Imagine this: you’re sitting at a coffee shop, enjoying a latte, and casually checking your email. Suddenly, a notification pops up, your credit card has been charged $500 for something you didn’t buy. Scenarios like this are becoming alarmingly common. Credit card fraud is a modern menace, evolving with every technological advancement. In this article, we dive deep into the latest statistics, trends, and insights, giving you the knowledge you need to protect yourself and your finances.

Editor’s Choice

- $40 billion in global credit card fraud losses is projected for 2025, a 25% jump from last year.

- 63% of Americans have experienced credit card fraud at least once in 2025, making the US the hardest-hit region.

- 81% of all fraud cases globally were card-not-present fraud in 2025, up sharply from previous years.

- 80% reduction in in-person fraud due to EMV chip technology, but online fraud increased with digital payments in 2025.

- 44% of Millennials fell victim to credit card fraud in 2025, the highest among all age groups.

- 170 million credit card details were exposed in 2025, a 186% surge in breached records globally.

- $7.5 billion in US merchant losses from credit card fraud in 2025, with e-commerce retailers hit hardest.

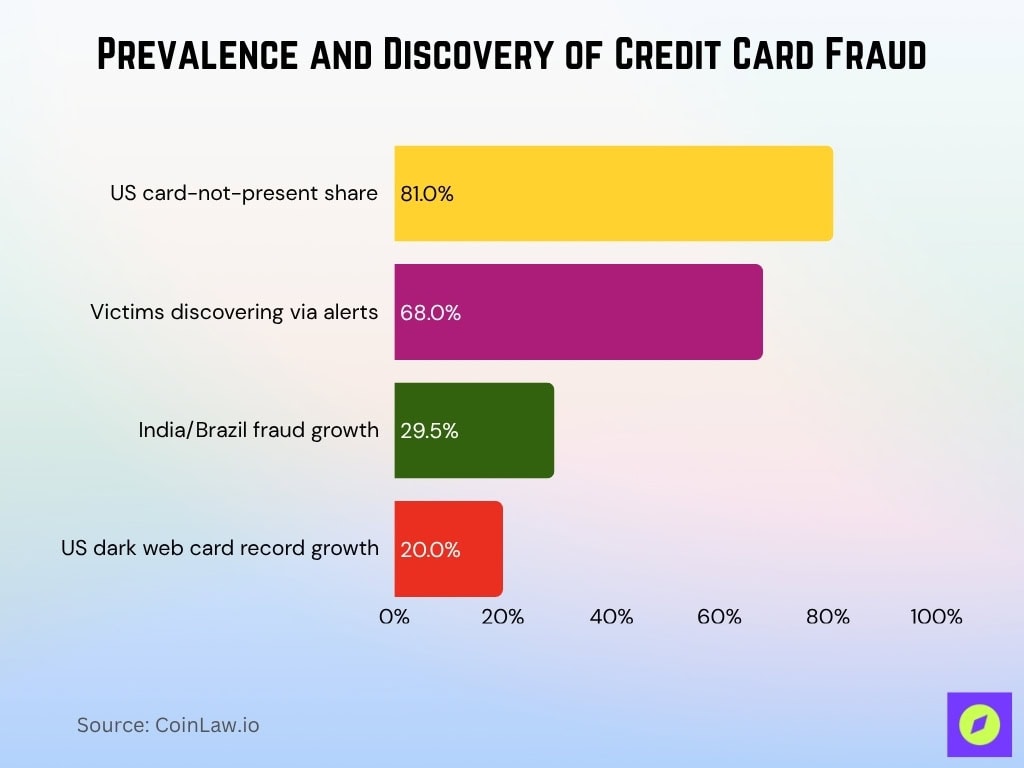

Prevalence of Credit Card Fraud

- 38% of all identity theft complaints reported to the FTC in 2025 involved credit card fraud, with over 323,000 cases in the first half.

- 81% of US fraud losses in 2025 stemmed from card-not-present transactions due to the continued surge in e-commerce.

- 68% of victims discovered fraud via alerts or statements instead of real-time monitoring in 2025.

- India and Brazil reported a 29.5% increase in credit card fraud cases in 2025, driven by digital payment growth.

- The use of dark web marketplaces for selling stolen credit card details surged by 20% in 2025, with 14.5 million U.S. card records listed.

- A fraudulent credit card transaction occurs every 14 seconds globally in 2025, reflecting a rise in fraud frequency.

- The US led with $13.7 billion in credit card fraud losses in 2025, the highest globally.

Demographic Analysis of Victims

- Millennials (25-40 years old) accounted for 41% of fraud victims in 2025, remaining the most targeted group.

- Older people aged 65+ reported the highest average financial losses, reaching $1,650 per incident in 2025.

- Low-income households faced a 32% higher fraud rate in 2025 due to limited access to advanced fraud prevention tools.

- Women accounted for 56% of phishing scam victims in 2025, slightly higher than men.

- Credit card fraud among college students (18-24) rose by 33% in 2025, with younger adults facing rapid increases.

- Urban residents reported 42% more fraud incidents compared to rural residents in 2025, driven by higher online activity.

- Small business owners represented 17% of credit card fraud victims in 2025, with business expenses frequently exploited.

Credit Card Fraud by Age

- Young adults (18-24) are the fastest-growing group of fraud victims in 2025, with a 33% year-over-year increase.

- Adults aged 35-44 experience the highest fraud incidence rates in 2025, with 47% of individuals in this bracket affected.

- Individuals aged 45-54 reported a 22% rise in card-not-present fraud cases over the past year.

- Fraud among the 55-64 age group declined by 12% in 2025, attributed to increased adoption of fraud protection tools.

- Teenagers (13-17) are increasingly targeted in 2025 due to parental credit card sharing for online transactions.

- Older people aged 65+ are victims of telephone-based credit card scams, accounting for 29% of fraud cases in this demographic in 2025.

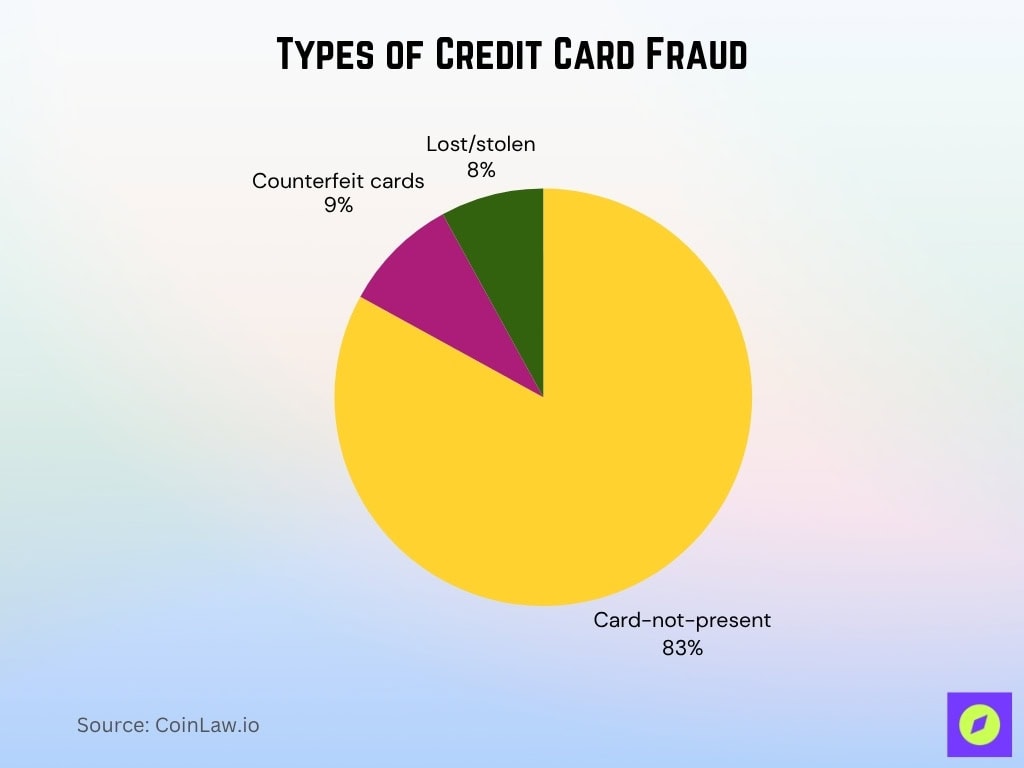

Types of Credit Card Fraud

- Card-not-present fraud accounted for 83% of cases in 2025, largely driven by global e-commerce and remote transactions.

- Counterfeit credit cards declined but still made up 9% of fraud in 2025, owing to gaps in EMV adoption and fallback attacks.

- Lost and stolen cards were responsible for 8% of global fraud cases in 2025, with most losses happening via contactless and unreported thefts.

- Synthetic identity fraud costs exceeded $23 billion worldwide in 2025, surging 31% over the previous year as AI and deepfakes improved fake identity creation.

- Account takeovers caused losses of $17 billion in 2025, growing 31% year-over-year due to bot automation and credential stuffing.

- Fraudulent new credit card applications increased by 21% in 2025, with spikes during peak shopping periods.

- Social engineering scams such as phishing and vishing tricked 18% of victims into sharing sensitive credit card details in 2025.

Credit Card Fraud by State

- California leads the US in reported credit card fraud cases, with over 82,000 incidents in 2025.

- Florida ranks second with 68,000 cases in 2025, driven by tourism and high online purchase activity.

- Texas and Nevada saw the fastest-growing fraud rates in 2025, at 11% and 15% respectively.

- New York recorded the highest average financial losses of $1,920 per incident in 2025.

- States with low fraud rates, such as Wyoming and Vermont, report fewer than 4,000 cases annually in 2025.

- Online credit card fraud in Washington, D.C., surged by 34% in 2025 due to increased remote work and digital payment volume.

- Illinois reported a 13% year-over-year decrease in fraud cases in 2025, tied to advanced statewide security technology adoption.

Financial Impact of Credit Card Fraud

- Global losses from credit card fraud are projected to reach $40 billion in 2025, a 25% year-over-year increase.

- In the US, financial institutions spent over $10.2 billion combating credit card fraud in 2025, including chargebacks and security upgrades.

- Businesses incur average costs of up to $4.50 for every $1 lost to credit card fraud in 2025, including operational and reputational damage.

- E-commerce platforms lost an average of $7.5 billion annually to card-not-present fraud in 2025.

- Fraud-related chargebacks surged by 21% in 2025, disproportionately affecting small businesses.

- Credit card fraud accounted for 52% of total global financial crime losses in 2025, surpassing check and wire fraud.

- Insurance companies covering fraud claims saw a 16% rise in payouts in 2025, particularly for online retail merchants.

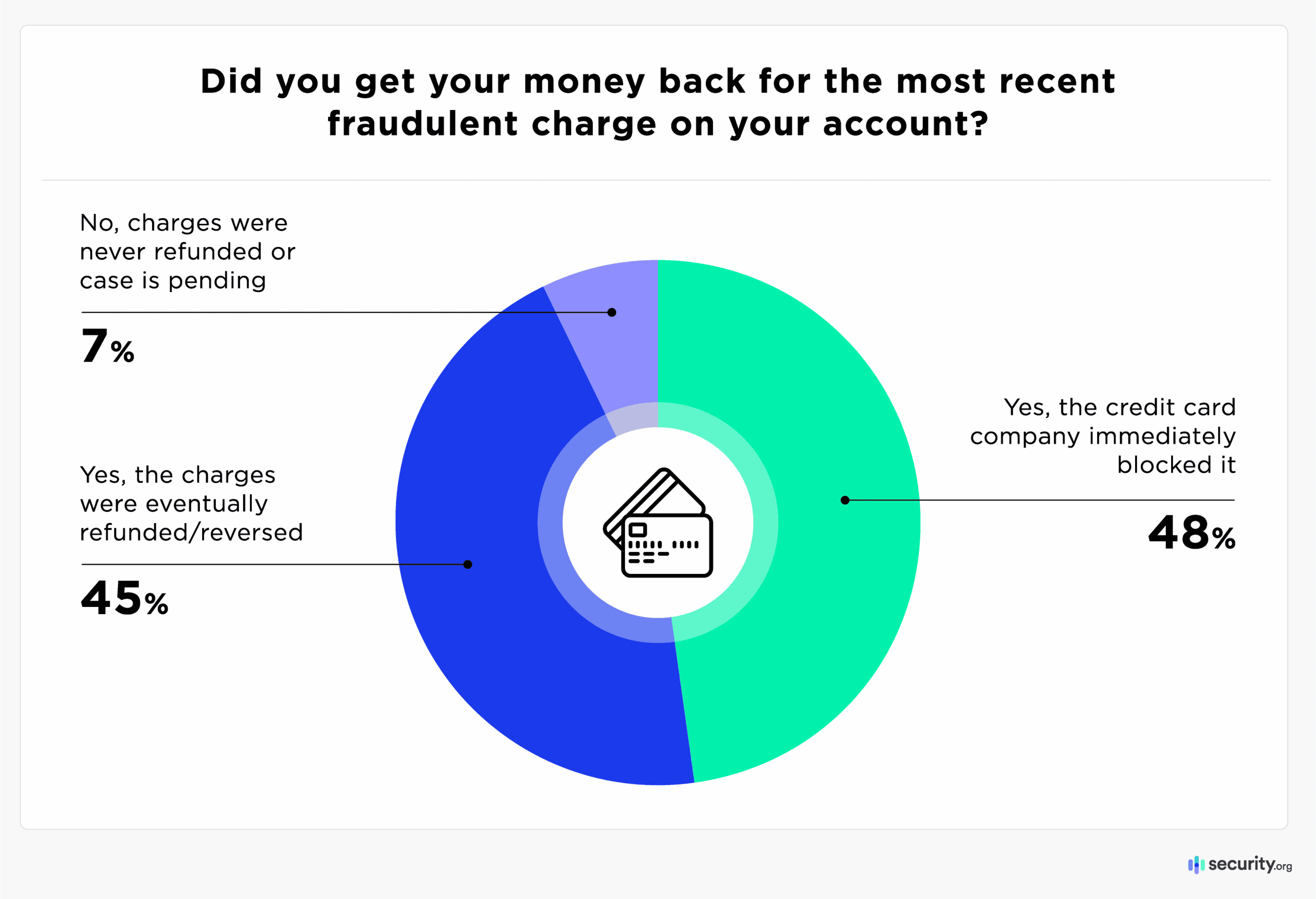

Refund Outcomes After Credit Card Fraud

- 48% of respondents said their credit card company immediately blocked fraudulent charges, preventing any financial loss.

- 45% reported that their charges were eventually refunded or reversed after an investigation.

- Only 7% said they never got their money back, or their case is still pending.

- The findings show that 93% of fraud victims recovered their funds, highlighting the effectiveness of modern fraud detection and refund mechanisms among credit card providers.

- However, the 7% unresolved cases underscore that a small but significant number of consumers still face delays or denials in getting refunds.

Annual Global Fraud Losses (Credit & Debit Cards)

- Annual global fraud losses on credit and debit cards are projected to reach $48 billion in 2025, up from $40 billion in 2024.

- The Asia-Pacific region reported a 17% increase in fraud losses in 2025, driven by rising digital payment adoption.

- Europe saw a 12% decline in fraud losses in 2025, due to wider enforcement of Strong Customer Authentication (SCA).

- North America accounted for 44% of global fraud losses in 2025, remaining the region with the highest absolute losses.

- Latin America reported $3.4 billion in fraud losses in 2025, driven by continued growth in e-commerce and mobile payments.

- Fraud tied to cross-border transactions jumped 21% in 2025, particularly affecting international retailers.

- Debit card fraud comprised $8.1 billion in global losses in 2025, representing a growing share of total card fraud.

Largest U.S. Data Breaches Exposing Credit Card Information

- The 2025 TransUnion breach exposed the sensitive data of 4.4 million Americans, including billing addresses and account details.

- A major hospitality chain breach in 2025 compromised over 18 million credit card records, making it the largest hotel-related incident this year.

- The Capital One data breach still impacts victims through the lingering use of stolen card numbers and led to a $190 million settlement and an $80 million regulatory fine in 2025.

- AI-driven phishing campaigns in early 2025 are projected to compromise over 14 million card records, with tactics bypassing advanced filters.

- Cyberattacks on point-of-sale (POS) systems rose by 36% in 2025, with each breach stealing an average of 50,000 credit card numbers.

- Dark web marketplaces saw a 27% year-over-year surge in U.S.-based card records for sale in 2025, with prices as low as $17 per card.

- The average cost to U.S. companies reporting breaches reached $10.2 million per incident in 2025, reflecting higher legal and regulatory penalties.

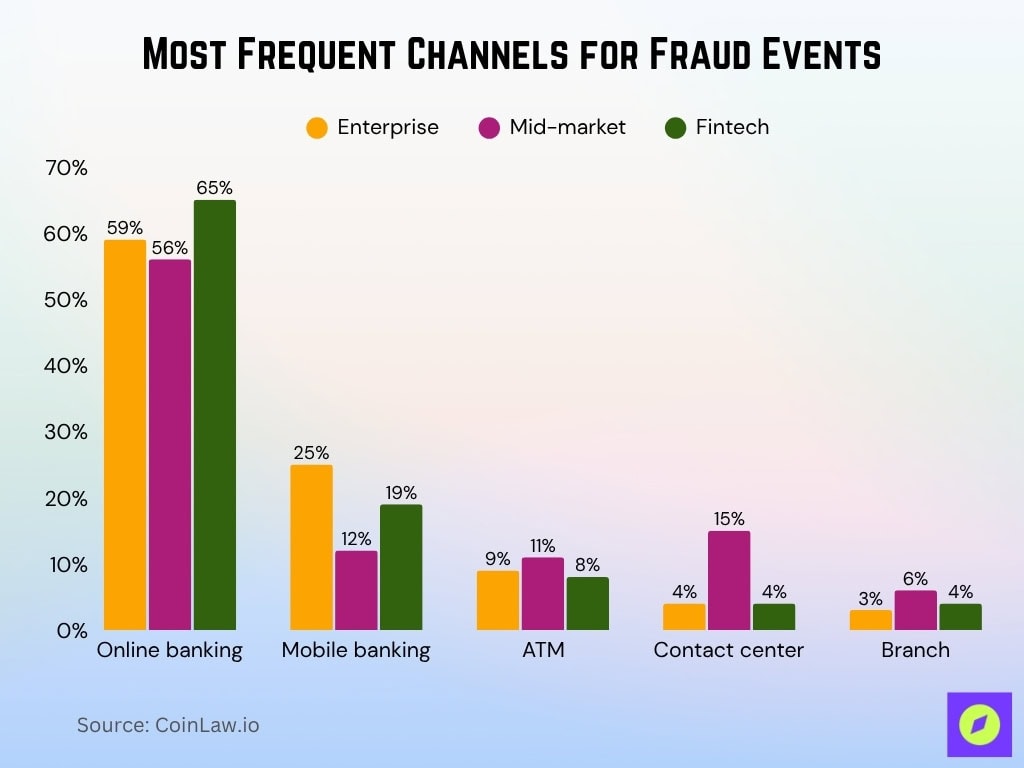

Most Frequent Channels for Fraud Events

- Online banking remains the top target for fraud across all sectors, reported by 65% of fintechs, 59% of enterprises, and 56% of mid-market firms.

- Mobile banking follows, with 25% of enterprise respondents and 19% of fintechs citing it as a major fraud channel, compared to only 12% in mid-market organizations.

- ATM fraud remains lower overall, at 9% for enterprises, 11% for mid-market, and 8% for fintechs.

- Contact center fraud is relatively rare but notable in the mid-market segment (15%), suggesting internal process vulnerabilities.

- Branch-level fraud accounts for a small share across all sectors, ranging from 3% to 6%.

- Overall, the data highlights how digital channels (online and mobile banking) dominate fraud exposure, reflecting the shift toward remote financial interactions and digital payments.

Prevention and Protection Measures

- Adoption of two-factor authentication (2FA) reduced fraudulent transactions by 41% for participating businesses in 2025.

- Tokenization technology now secures card-not-present transactions with 62% adoption among US retailers in 2025.

- Consumers who monitor their accounts regularly are 54% less likely to suffer financial losses from fraud in 2025.

- AI-driven fraud detection tools prevented over $18 billion in potential fraud in 2025.

- 42% of US consumers used virtual credit cards in the past six months, with adoption accelerating as a secure payment option in 2025.

- Awareness campaigns launched in 2025 increased fraud reporting rates by 29% among US consumers.

- Biometric authentication usage grew by 22% in 2025, sharply reducing fraud risks for payment systems.

Recent Developments

- Buy now, pay later (BNPL) providers implemented stricter identity verification and KYC measures in 2025, reducing fraud rates by 16%.

- Visa and Mastercard rolled out advanced AI-based fraud detection systems in 2025, leveraging $10 billion investments to analyze over 300 billion transactions yearly.

- Newly proposed US legislation in 2025 mandates real-time fraud reporting by financial institutions, with enforcement set for mid-year.

- A record $22 million investment into consumer fraud education programs is expected to launch in 2025.

- Blockchain-based credit card transactions now reduce payment fraud by up to 95%, providing more secure peer-to-peer payments in 2025.

- Cross-industry collaborations between banks and tech firms expanded in 2025 to combat synthetic identity fraud via shared databases and real-time alerts.

- Real-time spending notifications are offered by 97% of US card issuers in 2025, helping consumers promptly detect suspicious activity.

Frequently Asked Questions (FAQs)

62 million Americans experienced credit card fraud last year, representing 63% of all US credit card holders.

E-commerce credit card fraud in the US increased by 140% in the last 3 years, costing merchants $7.5 billion in 2025.

The global credit card fraud detection platform market is expected to grow at a CAGR of 15.6% between 2025 and 2033.

46% of global credit card fraud losses happen in the US.

Conclusion

The fight against credit card fraud remains a critical challenge as fraudsters adapt to evolving technologies. The data highlights the need for robust security measures, both at the consumer and institutional levels. While advancements like AI-driven tools and biometric authentication are encouraging, constant vigilance and innovation are essential. Together, informed consumers and proactive businesses can combat this growing threat effectively.