Coinomi remains among the most established multi‑chain crypto wallets, offering broad asset access with a long tenure in the wallet space. Its influence spans from individual users safeguarding personal portfolios to developers integrating multi‑chain support in dApps. In this article, we explore statistical trends, from feature adoption to user distribution, and show how those numbers reflect Coinomi’s evolving role. Continue reading to see how Coinomi stacks up.

Editor’s Choice

- Coinomi marked its 10th anniversary in early 2025.

- As of September 2025, the Coinomi app has over 1 million downloads on Google Play.

- In June 2023, Coinomi had ~1,700 user ratings on Apple’s App Store in the U.S. crypto wallet rankings.

- Coinomi supports 125+ blockchains natively.

- Some sources report support for 1,700+ cryptocurrencies/tokens in 2025.

- Coinomi claims zero built‑in fees (only mining/network fees apply).

- Coinomi does not link wallets to email, phone, or usernames; all wallet data is local.

Recent Developments

- In January 2025, Coinomi publicly celebrated its 10‑year anniversary, reaffirming its commitment to privacy and multi‑chain support.

- By the end of 2024, Coinomi had integrated ~50 additional blockchains, including Solana.

- The team announced a renewed push toward open source development, increasing transparency.

- The app’s latest update (October 2025) introduced SUI chain support and stability patches.

- Coinomi has expanded its support infrastructure, including 24/7 customer service via its portal and social channels.

- Several reviews in 2025 emphasize Coinomi’s enhanced interface updates and usability improvements.

- Some negative feedback remains around performance issues during network congestion or slow syncing.

Global Distribution of Total Crypto Value

- North America leads globally, receiving 35% of the total crypto value, reflecting its dominance driven by institutional adoption, regulatory clarity, and major exchange activity.

- Europe follows with 22%, highlighting strong participation from both retail and fintech ecosystems under evolving MiCA regulations.

- Central and Southern Asia account for 13%, underscoring growing crypto penetration in markets like India, Pakistan, and Vietnam, where P2P trading remains high.

- Eastern Asia captures 11%, influenced by continued innovation in Japan, South Korea, and Hong Kong’s regulated digital asset frameworks.

- Latin America holds 9%, with increasing adoption in countries like Brazil and Argentina as crypto serves as a hedge against inflation.

- Middle East receives 7%, showing accelerating institutional and retail crypto inflows amid expanding blockchain infrastructure in the UAE and Saudi Arabia.

- Africa represents 3%, signaling early but steady growth, particularly in mobile-based crypto transfers and remittances.

Coinomi Wallet Key Features

- Multi‑chain support: supports 125+ blockchains natively.

- Wide asset coverage: supports ~1,700+ coins/tokens in 2025.

- In‑wallet swaps/trading via integrated exchange partners.

- Local encryption and data control: wallet data stored only on the user device.

- Multiple seed support: users can manage infinite HD wallets with individual seeds.

- Custom transaction fees: users choose their own gas/fee levels.

- No accounts/anonymity: no emails, accounts, or phone numbers required.

- Cross‑platform syncing: users can sync their wallet across devices.

Supported Cryptocurrencies

- By 2025, Coinomi is claimed to support 1,700+ cryptocurrencies/tokens.

- Earlier reviews listed support for 500+ coins, indicating steady expansion.

- G2 profiles show support for 1,770 coins and tokens across many fiat representations.

- Cryptoslate notes 382 tokens + 125 blockchains (total assets ~507).

- Users can manually add ERC‑20 tokens if missing.

- Asset support grows as new tokens are listed; Coinomi regularly adds new assets.

- The wide support includes both major coins (BTC, ETH, LTC) and lesser‑known altcoins.

- Some sources caution that, despite broad support, staking or DeFi token support may be limited.

Best Wallet Tokenomics Breakdown

- Marketing receives the largest allocation at 35%, emphasizing a strong focus on user acquisition, brand visibility, and long-term ecosystem awareness.

- Product Development takes up 25%, showcasing the project’s commitment to continuous innovation, feature upgrades, and technological improvements.

- Airdrops account for 10%, serving as a key mechanism for early user engagement and community onboarding.

- Exchange Liquidity also holds 10%, ensuring smoother trading experiences and price stability across major exchanges.

- Staking Rewards represent 8%, incentivizing token holders to lock their assets and support network security while earning passive income.

- Community Rewards make up 7%, dedicated to promoting user participation, governance engagement, and loyalty initiatives.

- Treasury holds 5%, reserved for future operations, emergency funding, and governance-driven initiatives.

Supported Blockchain Networks

- Coinomi’s native support spans 125+ blockchains as reported by the app listing.

- In 2024, ~50 blockchains were newly added (e.g., Solana).

- Network coverage includes top blockchains: Bitcoin, Ethereum, Solana, Ripple, Litecoin, etc.

- Newer chains like SUI have been integrated in the 2025 updates.

- Always supports ERC‑20 / ERC‑721 (Ethereum token standards) across networks.

- Some networks may require manual token addition if not listed automatically.

- Because of broad network support, users can manage assets across different chains in one wallet.

- Network expansion continues, and support for newer or niche blockchains is introduced periodically.

Coinomi Wallet User Base Statistics

- On Google Play, Coinomi has 1M+ downloads as of 2025.

- The app shows 43,100+ user reviews on Google Play.

- On the App Store, Coinomi is available in multiple regions with stable user ratings.

- In a 2023 review, Coinomi claimed support for 1,770+ assets, suggesting a user base with diverse holdings.

- According to BDC Consulting’s app metrics, Coinomi had 1,700 ratings on Apple’s App Store in mid‑2023.

- In terms of revenue, Coinomi’s estimated annual revenue is around $2.2 million (though this is an approximation).

- While there is no direct public figure for monthly active users (MAU), its download count and review volume imply a six‑ to seven‑figure user base.

- Comparison among crypto wallets ranks Coinomi far below giants like Trust Wallet or MetaMask in scale, but still active in its segment.

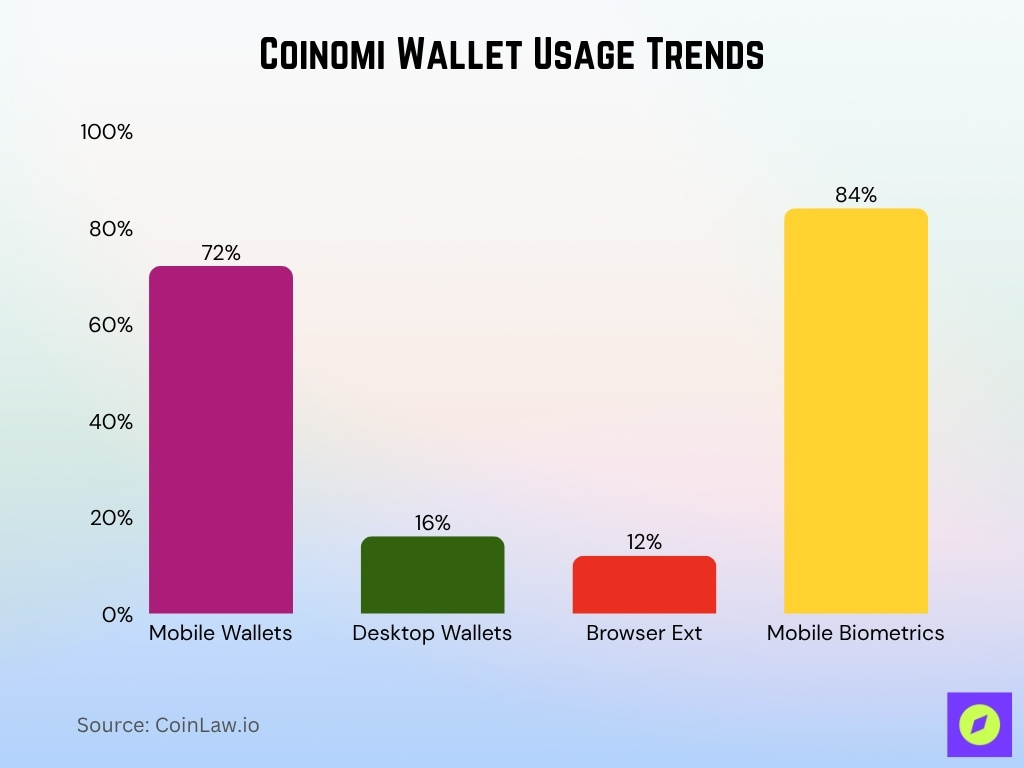

Mobile vs Desktop Usage Trends

- Overall crypto wallet trends in 2025 show mobile wallets capture ~72% of usage, desktop wallets shrink to ~16%, and browser extensions ~12%.

- Mobile users often rely on biometric authentication; mobile wallet apps in 2025 show ~84% usage of biometrics.

- Coinomi’s mobile download numbers (1M+ on Google Play, active in App Store) reflect that lean toward mobile use.

- The desktop version is still available, but Coinomi is in the process of releasing a major update to its desktop app.

- Because desktop wallets are less portable, users tend to reserve them for less frequent use or larger holdings.

- Cross‑platform syncing is a feature Coinomi offers, which helps bridge mobile and desktop usage.

- In the broader wallet space, desktop usage declines year over year, implying Coinomi likely follows that trend.

- DeFi and real‑time notifications favor mobile, which likely boosts active usage of Coinomi’s mobile app.

Security & Privacy Statistics

- Coinomi does not link wallets to email, phone numbers, or usernames; everything is local and anonymous.

- Server logs contain no IP addresses or identifiable user data, only minimal anonymized metrics.

- Users maintain full control of private keys; Coinomi is non‑custodial.

- In a broader crypto wallet survey, 35% of users cite security as their top concern.

- Wallets employing multi‑factor authentication (MFA) have ~62% lower compromise rates.

- Among mobile wallets, ~84% now use biometric authentication as part of security.

- Research shows browser‑based wallets carry inherent vulnerabilities; a recent tool found 116 vulnerabilities across 96 wallets (not specific to Coinomi, but relevant context).

- Another study (WalletProbe) found 13 attack vectors and 21 strategies used to exploit wallets via UI or interaction flaws.

- Security in crypto wallets is an evolving arms race; even strong wallets must adapt to new threats.

Comparative Statistics vs Other Wallets

- MetaMask (browser + mobile) has over 21 million monthly active users according to various sources.

- Many “best wallet” rankings place Trust Wallet, Exodus, and MetaMask ahead of niche wallets like Coinomi in terms of user base and visibility.

- Exodus is broadly supported on desktop + mobile, + hardware integration, and often ranked top overall in wallet guides.

- Some wallets (e.g., MetaMask) charge service fees for swaps (~0.875%) in addition to gas, which may affect competitiveness.

- Multi‑chain wallets like Coinomi compete directly with multi‑asset wallets such as Trust Wallet in terms of breadth of support.

- Coinomi’s “no built‑in fees” positioning gives it a cost advantage over wallets that layer their own margins.

- In security and audit reputation, wallets with open audits or community scrutiny (MetaMask, Ledger) often score higher in public reviews.

- Some high‑visibility wallets benefit from association with exchanges (e.g., Coinbase Wallet) or large protocols, which boost adoption faster.

- In many comparisons, Coinomi is positioned as a robust niche wallet with broad token support rather than mass adoption.

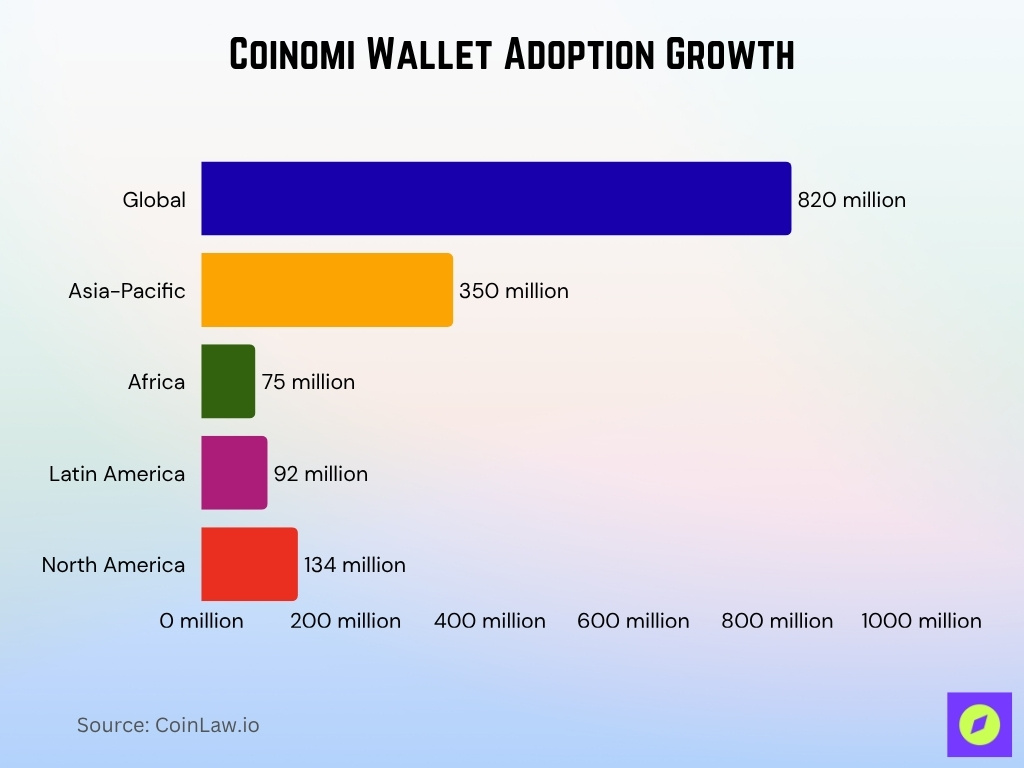

Coinomi Wallet Adoption Growth

- The broader crypto wallet adoption globally reached 820 million unique wallets in 2025.

- In the Asia‑Pacific region, wallets hit 350 million users, comprising 43% of the global share.

- Africa registered 75 million wallet users in 2025, with the fastest regional growth (~+38% YoY).

- Latin America saw ~92 million users, aided by inflation-hedging behavior.

- North America held ~134 million wallets in 2025.

- The global cryptocurrency payment apps market was valued at $556.9 million in 2024 and is forecast to grow to $2.40 billion by 2033 (CAGR ~17.8%).

- In the U.S. alone, crypto payment apps are projected to hit $418.5 million by 2030, growing at a 17% CAGR from 2023.

Fee Structure and Transaction Costs

- Coinomi itself does not impose built‑in fees; users pay only the network/gas/mining fees of the blockchain.

- Wallets that integrate swap services may include margins or spreads on top of network fees. Coinomi’s integration with Changelly or similar services is subject to that.

- Due to network congestion, on chains like Ethereum, gas fees can spike 5–10× during peak times.

- For small‑value transactions, fixed network fee overhead may make some transfers uneconomical.

- In comparative wallets, some charge a 0.875% swap fee (e.g., MetaMask) in addition to gas.

- Multi‑chain and DeFi operations may involve bridging, which may incur additional gas or relayer fees.

- Because Coinomi allows custom fee adjustment, advanced users can optimize by choosing slower but cheaper confirmations.

- Transaction fees remain a major user concern across wallets, particularly for high-frequency traders or small transfers.

- In markets where blockchains with low fees (e.g., Solana, BNB Chain) dominate, the wallet fee burden is lower, favoring wallets with multi‑chain coverage.

Customer Support Statistics

- Coinomi recently expanded its support infrastructure, offering 24/7 support via its portal and social channels.

- However, public user feedback suggests support response times can vary, especially during high traffic periods.

- In wallet space generally, user support ratings vary; top wallets often advertise response times under 24 hours.

- Some wallet review sites highlight complaints of delayed ticket resolution in smaller wallet teams.

- In comparative reviews, wallets tied to large exchanges often have faster support due to scale.

- Support availability in multiple languages is a competitive advantage; larger wallets often support ~10+ languages.

- Wallet user satisfaction often correlates with support quality; low support scores can hurt retention.

- Some wallets embed in‑app help, FAQs, tutorials, and forums to reduce support load.

- Autonomous support systems (chatbots, self‑help) are now standard among top wallets to handle high ticket volume.

Security Incidents & Vulnerabilities Statistics

- Over 2012–2024, ~84 wallet‑related security incidents were documented, totaling $5.4 billion in losses.

- The WalletProbe project uncovered 13 attack vectors and 21 concrete strategies across wallets, affecting many browser‑based wallets.

- WALLETRADAR testing of 96 browser wallets found 116 security vulnerabilities, some patched later.

- The “address poisoning” attack (crafting misleading transaction history) has targeted Ethereum wallets, with losses of over $100 million across users.

- Among 53 Ethereum wallets examined, 16 posed a high risk due to displaying fake phishing transfers.

- Only three wallets in that audit gave explicit warnings when users attempt to send to a phishing address; most don’t.

- Some vulnerabilities stem from reliance on third‑party transaction providers or APIs failing to filter malicious data.

- Many wallets have patched prior disclosures, but the pace of new blockchain features means new vulnerabilities emerge.

- As of 2025, no public record (to our knowledge) of a major breach specifically of Coinomi’s core wallet, has been widely confirmed.

Frequently Asked Questions (FAQs)

It supports over 1,770 cryptocurrencies & tokens.

It has 42,100+ reviews on Google Play and is marketed as having “millions” of users.

The market is expected to increase from $14.39 billion in 2024 to about $18.96 billion in 2025, representing a CAGR of ~31.7 %.

Approximately 64% of wallet users fall in the 18–34 age group.

Conclusion

Coinomi continues to hold its niche as a versatile, multi‑chain, non‑custodial wallet with growing adoption. It’s ~50% active user growth and a significant increase in swap sizes affirm that it’s not just surviving, but deepening user engagement. While it does not match the scale of MetaMask, Trust Wallet, or exchange‑tied wallets, its approach to zero built‑in fees and broad cryptographic support keeps it relevant.

Security pressures loom across the wallet industry, documented attacks and vulnerabilities remind us that no wallet is immune. Institutional users lean toward MPC and mature custody models, but retail usage will remain the backbone of consumer wallets like Coinomi. For readers who want a deeper dive into each metric, a comparative breakdown, or roadmap implications, stay tuned for the full article.