Imagine walking into a coffee shop, tapping your card, and instantly completing your payment. This seamless transaction is powered by EMV chip technology, a silent revolution in secure payments that has transformed how we shop, dine, and travel. Since its introduction, the EMV chip card has become a cornerstone of modern payment systems, ensuring not only convenience but also significantly enhanced security. With fraud reduction and global adoption on the rise, EMV chip technology is poised to dominate the payment landscape.

Editor’s Choice

- Over 14.7 billion EMV chip cards were in circulation globally by Q4 2024, marking 7% year-over-year growth.

- In the US, 96.2% of card-present transactions in 2025 used EMV chip technology, showing near-total adoption.

- Global EMV compliance reached 71.98% of issued cards in 2025, highlighting expanding worldwide adoption.

- Card-present fraud dropped 87% since EMV’s launch, with retailers seeing a 72% fall in fraudulent transactions by 2025.

- Over 80% of global card payments in 2025 were contactless EMV transactions, signaling a major consumer shift.

- The global EMV chip card market, worth $26.67 billion in 2025, is projected to hit $60.11 billion by 2034 with a 9.48% CAGR.

- Dual-interface EMV cards made up 65% of all issued EMV cards in 2025, confirming their strong global demand and versatility.

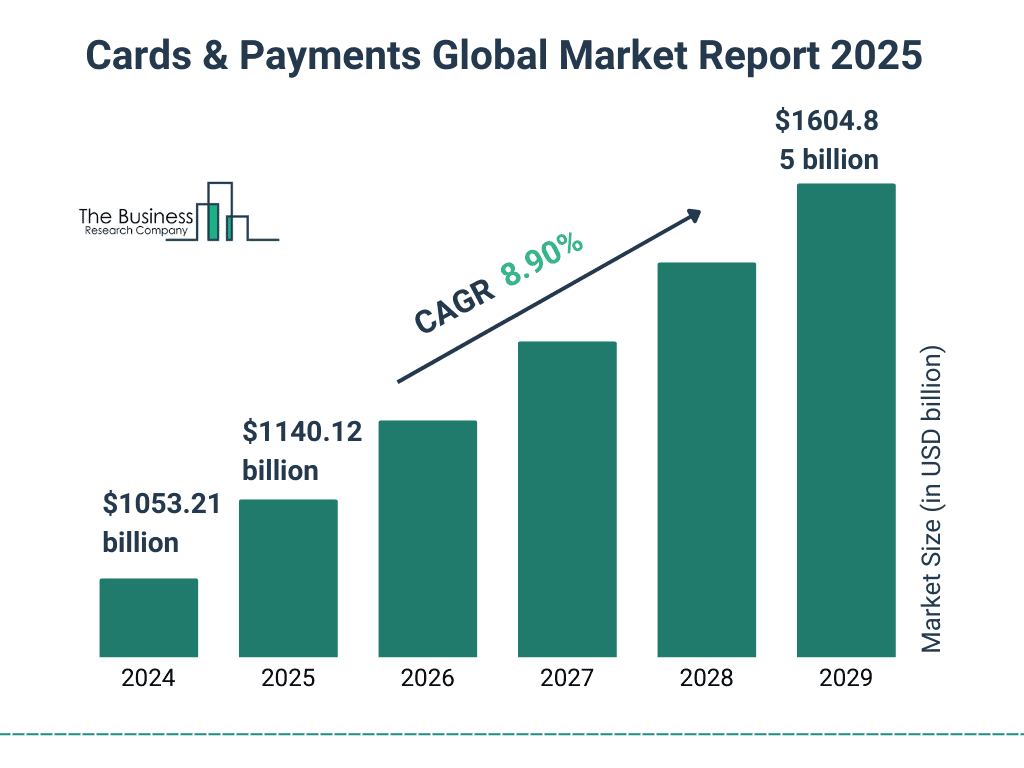

Global Cards & Payments Market Highlights

- The global cards and payments market is projected to grow to $1,140.12 billion in 2025, supported by digital transformation and cashless transaction adoption.

- Between 2024 and 2029, the market is expected to expand at a compound annual growth rate (CAGR) of 8.9%, signaling sustained momentum.

- By 2029, the total market value is forecasted to hit $1,604.85 billion, adding over $550 billion in new value within five years.

EMV Payments Adoption

- 96.2% of global card-present transactions in 2025 are conducted using EMV chip cards, a new record for secure payments worldwide.

- The US now achieves 95% EMV chip adoption for card-present payments in 2025, driven by liability shifts and security upgrades.

- Europe leads with a 99% EMV transaction adoption rate in 2025, solidifying its position as the global standard bearer.

- The APAC region leads in contactless EMV adoption with 1.9 billion cards issued to date, reflecting rapid digital integration.

- Brazil reports a 95.6% usage rate for EMV-enabled payment terminals in retail, maintaining regional leadership.

- 72% of US SMEs have deployed EMV terminals in 2025, showing accelerated uptake among small businesses.

- From 2023 to 2025, EMV-based contactless card usage grew by 37% across public transit systems in major cities such as London, New York, and Singapore, driven by tap-to-pay initiatives.

- Global EMV chip card issuance jumped 14.2% in 2025, achieving the fastest annual growth rate in digital payment history.

Global Adoption Rates

- 98% EMV adoption rate in Europe for all payment terminals in 2025, cementing its leadership in secure transactions.

- Latin America and the Caribbean hit 95% adoption in 2025, propelled by major infrastructure upgrades.

- The Asia-Pacific region accounts for 40% of global EMV chip card issuance in 2025, with China and India leading deployment volumes.

- Middle East and Africa’s EMV adoption climbed to 76% in 2025, demonstrating rapid digital progression.

- The US reached 95% EMV adoption for card-present transactions by 2025, a ninefold increase since 2015.

- Globally, 96% of ATMs are now EMV-enabled in 2025, reinforcing cardholder security for withdrawals.

- Canada stands at 100% EMV compliance for payment terminals in 2025, setting the North American benchmark.

- Australia reports a 89% rise in dual-interface EMV cards issued in 2025, accelerating contactless tech usage.

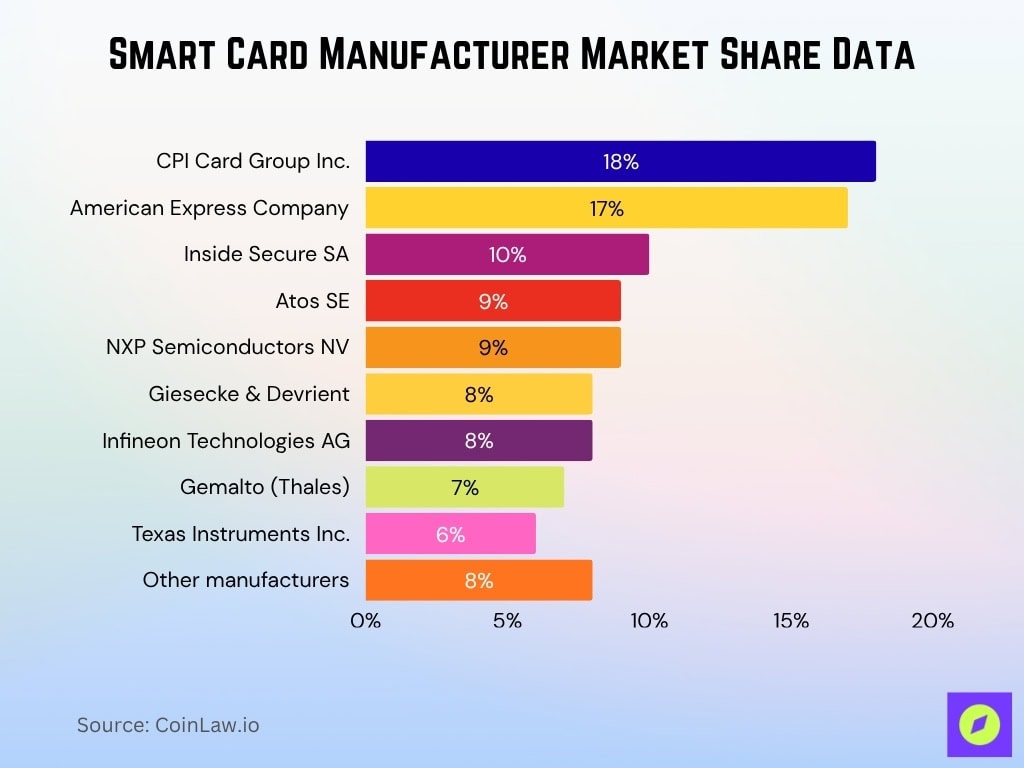

Smart Card Manufacturer Market Share Data

- CPI Card Group Inc. leads the market with an 18% share, making it a key player for both payment and identification cards.

- American Express Company follows closely at 17%, underscoring its strong presence in financial services-related smart card issuance.

- Inside Secure SA controls 10% of the market, focusing on security-enhanced solutions for digital transactions.

- Atos SE and NXP Semiconductors NV each account for 9%, reflecting their influence in both hardware and secure embedded technology sectors.

- Giesecke & Devrient and Infineon Technologies AG report shares at 8% each, positioning them as major providers in secure ID and payment technologies.

- Gemalto, now part of Thales, holds a 7% market share, shifting from its earlier position as the historical market leader.

- Texas Instruments Inc. maintains a significant niche with a 6% share, emphasizing its role in semiconductor and embedded applications.

- The “Other manufacturers” category, which encompasses a wide range of emerging and regional companies, collectively makes up 8% of market share.

Security Enhancements and Fraud Reduction

- Card-present fraud in the US has dropped by 87% since EMV chip cards, maintaining one of the lowest rates globally in 2025.

- Global payment fraud losses in 2025 exceeded $50 billion, despite a 30% drop from the pre-EMV era.

- Retailers using EMV terminals have seen a 72% reduction in fraudulent transactions with continued enhancements in 2025.

- Dynamic EMV chip authentication blocks 99.9% of cloned card attacks, maintaining strong defense over magnetic stripe methods.

- EMV technology saved the European Union $2.8 billion in fraud-related costs in 2025, an all-time high.

- Cross-border EMV transactions in 2025 record a 62% lower fraud rate versus non-EMV payments worldwide.

- Businesses upgrading with EMV report a 58% jump in customer trust and satisfaction as fraud rates declined further in 2025.

Technological Developments and Innovations

- Biometric EMV cards with fingerprint sensors represented 62% of premium banking launches in Europe and Asia-Pacific in 2025.

- Dual-interface EMV cards comprised over 65% of global EMV cards in 2025, fueling a $54.8 billion omni-channel payments market.

- Next-gen EMV chips reduced transaction times by 43% in 2025, completing in-store payments in under 0.7 seconds.

- AI-powered EMV fraud detection was used by 60% of financial institutions in 2025, boosting accuracy by 38% and cutting false alerts.

- EMV integration with mobile wallets secured 80% of digital payment systems by mid-2025, enabling smooth Apple Pay and Google Pay usage.

- Tokenized EMV transactions made up 35% of e-commerce payments in 2025, reducing chargebacks by 22% and fraud losses to $18 billion annually.

- Green EMV cards from recycled materials exceeded 70 million issued in 2025, introducing PVC-free and wooden alternatives for sustainability.

- By Q3 2025, around 40% of high-volume retail sites in developed markets used 5G-enabled EMV terminals for real-time cloud authentication.

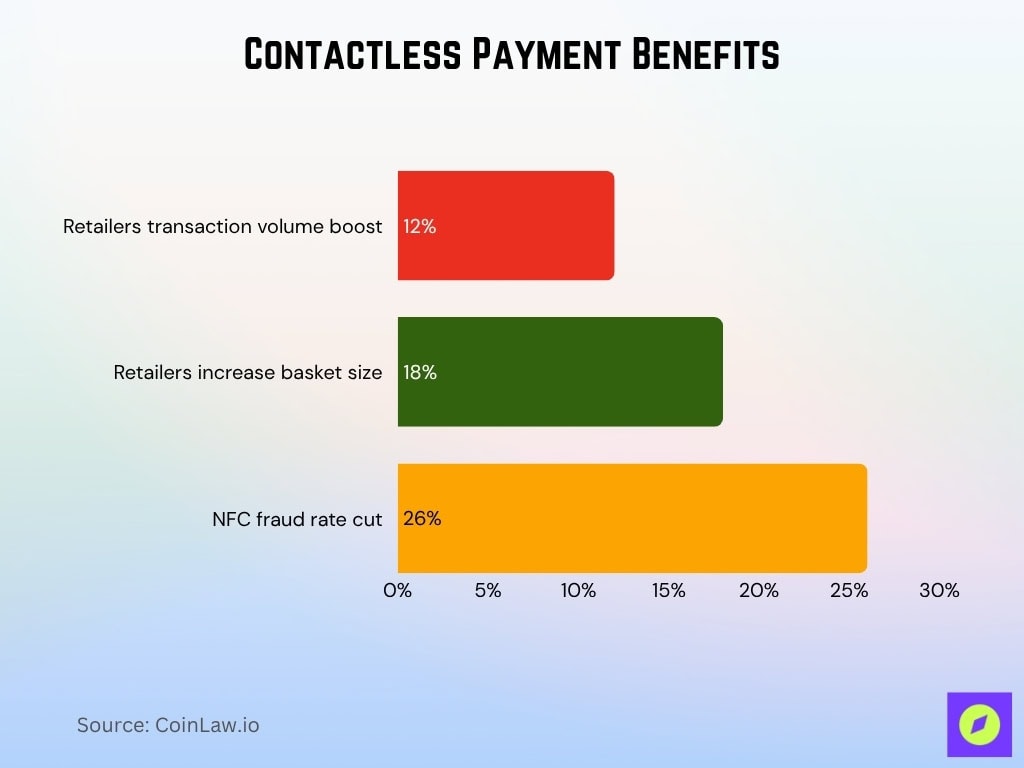

Contactless Payment Benefits

- Retailers with contactless payment systems see a 12% boost in transaction volume and an 18% increase in basket size from streamlined checkout experiences.

- EMV contactless technology protects users with dynamic cryptograms and has cut NFC fraud rates by 26%, strengthening security for billions worldwide.

- In 2025, over 80% of global card transactions are contactless, as tap-and-go technology drives the $35.4 billion market size.

- Contactless EMV payments cut transaction times by 30%, leading to a 20% faster checkout speed and higher customer satisfaction for retailers.

- The global issuance of contactless EMV cards rose by 23% in 2025, exceeding 5.2 billion cards in circulation.

- 66% of U.S. consumers report using contactless payments regularly in 2025, marking strong adoption and a trend toward digital wallets.

- Contactless EMV payments now accepted at over 150 public transit systems globally in 2025, reducing commuter wait times by 20%.

- 97% of EMV-enabled terminals worldwide process contactless payments in 2025, up from 94% in 2024, reflecting global infrastructure upgrades.

Regional Deployment Statistics

- Europe leads with 97% EMV compliance across payment terminals in 2025, maintaining its global benchmark for secure payments.

- North America hit 95% EMV adoption for card-present transactions, with over 1.5 billion EMV cards issued by mid-2025.

- The Asia-Pacific region holds 40% of global EMV card issuance, with rapid growth in India, China, and Southeast Asia markets.

- South America reached 92% EMV compliance, fueled by robust adoption in Brazil, Chile, and Mexico.

- The Middle East now achieves 95% EMV adoption in top markets like UAE, Saudi Arabia, and Qatar, up from 72% in 2023.

- African nations improved to 65% EMV adoption in 2025, driven by digital inclusion and strategic partnerships with major banks.

- Canada retains 99%+ EMV deployment, ensuring secure transactions and setting standards for North America.

- China leads with over 4.1 billion EMV chip cards issued in urban centers, reinforcing its status as the world’s fastest-growing card market.

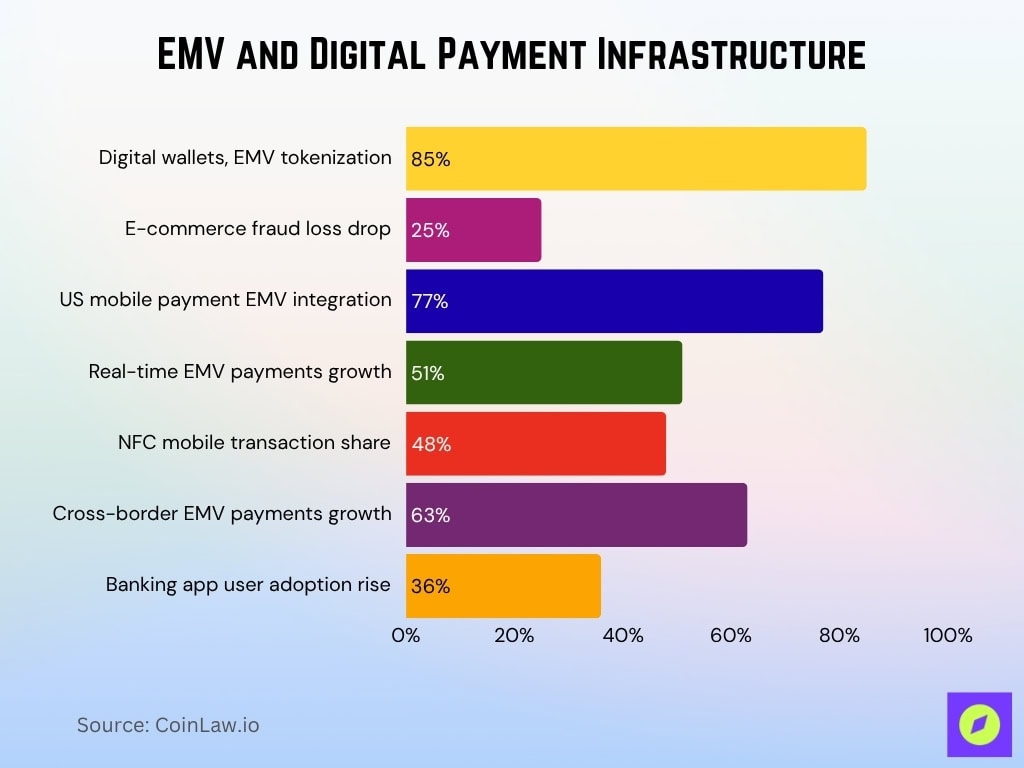

EMV and Its Digital Payment Infrastructure

- 85% of digital wallets globally support EMV tokenization in 2025, delivering safe mobile and online payments for over 2.8 billion consumers.

- Integrating EMV tokenization into online transactions helped reduce e-commerce fraud losses by 25% globally in 2025, particularly in markets with high contactless and mobile wallet adoption.

- EMV-enabled systems power 77% of all U.S. mobile payments in 2025, reflecting widespread integration into top banking and fintech apps.

- Real-time EMV-enabled payments climbed 51% in 2025, with instant peer-to-peer and B2C transactions defining the digital payment landscape.

- NFC-based EMV technology drives 48% of global mobile transactions in 2025, strengthening leaders like Google Pay and Apple Pay.

- Cross-border digital EMV payments grew 63% in 2025, streamlining international commerce and travel with secure settlement.

- 5G-powered EMV terminals now process payments in under 1 second at urban locations, driving high-speed retail adoption.

- Banking apps using EMV standards saw a 36% rise in user adoption in 2025, as convenience and enhanced security attract new users.

Recent Developments

- Biometric-enabled EMV cards surpassed 24 million global users in 2025, fueled by rising security adoption and fintech expansion.

- Visa and Mastercard achieved 98% global EMV terminal compliance by mid-2025, nearing universal payment acceptance.

- Banks issued EMV cards made with 72% recycled materials in 2025, introducing 35 million new eco-friendly cards.

- EMV-enabled wearables rose 48% in usage in 2025, surpassing $78 billion in transaction value and reflecting portable payment growth.

- The ISO 20022 standard covered 38.5% of global cross-border payment traffic by April 2025, improving EMV-FI interoperability.

- Contactless EMV payments in rural areas surged 34% in 2025, supported by government-led digital modernization efforts.

Frequently Asked Questions (FAQs)

Over 14.7 billion EMV chip cards are in circulation worldwide as of the end of 2024, a 7% increase year-over-year.

96% of card-present transactions worldwide rely on EMV chip cards for secure payments.

The Asia-Pacific region holds 40% of all EMV chip cards issued globally.

EMV chip adoption has helped reduce counterfeit card-present fraud and contributed to saving the industry over $10 billion annually in losses globally as of 2025.

Conclusion

EMV chip technology has become the backbone of secure and convenient payment systems worldwide. With its ability to reduce fraud, facilitate contactless transactions, and integrate seamlessly into digital platforms, EMV is shaping the future of payments. As regions and industries continue adopting this technology, consumers can expect safer, faster, and more innovative ways to pay. The journey of EMV chip cards is far from over, and its role in transforming global commerce is only just beginning.