Equifax remains a cornerstone of the global credit reporting ecosystem, shaping how lenders, consumers, and businesses assess financial risk. With deep data assets and analytics services, the company influences credit decisions that ripple through markets, from approving home loans to underwriting commercial credit.

For example, mortgage lenders increasingly rely on credit checks powered by Equifax to approve or adjust loan terms, while fintech firms use its data to automate onboarding and fraud detection. As you explore this article, you’ll gain a data-rich view of where Equifax stands today and how its operations and trends affect the broader credit landscape.

Editor’s Choice

- Equifax operates across 24 countries with millions of consumer and business credit records.

- In Q3 2025, Equifax reported ~$1.55 billion in revenue, a 7% increase year-over‑year.

- Total U.S. consumer debt tracked by Equifax reached ~$18.03 trillion in 2025.

- Subprime borrowers held 22.1% of all bankcard debt as of May 2025.

- Equifax employs ~15,000 people globally.

- In early 2025, the CFPB fined Equifax $15 million over dispute handling issues.

- Equifax cut prices on its VantageScore 4.0 product to compete with FICO’s pricing moves.

Recent Developments

- In late 2025, Equifax’s stock showed mixed performance, with share price volatility reflecting market reactions to industry shifts.

- Analysts attributed part of Equifax’s revenue growth in 2025 to increased demand for credit and income verification services.

- Equifax responded to FICO’s new direct licensing model by slashing VantageScore 4.0 prices, aiming to protect its market position.

- Morgan Stanley analysts highlighted credit bureau stocks, including Equifax, as a relative buying opportunity in 2025, citing strong underlying data assets.

- The CFPB fine of $15 million in early 2025 stemmed from flawed dispute handling systems and required process improvements.

- Equifax continued to integrate broader global credit insights into its reports covering more than 10 countries and regions.

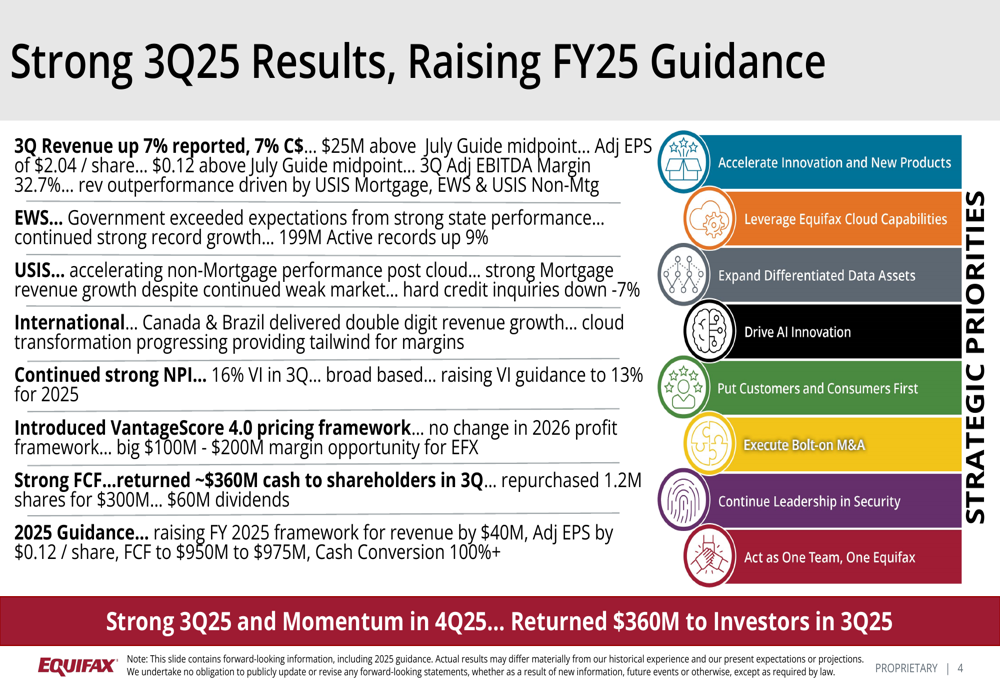

Equifax Results and Guidance

- 3Q revenue rose 7% year-over-year on a reported basis.

- 3Q revenue rose 7% in constant currency (C$).

- Revenue exceeded guidance by $25 million.

- Adjusted earnings per share (EPS) reached $2.04.

- EPS beat guidance midpoint by $0.12 per share.

- Adjusted EBITDA margin came in at 32.7%.

- Employer Services (EWS) posted 199 million active records.

- EWS active records increased 9% year-over-year.

- Hard credit inquiries fell 7%, despite mortgage growth.

- New Product Innovation (NPI) accounted for 16% of Q3 revenue.

- Vitality Index (VI) guidance raised to 13% for FY25.

- VantageScore 4.0 pricing framework was introduced in Q3.

- Potential profit uplift from the new pricing framework is estimated at $100 million to $200 million.

- Free cash flow (FCF) returned approximately $360 million to shareholders in Q3.

- 1.2 million shares were repurchased for $300 million.

- Cash dividends paid out totaled $60 million.

- FY25 revenue guidance was increased by $40 million.

- FY25 EPS guidance increased by $0.12 per share.

- FY25 FCF forecast raised to $950 million to $975 million.

- Cash conversion for FY25 expected to exceed 100%.

Equifax Company Background and History

- Founded in 1899 as the Retail Credit Company, Equifax is one of the longest-running credit bureaus in the U.S.

- Q2 revenue totaled $1.537 billion, increasing 8% in local currency.

- Market capitalization stands at $26.87 billion as of December.

- Employs nearly 15,000 people across 24 countries worldwide.

- Secured 62 new patents throughout the year.

- Manages data on over 800 million consumers globally.

- Workforce Solutions generated $649.4 million in Q3 revenue, up 5%.

- USIS segment revenue hit $530.2 million in Q3, rising 11%.

- 2017 data breach impacted nearly 148 million U.S. consumers.

Global Presence and Operations

- Operates in 24 countries across North America, Central America, South America, Europe, and the Asia Pacific.

- Aggregates data on 800 million consumers and 88 million businesses worldwide.

- International revenue reached $365.3 million in Q3, up 6% reported and 7% local currency.

- Latin America revenue totaled $102.1 million in Q3, up 6% reported and 9% local currency.

- Europe revenue hit $102.3 million in Q3, increasing 8% reported and 4% local currency.

- Asia Pacific revenue was $90.1 million in Q3, up 2% reported and 4% local currency.

- Canada revenue achieved $70.8 million in Q3, rising 9% reported and 11% local currency.

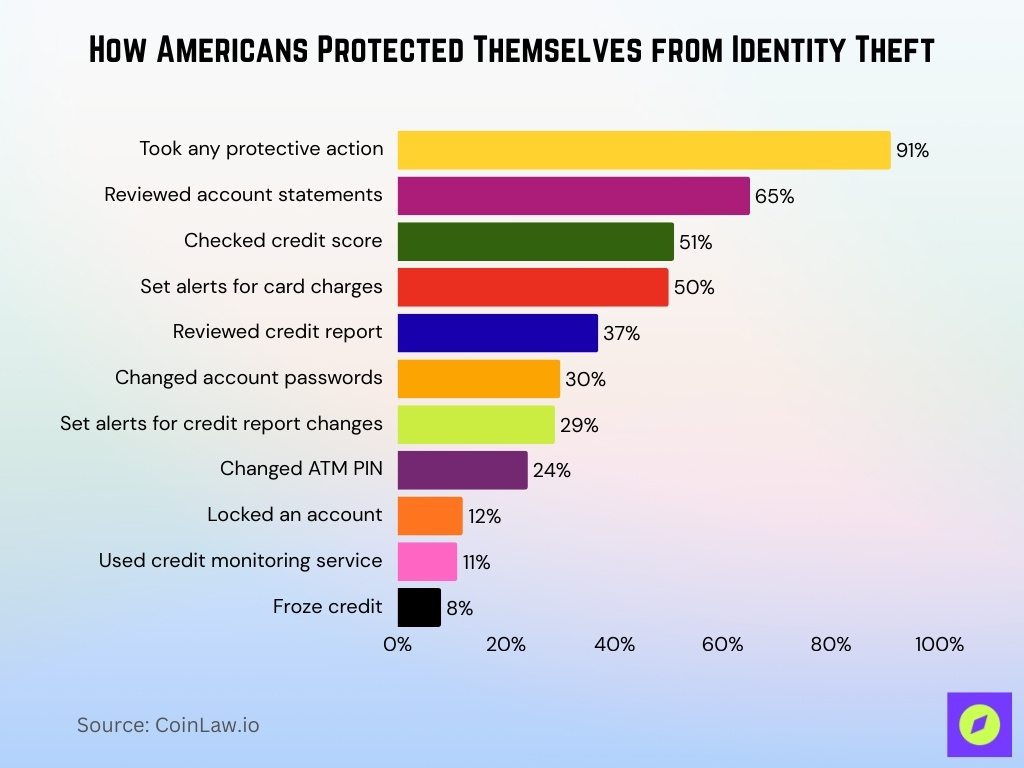

How Americans Protected Themselves from Identity Theft

- 91% of Americans took at least one action to guard against identity theft.

- 65% reviewed their online bank and credit card statements more frequently.

- 51% checked their credit score during the year.

- 50% activated alerts (text or email) for credit card charges.

- 37% reviewed their credit report for suspicious activity.

- 30% changed their bank or credit card account passwords.

- 29% set up alerts for changes on their credit reports.

- 24% changed the PIN on their ATM card as a security step.

- 12% locked at least one account to prevent unauthorized access.

- 11% subscribed to a credit monitoring service.

- Only 8% froze their credit files to block new credit inquiries.

Consumer Credit Trends

- Consumer debt rose ~2.5% year‑over‑year as of mid‑2025.

- Mortgage debt remains the largest category of outstanding consumer credit.

- Subprime borrowers held 22.1% of bankcard debt and accounted for rising delinquency metrics.

- Monthly credit trend reports show incremental increases in total U.S. debt through 2025.

- Growth in credit card balances and auto loan originations continued to outpace broader economic expansions.

- Consumer credit utilization rates indicate tightening repayment behavior in some segments.

- Reports from Q1 and mid‑year 2025 reflect diverging trends across regions globally.

Commercial and SME Credit Trends

- Overall, commercial credit applications in Q1 2025 rose by ~1.6% compared with the same period last year, showing cautious expansion post‑pandemic.

- Business loan demand climbed ~3.9% in early 2025, driven by refinancing and working capital needs.

- Asset finance applications dipped ~-2.3% year‑over‑year, indicating cautious capital expenditure among firms.

- Trade credit requests softened by ~-3.3%, reflecting slowing inventory and procurement activities.

- SME credit demand decreased by ~8.3% in Q1, suggesting smaller firms remain wary of new borrowings.

- Insolvency events surged, with ~3,393 businesses entering insolvency (+28% YOY) in Q1 2025.

- Construction sector credit demand fell by ~10.3%, the most pronounced industry contraction.

- Retail business credit activity decreased by ~7.4%, particularly among larger enterprises.

- Hospitality sector credit demand dropped ~16.9%, showing sensitivity to reduced consumer spending.

- SME insolvencies in key sectors remained elevated despite regional variations across Australia and other markets.

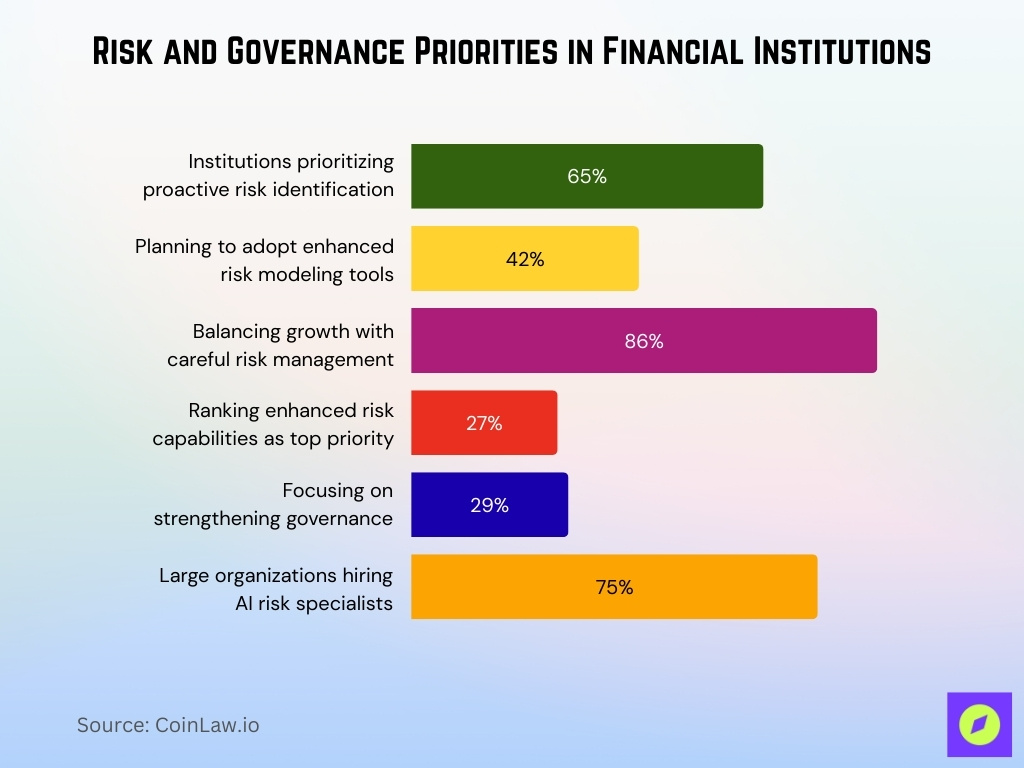

Risk Management and Compliance Metrics

- 65% of financial institutions prioritize proactive risk identification.

- 42% plan to adopt enhanced risk modeling tools.

- 86% balance growth opportunities with careful risk management.

- 27% rank enhancing risk management capabilities as top priority.

- 29% focus on strengthening governance in risk strategies.

- 75% of large organizations will hire AI risk specialists by year-end.

Credit Scores and Analytics

- VantageScore 5.0 launched in April 2025, providing improved predictive analytics and incorporating 24 months of credit behavior data.

- The updated scoring model can now generate credit scores for ~33 million more consumers, including renters.

- Approximately >10 million newly scored consumers have credit profiles of 620+, potentially expanding mortgage access.

- VantageScore’s broad acceptance includes Fannie Mae and Freddie Mac underwriting, boosting non‑FICO score use in the mortgage market.

- Equifax’s analytical services now focus on trend analytics and fraud‑risk indicators tied to real‑time behavior changes.

- Analytics insights show rising delinquencies in specific consumer segments, reinforcing risk monitoring.

- More lenders incorporate alternative data into credit decisions to improve scoring fairness and inclusivity.

- Analytics tools increasingly highlight credit utilization and payment behavior shifts over short intervals.

Products and Services Portfolio

- Workforce Solutions generated $649.4 million in Q3 revenue, up 5% year-over-year.

- USIS segment delivered $530.2 million in Q3 revenue, increasing 11%.

- Identity and Fraud segment revenue grew 12% to $366.1 million in Q3.

- VantageScore models are integrated into credit offerings for enhanced scoring.

- Consumer subscriptions provide daily credit score updates and monitoring.

- Cloud-native APIs support fintech onboarding with real-time verification.

- Premium scoring models drive risk-segmentation beyond basic files.

- Portfolio management tools enable real-time credit risk tracking.

Diversity, Equity, and Inclusion Statistics

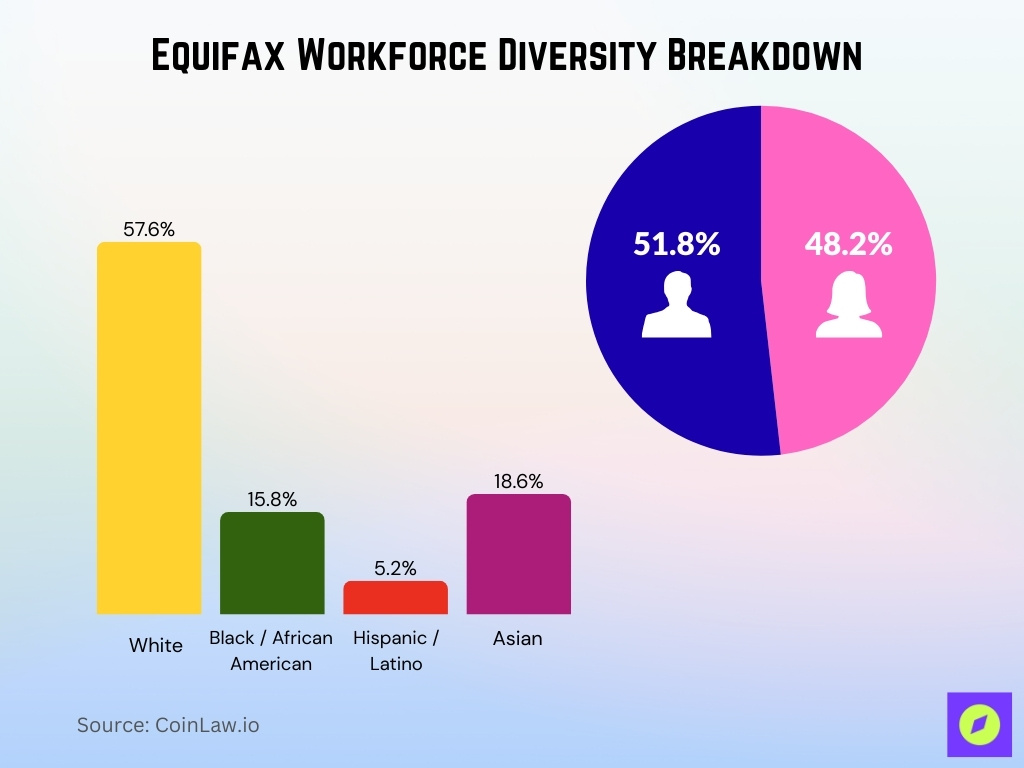

- Equifax’s workforce composition shows ~48.2% female and 51.8% male employees, reflecting gender balance trends in tech and data sectors.

- Racial and ethnic diversity includes ~57.6% White, 15.8% Black/African American, 5.2% Hispanic/Latino, and 18.6% Asian employees.

- Approximately 40% of board members are female, indicating board‑level gender diversity above some industry peers.

- Equifax was named to the Forbes Best Employers for Diversity 2024 list, underscoring its DEI recognition.

- Inclusion and diversity principles are core to corporate values and career development frameworks globally.

- Programs supporting underrepresented employees include mentorship, leadership pathways, and inclusive recruiting.

Market Share in Credit Reporting

- Big Three bureaus (Equifax, Experian, TransUnion) command over 90% of the U.S. credit agency market.

- U.S. credit agency market is valued at $18.63 billion.

- Credit reporting services hold 57.61% of the U.S. credit agency market share.

- VantageScore mortgage score usage surged 74% year-over-year in the first half.

- Equifax offers VantageScore 4.0 at $4.50 per mortgage score, over 50% below FICO.

- Credit bureaus market totals $123.89 billion globally.

- 90% of American adults have active credit files with major bureaus.

- Financial services represent 38.81% of U.S. credit agency end-user market.

Regulatory Fines, Settlements, and Legal Costs

- CFPB imposed $15 million civil penalty for FCRA violations in credit dispute handling.

- Flawed software code caused inaccurate credit scores for hundreds of thousands of consumers.

- Antitrust litigation costs reached $4.3 million ($3.2 million net of tax) in Q3.

- A federal judge allowed an antitrust lawsuit alleging a monopoly in verification services to proceed.

- Equifax processes approximately 765,000 consumer credit disputes monthly.

- CFPB order requires compliance upgrades and a penalty deposit to the victims’ relief fund.

- Past FTC fines included $2.5 million in 2000 for consumer access violations.

- Antitrust suit claims Equifax controls 40% of payroll data through exclusive agreements.

Workforce and Employee Statistics

- Equifax employs approximately 14,700 people worldwide as of 2024, spanning data science, analytics, technology, operations, and customer support.

- Its Workforce Solutions business remains a major unit, with revenue contributions from employment and income verification services growing in 2025.

- The Workforce Solutions database includes employment and payroll information for ~54 million U.S. workers, supporting staffing and HR decisions.

- Equifax’s global staffing mix covers more than 24 countries across the Americas, Europe, and Asia‑Pacific.

- Employee growth continued into 2025, aligned with expanded analytics, cloud transformation, and product innovation teams.

- Technical and data roles at Equifax have increased year‑over‑year as digital services expand.

- Customer support and professional services staffing contributed to broader revenue gains in Workforce Solutions segments.

Innovation, R&D, and Digital Transformation Metrics

- $3 billion multi-year investment completed in Equifax Cloud infrastructure.

- 90% of global revenue runs through Equifax Cloud as of June.

- Secured 62 new patents throughout the year, 20 in AI.

- Holds nearly 700 issued or pending patents across 15 countries.

- 320 patents support responsible AI initiatives.

- 95% of new models and scores are built using AI and ML.

- 52% year-over-year increase in original patent applications filed.

- 85% of revenue in Equifax Cloud is entering the year.

- 100+ new product innovations delivered annually.

ESG, Sustainability, and CSR Statistics

- Committed to net-zero greenhouse gas emissions by 2040.

- 61% of suppliers by spend have science-based emission targets.

- Scope 1 and 2 reduction target of 54.6% by 2032 validated by SBTi.

- 73% supplier engagement target for scope 3 by 2027.

- Published 2024 Climate Report, Security Report, and SASB disclosures.

- 40% senior manager roles will be occupied by females by 2026.

- $1.5 billion cloud investment supports decarbonization goals.

Frequently Asked Questions (FAQs)

Total U.S. consumer debt tracked by Equifax was $18.03 trillion as of September 2025.

Equifax was fined $15 million by the U.S. Consumer Financial Protection Bureau in January 2025.

Total U.S. consumer debt rose 2.7% year‑over‑year by September 2025.

Consumer mortgage write‑offs totaled $11.0 billion year‑to‑date through September 2025.

Conclusion

Equifax’s operational and strategic metrics reflect a blend of innovation, inclusion, and accountability. From workforce dynamics and diversity achievements to robust digital transformation and ESG integration, the company continues evolving in response to market demands and stakeholder expectations. Its focus on cloud‑enabled analytics, enhanced risk tools, and responsible business practices underscores both resilience and adaptability in a competitive credit environment. As data trends continue to shift, Equifax’s performance indicators offer a comprehensive lens on growth, compliance, and long‑term sustainability in credit reporting and analytics.