The Middle East is emerging as a pivotal region in global crypto regulation. Governments are crafting frameworks that balance innovation with consumer protection. In sectors such as real estate and payments, we’ve already seen tangible usage, while CBDC pilots offer a glimpse into future financial infrastructure. Explore the full article to see how regulations are shaping the digital asset landscape across the region.

Editor’s Choice

- 241% surge in crypto app downloads in the UAE from 2023 (6.2 million) to 2024 (15 million).

- Following crypto mining crackdowns, Al-Wafrah, Kuwait, reportedly experienced a 55% drop in electricity consumption, as cited by the Ministry of Electricity, Water, and Renewable Energy.

- The Middle East crypto market was valued at approximately $110.3 billion in 2024, with an expected CAGR of 8.74% through 2033.

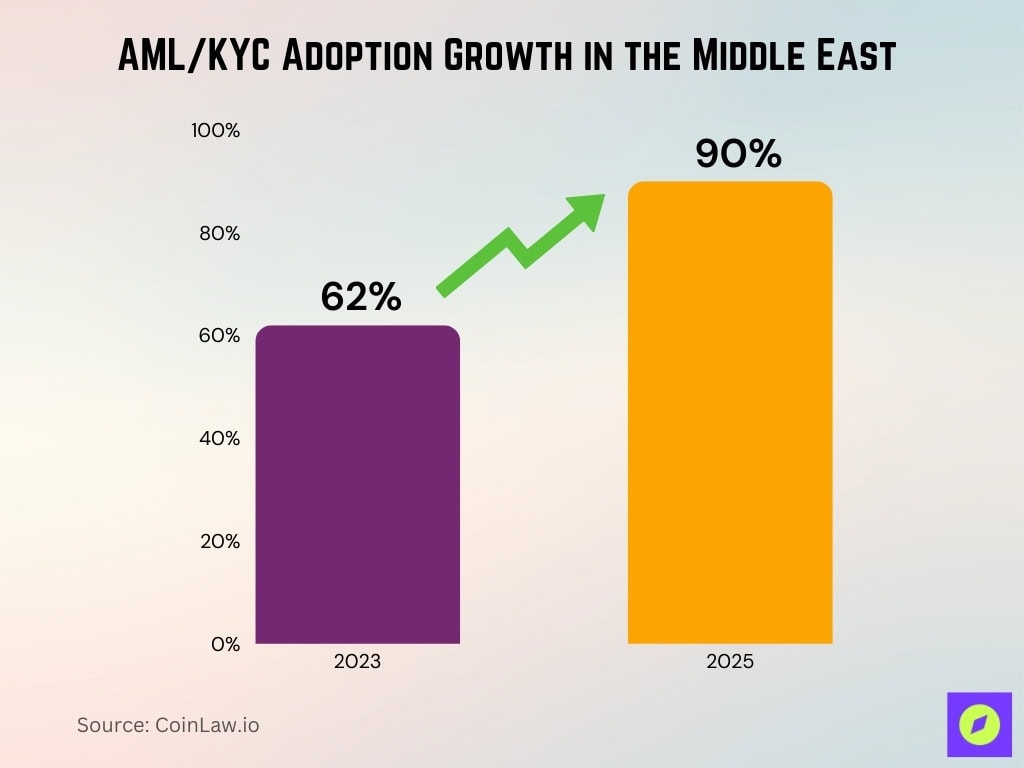

- Blockchain AML/KYC adoption jumped from 62% in 2023 to ~90% in 2025.

- Project Aber: UAE and Saudi central banks tested cross‑border CBDC in 2019, and broader GCC pilots continue.

- The Dubai Financial Services Authority (DFSA) regulates 837 entities, according to the official DFSA register and annual updates.

- Stablecoin frameworks were introduced in the UAE (2024) and Bahrain (2025).

Recent Developments

- In the UAE, some real estate firms (e.g., Emaar) and airlines like Emirates have piloted or accepted crypto payments via third-party processors, although such adoption varies by use case.

- New anti–money laundering rules target crypto flows into Dubai property markets.

- Bahrain is courting over 50 financial firms, especially crypto operators; Binance and Crypto.com hold licenses.

- Al‑Wafrah, Kuwait’s mining crackdown, cut local power usage by 55% in one week.

- The DIFC in Dubai now hosts over 7,700 companies and nearly 48,000 employees as of mid‑2025.

Market Size and Growth

- The Middle East crypto market totalled $110.3 billion in 2024 and is projected to reach $234.3 billion by 2033, with an 8.74% CAGR.

- App adoption soared: the UAE saw crypto app downloads jump from 6.2 million (2023) to 15 million (2024).

Adoption & Usage Statistics

- AML/KYC adoption soared from 62% in 2023 to 90% in 2025.

- Crypto app downloads doubled and more: 241% year‑on‑year growth in the UAE.

- Mid-2025 global losses from fake or stolen crypto funds exceeded $2.17 billion, with projections suggesting this could double by year-end.

- The mining crackdown in Kuwait led to a 55% reduction in electricity use locally.

Regulatory Bodies & Frameworks

- UAE’s regulatory hubs: VARA in Dubai and FSRA in Abu Dhabi set comprehensive crypto rules.

- DFSA: DIFC regulator overseeing crypto since 2021, as of August 2024, 837 regulated entities.

- Bahrain’s Central Bank licenses exchanges and token issuers. Rain was the first licensee.

- CBDC exploration: GCC nations, including the UAE, Saudi Arabia, Bahrain, and Oman running pilot programs.

UAE’s Regulatory Frameworks

- Effective August 2025, merchants in the UAE (excluding free zones) are permitted to accept only licensed Dirham Payment Tokens (DPTs), per the Central Bank’s Payment Token Services Regulations.

- ADGM’s FRT framework permits the issuance of fiat-referenced tokens, the UAE’s approach to secure stablecoin regulations.

- Stablecoin regulation: Central Bank of the UAE’s Payment Token Services Regulations (2024) restrict stablecoin use to licensed tokens. In April 2025, ADQ and First Abu Dhabi Bank (FAB) prepared a dirham-backed stablecoin launch.

- DFSA enhancements (launched 2021, updated June 2024): Investment Token and Crypto Token regimes, reduced recognition fees, recognition of USDC and EURC as stablecoins.

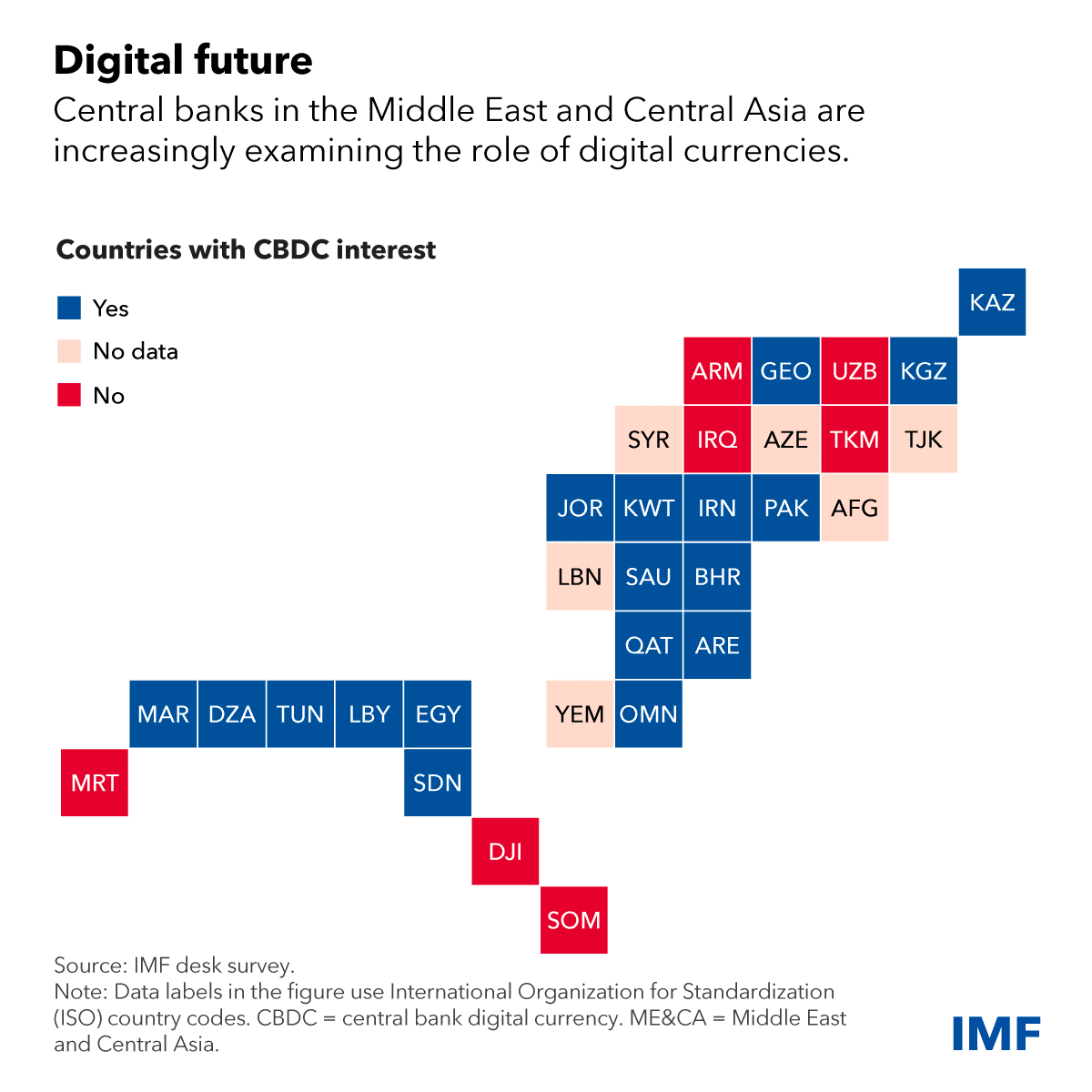

Central Bank Digital Currency (CBDC) Interest in the Middle East & Central Asia

- 21 countries in the region were highlighted in the IMF survey on CBDC interest.

- 15 countries have shown active interest in CBDCs, including the UAE, Saudi Arabia, Iran, Egypt, Morocco, and Kazakhstan.

- 6 countries explicitly reported no interest, such as Armenia, Uzbekistan, Turkmenistan, Georgia, Djibouti, and Somalia.

- 7 countries had no available data, including Lebanon, Yemen, Syria, Iraq, Afghanistan, Azerbaijan, and Mauritania.

- This indicates that over 70% of the region’s central banks are seriously exploring digital currencies as part of their future financial infrastructure.

Bahrain’s Regulatory Developments

- Over 50 financial services firms, nearly half focused on crypto or asset management, are in talks to set up in Bahrain in 2025.

- Binance secured a crypto‑asset service provider license in 2022, and Crypto.com obtained a payment service provider license in 2024.

- Bahrain hosts over 120 fintech companies, with payments and crypto among the most active sectors.

- The Central Bank of Bahrain (CBB) launched a Crypto‑assets (CRA) regulatory module in March 2023.

- Bahrain’s fintech ecosystem has nearly doubled since 2018, with the Fintech & Innovation Unit playing a central role.

- Bahrain enforces full Travel Rule compliance for all crypto‑asset transfers, regardless of amount.

- The CBB’s rulebook codifies licensing and operational details under the CRA module (CRA‑1.1 licensing for crypto‑asset services).

- Bahrain continues enhancing public trust via regulatory clarity, contributing to growing local DeFi and tokenized asset interest.

Saudi Arabia’s Crypto Policy Landscape

- Saudi Arabia’s crypto‑asset market was worth $23.1 billion in 2024, with a projected $45.9 billion by 2033, at a 7.9% CAGR.

- Crypto transaction value in Saudi Arabia grew a staggering 153% from July 2023 to June 2024, topping $31 billion, primarily due to institutional activity.

- 11.4% of Saudis (around 4 million) own crypto assets, contributing to regional digital asset growth.

- Saudi Arabia’s crypto market is expected to generate $498.2 million in revenue in 2025, with approximately 7.4 million users, reflecting strong institutional growth.

- Banks are prohibited from dealing with crypto unless they receive explicit SAMA approval.

- Saudi Arabia joined the mBridge CBDC pilot with the UAE, China, Thailand, and Hong Kong in 2024.

- Crypto is treated as an asset, not legal tender. Individuals pay no capital‑gains tax, but businesses may face 15% CGT, with corporate income taxed at 20% and 2.5% zakat applied.

- The country continues to monitor digital activity through entities like CST, ensuring broader tech regulation and alignment with Vision 2030 goals.

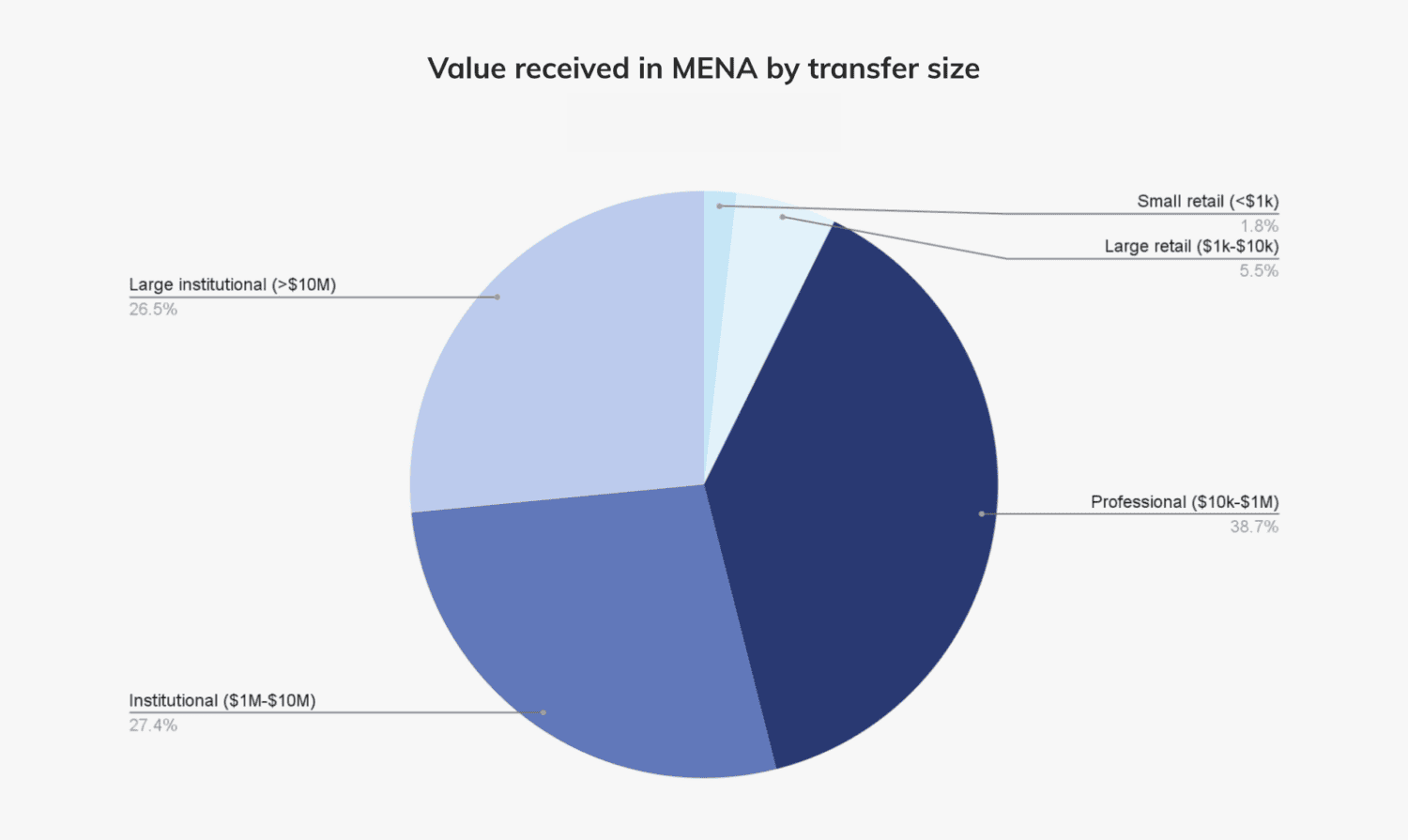

Value of Crypto Transfers in MENA by Transaction Size

- Professional transfers ($10k–$1M) dominate the region, making up 38.7% of all value received.

- Institutional transfers ($1M–$10M) represent 27.4%, showing strong mid-sized institutional activity.

- Large institutional transfers (>$10M) account for 26.5%, highlighting the significant role of big players in the MENA crypto market.

- Large retail transfers ($1k–$10k) make up only 5.5%, reflecting limited retail engagement compared to institutions.

- Small retail transfers (<$1k) are the smallest share at just 1.8%, underlining the market’s concentration in larger transaction sizes.

Qatar and Kuwait: Crypto Restrictions and Bans

- The Qatar Financial Centre (QFC) is expected to finalize its Digital Asset Regulatory (DAR) framework by Q2 2025, focusing on tokenization and legal recognition of smart contracts, per QFC announcements.

- Qatar has introduced a distinct regulatory zone for digital assets (DAR) to centralize oversight.

- Kuwait cracked down on crypto mining, leading to a 55% drop in local electricity usage, a sign of strict enforcement amid infrastructure stress.

Oman’s Emerging Crypto Regulations

- While detailed statistics for Oman are limited, sources underline that GCC nations, including Oman, are running CBDC pilots and advancing frameworks.

- Oman continues to observe developments across the Gulf, laying the groundwork for future regulation.

Stablecoin Regulation

- UAE (June 2024): The Central Bank issued Payment Token Services Regulations, permitting only licensed stablecoins for payment use.

- UAE (April 2025): ADQ and First Abu Dhabi Bank (FAB) are preparing to launch a dirham-backed stablecoin.

- Bahrain (July 2025): The CBB introduced the Stablecoin Issuance and Offering (SIO) Module, permitting issuance of fiat-backed stablecoins (e.g., Bahraini Dinar, USD) under approval.

Crypto Asset Usage Trends in MENA vs Global Average

- Israel shows a strong tilt toward altcoins (32.3%), while BTC accounts for 19.9% and stablecoins 40.6%, slightly below the global share.

- Saudi Arabia has a high share of stablecoins at 46.1%, above the global 44.7%, while BTC use is lower at 16.4% compared to the global average.

- Türkiye leads the region in stablecoin reliance at 55.2%, the highest in MENA, but has the lowest BTC share at 15.6%.

- UAE shows 51.3% stablecoin usage, also well above the global average, while BTC share is 16.5%, below the global 22.3%.

- Globally, BTC dominates at 22.3%, with ETH at 8.3%, altcoins at 24.6%, and stablecoins at 44.7%, making MENA’s heavy stablecoin tilt a notable divergence.

Specialized Sector Rules

- Bahrain’s Fintech & Innovation Unit supports digital banking, DeFi, robo‑advisory, open banking, and insurtech growth and regulation.

- Saudi Arabia’s tech regulation frameworks, enforced by CST, also design sandboxes and support innovation in emerging sectors, including blockchain and digital platforms.

- Qatar’s DAR (digital asset regulatory zone) serves as a specialized jurisdiction for emerging digital asset business models.

AML / KYC Compliance Trends

- In Bahrain, the Travel Rule applies to all crypto transfers, requiring originator and beneficiary details for every transaction.

- Bahrain’s CRA module provides structured licensing for compliant crypto‑asset services.

- Saudi Arabia includes crypto under existing AML frameworks (Anti‑Money Laundering Law 2017, CFT Law 2017), treating it as intangible assets, requiring full transaction disclosure.

- Qatar’s emerging framework in QFC anticipates AML/KYC requirements tailored to digital asset transactions by mid‑2025.

Licensing and Registration of Virtual Asset Service Providers (VASPs)

- Companies issuing ARVAs (asset‑referenced tokens) in the UAE must hold a Category 1 VASP license from VARA.

- Several Gulf countries, including Bahrain, have enacted licensing frameworks for crypto exchanges and token issuers as of early 2025, aligning with global regulatory shifts.

- BitOasis, the Middle East arm of CoinDCX, officially launched operations in Bahrain after securing a license from the Central Bank.

- In Bahrain, over 50 financial services firms, nearly half focusing on crypto and asset management, are in talks to establish operations amid favorable licensing conditions.

- Abu Dhabi Global Markets (ADGM) saw a 67% increase in new operating licenses in Q1 2025, helping the total number of firms exceed 2,380. Crypto and digital asset players are among them.

- Dubai’s VARA, the first dedicated crypto regulator, has issued dozens of VASP licenses, including to major platforms like Binance and Laser Digital.

- As licensing frameworks mature, regional regulators maintain enhanced due diligence and enforce AML/CFT standards across all licensed entities.

Taxation Guidelines for Cryptocurrency

- In Saudi Arabia, individuals pay no capital-gains tax on crypto, businesses may face 15% capital-gains tax, with corporate income taxed at 20%, plus a 2.5% zakat levy.

- Fiat-referenced tokens and licensed activities in the UAE fall under specific regulation, though explicit national crypto tax guidelines remain evolving.

- Global trends suggest that some jurisdictions may adopt up to 10% tax on crypto gains between 2023–2025, in alignment with FATF standards.

- No personal income tax exists in Bahrain, allowing crypto holders to operate tax-free, businesses may still be subject to standard corporate tax rules.

- The formalization of taxation parameters, including VAT or trading tax, remains under review across multiple GCC states.

- Crypto firms entering these markets must monitor both corporate tax and customs implications as regulatory layers deepen.

Institutional Participation and Licensing Numbers

- Abu Dhabi Global Market (ADGM) reported a 245% increase in assets under management (AUM) in 2024, per the ADGM Annual Report and press statements.

- Major financial institutions, including Goldman Sachs, Rothschild, and Lazard, have expanded or established footprints in Dubai, Abu Dhabi, and Riyadh to capture crypto sector growth.

- Abu Dhabi’s ADGM hosts crypto companies such as Circle and Coinbase, and the Abu Dhabi-backed MGX recently made a $2 billion crypto token investment in Binance.

- BitOasis’s licensed entry into Bahrain signifies growing institutional participation in regulated crypto platforms.

- As regulatory frameworks gain clarity, institutional participation across the GCC continues to shift from informal to licensed channels.

Banned, Restricted, and Permitted Activities by Country

- Saudi Arabia: Crypto is considered an asset (not legal tender), regulated usage is permitted, though banks need explicit SAMA approval to engage with crypto.

- UAE: Only licensed tokens, like Dirham Payment Tokens, are allowed for payments; unlicensed activity remains prohibited.

- Qatar: Finalizing a digital asset regulatory framework (DAR) by Q2 2025, aiming to clarify permitted operations while creating a dedicated regulatory zone.

- Kuwait: Crypto mining has been strictly restricted, evidenced by a sharp 55% reduction in local electricity usage following enforcement actions.

- Bahrain: A clear licensing regime determines which crypto‑asset activities are permitted; unlicensed activity is not allowed under the CRA module.

- Oman: Though specific regulations are emerging, broader GCC trends indicate that Oman will follow suit in defining and restricting crypto activities under structured frameworks.

Central Bank Digital Currency (CBDC) Initiatives in the Region

- Saudi Arabia joined the mBridge CBDC pilot, involving the UAE, China, Thailand, and Hong Kong, indicating strong CBDC collaboration in the Gulf.

- GCC leaders, including the UAE, Bahrain, and Oman, are running CBDC pilot programs, watching for regional interoperability and real‑use scenarios.

- SAMA (Saudi Central Bank) is actively exploring CBDC feasibility as part of its broader fintech sandbox approach.

- UAE’s financial regulators continue to engage in CBDC strategy discussions, often in partnership with international peers.

- While not yet broadly issued, CBDC readiness reflects the region’s push toward digital transformation and monetary innovation.

Crypto Exchange Licensing and Activity

- VARA in Dubai has licensed major crypto exchanges, including Binance and Laser Digital, underscoring Dubai’s credibility as a crypto hub.

- BitOasis’s licensed launch in Bahrain (via the Central Bank) illustrates growing legal compliance and market integration.

- GCC-wide licensing regimes (UAE, Bahrain) show growing regulatory maturity, encouraging both global and regional exchanges to operate legally.

- ADGM’s licensing environment has drawn platforms like Circle and Coinbase, further bolstering exchange activity under regulation.

- Licensing often entails stringent KYC/AML compliance, matching the 90% global KYC compliance in centralized crypto exchanges in 2025 (up from 85% in 2024).

- Institutions and incumbents increasingly see exchange licensing as a baseline requirement for trustworthy operations in the region.

Conclusion

Crypto regulation across the Middle East is shifting from ambiguity toward structured frameworks. Licensing regimes, from VARA in Dubai to Bahrain’s CRA module, are enabling legitimized platforms, drawing both startups and institutional giants. Clear tax positions, such as Saudi Arabia’s zero personal capital-gains policy and Bahrain’s tax-free atmosphere, further attract digital investment. Meanwhile, GCC-wide CBDC pilots and growing KYC enforcement indicate a region preparing for a digital financial future. As regulatory clarity continues to converge, the Middle East stands poised to lead in regulated crypto innovation and adoption.