Crypto tax evasion is gaining global attention as tax authorities, regulators, and blockchain analysts ramp up efforts to monitor undeclared income, capital gains, and offshore digital asset holdings. As decentralized finance (DeFi), NFTs, and privacy coins grow in popularity, governments are racing to close the widening compliance gap. From IRS crackdowns in the U.S. to cross-border enforcement in Europe, crypto’s pseudonymous nature poses unprecedented challenges for tax collection.

Whether it’s an NFT flipper dodging IRS scrutiny or large-scale use of mixers to hide Bitcoin transactions, the risks and implications are real. This article explores the most recent data, trends, and enforcement outcomes shaping the crypto tax landscape.

Editor’s Choice

- 88% of crypto users failed to report taxable transactions in a 2024 study from a major developed economy.

- The IRS collected $235 million in unpaid crypto taxes in 2024, reflecting rising detection rates.

- A Chainalysis report noted $40.9 billion in illicit crypto transfers in 2024, up from previous years.

- IRS-CI’s criminal investigations involving crypto surged 113% between 2018 and 2023.

- Offshore wallets remain a preferred method for evading disclosure in over 60 jurisdictions without strong reporting mandates.

- Direct transfers from illicit sources to exchanges fell to 15% of all illicit deposits in 2024, showing rising transaction obfuscation.

- Conviction rates for IRS-CI investigations involving financial crimes, including crypto, held at ≈ 90% in FY2024.

Recent Developments

- In FY 2024, IRS Criminal Investigation identified about $2.12 billion in tax fraud, including crypto-related schemes, while maintaining a 90% conviction rate in prosecuted cases.

- Global crypto tax evasion fines increased by about 33% in 2024, highlighting rapidly escalating enforcement pressure entering 2025.

- The IRS collected roughly $235 million in unpaid crypto taxes in 2024, feeding into expanded enforcement initiatives planned for 2025 and beyond.

- By late 2025, at least 68 jurisdictions had formally committed to implement the Crypto-Asset Reporting Framework (CARF), with exchanges of information starting between 2027–2029.

- In 2025, a coordinated European crackdown on a crypto fraud and laundering network tied to over €600 million in illicit gains led to seizures of about €415,000 in cryptocurrencies and €300,000 in cash.

- A 2025 global financial crime operation recovered about $439 million, including roughly $16 million traced to cryptocurrency wallets, showing deeper integration of crypto into mainstream financial crime cases.

- Starting with the 2025 tax year, new U.S. rules require crypto brokers to issue Form 1099‑DA, reporting customers’ crypto proceeds to the IRS in a manner similar to traditional securities.

Taxation Challenges: Web3 vs Traditional Companies

- 24% of Web3 companies face taxation difficulties, highlighting persistent regulatory complexity in the crypto sector.

- In contrast, only 18% of traditional companies report tax-related challenges, indicating a more mature compliance environment.

- A majority (76%) of Web3 firms do not face taxation issues, showing that many have adapted to evolving rules.

- 82% of traditional firms report no taxation difficulties, reflecting streamlined tax processes and better-established frameworks.

- The gap in tax challenges between Web3 and traditional companies underscores the need for clearer crypto tax guidelines.

Share of Crypto Users Involved in Tax Noncompliance

- In a study using exchange data, 88% of crypto holders in a G20 country failed to report gains or income from crypto.

- U.S.-based surveys show that under 50% of crypto users believe they are required to pay taxes on DeFi or staking rewards.

- Around 44% of U.S. crypto holders surveyed in 2024 were unaware that swapping one crypto for another is a taxable event.

- Studies found that crypto users with smaller portfolios were as likely to evade taxes as those with large holdings.

- Among audited filers, crypto users showed a 4x higher noncompliance rate compared to traditional investors.

- A majority of crypto users wrongly assumed custodial platforms would handle all tax reporting on their behalf.

- Noncompliance is widespread across income levels, not just among high-net-worth individuals.

Capital Gains and Income Tax Revenue at Risk from Crypto

- Estimates suggest the U.S. loses $10–$15 billion annually in tax revenue from unreported crypto activity.

- Global tax gaps related to crypto may exceed $40 billion by 2025, factoring in DeFi, staking, and tokenized income streams.

- NFT trading volume alone topped $24 billion in 2024, yet only a fraction of those gains appear in filed tax returns.

- Capital gains from long-held assets like Bitcoin are frequently underreported, especially when sold via OTC or peer-to-peer channels.

- IRS data indicates that 75% of crypto gains go unreported without third-party transaction summaries.

- Mining and staking rewards, while taxable as income, are often excluded from filings due to unclear cost basis and timing.

- Airdrops and forks contributed to over $1.1 billion in untaxed value in 2024, according to blockchain analysts.

- U.S. states with large crypto populations, like California and Florida, report greater discrepancies in declared crypto income.

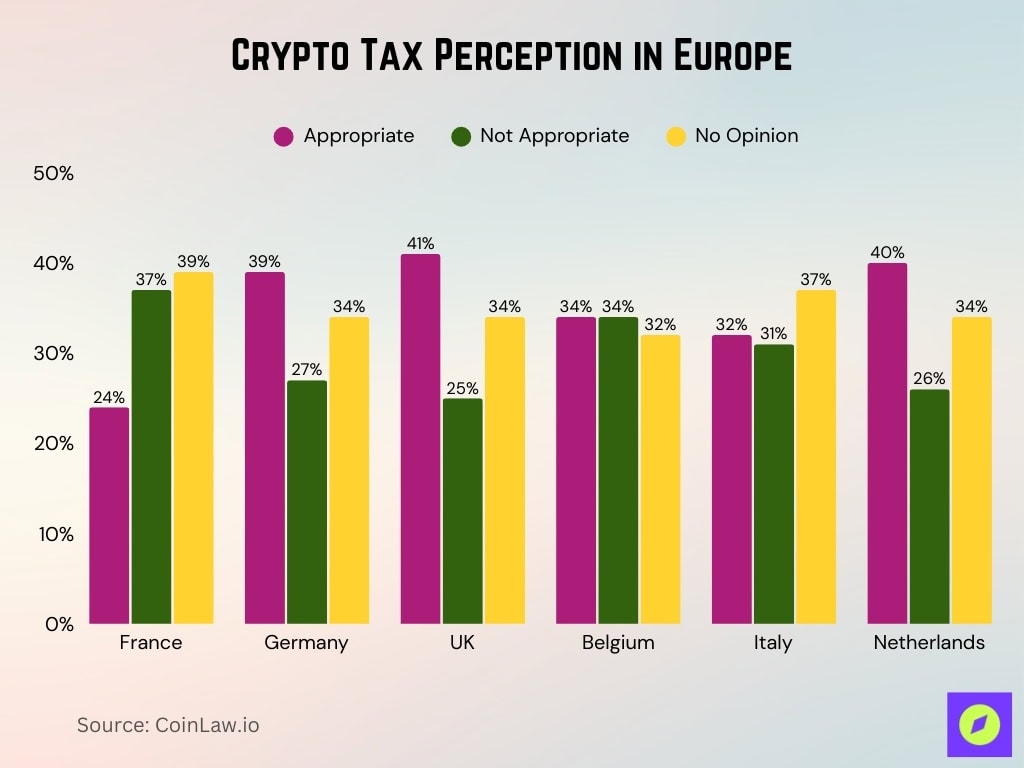

Crypto Tax Perception in Europe

- France shows the lowest support for crypto tax, with only 24% saying it’s appropriate, while 39% have no opinion.

- In the United Kingdom, 41% believe crypto tax is appropriate, the highest approval rate among the listed countries.

- Netherlands follows closely with 40% approval, while 34% of respondents have no opinion.

- Germany records 39% support for crypto tax, with a relatively low 27% opposing it.

- Belgium is evenly split, with 34% each for both supporting and opposing crypto tax, and 32% undecided.

- Italy shows 32% support and 31% opposition, with 37% expressing no opinion, indicating uncertainty

Types and Methods of Crypto Tax Evasion

- $40.9 billion flowed to illicit crypto addresses in 2024, with mixers and tumblers used to launder funds before 2025 enforcement ramps up.

- Privacy coins like Monero and Zcash surged in 2025, comprising growing shares of darknet and evasion-related transactions amid regulatory scrutiny.

- Cross-chain bridges for chain-hopping processed part of $22 billion in cross-chain crime volume through mid-2025, evading single-chain tracking.

- Tornado Cash mixers saw renewed inflows post-sanctions, handling portions of $1.5 billion peak mixer volume earlier, persisting into 2025 laundering tactics.

- 80% of New Zealand crypto trades occur on unreported offshore DEX platforms in 2025, mirroring global underreporting patterns.

- Staking rewards are taxable as income upon receipt in 75% of frameworks, yet are frequently unreported in DeFi yield farming activities through 2025.

- Wash trading in NFTs accounted for up to 94.5% of volume on platforms like LooksRare, generating $8.9 million in illicit profits by 2025.

- Self-custody wallets facilitate peer-to-peer anonymity, linked to 5-10% traceable illicit flows despite 2025 analytics advances.

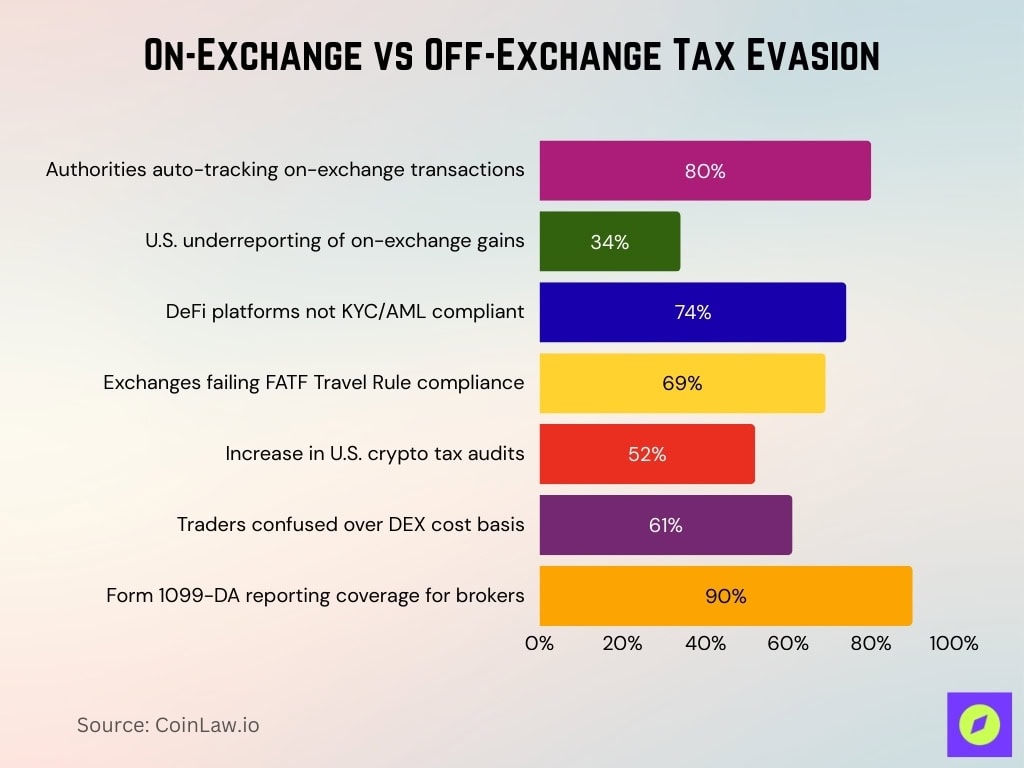

On-Exchange vs Off-Exchange Tax Evasion

- 80% of tax authorities in OECD countries now track on-exchange crypto transactions automatically, reducing noncompliance by ~35% where reporting is mandated.

- 34% of U.S. crypto investors under-reported on-exchange gains in 2024, despite visible broker data feeding IRS audits in 2025.

- $50 billion+ in unreported U.S. digital asset revenue stems largely from off-exchange trades and DEX activity through 2025.

- 74% of DeFi platforms, key to off-exchange evasion, remain non-compliant with KYC/AML standards entering Q2 2025.

- 69% of crypto exchanges struggle with FATF Travel Rule for on-exchange cross-border flows, but offshore DEX evasion persists unchecked.

- 52% rise in U.S. crypto tax audits from 2024-2025 targets on-exchange data mismatches, exposing off-exchange shifts.

- 61% of crypto traders face off-exchange confusion over cost basis, driving underreporting in non-custodial DEX volumes.

- IRS obtained data from over 14,000 on-exchange accounts by 2025, yet off-exchange P2P creates a 5-10% enforcement blind spot.

- 90% of Form 1099-DA reporting starts in 2025 for on-exchange brokers, but non-custodial gaps enable persistent off-exchange noncompliance.

Use of Privacy Coins, Mixers, DeFi, NFTs, and Stablecoins for Tax Evasion

- Privacy coins processed $258 billion in Q1 2025 volume, representing 12% of all crypto transactions, often linked to evasion tactics.

- Monero (XMR) held 58% privacy coin market share at $4.3 billion cap in 2025, fueling untraceable tax concealment flows.

- Zcash (ZEC) transactions hit $29 billion in Q1 2025, with only 12% using audit-friendly features amid evasion risks.

- South Korea identified $140 million in 2024 tax evasion via privacy coins, doubling the prior year and persisting into 2025 probes.

- $40.9 billion reached illicit addresses in 2024, with mixers embedded in DeFi handling evasion portions through 2025.

- FBI 2025 report ties privacy coins to 38% data extortion cases demanding Monero, evading stablecoin traceability norms.

- NFT evasion via wash trading hit 94.5% manipulated volume on key platforms, distorting bases into 2025 audits.

Offshore Exchanges and Wallets in Tax Evasion Schemes

- 80% of New Zealand crypto trades occur on offshore exchanges in 2025, evading local tax reporting entirely.

- NZ$7.2 billion in crypto traded by 188,000 New Zealanders via local exchanges alone, dwarfed by unreported offshore volumes.

- 67 jurisdictions committed to CARF implementation by 2028, targeting offshore exchange data sharing starting in 2027.

- $2.3 billion recovered by IRS from offshore crypto accounts in 2025 through enhanced international probes.

- 108,000 SARs filed by U.S. exchanges on unregistered offshore crypto activity from 2020-2022, surging into 2025.

- Indian tax authorities probe offshore Binance wallets linked to undisclosed profits via P2P and hawala in 2025.

- Over 90% noncompliance persists among crypto investors using self-hosted offshore wallets post-2019 crackdowns.

- CRS 2.0 and CARF force 50+ nations, including the UAE, to report offshore wallet crypto transfers by 2027.

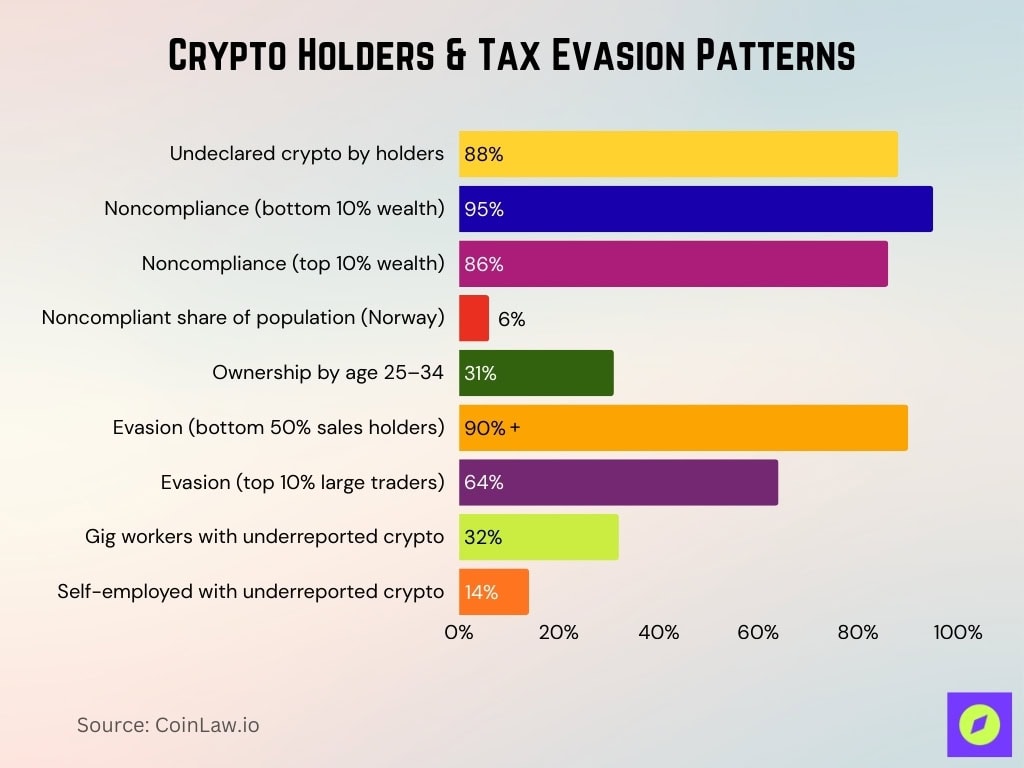

Demographic Profile and Wealth Characteristics of Noncompliant Crypto Users

- 88% of crypto holders fail to declare assets on tax returns, even on domestic exchanges, per 2021 Norwegian data persisting into 2025 trends.

- 95% noncompliance rate among the bottom 10% wealth crypto investors drops to 86% in the top 10%, showing broad evasion across brackets.

- 6% of the Norwegian population are crypto tax noncompliers holding undeclared assets, concentrated in young urban males.

- 31% of crypto users aged 25–34 dominate ownership, with the highest noncompliance linked to male gig workers in 2025.

- Bottom 50% smallest sales holders evade at 90%+, while the top 10% large traders at 64% noncompliance across incomes.

- 32% gig economy workers and 14% self-employed show sharp crypto investment growth tied to underreporting in 2025.

Case Volumes, Detection Rates, and Undisclosed Wallet Discoveries

- Law enforcement links only 5–10% of suspicious wallet addresses definitively to individuals using blockchain analytics in 2025.

- Crypto tax evasion fines rose 33% globally in 2024, with trends accelerating into 2025 enforcement actions.

- IRS collected $235 million in unpaid crypto taxes in 2024, targeting undisclosed wallets in 2025.

- IRS-CI initiated 2,667 criminal investigations in FY24, many crypto-related, with a 90% conviction rate persisting.

- 52% increase in U.S. crypto tax audits from 2024-2025, focusing on high-risk undisclosed wallet cases.

- Over 14,000 cryptocurrency accounts’ data was obtained by the IRS through 2025, uncovering hidden noncompliant holdings.

- $400 million+ in fines levied by U.S. authorities since 2023 for crypto tax evasion via wallet probes.

Audit Coverage and Reporting Gaps for Crypto Investors

- Crypto holders face 2–5% audit rates vs the general 0.6–1%, with the IRS prioritizing high-risk digital asset returns in 2025.

- 34% of U.S. crypto investors under-reported gains in 2024, exposing DeFi and offshore gaps entering 2025 audits.

- 90% of OECD tax authorities mandate crypto platform transaction reporting per CARF by 2025, yet DeFi escapes third-party mandates.

- 74% of DeFi platforms lack KYC/AML compliance, creating structural reporting gaps for offshore crypto activity in 2025.

- 67% of U.S. crypto investors reported income on IRS forms in 2025, up from 65%, but offshore exchanges remain unreported.

- Form 1099-DA covers centralized brokers from 2025, leaving non-custodial DeFi and P2P trades outside routine audit trails.

- 27% rise in Australia crypto audits yielded $18 million fines in 2024, highlighting poor record-keeping gaps persisting in 2025.

- 48 jurisdictions committed to CARF by 2025, but uneven enforcement leaves self-hosted wallets beyond compliant intermediary reach.

Estimated Value and Monetary Scale of Crypto Tax Evasion

- Average undeclared crypto tax per user ranges $200–$1,087, scaling to billions across millions of holders.

- $40.9 billion flowed to illicit crypto addresses in 2024, with complex routes persisting into 2025 evasion tactics.

- Illicit volumes on track to hit or exceed $51 billion in 2025, driven by sophisticated non-exchange transfers.

- Global crypto tax evasion fines up 33% in 2024, signaling billions in annual systemic revenue losses.

- Non-exchange transfers complicate valuation, with $2.17 billion stolen from services alone by mid-2025.

Civil vs Criminal Crypto Tax Enforcement Statistics

- IRS-CI saw a 113% increase in crypto-related cases from 2018 to 2023.

- In FY2024, IRS-CI initiated 2,667 cases, with 1,794 referred for prosecution.

- 1,571 convictions were obtained, maintaining a ≈ 90% conviction rate.

- $9.1 billion in fraud was identified, with $1.7 billion in restitution.

- Many cases include both tax and financial crimes involving crypto.

- TIGTA reports reveal civil audit efforts remain insufficient.

- Only 224 of 390 crypto investigations were prosecuted from 2018–2023.

- Criminal enforcement is increasing, but civil coverage remains patchy.

Criminal Prosecutions, Convictions, and Sentencing Data

- A Bitcoin investor was sentenced to two years for underreporting $3.7 million in gains.

- Most cases involve multiple offenses, like laundering and fraud.

- Conviction rates remain high, around 90% in tax-related crypto cases.

- $1.2 billion in criminal assets were seized in FY2024.

- $1.7 billion in restitution was ordered.

- Crypto prosecutions remain a fraction of IRS-CI case volume.

- Experts expect prosecution volume to increase with improved tracing tools.

- Willfulness is key to conviction, complicating cases of poor reporting vs evasion.

Enforcement Campaigns and Blockchain Analytics in Investigations

- Direct transfers from illicit sources dropped to 15% of flows in Q2 2025, as actors shift to mixers and bridges.

- Illicit inflows reached $40.9 billion globally in 2024, with blockchain analytics central to 2025 tracing efforts.

- IRS-CI used blockchain forensics to recover $475 million from crypto hacks in 2024, scaling into 2025 probes.

- AI blockchain analytics cut tracing time by 55%, boosting IRS-CI detection in 1,600+ FY2024 currency cases.

- Machine learning improved suspicious wallet detection by 48% in 2024, aiding global enforcement campaigns.

- IRS-CI expanded to international attachés, supporting 2,667 criminal cases with blockchain tools in FY2024.

- Cross-chain bridges laundered ransomware beyond mixers, with forensic audits preventing $750 million fraud in 2024.

Reporting, Transparency, and Information-Sharing Frameworks

- 74 jurisdictions committed to CARF by 2027-2028, mandating crypto transaction data exchange starting 2027.

- Form 1099-DA requires brokers to report gross proceeds from crypto sales for the 2025 tax year, aligning with securities rules.

- 67 jurisdictions pledged CARF implementation by 2028, with legislation drafting due end-2025 for 2026 collection.

- EU DAC8 enforces CARF across member states, with data collection from 2026 and exchanges starting in 2027.

- 65 jurisdictions updated CARF commitments per OECD January 2025 report, expanding cross-border crypto transparency.

- $10,000 de minimis threshold for stablecoins and $600 for NFTs exempts brokers from 1099-DA reporting in 2025.

- IRS proposal for broker digital transaction reporting submitted in November 2025, boosting U.S. CARF alignment.

- Non-custodial DeFi and DEXs are excluded from 1099-DA initially, hindering civil audit access in 2025.

Policy, Regulatory Responses, and International Cooperation

- 74 jurisdictions committed to CARF implementation by 2027-2028, expanding cross-border crypto data sharing.

- 63 jurisdictions pledged CARF adoption early 2025, with first reporting in 2027 or 2028 via OECD frameworks.

- 90% of centralized U.S. exchanges achieved full KYC compliance in 2025, up from 85% prior year under new rules.

- IRS plans to audit 15% of high-value crypto accounts over $10,000 starting late 2025 with enhanced tools.

- EU DAC8 mandates crypto reporting from January 2026, aligning MiCA definitions for full tax transparency.

- Machine learning forensics improved suspicious wallet detection by 48% in 2024, scaling via 2025 agency investments.

- GENIUS Act passed July 2025, streamlining state-federal crypto tax and reserve compliance nationwide.

- 65% of crypto cases require cross-border cooperation in 2025, slowing probes without enhanced data-sharing.

Frequently Asked Questions (FAQs)

About 88% of crypto holders in the referenced study did not declare their crypto for tax purposes.

The tax authority sent 65,000 nudge letters in 2024/25, more than double the 27,700 letters from the prior year.

As of 2025, approximately 65% of US crypto investors reportedly use automated tax‑reporting tools, and many countries globally have tax regimes for crypto, though the exact global implementation percentage of crypto tax laws varies by region.

Conclusion

Crypto tax evasion, once a fringe concern, has emerged as a systemic challenge with large-scale financial consequences. The data show that noncompliance remains widespread, enforcement efforts are ramping up, and illicit crypto activity retains massive monetary value. At the same time, evolving regulations, enhanced blockchain analytics, and international cooperation are beginning to close major gaps in transparency and enforcement. For regulators, the message is clear: treating crypto as property, with rigorous reporting and oversight, is vital to protect tax revenue and financial integrity. For investors, the takeaway is equally stark: accurate reporting and compliance are no longer optional.