Core Scientific, one of North America’s largest blockchain infrastructure providers, is in the middle of a significant operational shift. After emerging from bankruptcy, the company has prioritized colocation services and AI infrastructure, while continuing to operate one of the largest self-mining operations for bitcoin in the U.S. Real-world applications include their growing partnership with CoreWeave for high-performance computing workloads and their massive energy footprint management across data centers.

The numbers tell a compelling story of resilience, redirection, and reemergence. This article unpacks Core Scientific’s key financial and operational statistics, offering a full breakdown of the company’s performance across business lines, earnings, mining, and growth outlook.

Editor’s Choice

- Net income for Q1 2025 was $580.7 million, up from a net income of $210.7 million in Q1 2024.

- $6 billion market cap in October 2025, reflecting over 50% Y/Y growth.

- Self-mined 256 bitcoin in January 2025 alone.

- In March 2025, the company operated approximately 163,000 total bitcoin miners, including 156,000 self-owned miners and approximately 7,000 customer-owned hosted miners.

- 250 MW billable colocation capacity targeted by the end of 2025.

- Delivered 50,373 MWh of power back to the grids in February 2025.

- Partnership with CoreWeave projected to generate $10 billion in contracted revenue over 12 years.

Recent Developments

- The company announced a strategic pivot from bitcoin self-mining to colocation and HPC hosting services.

- In early 2025, CoreWeave and Core Scientific entered a large-scale agreement involving 250 MW of colocation capacity.

- Core Scientific restructured its balance sheet and exited bankruptcy in January 2024.

- The firm’s share price climbed to the $18–$20 range in October 2025, up from ~$9 in early 2024.

- In March 2025, they operated approximately 19.1 EH/s of hash rate capacity.

- Their power infrastructure now spans a 1.3 GW footprint across U.S. sites.

- In 2025, they expanded their Denton, TX facility by 70 MW, investing over $100 million.

- The company reported $8.6 million in colocation revenue in Q1 2025.

- Bitcoin mining revenue continues to decline in relative terms as colocation gains traction.

Global Scientific Research and Development Services Market Growth

- The global Scientific Research and Development Services market is projected to grow to $1,387.92 billion by 2029.

- The market is expanding at a compound annual growth rate (CAGR) of 10.2% from 2024–2029.

- In 2025, the market is expected to reach $940.33 billion, showing steady year-over-year momentum.

- Continued growth is driven by rising global R&D investments, especially in biotechnology, AI, and material sciences.

- By 2029, the industry is forecast to surpass the $1.3 trillion mark, reflecting robust expansion and diversification.

Company Overview

- Core Scientific, Inc. is based in Austin, Texas, and operates blockchain and AI infrastructure data centers across the United States.

- The company’s main revenue drivers are digital asset self-mining, hosted mining, and colocation services.

- It filed for Chapter 11 bankruptcy in late 2022 and emerged successfully in early 2024.

- In 2025, the company employs over 200 full-time staff, primarily across its 9 operating facilities.

- Core Scientific runs one of the largest fleets of self-owned bitcoin mining rigs in North America.

- As of October 2025, the company’s market capitalization stands at approximately $6 billion.

- Core Scientific trades under the ticker symbol CORZ on the NASDAQ.

- The company’s leadership team includes CEO Adam Sullivan, who has led its transformation post-bankruptcy.

- Core Scientific has signed a $10 billion+ revenue deal with CoreWeave, reflecting its pivot to colocation.

Business Segments

- Core Scientific operates in three key segments: self-mining, hosted mining, and colocation services.

- In Q1 2025, self-mining remained the largest segment, generating over $66 million in revenue.

- The hosted mining segment generated $3.8 million in Q1 2025.

- Colocation services, the newest segment, contributed $8.6 million in revenue during Q1 2025.

- In FY 2024, the self-mining gross profit was $94.4 million, representing a 23% margin.

- Hosted mining gross profit was $24 million in FY 2024, with a 31% gross margin.

- Colocation segment gross profit was only $0.5 million in Q1 2025, due to high ramp-up costs.

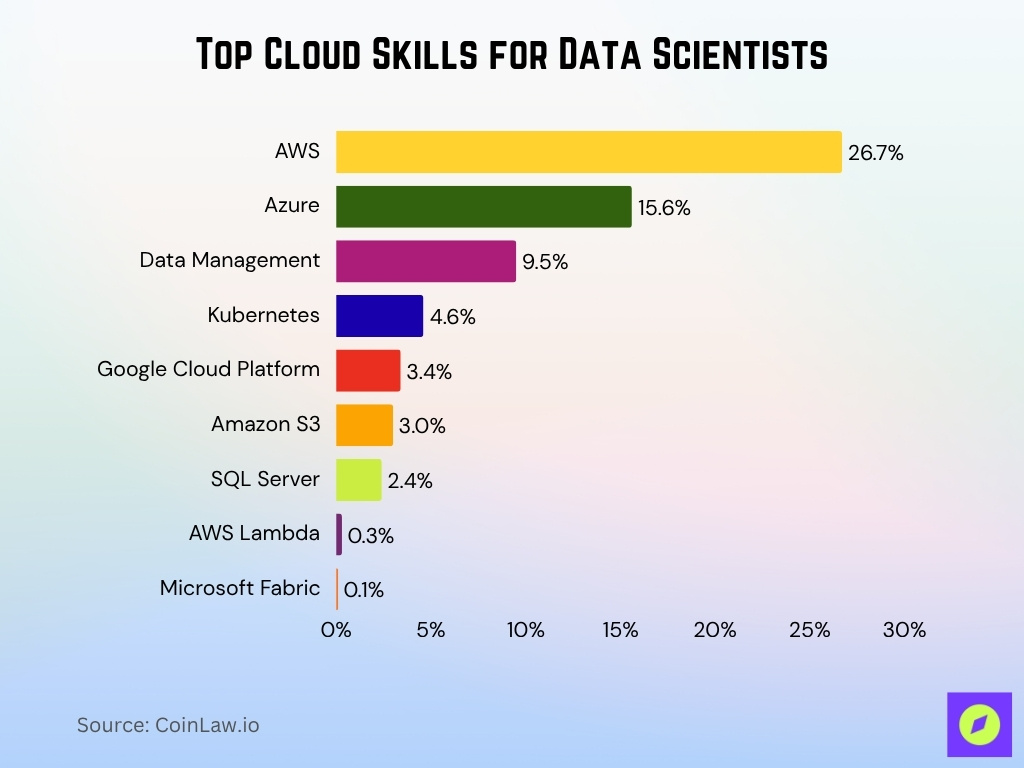

Top Cloud Skills for Data Scientists

- AWS leads the demand, appearing in 26.7% of total job postings.

- Azure follows with 15.6%, showing its strong enterprise adoption rate.

- Data Management ranks third with 9.5%, reflecting the importance of organizing and structuring data efficiently.

- Kubernetes skills are mentioned in 4.6% of roles, driven by demand for scalable data pipelines.

- Google Cloud Platform appears in 3.4% of listings, suggesting growing multi-cloud strategies.

- Amazon S3 (3.0%) and SQL Server (2.4%) remain essential tools for storage and database management.

- AWS Lambda (0.3%) and Microsoft Fabric (0.1%) show limited but emerging mentions, indicating niche expertise requirements.

- Overall, AWS and Azure together account for over 42% of all cloud-related skill mentions, confirming their dominance in the data science cloud ecosystem.

Key Financial Highlights

- Non-GAAP adjusted EBITDA for Q1 2025 was $(6.1 million), indicating operating losses despite headline profits.

- The company had approximately $697.9 million in cash and cash equivalents by March 31, 2025.

- Operating cash flow was $(6.6 million) in Q2 2025.

- Gross profit for Q2 2025 was approximately $5 million, resulting in a 6% gross margin.

- In FY 2024, total revenue was $510.7 million.

- FY 2024 net loss totaled $1.3 billion, largely due to mark-to-market accounting losses.

- The company had total assets worth over $1.97 billion by mid-2025.

Revenue Statistics

- FY 2024 revenue: $510.7 million, with bitcoin mining accounting for the majority.

- In Q1 2025, total revenue reached approximately $79.5 million.

- Self-mining revenue in Q1 2025: $67.2 million.

- Hosted mining revenue in Q1 2025: $3.8 million.

- Colocation revenue in Q1 2025: $8.6 million.

- Revenue in FY 2024: $510.7 million, down from approximately $583.6 million in FY 2023, showing a Y/Y decline.

- March 2025 production earned 247 bitcoin via self-mining.

- Revenue forecast for FY 2025: projected at around $425 million.

- Average monthly bitcoin production in Q1 2025: ~240 bitcoin/month.

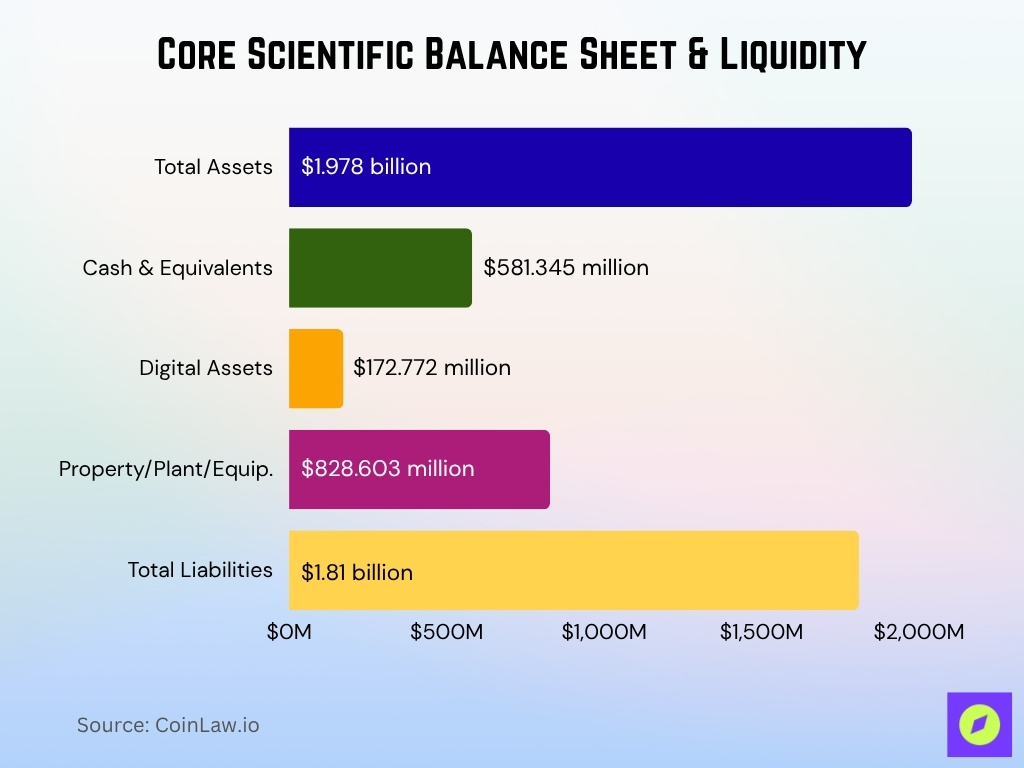

Balance Sheet Data

- As of August 8, 2025, total assets stood at approximately $1.978 billion, compared with $1.598 billion in the prior period.

- Current assets included $581.345 million in cash and cash equivalents and $172.772 million in digital assets.

- Property, plant and equipment, net was $828.603 million in the latest period.

- Total liabilities stood at ~$1.81 billion as of Q1 2025, resulting in negative shareholders’ equity of –$181 million.

- Shares outstanding rose significantly, to over 360 million diluted shares by Q1 2025, impacting per-share metrics.

Profit and Loss Figures

- That reported profit was driven primarily by a $621.5 million non-cash mark-to-market adjustment on warrants and other contingent value rights.

- Operating loss in Q1 2025 was $42.6 million, as compared with operating income of $55.2 million in Q1 2024.

- Non-GAAP Adjusted EBITDA in Q1 2025 was $(6.1) million, versus $88.0 million in Q1 2024.

- In FY 2024, revenue was $510.7 million, yet the company recorded a net loss of $1.3 billion, largely due to a $1.4 billion warrant-liability fair value adjustment.

- For FY 2024, the digital asset self-mining gross profit was $94.4 million (23% margin), down from $98.6 million (25%) the prior year.

- The hosted-mining segment gross profit in 2024 was $24.0 million (31% margin), compared with $24.8 million (22% margin) in 2023.

- SG&A expenses in Q1 2025 reached $40.1 million, up from $16.9 million a year earlier, driven by stock-based compensation and the start-up of colocation sites.

EBITDA Statistics

- Q1 2025 Non-GAAP Adjusted EBITDA was $(6.1) million, a steep drop from $88.0 million in Q1 2024.

- For FY 2024, Non-GAAP Adjusted EBITDA was $157.4 million, compared with $169.5 million in FY 2023, an approximate decrease of 7%.

- While net income was positive in Q1 2025, the negative EBITDA indicates that the company’s core operations remained under pressure.

- The EBITDA contraction reflects decreases in revenue (driven by bitcoin halving and mining shift) and higher operating costs.

- The gross margin in Q2 2025 was approximately 6%, indicating margin compression in the business.

- MacroTrends historical data shows EBITDA for Core Scientific declining from ~$157.4 million in 2024 to an estimated ~$128.4 million in 2025.

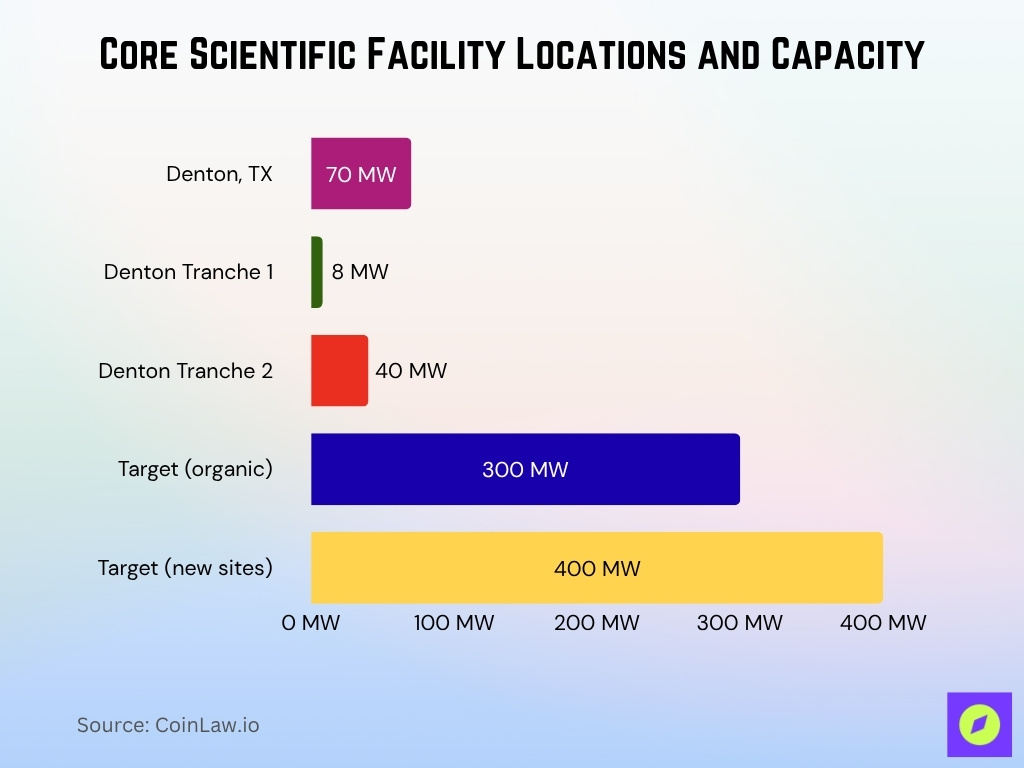

Facility Locations and Capacity

- A key site in Denton, Texas, is being expanded by 70 MW, with $104 million in capital investment.

- The first tranche of 8 MW billable capacity at Denton was targeted for Q2 2025 delivery.

- Another ~40 MW was scheduled to be deployed at Denton by the end of Q2 2025.

- The facility development plan targets approximately 300 MW of organic expansion by 2027 and another 400 MW through new site construction.

- Core Scientific operates nine data centers across the U.S., located in Alabama, Georgia, Kentucky, North Carolina, North Dakota, and Texas, with a new site in Oklahoma.

- Their contracted gross power footprint stands at about 1.3 GW, with potential for an additional ~1 GW of expansion.

- Approximately 400 MW of that power is allocated to bitcoin mining, while the remainder is planned for AI and HPC compute workloads.

Cash Flow Statistics

- For the quarter ended June 30, 2025, net cash used in operating activities was $6.599 million, compared to net cash provided of $23.378 million in the prior year period.

- Cash flows from investing activities in that period amounted to $(213.066) million, compared with $(35.154) million in the prior year period.

- Cash flows from financing activities in the same period showed a net use of $(35.970) million, versus net provided cash of $39.172 million in the prior year period.

- As of Q1 2025, the company reported cash and cash equivalents of approximately $697.9 million.

- Free cash flow for 2024 was essentially $0 billion, indicating no net positive free cash generation.

- The company’s negative cash flows from operations and heavy investing outflows in 2025 highlight significant capital intensity and short-term liquidity risk.

- Adjustments to reconcile net loss to operating cash flow included a large increase in warrant liabilities’ fair value ($289.4 million) as of August 8, 2025.

Market Capitalization

- As of October 2025, the company’s market capitalization was approximately $6.00 billion.

- Market cap rose from ~$3.92 billion at the end of 2024 to ~$6.00 billion in 2025, a ~53% increase.

- Market cap increased roughly 90.9% year-over-year, reaching $5.93 billion by mid-October 2025.

- The increase in market cap comes despite declining core operating revenue, indicating investor focus on strategic transition and asset value.

- Enterprise value was reported at ~$6.14 billion, reflecting the addition of debt and other liabilities.

- Analyst forecasts estimated net sales of ~$425.5 million for 2025 and EBITDA ~$128.4 million, implying potential valuation upside if business stabilizes.

Stock Performance

- The company’s ticker CORZ trades on NASDAQ and in October 2025 was priced around $18–$20 per share.

- Shares outstanding increased from mid-200 million to over 360 million diluted shares in Q1 2025.

- Though profitable on a non-operational basis in Q1 2025, the negative operating EBITDA and high debt burden keep the stock volatile.

- The pending acquisition by CoreWeave, Inc. (deal value ~$9 billion) has added significant merger-related shares and volatility.

- The valuation implies a Price/Sales ratio (~30x) given projected sales of ~$425 million for 2025 and a market cap of ~$6 billion.

Mining Operations Statistics

- In January 2025, Core Scientific mined 256 bitcoin using its self-owned fleet.

- In February 2025, the company mined 215 bitcoin.

- In March 2025, Core Scientific mined 247 bitcoin from its self-mining operations.

- The total company hash rate, including hosted mining, was ~19.1 EH/s in March 2025.

- Self-mining accounted for ~18.1 EH/s, while hosted customers contributed ~1 EH/s.

- The average fleet efficiency in March 2025 was ~24.3 J/TH.

Colocation Services Statistics

- For Q1 2025, the colocation segment generated $8.6 million in revenue.

- Colocation gross profit in Q1 was $0.5 million, translating into a 5% gross margin.

- Non-GAAP gross margin for colocation (excluding power cost pass-through) was 8% in Q1 2025.

- The company is on track to deliver 250 MW of billable colocation capacity by the end of 2025.

- They target approximately 590 MW of colocation capacity by early 2027.

- Existing gross use-power footprint is about 1.3 GW, with a portion assigned to colocation deals.

- The company’s major partner, CoreWeave, has contracted large capacity via the colocation segment, giving partly $10 billion+ in long-term revenue potential.

Hosted Mining Statistics

- In January 2025, hosting services supported approximately 7,000 customer-owned bitcoin miners.

- Those hosted miners earned an estimated 17 bitcoin in January 2025.

- In February 2025, customer-owned miner earnings were estimated at 16 bitcoin.

- In March 2025, hosting customers earned approximately 17 bitcoin.

- The hosting segment accounted for $3.8 million in revenue in Q1 2025.

- The hosting segment gross profit in Q1 was $1.7 million, representing a 46% margin, up from 32% a year earlier.

Power Usage and Efficiency

- As of March 31, 2025, the total energized hash rate was ~19.1 EH/s for both self-mining and hosting.

- Self-mining fleet hash rate was ~18.1 EH/s in March 2025.

- The fleet average efficiency in January 2025 was ~24.5 J/TH, compared to ~24.6 J/TH in December 2024.

- Average efficiency improved to ~24.3 J/TH in March 2025.

- In January 2025, the company delivered ~48,236 MWh to local grids via curtailment.

- In February 2025, it delivered ~50,373 MWh.

- In March 2025, grid support contribution was ~35,295 MWh.

Production Output

- In January 2025, Core Scientific earned 256 bitcoin from its self-mining fleet.

- In February 2025, it earned 215 bitcoin.

- In March 2025, it earned 247 bitcoin.

- The total number of miners operated was approximately 161,000 owned bitcoin miners in January 2025, representing approximately 96% of all miners in its data centers.

- Hosted miners remained ~7,000 as of March 2025.

- The total hash rate of the fleet remained ~19.1 EH/s in March 2025.

Growth Trends and Projections

- The company reaffirmed its target of 250 MW of billable capacity by the end of 2025 for the colocation business.

- They project reaching ~590 MW of billable capacity by early 2027.

- They are targeting ~300 MW of organic growth at existing sites by the end of 2027, plus ~400 MW through new sites.

- As of Q1 2025, they reported liquidity (cash + digital assets) of ~$778.6 million.

- Partnership with CoreWeave is expected to deliver more than $10 billion in cumulative revenue over 12-year contract terms.

Frequently Asked Questions (FAQs)

$79.5 million.

Net income was $580.7 million in Q1 2025 versus $210.7 million in Q1 2024.

$67.2 million revenue with a 9 % gross margin.

Conclusion

In summary, Core Scientific, Inc. is navigating a major transformation, from primarily bitcoin mining to a broader role as a high-density colocation and HPC provider. The company’s key statistics show a pivot in revenue mix, targets for significant capacity expansion, and rigorous execution underway across its mining, hosting, and colocation segments.

For investors and industry watchers alike, the standout metrics in production output, facility expansion, and long-term contracted revenue illustrate both the opportunities and the risks in this pivot. As computing demand continues to escalate, especially in AI and large-scale data infrastructure, Core Scientific’s performance will be a valuable lens on how the market evolves. Let’s continue exploring this story in depth.