The story of Cyber Monday is one of innovation meeting consumer enthusiasm. Born out of the online shopping boom, Cyber Monday has evolved into a global phenomenon. Today, as digital commerce reaches new heights, this day stands as a beacon of convenience and competitive pricing for shoppers worldwide. From record-breaking sales to shifting consumer behaviors, the numbers reveal much about the e-commerce landscape’s transformation. Let’s dive into the statistics that paint a vivid picture of Cyber Monday’s immense impact.

Editor’s Choice

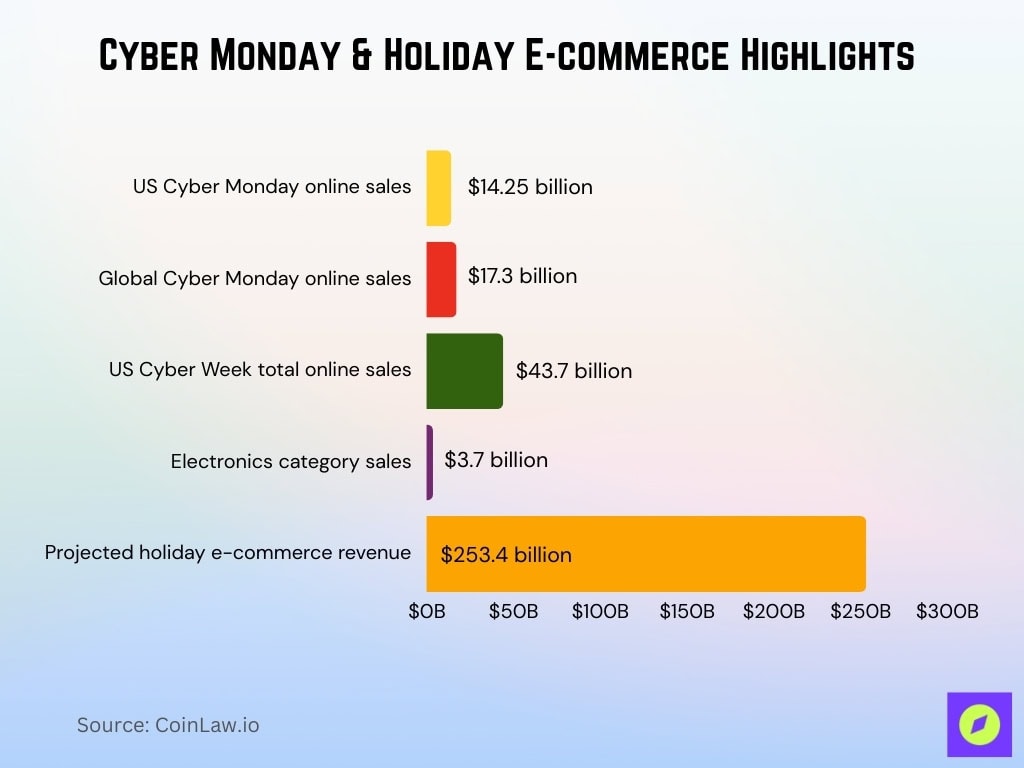

- $14.25 billion in online sales marked Cyber Monday 2025 as the biggest shopping day ever, up 7.1% YoY.

- Mobile commerce accounted for 57.5% of Cyber Monday purchases, totaling $8.2 billion, an 8% increase YoY.

- Peak spending reached $16 million per minute from 8-10 p.m. EST on Cyber Monday.

- Electronics sales hit $3.7 billion with discounts averaging 31%, a 12.8% increase YoY.

- Buy Now Pay Later (BNPL) transactions totaled $10.1 billion during the season, growing 9% YoY.

- Social commerce surged 56.5% YoY, making up 3.6% of Cyber Monday revenue.

- 75.9 million Americans shopped online on Cyber Monday, up from 64.4 million in 2024.

- Holiday season e-commerce sales are forecast to reach $253.4 billion, a 5.3% growth year over year.

E-Commerce Revenue Growth on Cyber Monday

- $14.25 billion US Cyber Monday online sales marked 7.1% YoY growth.

- Global Cyber Monday online sales hit $17.3 billion, up 5.3% YoY.

- Cyber Week totaled $43.7 billion in US online sales, surging 7.7% YoY.

- SMBs captured a significant share of $14.25 billion Cyber Monday revenue, leveraging online trends.

- Electronics generated $3.7 billion, leading with 31% peak discounts and 12.8% growth.

- Holiday e-commerce projected at $253.4 billion, a 5.3% YoY rise post-Cyber Week.

- Cross-border orders reached 16% of total, with 20.4 million Shopify cross-border orders up 20% YoY.

- AI-powered tools drove a 46% conversion rate increase during Black Friday/Cyber Monday.

- Free shipping boosts sales by up to 50% in conversion rates on Cyber Monday.

Mobile vs. Desktop Shopping Statistics

- 57.5% of Cyber Monday 2025 sales came from mobile devices, totaling $8.2 billion, up 8% YoY.

- Desktop accounted for 42.5% of Cyber Monday transactions, behind mobile dominance.

- Mobile drove 52.8% of season-to-date online sales at $73.7 billion, up 7.2% YoY.

- Mobile apps show 2.8% conversion rates vs. 2.2% for mobile web.

- Apps deliver 15% higher AOV at $112 compared to $86 on mobile web.

- Mobile hit 61.6% of Thanksgiving transactions, the highest ever.

- Desktop maintains strength in high-AOV categories and EMEA markets.

- 83% mobile cart abandonment vs. 67% desktop highlights optimization needs.

Payment Method Trends

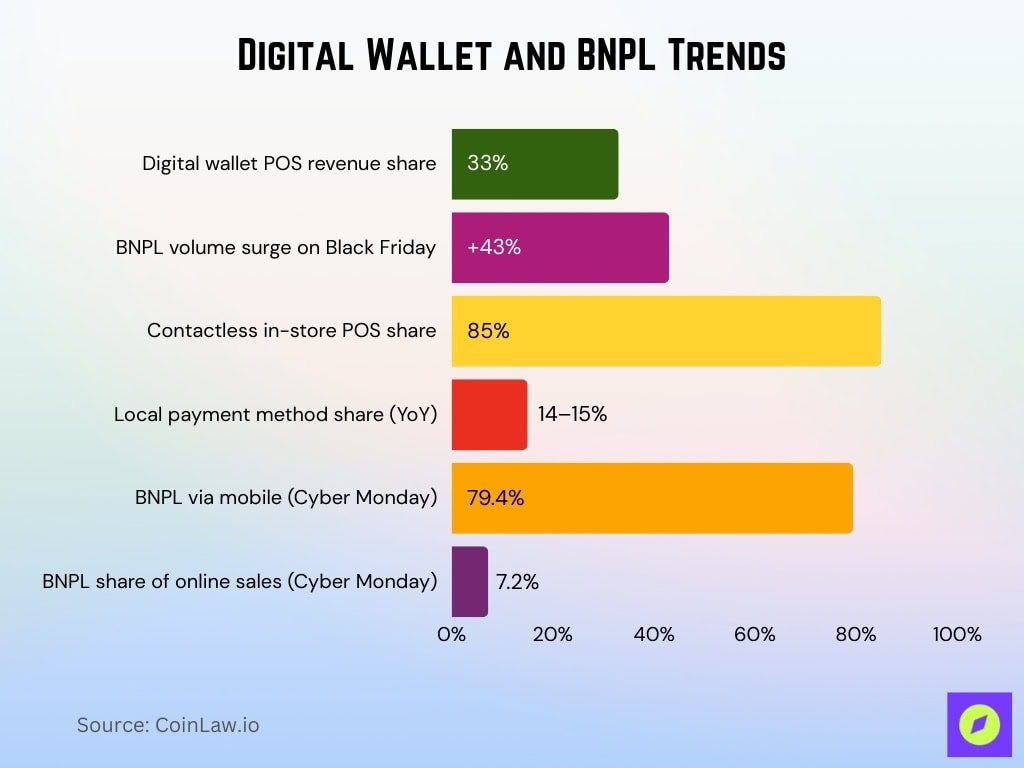

- $1.03 billion in BNPL sales on Cyber Monday 2025 exceeded $1 billion for the first time, up 4.2% YoY.

- Digital wallets captured 33% of Black Friday POS revenue, rising from 21% last year.

- BNPL volume surged 43% on Black Friday versus the prior month.

- Contactless payments reached 85% of in-store POS during BFCM 2025, up from 81%.

- Local payment methods maintained a 14-15% share across all channels YoY.

- 79.4% of BNPL transactions occurred via mobile devices on Cyber Monday.

- 7.2% of total online sales derived from BNPL amid $14.25 billion Cyber Monday spend.

- Adyen processed $43 billion total BFCM volume with diverse payment methods.

Impact of ‘Buy Now, Pay Later’ Services

- $1.03 billion in BNPL sales on Cyber Monday 2025 marked the first time exceeding $1 billion, up 4.2% YoY.

- BNPL comprised 7.2% of the total $14.25 billion Cyber Monday online sales.

- 79.4% of BNPL transactions occurred on mobile devices during Cyber Monday.

- Millennials accounted for 51% of BNPL purchases over the BFCM weekend.

- Electronics, apparel, toys, and furniture led BNPL category usage on Cyber Monday.

- Season-to-date BNPL spending hit $10.1 billion, projected $20.2 billion holiday total up 11% YoY.

- Zip processed 1.6 million BNPL transactions across 280,000 locations during BFCM.

Cyber Week Revenue Breakdown Highlights

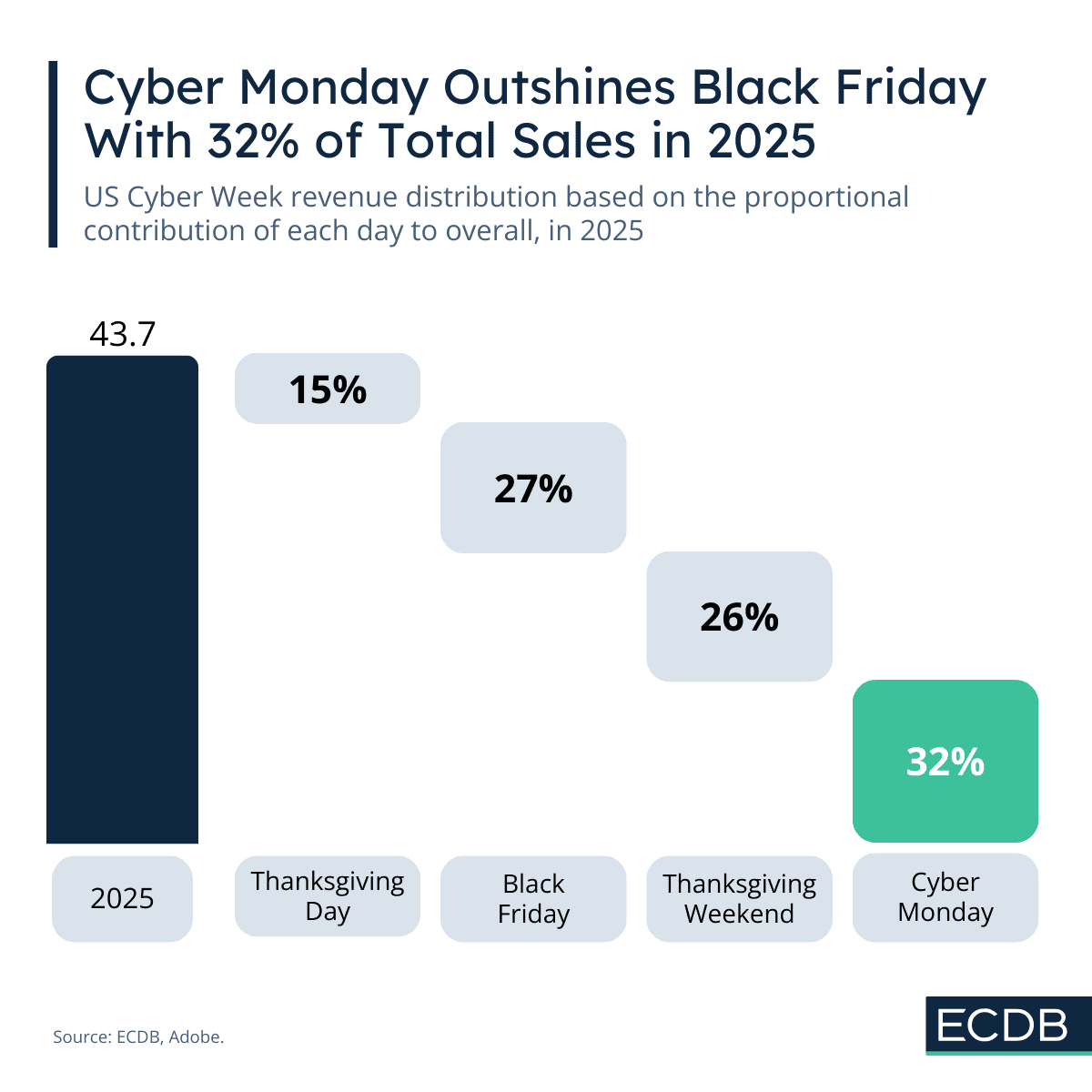

- Cyber Monday accounted for 32% of total US Cyber Week sales, making it the highest-grossing day of the event.

- Black Friday followed closely, capturing 27% of the overall Cyber Week revenue.

- Thanksgiving Weekend contributed 26%, maintaining strong momentum across Saturday and Sunday.

- Thanksgiving Day sales made up 15% of the week’s total, showing early shopper engagement.

- The total US Cyber Week online sales reached $43.7 billion in 2025, reflecting robust consumer spending.

- Cyber Monday’s dominance signals a continued shift toward mobile-first, end-of-week shopping peaks during the holiday season.

Global Participation and Regional Insights

- $17.3 billion global Cyber Monday online sales up 5.3% through midday, projected $52.7 billion full day.

- North America dominated US $14.25 billion Cyber Monday sales within $17.3 billion global total.

- 16% of Shopify orders were cross-border at 20.4 million, up 20% YoY.

- Stripe cross-border volume hit $4.4 billion BFCM, 11% of total transactions, up 37% YoY.

- Asia-Pacific saw 69% e-commerce firms report higher BFCM sales than in 2024, Thailand at 88%.

- $336.6 billion Cyber Week global sales up 7% YoY led by AI agents.

- US dollars, euros, and GBP topped Stripe BFCM currency volumes.

- 81 million customers shopped on Shopify BFCM globally, $14.6 billion in sales.

Black Friday vs Cyber Monday: Generational Shopping Preferences

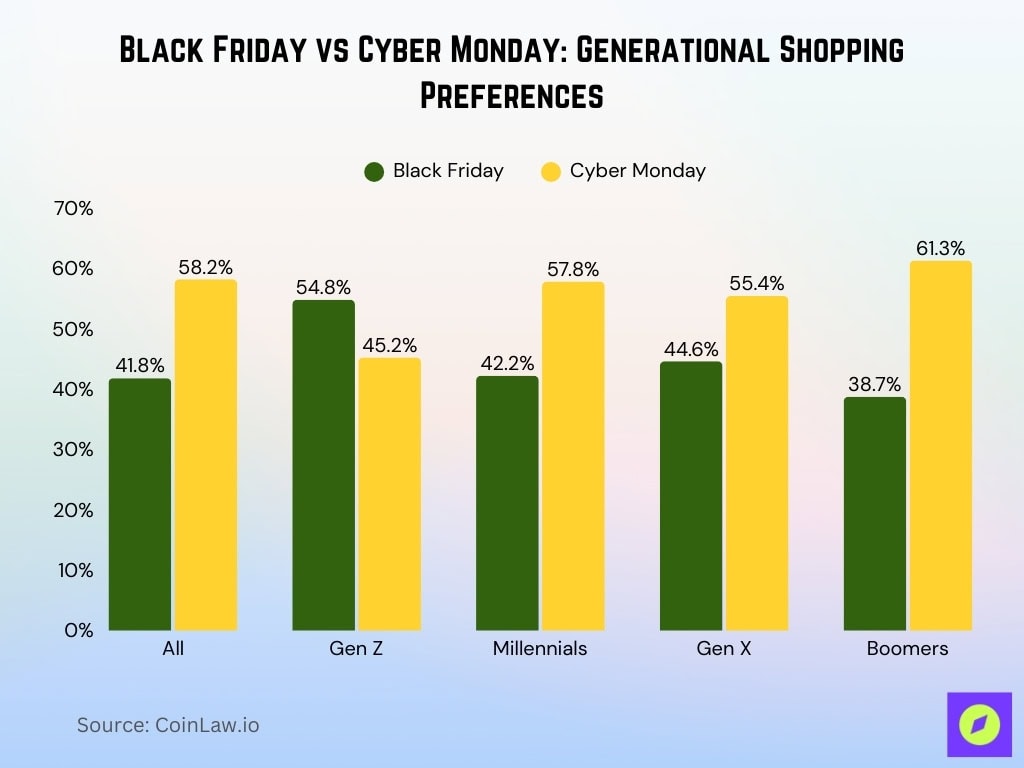

- 58.2% of Americans overall preferred Cyber Monday, while 41.8% favored Black Friday.

- Gen Z stood out as the only generation preferring Black Friday, with 54.8% choosing it over Cyber Monday (45.2%).

- Millennials leaned toward Cyber Monday, with 57.8% preferring it versus 42.2% for Black Friday.

- Gen X also favored Cyber Monday at 55.4%, compared to 44.6% for Black Friday.

- Boomers showed the strongest Cyber Monday preference, with 61.3% selecting it over 38.7% who preferred Black Friday.

- The trend reflects a generational shift, with older shoppers gravitating toward online deals, especially during Cyber Monday.

Recent Developments

- AI agents influenced 20% of Cyber Week orders, driving $67 billion in global sales.

- AI-driven shoppers converted at 15.9% vs 1.8% organic search during Cyber Monday.

- AR virtual try-ons boosted conversions by 94% and 27% higher order likelihood.

- Retailers with AI agents saw 32% faster sales growth during Cyber Week 2025.

- Gamification increased engagement by 48% across marketing channels.

- AI traffic to US retail sites surged 670% on Cyber Monday alone.

- AR experiences reduced returns by 25-40% in fashion e-commerce.

Frequently Asked Questions (FAQs)

$14.25 billion in US online sales, up 7.1% YoY.

57.5% of sales or $8.2 billion from mobile, up 8% YoY.

$1.03 billion in BNPL sales, 7.2% of total and up 4.2% YoY.

$17.3 billion globally through 12 p.m. ET, up 5.3% YoY.

Conclusion

Cyber Monday has cemented itself as a cornerstone of global e-commerce, showcasing remarkable growth and evolution. In the US alone and with significant participation worldwide, it highlights the dynamic interplay of technology, consumer behavior, and global market trends. From the rise of mobile commerce to the influence of social media and AI, Cyber Monday reflects the innovations shaping modern retail. As we look to the future, the ongoing advancements in personalization, payment flexibility, and sustainable practices promise even greater opportunities for businesses and shoppers alike.