BlackRock has moved $229 million in Bitcoin and Ethereum to Coinbase Prime, signaling strategic shifts as crypto ETFs face mounting outflows and market sentiment turns bearish.

Key Takeaways

- BlackRock transferred $200 million in Bitcoin and $29 million in Ethereum to Coinbase Prime, according to Arkham Intelligence.

- The transfers come as BlackRock’s Bitcoin and Ethereum ETFs report continued net outflows, raising concerns about waning investor confidence.

- CryptoQuant analysis warns of a potential bear market, with key indicators showing structural weakness in Bitcoin’s price action.

- Despite outflows, BlackRock still sees Bitcoin as a top investment theme for 2025, alongside Treasury bills and tech stocks.

What Happened?

BlackRock, the world’s largest asset manager, deposited a total of $229 million worth of Bitcoin and Ethereum into Coinbase Prime this week. The move aligns with a period of declining demand for crypto ETFs, with the firm’s flagship Bitcoin ETF (IBIT) and Ethereum ETF (ETHA) experiencing net redemptions of $157 million and $25 million, respectively.

🚨 JUST IN:

— Crypto News Hunters 🎯 (@CryptoNewsHntrs) December 24, 2025

💰 BlackRock DEPOSITS 2,292 $BTC ($199.8M) & 9,976 $ETH ($29.23M) to Coinbase Prime

📊 Source: Lookonchain#Crypto #Bitcoin #Ethereum #BlackRock #Coinbase #Blockchain pic.twitter.com/zIkGNYBSbi

BlackRock Moves Funds Amid ETF Outflows

According to Arkham Intelligence, BlackRock transferred 2,292 BTC worth nearly $200 million and 9,976 ETH valued at around $29.23 million into Coinbase Prime. These transfers came as ETF tracking data from SoSo Value and Farside Investors highlighted a broader trend of net outflows across crypto funds. On December 23 alone, Bitcoin ETFs saw $189 million in net outflows, with BlackRock accounting for the bulk.

Ethereum ETFs fared similarly, with total daily net outflows hitting $96 million, including a $25 million reduction from BlackRock’s ETHA fund. These persistent outflows mark a difficult stretch for BlackRock’s crypto investment products, which have now seen net outflows in seven of the last ten trading days, totaling $629 million since the start of December.

Market Sentiment Turns Bearish

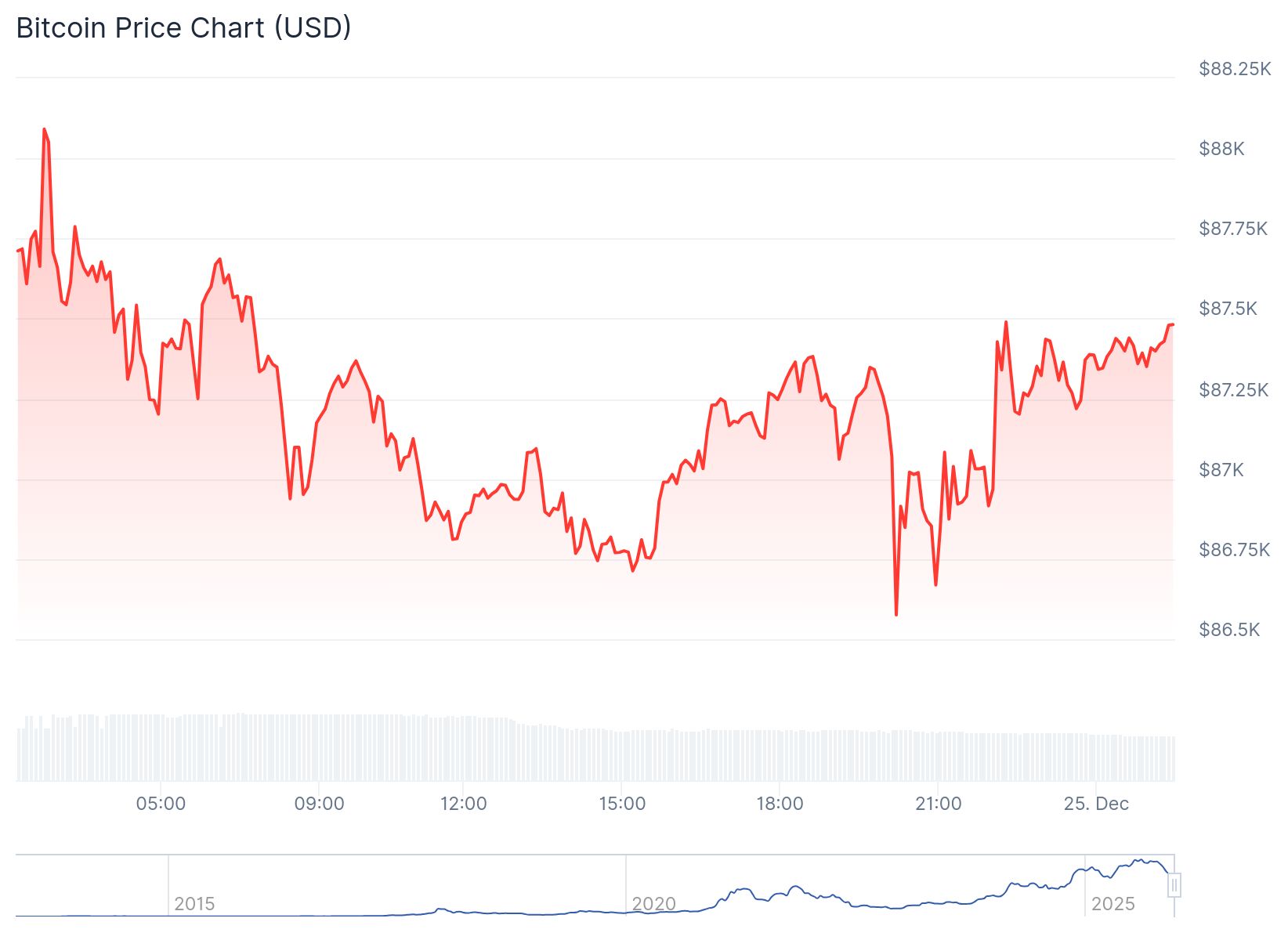

The crypto market’s broader performance has also shown weakness. Bitcoin continues to trade below key resistance levels and is currently under $90,000, despite rallies in other asset classes like equities and gold.

On-chain analytics firm CryptoQuant raised a red flag this week, suggesting the market may be transitioning into a bear phase rather than experiencing a temporary pullback. Their analyst Woominkyu pointed to the Bitcoin Combined Market Index (BCMI) falling below equilibrium, signaling weakening on-chain momentum.

Historically, meaningful market bottoms have occurred when BCMI fell into the 0.25 to 0.35 range, far below its current level. While the index is not yet in the historical bottom zone, its decline suggests the market may still be in for more pain.

Veteran trader Peter Brant added to the caution, noting that Bitcoin has faced 80 percent declines in past cycles, implying the asset could drop to as low as $25,000 if history repeats itself.

Coinbase Prime Takes Center Stage

BlackRock’s decision to move such a large amount of Bitcoin and Ethereum to Coinbase Prime is also noteworthy. The platform is known for offering institutional-grade custody and trading services, suggesting that BlackRock may be positioning itself for more strategic flexibility, even amid current outflows.

Coinbase Prime’s role in handling these assets underscores the increasing reliance on secure infrastructure in the crypto space, especially among traditional financial giants like BlackRock.

BlackRock Stays Bullish on Bitcoin

Despite the current downturn, BlackRock maintains a long-term bullish stance on Bitcoin. The firm has named Bitcoin a core investment theme for 2025, alongside U.S. Treasury bills and major tech stocks. While recent ETF performance reflects shifting investor sentiment, BlackRock’s continued focus suggests it sees enduring value in digital assets.

IBIT, BlackRock’s Bitcoin ETF, still leads the market in assets under management, reflecting its dominant role despite recent redemptions.

CoinLaw’s Takeaway

In my experience, large institutional moves like this signal more than just a market reaction. BlackRock moving $229 million in crypto to Coinbase Prime isn’t just a withdrawal. It could be strategic repositioning or preparation for further reallocation. Even as retail sentiment wavers and ETFs face outflows, BlackRock’s firm stance on Bitcoin for 2025 tells me they’re in it for the long haul. That kind of conviction from the biggest asset manager in the world is hard to ignore.