Bitcoin funds roared back into the spotlight as BlackRock’s iShares Bitcoin Trust (IBIT) led a major rally in ETF inflows, boosting Bitcoin’s price past $92,000 to kick off 2026.

Key Takeaways

- BlackRock’s IBIT recorded $287.4 million in inflows on Jan. 2, the fund’s largest single-day intake since October 2024.

- Total U.S. spot Bitcoin ETF inflows hit $471.3 million, the highest since November 2025.

- Bitcoin rallied to above $93,000, driven by renewed investor confidence and geopolitical uncertainty.

- Analysts cite the January portfolio rebalancing effect and institutional demand as key drivers behind the ETF resurgence.

What Happened?

BlackRock’s flagship Bitcoin ETF has once again drawn intense market attention after pulling in nearly $287.4 million in a single day. The inflow, the largest since October 8, 2024, signals a potential return of institutional optimism toward digital assets. Bitcoin itself responded with a multi-day rally, climbing to a high of $93,169 on January 5.

Bitcoin ETFs saw $697 million in inflows yesterday.

— Lark Davis (@LarkDavis) January 6, 2026

The largest daily inflows in the past 91 days.

The Bitcoin bulls are back! pic.twitter.com/sWhZJZD7pv

Bitcoin ETFs Reignite in Early 2026

The fresh surge in ETF interest marks a reversal from the quieter trading environment seen in late 2025. According to Farside Investors, BlackRock’s IBIT alone captured over 60 percent of the day’s $471.3 million total inflow into U.S. spot Bitcoin ETFs. Notably, none of the Bitcoin ETFs reported outflows that day.

Other major players joined the trend:

- Fidelity’s FBTC attracted $88.1 million.

- Bitwise’s BITB saw $41.5 million in inflows.

- Grayscale’s GBTC brought in $15.4 million.

- Other ETFs contributed another $54.3 million.

This wave of capital brought the weekly total to $459 million, helping offset previous redemptions and suggesting growing institutional appetite for crypto exposure.

Apollo Crypto partner Pratik Kala explained the uptick as part of an early-year rebalancing, noting that tax-loss harvesting in Q4 2025 has shifted toward more constructive positioning in Q1 2026.

Geopolitical Tensions Add Fuel

The timing of the ETF inflows aligns with geopolitical shifts that have stirred global markets. Over the weekend, the U.S. captured Venezuelan President Nicolás Maduro, sparking a rise in market volatility. This development has amplified Bitcoin’s appeal as a geopolitical hedge, particularly under renewed attention to the Trump administration’s “America First” policies.

Investors are now seeing Bitcoin not only as a speculative asset but as a strategic macro hedge, especially in times of global unrest.

Bitcoin Price Pushes Higher

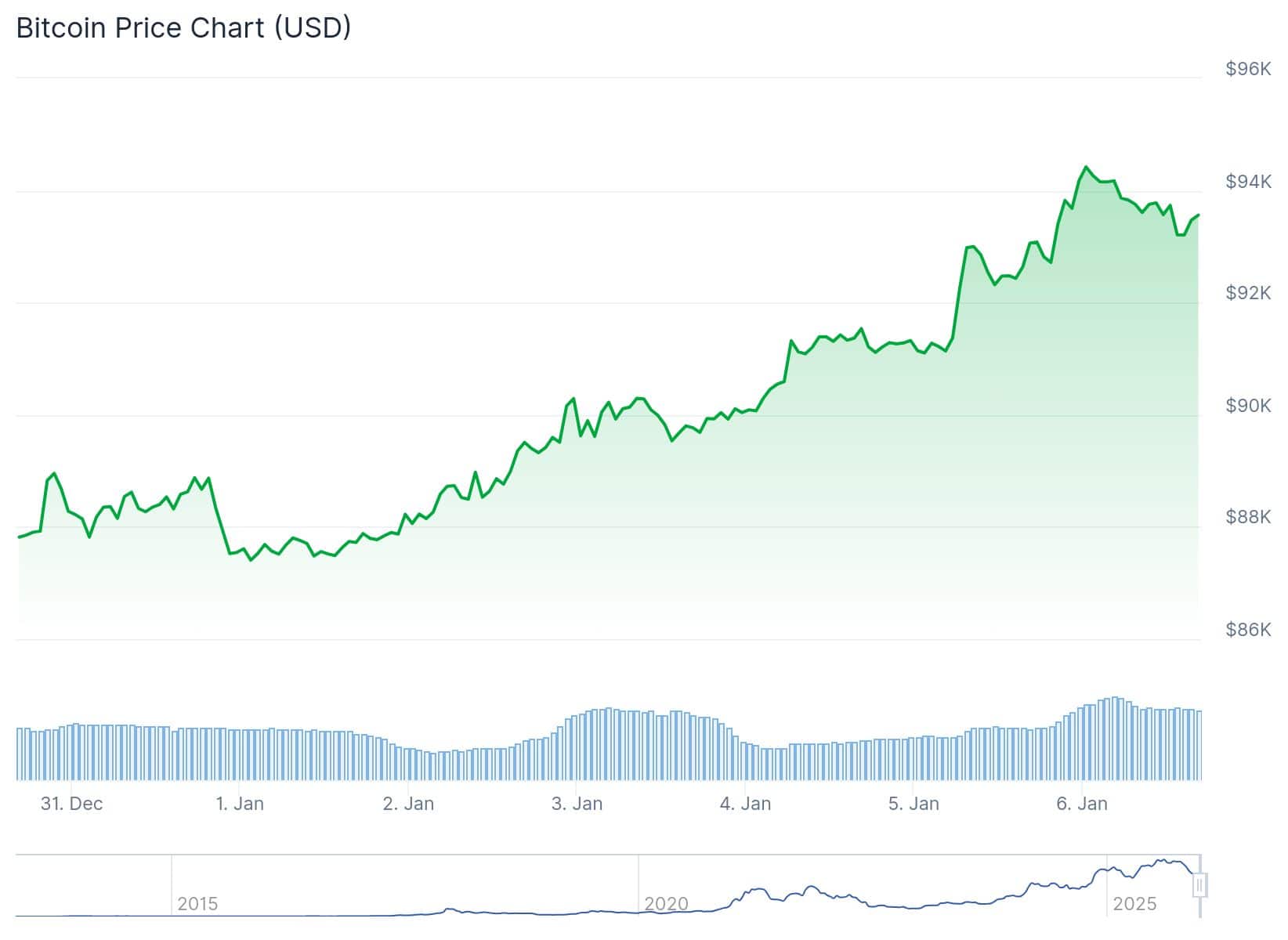

Bitcoin’s price rose from around $87,480 on January 1 to over $92,500 just days later. On the technical side, it has broken out of a symmetrical triangle pattern on the daily chart, often a bullish signal. Analysts are watching closely to see if Bitcoin can hold above the key $91,488 support level, which aligns with the 23.6 percent Fibonacci retracement.

If bullish momentum continues, Bitcoin could test its December high of $94,267 in the coming sessions.

CoinLaw’s Takeaway

I find this return of strong ETF inflows incredibly telling. In my experience, institutional money does not move in a vacuum. A $287 million single-day inflow into BlackRock’s Bitcoin ETF is not just a coincidence, it’s a signal. It shows that large investors are once again comfortable treating Bitcoin as a serious piece of their portfolios. The geopolitical narrative only strengthens that view. When fear rises, safe haven assets shine. Bitcoin is earning its spot in that conversation, not just as a tech bet, but as a true macro asset. This ETF activity could be the start of something bigger in 2026.