DMG Blockchain Solutions Inc. has become a notable public company in the Bitcoin mining and blockchain infrastructure space, blending digital asset mining with advanced data center services. Today, the company logged significant growth in revenue, mining output, and digital asset holdings, reflecting wider adoption of blockchain technology and institutional interest in Bitcoin reserves.

Industries such as crypto mining infrastructure and digital custody services illustrate how companies like DMG are driving tangible impact through secure mining operations and data center expansion. Below, explore comprehensive statistics that shape DMG’s positioning as a dynamic player.

Editor’s Choice

- 40% year-over-year revenue growth in FY2025, rising to CAD $47.3 million.

- 344 Bitcoin mined in FY2025, with nearly 342 BTC retained at year-end.

- Cash flow from operations up 97% to CAD $16.2 million.

- Hashrate improved to 1.70 EH/s with better energy efficiency.

- Bitcoin balance reached 403 BTC at year-end 2025.

- Preliminary January 2026 BTC balance grew to 414 BTC.

- Expanded data center initiatives, including U.S. facility plans.

Recent Developments

- February 2026, January operational results reported 23 BTC mined with a balance of 414 BTC.

- December 2025, DMG mined 23 BTC in Dec and increased its hashrate to 1.77 EH/s, ending the month with 403 BTC.

- November 2025, Announced asset purchase for first U.S.-based data center launch.

- September 2025, Preliminary results showed a balance of 342 BTC with 23 BTC mined.

- 2025, Participation in Digital Assets 2025: Bitcoin and Beyond conference.

- Software and services expansion through blockchain infrastructure platforms.

- Energy efficiency incentive of $1.5 million recognized for operations.

- Ongoing discussions to convert Christina Lake into an AI-focused data center.

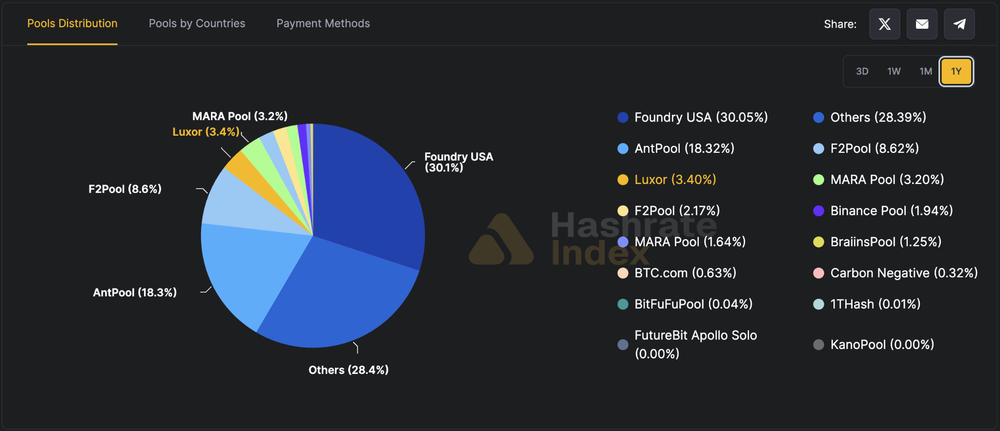

Bitcoin Mining Pool Distribution

- Foundry USA dominates the Bitcoin mining landscape with approximately 30.05% of total hashrate, making it the largest pool globally.

- AntPool ranks second with about 18.32% share, reinforcing the strong presence of major Chinese-linked mining infrastructure.

- The category labeled “Others” collectively controls 28.39%, showing that a large portion of hashrate remains fragmented across smaller pools.

- F2Pool holds 8.62%, maintaining its long-standing position among the top global mining pools.

- Luxor accounts for 3.40%, reflecting its growing influence, particularly in North American mining operations.

- MARA Pool contributes 3.20%, highlighting Marathon Digital’s strategy to mine within its own proprietary pool.

- Binance Pool captures 1.94%, representing the exchange’s integrated mining services segment.

- An additional MARA Pool segment at 1.64% suggests separate reporting categories or sub-pool distribution.

- Braiins Pool controls 1.25%, notable as one of the oldest Bitcoin mining pools and the developer of Slush Pool technology.

- BTC.com holds 0.63%, indicating a smaller but still measurable presence in the ecosystem.

- Environmentally focused operations such as Carbon Negative mining represent 0.32%, signaling early adoption of green mining initiatives.

- Smaller participants, including BitFuFuPool (0.04%) and 1THash (0.01%), contribute only marginal shares.

- Solo or niche operations such as FutureBit Apollo Solo and KanoPool register near 0%, showing the extreme concentration of industrial-scale mining.

- A secondary listing shows F2Pool at 2.17%, which may reflect a separate sub-pool or alternative measurement methodology.

Profitability and Net Income Metrics

- DMG Blockchain Solutions reported FY2025 revenue of CAD $47.3 million, up approximately 40% year over year, reflecting stronger Bitcoin production and higher average BTC prices.

- Gross profit for FY2025 reached roughly CAD $18.6 million, compared with CAD $12.1 million in FY2024, improving gross margin performance.

- Cash flow from operations increased 97% year over year to CAD $16.2 million in FY2025, strengthening internal funding capacity.

- In FY2025, DMG reported a net loss of approximately CAD $10.3 million, while comprehensive income turned positive at about CAD $11.3 million, reflecting stronger BTC revaluation gains and asset growth.

- EBITDA for FY2025 reached about CAD $14.8 million, compared with CAD $7.9 million in the prior year, nearly doubling profitability metrics.

- Average revenue per Bitcoin mined improved in 2025 due to higher BTC spot prices, aligning with broader market recovery trends.

- Energy efficiency incentives totaling $1.5 million were recognized in early 2026, positively impacting operating margins.

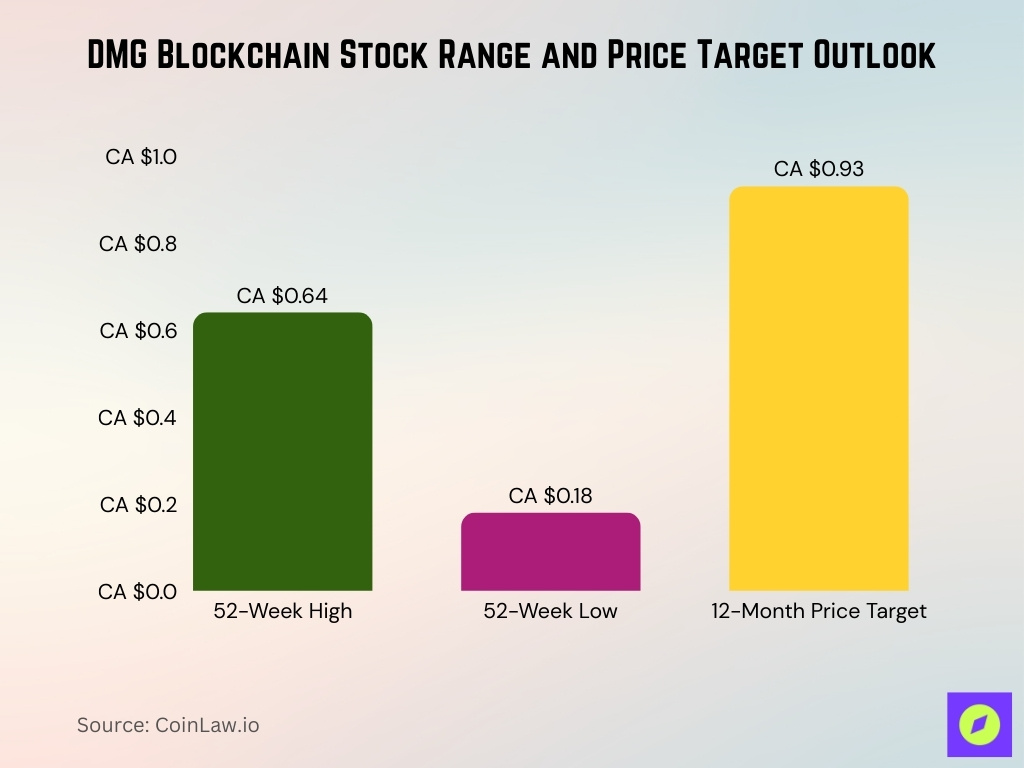

Market Position and Ranking

- 52-week stock range: high~CA$0.64 and low ~CA$0.18.

- The average 12-month price target of roughly CA$0.93 implies potential upside.

- DMG is publicly traded under TSX-V: DMGI.V and OTCQB: DMGGF.

- Ranked among Canadian public companies with significant Bitcoin holdings.

- DMG’s business model includes mining, AI compute, and digital custody services.

- Competes with other mining and blockchain infrastructure firms like Argo and Bitcoin Well.

- DMG is expanding beyond mining into blockchain software solutions.

Stock Performance Statistics

- DMG trades on the TSX Venture Exchange under ticker DMGI.V and on OTCQB as DMGGF.

- As of early 2026, the company’s market capitalization hovered around CAD $50 million, reflecting recovery from 2023–2024 lows.

- The stock recorded a 52-week high near CAD $0.64 and a low near CAD $0.18, illustrating volatility typical of crypto-exposed equities.

- Year-to-date 2026 performance showed moderate gains aligned with Bitcoin’s upward trend above $60,000 levels.

- Analyst consensus price targets suggest potential upside toward CAD $0.90–$0.95, depending on BTC price stability.

- DMG’s beta remains above 2.0, indicating high correlation with Bitcoin price movements and broader crypto market swings.

- Share count outstanding exceeded 200 million shares in 2025, reflecting capital raises and equity financing in prior years.

- Trading volumes surged during major Bitcoin rallies in late 2025, with monthly volumes exceeding historical 12-month averages.

- Institutional ownership remains relatively limited compared with larger U.S.-listed mining firms, reflecting its TSX-V listing profile.

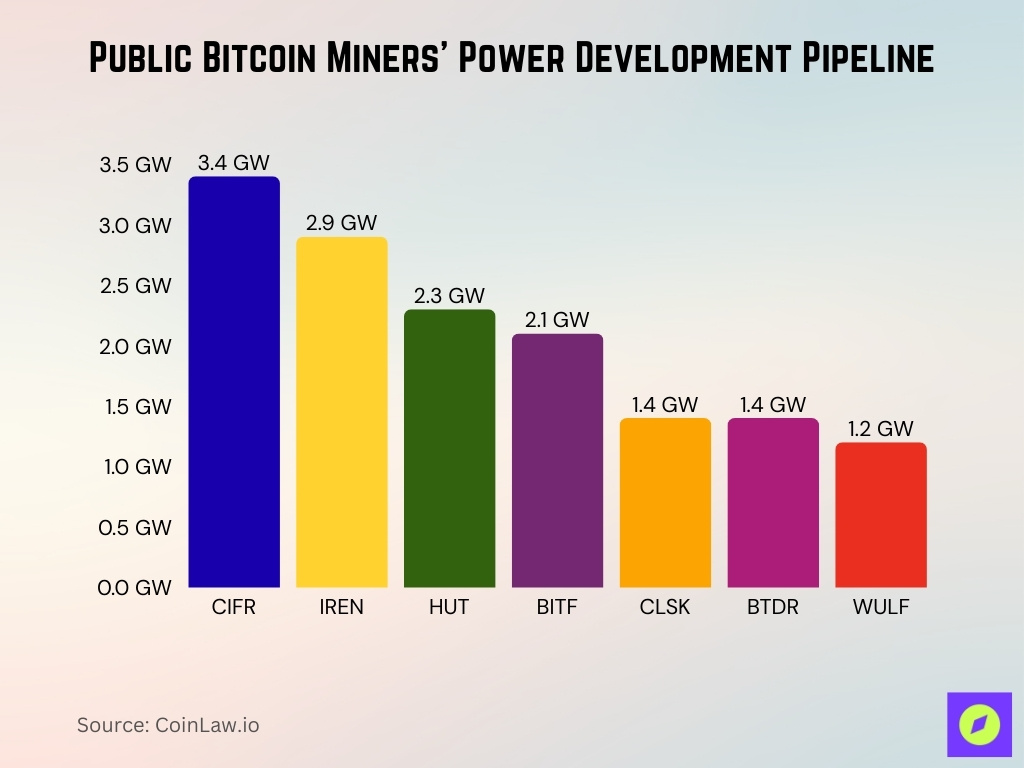

Public Bitcoin Miners’ Power Development Pipeline

- CIFR leads the expansion race with the largest planned capacity at 3.4 GW, positioning it as a major future player in large-scale Bitcoin mining infrastructure.

- IREN follows closely with 2.9 GW, signaling aggressive growth ambitions and substantial long-term energy commitments.

- HUT plans 2.3 GW of power capacity, reinforcing its strategy to scale mining operations and high-performance computing capabilities.

- BITF targets 2.1 GW, placing it among the top tier of miners investing heavily in new energy-backed facilities.

- CLSK and BTDR each project 1.4 GW, indicating comparable mid-range expansion pipelines among publicly listed miners.

- WULF reports 1.2 GW of planned capacity, still representing a significant build-out despite being the smallest pipeline among the companies listed.

- Collectively, these public miners are developing approximately 15 GW of power capacity, highlighting the enormous energy requirements of industrial Bitcoin mining.

Trading Volume and Liquidity Metrics

- Average daily trading volume on TSX-V in 2025 ranged between 250,000 and 500,000 shares, depending on BTC market conditions.

- OTCQB trading activity in the U.S. contributed additional liquidity, averaging over 100,000 shares daily in peak months.

- During December 2025 Bitcoin rallies, daily volume spikes exceeded 1 million shares, highlighting speculative inflows.

- Bid-ask spreads narrowed during periods of heightened crypto interest, improving short-term liquidity.

- DMG’s free float represents a substantial portion of outstanding shares, enhancing trading flexibility for retail investors.

- Liquidity ratios improved in FY2025, with the current ratio estimated above 2.0, indicating short-term financial stability.

- The company’s dual listing structure supports cross-border investor access, especially from U.S. crypto-focused traders.

- Compared with major U.S. miners like Marathon Digital, DMG trades at lower absolute volumes but maintains steady participation within Canadian small-cap crypto equities.

- Periods of Bitcoin halving cycle volatility in 2024–2025 corresponded directly with elevated DMG trading activity, reinforcing its crypto-linked equity profile.

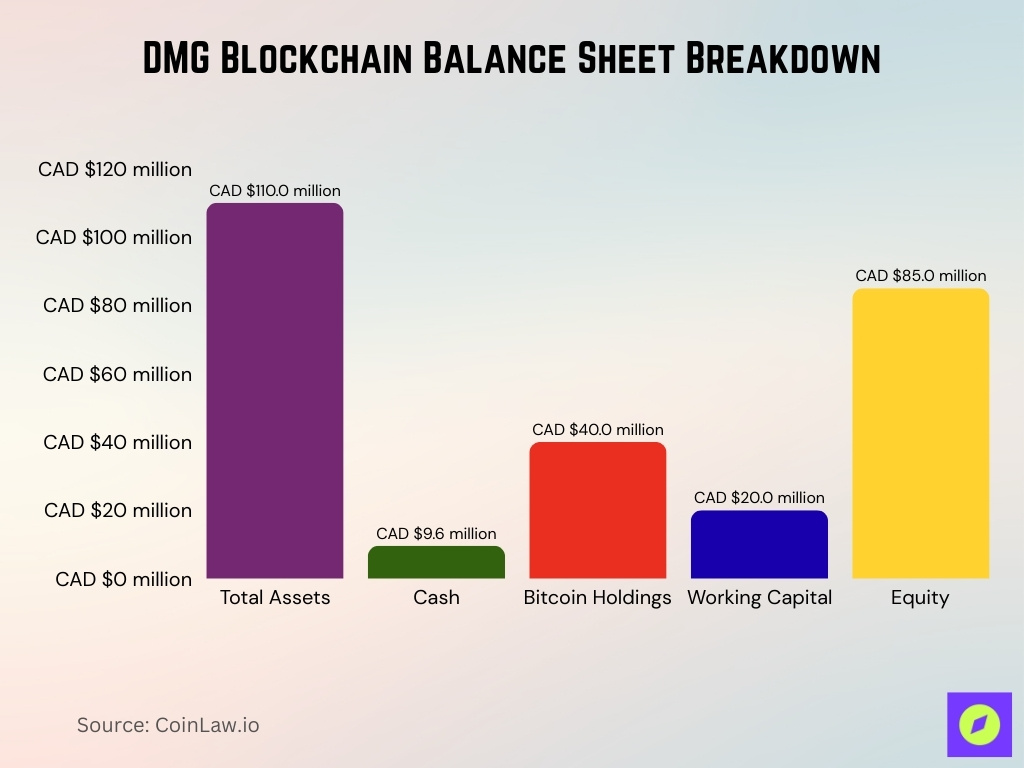

Balance Sheet Statistics

- As of the FY2025 year-end, DMG held approximately 403 BTC, valued at prevailing market prices, strengthening its digital asset reserve base.

- Total assets increased to roughly CAD $110 million, reflecting asset revaluation and expanded infrastructure investments.

- Cash and cash equivalents stood at approximately CAD $9.6 million at fiscal year-end 2025.

- Digital asset holdings represented a significant share of total assets, with Bitcoin valued in excess of CAD $40 million at year-end pricing.

- Working capital improved year over year, exceeding CAD $20 million in FY2025, supporting operational resilience.

- Total liabilities declined compared with FY2024, improving the company’s debt-to-equity ratio.

- Shareholders’ equity expanded to approximately CAD $85 million, reflecting retained earnings and asset appreciation.

- DMG maintained a relatively low long-term debt profile compared with several peer mining companies, positioning it conservatively within the sector.

Bitcoin Treasury and Holdings Statistics

- As of December 31, 2025, DMG held approximately 403 BTC, up from roughly 342 BTC earlier in the fiscal year, reflecting a strong treasury accumulation strategy.

- Preliminary January 2026 updates reported Bitcoin holdings increased further to 414 BTC, signaling continued retention of mined assets.

- In FY2025, DMG mined 344 BTC, retaining the vast majority rather than liquidating into fiat, aligning with a long-term treasury strategy.

- At Bitcoin prices near $60,000–$65,000 in early 2026, DMG’s BTC holdings represented an estimated market value exceeding CAD $35–$40 million, depending on spot pricing.

- DMG ranks among publicly listed Canadian companies with meaningful Bitcoin reserves, as tracked by BitcoinTreasuries.

- The company retained nearly 99% of BTC mined in FY2025, underscoring a strategic shift from immediate monetization to balance sheet strengthening.

- BTC holdings accounted for a significant portion of total assets, making digital asset price volatility a direct driver of book value fluctuations.

- During 2024’s Bitcoin halving cycle, DMG adjusted its treasury management strategy to optimize post-halving reward economics.

- Management continues to evaluate treasury optimization, including selective BTC sales for capital deployment while maintaining a core reserve strategy.

Data Center and Infrastructure Capacity Metrics

- Christina Lake facility operates at 1.69 EH/s in January.

- The company mined 23 BTC in January, matching December’s output.

- Bitcoin holdings reached 414 BTC by the end of January.

- Awarded $1.5 million energy efficiency incentive for DLC tech.

- Plans 50 MW liquid-cooled AI data center at Christina Lake.

- US Oregon facility: 27,600 sq ft building on 8 leased acres.

- Fleet efficiency improved via hydro direct liquid cooling upgrades.

- Withdrew prior 3 EH/s end-2025 hashrate guidance for AI shift.

Capital Expenditure and Investment Metrics

- FY2025 revenue reached $47.3 million, up 40% from $33.9 million in the prior year.

- Operating cash flow hit $16.2 million, surging 97% from $8.2 million.

- Cash, investments, and digital assets totaled $65.2 million at year-end.

- Capital expenditures approximated CAD $20.64 million for the period.

- Acquired 2 MW prefabricated AI data center infrastructure.

- Purchased a US Oregon data center building for 27,600 sq ft.

- Short-term investments purchased for $9.1 million.

- Utilities expenses rose by $6.3 million due to capacity expansion.

Frequently Asked Questions (FAQs)

DMG held 414 BTC as of January 31, 2026.

The company’s hashrate averaged 1.69 EH/s in January 2026.

Revenue is forecasted to decline by 22% annualized to the end of 2026.

The projected average DMGGF stock price in 2026 is $0.6572.

Conclusion

DMG Blockchain Solutions enters this year with measurable gains in revenue growth, operational efficiency, and Bitcoin treasury expansion. The company strengthened its balance sheet, nearly doubled operating cash flow year over year, and increased BTC reserves. At the same time, infrastructure expansion into the U.S. and exploration of AI data center applications show a strategic push beyond pure mining.

However, DMG’s performance remains closely tied to Bitcoin price volatility and post-halving economics. Its modest market capitalization and trading liquidity reflect its small-cap profile, yet its disciplined treasury strategy and low-carbon infrastructure differentiate it within the Canadian mining sector.