The holiday season is synonymous with shopping sprees, and Black Friday stands as the crown jewel of consumer enthusiasm. Every year, millions of shoppers flock to stores and online platforms, hunting for the best deals on everything from electronics to fashion. But Black Friday isn’t just a shopping day; it’s a cultural phenomenon that reflects broader economic trends and consumer behaviors. Let’s delve into key statistics and insights that reveal what makes this event a global retail spectacle.

Editor’s Choice

- $11.8 billion in U.S. online sales on Black Friday 2025, up 9.1% year-over-year.

- About 202.9 million shoppers bought in‑store or online over the 2025 Thanksgiving weekend (Thanksgiving through Cyber Monday), the highest on record.

- 85.7 million Americans shopped online on Black Friday 2025, making it the top day for online shopping during the Thanksgiving weekend.

- Mobile accounted for 55% of Black Friday 2025 online traffic.

- BNPL processed $747 million on Black Friday 2025, rising 8.9% from 2024.

- AI traffic to retail sites jumped 805% on Black Friday 2025.

- Electronics dominated as the top category with the heaviest AI tool usage in 2025 sales.

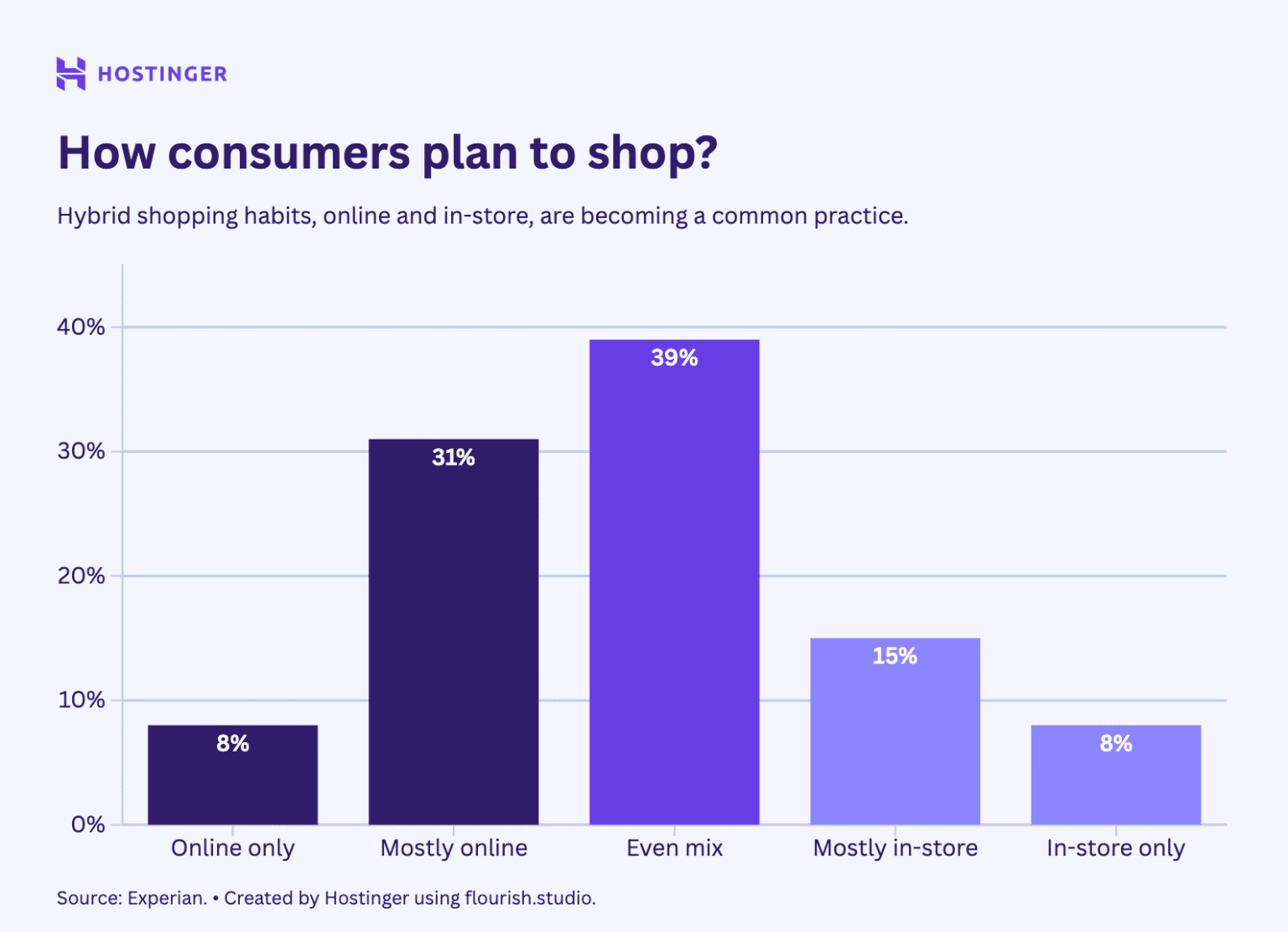

How Consumers Plan to Shop

- 39% of consumers plan an even mix of online and in-store shopping, confirming the rise of hybrid retail habits.

- 31% intend to shop mostly online, signaling strong e-commerce dominance across retail categories.

- 15% prefer mostly in-store shopping, showing that physical retail still attracts a sizable share.

- 8% will shop online only, reflecting a niche but committed group of digital-first buyers.

- 8% will shop in-store only, highlighting a small segment that remains offline by choice.

Average Consumer Spending per Capita

- The average shopper spent $337.86 during Black Friday 2025 Thanksgiving weekend.

- Households over $100k drove nearly half of all 2025 consumer spending.

- BNPL users spent 8.9% more via $747.5 million in Black Friday 2025 transactions.

- Millennials averaged $1,369 in planned holiday spending per household in 2025.

- Gen Z planned $1,131 holiday spend per capita, leading younger cohorts in 2025.

- Baby Boomers averaged $842 in planned 2025 holiday expenditures.

- Average cart value hit $110.71 on Black Friday 2025 across platforms.

- High-income consumers boosted Black Friday 2025 sales by prioritizing luxury goods.

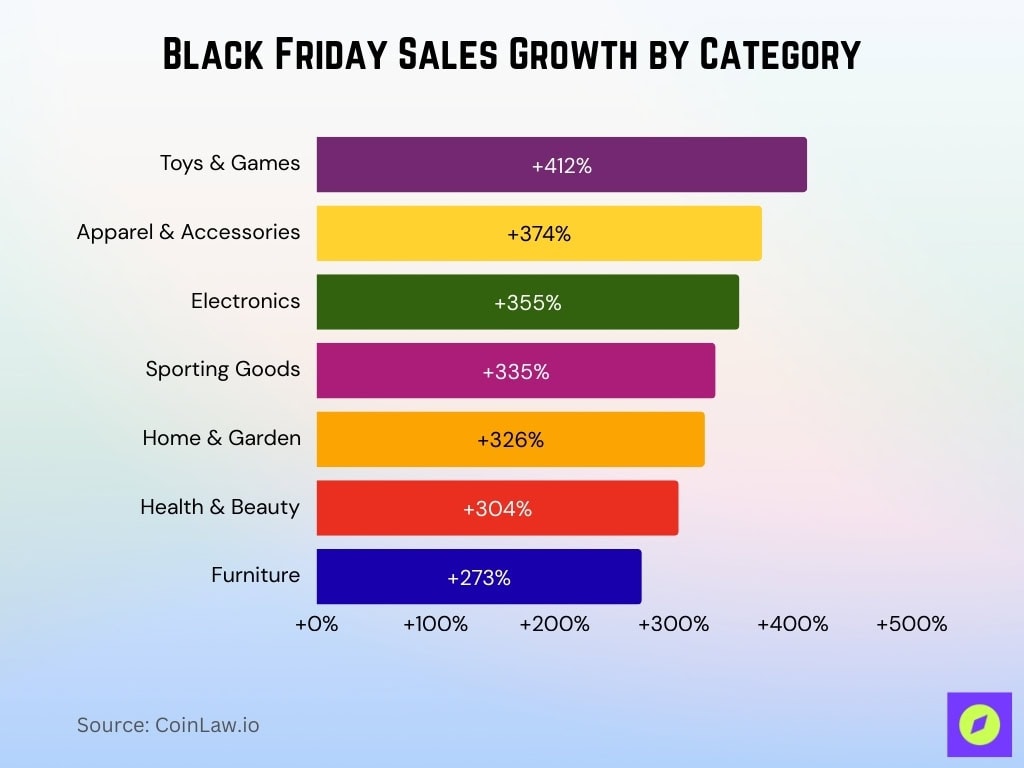

Top Product Categories by Revenue

- Electronics saw a +355% sales surge over a normal day on Black Friday 2025.

- Apparel & Accessories recorded a +374% sales increase compared to the average day in 2025.

- Toys & Games led with +412% sales growth on Black Friday 2025.

- Home & Garden generated a +326% sales boost during Black Friday 2025.

- Health & Beauty achieved +304% revenue spike over baseline in 2025.

- Furniture posted a +273% sales rise on Black Friday 2025.

- Sporting Goods delivered +335% sales increase versus a normal day in 2025.

- Cosmetics topped Shopify with the highest Black Friday 2025 category share.

- Activewear ranked among the top revenue drivers on Black Friday 2025 platforms.

Mobile Shopping and Payment Trends

- Mobile devices drove 55.2% of Black Friday 2025 online sales, totaling $6.5 billion.

- Mobile commerce accounted for 58.6% of online spending through early Black Friday 2025.

- Digital wallets claimed 33% of POS revenue on Black Friday 2025, up from 21% in 2024.

- Retail apps saw 42% consumer preference over websites during Black Friday 2025.

- Social commerce powered 20.3% of Cyber Monday 2025 revenue via influencers.

- BNPL on mobile handled 80.7% of Black Friday 2025 transactions, generating $747.5 million.

- Contactless payments reached 85% of in-store POS transactions on Black Friday 2025.

- Over 70% Black Friday 2025 traffic originated from mobile devices.

Regional Spending Variations

- Los Angeles, New York, San Francisco, and Miami recorded the highest Shopify sales on Black Friday 2025.

- Urban high-income consumers drove 4.1% overall Black Friday 2025 sales growth.

- California, New York led state-level Black Friday 2025 spending patterns.

- Affluent coastal regions prioritized luxury goods during Black Friday 2025 shopping.

- K-shaped economy split spending with high earners boosting Black Friday 2025 totals.

- Urban shoppers embraced mobile payments, dominating Black Friday 2025 transactions.

- Top metro areas generated peak $114.70 average transaction values in 2025.

- East/West Coast cities outperformed the Midwest in Black Friday 2025 revenue share.

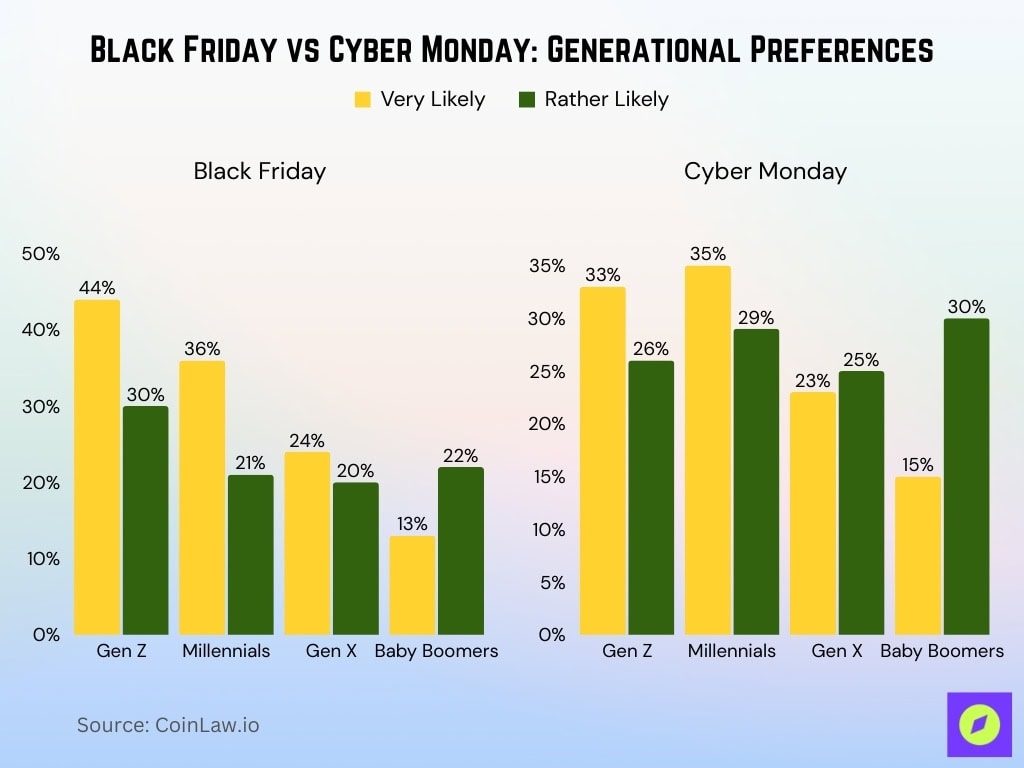

Black Friday vs Cyber Monday: Generational Preferences

- Gen Z favors Black Friday the most, with 44% very likely and 30% rather likely to shop that day.

Millennials also lean toward Black Friday, with 36% very likely and 21% rather likely to participate. - Gen X shows moderate interest in Black Friday, with 24% very likely and 20% rather likely to shop.

- Baby Boomers are less enthusiastic about Black Friday, with only 13% very likely but 22% rather likely to shop.

- On Cyber Monday, Millennials lead, with 35% very likely and 29% rather likely to shop online.

- Gen Z is also engaged on Cyber Monday, with 33% very likely and 26% rather likely to participate.

- Gen X is less inclined toward Cyber Monday, showing 23% very likely and 25% rather likely preferences.

- Baby Boomers prefer Cyber Monday over Black Friday, with 15% very likely and 30% rather likely to shop.

Impact of Economic Factors on Consumer Behavior

- Inflation forced shoppers to prioritize essentials during Black Friday 2025 despite record spending.

- 76% of consumers maintained holiday budgets despite economic pressures in 2025.

- High-income households drove nearly 50% of Black Friday 2025 total spending.

- BNPL usage surged 8.9% amid high interest rates on Black Friday 2025.

- 85% of shoppers sought deep discounts over brand preference during 2025 sales.

- Economic uncertainty boosted price comparison app downloads by 25% pre-Black Friday 2025.

- Flexible payments increased conversion rates by 20% for retailers in 2025.

- 56% low-income households participated in Black Friday 2025, focusing on necessities.

Buy Now, Pay Later (BNPL) Adoption Rates

- BNPL generated $747.5 million in Black Friday 2025 online spending, up 8.9% year-over-year.

- PayPal BNPL transactions rose 23% year-over-year, leading into Black Friday 2025.

- 41% of shoppers aged 16-24 used BNPL during Black Friday 2025.

- Gen Z showed 54% BNPL usage vs 50% credit cards during the 2025 holidays.

- BNPL users averaged $598 spent on Black Friday vs $452 for non-users.

- Electronics dominated BNPL purchases alongside apparel during Black Friday 2025.

- 80.7% of Black Friday 2025 BNPL transactions occurred on mobile devices.

- Klarna reported 45% YoY volume growth through Black Friday 2025.

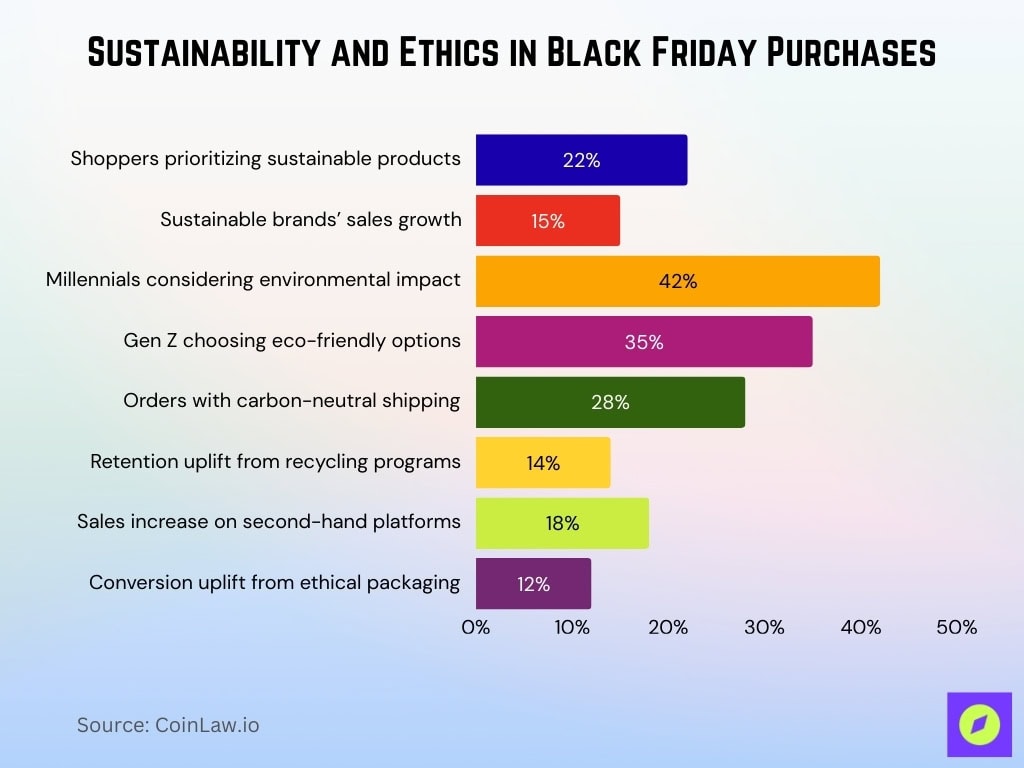

Environmental and Ethical Spending Considerations

- 22% of Black Friday 2025 shoppers prioritized sustainable products.

- Sustainable brands saw 15% higher sales growth during Black Friday 2025.

- 42% Millennials considered environmental impact before 2025 purchases.

- Gen Z led with 35% choosing eco-friendly options on Black Friday 2025.

- Carbon-neutral shipping was selected in 28% of online orders during 2025 sales.

- Recycling programs boosted retention 14% for retailers post-Black Friday 2025.

- Second-hand platforms reported an 18% sales increase on Black Friday 2025.

- Ethical packaging drove a 12% conversion uplift during Black Friday 2025.

Recent Developments

- 80% of major retailers launched Black Friday deals a week early in 2025.

- AI personalization boosted conversion rates by 18% during Black Friday 2025.

- AI shopping assistants drove an 805% traffic surge to retail sites on Black Friday 2025.

- Amazon’s Rufus AI significantly increased sales through personalized recommendations in 2025.

- Live-stream shopping generated 20.3% of Cyber Monday 2025 revenue.

- Cross-border sales hit $8.2 billion from international shoppers on US platforms in 2025.

- Cryptocurrency payments comprised 1.2% of transactions by tech-savvy youth in 2025.

- Same-day delivery demand spiked 32% during Black Friday 2025 weekend.

Frequently Asked Questions (FAQs)

$11.8 billion, marking a 9.1% year-over-year increase.

202.9 million U.S. consumers shopped from Thanksgiving through Cyber Monday.

55.2% of online sales, totaling $6.5 billion.

$747.5 million, up 8.9% year-over-year.

Conclusion

Black Friday promises to be another record-breaking event, shaped by evolving consumer behaviors, economic factors, and technological advancements. The event remains a cornerstone of the retail calendar. As more shoppers embrace sustainability, mobile commerce, and flexible payment solutions, businesses must innovate to meet their expectations. By understanding these trends, retailers can capitalize on Black Friday’s immense potential and deliver value to consumers in a rapidly changing market.