Balcony has partnered with Chainlink to bring over $240 billion in government-sourced real estate assets onchain, aiming to transform the property market through verified, tokenized ownership.

Key Takeaways

- Balcony is integrating Chainlink’s Runtime Environment (CRE) into its Keystone platform to digitize and secure more than $240 billion in real estate assets.

- The partnership enables verifiable onchain property data, improving transparency, trust, and accessibility in the real estate sector.

- Chainlink’s Proof of Reserve and price feeds will support secure and compliant tokenized real estate infrastructure.

- This marks a major move in Chainlink’s real-world asset (RWA) expansion, reinforcing its role in bridging traditional finance with blockchain.

What Happened?

Chainlink and Balcony have announced a significant partnership to bring more than $240 billion worth of real estate assets onto the blockchain. Balcony, known for digitizing government-sourced property data, will utilize Chainlink’s trusted oracle infrastructure to enable compliant, transparent, and programmable tokenized real estate.

Balcony is excited to announce our partnership with @chainlink to use Chainlink’s Runtime Environment(CRE), enabling ~$240B worth of property onchain.

— Balcony (@balconytech) October 24, 2025

Our Keystone platform unifies government-backed property data into a single, verifiable system, underlining our deep commitment… https://t.co/xxHb3j1OHW

Partnership Targets Real Estate’s Longstanding Problems

The collaboration brings Chainlink’s Runtime Environment (CRE) into Balcony’s Keystone platform, allowing property data to be securely streamed and authenticated onchain. This creates a verified, unified database that has historically been fragmented, opaque, and reliant on manual records.

According to Balcony’s co-CEO and President Gregg Lester:

CRE will enable a number of key benefits for the real estate sector:

- Digitized ownership records that can be verified and traced in real time.

- Fractional ownership models that lower entry barriers for investors.

- Automated compliance checks and settlements.

- Higher liquidity in a market traditionally limited by paperwork and intermediaries.

Chainlink Strengthens Its Real-World Asset Strategy

This partnership adds to Chainlink’s broader effort to expand its footprint in real-world asset tokenization. The use of Proof of Reserve and price feed oracles will further secure tokenized property data, an essential component for institutional acceptance.

Colin Cunningham, Head of Tokenized Asset Sales at Chainlink Labs, commented:

The partnership underscores Chainlink’s ambition to support a trillion-dollar tokenization market, especially as institutional interest in real-world asset applications accelerates. Analysts have noted this move could solidify Chainlink’s role as a go-to data layer for the next wave of blockchain-powered financial infrastructure.

Market Responds With Optimism

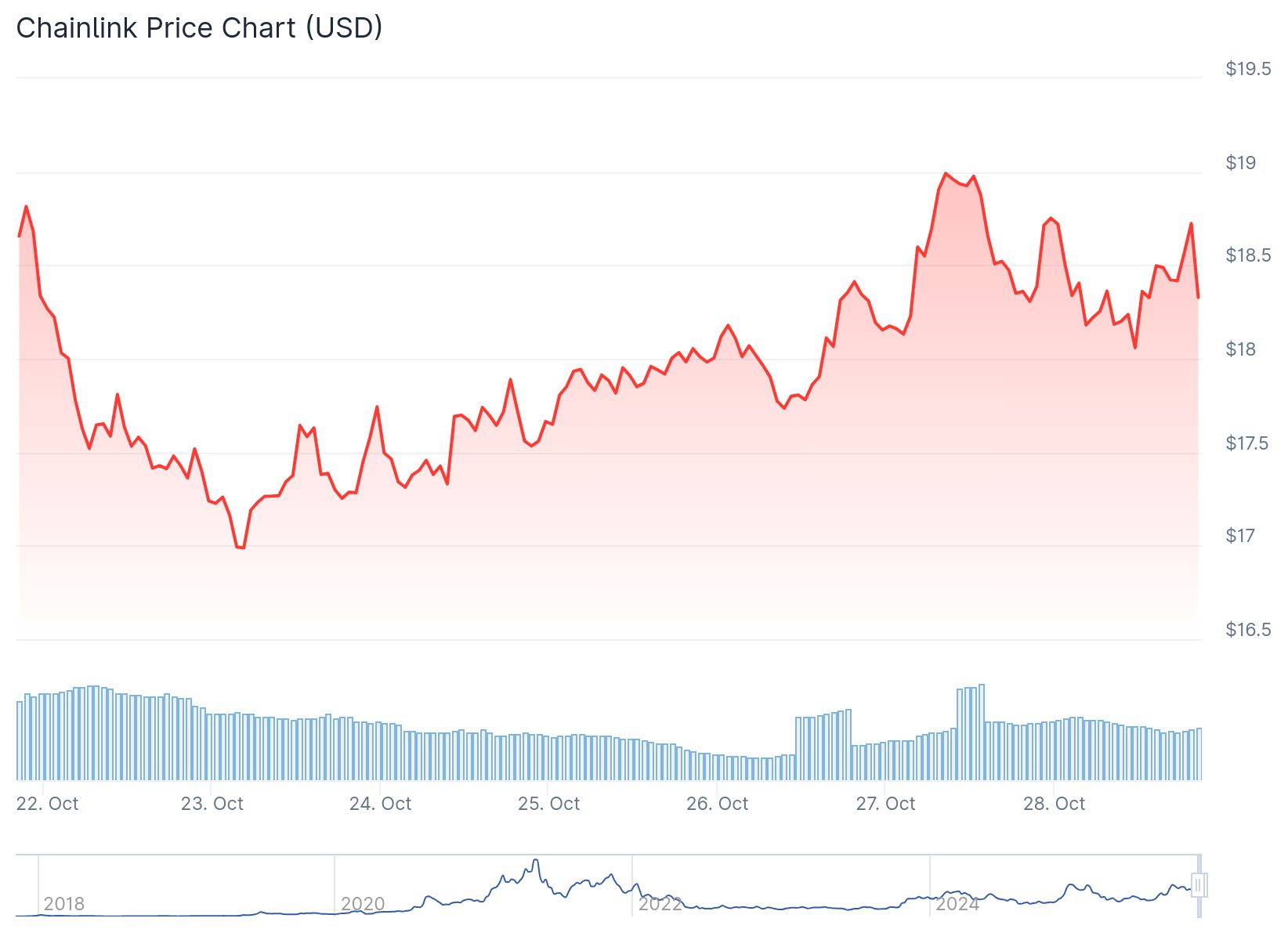

The crypto market has reacted positively to the news. Chainlink’s token, LINK, recently climbed to $18.50, and market analysts suggest this momentum may continue. LINK has already seen a 7% rise over the past week, and if adoption grows through real-world integrations like this, the price outlook remains bullish.

This collaboration also arrives at a time when decentralized finance is maturing, and Chainlink’s strategic focus on real-world utility puts it ahead of many competitors in the data oracle space.

CoinLaw’s Takeaway

In my experience, successful blockchain adoption always comes down to solving real-world problems. This partnership does exactly that. By tackling inefficiencies in real estate head-on, Chainlink and Balcony are making one of the most traditional asset classes more modern, efficient, and investor-friendly. I found it especially compelling how CRE isn’t just about streaming data, but transforming how property is accessed and traded. This is the kind of real-world integration that moves the needle, and it’s a big step toward blockchain being more than just hype.