Despite the increasing number of cryptocurrency trading platforms, selecting a beginner-friendly option can be challenging at times. You cannot compromise the potential for profits for being beginner-friendly, either. BYDFi, a comprehensive crypto trading platform, appears to have struck a balance between user-friendliness and a reliable trading experience for beginners.

In this review, we will examine how BYDFi performs in various aspects.

What Is BYDFi?

BYDFi is a cryptocurrency trading platform that was founded in 2020. Since then, the company has offered a variety of trading solutions for individual investors. The company now serves over 1 million customers from more than 190 countries. The trading platform has continued to introduce new features, including but not limited to copy trading and memecoin trading. At the same time, the platform has ensured that all necessary elements for secure trading practices are in place.

We will now examine the performance of BYDFi in various aspects, including UI, trading, and fees. It would also help us understand whether BYDFi is a worthwhile top pick for beginners.

User Experience and Onboarding

BYDFi could be one of the easiest-to-onboard cryptocurrency trading platforms available. Several factors make it accessible to both beginners and experienced traders.

Because it is a no-KYC trading platform, the registration is straightforward. The no-KYC nature also offers an improved layer of privacy. The sign-up process involves providing basic verification and setting up two-factor authentication (2FA), which takes only a few minutes to complete. Once this is done, you can easily obtain crypto assets. Compared to other trading platforms we have used, BYDFi needs only a fraction of the time for onboarding.

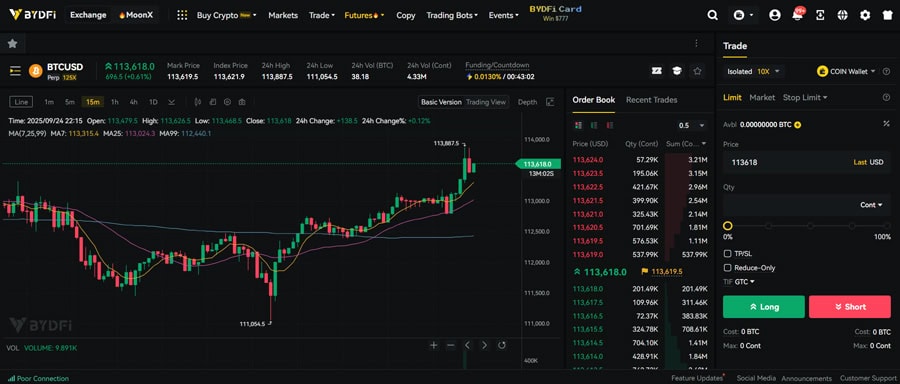

The UI design is also pretty minimal and optimized for beginners. Even if you haven’t used trading platforms before, you wouldn’t have trouble getting started. The Interface makes a clear distinction between the many aspects of the platform, offering impressive performance. We also tried the BYDFi apps, which are available for both Android and iOS, and they offer an intuitive UI design on your mobile devices.

We also felt that the learning curve is quite minimal.

Trading Features and Performance

BYDFi offers a range of trading instruments that you can rely on.

When it comes to Spot Trading, you can choose between over 1000 trading pairs. We found almost every coin we looked for, including Bitcoin, Ethereum, Solana, Dogecoin, and many other altcoins. Thanks to the newest feature, called MoonX, BYDFi also offers access to emerging cryptocurrencies.

If you want to try perpetual contract options, BYDFi offers access to over 600 crypto trading pairs. All these options are designed to offer up to 200x leverage without compromising on flexibility or convenience. Given that other exchanges’ perpetual contract leverages average around 120x, the 200x leverage options from BYDFi are great for ambitious users.

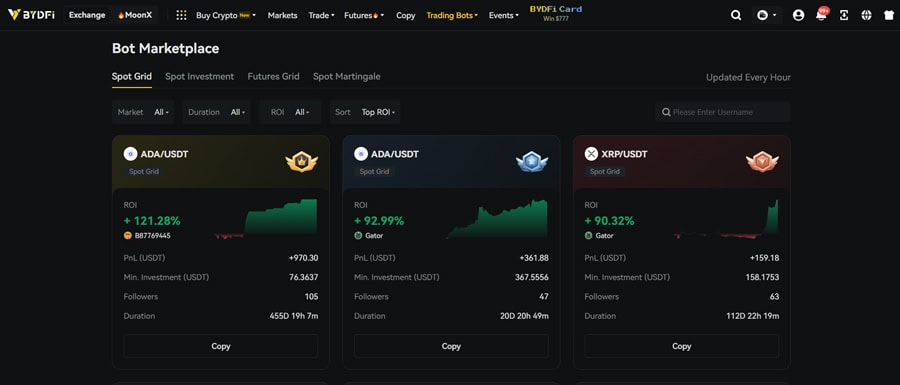

We also loved how BYDFi has integrated Copy Trading and Bot Trading into the infrastructure. Both are great options for those who can spend only minimal time on research. While copy trading allows you to follow the top traders, trading bots allow you to trade across over 100 trading pairs while offering spot investment as well.

The ultra-low trading threshold of $10 is also a great reason to choose BYDFi over other platforms.

BYDFi also offers a few additional convenience-centric features, like a debit card.

BYDFi Card is an impressive way to spend your crypto assets in real life. You can transfer your USDT assets to the card account and use the USD-denominated VISA card everywhere. The platform allows you to opt for a physical card if you want features like ATM withdrawals, but the charges will vary.

In addition to quick onboarding and convenient trading instruments, BYDFi appears to be adapting to the new world of crypto as well.

Fees and Transaction Costs

BYDFi keeps everything transparent regarding fees and transaction costs. We believe you don’t have to worry about hidden costs at all. BYDFi also maintains updated knowledge base pages that contain information on fees.

As mentioned earlier, you only need to deposit a minimal amount of $1 to create an account with BYDFi. When it comes to live trading, you can start with as little as $10. It is great that the company doesn’t discriminate against those who have a lot of money and those who don’t have.

There are no account maintenance fees or inactivity fees, providing you with considerable flexibility when managing your account. Now, when it comes to sport trading and perpetual contracts, the first one has a 0.1% flat fee, whereas perpetual contracts may charge a fee as low as 0.02% and take a fee of 0.06%.

Additionally, you will incur a withdrawal fee ranging from $ 0.20 to $1. The actual amount depends on the network and withdrawal method as well. As always, you will have to pay currency conversion fees when you move your assets between multiple blockchain networks, too.

Security and Reliability

BYDFi takes several steps to ensure the security and reliability of the platform and its assets.

For starters, the platform maintains 1:1 reserves as part of Proof of Reserves, and public reports are made available by the company at frequent intervals. While these reports are not comparable to those from, say, Kraken, the initiatives towards transparency are great indeed.

There’s also an 800BTC protection fund as of September 2025.

Instead of relying on the user’s private wallets, BYDFi stores all assets in cold wallets, which require multiple authentication steps for access. In addition to these, enforced 2FA and account segregation ensure top-notch security for the assets you manage through your BYDFi account.

We also found BYDFi to be an amazing choice from a reliability standpoint. The company strikes a sweet balance between security and flexibility. Considering that we are discussing a no-KYC platform, the options are quite impressive here.

Despite offering these strong security and reliability options, BYDFi remains a convenient option for most beginners. It is also great to have competitive fees here.

Customer Support and Community

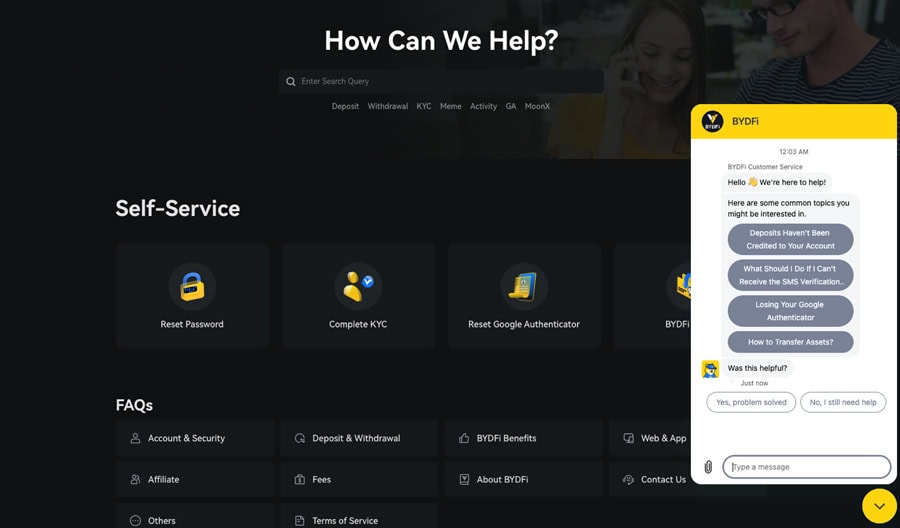

It is completely common to have doubts while dealing with something like cryptocurrencies, and you can use a few methods to get support from BYDFi. First, you can explore the self-service options, which provide a wider variety of knowledge-based articles and frequently asked questions and answers.

If that doesn’t help, you can contact BYDFi using two methods. The live chat option provides almost instant results, and we were connected in just a few seconds. Alternatively, you can contact them via email. The lack of phone support is a problem, but we believe the company is working on it.

Pros and Cons

- No-KYC trading platform with quick onboarding

- Access to 1000+ cryptocurrencies and other assets

- Multiple trading instruments and support for debit cards

- Competitive fees and minimal maintenance charges

- Straightforward UI with dedicated apps for mobile

- Lacks telephone support options

- You don’t get options like crypto staking

Conclusion: Who Should Consider BYDFi?

Ultimately, BYDFi is a great option for those who want to quickly begin their crypto trading journey while still having access to nearly all the popular cryptocurrencies and assets available.

In addition to quick onboarding and minimal setup costs, this is a great way for users to explore trading instruments, including trading, margin trading, and copy trading.

The company has also done a great job of balancing easy-to-use features with competitive pricing, so you don’t have to spend too much on margins or conversion fees.