Buy‑Now‑Pay‑Later (BNPL) and credit cards both let consumers spread out payments, but their mechanisms and impact differ. In 2025, BNPL continues its sharp rise among younger and financially vulnerable Americans, while credit cards remain foundational, especially for building credit and securing rewards. In retail and e‑commerce, BNPL is reshaping checkout experiences and nudging spending behavior. Meanwhile, travel and card rewards industries are feeling strategic pressure from fintech alternatives. Dive into the numbers below to see how these payment methods stack up, and explore the full comparison ahead.

Editor’s Choice

- 27% of US households now use BNPL, nearly double from two years ago.

- BNPL sector in the US is on track to reach $97.3 billion in spending in 2025.

- 86.5 million Americans used BNPL in 2024.

- 76% of US adults had at least one credit card in 2025.

- BNPL users carry an average credit card utilization of 60–66%, versus 34% for non‑users.

- Among Gen Z during the 2024 holiday season, 54% used BNPL, while 50% used credit cards.

- The global BNPL market is projected to reach US$560 billion in 2025.

Recent Developments

- BNPL usage has nearly doubled over the past two years, now reaching 27% of US households.

- In 2024, 86.5 million Americans used BNPL services.

- BNPL spending in the US is expected to jump 20.4% year-over-year in 2025, toward $97.25 billion.

- CPFB reports 21% of consumers with credit records used BNPL in 2022, up from earlier years.

- BNPL providers like Klarna and Afterpay hesitate to share payment data with credit bureaus, but Affirm has begun doing so.

- Klarna’s credit losses rose 17% in Q1 2025, highlighting repayment concerns.

- BNPL is now used for essentials, and 55% of Americans using these apps include grocery shopping.

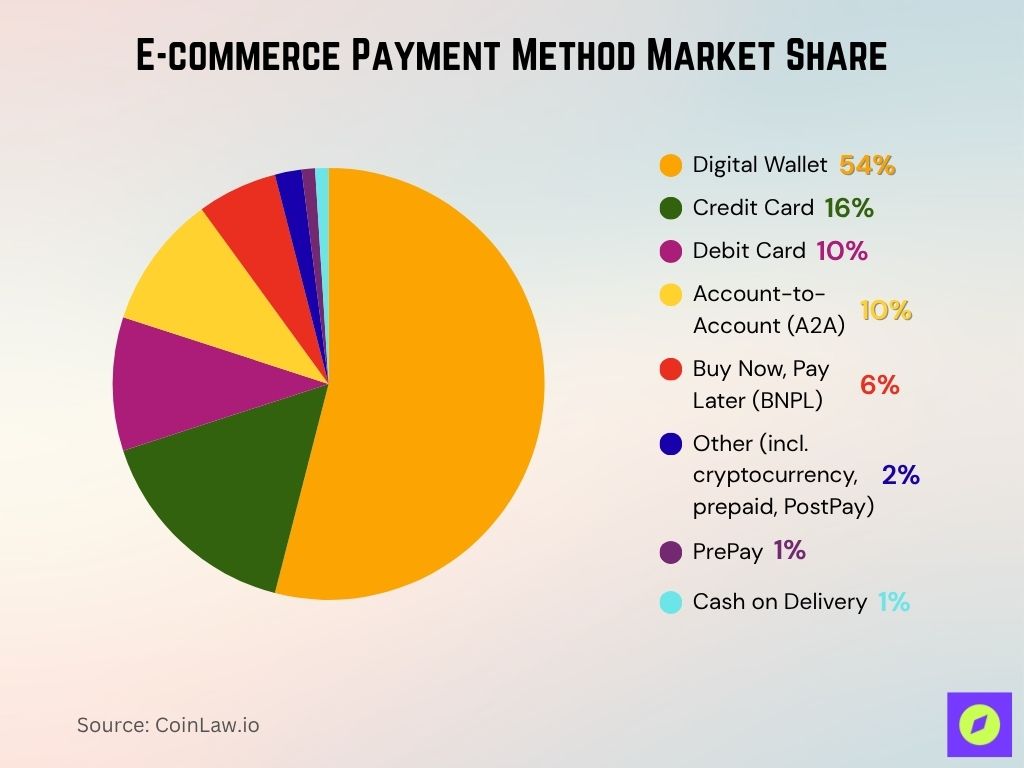

E-commerce Payment Method Market Share

- Digital wallets dominate e-commerce payments with a massive 54% market share, making them the most popular method globally.

- Credit cards hold the second-largest share at 16%, reflecting continued trust in traditional payment methods.

- Both debit cards and account-to-account (A2A) transfers each account for 10%, showing a strong preference for direct bank payments.

- Buy Now, Pay Later (BNPL) services capture 6%, highlighting the growing adoption of flexible financing options.

- Alternative methods, including cryptocurrency, prepaid, and PostPay, make up a modest 2%.

- PrePay solutions and cash on delivery remain minimal, with just 1% each, signaling a shift away from these traditional options.

BNPL Adoption Statistics

- 86.5 million US consumers used BNPL in 2024.

- BNPL spending in the US is projected at $97.25 billion in 2025, up 20.4% from 2024.

- 21% of US consumers with a credit record used BNPL in 2022.

- 27% of households now use BNPL, a near doubling from two years prior.

- The global BNPL market is estimated at US$560.1 billion in 2025.

- BNPL platform market value is US$42.46 billion in 2025.

- Adoption remains strongest among Millennials and Gen Z. 54% of Gen Z used BNPL during the 2024 holidays, 44% across the full year.

Credit Card Adoption Statistics

- Credit card ownership in the US stands at 76% of adults in 2025.

- That reflects a 3 percentage‑point increase since 2017.

- Globally, credit/debit cards account for over 70% of online transactions in developed regions like the U.S. and the EU.

- As of earlier data, around 72.5% of US adults held at least one card, aligning closely with current rates.

- Credit card debt in the US reached $1.2 trillion by late 2024.

- Rewards and perks have driven card loyalty, though signs suggest these benefits may be scaled back amid economic uncertainty.

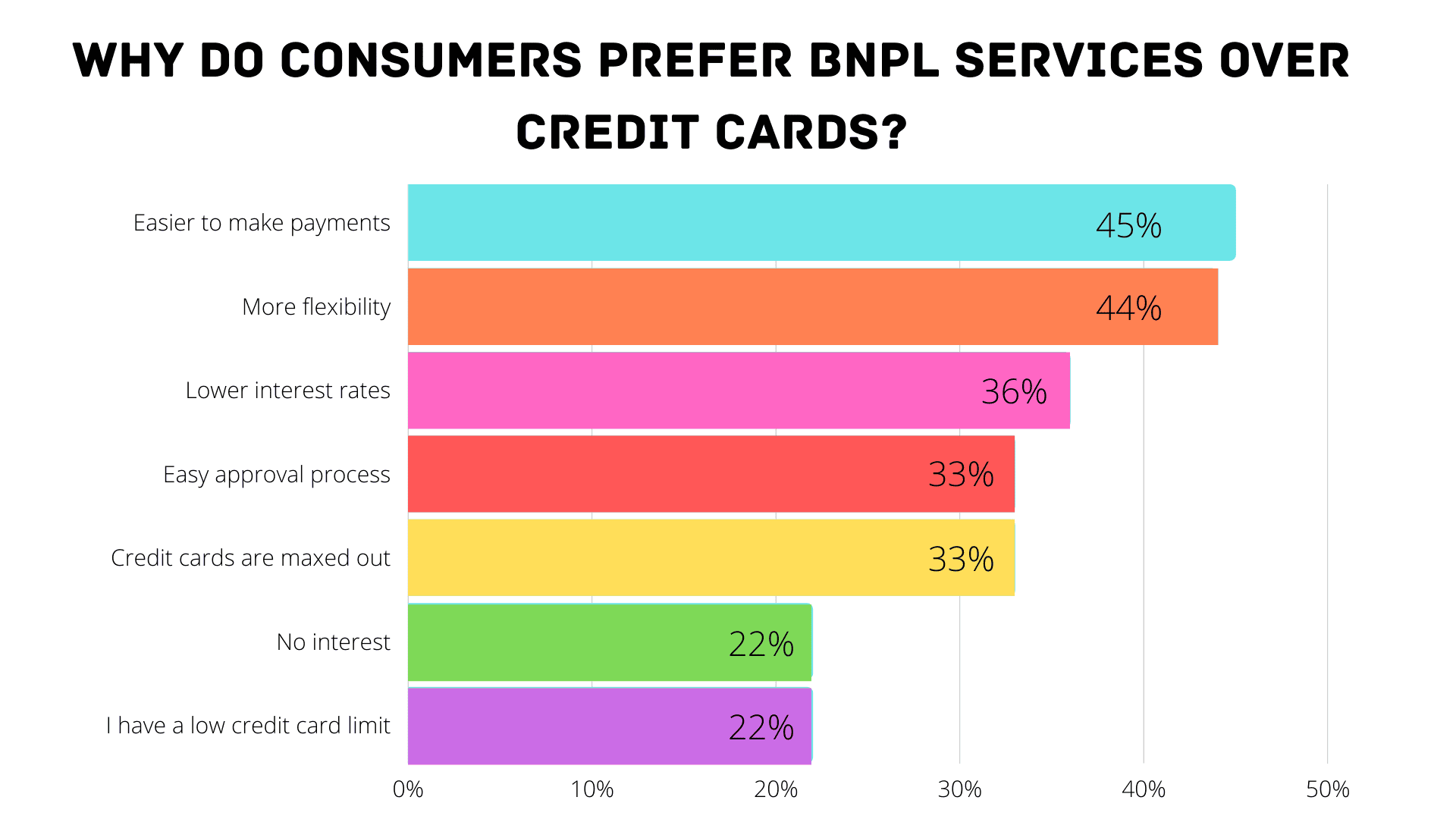

Why Consumers Prefer BNPL Over Credit Cards

- 45% say BNPL makes it easier to make payments, highlighting its user-friendly structure.

- 44% prefer BNPL for offering more flexibility than credit cards.

- 36% cite lower interest rates as a key reason for choosing BNPL.

- 33% find BNPL’s easy approval process appealing.

- Another 33% use BNPL because their credit cards are maxed out.

- 22% value BNPL’s no-interest offerings.

- 22% choose BNPL due to having a low credit card limit.

BNPL Market Size and Growth Trends

- BNPL market globally is set to hit US$560.1 billion in 2025.

- Platform-specific market value estimated at US$42.46 billion in 2025.

- BNPL sector in the US expected to grow 20.4% YoY, achieving $97.25 billion in spending.

- By 2027, the US BNPL market may reach $124.82 billion.

- Global BNPL CAGR projected at 10.2% to 11.4% over 2025–2030.

- AP’s research shows that spending on essential categories like groceries counts for up to 30–40% of BNPL use.

- Klarna experienced rising delinquency and credit loss, highlighting financial risks in the BNPL model.

Credit Card Market Size and Growth Trends

- Credit card ownership in the US is robust at 76% of adults.

- Since 2017, adoption has grown by 3 percentage points in the U.S.

- Credit card debt reached an all‑time high of $1.2 trillion by late 2024.

- Cards drive over 70% of online payments in the U.S. and EU.

- The value of rewards remains a major advantage, though programs may diminish amid rising debt and recession fears.

- Credit cards offer protection, credit building, and structured debt, contrasting with BNPL’s short-term model.

Most Popular BNPL Platforms by Market Share

- PayPal leads the BNPL market with a 35% share, making it the most widely used platform.

- Afterpay follows with a strong 20%, reflecting its broad consumer adoption.

- Klarna holds 15%, continuing to grow in both the U.S. and international markets.

- Uplift accounts for 10%, particularly popular for travel-related financing.

- Sezzle captures 6%, appealing to budget-conscious shoppers.

- Splitit maintains a 5% share, offering interest-free installment plans.

- Other BNPL providers collectively represent 5% of the market.

BNPL User Demographics

- 64% of Gen Z (ages 18–28) say they’ve used BNPL, compared with just 29% of Baby Boomers (ages 61–79).

- 33.6% of Millennials use BNPL in the U.S., followed by 26.4% of Gen Z.

- Black consumers are 63% more likely to use BNPL than White consumers, with usage rates, 26% Black, 24% Hispanic, and 16% White.

- 42% of adults aged 18–24 have used BNPL, with usage peaking at 50% among those aged 25–44.

- Women use BNPL more; 29% of women used BNPL in the past year versus 26% of men, and 11% of women used it more than five times.

- Median income of BNPL users: 72.6% earn less than $75,000 annually.

- People renting homes are 51.9% more likely to use BNPL than homeowners, 24.3% of renters vs 16% of owners used BNPL in the past year.

- Chief motivations: 36% cite managing cash flow, 28% say to afford larger purchases.

- BNPL users are 82% more likely to enjoy online shopping, 49% more likely to research products online, and 42% more likely to place weekly online orders.

Credit Card User Demographics

- Over 80% of US adults own at least one credit card, and the average person carries five different accounts.

- Baby Boomers hold the most cards, averaging 4.3 cards per person.

- Americans earning $100,000+ are 110% more likely to own credit cards than those earning under $25,000.

- Adults aged 60+ have 46% higher credit card ownership than those aged 18–29.

- 50% of credit card owners are Millennials and younger, and 41% of Gen Z and 40% of Millennials say building credit history is a major reason to use cards.

- A 2022 Experian study found Gen X and Baby Boomers average over 4 cards, while Gen Z (18–25) holds just two cards each.

- 35% of people aged 25–34 use credit cards as their primary payment method, versus 28% of those 55+.

How Confident Are Consumers About Paying Their Credit Card Bills

- 50% of cardholders are very confident they can pay their next credit card bill in full.

- 20% feel somewhat confident about meeting their payment.

- 8% are neutral, expressing neither confidence nor uncertainty.

- 8% are somewhat unconfident about paying their next bill.

- 14% are very unconfident, indicating high financial stress.

BNPL vs Credit Card Usage Rates

- In 2024, 86.5 million Americans used BNPL, and by 2025, that’s expected to rise to 91.5 million users.

- BNPL accounts for 6% of e-commerce payments in the U.S. (versus 5% globally).

- 73% of Americans have heard of BNPL as of 2022, up from 56% in 2021.

- Credit card ownership remains higher, with over 80% of adults possessing at least one card.

BNPL vs Credit Card Spending Patterns

- BNPL average loan size $135 per purchase over six weeks.

- BNPL users borrow on average $2,085 across all purchases.

- User volume (GMV) in 2024 is $109 billion, forecast to reach $122.3 billion in 2025.

- BNPL purchases deliver an 85% higher average order value than other payment methods.

- Average credit card balance per person was $6,580 in Q4 2024, up 3% from 2023.

- $1.182 trillion in total U.S. credit card debt was recorded in Q1 2025.

BNPL and Credit Card Default and Repayment Rates

- 41% of BNPL users reported late payments in the past year, up from 34% previously.

- A Credit Karma survey found 34% of BNPL users have missed at least one payment, affecting credit scores and incurring fees.

- 89.3% of BNPL users report making all payments on time.

- Less than half (46%) of credit card holders carried a balance at any point in the past year.

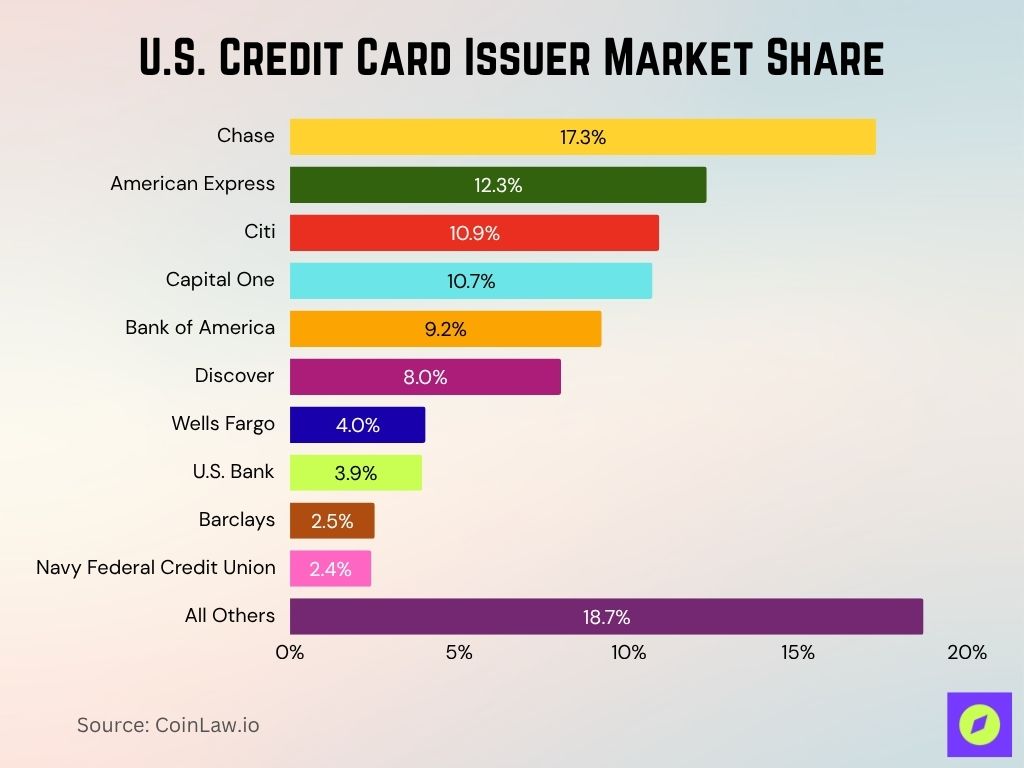

U.S. Credit Card Issuer Market Share

- Chase leads the market with a 17.3% share, making it the top credit card issuer in the U.S.

- American Express follows with 12.3%, known for premium rewards and customer loyalty.

- Citi holds 10.9%, maintaining a strong presence in both consumer and business segments.

- Capital One captures 10.7%, popular for cash-back and travel cards.

- Bank of America has a 9.2% share, boosted by its large banking customer base.

- Discover owns 8% of the market, favored for no-annual-fee cards and student offerings.

- Wells Fargo accounts for 4%, with a growing digital presence.

- U.S. Bank holds 3.9%, known for its flexible card options.

- Barclays controls 2.5%, offering co-branded cards with airlines and retailers.

- Navy Federal Credit Union takes 2.4%, primarily serving military members.

- All other issuers combined represent 18.7% of the market.

BNPL and Credit Card Approval/Eligibility Rates

- BNPL approval rates rose from 56% in 2019 to 79% in 2022.

BNPL vs Credit Card Average Loan/Transaction Size

- BNPL average loan size, $135 per purchase over 6 weeks.

- Typical BNPL users have borrowed about $2,085 total across transactions.

- Average credit card balance held per person, $6,580 in Q4 2024.

Reasons for Choosing BNPL Over Credit Cards

- 57% of Americans use BNPL because it lets them spread payments to manage cash flow effectively.

- 58% find BNPL more convenient at checkout than traditional credit.

- 36% cite better budgeting as a core motivator for choosing BNPL.

- 32% use BNPL to avoid interest charges, a major appeal compared to average credit card APRs around 22.8%.

- 53% avoid using credit cards, preferring BNPL’s simplicity and fewer barriers.

- 42% of Gen Y and Z prefer BNPL over credit options, especially amid economic uncertainty.

- Nearly half the U.S. population (48%) considers BNPL for purchases over $200, more likely than non‑users to do so.

- Automatic, interest‑free installments make BNPL appealing for everyday goods and essentials.

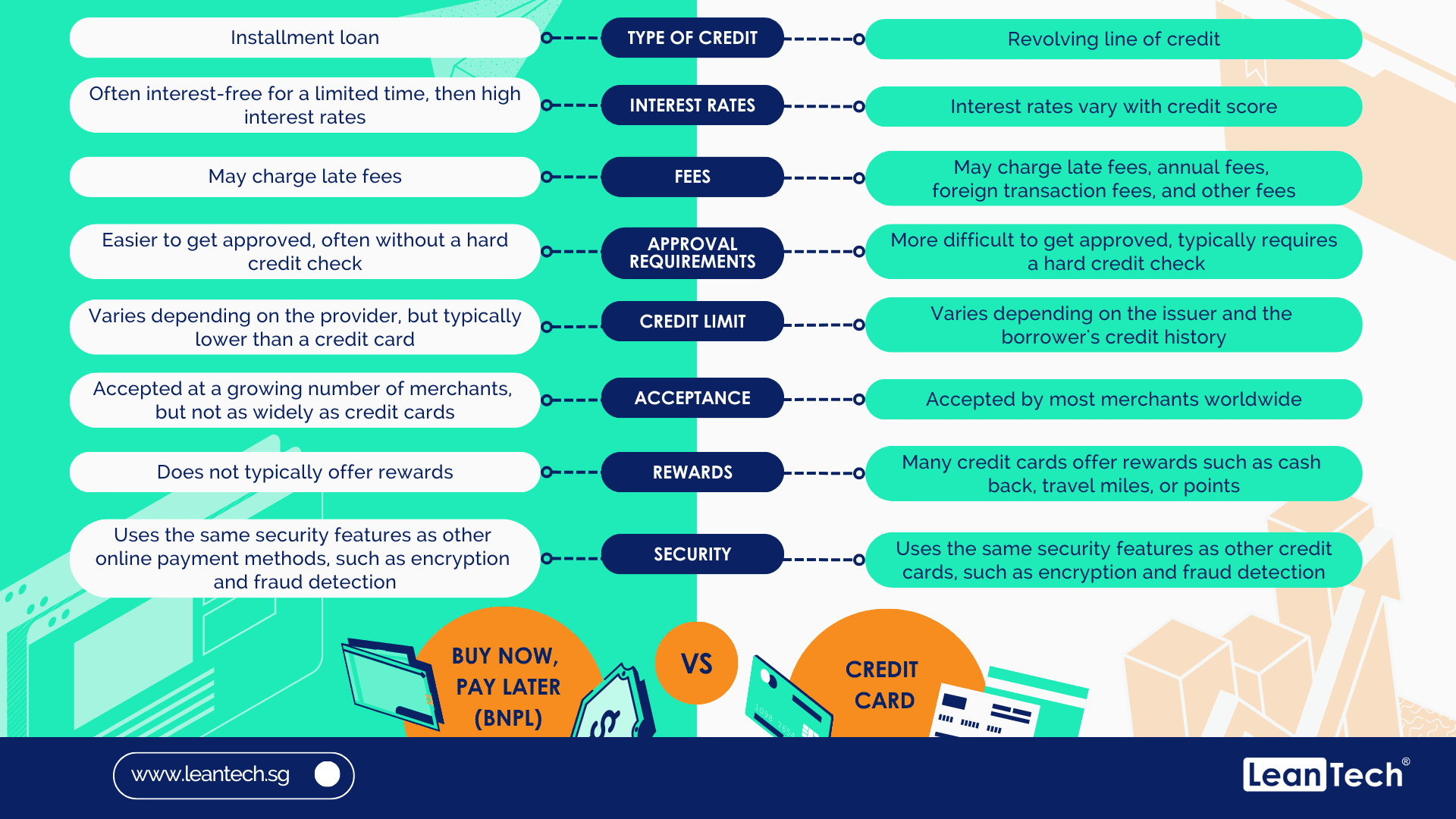

BNPL vs Credit Card: Key Differences

- Type of Credit: BNPL is an installment loan, while a credit card is a revolving line of credit.

- Interest Rates: BNPL is often interest-free for a limited time, then charges high rates. Credit card interest varies by credit score.

- Fees: Both may charge late fees, but credit cards can also have annual fees, foreign transaction fees, and others.

- Approval Requirements: BNPL is easier to get approved, often without a hard credit check. Credit cards usually require a hard check.

- Credit Limit: BNPL limits are usually lower, while credit card limits depend on the issuer and credit history.

- Acceptance: BNPL is growing in acceptance, but still less widely accepted than credit cards, which are used worldwide.

- Rewards: BNPL typically doesn’t offer rewards. Many credit cards offer cash back, travel points, or miles.

- Security: Both offer similar security features, including encryption and fraud detection.

Reasons for Choosing Credit Cards Over BNPL

- Fraud protection ranks high; 77% of consumers cite it as a critical reason to prefer cards.

- Building credit history is a major factor, meaningful to 40–41% of Millennials and Gen Z.

- 35% of U.S. adults use credit cards primarily to earn rewards.

- Established trust and convenience drive Baby Boomer adoption; many rely on cards for large purchases and stability.

- Experts note rewards and credit‑building benefits, plus protections, make cards more strategic for long‑term financial health.

- Although reward programs may scale back due to economic shifts, they remain a key loyalty anchor.

- With FICO now including BNPL data, credit cards retain more certainty and predictability in borrowing behavior.

BNPL vs Credit Card Interest and Fees

- BNPL often offers 0% interest if paid on time, making it more appealing for short‑term purchases.

- In contrast, the average credit card APR hovers around 22.8%, with additional fees if balances are carried over.

- Some BNPL lenders are beginning to charge interest; for example, Klarna’s longer‑term loan products carry APRs near 19.99%.

- BNPL generally has fewer fees, no annual or overlimit charges, but late fees and loan stacking can add up.

- Credit cards may reduce or eliminate fees through autopay and loyalty tiers, though interest remains if not paid in full.

- The growing transparency of BNPL reporting may expose users to traditional fee structures in the future.

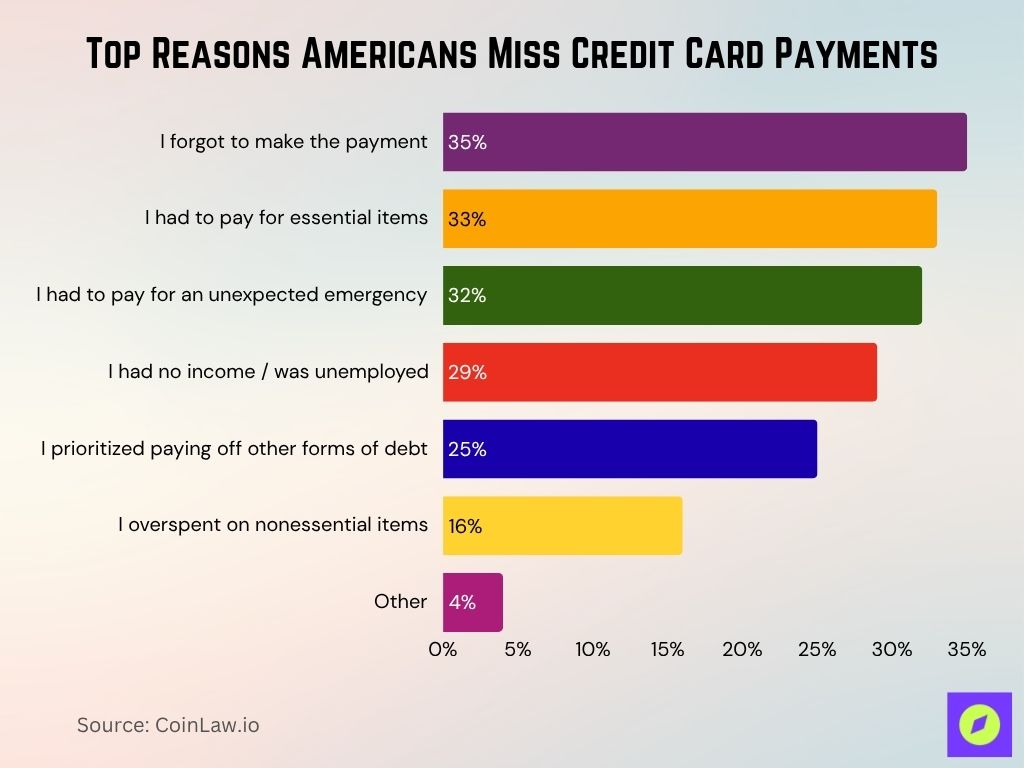

Top Reasons Americans Miss Credit Card Payments

- 35% of Americans said they were delinquent because they forgot to make the payment.

- 33% missed payments due to needing to pay for essential items.

- 32% had to cover an unexpected emergency, leading to missed credit card bills.

- 29% cited no income or unemployment as the reason for falling behind.

- 25% prioritized paying off other forms of debt over credit card bills.

- 16% admitted to overspending on nonessential items, causing delinquency.

- 4% selected other reasons for their missed payments.

BNPL and Credit Card Impact on Credit Scores

- Starting in 2025, FICO will include BNPL data in credit scoring, signaling a shift toward mainstream accountability.

- Affirm already reports BNPL transactions to Experian; others may follow, impacting credit visibility.

- Credit cards remain reliable score builders when payments are timely and utilization remains low.

- High utilization or late payments on either instrument can negatively affect credit health over time.

- BNPL’s flexible schedule eases credit strain in the short term, but new reporting turns it into conventional credit.

BNPL and Credit Card Debt Accumulation

- BNPL users face growing risk, 41% reported late payments in 2025, up from 34% in 2024.

- In contrast, under 50% of credit card holders carry a balance, indicating broader usage of cards for convenience rather than debt.

- Credit card debt remains massive, ~$1.18 trillion in Q1 2025, down slightly from Q4 2024’s all‑time high.

- Average American credit card debt is $6,580 as of Q4 2024.

- BNPL default rates are structurally lower due to autopay setup, but stacking multiple loans raises financial stress.

- Experts warn that frequent reliance on BNPL for essentials can create cycles of dependency.

User Satisfaction: BNPL vs Credit Cards

- In the 2025 J.D. Power study, card‑based BNPL products led the segment in satisfaction, thanks to brand familiarity and trust.

- Consumers give high marks to BNPL’s predictable payments and user‑friendly experiences.

- However, many users still prefer traditional credit cards for their flexibility, protections, and long-term value.

Conclusion

BNPL and credit cards each serve distinct financial needs. BNPL offers convenient, interest‑free installments ideal for managing cash flow and smaller purchases, especially among younger, digitally native consumers. Meanwhile, credit cards shine through rewards, fraud protection, and opportunities for credit building. As FICO begins to report BNPL behavior, the once-detected models begin to intersect.

Ultimately, responsible use of either tool depends on discipline, keeping balances manageable, paying on time, and choosing the right method for each scenario. We invite you to explore the full article for deeper insights.