Equity market liquidity matters because it determines how easily investors can buy or sell shares without affecting prices too much. Liquidity conditions in U.S. and global equity markets remain critical for institutional investors, retail traders, and market makers alike. Good liquidity supports smooth trading, reduces transaction costs, and helps markets absorb large orders, all essential for market stability and investor confidence. Real-world applications include large pension funds executing block trades without disturbing prices, and active trading desks quickly adjusting positions in response to news. Read on to explore the key statistics shaping equity market liquidity.

Editor’s Choice

- U.S. equity markets saw average daily volume (ADV) of 17.7 billion shares, a +51.2% year-over-year increase as of October 2025.

- Institutions listed $192.6 billion in total equity issuance year to date, a 2.2% increase from the prior year reporting.

- On the New York Stock Exchange, the closing auction delivers about $18.9 billion per day in liquidity, making it the single largest daily liquidity event.

- On average, NYSE trades about 1.54 billion shares per day, worth roughly $80.6 billion.

- The composite liquidity indicator used by regulators and central banks continues to show relatively stable liquidity conditions in major markets as of mid-2025.

Recent Developments

- The 2025 uptick in U.S. equity trading volume coincides with a surge in retail and institutional activity, partly driven by a resurgence in IPOs and new listings.

- Initial public offering issuance hit $36.1 billion, up 19.8% year over year.

- The growth in equity issuance suggests more supply and secondary market depth, which tends to support liquidity over time.

- On the NYSE, the closing auction remains a key anchor of liquidity, now accounting for nearly $18.9 billion daily, helping institutional orders avoid excessive price impact.

- Despite overall growth, pockets of the market, such as smaller or less frequently traded securities, continue to exhibit liquidity fragility, especially during volatility spikes or macro shocks.

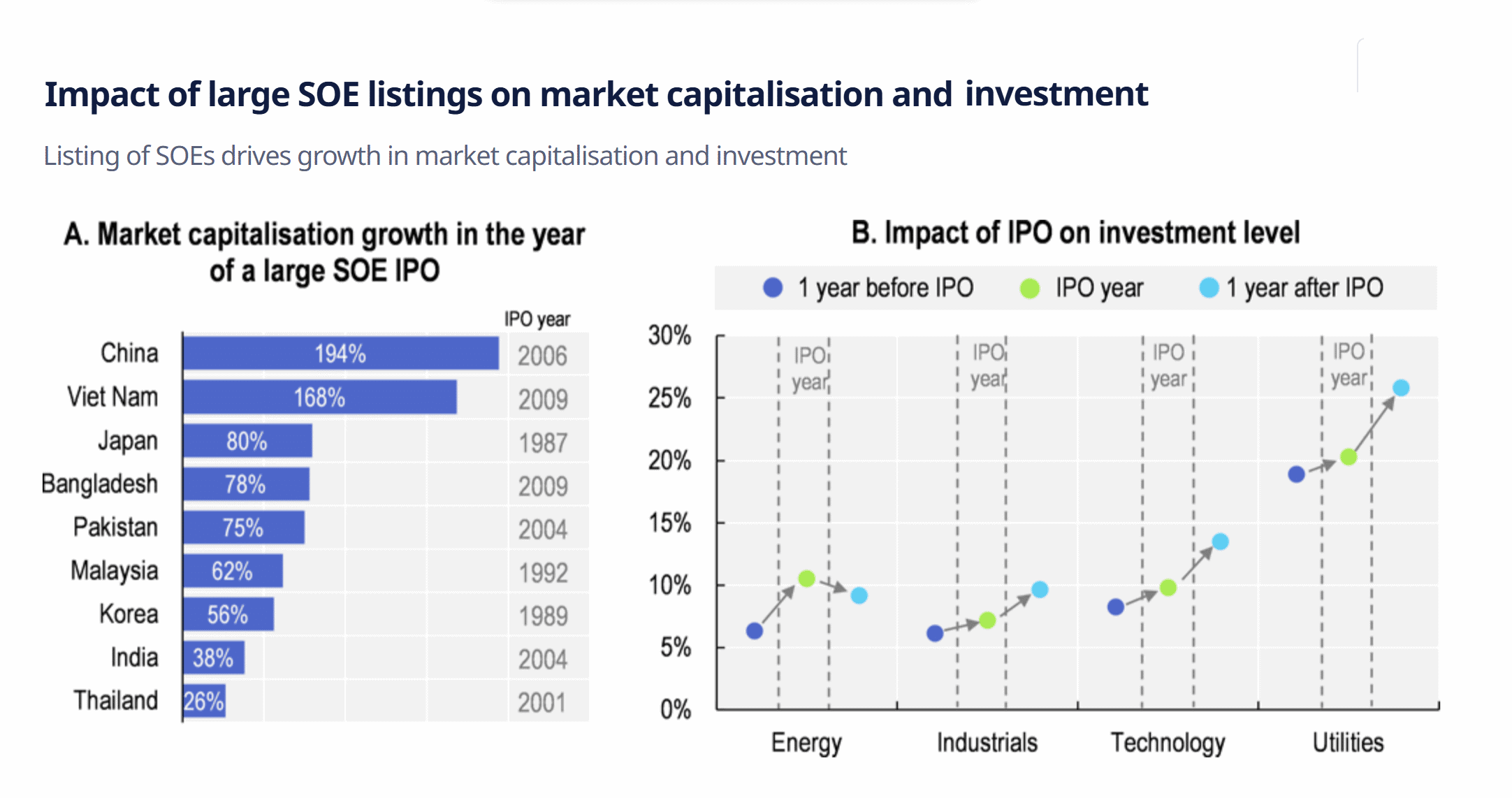

SOE Listings and Their Market Impact

- China’s market cap grew 194% in 2006 following a large SOE IPO.

- Vietnam saw a 168% increase in market cap in 2009 due to a major SOE listing.

- Japan’s market cap rose 80% in 1987 from a large SOE IPO.

- Bangladesh recorded a 78% gain in market cap in 2009 after an SOE IPO.

- Pakistan experienced a 75% increase in 2004 from an SOE IPO.

- Malaysia’s market cap grew 62% in 1992 with a major SOE listing.

- Korea posted a 56% rise in 1989 due to SOE listing activity.

- India’s market capitalisation rose 38% in 2004 during a large SOE IPO.

- Thailand registered a 26% increase in market cap in 2001 from SOE privatization.

- Energy sector investment rose from ~8% to ~13% after SOE IPOs.

- Industrials investment grew from ~6% to ~9% post-IPO.

- Technology sector investment increased from ~6% to ~10% one year after IPO.

- Utilities investment jumped from ~9% to ~18% in the year following an SOE IPO.

Measures of Equity Market Liquidity

- Australian equity market averaged $8.5 billion daily turnover in Q1 2025.

- NYSE averaged 1.54 billion shares daily, valued at $80.6 billion mid-November 2025.

- E-mini S&P 500 futures volume surged 99% above Q1 2025 ADV on April 7.

- ASX order book depth reached $525,000 average across the top 200 securities in Q1 2025.

- Quoted spreads for ASX top 200 securities averaged 9.99 bps in Q1 2025.

- The effective bid-ask spread for ASX all securities averaged 15.70 bps in Q1 2025.

- E-mini S&P 500 order book depth dropped 68% on April 7 versus late March 2025.

- Price impact for $59mm notional E-mini S&P 500 was 5.4 bps on April 7, 2025.

Turnover Velocity Trends

- U.S. equity markets reached an average daily trading volume of 17.7 billion shares by late 2025, a sharp rise from 12.2 billion shares in 2024.

- That increase corresponds to about +51.2% year over year in trading volume, aligning with recent U.S. equity market structure data.

- In 2024, the 12.2 billion share ADV already reflected a +24% year-over-year rise compared with 2023.

- The rise in turnover suggests more frequent trading and quicker rotation of shares, a sign of stronger market participation and activity.

- Exchange-traded funds averaged about 2.4 billion shares per day, representing roughly 19.6% of total equity volume.

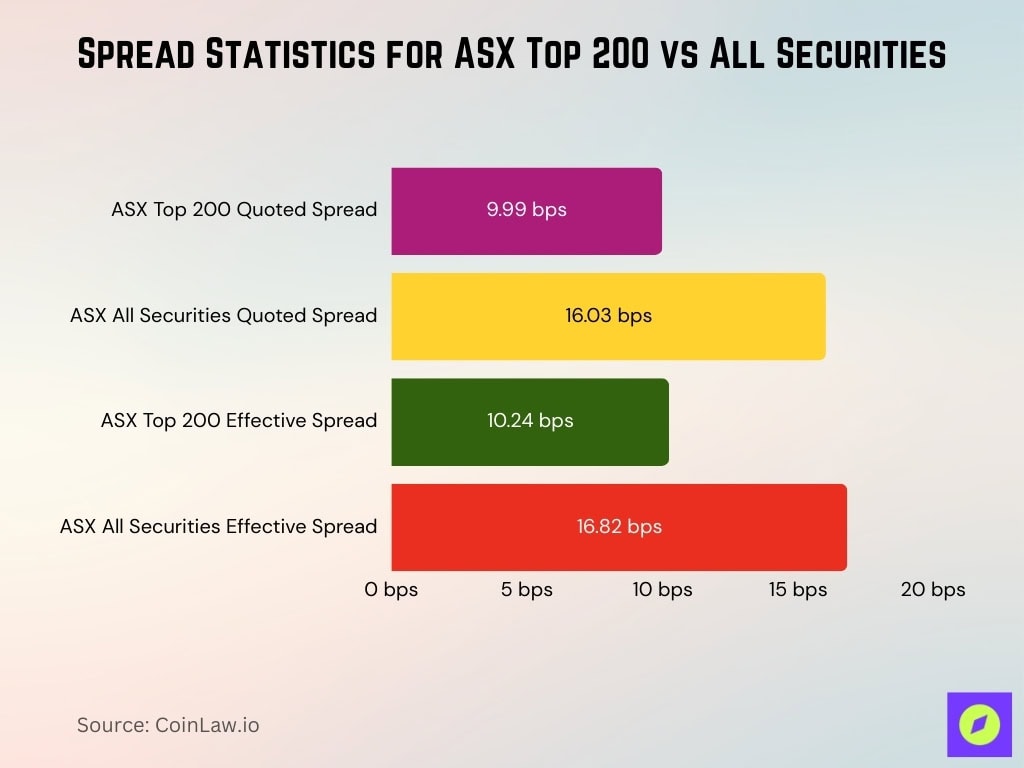

Bid Ask Spread Statistics

- ASX top 200 securities quoted spreads averaged 9.99 bps.

- ASX all securities quoted spreads averaged 16.03 bps.

- ASX top 200 effective spreads averaged 10.24 bps.

- ASX all securities effective spreads averaged 16.82 bps.

- European HY bond spreads reduced by 21-27% early years.

- US HY bond bid-ask spreads fell average 17% first two weeks.

- US IG bond spreads dropped 35-30% weeks 1-2.

- ASX top 200 quoted spreads rose from 9.78 bps prior quarter.

Average Daily Value Traded

- NYSE averaged $80.6 billion for 1.54 billion shares.

- ASX total equity market averaged around $8.5 billion in daily turnover in Q1 2025.

- Tradeweb reported $2.9 trillion across asset classes in November.

- Tradeweb’s March hit a record $2.71 trillion.

- Tradeweb Q1 averaged $2.55 trillion.

- Australian ETFs surpassed AU$600 million.

- European equity trading rose 16% YoY in Q1.

- OTC markets averaged $3,069,683,067 dollar volume in November.

- Tradeweb January totaled $2.44 trillion.

Liquidity Risk Measures

- E-mini S&P 500 order book depth dropped 68% during April volatility.

- $59mm notional trade caused 5.4 bps price impact on April 7.

- Fill quality degraded 6.7 ticks wider at cash open versus March.

- 90th percentile trading rate hit 235 contracts/second at open.

- Small-cap tech stocks saw 6.33% intraday volatility post-market maker exit.

- The square-root model underestimated the impact by 1.1% during peak stress.

- Price dispersion reached 10.8 ticks for 90th percentile orders.

- Market impact halved to 5.4 bps from 10 bps. COVID levels normalized.

- 52.21% stop orders experienced negative slippage in analyzed trades.

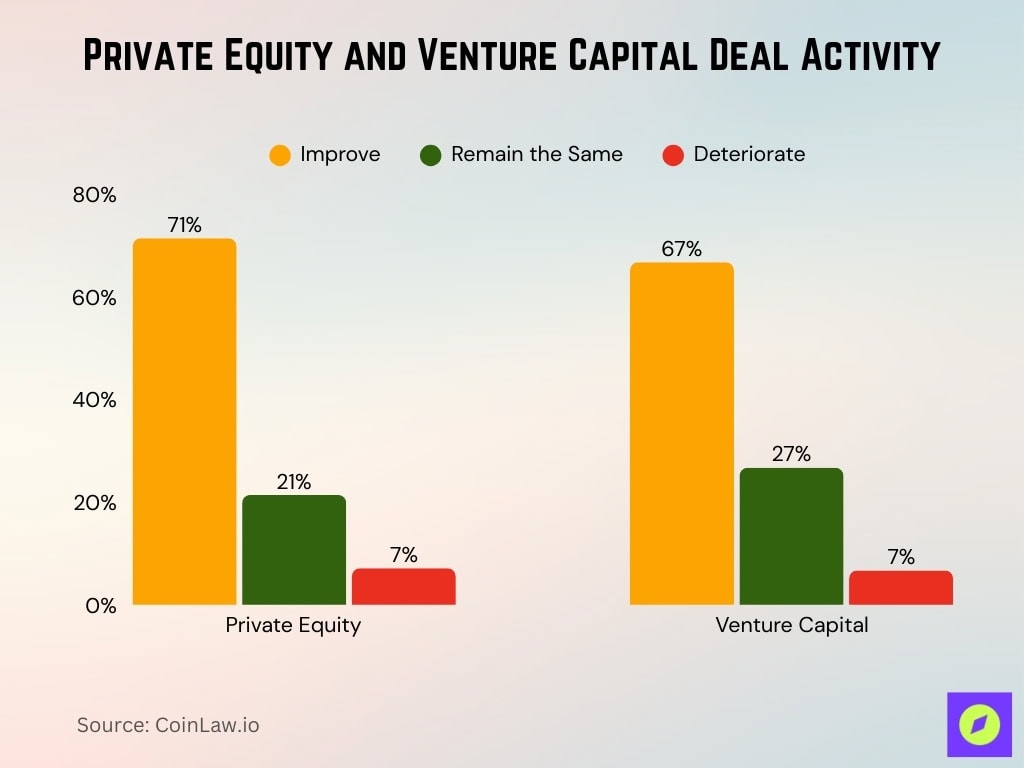

Private Equity and Venture Capital Deal Activity

- 71.4% of respondents expect private equity deal activity to improve in 2025.

- 21.4% believe private equity activity will remain the same throughout the year.

- 7.1% anticipate that private equity deal activity will deteriorate in 2025.

- 66.7% of respondents forecast that venture capital activity will improve in 2025.

- 26.7% expect venture capital deal activity to remain unchanged during the year.

- 6.7% believe that venture capital deal activity will deteriorate in 2025.

Cost of Liquidity Insights

- ASX top 200 effective spreads narrowed to 10.24 bps.

- ASX all securities effective spreads reached 16.82 bps.

- European equity turnover ratio climbed to 153%.

- Midpoint effective spread overstated true costs by 16% S&P 500.

- S&P 500 illiquidity costs are overstated by $148 million annually.

- ETF primary market liquidity optimizes trading efficiency.

- Vanguard Treasury ETF traded at a 1 bp bid-ask spread.

- Implicit costs are substantial for less liquid assets during stress.

Large Cap Liquidity Stats

- NYSE large cap ADV hit 1.54 billion shares worth $80.6 billion.

- E-mini S&P 500 futures traded 11x volume of the top S&P 500 ETFs.

- S&P 500 large caps dominated 36.12% of trading value.

- ASX top 200 large caps averaged $8.5 billion daily turnover.

- Large-cap bid-ask spreads tightened to 9.99 bps ASX top 200.

- E-mini S&P 500 large cap depth supported a 99% ADV surge in April.

- S&P 500 traded 12.2 billion shares ADV across large caps.

- Large-cap order books showed 10,000+ shares at key levels.

- ETF large-cap participation boosted 153% European turnover.

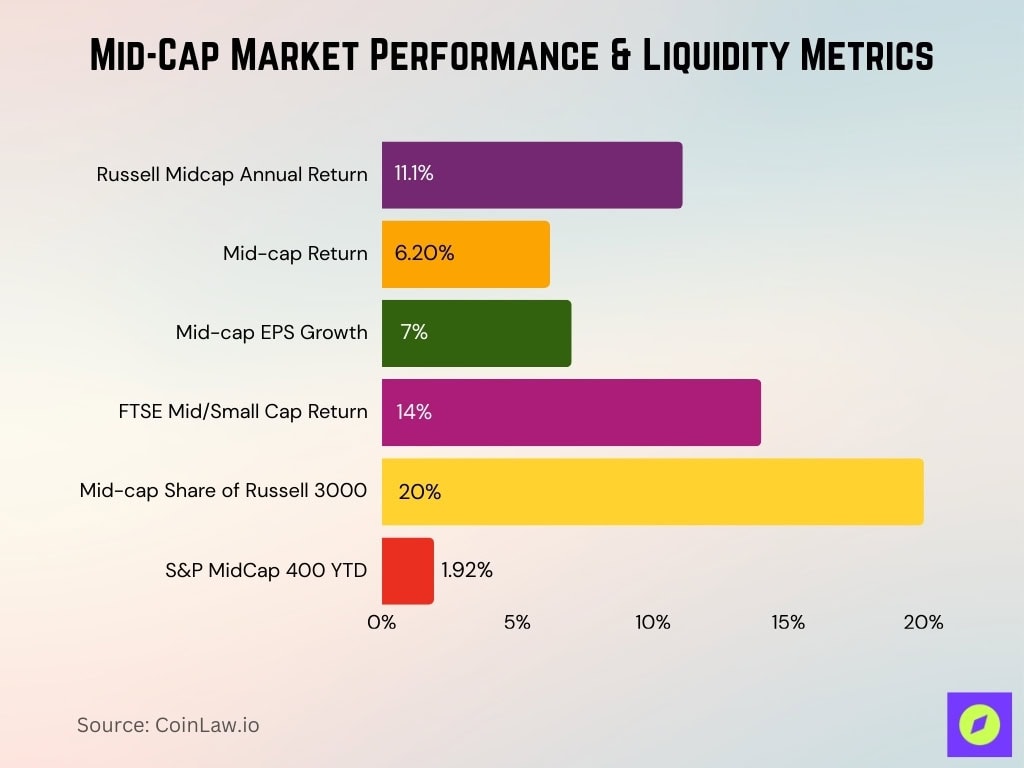

Mid Cap Liquidity Figures

- Russell Midcap Index annualized return has reached 11.1% since 1992.

- Mid-cap index posted a 6.20% performance for August-November.

- Mid-cap EPS growth is estimated at 7% for the year.

- FTSE ST Mid & Small Cap Index generated a 14% total return since May.

- Mid-caps represented 20% Russell 3000 market capitalization.

- S&P MidCap 400 YTD return stood at 1.92% November.

Tightness Indicators

- ASX top 200 quoted spreads compressed to 9.99 bps.

- ASX top 200 effective spreads tightened to 10.24 bps.

- European HY spreads reduced by 21-27% early weeks.

- US HY bid-ask spreads fell average 17% first weeks.

- US IG spreads dropped 35-30% weeks 1-2.

- Mid-cap volatility hit 1.25 versus small-cap 1.6.

Immediacy Measures

- Limit orders achieved a 50% average fill rate for retail investors.

- Execution probability is lowest first hour despite 50% order submissions.

- NYSE speed bump improved immediacy cost measures post-implementation.

- Limit order survival increased execution with longer duration.

- Retail limit orders represented 30% submitted shares.

- Order fill ratios maintained above the 95% benchmark for fast brokers.

- Execution latency is targeted under 50ms for most pairs.

Resilience Factors

- E-mini S&P 500 depth recovered to 4.5 ticks dispersion by April 21.

- Order book trading rate reverted to 63 50th percentile post-volatility.

- Market repriced risk 1 tick above March levels after the April peak.

- Fill quality degradation moderated versus order book, 68% drop.

- Euro area banks maintained 10% ROE with ample liquidity buffers.

- Private equity exits hit $302 billion in Q1, supporting liquidity recovery.

- LCR self-insurance reduced the need for drastic measures during stress periods.

- S&P 500 rebounded to new highs post-April tariff shock.

- Market impact normalized to 5.4 bps from COVID-10 bps levels.

Liquidity Trends in Major Exchanges

- US equity daily average reached 17.1 billion shares.

- E-mini S&P 500 volume surged 99% above Q1 ADV on April 7.

- ASX equity turnover averaged $8.5 billion daily in Q1.

- European lit primary venues captured 30% total liquidity.

- Off-exchange trading exceeded 50% total US volumes.

- HKEX small-cap reforms targeted a 15-30% volume boost.

- ATS sub-2,000 share trades hit 1.8 billion daily.

- European intra-market fragmentation split 70% across MTFs.

Implications of Liquidity for Investors and Market Stability

- Strong liquidity reduced execution costs by 16% S&P 500 midpoint spreads.

- Mid-caps delivered 9.27% annualized returns, balancing liquidity risk.

- Small-cap liquidity risk elevated 6.33% intraday volatility spikes.

- Fragmentation amplified 70% European equity trading across MTFs.

- Off-exchange volume hit 50%+ US total, amplifying stress transmission.

- ETF liquidity optimized 1 bp spreads for Treasury exposure.

- Retail limit orders filled at a 50% average rate.

- Diversified cap exposure improved portfolio resilience, with 11.1% mid-cap returns.

- Liquidity reforms boosted HKEX small-cap volume by 15-30%.

Frequently Asked Questions (FAQs)

As of late 2025, U.S. equities recorded an ADV of 17.7 billion shares, up 51.2% year‑over‑year.

Total equity issuance reached $192.6 billion, a 2.2% increase from the prior year.

IPO issuance totaled $36.1 billion, rising 19.8% year‑over‑year.

The average daily cost to trade is up approximately 36% in 2025 vs. 2024, reflecting wider bid‑offer spreads.

Conclusion

Equity market liquidity reflects both strength and nuance. Large caps remain the deepest and most reliable segment, while mid caps continue to improve, offering a compelling blend of liquidity, growth potential, and resilience. At the same time, liquidity remains uneven across the market, particularly for smaller or thinly traded equities. As market structure evolves and trading behavior shifts, liquidity will remain central to execution quality, risk management, and overall market stability. Investors who integrate liquidity analysis alongside valuation and fundamentals will be better positioned to navigate modern equity markets.