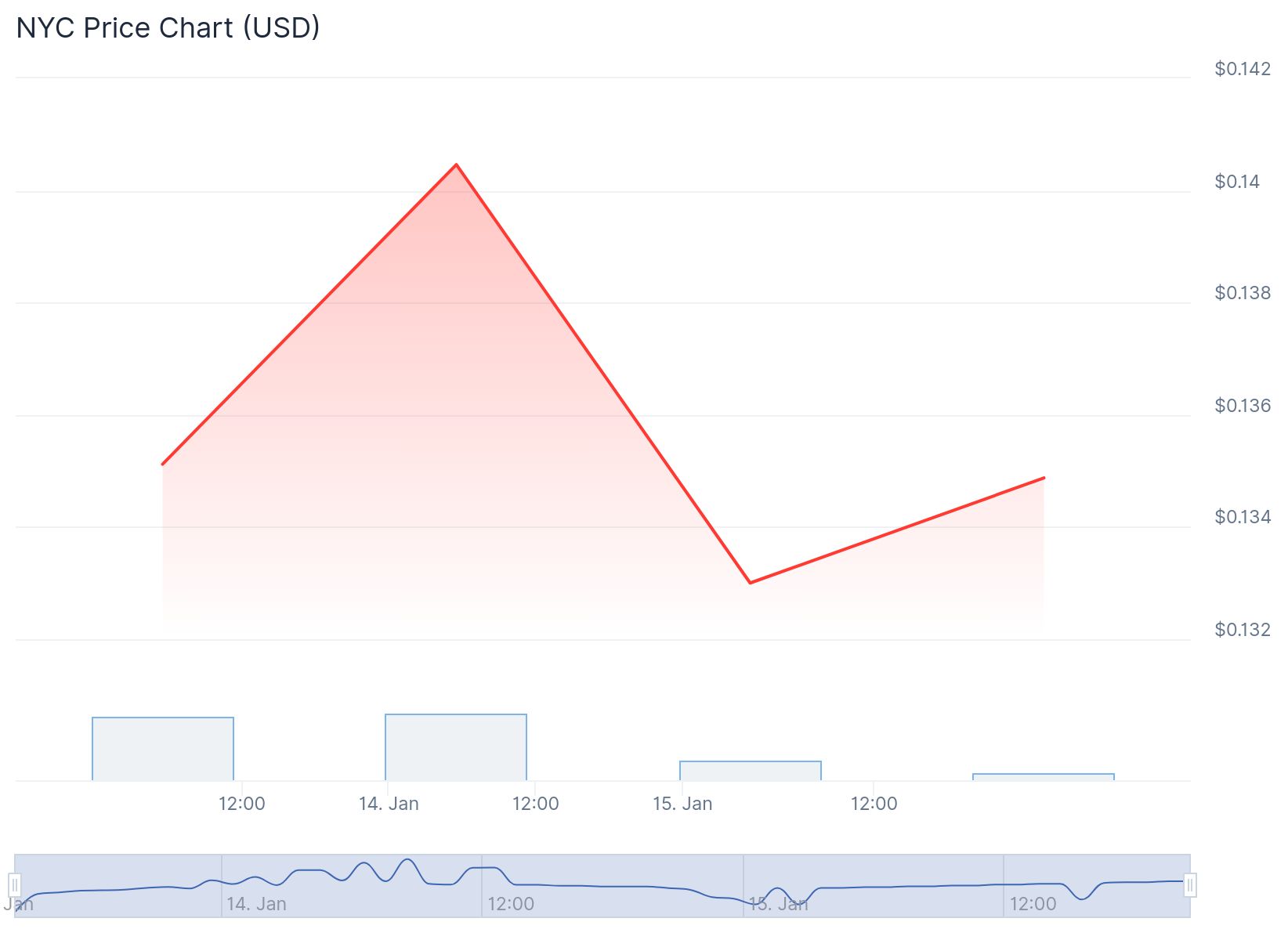

The NYC Token surged to a market cap of around $580 million, trading at roughly $0.50, before crashing to under $0.09. As of the latest data, the token was trading around $0.13, with over $400 million in value wiped out.

Bubblemaps, a crypto analytics platform, revealed unusual patterns in the token’s liquidity activity. It found that several wallets acquired large amounts of the token early and quickly moved funds in and out of liquidity pools. The biggest red flag was a $2.5 to $3 million liquidity withdrawal, of which only $1.5 million was later returned.

Despite the dramatic activity, Adams’ spokesperson Todd Shapiro issued a strong denial. He told CoinDesk:

Conflicting Explanations from the Token Team

While Adams’ team insists that no money was taken, statements from the NYC Token team offered a slightly different narrative. On social media, the official NYC Token account claimed that the liquidity was “rebalanced” due to overwhelming launch demand. Elissa Buchter, a spokesperson for NYC Token, said their market maker made the changes to keep trading smooth and added that the team did not sell any tokens and remains bound by lockup and transfer restrictions.

In a separate statement to Bloomberg, NYC Token repeated that no money was withdrawn and the liquidity changes were part of standard operations during volatile trading.

Adams’ Role and Previous Crypto Ties

Adams promoted the token in Times Square, calling it a tool to fight antisemitism and anti-Americanism and promising that proceeds would go toward blockchain education and scholarships for underserved youth. However, he did not disclose key partners or the governance structure of the token.

The former mayor’s crypto enthusiasm is well documented. He previously backed “NYCCoin” early in his term, which also collapsed and was later disavowed by the city. That history is now drawing renewed scrutiny as another Adams-linked crypto venture ends in controversy.

Questions Around Project Affiliations

Documents show that C18 Digital LLC, linked to NYC Token’s terms of service, was incorporated just weeks before the launch and connected to Sefi Zvieli, a Brooklyn landlord with a controversial track record. Zvieli previously secured a $3.5 million city-funded shelter contract after hiring a lawyer with ties to Adams. The property was later criticized as dangerous and unsanitary. Neither Zvieli nor the attorney has commented on their connection to the token.

CoinLaw’s Takeaway

In my experience, when a crypto token rises and collapses this quickly and especially when millions in liquidity vanish and reappear. There’s always more than meets the eye. Eric Adams’ denial may hold water legally, but the optics are messy, to say the least. The lack of transparency about who controls NYC Token, how it operates, and what exactly Adams’ role is raises serious concerns. If this was truly about charity and education, the public deserves a lot more clarity. Crypto projects tied to public figures need airtight accountability or they risk damaging both wallets and reputations.