In a small café in Lagos, Nigeria, a young entrepreneur sips his coffee while reviewing his crypto portfolio. Across the globe in Buenos Aires, a graphic designer invoices her client in Bitcoin to avoid Argentina’s spiraling inflation. Stories like these are becoming common in emerging markets, where cryptocurrency adoption is not just about innovation, it’s about survival and opportunity.

As digital assets redefine how people transfer and store value, governments in emerging economies are racing to establish clear regulatory frameworks. In this article, we dive deep into the latest statistics and trends shaping crypto regulations in developing countries. Whether you’re a trader, investor, policymaker, or simply curious about the future of finance, this comprehensive guide will bring you up to speed.

Editor’s Choice

- 68% of central banks in emerging economies are actively researching or piloting Central Bank Digital Currencies (CBDCs).

- Crypto adoption in emerging markets has risen by 23% year-over-year (YoY), with India, Brazil, and Nigeria leading the growth.

- 40% of crypto service providers in developing countries are now licensed or registered with national regulators.

- 56% of emerging market governments cite financial inclusion as the primary driver behind their crypto policies.

- Cross-border crypto remittances surged by 31%, reaching an estimated $220 billion value across emerging economies.

- 63% of institutional investors in developing markets increased their crypto exposure within the past 12 months.

Cryptocurrency Adoption in Emerging Economies

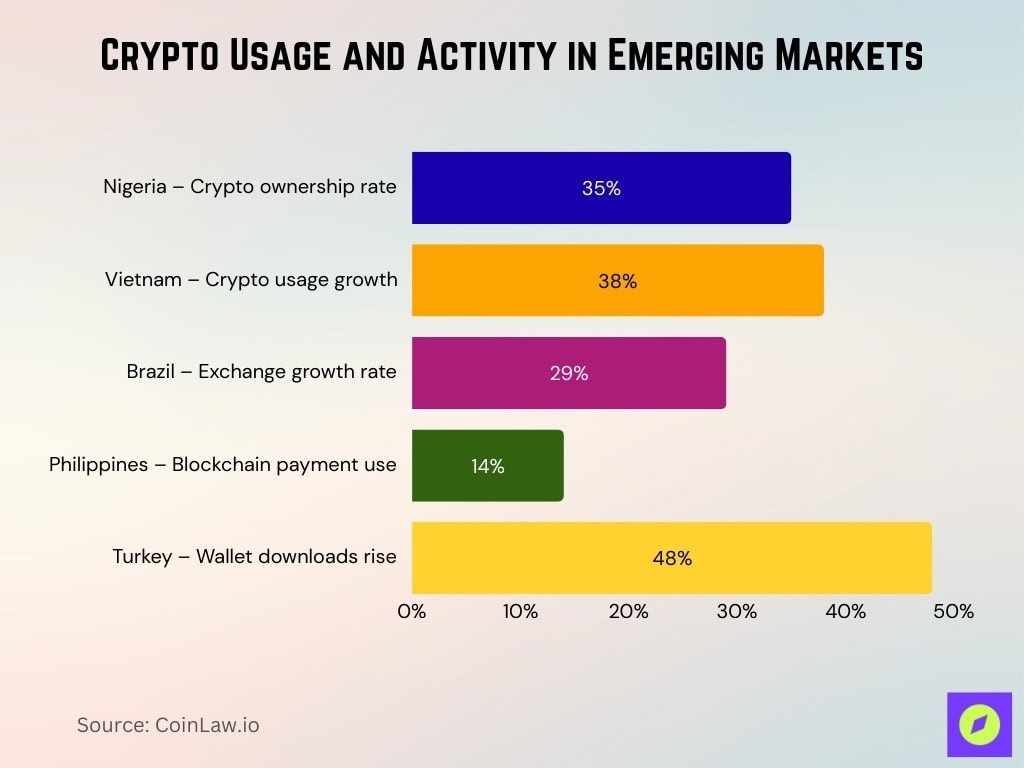

- In Nigeria, 35% of adults report using or holding cryptocurrency, one of the highest penetration rates globally.

- Vietnam recorded a 38% YoY increase in crypto usage, with remittances via stablecoins totaling $4.3 billion.

- Brazil has licensed over 150 crypto exchanges, reflecting a 29% growth in registered trading platforms.

- The Philippines’ Central Bank reports 14% of the population actively uses blockchain-based payment services, driven by play-to-earn gaming revenues.

- Turkey saw a 48% rise in crypto wallet downloads amid the lira’s devaluation.

- Argentina processed $17 billion in stablecoin transactions in 2024 as citizens sought to hedge against inflation.

Regulatory Approaches by Region: Asia, Africa, and Latin America

Asia

- India’s RBI and SEBI regulatory sandboxes enable blockchain testing without full compliance for crypto firms.

- Indonesia mandates crypto exchanges maintain a minimum paid-up capital of IDR 1 trillion with 80% equity.

- Thailand’s SEC approved crypto ETFs, including Ethereum and Solana beyond Bitcoin, in 2025.The

- Philippines enforces dual licensing for crypto exchanges from the BSP and the SEC with strict AML standards.

- Malaysia launched Green Digital Asset, a $1 million tokenized renewable energy instrument in 2025.

- Vietnam legalized crypto under the Law on Digital Technology Industry, with five exchange licenses piloted.

Africa

- Nigeria recognizes crypto as securities under the Investments and Securities Act, with a 32% population adoption rate.

- South Africa approved 248 crypto licenses from 420 applications, achieving a 95% approval rate.

- Kenya Virtual Asset Service Providers Act mandates licensing for exchanges with Capital Markets Authority oversight.

- Ghana requires VASP license registration with the Bank of Ghana and a minimum capital of 5 million cedis.

- Uganda Bank mandates licensing, client asset segregation, and third-party audits for all VASPs.

- Egypt maintains a crypto trading ban under Central Bank Law No. 194 while advancing its national blockchain strategy.

- Nigeria SEC oversees an 11.66% crypto penetration rate with projected $2.4 billion revenue.

- Ghana recorded $3 billion in crypto transactions involving 3 million adults or 17% of the population.

Institutional Crypto ETF Flows and Holdings

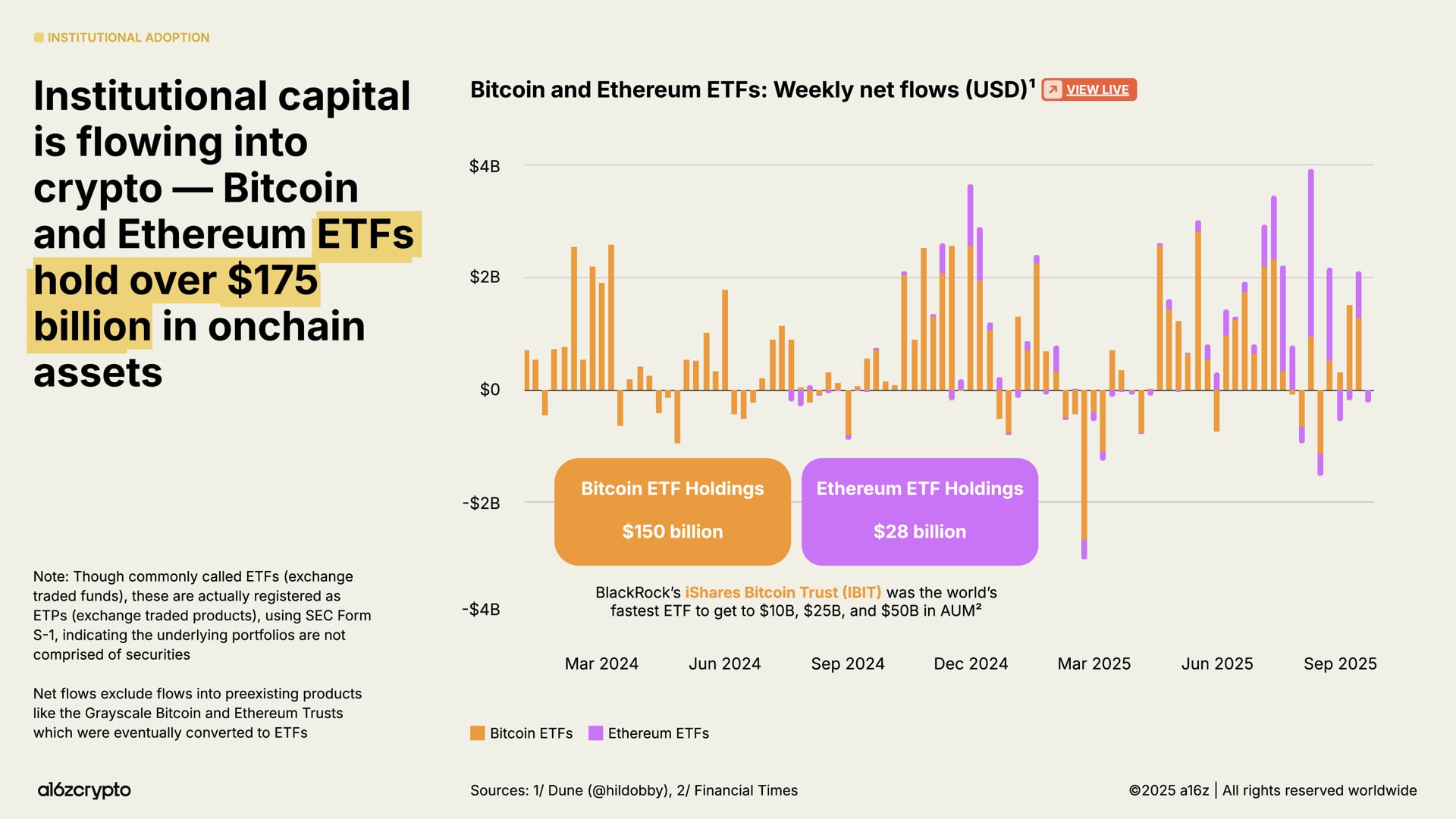

- Over $175 billion in onchain assets is held by Bitcoin and Ethereum ETFs, reflecting massive institutional capital flow into crypto.

- Bitcoin ETFs account for $150 billion, making them the dominant vehicle for institutional crypto exposure.

- Ethereum ETFs hold $28 billion, showing strong traction despite a smaller share compared to Bitcoin.

- Weekly net flows for both ETFs range between −$4 billion and +$4 billion, signaling high volatility and active capital rotation.

- Bitcoin ETF inflows consistently outperform Ethereum, with more frequent and higher positive net flow spikes.

- BlackRock’s iShares Bitcoin Trust (IBIT) was the fastest ETF to reach $10 billion, $25 billion, and $50 billion in AUM, setting industry records.

Latin America

- Brazil imposes a 17.5% flat tax on all crypto capital gains under Provisional Measure 1303, effective June 2025.

- Argentina CNV Resolution 1069/2025 mandates VASP registration by September 1 for foreign entities with a 15% individual gains tax.

- Colombia DIAN requires annual cryptoasset reporting by RCASPs starting the 2026 tax year in XML format.

- Chile Fintech Law approves digital asset custodians with UAF anti-money laundering registration for VASPs.

- Mexico Fintech Law 2.0 mandates $200,000 minimum capital for crypto custodians tied to national digital ID.

- Peru blockchain pilot generates $403.8 million crypto market revenue with 68.72% CAGR through 2026.

- Venezuela crypto remittances reach 9% of $5.4 billion total inflows amid bolívar devaluation crisis.

- Ecuador Fintech regulations require quarterly stablecoin audits and USD 200,000 paid-in capital for VASPs.

Impact of Regulations on Crypto Trading Volumes

- Brazil-regulated exchanges hit $1.8 billion daily volumes, up 24% YoY post-tax legislation.

- Nigeria licensed exchanges surged 47% to $312 million monthly after the banking ban reversal.

- India crypto volumes recovered 27% post-1% TDS clarifications despite an initial 68% drop.

- South Africa institutional trading rose 14%, comprising 25% of total crypto volume.

- Argentina stablecoin transactions grew 19%, representing 68% of all crypto trades.

- Kenya P2P volumes reached $49 million in Q2, increasing 12% quarterly.

- Thailand crypto ETFs drew $980 million in inflows, boosting overall activity 16%.

- Vietnam trading volumes climbed 35% YoY amid state-backed digital asset pilots.

- High-tax nations like Pakistan saw a 28% volume drop, shifting to offshore platforms.

Top Categories of Global Financial Crimes

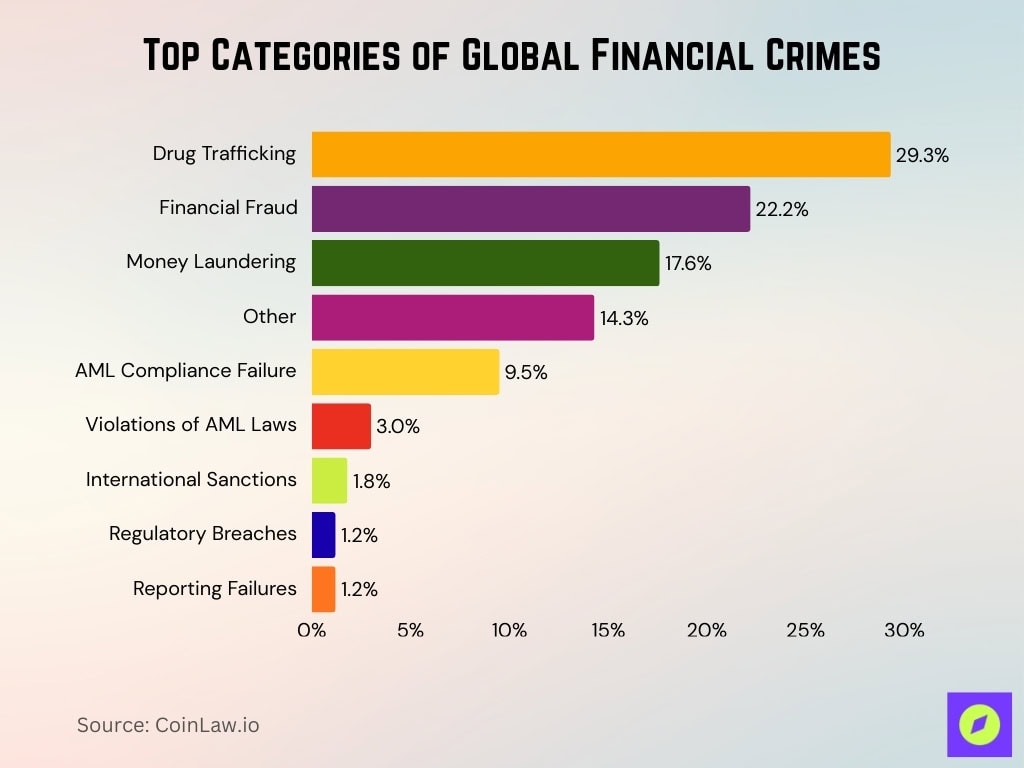

- Drug trafficking is the leading category, accounting for 29.3% of all financial crime incidents globally.

- Financial fraud follows closely, making up 22.2%, driven by scams, misappropriation, and illicit investment schemes.

- Money laundering represents 17.6%, reflecting persistent weaknesses in global financial controls.

- Other crimes collectively contribute 14.3%, covering lesser-known or uncategorized financial offenses.

- AML (Anti-Money Laundering) compliance failures account for 9.5%, showing the cost of weak institutional controls.

- Violations of AML laws make up 3.0%, indicating legal breaches beyond procedural compliance gaps.

- International sanctions violations contribute 1.8%, tied to geopolitical and regulatory non-compliance.

- Regulatory breaches and reporting failures are each responsible for 1.2%, reflecting gaps in oversight and transparency.

Compliance and Enforcement Actions

- India FIU imposed $2.25 million penalty on Binance for AML non-compliance in 2024.

- South Africa FSCA issued information requests to all 420 CASP license applicants in 2025.

- Brazil CVM revoked stop orders against crypto firms after 11 token compliance appeals.

- Kenya CMA requires quarterly audits under the VASP Act for all licensed trading platforms.

- Colombia proposes an OECD crypto reporting framework with annual XML submissions by RCASPs.

- Nigeria’s EFCC arrested 792 suspects in a crypto fraud raid, seizing $200,000 in assets.

- Egypt maintains a crypto ban with arrests for violations under Central Bank Law No. 194.

- Argentina requires VASPs to retain transaction records for five years exceeding $10,000.

Role of Central Bank Digital Currencies (CBDCs) in Regulatory Frameworks

- 68% of emerging market central banks actively pilot or research CBDCs, up from 54% in 2023.

- India Digital Rupee pilot expanded to 600,000 users across 17 banks, processing Rs 1,016 crore.

- Brazil DREX pilot involved 16 financial institutions testing $700 million in transactions.

- China Digital Yuan facilitates $2.5 billion cross-border trade settlements with ASEAN partners.

- Ghana eCedi pilot engaged 35,000 rural users, prioritizing offline functionality for inclusion.

- South Africa Project Khokha 2 processed $500 million in wholesale CBDC interbank settlements.

- Thailand’s retail CBDC pilot tested with 4,000 users and 140 merchants handling high volumes.

- Mexico CBDC whitepaper outlines Digital Peso testing by 2026 with a cross-border focus.

- Egypt initiated a CBDC feasibility study amid a blockchain strategy despite a crypto trading ban.

Legalization vs. Bans: Comparative Data on Policy Trends

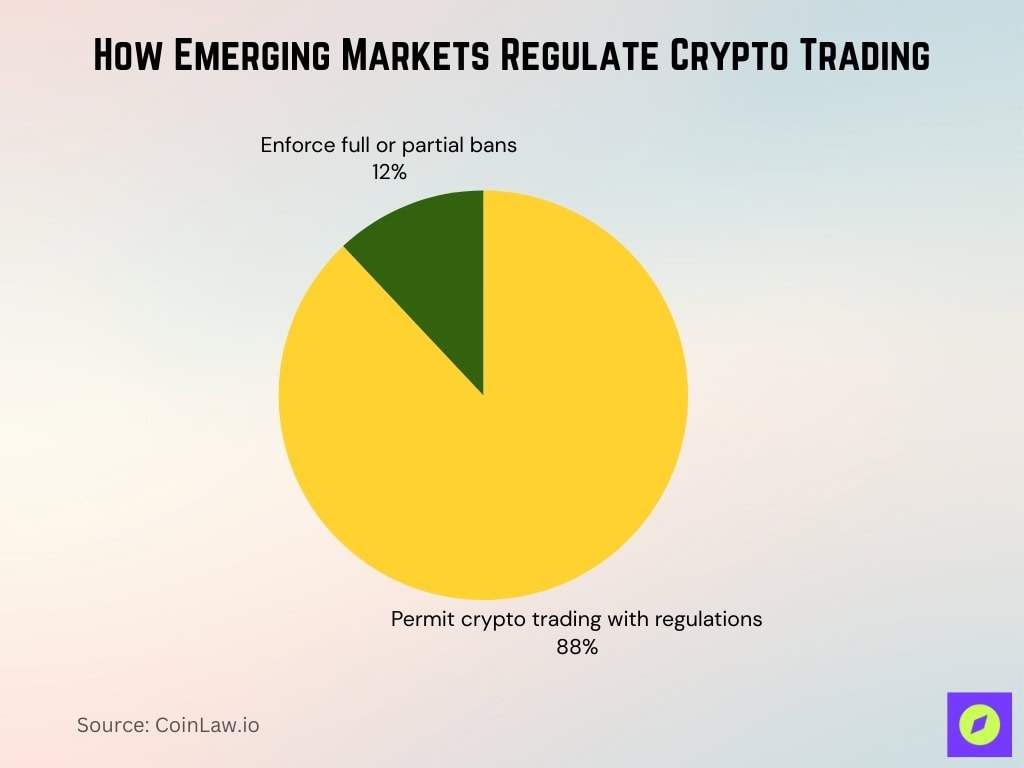

- 88% of emerging markets permit crypto trading under regulations, while 12% enforce full or partial bans.

- India shifted to regulatory legalization with 1% TDS and 30% gains tax frameworks operational.

- Brazil authorizes crypto payments, requiring CVM registration for AML compliance nationwide.

- South Africa classifies crypto as a financial product under FSCA licensing for all providers.

- Egypt, Algeria, and Bolivia maintain blanket bans citing financial stability risks.

- Argentina legalized crypto for international trade settlements under CNV VASP registration.

- Pakistan restricts crypto but permits limited P2P trading with strict oversight measures.

- China enforces a trading ban while Hong Kong licenses exchanges as a regulated hub.

- Kenya reversed the crypto banking ban, enabling regulated exchanges via the VASP Act.

Taxation Policies and Crypto Asset Reporting Requirements

- Brazil requires crypto holdings reporting if exceeding BRL 5,000 (~$900) annually to the Federal Revenue Service.

- India collects 30% tax on crypto profits plus 1% TDS, generating $1.8 billion in FY 2024–2025.

- South Africa applies capital gains tax on crypto above R40,000 (~$2,200) annual exclusion at an 18% effective rate.

- Philippines levies 12% VAT on crypto exchange commissions and goods sold for cryptocurrency.

- Turkey plans 7% transaction tax on crypto trades with annual declarations over $10,000 holdings.

- Nigeria imposes 5% VAT on crypto services by exchanges and wallet providers under the Finance Act.

- Kenya Finance Act 2025 replaces 3% DAT with excise duty on VASP platform fees and commissions.

- Argentina provides a 10% tax rebate incentive for exporters using stablecoins in settlements.

Consumer Protection and Anti-Money Laundering (AML) Measures

- 74% of emerging market countries implemented specific consumer protection regulations for crypto users, up from 61% in 2023.

- India mandates cold wallet custody for 95% of customer funds using HSM devices and multi-signature authentication.

- Brazil Virtual Assets Law requires VASPs to implement KYC, AML reporting to COAF, and client asset segregation.

- South Africa VASPs must file STRs within 24 hours to FIC under the goAML platform for suspicious activities.

- Nigeria SEC mandates custody standards and asset segregation for VASPs under the Investment and Securities Act.

- Philippines, 93% of crypto accounts completed real-name KYC verification per BSP Circulars 944 and 1108.

- Argentina processed 4,200 crypto fraud reports through victim support mechanisms amid pyramid schemes.

Influence of International Bodies on Emerging Market Regulations

- 58% of emerging market regulatory frameworks are directly influenced by FATF guidelines.

- IMF issued technical assistance to 18 emerging economies drafting crypto regulations.

- World Bank-funded blockchain identity systems in Kenya, Ghana, and Uganda for AML/KYC.

- Brazil and Colombia integrated OECD CARF tax reporting standards for crypto assets.

- South Asia Blockchain Forum coordinates crypto regulation across India, Bangladesh, Nepal, and Sri Lanka.

- AfCFTA pilots a regional crypto sandbox involving six nations, including Kenya, Rwanda.

- APAC Financial Regulators Roundtable hosted 19 countries standardizing crypto compliance.

- Interpol reported a 34% rise in crypto cross-border investigations involving emerging markets.

Recent Developments

- Brazil’s Central Bank published Resolutions 519-521 operationalizing the Virtual Assets Law for DASP registration.

- India IFSCA sandbox enables tokenized real estate pilots under the GIFT City regulatory framework.

- Argentina Resolution 05/2025 establishes stablecoin frameworks for cross-border settlements.

- South Africa FSCA approved VALR for crypto CFDs and derivatives under ODP licensing.

- Kenya’s IMF technical assistance supports the VASP Act implementation by April 2025.

- Nigeria SEC guidelines clarify staking rules under the Investment and Securities Act revisions.

- Vietnam Resolution 05/2025 introduces a licensing regime for cryptocurrency exchanges.

- Mexico Digital Peso pilot advances with retail payments testing targeted for 2026.

- Turkey’s anti-fraud task force closed 87 platforms, seizing $54 million in assets.

Frequently Asked Questions (FAQs)

74% of emerging markets have formal crypto regulations or guidelines in place.

68% of central banks in emerging economies are actively researching or piloting CBDCs.

83% of emerging market countries require mandatory VASP registration.

Conclusion

Emerging markets are no longer playing catch-up when it comes to crypto regulations. These nations are shaping new financial paradigms by balancing innovation, investor protection, and economic stability. Countries like India, Brazil, and Nigeria are at the forefront, establishing frameworks that foster financial inclusion and attract global investment.

At the same time, regulatory complexity and resource constraints continue to challenge developing economies. Yet, the momentum is undeniable. From CBDCs to stablecoins, from tax reforms to consumer safeguards, emerging markets are crafting rules that could soon become blueprints for the global crypto industry.