CleanCore Solutions stock rallied after-hours as the company announced it had surpassed 500 million Dogecoin in its treasury, marking a major step toward its 1 billion DOGE goal.

Key Takeaways

- CleanCore Solutions has now accumulated more than 500 million DOGE, halfway to its 1 billion token target.

- The company bought $130 million in DOGE on Thursday after a 285.42 million DOGE purchase earlier this week.

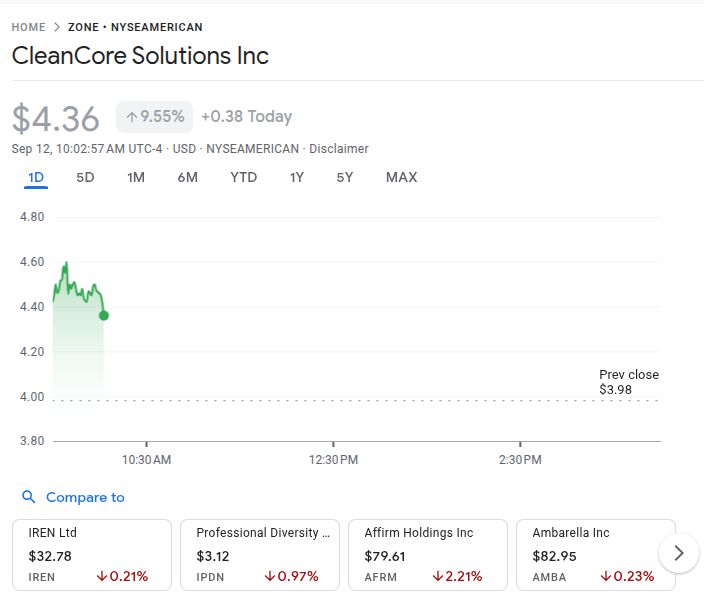

- ZONE stock jumped 11.81% in after-hours trading to $4.45, up over 200% year-to-date.

- CleanCore aims to secure 5% of Dogecoin’s circulating supply while the first DOGE ETF launch faces delays.

What Happened?

CleanCore Solutions, a Nebraska-based maker of aqueous ozone cleaning systems, announced Thursday that it had surpassed 500 million Dogecoin in its Official Treasury. The milestone comes less than a week after the company bought hundreds of millions of DOGE as part of its plan to accumulate 1 billion tokens within 30 days.

The move sparked strong market reaction, with shares of CleanCore surging nearly 12% in after-hours trading.

🔥 LATEST: CleanCore Solutions doubles down on Dogecoin — now holding 500M+ $DOGE, halfway to its 1B $DOGE goal in just 30 days. 🚀🐕 pic.twitter.com/AozlybKdXB

— CNC Signal Global Inc. (@CNCSignalGlobal) September 12, 2025

CleanCore’s Growing Dogecoin Treasury

CleanCore Solutions became the first publicly traded company to establish a Dogecoin treasury, created in partnership with the Dogecoin Foundation and its corporate arm, House of Doge. The company said its treasury is custodied by Robinhood’s platform via Bitstamp, adding an extra layer of transparency and security.

- Current holdings: Over 500 million DOGE

- Acquisition goal: 1 billion DOGE in 30 days

- Long-term vision: Control up to 5% of Dogecoin’s supply

“Crossing the 500 million DOGE threshold demonstrates the speed and scale at which ZONE is executing its treasury strategy,” said Marco Margiotta, CleanCore’s Chief Investment Officer and CEO of House of Doge.

Margiotta added that the company wants to “establish Dogecoin as a premier reserve asset while supporting its broader utility across payments, tokenization, staking-like products, and global remittances.”

Funding the DOGE Push

To fund this large crypto acquisition, CleanCore announced on September 3 that it would raise $175 million via private placement. The news initially sent its stock tumbling 60 percent, but the financing closed successfully just two days later.

Since then, the company’s stock performance has stabilized, even thriving in recent weeks. Despite Thursday’s small dip during regular trading hours, CleanCore shares rallied to $4.36 after-hours, up 201.52% year-to-date.

Financial Performance and Market Sentiment

CleanCore reported a 26% year-on-year revenue increase in the June quarter, although its net profit margin declined 229% during the same period. Still, retail investors remain enthusiastic. Stocktwits sentiment data shows an “extremely bullish” outlook on the company’s DOGE strategy.

DOGE ETF Delay and Market Impact

The timing of CleanCore’s move comes as excitement builds around the first-ever Dogecoin spot ETF. The Rex-Osprey DOGE ETF, initially set to launch this week, has faced multiple delays. Bloomberg ETF analyst Eric Balchunas now expects it to debut sometime next week.

DOGE itself is rallying, up 23% in the past seven days according to CoinGecko, trading at around $0.26. Analysts suggest the ETF launch could further strengthen market momentum.

CoinLaw’s Takeaway

I find this story fascinating because it shows how quickly corporate treasuries are embracing crypto beyond Bitcoin. In my experience, most companies that dive into crypto usually stick with BTC or ETH, so CleanCore betting on Dogecoin is bold and unexpected. The fact that they want to control 5% of Dogecoin’s circulating supply makes it clear this is not just a publicity stunt but a long-term strategy.

Yes, the stock took a hit after the financing announcement, but in my view, that was short-term panic. Now with DOGE rallying and ETF approval on the horizon, CleanCore is positioning itself as the MicroStrategy of Dogecoin. I found it particularly telling that retail investors are extremely bullish, and honestly, I share some of that optimism. If CleanCore executes this plan, they could rewrite the playbook for corporate crypto adoption.