Cardano founder Charles Hoskinson believes ADA could massively rally if it becomes Bitcoin’s DeFi yield layer, potentially pushing its price to $80 or even $800.

Key Takeaways

- 1Charles Hoskinson predicts ADA could rise 100x to 1000x, hitting between $80 and $800

- 2Key driver is ADA’s potential role as a yield-generating token in Bitcoin’s decentralized finance (DeFi) system

- 3Short-term technicals show mixed signals, with support at $0.80 and bearish pressure near the 200-day SMA

- 4Upcoming airdrops and growing Cardano ecosystem fuel investor optimism

What Happened

In a recent Blockworks interview, Charles Hoskinson shared a bold prediction: Cardano (ADA) could outperform Bitcoin and climb 100 to 1000 times in value, possibly reaching $80 or even $800. His vision centers around ADA evolving into the yield-generating backbone for Bitcoin’s DeFi layer, giving it unmatched utility and appeal for investors.

The prediction comes as Cardano continues expanding its infrastructure, with over 2,000 projects now building on the platform, and upcoming airdrops aiming to boost user incentives.

Hoskinson’s Big Vision for ADA

Hoskinson did not hold back during the interview, stating, “ADA could do 100x, or 1000x. We’re not second-class citizens. Cardano does substantially more, and it will end up being the yield layer of Bitcoin DeFi.”

He emphasized that ADA offers more than just price appreciation. Unlike Bitcoin, which mainly serves as a store of value, ADA holders gain staking rewards and access to other tokens within the Cardano ecosystem.

Hoskinson backed his optimism with past performance data. He said that at one point, Cardano held 108,000 BTC, valued around $15 billion at today’s prices, while ADA’s market cap hit $30 billion, doubling Bitcoin’s relative growth over the same period.

ADA vs BTC: The Battle of Performance

While ADA did outperform Bitcoin by 160% in late 2024, it has struggled to maintain that momentum in 2025. For most of this year, ADA has lagged behind BTC. But since June, ADA has rallied 30% more than Bitcoin, indicating a possible trend reversal.

Still, zooming out paints a cautious picture. Since 2021, ADA is down 88% against Bitcoin, raising questions about the feasibility of Hoskinson’s long-term price targets.

Technical Outlook: Can ADA Hold the Line?

ADA is currently priced at $0.7664, hovering near the critical $0.80 support level. This zone has acted as a resistance in the past, and defending it could enable bulls to target $1.00 or even $1.15.

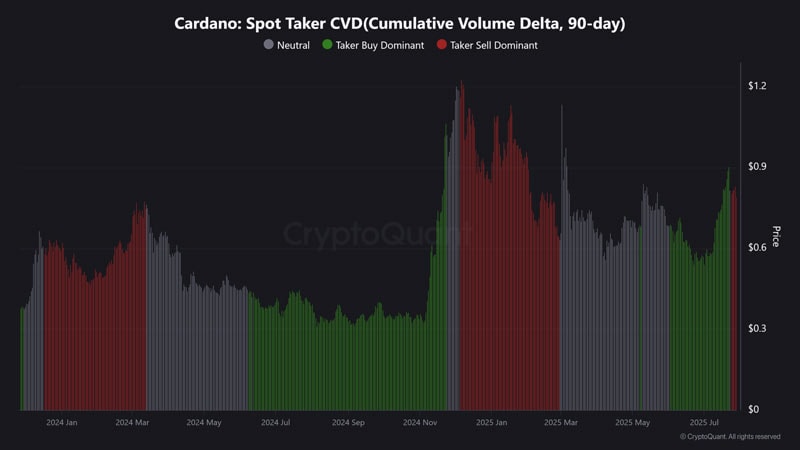

- Spot taker CVD has turned negative, showing recent selling pressure

- 200-day Simple Moving Average (SMA) remains a key barrier

- Realized cap increased slightly from $23.4 billion to $23.6 billion, suggesting continued investor conviction

These indicators reflect a market tug-of-war between bullish optimism and bearish caution.

Airdrops and Ecosystem Growth Fuel Optimism

August will see two significant airdrops: Midnight and Glacier. Holders of ADA will receive 50% of the NIGHT token allocation, and XRP holders will get 5%. These distributions are designed to enhance Cardano’s privacy and DeFi functionality.

Meanwhile, Cardano’s ecosystem continues expanding:

- Over 2,000 projects are in development

- Mempool optimizations and smart contract enhancements have been implemented

- Tools like “Reeve,” an on-chain financial reporting system, and Intersect’s treasury smart contracts bolster ecosystem transparency

Bitcoin DeFi Integration: The Game Changer?

Hoskinson’s ambitious forecast hinges on one big idea: integrating ADA into Bitcoin’s DeFi infrastructure. While details remain scarce, the notion is that ADA could become the utility token for Bitcoin-based smart contracts, creating a bridge between the two blockchain giants.

However, this vision depends on several unknowns:

- Robust cross-chain infrastructure

- Developer adoption

- A supportive regulatory environment

While the plan is speculative, it sets Cardano apart from other Ethereum competitors by targeting a unique role in crypto finance.

CoinLaw’s Takeaway

I think Hoskinson’s vision is bold, maybe even wild. But here’s the thing: Cardano’s got real momentum, and if it truly becomes a yield platform tied to Bitcoin’s liquidity, that could change everything. Sure, $800 might sound like moon talk today, but even a fraction of that would mean massive gains from current levels. What we need to watch now is whether ADA can hold that $0.80 mark, pull in new capital, and start delivering on this cross-chain dream.